OPEC and Non-OPEC Crude Oil Production Agreement: Compliance Status

Founded in 1960 by Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela, the Organization of the Petroleum Exporting Countries (OPEC) currently has 13 member countries that represent approximately 40% of global oil (e.g., crude oil, condensate, natural gas liquids) production. OPEC can influence global oil prices through coordinated production decisions that can impact the global oil market supply and demand balance. Additionally, through statements and announcements, OPEC and member countries can affect oil market sentiment that can influence oil prices.

Oil supply decisions by OPEC and its members have been of interest to Congress since at least 1973 when Arab member countries instituted an embargo of oil supply to the United States, which resulted in oil price increases and localized supply shortages of gasoline. Energy supply adequacy and security became an issue of intense national interest, and in 1975 Congress passed the Energy Policy and Conservation Act (P.L. 94-163), which created the Strategic Petroleum Reserve and established energy efficiency and conservation programs.

Recently, the global oil market has been oversupplied. According to the Energy Information Administration (EIA), except for the third quarter of 2016, oil production exceeded consumption since the third quarter of 2014. As a result, commercial stocks of crude oil and petroleum liquids have been at five-year highs and there has been downward pressure on benchmark (e.g., West Texas Intermediate, or WTI, and Brent) crude oil prices. The WTI spot price declined from $108 per barrel in June 2014 to approximately $75 in November 2014. OPEC announced in November 2014 that member countries would maintain production levels and not respond to oversupply and declining prices. Oil prices continued their descent to as low as $26 per barrel in February 2016. OPEC's production decision and the resulting price declines were interpreted by some to be anti-competitive and a targeted effort to put price pressure on U.S. tight (shale) oil producers, which had steadily increased production since 2008 and contributed to the oversupply situation. H.R. 545 would establish a commission to investigate anti-competitive actions taken by OPEC. (The bill had been previously introduced as H.R. 4559 in the 114th Congress.)

On November 30, 2016, in an effort to address low prices and global oversupply, OPEC announced an agreement (the "Vienna Agreement") under which the organization would reduce crude oil production by 1.2 million barrels per day (bpd) from October 2016 levels for an initial six months starting January 2017. OPEC also indicated its plans to "institutionalize a framework" with non-OPEC countries to manage crude oil production levels. On December 10, 2016, OPEC announced that a group of 11 countries had joined the Vienna Agreement and had committed to reduce oil production by 558,000 bpd. Combined, the OPEC and non-OPEC commitments would reduce crude oil production by nearly 1.8 million barrels per day.

OPEC Agreement Compliance

As indicated in Table 1, actual OPEC crude oil production in April 2017 had declined by nearly 1.4 million bpd, more than the target adjustment included in the November 2016 agreement (~1.2 million bpd). Approximately 43% of the actual decline observed was a result of Saudi Arabia crude oil output reductions. Of the 11 countries that were assigned output adjustments—Libya and Nigeria were exempted—five (Kuwait, Qatar, Saudi Arabia, UAE, and Venezuela) met or exceeded their output reduction targets for April 2017.

|

Country |

Reference Level |

Adj. |

Target Production Level |

Jan. 17 Actual |

Feb. 17 Actual |

Mar. 17 Actual |

Apr. 17 |

Actual Adj. |

|

Algeria |

1,089 |

(50) |

1,039 |

1,053 |

1,052 |

1,055 |

1,407 |

(42) |

|

Angola |

1,753 |

(80) |

1,673 |

1,658 |

1,633 |

1,595 |

1,692 |

(61) |

|

Ecuador |

548 |

(26) |

522 |

530 |

529 |

525 |

524 |

(24) |

|

Gabon |

202 |

(9) |

193 |

203 |

196 |

197 |

206 |

8 |

|

Irana |

3,709 |

90 |

3,797 |

3,780 |

3,819 |

3,793 |

3,759 |

50 |

|

Iraq |

4,561 |

(210) |

4,351 |

4,475 |

4,411 |

4,412 |

4,373 |

(188) |

|

Kuwait |

2,838 |

(131) |

2,707 |

2,722 |

2,712 |

2,702 |

2,702 |

(136) |

|

Libya |

528 |

N/A |

N/A |

678 |

683 |

612 |

550 |

22 |

|

Nigeria |

1,615 |

N/A |

N/A |

1,533 |

1,575 |

1,457 |

1,508 |

(107) |

|

Qatar |

648 |

(30) |

618 |

620 |

595 |

610 |

618 |

(30) |

|

Saudi Arabia |

10,544 |

(486) |

10,058 |

9,809 |

9,952 |

9,905 |

9,954 |

(590) |

|

UAE |

3,013 |

(139) |

2,874 |

2,958 |

2,928 |

2,905 |

2,842 |

(171) |

|

Venezuela |

2,067 |

(95) |

1,972 |

2,007 |

1,998 |

1,982 |

1,956 |

(111) |

|

Total |

33,115 |

(1,166) |

32,026 |

32,083 |

31,750 |

31,731 |

(1,384) |

Source: Compiled by CRS with data from OPEC documents and reports. Reference Level, Adjustment, and Target Production from the November 30, 2016, OPEC 'Vienna' Agreement. Actual production levels for January and February are from the April 2017 OPEC Monthly Oil Market Report (MOMR), provided by secondary sources. Actual production levels for March and April are from the May 2017 OPEC MOMR.

Notes: Actual Adjustment calculated by subtracting April 2017 Actual from Reference Level. Libya and Nigeria were exempt from the production agreement and were not assigned target production levels.

a. Reference Level for Iran is from the January 2017 OPEC Monthly Oil Market Report, since the production agreement included a reference level that exceeded Iran's actual October 2016 crude oil production.

Non-OPEC Agreement Compliance

As illustrated in Table 2, the 11 non-OPEC countries as of April 2017 had reduced their collective oil production by 413,000 bpd, roughly 74% of the 558,000 bpd reduction commitment.

|

Country |

Reference Level (Oct. 2016) |

Jan. 17 Actual |

Feb. 17 Actual |

Mar. 17 Actual |

Apr. 17 Actual |

Actual Adjustment |

|

Azerbaijan |

759 |

747 |

734 |

703 |

735 |

(24) |

|

Bahrain |

197 |

193 |

192 |

192 |

192 |

(5) |

|

Brunei |

125 |

110 |

110 |

110 |

110 |

(15) |

|

Equatorial Guinea |

234 |

227 |

225 |

222 |

219 |

(15) |

|

Kazakhstan |

1,353 |

1,379 |

1,420 |

1,451 |

1,438 |

85 |

|

Malaysia |

557 |

591 |

582 |

575 |

572 |

15 |

|

Mexico |

2,017 |

1,931 |

1,924 |

1,928 |

1,899 |

(118) |

|

Oman |

923 |

884 |

883 |

876 |

877 |

(46) |

|

Russia |

10,512 |

10,329 |

10,331 |

10,286 |

10,216 |

(296) |

|

Sudan |

76 |

73 |

72 |

71 |

70 |

(6) |

|

South Sudan |

104 |

89 |

125 |

139 |

116 |

12 |

|

Total |

16,857 |

16,553 |

16,598 |

16,551 |

16,444 |

(413) |

Source: Compiled by CRS, based on International Energy Agency data from the Monthly Oil Data Service © OECD/IEA 2017, http://www.iea.org/statistics, accessed May 17, 2017.

Market Impacts

One of the primary stated goals of the OPEC/Non-OPEC production agreement was to reduce global oil stocks—which have grown to record levels since 2014—to below their five-year average. OPEC reports indicate that commercial oil stocks in the Organization for Economic Co-operation and Development (OECD) countries exceeded 3 billion barrels in March 2017. While stock levels have reportedly declined since the Vienna Agreement was implemented, they remain 276 million barrels above their five-year average.

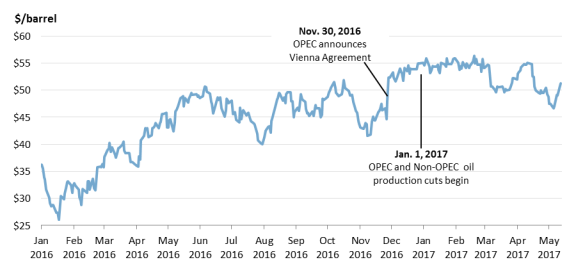

Oil prices have ranged from $47 to $56 per barrel since the agreement came into effect (see Figure 1). However, OPEC rhetoric in the months prior to the agreement may have contributed to oil price increases between January and November 2016.

|

Figure 1. Brent Crude Oil Spot Prices January 2016–May 15, 2017 |

|

|

Source: Energy Information Administration. |

One factor limiting oil price escalation is increasing U.S. oil production. After an initial decline of more than 1 million bpd between April 2015 and September 2016, monthly U.S. oil production has since increased by nearly 500,000 bpd and weekly oil production reports indicate 9.3 million bpd of production in early May. This production growth is offsetting OPEC supply reductions, limiting global stock draws, and putting downward pressure on benchmark prices.

On May 25, 2017, OPEC is to convene its 172nd meeting to evaluate oil market conditions and formally decide, along with non-OPEC countries, to extend, modify, enhance, or terminate the Vienna Agreement. Saudi Arabia and Russia already announced their commitment to extend the agreement.