Under the Outer Continental Shelf Lands Act (OCSLA), as amended,1 the Bureau of Ocean Energy Management (BOEM) must prepare and maintain forward-looking five-year plans—referred to by BOEM as five-year programs—for proposed public oil and gas lease sales on the U.S. outer continental shelf (OCS). During the Obama Administration, BOEM released a leasing program for the period from mid-2017 through mid-2022.2 The program schedules 11 lease sales on the OCS during the five-year period: 10 in the Gulf of Mexico region (occurring twice each year), 1 in the Cook Inlet planning area of the Alaska region (scheduled for 2021), and none in the Atlantic or Pacific regions. Three sales proposed in earlier versions of the program—one in the Atlantic and two off Alaska—were not ultimately included in the program. On April 28, 2017, President Trump issued an executive order directing the Secretary of the Interior to review and consider revising the 2017-2022 program.3

The leasing decisions in BOEM's five-year programs may affect the economy and environment of individual coastal states and of the nation as a whole. Accordingly, Congress typically has been actively involved in planning and oversight of the five-year programs. The following discussion summarizes developments in the 2017-2022 program and considers selected congressional issues and actions related to the program. The history, legal and economic framework, and process for developing the program are discussed in CRS Report R44504, The Bureau of Ocean Energy Management's Five-Year Program for Offshore Oil and Gas Leasing: History and Final Program for 2017-2022.

The 115th Congress could influence the five-year program by enacting legislation to alter the program, as well as by conducting oversight. For example, Members could enact legislation to add new sales to the program (e.g., H.R. 1756, S. 665, and S. 883) or to remove scheduled sales. Congress also could end leasing moratoria imposed by Congress or the President on some offshore areas, and could mandate sales in these previously unavailable areas.4 Alternatively, Congress could impose leasing moratoria on new areas; for example, H.R. 169, H.R. 728, H.R. 731, H.R. 2002, H.R. 2242, H.R. 2252, H.R. 2272, S. 31, S. 74, S. 750, and S. 999 would prohibit oil and gas leasing (or extend existing moratoria) in various parts of the OCS.

The options for the Administration to alter the finalized five-year program are more constrained than those of Congress. The Secretary of the Interior's review of the 2017-2022 leasing program under President Trump's executive order must adhere to the program development process required by the OCSLA,5 which includes requirements for analysis, public input, and environmental review under the National Environmental Policy Act.6 The process typically takes two to three years. Additionally, any revision of the five-year program by the Administration could not provide for sales in areas that remained under congressional moratorium or presidential withdrawal. However, President Trump's executive order ended previous presidential withdrawals in parts of the Arctic and Atlantic regions, thus opening these areas for leasing consideration in a revised five-year program. Legal challenges to this aspect of the executive order have arisen.7

Recent Developments

On April 28, 2017, President Trump issued an executive order on U.S. offshore energy strategy. The executive order directs the Secretary of the Interior to review and consider revising the federal offshore oil and gas leasing schedule for 2017-2022, along with other offshore energy policies established by the Obama Administration. The order also modifies earlier presidential withdrawals of certain offshore areas from leasing consideration. For more information on the executive order, see CRS Insight IN10698, Review of Offshore Energy Leasing: President Trump's Executive Order.

The executive order specifies that any revisions to the 2017-2022 program must not hinder ongoing sales under the current version of the program, which begin in summer 2017. On March 6, 2017, Secretary of the Interior Ryan Zinke announced the first lease sale in the 2017-2022 program (Lease Sale 249), which will offer 73 million acres in the Gulf of Mexico in August 2017.8 Unlike previous Gulf lease sales, which focused on a particular planning area (either the Western, Central, or Eastern Gulf), this sale—along with the other Gulf sales in the 2017-2022 program—is region-wide, offering available blocks in all three planning areas combined.9 The Obama Administration shifted to a region-wide approach for the 2017-2022 program partly to increase flexibility for companies that also are bidding on lease blocks in Mexican Gulf waters.10

BOEM also is completing lease sales for the 2012-2017 leasing program, which concludes in June 2017. The final sale in this program is a special-interest lease sale in Alaska's Cook Inlet scheduled for June 21, 2017.11

Selected Issues for Congress

Under the OCSLA, BOEM must take into account economic, social, and environmental values in making its leasing decisions.12 BOEM's assessments of the appropriate balance of these factors for leasing in the four OCS regions—the Atlantic, Pacific, Alaska, and Gulf of Mexico regions—are matters for debate in Congress and elsewhere in the nation.

Congress may consider whether the 2017-2022 program approved by the Obama Administration strikes the appropriate balance or whether the program should be altered with an alternative leasing schedule. If the Secretary of the Interior revises the program pursuant to President Trump's executive order, Congress may similarly consider whether to alter or leave in place the revised version of the program. More broadly, Congress may consider whether the OCSLA parameters that shape agency leasing decisions are appropriate or should be changed. Bills in the 115th Congress (see "Role of Congress," below) would address both the individual sales in the 2017-2022 program and the broader OCSLA planning criteria.

The Obama Administration's 2017-2022 leasing strategy differed for each region. In the Gulf of Mexico, the program made available all unleased acreage except for areas that BOEM is prohibited from leasing.13 In the Alaska region, the Obama Administration chose a targeted leasing strategy, focused on a single planning area that the Administration identified as best balancing economic, social, and environmental considerations. The final program contained no sales in the Atlantic or Pacific regions, for various reasons specific to each region.14 Congressional debate on the 2017-2022 program has focused on the total number of sales and acres offered under the program and on BOEM's lease sale decisions for particular regions, especially the Alaska and Atlantic regions.

Total Acreage Available for Leasing

The 2017-2022 program, as approved by the Obama Administration, makes available for leasing approximately 97 million offshore acres out of a total of approximately 1.7 billion acres on the U.S. OCS. The available acreage consists of 96 million acres in the Gulf of Mexico and 1 million acres in the Alaska region.15 The overall acreage available for leasing, and the overall number of lease sales planned in the program, is controversial. Some Members of Congress, industry representatives, and others contend that the program is overly restrictive, with a lower number of sales than previous five-year programs and an inadequate portion of U.S. waters available for leasing.16 They argue that the program limits the potential of offshore oil and gas as a component of the nation's "all of the above" energy strategy and restricts job creation and economic growth. For example, they assert that BOEM should offer access to broader areas of the OCS because a wide range of options is needed for companies to find tracts that are economic to produce.17

Other stakeholders contend that the Obama Administration's leasing schedule reflects an appropriate balance of economic, environmental, and social considerations. The Obama Administration emphasized that although a relatively small percentage of the entire OCS is made available for leasing in the program, the tracts to be offered contain nearly half of all undiscovered technically recoverable oil and gas resources estimated to exist on the OCS.18 Supporters point out that the program provides for a robust leasing schedule in the region with the most mature infrastructure, strong industry interest and state support, and the greatest resource potential (the Gulf of Mexico). They assert that the Obama Administration's caution was appropriate in the other regions, where infrastructure may be weak, industry interest may be low, or states and their citizens may oppose leasing. With respect to the concern that fewer sales are offered in the 2017-2022 program than in previous programs, supporters point out that each Gulf of Mexico sale is planned as a combined, region-wide sale, whereas earlier five-year programs offered only a portion of the Gulf in each sale.19

Still others, including some environmental groups, advocate for less offshore oil and gas leasing than is provided for under the program. These stakeholders are concerned about the climate change implications of offshore oil and gas development. They question whether the 2017-2022 program adequately accounted for downstream carbon emissions and other indirect climate change effects of oil and gas development.20 In addition to emissions concerns, these stakeholders raise the possibility of environmental damage from a catastrophic oil spill, such as the spill that took place in 2010 on the Deepwater Horizon oil platform in the Gulf of Mexico.21 While industry representatives make the case that new government regulations and industry efforts have resulted in safety improvements since the 2010 spill, other stakeholders assert that the threat of major spills remains significant.

Projections of the effects of the program's leasing decisions are complicated by the fact that tracts leased under the program would not begin producing oil and gas for years or, in some cases, decades to come.22 Given these long production timelines, tracts leased in the upcoming five-year period could be producing at a time when the nation's economic and environmental priorities and available technologies have changed. This could be the case, for instance, if U.S. commitments to greenhouse gas emissions reductions required the nation's energy portfolio to be more or less weighted toward renewable energy sources. During development of the 2017-2022 program, some stakeholders contended that including more acreage in the program would be inconsistent with long-term energy and climate goals and that offshore policies should focus instead on renewable energy development.23 At the same time, U.S. energy data suggest that even significant growth in renewable energy production would still leave a large energy gap to be filled with conventional sources in the next several decades.24 With this in mind, proponents of expanded program acreage contended that the United States must continue to pursue a robust offshore oil and gas program to ensure U.S. energy security and remain competitive with other nations.25

Gulf of Mexico Region

Almost all U.S. offshore oil and gas production currently takes place in the Gulf of Mexico.26 In addition to the broad debates discussed above, a particular issue in the region is leasing in the Eastern Gulf close to the state of Florida. Under the Gulf of Mexico Energy Security Act of 2006 (GOMESA), offshore leasing is prohibited through June 2022 in a defined area of the Gulf off the Florida coast.27 Some Members of Congress and other stakeholders wish to extend this prohibition or make it permanent. They contend that leasing in Gulf waters around Florida could potentially damage the state's beaches and fisheries, which support strong tourism and fishing industries, and could jeopardize mission-critical defense activities connected with Pensacola's Eglin Air Force Base.28 By contrast, others advocate for shrinking the area covered by the ban or eliminating the ban before its scheduled expiration date. They emphasize the economic significance of oil and gas resources off the Florida coast and contend that development would create jobs, strengthen the state and national economies, and contribute to U.S. energy security.29

Alaska Region

Congressional debate has been especially intense over the Obama Administration's leasing decisions in the Alaska region. Interest in exploring for offshore oil and gas in the region has grown as decreases in the areal extent of summer polar ice make feasible a longer drilling season. Recent estimates of substantial undiscovered oil and gas resources in Arctic waters also have contributed to the increased interest.30 However, the region's severe weather and perennial sea ice, and its relative lack of infrastructure to extract and transport offshore oil and gas, continue to pose technical and financial challenges to new exploration. Among 15 BOEM planning areas in the region, the Beaufort and Chukchi Seas are the only two areas with existing federal leases, and only the Beaufort Sea has any producing wells in federal waters (from a joint federal-state unit). Stakeholders including the State of Alaska and some Members of Congress seek to expand offshore oil and gas activities in the region. Other Members of Congress and many environmental groups oppose offshore oil and gas drilling in the Arctic, due to concerns about potential oil spills and about the possible contributions of these activities to climate change.

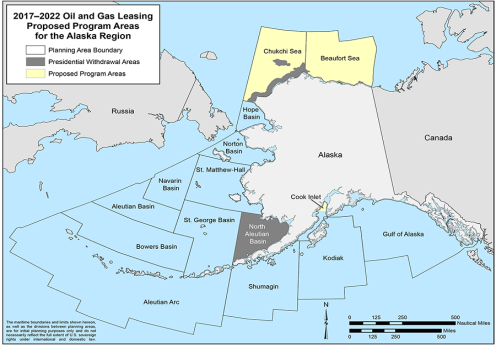

The Obama Administration at times expressed support for expanding offshore exploration in the Alaska region, while also pursuing safety regulations that aimed to minimize the potential for oil spills.31 The Obama Administration's originally proposed program for 2017-2022 included three Alaska sales—one each in the Beaufort Sea, Chukchi Sea, and Cook Inlet Planning Areas (Figure 1).32 However, for the final program, the Administration removed the sales for the Beaufort and Chukchi Seas and retained only the sale for Cook Inlet. The Obama Administration stated that it weighed factors that favored the Beaufort and Chukchi sales, including the significant hydrocarbon resources in those waters and the support of the State of Alaska for the sales. Nonetheless, it ultimately decided against the sales based on other factors, including "opportunities for exploration and development on [already] existing leases, the unique nature of the Arctic ecosystem, recent demonstration of constrained industry interest in undertaking the financial risks that Arctic exploration and development present, current market conditions, and sufficient existing domestic energy sources already online or newly accessible."33 Further, in December 2016, after publication of the final program, President Obama withdrew much of the U.S. Arctic from leasing disposition for an indefinite time period.34 In April 2017, President Trump's executive order on offshore energy strategy modified President Obama's withdrawals and opened these areas for consideration in a revised leasing program.35

|

Figure 1. BOEM's Originally Proposed Program Areas for Offshore Oil and Gas Leasing in Alaska (only Cook Inlet remains in final program) |

|

|

Source: BOEM, 2017-2022 PP, "Maps," at http://www.boem.gov/Alaska-Program-Areas/. |

The Obama Administration's removal of the Beaufort and Chukchi lease sales from the program and President Obama's subsequent Arctic withdrawals were viewed unfavorably by advocates for expanded leasing in the region, including the Alaska congressional delegation.36 These stakeholders expressed support for President Trump's policy changes.37 They contend that growth in offshore oil and gas development is critical for Alaska's economic health as the state's onshore oil fields mature.38 They further assert that Arctic offshore energy development will play a growing role nationally by reducing U.S. dependence on oil and gas imports and allowing the United States to remain competitive with other nations, including Russia and China, that are pursuing economic interests in the Arctic.39 These stakeholders feel that Arctic offshore activities can be conducted safely, and point to a history of successful well drilling in the Beaufort and Chukchi Seas in the 1980s and 1990s.40

Those who favor few or no Alaska offshore lease sales, by contrast, are concerned that it would be extremely challenging to respond to a major oil spill in the region, because of the icy conditions and lack of spill-response infrastructure.41 The Obama Administration's Arctic regulations focus on ways in which companies would need to compensate for the lack of spill-response infrastructure, such as by having a separate rig available at drill sites to drill a relief well in case of a loss of well control.42 Opponents of Arctic leasing also are concerned that it represents a long-term investment in oil and gas as an energy source, which could slow national efforts to address climate change. They contend, too, that new leasing opportunities in the region are unnecessary, since industry has been pulling back on investing in the Arctic in the current investment climate of low oil prices. For example, the Obama Administration stated in the 2017-2022 final program that the number of active leases on the Arctic OCS had declined by more than 90% between February 2016 and November 2016, as companies relinquished leases in the face of low oil prices and Shell Oil Company's disappointing exploratory drilling effort in the Chukchi Sea in 2015.43 Others assert, however, that tepid industry interest in the region is due more to the overly demanding federal regulatory environment than to market conditions.44

Among those favoring expanded leasing in the region are some Alaska Native communities, who see offshore development as a source of jobs and investment in localities that are struggling financially. Other Alaska Native communities have opposed offshore leasing in the region, citing concerns about environmental threats to subsistence lifestyles. Alaska Governor Bill Walker supports offshore oil and gas development and had formally petitioned the President to keep the previously scheduled Alaska sales in the final program.45

Atlantic Region

The program for 2017-2022 also excluded an earlier-proposed lease sale in the Atlantic region.46 If conducted, it would have been the first offshore Atlantic oil and gas lease sale since 1983. The lack of oil and gas activity in the Atlantic region in the past 30 years was due in part to congressional bans on Atlantic leasing imposed in annual Interior appropriations acts from FY1983 to FY2008, along with presidential moratoria on offshore leasing in the region during those years. Starting with FY2009, Congress no longer included an Atlantic leasing moratorium in annual appropriations acts. In 2008, President George W. Bush also removed the long-standing administrative withdrawal for the region.47 These changes meant that lease sales could potentially be conducted for the Atlantic. However, no Atlantic lease sale has taken place in the intervening years.48 More recently, President Obama's December 2016 withdrawals included certain areas of the Atlantic Ocean associated with major canyons and canyon complexes; however, President Trump's April 2017 executive order modified these Atlantic withdrawals and made the areas available for future leasing consideration.

|

Geological and Geophysical (G&G) Activities in the Atlantic Ocean A complicating factor in considering oil and gas leasing in the Atlantic Ocean is uncertainty about the extent and location of hydrocarbon resources. Congressional and administrative moratoria on Atlantic leasing activities for most of the past 30 years prevented geological and geophysical (G&G) surveys of the region's offshore resources. Previous seismic surveys, dating from the 1970s, used older technologies that are considered less precise than recent methods. The Obama Administration issued a record of decision (ROD) in July 2014 to allow new G&G surveys. However, in January 2017, the Obama Administration denied applications from companies to conduct surveys under the ROD, citing among other reasons a diminished need for the information because no Atlantic lease sales were included in the 2017-2022 program. In April 2017, President Trump's executive order on offshore energy ordered the agencies to expedite seismic survey permits, and BOEM subsequently announced that it would resume evaluations of the G&G permit applications. The G&G permitting decisions are separate from the five-year program, which is specifically concerned with lease sales. The House Natural Resources Committee held a hearing on Atlantic G&G testing in July 2015, during which some Members sought to expedite the permit-review process and others opposed letting G&G testing go forward. Witnesses differed in their evaluations of the potential harm to Atlantic marine mammals from seismic activities. BOEM had included in its ROD measures to mitigate the impacts of G&G activities on marine life, but some argued that the measures were inadequate. Some bills in the 115th Congress (e.g., H.R. 2158) would prohibit seismic surveys in the Atlantic region. |

|

Figure 2. BOEM's Originally Proposed Program Area for Offshore Oil and Gas Leasing in the Atlantic (subsequently removed from the five-year program) |

|

|

Source: 2017-2022 PP, p. 4-12. |

For the draft versions of the 2017-2022 program, the Obama Administration analyzed a variety of factors for the Atlantic region, including the region's resource potential and infrastructure needs, ecological and safety concerns, competing uses of the areas, and state and local attitudes toward drilling, among others. The initial analysis for the draft program resulted in a planned lease sale in a combined portion of the Mid- and South Atlantic Planning Areas in 2021 (Figure 2). However, after the comment period and further analysis, the Obama Administration removed the Atlantic sale. The Administration gave several reasons for the removal, including "strong local opposition, conflicts with other ocean uses,... [and] careful consideration of the comments received from Governors of affected states."49 The Obama Administration further cited the broader U.S. energy situation as a factor in its decision not to hold an Atlantic lease sale in the 2017-2022 period. Given growth over the past decade in onshore energy development, the Administration stated, "domestic oil and gas production will remain strong without the additional production from a potential lease sale in the Atlantic."50

The Atlantic states, and stakeholders within each state, disagree about whether oil and gas drilling should occur in the Atlantic.51 Supporters contend that oil and gas development in the region would lower energy costs for regional consumers, bring jobs and economic investment, and strengthen U.S. energy security.52 Opponents express concerns that oil and gas development would undermine national clean energy goals and that oil spills could threaten coastal communities. Also of concern for leasing opponents is the potential for oil and gas activities to damage the tourism and fishing industries in the Atlantic region and to conflict with military and space-related activities of the Department of Defense (DOD) and National Aeronautics and Space Administration (NASA).53

The Obama Administration's Atlantic lease sale proposal in the earlier draft of the 2017-2022 program included a 50-mile buffer zone off the coast where leasing would not take place, in order to reduce conflicts with other uses of the OCS, including DOD and NASA activities.54 However, on further analysis, the Administration assessed that the areas of DOD and NASA concern "significantly overlap the known geological plays and available resources," which contributed to its decision to remove the Atlantic sale altogether from the final program.55

Pacific Region

The Obama Administration's decision not to hold any lease sales in the Pacific region for 2017-2022 was less controversial than the decisions for the Atlantic and Alaska regions. No federal oil and gas lease sales have been held for the Pacific since 1984, although active leases with production remain in the Southern California planning area.56 Like the Atlantic region, the Pacific region was subject to congressional and presidential leasing moratoria for most of the past 30 years.57 These restrictions were lifted in FY2009, but the governors of California, Oregon, and Washington continue to oppose new offshore oil and gas leasing in the region.

Congressional stakeholders disagree on whether leasing should occur in the Pacific. Members of the 114th Congress who favored broad leasing across the entire OCS introduced legislation that would have required BOEM to hold lease sales in the Pacific region.58 Members concerned about environmental damage from oil and gas activities in the region introduced legislation in both the 114th and 115th Congresses that would prohibit Pacific oil and gas leasing.59 Other issues concerning oil and gas activity in the Pacific—such as concerns about the use of hydraulic fracturing (fracking) in existing wells off the California coast—lie outside the scope of the five-year program.60

Role of Congress

Congress can influence the Administration's development and implementation of a five-year program by submitting public comments during formal comment periods, by evaluating proposed or final programs in committee oversight hearings, and, more directly, by enacting legislation to set or alter a program's terms. Members of Congress pursued all these types of influence with respect to the leasing program for 2017-2022. For example, BOEM received comments from numerous Members while drafting the program. Some opposed the inclusion of certain regions in the program, while others supported the planned lease sales or sought an expansion of lease areas and a higher number of sales.61 The House and Senate also held oversight hearings to evaluate draft versions of the five-year program. At an April 2015 House hearing, Members and witnesses addressed issues such as the overall number of lease sales proposed for the program, whether leasing should occur in the Atlantic and Arctic, and whether seismic surveying should occur in the Atlantic, among others.62 At a May 2016 Senate hearing, Members and witnesses discussed, among other issues, the Obama Administration's proposal for targeted rather than area-wide lease sales in Alaska and the factors that contributed to removal of the Atlantic lease sale from the program.63

Congress also is considering directly modifying the 2017-2022 program through legislation. Some bills in the 115th Congress (H.R. 1756, S. 665, S. 883) would add lease sales to the program or would amend the OCSLA to make it easier for the Interior Secretary to add new sales. Other bills (H.R. 169, H.R. 728, H.R. 731, H.R. 2002, H.R. 2242, H.R. 2252, H.R. 2272, S. 31, S. 74, S. 750, S. 999) aim to restrict leasing by establishing new moratoria or extending existing moratoria. Some of these bills would permanently prohibit leasing in large areas, such as in all of the Pacific region or throughout the extent of the OCS.

Under President Trump's executive order, BOEM is to review the 2017-2022 program in accordance with OCSLA requirements and may make changes to the leasing schedule, likely through a multiyear process. Either during or after that review, Congress could affect the program by pursuing the above bills or other measures. Alternatively, Congress could choose not to intervene and could let BOEM's review and any subsequent changes take their course.