The 2017 tax revision (P.L. 115-97) temporarily authorized Opportunity Zone (OZ) tax incentives for investments held by Qualified Opportunity Funds (QOFs) in qualified OZs.1 The Community Development Financial Institutions (CDFI) Fund (hereinafter, the "Fund"), organized under the Department of the Treasury, will designate qualified census tracts that are eligible for OZ tax incentives. The Fund will also certify QOFs that are eligible to claim tax incentives for eligible activities within an OZ. Qualified OZ designations are in effect for 10 years. The tax benefits for these investments include a temporary tax deferral for capital gains reinvested in a QOF, a step-up in basis for any investment in a QOF held for at least five years (10% basis increase) or seven years (15% basis increase), and a permanent exclusion of capital gains from the sale or exchange of an investment in a QOF held for at least 10 years. The Joint Committee on Taxation estimated that the provision will cost $1.6 billion over 10 years.2

This report briefly describes what census tracts are eligible to be nominated as an OZ by the "chief executive officer" (typically, the governor) of each state or territory, what types of entities can be certified as QOFs, and the tax benefits of investments in QOFs.3

For further reading on the Fund's other programs and analysis of related policy issues, see CRS Report R42770, Community Development Financial Institutions (CDFI) Fund: Programs and Policy Issues, by [author name scrubbed].

What Census Tracts Can Be Nominated as Opportunity Zones?

To become a qualified OZ, the CEO (e.g., governor) of the state must nominate, in writing, a limited number of census tracts to the Secretary of the Treasury.4 A nominated tract must be either (1) a qualified low-income community (LIC), using the same criteria as eligibility under the New Markets Tax Credit (NMTC),5 or (2) a census tract that is contiguous with a nominated LIC if the median family income of the tract does not exceed 125% of that contiguous, nominated LIC.6 Nominations were due to the Fund by March 21, 2018.7

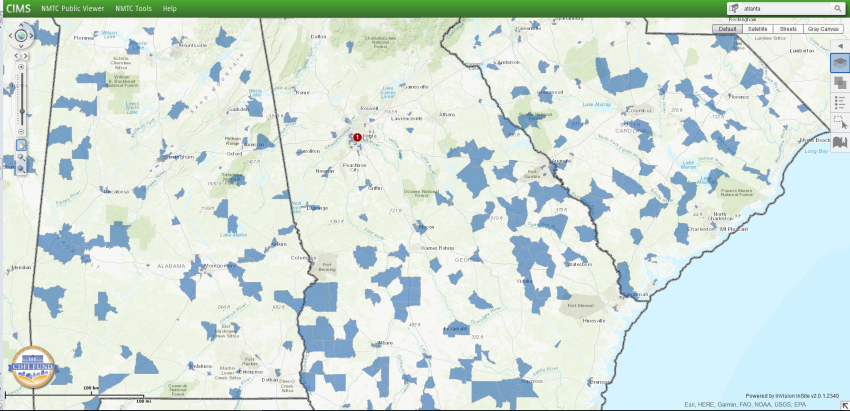

Figure 1 provides a screenshot of the Fund's online mapping tool, which displays census tracts that have been nominated as an OZ by the state or territory's CEO (as of April 23, 2018). An official list of qualified OZs will be published in the Federal Register at a later time, to be determined.

|

Figure 1. CDFI Fund Mapping Tool Showing Designated Opportunity Zones (OZs) |

|

|

Source: CRS screenshot of CDFI Fund, CIMS mapping tool, accessed April 23, 2018, at https://www.cims.cdfifund.gov/preparation/?config=config_nmtc.xml. Notes: Census tracts that have been designated by the state or territory's chief executive (e.g., governor) and submitted to the Fund are shown in blue. An official list of qualified Opportunity Zones will be published in the Federal Register at a later date. States that do not display any blue OZ designations might have requested a 30-day extension of the March 21, 2018 deadline to submit OZ designations to the CDFI Fund. |

P.L. 115-97 limits the number of census tracts within a state that can be designated as qualified OZs based on the following criteria:

- If the number of LICs in a state is less than 100, then a total of 25 census tracts may be designated as qualified OZs.

- If the number of LICs in a state is 100 or more, then the maximum number of census tracts that may be designated as qualified OZs is equal to 25% of the total number of LICs.

- Not more than 5% of the census tracts designated as qualified OZs in a state can be non-LIC tracts that are contiguous to nominated LICs.

Table 1 displays the maximum number of census tracts in each state or territory that are eligible for OZ designation under each of the two nomination criteria.

Table 1. Maximum Number of Census Tracts Eligible

for Opportunity Zone Designation, by State or Territory

|

A |

B |

C |

|

|

State/Territory |

Total Number of Low-Income Community (LIC) Tracts in State |

Maximum Number of Tracts That Can Be Nominated (the greater of 25% of All LICs or 25 if state has fewer than 100 LICs) |

Maximum Number of Eligible Non-LIC Contiguous Tracts That Can Be Nominated (5% of Column B) |

|

Alabama |

629 |

158 |

8 |

|

Alaska |

55 |

25 |

2 |

|

American Samoa |

16 |

25 |

See Notes |

|

Arizona |

671 |

168 |

9 |

|

Arkansas |

340 |

85 |

5 |

|

California |

3,516 |

879 |

44 |

|

Colorado |

501 |

126 |

7 |

|

Connecticut |

286 |

72 |

4 |

|

Delaware |

80 |

25 |

2 |

|

District of Columbia |

97 |

25 |

2 |

|

Florida |

1,706 |

427 |

22 |

|

Georgia |

1,039 |

260 |

13 |

|

Guam |

31 |

25 |

2 |

|

Hawaii |

99 |

25 |

2 |

|

Idaho |

109 |

28 |

2 |

|

Illinois |

1,305 |

327 |

17 |

|

Indiana |

621 |

156 |

8 |

|

Iowa |

247 |

62 |

4 |

|

Kansas |

295 |

74 |

4 |

|

Kentucky |

573 |

144 |

8 |

|

Louisiana |

597 |

150 |

8 |

|

Maine |

128 |

32 |

2 |

|

Maryland |

593 |

149 |

8 |

|

Massachusetts |

550 |

138 |

7 |

|

Michigan |

1,152 |

288 |

15 |

|

Minnesota |

509 |

128 |

7 |

|

Mississippi |

399 |

100 |

5 |

|

Missouri |

641 |

161 |

9 |

|

Montana |

90 |

25 |

2 |

|

Nebraska |

176 |

44 |

3 |

|

Nevada |

243 |

61 |

4 |

|

New Hampshire |

105 |

27 |

2 |

|

New Jersey |

676 |

169 |

9 |

|

New Mexico |

249 |

63 |

4 |

|

New York |

2,055 |

514 |

26 |

|

North Carolina |

1,007 |

252 |

13 |

|

North Dakota |

50 |

25 |

2 |

|

Northern Mariana Islands |

20 |

25 |

See Notes |

|

Ohio |

1,280 |

320 |

16 |

|

Oklahoma |

465 |

117 |

6 |

|

Oregon |

342 |

86 |

5 |

|

Pennsylvania |

1,197 |

300 |

15 |

|

Puerto Rico |

835 |

See Notes |

See Notes |

|

Rhode Island |

78 |

25 |

2 |

|

South Carolina |

538 |

135 |

7 |

|

South Dakota |

69 |

25 |

2 |

|

Tennessee |

702 |

176 |

9 |

|

Texas |

2,510 |

628 |

32 |

|

Utah |

181 |

46 |

3 |

|

Vermont |

48 |

25 |

2 |

|

Virgin Islands |

13 |

25 |

See Notes |

|

Virginia |

847 |

212 |

11 |

|

Washington |

555 |

139 |

7 |

|

West Virginia |

220 |

55 |

3 |

|

Wisconsin |

479 |

120 |

6 |

|

Wyoming |

33 |

25 |

2 |

Source: CDFI Fund, "Opportunity Zones Information Resources," updated February 27, 2018, at https://www.cdfifund.gov/Pages/Opportunity-Zones.aspx.

Notes:

Puerto Rico: The Bipartisan Budget Act of 2018 (P.L. 115-123) deemed each population census tract in Puerto Rico that is a low-income community to be certified and designated as a qualified OZ. The maximum number of tracts that can be nominated by Puerto Rico as well as the maximum number of Eligible Non-LIC Contiguous Tracts that may be included in that nomination is being determined by the CDFI Fund and will be reflected in an update to the table.

USVI: The U.S. Virgin Islands may nominate Eligible Non-LIC Contiguous Tracts, provided that the nominated non-LIC tracts do not exceed 5% of all nominated tracts (both low-income communities and nominated contiguous tracts). Thus the Virgin Islands may nominate no more than one of its Eligible Non-LIC Contiguous Tracts.

Northern Mariana Islands and American Samoa: Neither the Northern Mariana Islands nor American Samoa has any Eligible Non-LIC Contiguous Tracts.

What Is a Qualified Opportunity Fund?

Qualified Opportunity Funds (QOFs) are defined in P.L. 115-97 as follows:

... any investment vehicle which is organized as a corporation or partnership for the purpose of investing in qualified opportunity zone property (other than another qualified opportunity fund) that holds at least 90% of its assets in qualified opportunity zone property...

"Qualified Opportunity Zone (OZ) property" can be stock or partnership interest in a business located within a qualified OZ or tangible business property located in a qualified OZ. Qualified OZ property must have been acquired by the QOF after December 31, 2017. For each month that a QOF fails to meet the 90% requirement it must pay a penalty equal to the excess of the amount equal to 90% of its aggregate assets divided by the aggregate amount of qualified OZ property held by QOF multiplied by an underpayment rate (short-term federal interest rate plus three percentage points). There is an exception from this general penalty for reasonable cause. P.L. 115-97 authorizes the Fund to promulgate regulations and rules regarding specific processes for QOF certification.

What Are the Tax Benefits for Qualified Investments?

P.L. 115-97 provides three main tax incentives to encourage investment in qualified OZs:

- 1. Temporary deferral of capital gains that are reinvested in qualified OZ property: Taxpayers can defer capital gains tax due upon sale or disposition of a (presumably non-OZ) asset if the capital gain portion of that asset is reinvested within 180 days in a QOF.8

- 2. Step-up in basis for investments held in QOFs: If the investment in the QOF is held by the taxpayer for at least five years, the basis on the original gain is increased by 10% of the original gain. If the OZ asset or investment is held by the taxpayer for at least seven years, the basis on the original gain is increased by an additional 5% of the original gain.

- 3. Permanent exclusion of capital gains tax on qualified OZ investments held for at least 10 years: Investments maintained (a) for at least 10 years and (b) until at least December 31, 2026, will be eligible for permanent exclusion of capital gains tax on any gains from the qualified OZ portion of their investment when sold or disposed.

Table 2. Illustration of Opportunity Zone (OZ) Tax Benefits

for a Hypothetical Investment of $100,000 in Reinvested Capital Gains

(Assuming an annual rate of return of 7%)

|

A |

B |

C |

D |

|

|

Year of Investment |

Investment Value |

Increase in Adjusted Basis |

Qualified OZ Investment Return |

Amount of Capital Gains Subject to Tax |

|

0 |

$100,000 |

$0 |

$0 |

$100,000 |

|

1 |

$107,000 |

$0 |

$7,000 |

$107,000 |

|

2 |

$114,490 |

$0 |

$14,490 |

$114,490 |

|

3 |

$122,504 |

$0 |

$22,504 |

$122,504 |

|

4 |

$131,080 |

$0 |

$31,080 |

$131,080 |

|

5 |

$140,255 |

$10,000 |

$40,255 |

$130,255 |

|

6 |

$150,073 |

$10,000 |

$50,073 |

$140,073 |

|

7 |

$160,578 |

$15,000 |

$60,578 |

$145,578 |

|

8 |

$171,819 |

$15,000 |

$71,819 |

$156,819 |

|

9 |

$183,846 |

$15,000 |

$83,846 |

$168,846 |

|

10 |

$196,715 |

$15,000 |

$96,715 |

$85,000a |

Source: CRS calculations.

Notes: This hypothetical calculates OZ tax benefits from $100,000 in capital gains earned from outside of an OZ (e.g., sale of appreciated real property) that is rolled over into a qualified opportunity fund (QOF), assuming constant reinvestment over the life of the OZ investment (i.e., no periodic dividends issued from the qualified opportunity fund to the investor). Generally, taxes on accrued capital gains (or losses) are not due in a particular tax year until the gain (or loss) is realized. This example does not include any economic benefit from the deferral of the capital gains of the initial $100,000 investment rolled into the OZ investment.

a. Investments maintained (a) for at least 10 years and (b) until at least December 31, 2026, will be eligible for permanent exclusion of capital gains tax on any gains from the qualified OZ portion of their investment when sold or disposed. In this hypothetical, the $96,715 in earnings over the 10 years that the investment is held in a QOF would be excluded from capital gains tax, and tax would be due on the initial $100,000 in outside capital gains rolled over into the QOF after applying the OZ adjusted basis increase benefit of 15% (i.e., tax due on $85,000 in capital gains).

Table 2 illustrates the tax benefits to a hypothetical investment of $100,000 in a QOF. This investment could be $100,000 in capital gains earned from the sale or disposition of another asset (e.g., real property) from outside of an OZ that is reinvested into a QOF within 180 days from the date of that sale or disposition. Taxes on these capital gains are deferred while the investment is held in a QOF.

Column A shows the investment's value over time, assuming a 7% annually compounded rate of return. This hypothetical investment is simplified to assume that an initial investment is made in a QOF in year one and the QOF constantly reinvests any returns to that initial investment (i.e., the QOF does not pay out a periodic dividends to the investor during the life of the investment).

Column B shows the increase in adjusted basis earned from holding that investment in a QOF over time: 10% of the original capital gain of $100,000 after the investment is held in a QOF for at least five years and 15% after the capital gain is held for at least seven years.

Column C shows the qualified OZ investment return. This is the 7% annual rate of return after the $100,000 in outside capital gains has been reinvested in a QOF. This return is subject to capital gains tax if the investment is sold or disposed within 10 years.

Column D shows the basis for capital gains tax if the investment in a QOF is sold or disposed in any of the 10 years shown. One of the three major economic incentives to investing in a QOF is the permanent exclusion of capital gains earned after the acquisition of the QOF investment. Put differently, in Year 10, the taxpayer pays no capital gains tax on earnings in column C and is subject to capital gains tax on $85,000 ($100,000*0.85) that was initially reinvested in a QOF. In contrast, if the investment in the QOF was sold in year nine, the taxpayer would have to pay capital gains tax on all of the QOF earnings (column C) but would still have the benefit of the step-up in basis on the initial investment in the QOF (column B).

Note that Table 2 only shows the tax-related benefits of investing in a QOF. It does not include the economic benefits of deferring capital gains tax on the initial $100,000 investment, which would depend on the time value of money. From an income tax perspective, though, deferral of capital gains tax just delays a tax liability from one period to another.

Actual QOF investment structures could differ from the arrangement in Table 2. As seen in the New Markets Tax Credit (NMTC), investors have developed financial structures that increase the amount of other funding from either private or public sources that are used with the NMTC (i.e., increasing leverage on the NMTC investment).9 Additional layers of financing structures could increase the complexity of investment arrangements and costs attributed to fees and transactional costs instead of development.10

OZ tax incentives are in effect from the enactment of P.L. 115-97 on December 22, 2017, through December 31, 2026. There is no gain or deferral available with respect to any sale or exchange made after December 31, 2026, and there is no exclusion available for investments in qualified OZs made after December 31, 2026.