Proposals to Impose Sanctions on Russian Sovereign Debt

The United States imposes sanctions on hundreds of Russian individuals and entities for aggression against Ukraine, election interference, malicious cyber activity, human rights violations, weapons proliferation, and other activities. Some Members of Congress are proposing additional sanctions in response to continuing objectionable behavior by the Russian government. One proposal is to sanction new debt issued by the Russian government. If enacted, U.S. investors would be prohibited from buying or trading new Russian sovereign debt.

Targeting Russian sovereign debt would escalate U.S. sanctions against Russia. Some analysts call it the "nuclear option." No other government sanctions Russian sovereign debt, although the British government debated it following the nerve agent attack against a former Russian intelligence officer and his daughter in the United Kingdom in March 2018. However, the United States has sanctioned the sovereign debt of other countries, including Iran and Venezuela.

Proponents of the sanction argue it would directly exert pressure on the Russian government. They also argue it would improve the effectiveness of existing sanctions, by eliminating the ability of the Russian government to borrow from U.S. investors in order to finance loans to sanctioned Russian firms. Skeptics argue it could create instability in global markets and adversely impact U.S. investors.

Russian Sovereign Debt

The Russian government sells government (sovereign) bonds to investors as a way to raise funds, a common practice for governments of both advanced economies and emerging markets. The Russian government primarily sells two types of bonds:

- Bonds denominated in its own currency (rubles) to finance budget deficits and increase liquidity in its banking sector. Russian sovereign bonds denominated in rubles are almost exclusively a type of medium- to long-term bond called "Federal Loan Obligations" (OFZs).

- Bonds denominated in foreign currencies called Eurobonds (although they are primarily denominated in U.S. dollars), which helps the government access foreign currency. Access to foreign currencies helps the government build foreign currency reserves, make payments in foreign currencies on previously incurred debt, and pay for imports.

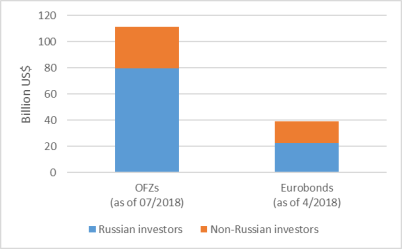

According to Russia's central bank, outstanding OFZs total $112 billion and its outstanding Eurobonds total $39 billion (Figure 1). Russian investors are the primary investors; non-Russian investors hold 28% of OFZs and 43% of Eurobonds.

|

|

Source: Russian Central Bank. |

Although the Russian government actively borrows from Russian and international investors, its reliance on such loans is relatively low. The Russian government has been able to build sizeable reserves ($457 billion in June 2018) from the proceeds of natural gas and oil, of which Russia is a major producer and exporter. The Russian government's debt is 19% of GDP, compared to 51% of GDP on average for emerging-market and developing countries and 103% of GDP for advanced economies.

Russia's Recent Sovereign Bond Sales

Under existing sanctions, U.S. investors are allowed to buy and trade Russian sovereign bonds. Starting in 2014, however, Ukraine-related sanctions created a broader chilling effect; western financial institutions and clearing houses were unwilling to buy or process sales of Russian sovereign bonds over sanctions concerns, effectively cutting the Russian government off from western capital markets. Although Russia has ample foreign exchange reserves, losing access to international financing exacerbated fiscal challenges stemming from new sanctions and a collapse in global oil prices.

In 2016, Russia was able to complete its first bond sale since its annexation of Crimea, although there was uncertainty over whether western clearing houses would process the transactions. Reportedly, the Obama Administration pressured U.S. financial institutions to avoid the sale. However, Euroclear, the world's largest clearing house, eventually began processing the bonds, paving the way for a number of successful Russian Eurobond sales. VTB, a Russian state-owned bank subject to U.S. debt and equity sanctions, administers Russia's international sovereign bond sales.

According to Russian officials, U.S. and European investors are active purchasers in these bond sales. For example, in March 2018, U.S. investors reportedly accounted for 34% of a $1.5 billion Russian Eurobond issue, the second largest group of buyers after Russians. At the end of 2017, many Western banks recommended investments in Russian government bonds due to their strong performance.

Legislative Proposals

The 115th Congress is debating whether to restrict U.S. purchases of Russian sovereign debt. In 2017 sanctions legislation, Congress directed the Department of the Treasury to produce a report analyzing the potential effects of expanding sanctions to Russian sovereign debt and related derivatives products (Section 242, P.L. 115-44). The report, released in February 2018, cautions such sanctions could potentially have "negative spillover effects in global financial markets and businesses."

Several bills would sanction Russian sovereign debt, among other sanctions

- Counteracting Russian Hostilities Act of 2017 (S. 94; H.R. 1751),

- Defending Elections from Threats by Establishing Redlines Act of 2018 (S. 2313; H.R. 4884),

- Stand with UK against Russia Violations Act (H.R. 5428),

- Secure America from Russian Interference Act of 2018 (H.R. 6437), and

- Defending American Security from Kremlin Aggression Act of 2018 (Senate bill number forthcoming).

Potential Impact

Impact on Russia. If enacted, Russia's government would lose access to capital from U.S. investors. The impact on Russia's finances would depend on at least two factors. First, it would depend on the size of Russia's financing needs. Higher oil prices have alleviated the budgetary pressures facing the government, although its foreign reserve holdings remain well below 2013 levels. Second, the impact would depend on the extent to which Russia could fill its financing needs through non-U.S. investors, including European, Asian, and domestic (Russian) investors. Coordinating the sanction with the European Union would increase its effectiveness, but it is unclear the European Union is willing to impose a similar sanction.

Impact on the United States. Sanctions on new Russian sovereign bonds could depress the value of U.S. investors' holdings of existing Russian sovereign bonds. According to the Bank for International Settlements, U.S. banks held $4.08 billion in Russian sovereign debt at end-March 2018, compared to $3.4 trillion in foreign claims worldwide. Data on U.S. pension fund and mutual fund holdings of Russian sovereign bonds is not publicly available.

Given the size of Russia's economy, the 10th largest in the world, the sanction could have broader ramifications in global financial markets that could negatively impact U.S. economic interests, as cautioned by Treasury's February 2018 report to Congress. However, spillover risks are difficult to estimate, and there may be questions about the potential risks given the low levels of U.S.-Russian economic activity. Finally, Russia could retaliate, as it did in 2014 when it banned agricultural imports from the United States and other western countries imposing sanctions.