Overview

Congress has demonstrated long-standing interest in the U.S. trade deficit as part of its efforts to examine U.S. trade policy and key trading relationships. Congress's role in trade policy stems from a number of overlapping responsibilities, including Congress's constitutional authority over regulating commerce with foreign countries and broad oversight responsibility over the performance of the economy. In some areas, particularly in negotiating trade agreements, Congress has opted to delegate certain authorities to the executive branch. Interest in the trade deficit has been heightened by the Trump Administration, which has addressed trade broadly and trade agreements more directly through an assertive trade policy agenda that includes proposed increased tariff measures based on various trade investigations and vocal skepticism of past U.S. trade agreements and the potential benefits of trade.

At times, the Trump Administration's approach to international trade agreements has been termed a "reset," or a renegotiation of past agreements, while at other times it has been viewed as a fundamental change in U.S. trade policy. A key element of the Trump Administration's approach to international trade has been the use of the U.S. trade deficit as a barometer for evaluating the success or failure of the global trading system, U.S. trade policy, and trade agreements.

Although Congress and previous Administrations have focused on the trade deficit as a key economic issue at times, they generally have not implemented specific measures to lower the trade deficit or to make reducing bilateral trade deficits a major objective in evaluating or negotiating U.S. free trade agreements (FTAs). In addition, previous Administrations have largely avoided linking the broad rubric of national economic security, including trade policy and U.S. trade deficits, with other elements of U.S. national security.1 Rather than using tariffs and other sectoral policies to protect the interests of specific firms or specific sectors of the economy, the United States has used monetary, fiscal, and other broad policies to affect the overall course of the economy and relied on market forces to sort out which firms or sectors are successful. It also has used numerous other policy tools to address specific trade and investment issues regarding U.S. commercial economic engagement with other countries to achieve a level playing field, and other trade policy objectives.

The Trump Administration has reportedly justified its approach to trade negotiations by characterizing U.S. free trade agreements (FTAs) as unfair and detrimental to the economy, in part basing this conclusion on the size of bilateral and overall U.S. trade deficits.2 The Administration also has reportedly characterized the trade deficit as a major factor in a number of perceived ills afflicting the U.S. economy, including the rate of unemployment and slow gains in wages.3 Some analysts argue that trade agreements play an important role in the U.S. trade deficit; they contend the agreements have failed to provide U.S. exporters with reciprocal treatment or have exposed U.S. producers to increased competition. They also argue that trade deficits have cost U.S. jobs; depressed wages; are economically unsustainable; or result from unfair trade practices by foreign competitors. These issues will be addressed in later sections of this report.

While most economists are concerned over the long-term impact of sustained trade deficits on the economy, they question the role that trade agreements play in determining the trade deficit or the conclusion that the trade deficit is substantially the product of unfair treatment. Instead, standard trade theory contends that trade represents an exchange of assets between willing participants who engage in trade because they believe it maximizes their best interests.

On March 8, 2018, the Trump Administration announced that it would apply 10% tariffs on aluminum and 25% on steel products from several U.S. trading partners, based on an investigation under Section 232 of the potential national security impact of these imports.4 Similarly, the Administration announced on May 24, 2018, a Section 232 investigation into the potential national security implications of imported automobiles with potential imposition of new tariffs depending on the outcome of the investigation.5 The Administration also announced on March 22, 2018, that it would impose new tariffs on $50 billion in Chinese exports to the United States as a result of an investigation under Section 301 of China's trade practices on intellectual property and forced technology transfers; subsequently, the Trump Administration and the Chinese government announced the possible imposition of additional tariffs on each other's imports.6

Although negotiations had been underway to remove some of the proposed tariff measures related to steel and aluminum imports, the Trump Administration ended a temporary exemption from the tariffs on May 31, 2018, and proceeded to impose tariffs on steel and aluminum products imported from China, Canada, Mexico, the European Union, and other countries. To date, the amounts of proposed tariffs that have been announced are small relative to the total value of U.S. annual imports (over $2 trillion), but the actions have raised concern in financial markets, various industries, and U.S. allies over the prospect of escalating tariffs among trading partners.7 As the chief architect of the post-WWII global trading system rules and institutions, the United States generally has imposed trade restrictions under Sections 232 and 301 in limited instances since these laws were first enacted decades ago.

The overall U.S. trade deficit, or more broadly the current account balance, represents an accounting principle that expresses the difference between the country's exports and imports of goods and services. The United States has experienced an annual current account deficit since the mid-1970s. Some observers view this deficit with concern because they believe it costs U.S. jobs; depresses wages; is economically unsustainable; or results from unfair trade practices by foreign competitors. Most economists, however, argue that this characterization misrepresents the nature of the trade deficit and the role of trade in the U.S. economy. In general, most economists conclude that the overall U.S. trade deficit stems from U.S. macroeconomic policies and, as such, attempting to alter the trade deficit without addressing the underlying macroeconomic issues would be counterproductive and create distortions in the economy. This approach, however, does not preclude the possibility that some countries are not fully abiding by international trade agreements and rules or have in place other trade practices that may be discriminatory or present barriers to U.S. market access. Addressing these issues may be worthwhile, but is unlikely to affect the overall U.S. trade deficit.

Economic theory also generally concludes that liberalized trade creates both economic costs and benefits, but that the economy as a whole benefits over the long run from a more open trade environment and greater competition, because such an environment pushes an economy to use its resources more efficiently. Standard economic theory recognizes, however, that some workers and producers in the economy may experience a disproportionate share of the short-term adjustment costs that are associated with shifts in resources stemming from greater international competition. Although the attendant adjustment costs for businesses and labor are difficult to measure, some estimates suggest they may be significant over the short run and can entail dislocations for some segments of the labor force, companies, and communities. Closed plants can result in depressed commercial and residential property values and lost tax revenues, with effects on local schools, local public infrastructure, and local community viability.8

This report examines the components of the U.S. trade deficit in terms of the merchandise trade account and the broader current account. It also assesses the relationship between the trade deficit and U.S. free trade agreements, perceived unfair treatment in trading relationships, the trade deficit and U.S. rates of unemployment, and the impact of tariffs on the U.S. trade deficit, as well as raises issues for potential congressional consideration.

The U.S. Trade Deficit

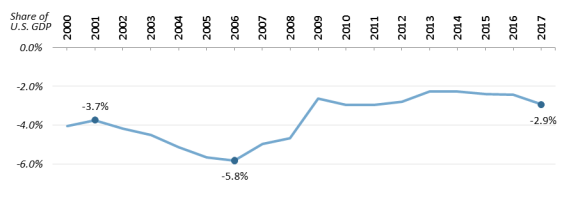

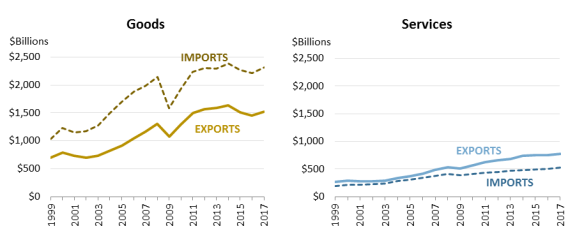

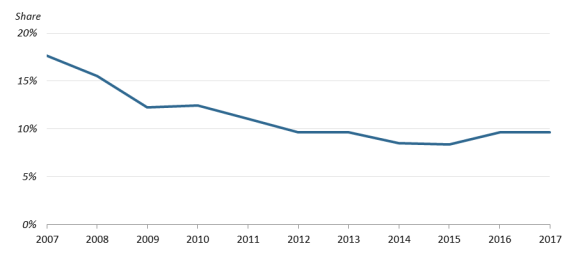

The U.S. merchandise trade deficit, a frequent focus of the Trump Administration, is an accounting of the net balance of exports and imports of goods; it is one component of the overall balance of payments. A broader measure of U.S. global economic engagement, the current account, includes trade in goods, services, and some official, or government, flows. U.S. exports in 2017 are estimated to be about $1.5 trillion; imports are estimated at $2.4 trillion; and the merchandise (goods) trade deficit is estimated to be around $811 billion on a balance of payments basis.9 Exports account for about 13% of U.S. GDP, while imports account for about 16%. Exports of services in 2017 are estimated to be about $781 billion, with services imports valued at about $538 billion, or a services surplus of about $243 billion. As a result, the combined goods and services deficit, or the current account balance, is estimated to have been about -$568 billion in 2017. Relative to the size of the U.S. economy, as measured by U.S. gross domestic product (GDP), the current account deficit currently is equivalent to less than 3.0% of U.S. GDP, as shown in Figure 1.

Between 2002 and 2007, the current account deficit grew from less than -4.0% to nearly -6.0% of U.S. GDP, reflecting a low overall national rate of saving and large capital inflows. The financial and housing mortgage lending crises from 2007 to 2009 and slowdown in global trade reduced the current account deficit by half by 2010, where it has since moved between -2.0% and -3.0% of U.S. GDP. During the decade of the 2000s, the current account deficit-to-GDP ratio averaged about -4%; after 2010, the share averaged about -3% of U.S. GDP. These values contrast with the average shares in the 1940-1970 period, when the current account-to-GDP share typically averaged less than a positive 1%, or the current account was in surplus.10

|

Figure 1. U.S. Current Account Deficit as a Relative Share of U.S. GDP (in percent share) |

|

|

Source: CRS calculations based on data published by the Census Bureau and Bureau of Economic Analysis. |

As shown in Figure 2, the United States annually experiences a deficit in goods trade, but a surplus in services trade. By standard convention, each transaction in the balance of payments has a corresponding and offsetting transaction. This means that a surplus or deficit in the merchandise trade account is offset by a transaction in the financial accounts, or a deficit in the current account is financed by an offsetting surplus transaction in the financial accounts, represented by a capital inflow.

|

|

Source: Data from Census Bureau. Figure created by CRS. Notes: Goods and services balances are on a balance of payments basis. |

Global Value Chains

Trade data typically have treated exports and imports of goods and services as strictly domestic or foreign goods. However, the rapid growth of global value chains (GVCs) and intra-industry trade (importing and exporting goods in the same industry) have significantly increased trade in intermediate goods in ways that can blur the distinction between domestic and foreign firms and goods and the accuracy of bilateral trade balances as drivers of public policy. Intermediate goods are products that are used as inputs into the production of final goods and services. Foreign value added in goods and services, or the share of the value of a good that was imported as an intermediary product, accounts for about 28% of the content on average of global exports, This share, however, can vary considerably by country and industry.11

As a result of the growth in GVCs, traditional methods of counting trade may obscure the actual sources of goods and services and the allocation of resources used in producing those goods and services. Trade in intermediate goods also means that imports may be essential inputs for exports. As a result, countries that impose trade measures restricting imports may hurt their own exports.12 Trade in intermediate goods and services through value chains uses a broad range of services in ways that have expanded and redefined the role that services play in trade. It also has increased the number of jobs in the economy that are tied directly and indirectly to international trade. Often this expanded role of trade in goods and services through trade in intermediate goods is not fully captured in trade data, particularly in bilateral merchandise trade data. While some imports and exports are substitutable, other imports represent items that are either unavailable or more costly to produce domestically. Also, demands on labor and capital markets vary substantially between export and import sectors. While some job losses associated with imports can be highly concentrated, imports also support a broad range of widely dispersed service-sector jobs in such areas as transportation, sales, finance, marketing, insurance, legal, and accounting.

Source of the Trade Deficit

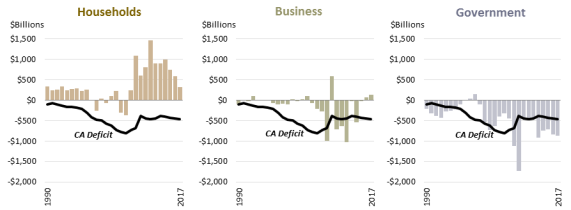

Given the current composition of the U.S. economy, most economists contend that the U.S. trade deficit is largely the product of U.S. macroeconomic policy, or the combination of fiscal and monetary policies. While this conclusion may seem counterintuitive, it stems from some basic economic relationships and the interaction of the U.S. economy with the global economy through trade and financial linkages. The economy can be represented by four major sectors: households, businesses, government, and foreign trade, represented here by the current account balance. These sectors interact to provide the basic funds for business investment and funds for the government sector. Generally, the household sector supplies the funds that are used by the government sector and by businesses to invest, as shown in Figure 3.

When the combination of three sectors—households, business, and government—creates a net savings deficit, the economy is said to experience a savings-investment imbalance. Currently, the demand for capital in the U.S. economy from the business and government sectors is outstripping the amount of savings supplied domestically by households. This gap between domestic savings and the demand for capital is filled by capital inflows. Following the financial crisis of 2008-2009, household savings increased sharply and personal consumption fell, while the business and government sectors experienced similarly sharp swings into negative net balances. The combination of these three forces tended to reduce capital inflows and the current account deficit fell from the values recorded in 2005-2007. Since 2009, household savings has remained above the levels recorded in the period immediately preceding the financial crisis, but the amounts generally have declined annually. During the same period after the financial crisis, the government sector continued to experience large net negative balances, while the business sector alternated between positive and negative net balances. Since 2009, the annual U.S. current account deficit has remained around -$500 billion (-$486.6 billion in 2016).

|

Figure 3. U.S. Net Saving Balances by Major Sector and Current Account Deficit |

|

|

Source: Data from Board of Governors of the Federal Reserve System; Bureau of Economic Analysis. Figure created by CRS. |

With floating exchange rates and liberalized capital flows, capital inflows bridge the gap between domestic sources of capital and demand, or between the total amount of savings in the economy relative to the total amount of investment, allowing the country to spend beyond its means, represented by the current account deficit.13 Typically, the exchange rate would be expected to adjust to eliminate the current account deficit over time. The United States, however, is unique in its ability to sustain current account deficits. The dollar serves as the de facto global reserve currency; this means the international value of the dollar reflects a broad range of international and domestic economic activities that can far outweigh the size of domestic trade balances alone. The overall performance of the U.S. economy, combined with economic, political, and legal institutions also make the United State an attractive location for foreign investors, especially during periods of heightened economic, political, or financial uncertainty.

Foreign capital inflows also keep U.S. interest rates below the level they otherwise would reach, which tends to support a higher rate of economic growth through increased personal consumption and business investment, but also may increase demand for imports and potentially lead to a larger current account deficit. Economists generally argue that it is this interplay between the demand for and the supply of credit in the economy, rather than the flow of manufactured goods and services, that drives the broad inflows and outflows of capital and serves as the major factor in determining the international exchange value of the dollar and, therefore, the overall size of the nation's trade deficit.

As U.S. demand for capital outstrips domestic sources of funds, domestic interest rates rise relative to those abroad, which tend to draw capital away from other countries to the United States. Capital inflows also place upward pressure on the dollar's exchange rate, pushing the exchange value of the dollar higher relative to other currencies. As the dollar rises in value, the price of U.S. exports rises and the price of imports falls, which tends to increase the current account deficit. These foreign funds have been available to the United States because foreign investors have remained willing to loan their excess savings to the United States in the form of acquiring U.S. assets. In turn, these capital inflows have accommodated the current account deficits. The sustained current account deficit would not have been possible without the accommodating inflows of foreign capital.

Due to the savings-investment imbalance in the U.S. economy, usually as the economy approaches its potential full-employment level of output, the rate of unemployment falls, credit markets tighten, interest rates rise, the savings-investment imbalance worsens, and capital inflows increase. These developments tend to strengthen the value of the dollar relative to other currencies. As a result of the appreciation in the exchange value of the dollar, generally import prices fall relative to U.S. export prices, increasing the merchandise trade deficit. In addition, usually as the economy approaches full employment, national income rises, and consumers increase their purchases of all goods, including imports, which adds to the trade deficit.

In contrast, usually when the U.S. economy is growing at a rate below its potential, demands on financial markets are reduced, interest rates fall, the savings-investment imbalance lessens, and capital inflows decline, which reduces pressure on the dollar, all other things being equal. As a result, generally the international exchange value of the dollar falls relative to other currencies and the price of U.S. exports falls, while the relative price of imports rises, which tends to make U.S. exports more competitive and reduce the trade deficit. In addition, usually when the economy underperforms, national income is below its potential and consumer spending falls. This drop in consumption reduces demand for domestic goods and for imports, which contributes to a decline in the trade deficit.

Foreign investors also often seek dollar-denominated assets as safe-haven assets during times of economic stress. This means that the balance of payments records not only the accommodating flows of capital which correspond to imports and exports of goods and services, but also autonomous flows of capital that are induced by a broad range of economic factors that are unrelated directly to the trading of merchandise goods. Foreign demand for dollars and dollar-denominated assets places upward pressure on the exchange value of the dollar, which raises the cost of U.S. exports and reduces the cost of imports. As a result, the trade deficit is the offsetting amount of the capital inflows. Demand for U.S. assets, such as financial securities, translates into demand for the dollar, since U.S. securities are denominated in dollars. As demand for the dollar rises or falls according to overall demand for dollar-denominated assets, the value of the dollar changes. These exchange rate changes, in turn, have secondary effects on the prices of U.S. and foreign goods, which tend to alter the U.S. trade balance.

One concern expressed by economists and others is the debt accumulation associated with sustained trade deficits. They argue that the long-term impact on the economy of borrowing to finance imports depends on whether those funds are used for greater investments in productive capital with high returns that raise future standards of living, or whether they are used for current consumption. Economists argue, however, that attempting to reduce the trade deficit as a public policy goal without addressing the underlying macroeconomic imbalances likely will make the economy less productive and reduce the annual rate of economic growth. Furthermore, most economists argue that domestic wage rates, the rate of unemployment, and the overall rate of growth in the economy are the product of the macroeconomic policy environment rather than from trade generally or from the trade deficit.14

Oil Prices and the Trade Deficit

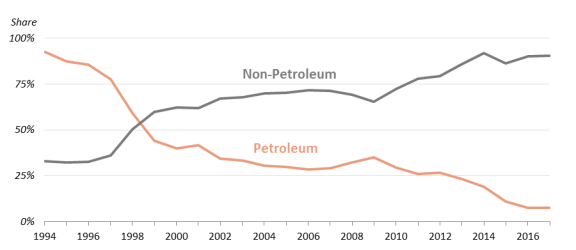

The macroeconomic origins of the trade deficit are apparent when considering changes in the price of oil and its impact on the U.S. trade deficit. Given the prominent role that energy imports have played at times in U.S. trade, the U.S. trade deficit might be expected to decline along with a decline in the price of imported oil, but that has not been the case. From 2014 to 2015, for example, the average price of an imported barrel of crude oil fell by nearly half from an average annual price of $91 per barrel to an average annual price of $47 per barrel, although the price of imported crude oil fell below $40 per barrel by the end of 2015. During this period, petroleum imports as a share of the total annual U.S. trade deficit fell from 26% to 11%. However, while the average price of imported crude oil dropped by nearly half from 2014 to 2015, the quantity of imported crude oil fell by 1.4%. As a result of the drop in crude oil prices combined with the relatively stable quantity of imports, crude oil imports fell from accounting for more than 40% on average of the annual U.S. merchandise trade deficit in 2012 to about 10% on average of the annual U.S. trade deficit in 2015.15 During 2016, the average price of imported crude oil fell to an average monthly price of $36 per barrel, before rising to an average price of $46 per barrel in 2017 and continued rising in 2018 to reach over $70 per barrel at times. By December 2017, oil imports accounted for 4% of the U.S. merchandise trade deficit, but averaged 12% of the deficit in the first quarter of 2017, compared with 9% of the deficit in the comparable period of 2018.16

Despite the drop in the average annual price of imported crude oil in 2015 and the decline in the role of imported crude oil in the value of the U.S. trade deficit, the total U.S. merchandise trade deficit increased in 2015 over that recorded in 2014, as shown in Figure 4. Instead of seeing the overall trade deficit decline, the composition of the trade deficit changed, with non-petroleum products replacing petroleum products, reflecting a growing economy and rising household consumption, seemingly affirming the proposition that the overall value of the trade deficit is determined by macroeconomic forces.

|

Figure 4. Petroleum and Non-Petroleum Shares in the Annual U.S. Merchandise Trade Deficit (in percent shares) |

|

|

Source: Data from U.S. Bureau of the Census. Figure created by CRS. |

Trade Agreements and the Trade Deficit

Some analysts argue there is a link between the trade deficit and the level of unemployment in the economy; they contend that domestic production could be substituted for imports, which could boost both production and employment in the U.S. economy. As indicated, most economists argue that the macroeconomic origins of the U.S. trade deficit mean that trade agreements tend to alter the composition of the trade deficit among various trading partners and among a different mix of goods and services, but they are unlikely to alter the overall size of the U.S. trade deficit.17 Consequently, without any changes in the underlying savings-investment balance in the economy, attempts to alter the U.S. bilateral trade balance with one country, or group of countries, could cause an offsetting deterioration in all other bilateral balances.

Ultimately, bilateral trade depends on the choices of individual firms and consumers. At the same time, bilateral trade balances are influenced by a seemingly innumerable list of economic activities at the micro level, or at the level of the individual firm or consumer, that are as diverse as the trading partners themselves. These activities can include, but are not limited to, the overall level of economic development, the abundance of raw materials, relative rates of economic growth, rates of technological change, changes in productivity, differences in rates of inflation, changes in commodity prices (especially the price of oil), and changes in exchange rates.

Economists have identified other economic effects that can arise specifically from trade agreements between two or more countries, often termed preferential trade agreements, in terms of trade creation and trade diversion. These effects can alter existing trade relationships among participants and nonparticipants in trade agreements in ways that complicate efforts to observe the cause and effect relationship between trade agreements, bilateral trade, and the trade deficit. Trade creation stems from lower tariff rates and lower import prices for the participants of the trade agreement, which tends to create new trade opportunities. In contrast, trade diversion reflects a shift in trade patterns that may arise as a result of lower tariff rates among the participants to a trade agreement. In this case, trade can be diverted away from the relatively higher-priced competitors who are not party to the agreement to competitors with relatively lower-priced goods as a result of the reduction in tariff rates. At times, countries are motivated to participate in trade agreements to forestall this type of trade diversion.

As noted above, the United States experienced an overall merchandise trade deficit in 2016 of $734.3 billion and a surplus in services trade of $247.7 billion, for a combined total of -$486.6 billion. During the same year, the United States ran a merchandise trade deficit of -$71.3 billion with the 20 FTA partner countries and a services surplus of $68.9 billion, or a goods and services deficit of -$2.5 billion. The share of the U.S. trade deficit with FTA partners, however, has fallen by nearly half over the 2007-2017 period, from 18% to about 10% of the total U.S. merchandise trade deficit, as shown in Figure 5.

|

Figure 5. U.S. Merchandise Trade Deficit With FTA Partners as a Share of the Total U.S. Merchandise Trade Deficit, 2007-2017 |

|

|

Source: Data from U.S. Census Bureau. Figure created by CRS. |

In trade with the European Union in 2016, the United States ran a goods deficit of -$146 billion and a services surplus of $54.8 billion, or a combined goods and services deficit of -$91.5 billion. With NAFTA, the United States experienced a merchandise goods trade deficit in 2016 of -$74.4 billion and a services surplus of $31.5 billion, or a combined goods and services deficit of -$42.9 billion.18

Estimating the economic effect of trade agreements on trade balances is complicated further by two major economic forces. When import prices are lowered due to a trade agreement, the lower prices have two main effects: (1) they lower the prices of imported goods, which can stimulate a shift in domestic demand toward the comparably lower-priced imported goods (the substitution effect); and (2) they increase the real purchasing power of consumers and producers, which may increase demand for all goods and services (the income effect). For some goods, these two effects work in tandem to unambiguously increase demand, tending to increase production and employment. In some cases, however, the two effects work in opposite directions: the substitution effect has a negative impact on demand, while the income effect has a positive impact on demand. In these cases, the net result of these two effects can be ambiguous.

The U.S. International Trade Commission (ITC) is tasked by Congress to provide the official U.S. government assessment of the economic effects of U.S. trade agreements. In June 2016, the ITC published a congressionally mandated19 report on the estimated economic effects of U.S. FTAs.20 The ITC's analysis considered industry-specific agreements and bilateral, regional, and multilateral agreements.21

The commission's economic analysis, as seen in Table 1, indicates that in 2012 U.S. bilateral and regional trade agreements increased U.S. aggregate trade by about 3% and U.S. real GDP and U.S. employment by less than 1%, $32.2 billion and 159,300 fulltime equivalent employees, respectively, and increased bilateral trade with partner countries by 26.3%. The ITC also estimated that bilateral and regional trade agreements had a positive effect, on average, on U.S. bilateral merchandise trade balances with the partner countries, increasing trade surpluses or reducing trade deficits by a total of $87.5 billion (59.2%) in 2015. The ITC's analysis also indicated that agreements that focus on specific industries had larger impacts on trade in their targeted industries than bilateral agreements that cover many sectors. The ITC also estimated that FTAs provided

- gains to consumers through lower prices to the extent that the lower-priced items were present in consumers' budgets;

- greater product variety;

- increased receipts for intellectual property; and

- a positive effect, on average, on U.S. bilateral merchandise trade balances with partner countries.

|

Type of economic impact |

Findings |

|

Effects on bilateral trade |

The bilateral and regional trade agreements increased bilateral trade with partner countries by 26.3% in 2012. |

|

Effects on total exports and imports |

The bilateral and regional trade agreements increased total U.S. exports by 3.6% in 2012. They increased total U.S. imports by 2.3%. |

|

Effects on real GDP |

The bilateral and regional trade agreements increased real GDP by $32.2 billion (0.2%) in 2012. |

|

Effects on U.S. labor markets |

The bilateral and regional trade agreements increased total employment by 159,300 fulltime equivalent employees (0.1%) and increased real wages by 0.3% in 2012. |

|

Effects on U.S. receipts for intellectual property |

Increases in patent protection since the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) entered into force increased U.S. international receipts for the use of intellectual property by $10.3 billion (12.6%) in 2010. |

|

Effects on international investment |

The bilateral and regional trade agreements had a mixed effect on foreign direct investment, in some cases increasing and in other cases decreasing inbound and outbound investment flows. |

|

Effects on bilateral trade balances |

The bilateral and regional trade agreements had a positive effect, on average, on U.S. bilateral merchandise trade balances with the partner countries, increasing trade surpluses or reducing trade deficits by a total of $87.5 billion (59.2%) in 2015. |

|

Effects on U.S. consumers |

The bilateral and regional trade agreements resulted in tariff savings of up to $13.4 billion in 2014, with a significant part of these savings benefiting U.S. consumers, and also increased the variety of products imported by the United States. |

|

Effects of the Information Technology Agreement (ITA) on U.S. information technology exports |

The ITA increased annual U.S. exports of covered information technology products by $34.4 billion (56.7%) in 2010. |

|

Effects of the Uruguay Round and NAFTA tariff reductions on U.S. steel imports |

These agreements are estimated to have increased annual U.S. steel imports by $1.2 billion (14.7%) in 2000. |

|

Effects on U.S. employment in the textile and apparel industries |

Rising imports, due in part to the Agreement on Textiles and Clothing (ATC), accounted for most of the reduction in U.S. employment in the apparel industry between 1998 and 2014. |

Source: Economic Impact of Trade Agreements Implemented Under Trade Authorities Procedures, 2016 Report, Publication number 4614, United States International Trade Commission, June 2016, p. 21.

Bilateral Trade and the Trade Deficit

Most economists argue that a broad range of factors affect national economies and trade balances more than even the most robust bilateral or international trade agreement. Generally, it is difficult to unravel the complicated linkages that exist between a trade agreement and the broader economy in order to track movements in bilateral trade balances. Also, global trade has been affected by macroeconomic events like the 2008-2009 financial crisis and the associated economic recession in the United States and elsewhere, which caused global trade to decline by 30% in 2009 from the previous year.22 As a result, most economists question the usefulness of using bilateral trade balances as indicators of trade relations, the effectiveness of a trade agreement, or the costs and benefits of a trade agreement. With or without a formal trade agreement, trade with specific countries may have a concentrated impact on certain sectors of the economy and entail certain adjustment costs, including changes in employment, which can be highly concentrated, with some workers, firms, and communities affected disproportionately.

On a bilateral basis, trade balances are shaped by a host of factors. Indeed, U.S. FTA partners display great variation in their economies, ranging from Canada, which has a highly developed open economy and is very close to the United States, to small, Central American developing countries whose economies are quite different in structure from the U.S. economy and who are further away from the United States. In addition, many U.S. FTA partners represent economies that are substantially smaller than the U.S. economy and often are limited in what they produce. As a result, U.S. trade with these countries often is concentrated in a small number of items and often is comprised of trade in raw materials and intermediate processed goods. In most of the countries that have an FTA with the United States, the top 10 export and import commodities account for significant shares of total bilateral trade: more than 90% in some cases. Also, bilateral trade is reliant in some cases on trade in raw materials and agricultural commodities; in other cases, bilateral trade is based on trade in energy items, particularly U.S. trade with Canada and Mexico. Such differences in the underlying structure of trade with particular trading partners, however, complicate efforts to compare the performance of one trade agreement with another and to derive cause and effect relationships between the implementation of an FTA and bilateral trade balances.

Another factor that can affect bilateral trade relations and trade balances is the composition of trade relationships, which differ from one country to another. While trade agreements determine the rules by which nations conduct trade and provide incentives to consumers in the form of lower tariff rates and firms in the form of lower trade barriers, behavioral characteristics of consumers and firms determine how those incentives affect bilateral trade. Economists often attempt to estimate the impact of a trade agreement on bilateral trade based on estimates of the strength of the responsiveness by consumers and firms to the incentives provided by the agreement. The responsiveness of consumers and firms to the incentives associated with trade agreements seems to vary by different types of goods, or by major end-use categories. Consumer purchases of luxury goods, for instance, are highly responsive to changes in prices and consumers' incomes, while consumer consumption of agricultural products is less responsive.

Although China is a major U.S. trading partners with large trade imbalances, the United States does not have an FTA with China. Over four decades, China has risen from a poor developing country to become a major global economic power in ways that are challenging the established economic order. In particular, China is intervening in its economy in various ways to alter the basic structure of its economy and its trade relationships, while seeking to exert a role in the global economic order in line with its economic presence.23 Given the size of the U.S. trade deficit with China, it has received particular attention from the Trump Administration, which has indicated its interest is gaining commitments from China to reduce the size of its annual bilateral trade deficit.24

Another factor potentially affecting U.S. bilateral trade deficits mentioned by the Trump Administration, some Members of Congress, and others is the prospect of "unfair" foreign trade practices. There is no official definition of what constitutes an "unfair" foreign trade practice. Some countries, however, may not be fully abiding by international trade agreements and rules, or they may continue to maintain certain trade barriers. Annually, the United States Trade Representative (USTR) prepares a report mandated by Congress on formal and informal barriers that negatively affect U.S. exports of goods and services to, and investments with, U.S. trade partners. While formal barriers to trade in goods, often constituting product-specific tariffs, can be estimated, barriers to trade in services and investments and other nontariff barriers rarely have an estimated dollar-equivalent value. The report also notes that:

Trade barriers elude fixed definitions, but may be broadly defined as government laws, regulations, policies, or practices that either protect domestic goods and services from foreign competition, artificially stimulate exports of particular domestic goods and services, or fail to provide adequate and effective protection of intellectual property rights.25

In evaluating foreign trade barriers, the Trade Barriers report classifies trade barriers into ten categories, including

- Importing policies (tariffs and other import charges, quantitative restrictions, import licensing, customs barriers, and other market access barriers);

- Sanitary and phytosanitary measures and technical barriers to trade;

- Government procurement (e.g., buy national policies and closed bidding);

- Export subsidies (e.g., export financing on preferential terms and agricultural export subsidies that displace U.S. exports in third country markets);

- Lack of intellectual property protection (e.g., inadequate patent, copyright, and trademark regimes and enforcement of intellectual property rights);

- Services barriers (e.g., limits on the range of financial services offered by foreign financial institutions, restrictions on the use of foreign data processing, and barriers to the provision of services by foreign professionals);

- Investment barriers (e.g., limitations on foreign equity participation and on access to foreign government-funded research and development programs, local content requirements, technology transfer requirements and export performance requirements, and restrictions on repatriation of earnings, capital, fees and royalties);

- Government-tolerated anticompetitive conduct of state-owned or private firms that restricts the sale or purchase of U.S. goods or services in the foreign country's markets;

- Digital trade barriers (e.g., restrictions and other discriminatory practices affecting cross-border data flows, digital products, internet-enabled services, and other restrictive technology requirements); and

- Other barriers (barriers that encompass more than one category, e.g., bribery and corruption, or that affect a single sector).26

The Trade Barriers report notes that it attempts to provide a quantitative assessment of the potential effect of removing certain foreign trade barriers on particular U.S. exports, but that such estimates cannot be used to determine the total effect on U.S. exports either to the country in which a barrier has been identified or to the world in general. According to the report, the estimates cannot be aggregated to derive a total estimate of the gains in U.S. exports to a given country or to the world that would be derived from reducing or eliminating the identified trade barriers.27

Trade Deficits and Unemployment

Some analysts argue that the trade deficit translates to a net loss of jobs in the economy by implying that domestic production could be substituted for imports, which would boost both production and jobs in the U.S. economy. Most economists argue that equating a trade deficit, whether on a bilateral basis or overall, with unemployment or job losses is questionable given the macroeconomic origin of the trade deficit and the relatively limited role trade plays in the U.S. economy. In general terms, viewing trade balances in isolation or as a measure of a trade agreement represents an approach that is fundamentally different from general economic arguments concerning the costs and benefits of trade and trade agreements.

The Commerce Department's International Trade Administration (ITA) estimates that U.S. exports of goods and services in 2016 supported 10.7 million jobs, or 7.4% of the U.S. workforce—6.3 million in the goods producing sector and 4.4 million in the services sector. In some cases, various groups have argued that if a certain number of jobs were supported by $1 billion of exports, then that same number could be used to estimate the number of jobs that would be "lost" by $1 billion of imports, represented by the trade deficit, so any net increase in imports with FTA countries would necessarily result in a loss of employment for the economy. The ITA's methodology, however, is unique to estimating a static number of jobs supported (not created) by exports. The composition of U.S. imports is fundamentally different from that of U.S. exports.28

While some imports and exports represent clearly substitutable items, which may adversely affect U.S. jobs, other imports represent inputs to further processing, or are items that either are not available or are not fully available in the economy. In addition, import-competing industries likely do not have the same mix of capital and labor in their production processes as do export-oriented industries so that demands on capital and labor markets could vary substantially across industrial sectors. Also, demands on labor and capital markets vary between export and import sectors. Some job losses associated with imports can be highly concentrated. Imports also support a broad range of widely dispersed service-sector jobs, in such areas as transportation, sales, finance, marketing, insurance, and accounting.

Although some observers argue that international trade and trade deficits in particular tend to reduce the number of jobs and increase the unemployment rate for the economy as a whole, the data and economic theory offer a mixed assessment. International competition may be one among a number of factors that affect the overall composition of employment in the economy and may result in job gains and losses. In general, the unemployment rate and the trade deficit are not directly related.29 Over the long run, however, sustained trade deficits in which foreigners acquire U.S. assets through export earnings and expropriate profits or other income earned from their asset holdings could result in a reduced amount of capital available in the U.S. economy and, thereby, potentially reduce the rate of economic growth and total employment. Such effects could be offset somewhat by the extent to which the capital outflows tended to weaken the exchange value of the dollar and improve the price competitiveness of U.S, exports, potentially increasing production and employment in the export sector.

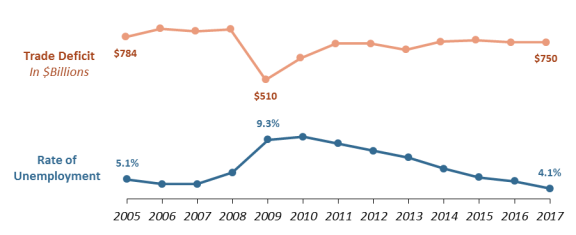

Recent data indicate that high unemployment rates have occurred during periods when there were smaller deficits in the merchandise trade accounts as a result of the overall industrial composition of the economy. For instance, in 2006, the U.S. unemployment rate had fallen to about 4.0%, with the economy growing at an annual rate of 2.7%. At the same time, the economy experienced a merchandise trade deficit of over -$800 billion, as shown in Figure 6. In 2009, however, the rate of economic growth had fallen to a negative 3.0% and the rate of unemployment had risen to 9.9%, but the trade deficit had fallen to -$510 billion.30

|

Figure 6. U.S. Merchandise Trade Deficit and Rate of Unemployment 2005-2017 |

|

|

Source: Data from Bureau of Economic Analysis and Bureau of Labor Statistics. Figure created by CRS. |

Since 2009, the annual U.S. merchandise trade deficit increased from around -$500 billion to around -$750 billion in 2011; it has remained within a narrow range through 2017. During this same period, however, the rate of unemployment has fallen from nearly 10% in 2010 to under 4.0% in mid-2018.

While many of the economic arguments can be arcane at times, economists generally contend that from the perspective of the economy as a whole, both consumers and producers benefit from liberalized trade and that the gains for the economy as a whole outweigh the costs, irrespective of the bilateral trade deficit or surplus. Most economists argue that the economy operates more efficiently as a result of competition through international trade and that consumers throughout the economy experience a wider variety of goods and services at varying levels of quality and price than would be possible in an economy closed to international trade. They also contend that trade may have a long-term positive dynamic effect on an economy that enhances both production and employment. In addition, U.S. trade agreements comprise a broad range of issues that may affect trade and commercial relations over the long run between the negotiating parties, particularly for developing and emerging economies.

In a dynamic economy like that of the United States, jobs are constantly being created and replaced as some economic activities expand, while others contract. For instance, the Department of Labor reported that there was an annual average of 147 million jobs in the U.S. economy in 2017. During this same period, jobs supported by exports were estimated at 10.7 million jobs. The data also indicate that in 2017 there were 12.9 million gross jobs gained in the economy and 10.9 million gross jobs lost, accounting for 8.8% and 7.4%, respectively, of the number of jobs in the economy, or amounts that are greater than the total number of jobs in the economy that were supported by exports. The combined share of 16.2% (the combined shares of gross jobs gained and lost) reflects the process of job turnover during the year, or the churning in the labor market.31 As part of this constant economic transformation process, various industries and sectors evolve at different speeds, reflecting differences in technological advancement, productivity, and efficiency. Those sectors that are the most successful in developing or incorporating new technological advancements generate greater economic rewards and are capable of attracting larger amounts of capital and labor. In contrast, those sectors or individual firms that lag behind attract less capital and labor and confront ever-increasing competitive challenges. Indeed, to avoid economic stagnation, some sectors may need to relinquish some capital and labor so that others sectors can grow.

Beyond external forces that affect the economy, multi-directional interactions within the economy complicate efforts to determine cause and effect relationships between trade and trade agreements and the gains or losses of jobs. International trade is not the primary force that creates jobs in the U.S. economy; exports account for about 13% of total U.S. annual GDP, compared with 45% in Germany and 30% in Canada.32 The total number of jobs and the overall level of production in the United States are determined by such macroeconomic factors as productivity growth, the growth rate of the population, worker participation rates, and the pace of technological innovation. To the extent that foreigners repatriate profits from their U.S. activities, the international exchange value of the dollar would decline as foreigners trade dollars for foreign currency. A lower-valued dollar, in turn, reduces the price of U.S. exports in foreign markets, potentially increasing U.S. production and employment in the export sector.

Trade Deficits and Import Tariffs

The United States generally has aimed over several decades to negotiate lower tariff and other trade barriers through reciprocal multilateral, regional and bilateral agreements. It has avoided imposing import tariffs as a broad approach to reducing the trade deficit out of a commitment to support principles of multilateral rules and nondiscrimination and due to concerns over the potentially negative effects on the economy of higher tariffs. At the same time, the United States and its trading partners have adopted special safeguards and other specific rules to address import surges and certain unfair trade practices that may cause or threaten to cause injury to domestic industries, which could lead to tariff remedies in specific instances. It also has supported worker retraining and other social safety net policies to mitigate the potential adverse effects of trade liberalization.33 The three most frequently applied U.S. trade remedies are: (1) antidumping (AD), which provides relief to domestic industries that have experienced, or are threatened with, material injury caused by the adverse impact of imports sold in the U.S. market at prices determined to be less than fair market value; (2) countervailing duties (CVD), which provide relief to domestic industries that are threatened with material injury due to the adverse impact of imported goods that have been subsidized by a foreign government or public entity; and (3) safeguards (also referred to as escape clauses), which provide temporary relief from imports of fairly traded goods that cause or threaten to cause serious injury. Identified as Section 201 of the Trade Act of 1974, the safeguards clause may provide domestic industries with temporary relief from import competition through a temporary import duty, import quota, or a combination of both, based on a presidential decision.34 In January 2018, the Trump Administration announced safeguard tariffs on imports of large washing machines, solar cells and modules for three years.35

According to standard economic theory, import tariffs generally create two sets of effects: microeconomic effects at the consumer and firm level; and macroeconomic effects through movements in the exchange rate. These combined effects may partially or fully offset the intended impact of the tariff, challenging the tariff's usefulness as a policy tool for correcting trade imbalances. In general, an import tariff raises the price of imports relative to similar domestically produced goods. The difference in price between imports and domestic goods is intended to shift demand toward domestic products, with anticipated changes in increased domestic production and employment in the protected sector. How these microeconomic effects unfold, however, likely depends on a number of factors, including the response by domestic producers, foreign producers, and domestic consumers.

Industry and Consumer-level Effects

As domestic producers attempt to increase production in response to a tariff-induced shift in demand, they would require additional capital and workers. The cost of acquiring these resources, however, depends on how fully employed such resources are within the economy. As the economy approaches full employment, firms attempting to increase employment or gain additional capital need to bid those resources away from other firms and economic activities in the economy, ultimately raising production costs for all firms. Such resource constraints would become increasingly more binding the closer the economy moves toward full employment. To the extent that such price increases are passed along through the economy to other producers and consumers, the real incomes of firms and consumers would be eroded, leading to a lower overall level of consumption of domestic and imported goods. In addition, an increase in domestic prices could erase the price advantage for domestic firms that initially stems from the tariff on imports, making them no more competitive with foreign firms than they were prior to the tariff, while saving neither workers nor firms in the protected sectors. For instance, various studies suggest that protection for the steel sector through tariffs and quotas have not reversed the decline in the steel sector.36 To the extent that domestic firms can find substitutes for the imported items, such as glass and plastic for aluminum, they may be successful in avoiding prices increases over the near term. Over the long term, however, a shift to substitutes will require additional resources shifting to those sectors with associated price increases as firms attempt to increase output by drawing resources away from other economic activities.

Foreign firms can also affect the domestic economic impact of tariffs on imports. In general terms, standard economic theory assumes that foreign firms will pass along the entire tariff in terms of higher prices. In some cases, however, foreign firms may opt to reduce their profit margins to maintain their market shares. In this case, domestic firms in the protected market would not experience a shift in demand away from higher-priced imports and market conditions would remain as before the imposition of the tariff.

The impact of an import tariff on consumers generally is considered to be the single largest effect. Price increases in the economy associated with an import tariff likely would ripple through the economy, ultimately affecting all consumers. Although the economic impact on any single consumer may be small, the cumulative effect for the economy as a whole could be large. Price increases in the economy associated with the tariff would erode consumers' real incomes and result in a lower level of consumption of domestic and imported goods. To the extent that the tariffs reduce imports, consumers could also experience fewer consumption choices.

Macroeconomic Effects

In a global economy with floating exchange rates and markets interconnected through large cross-border capital flows, movements in the values of exchange rates could have a determinative effect on the economic impact of an import tariff. As previously indicated, an import tariff raises the price of imports relative to domestic goods, spurring a shift in demand away from imports toward domestically produced goods. This shift away from foreign goods also implies a shift in demand away from foreign currencies, since imports are priced in foreign currency. For the United States, such a shift would imply a weaker foreign currency relative to the dollar, or an appreciation in the relative exchange value of the dollar. In turn, a stronger dollar makes imports less expensive, thereby offsetting some or potentially the entire tariff, while raising the price of U.S. exports. As a result, imports as a whole would increase, while U.S. exports would decline, thereby increasing the overall U.S. trade deficit. To the extent that lower foreign exports due to the tariff negatively affect the economic growth prospects of U.S. trade partners, the United States could become a relatively more attractive place to invest, resulting in additional capital inflows likely appreciating the international exchange value of the dollar.

Issues for Congress

The persistence of the U.S. current account deficit and its impact on the economy are hotly debated among policymakers and among some economists. For Members of Congress and other policymakers, the trade deficit may raise questions concerning the impact on jobs and the economy more broadly, especially for some communities, firms, and workers.37 Among economists, concerns generally focus on the long-term impact of the deficit on the accumulation of the debt associated with sustained trade deficits. Since taking office, the Trump Administration has used the U.S. trade deficit as a proxy for evaluating the success or failure of the global trading system and of U.S. trade policy. It also has characterized the trade deficit as a major factor in a number of ills afflicting the U.S. economy.

For Congress, the U.S. trade deficit potentially raises a number of questions, including

- Given the macroeconomic nature of the trade deficit, as is generally accepted, what policy mix should Congress pursue to address the underlying economic issues that are driving the trade deficit? What role should or do trade agreements and U.S. trade policy play in addressing the trade deficit?

- Congress faces a number of complex trade policy issues. Within this mix, how much importance should Congress place on lowering the trade deficit relative to competing policy goals, given the combination of macroeconomic, or fiscal and monetary policies, the nation has chosen that drive the trade deficit?

- Another issue facing Congress is the role of foreign trade barriers and "unfair" trade practices in affecting the U.S. trade deficit. Addressing foreign trade barriers and unfair trade practices has been a long-term objective of Congress and U.S. trade policy and aimed at removing such barriers and practices potentially can improve the international trading system and build public support for trade and trade agreements. At the same time, given the underlying macroeconomic drivers of the trade deficit can governments lower or increase trade deficits by mandating reductions through managed trade? Will proposed and increased U.S. tariffs achieve a lower trade deficit?

- Given the link often made between the trade deficit and employment in the economy, should there be a closer examination of the role the trade deficit plays relative to other domestic factors in determining wages and employment in the economy?

- The role of the dollar as the preeminent global reserve currency facilitates the persistent current account deficits. Should the costs and benefits of this role be examined more closely?