OPEC and Non-OPEC Crude Oil Production Agreement: Compliance Status

On November 30, 2016—in an effort to stabilize declining oil prices—the Organization of the Petroleum Exporting Countries (OPEC) announced an agreement whereby 11 of the then-active 13 members would reduce crude oil production by approximately 1.2 million barrels per day (bpd) for 6 months starting January 1, 2017. On December 10, 2016, OPEC announced that 11 non-OPEC countries, led by Russia, had joined the agreement by pledging to further reduce oil production by 558,000 bpd. This "Declaration of Cooperation" to collectively reduce oil production by approximately 1.7 million bpd has been extended twice and is currently in effect through December 2018.

Congressional interest in OPEC dates back to at least 1973 when some Arab members of the organization instituted oil production cuts and embargoed oil shipments to the United States, South Africa, the Netherlands, and Portugal. The embargo created perceived shortages and resulted in increased gasoline prices for U.S. consumers. Following a period of increasing oil prices in the early 2000s, versions of a proposed No Oil Producing and Exporting Cartels (NOPEC) Act were introduced in the 110th (H.R. 2264, which was passed by the House, and S. 879) and 112th (H.R. 1346 and S. 394) Congresses. The NOPEC Act would have amended the Sherman Act (15 U.S.C. 1 et seq.) by making foreign country oil-producing and exporting cartels illegal. Alternatively, during a period of oversupply and declining prices in 2014/2015, non-action by OPEC to increase oil prices was perceived as a targeted effort to harm U.S. oil producers. Subsequently, H.R. 545 was introduced in the 115th Congress to establish a commission to investigate anticompetitive actions taken by OPEC (the bill was previously introduced as H.R. 4559 in the 114th Congress).

Overview of the Agreement

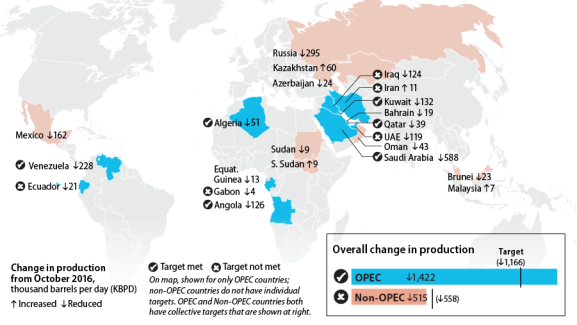

Two primary objectives of the OPEC/non-OPEC production agreement are (1) reduce global excess production that reached surplus levels of 1.5 million bpd in 2015 and (2) reduce oil stocks that were at record levels. The OPEC portion of the agreement set country-level production quotas for 11 of 13 then-active members (Libya and Nigeria are exempt) that would reduce crude oil production by nearly 1.2 million bpd compared to October 2016 levels. For the 11 non-OPEC countries that committed to reduce oil production, the agreement indicated a cumulative reduction target of 558,000 bpd for the group (no country-specific reduction targets) compared to October 2016 production.

Agreement Compliance

For the period January 2017 through March 2018, OPEC and non-OPEC countries party to the production agreement were, as a group, 112% compliant with the production targets. During this period the group collectively reduced crude oil production by approximately 1.9 million barrels per day (mbpd) compared to the October 2016 reference level. OPEC member countries subject to the agreement were 122% compliant during the period; 6 of 11 countries (Algeria, Angola, Kuwait, Qatar, Saudi Arabia, and Venezuela) either met or exceeded their target reductions. Non-OPEC countries were not assigned individual reduction targets; however, the non-OPEC group was 92% compliant with the 558,000 bpd reduction target. With the exception of Kazakhstan, Malaysia, and South Sudan, each non-OPEC country reduced crude production during the period. Figure 1 below summarizes crude oil production changes for OPEC and non-OPEC countries.

Market Impacts and Issues to Watch

Generally, compliance with the Declaration of Cooperation appears to be achieving the stated goals of eliminating excess production as well as reducing global petroleum stocks. Commercial petroleum storage levels in the United States and other Organization for Economic Co-operation and Development (OECD) countries—the benchmark for global petroleum stocks—declined by 230 million barrels during the period January 2017 to February 2018. Over the same period OECD stock levels in excess of the five-year average—the current metric used by OPEC to determine market balance—declined from 300 million to 30 million barrels. According to the International Energy Agency (IEA), five-year average stock levels could be reached as early as May 2018.

Communication from President Trump on April 20, 2018, stated that "Oil prices are artificially Very High" due to OPEC actions. The spot price for Brent crude—a global benchmark—started 2017 at around $55 per barrel and was over $73 on April 16, 2018. Gasoline prices increased from $2.49 per gallon to $2.86 per gallon over the same period and the U.S. Energy Information Administration's (EIA's) April 2018 Short-Term Energy Outlook reported that U.S. households are expected to spend an additional $190 on motor fuel this year compared with 2017. However, higher oil prices have encouraged more U.S. oil production. Monthly production from January 2017 to January 2018 increased by more than 1.1 mbpd.

On June 22, 2018, OPEC is to hold its 174th meeting in Vienna, Austria. One agenda item being closely monitored is a potential OPEC/non-OPEC decision to maintain, extend, enhance, or unwind the production agreement that is set to expire on December 31, 2018. Indications from OPEC members suggest that market balance is not yet complete and the group is considering alternative metrics to measure the effects of the agreement. Reports from the EIA and IEA project that the oil market will be undersupplied in 2018 if OPEC maintains production levels set forth in the agreement. In an undersupply market condition with declining stocks, unforeseen geopolitical and/or weather events could potentially result in oil and gasoline price escalation.