Productivity Growth Across the Economy

Long-term economic growth is generally dependent on three factors: growth in the size of the labor force, growth in the amount of physical capital (e.g., tools, machines, computers) available to workers, and growth in productivity. Productivity is a measure of how well an economy produces goods and services with a given number of workers and amount of physical capital. Productivity growth is often of particular concern to policymakers because it is a vital determinant of long-term economic growth and drives increases in income for businesses and individuals. This Insight examines recent trends in productivity growth in the U.S. economy and particular industries, and briefly discusses potential programs and policies that can increase productivity growth.

Productivity in the Economy

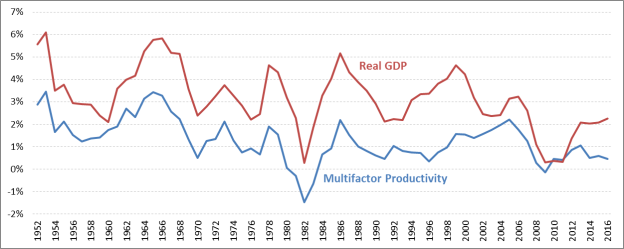

Productivity is a measure of how efficiently economic actors can combine inputs to produce goods and services. Advances in productivity allow the economy to produce more goods and services with the same level of inputs, improving overall living standards. Changes in productivity are not observed directly in the economy; rather, they are inferred from movements in other economic indicators. The inability to directly observe changes in productivity obscure potential policy mechanisms that improve productivity growth. In general though, productivity growth comes from many sources, such as technological advances (e.g., internal combustion engines and personal computers), organizational changes (e.g., assembly lines), and regulatory environment changes. Importantly, these advances have been observed to drive economic growth and income increases. As shown in Figure 1, productivity growth and real gross domestic product (GDP) growth move together quite consistently, with periods of high productivity growth occurring alongside periods of higher GDP growth.

This Insight uses multifactor productivity to measure productivity growth, which estimates the change in total economic output that is unexplained by changes in the labor force or amount of physical capital. This measure can be used to analyze productivity changes at the economy-wide and industry level. For more information regarding measures of productivity, refer to CRS In Focus IF10557, Introduction to U.S. Economy: Productivity.

In recent years, productivity has garnered additional scrutiny from both economists and policymakers, as productivity growth has slowed compared with its historical average. Over the past five years, productivity has increased by 0.5% per year on average, compared with an average growth rate of 1.3% between 1948 and 2016. Real GDP growth has also been particularly slow, growing 2.1% per year on average over the past five years, compared with an average annual real GDP growth rate of 3.2% between 1948 and 2016.

Productivity Across Industries

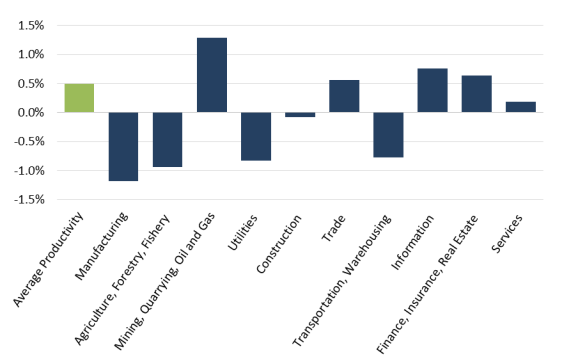

Overall, productivity growth has been slow in recent years compared to its historical average; however, looking simply at average productivity growth conceals some large differences in productivity growth across industries. Between 2010 and 2015, the latest data available at the industry level, average multifactor productivity growth was about 0.5% per year on average, but across major industries only half saw any increase in productivity whereas the others saw a decrease in productivity, as shown in Figure 2. Relatively strong productivity growth occurred in mining, quarrying, and oil and gas extraction, growing 1.3% per year on average between 2010 and 2015. Other industries have experienced more modest growth, including wholesale and retail trade (0.6%); information (0.8%); finance, insurance, and real estate (0.6%); and services (0.2%). Over the same period, a number of industries experienced declining productivity, including manufacturing (-1.2%); agriculture, forestry, and fishery (-0.9%); utilities (-0.8%); construction (-0.1%); and transportation and warehousing (-0.8%).

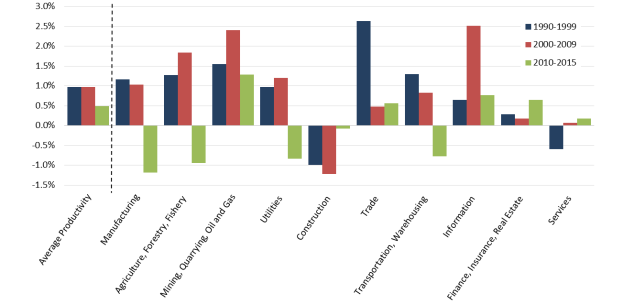

The concentration of productivity growth among a handful of major industries between 2010 and 2015 appears to be a departure from previous periods. As shown in Figure 3, in the 1990s and 2000s, productivity growth was shared more broadly among major industry groups. During the 1990s, eight industries experienced increased productivity, whereas in the 2000s, nine industries experienced increased productivity, in comparison to 2010-2015 in which only five industries experienced increased productivity.

|

Figure 3. Multifactor Productivity Growth Across Major Industries |

|

|

Source: CRS calculations using data from BLS, https://www.bls.gov/mfp/mprdload.htm. Note: Average annual growth in multifactor productivity. |

Policy Alternatives to Boost Productivity

Increasing the rate of productivity growth could improve a number of economic and social outcomes. However, the processes governing productivity growth are not very well understood. One potential solution to improve productivity growth includes policies that encourage labor market and business dynamism. Encouraging workers and making it easier for them to switch between companies and industries may help increase productivity growth, as employees are drawn to more productive businesses and industries (see CRS Insight IN10506, Declining Dynamism in the U.S. Labor Market). In addition, declining business dynamism may be holding back productivity growth, and policies targeted toward encouraging entrepreneurship may help to reverse this trend. Alternatively, increased investment by businesses into research and development is expected to increase productivity growth as some portion of these investments leads to new technology or production advancements. Further, government investment in research and development has helped fuel productivity growth in the private sector previously (e.g., the Internet).