Agricultural Trade with Mexico and the Preliminary U.S.-Mexico Agreement in NAFTA Negotiations

On August 27, 2018, the Trump Administration announced that it had reached a preliminary agreement with Mexico in the renegotiation of the North American Free Trade Agreement (NAFTA). The announcement followed more than a year of negotiations among the United States, Canada, and Mexico on NAFTA at the request of the Trump Administration. Canada is currently in talks for a possible trilateral agreement. Mexico is the third leading export market for U.S. agricultural goods; therefore, any agreement could affect U.S. farmers, ranchers, and food manufacturers.

Overview of U.S.-Mexico Agricultural Trade

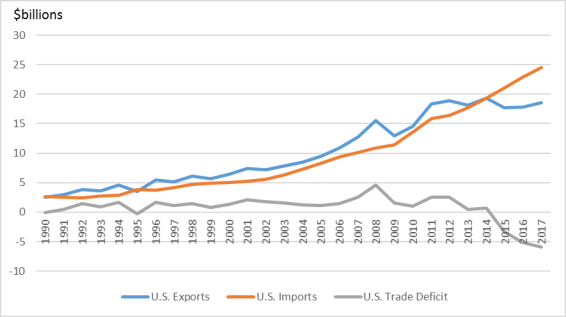

The U.S.-Mexico trading relationship has been governed by NAFTA since it went into force in January 1994. NAFTA eliminated U.S. and Mexican tariffs on agricultural goods. According to U.S. Department of Agriculture data, the value of trade in agricultural goods between Mexico and the United States has increased significantly under the trade agreement. From 1991 through 1993, the three years before NAFTA went into effect, U.S. agricultural exports averaged about $3.5 billion annually. From 2015 through 2017, U.S. food and agriculture exports to Mexico averaged more than $18 billion (see Figure 1). The $18.6 billion worth of U.S. food and agriculture products that were exported to Mexico in 2017 accounted for about 13% of the total of about $138 billion in U.S. food and agriculture exports that year. Only Canada and China buy more U.S. food and agricultural products than Mexico, accounting for 15% and 14% of the total value of U.S. food and agriculture exports in 2017, respectively.

|

|

Source: USDA Global Agricultural Trade System, August 29, 2018. Data are in nominal values. |

Mexico was the leading export market by value for U.S. dairy, poultry products, and corn in 2017. That year, U.S. farmers and ranchers exported more than $1.3 billion worth of dairy products, about $1.1 billion worth of poultry products, and roughly $2.7 billion worth of corn to Mexico. In addition, Mexico is also a large market for U.S. pork and soybeans, accounting for about $1.3 billion in pork exports and about $1.6 billion in soybean exports.

Meanwhile, Mexico is the top foreign supplier by value of food and agricultural products to the United States, with a trade surplus of roughly $6 billion in those goods. U.S. imports of Mexican food and agricultural products totaled almost $25 billion in 2017, led by about $13 billion in fruits and vegetables. U.S. imports of Mexican food and agriculture products averaged $2.5 billion annually in the three years before NAFTA went into force. From 2015-2017, Mexican shipments of those products averaged $22.8 billion.

In July 2018, in response to the Trump Administration's tariffs on steel and aluminum imports from Mexico, the Mexican government imposed retaliatory tariffs of 15%-25% on U.S. pork, cheese, and certain other food and agricultural products, negating their duty-free status under NAFTA. At this time, it is unclear if U.S. tariffs on steel and aluminum will be dropped as part of a new trade agreement with Mexico, though Mexican steel groups are pushing their government to make that a condition of a final agreement. The tariff advantage of U.S. agricultural exports to Mexico under NAFTA could be further eroded should negotiations over a free trade agreement between Mexico and the European Union be finalized. The current advantage could also be impacted if the 11-member Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) goes into effect. Mexico and Canada are both parties to the CPTPP. Mexico was the first country to ratify the CPTPP, followed by Japan, but at least four more countries need to do so before the agreement can enter into force.

The Preliminary U.S.-Mexico Trade Deal

While the text of the preliminary U.S.-Mexico agreement has yet to be made public, in an August 27, 2018, fact sheet, the U.S. Trade Representative (USTR) said that the potential new agreement would maintain the duty-free access for both countries that was put in place under NAFTA. USTR also says that the agreement includes

- standards for agricultural biotechnology that include gene editing and other new technologies, and provisions for "information exchange and cooperation" on agricultural biotechnology related trade issues;

- commitments to reduce trade-distorting policies and ensure non-discriminatory grading of agricultural products;

- enhanced sanitary and phytosanitary (SPS) rules that include increased transparency, improved certification and equivalency determination processes, and a new technical consultation mechanism to resolve issues;

- standards for geographical indications and common names for cheese;

- recognition of Bourbon and Tennessee Whiskey as distinctive U.S. products, and recognition of Tequila and Mezcal as distinctive Mexican products, as well as new labeling and certification provisions for wine and distilled spirits; and

- protections for proprietary food formulas.

Outlook

In order for a modified NAFTA or a bilateral U.S.-Mexico trade agreement to enter into force, it must be approved by Congress, as required under Trade Promotion Authority (TPA). Several issues exist in the U.S.-Mexico trading relationship for agricultural products as described above, but without details from USTR on the preliminary agreement, it is unclear whether those issues were addressed sufficiently to meet TPA objectives. For example, it remains to be seen if the update to the SPS rules will be in line with the provisions that Mexico has agreed to as part of the CPTPP. While the United States under the Obama Administration was signed on to the precursor to that agreement—known then as the Trans Pacific Partnership (TPP)—President Trump withdrew shortly after taking office. TPP included commitments regarding SPS and other technical standards, provided for public comment on proposed SPS measures, and provided for information exchange related to livestock disease outbreaks. It also included assurances that import programs be risk-based and that import checks would be carried out without undue delay. Those provisions were carried over into CPTPP. SPS barriers are currently blocking certain U.S. exports to Mexico, including fresh potatoes, stonefruit from states outside of the Pacific Northwest, and raw milk for pasteurization, according to USTR's 2018 National Trade Estimate Report on Foreign Trade Barriers.