Trump-Abe Meeting and Prospects for U.S.-Japan Trade Talks

Overview

Since coming into office, the Trump Administration has expressed concerns about the U.S. trade deficit with Japan and an interest in talks on a bilateral free trade agreement (FTA), a move Japan has resisted. On April 17-18, 2018, President Trump and Prime Minister Abe held a summit to discuss U.S.-Japan relations and regional security issues. Trade was a highly anticipated subject of the meeting.

Several recent trade developments posed an important backdrop to the meeting. In early March, Japan with 10 other countries, not including the United States, signed the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). The Japan-led CPTPP, also called TPP-11, is a revised version of the original U.S.-signed (but not enacted) TPP agreement, from which President Trump withdrew in 2017. CPTPP is designed to eventually eliminate most tariff and many non-tariff barriers among the parties.

In March, President Trump also proclaimed new steel and aluminum tariffs following an investigation over the national security implications of U.S. imports of these products. Unlike other major U.S. trading partners and allies, including Canada, Mexico, the European Union, and South Korea, Japan was not granted a tariff exemption. Some viewed the lack of an exemption as an attempt to pressure Japan into agreeing to bilateral trade talks.

The April summit, however, did not lead to breakthrough announcements on bilateral trade issues or a clear path forward for future negotiations. Both sides agreed to "intensify trade and investment discussions," to be led by U.S. Trade Representative Robert Lighthizer and Japan's Minister in charge of Economic Revitalization, Toshimitsu Motegi, but largely maintained their earlier positions. Japan continued to hold back from endorsing a bilateral FTA negotiation, instead preferring U.S. participation in the TPP-11. Meanwhile, President Trump, despite giving mixed signals before the summit on potential interest in rejoining TPP, emphasized a preference for "negotiating a one-on-one deal," focusing on reducing the U.S. trade deficit and removing barriers to U.S. exports.

U.S.-Japan Trade and Investment Snapshot

|

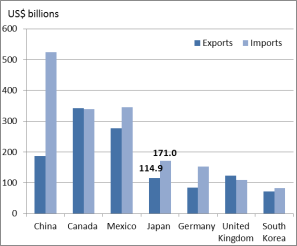

Figure 1. U.S. Goods and Services Trade with Top Partners, 2017 |

|

|

Source: U.S. Census Bureau and Bureau of Economic Analysis. |

In 2017, the United States exported $115 billion in goods and services to Japan and imported $171 billion (Figure 1). Over the past decade, however, Japan's relative importance in U.S. trade has declined with the rise of China. Japan is the second largest source of U.S. foreign direct investment (FDI), behind the United Kingdom. In 2017, the United States had a bilateral trade deficit (goods and services) with Japan of $56 billion, which has been flagged by the Trump Administration as a concern. With a deficit of about $50 billion, motor vehicles and parts are a major driver of the U.S.-Japan goods trade deficit (about $70 billion). Motor vehicle and parts trade has historically been a source of bilateral trade frictions, particularly concerns over U.S. access to the Japanese market for these and other products. At the same time, Japan is a key source of investment supporting motor vehicle and parts production in the United States.

Prospects for U.S.-Japan Trade Talks

Whether forthcoming consultations will accelerate prospects for a formal U.S.-Japan trade negotiation is an open question. USTR Lighthizer acknowledged in recent testimony that despite the Administration's stated interest, it may not be the "appropriate time" for an FTA negotiation with Japan, given Japanese preoccupation with implementing CPTPP. At the same time, some members of Congress have called for the Administration to follow through on its pledge to negotiate new trade deals, including with Japan. Proponents of a U.S.-Japan trade deal highlight the potential economic benefits of gaining new access to the Japanese market, particularly for agriculture and services, and dismantling various non-tariff barriers. Both countries also share several priorities in advancing new trade rules, including digital trade.

Key issues potentially affecting prospects for formal negotiations include:

- Moving Beyond TPP. Revisiting market access negotiations, either in a revised TPP or new bilateral FTA talks will likely be politically challenging in both countries. The United States and Japan have engaged in a high-level economic dialogue since April 2017—in the U.S. view, a stepping stone toward a bilateral FTA—and announced some progress toward resolving discrete bilateral trade irritants. The broad talks, however, have avoided major commitments in agriculture and auto trade, which were subject to extensive bilateral negotiations under TPP, and will likely be at the heart of any new FTA negotiation. Japan asserts it offered the United States unprecedented market access, especially in agriculture, in the original TPP, which some suggest resulted in election losses for Abe's ruling LDP party. In TPP motor vehicle commitments, Japan's primary offensive interest, the United States secured the longest tariff phaseouts of any U.S. FTA (25 years for autos, 30 for light trucks).

- U.S. FTA Review and Revision. A stated top priority of the Trump Administration is concluding the North American Free Trade Agreement (NAFTA) renegotiation by year end, which may limit the Administration and Congress' ability to pursue new trade negotiations in the short term. The final elements of an updated NAFTA, especially in areas like auto rules of origin, would also provide indication of the Trump Administration's FTA priorities, which is likely to affect Japanese interest in an FTA negotiation.

- Bilateral versus Regional Approach. Japan continues to push for a regional approach to trade integration, viewing TPP as important to enhance U.S.-Japan trade relations, as well as to establish regional rules that may help address existing challenges with other major economies in the region, including China. The Trump Administration, however, favors bilateral negotiations, arguing they provide the United States more leverage.

- Implications of FTAs that Exclude the United States. A number of Members of Congress and other stakeholders have raised concerns about U.S. exporters and producers, especially in agriculture, losing out as other countries gain market access to Japan through other trade deals. These include existing agreements such as the Australia-Japan FTA, concluded but not yet implemented agreements such as the EU-Japan FTA and CPTPP, and agreements still under negotiation, such as the Regional Comprehensive Economic Partnership (RCEP). As new agreements come into effect the Administration and Congress may be under increased pressure to secure comparable access to the Japanese market.

Issues for Congress

While a trade deal with Japan appears unlikely in the near term, Congress may consider several policy issues related to U.S.-Japan relations and future U.S. trade policy:

- How might U.S.-Japan cooperation advance mutual interests to shape regional and global trade rules, particularly in the wake of U.S. TPP withdrawal?

- What are the economic effects and broader strategic implications of a potential U.S.-Japan bilateral FTA?

- How will Japan's pursuit of FTAs without the United States potentially affect the competitiveness of U.S. producers and exporters?