COVID-19 and Direct Payments to Individuals: Summary of the 2020 Recovery Rebates/Economic Impact Payments in the CARES Act (P.L. 116-136)

Changes from April 2, 2020 to April 17, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act; P.L. 116-136), which was signed into law by President Trump on March 27, 2020, includes direct payments to individuals—referred to in the law as "2020 recovery rebates" in the law.." The Internal Revenue Service (IRS) refers to the payments issued this year—2020—as in 2020 as economic impact payments., whereas some media reports call them "stimulus payments." This Insight provides a brief overview of these direct payments. (These payments are virtually identical to those included in bill text circulated on March 22, 2020.)

The 2020 recovery rebates equal $1,200 per personeligible individual ($2,400 for married taxpayers filing a joint tax return) and $500 per eligible child. These amounts phase down for higher-income taxpayers. These payments are structured as tax credits automatically advancedissued to households in 2020 if they filedfiled a 2019 income tax return and will generally be received as a direct deposit or check by mail. If a 2019 return has not been filed, rebates will be advanced automatically based on 2018 return information.

On April 1, 2020, the IRS indicated that 2020 recovery rebates will automatically be issued On April 15, 2020, the IRS announced that eligible Supplemental Security Income (SSI) recipients will automatically receive their $1,200 payment through "direct deposit, Direct Express debit card, or by paper check, just as they would normally receive their SSI benefits." The IRS anticipates eligible SSI recipients will receive these payments in early May. On April 17, 2020, the IRS announced that eligible "veterans and their beneficiaries who receive Compensation and Pension (C&P) benefit payments" from the Department of Veterans Affairs (VA) will also automatically receive the $1,200 direct payment. As with Social Security beneficiaries who do not file tax returns, SSI recipients and recipients of VA benefits with eligible dependent children are directed to provide information on these children to the IRS to receive the $500 payments.to to Social Security beneficiaries and railroad retirees who are not required to file an income tax return, using information from their Social Security benefits statement (SSA-1099) or Railroad retirement benefits statement (RRB-1099). This was a reversal from guidance provided earlier in the week. If these eligible beneficiaries also have dependent children (eligible for the $500 payment), they are directed to provide that information to the IRS directly via the nonfiler portal to receive the child benefit.

reversal from guidance provided earlier in the week.

Otherwise eligible individuals who did not file a 2019 or 2018 income tax return, and are not Social Security beneficiaries, SSI recipients, or recipients of VA benefits as described above, will generally not receive the benefit in 2020. To receive the benefit in 2020, these individuals will need to file a 2019 (or 2018) income tax return. Alternatively, they can file and claim this benefit on their 2020 tax return next year.

Credit Amount

payments automatically in 2020. Instead, these individuals are encouraged to manually provide information to the IRS via the nonfiler portal in order to receive these payments in 2020. More details on administration can be found on the IRS website.

Credit Amount

These direct payments are structured as a one-time refundable tax credit. The credit equals $1,200 per person ($2,400 for married joint filers) for eligible individuals. Generally, an eligible individual is any individual excluding (1) nonresident aliens, (2) individuals who can be claimed as a dependent by another taxpayer, and (3) an estate or trust.

Individuals eligible for the credit will receive an additional $500 for each child that qualifies for the child tax credit—generally a taxpayer's dependent child that is aged 16 or younger. Individuals cannot receive the $500 amount for older children and adult dependents.

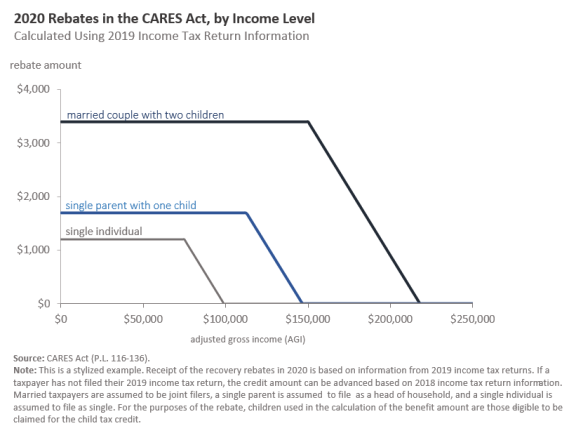

The total credit phases out at a rate of 5% of adjusted gross income (AGI) above $75,000 ($112,500 for head of household filers and $150,000 for married joint returns). An illustration of the amount of the rebate by income level is provided in the figure below.

|

As with any tax refundcredit, these payments do not count as income or resources for a 12-month period in determining eligibility for, or the amount of assistance provided by, any federally funded public benefit program. In addition, these payments are not taxable.

The credit is a fixed amount until income reaches the phaseout level. Lower-income taxpayers with little or no income tax liability are eligible for a tax credit equal in dollar value to that received by middle-income and upper-middle-income taxpayers. Hence, as a percentage of income, this rebate is largest for the lowest-income recipients. The tax credit phases out at the upper end of the distribution, as shown in the figure above.

Estimates by the Congressional Research Service and the Tax Policy Center suggest these payments will provide significant benefits to eligible low- and middle-income households.

Other Features of the 2020 Recovery Rebates

- SSN

RequirementRequirement: Taxpayers must provide a Social Security number (SSN) for themselves, their spouse (if married filing jointly), and any child for whom they claim the $500 child credit. Adoption taxpayer ID numbers (ATINs) are also acceptable for adopted children. Taxpayers who provide an individual taxpayer identification number (ITIN) are ineligible for the credit. Hence, married couples in which one spouse has an SSN and another has an ITIN are generally ineligible for the credit. - The law relaxes these ID requirements for married joint filers in which at least one spouse is a member of the Armed Forces. In those cases, only one spouse must provide an SSN.

- Public Awareness Campaign: The law instructs the Treasury Secretary, in coordination with the Commissioner of Social Security and the heads of other relevant federal agencies, to provide information about the payment to individuals who may not have filed a 2019 or 2018 income tax return.

- Notice to Taxpayers: The law requires that individuals identified as eligible to receive a payment be sent a notice that provides them with information on the amount of the payment, how it will be delivered (direct deposit/paper check), and a phone number at the Internal Revenue Service (IRS) to call if the payment is not received.

Nonresident AliensNonresident Aliens: The credit is not available to nonresident aliens.- Territories: The law includes a provision requiring Treasury to make payments to individuals in the territories (mirror code and non-mirror code) equal to the aggregate amount of credits claimed by their residents. Many territorial residents will claim the rebate under a version of the provision administered via the territorial government, rather than the IRS.

- Past-Due Debts: The credit cannot be reduced for certain unpaid debts, including debts owed to a federal agency (but excluding child support), past-due state income taxes, federal taxes,

orand unemployment compensation debts. - Appropriations: The law includes an appropriation of $617.35 million in FY2020 for the administration of these payments.

Advancing the 2020 Recovery Rebates

The law automatically advances the credit, which will be received as a direct deposit or a check by mail. The advancing provision allows taxpayers to receive this credit before 2020 tax returns are filed in early 2021.

The advanced credit amount will be estimated by the IRS based on taxpayers' 2019 income tax return information (if the taxpayer did not file a 2019 income tax return, 2018 income tax return information can be used instead). For Social Security and Railroad Retirement recipients, if neither a 2019 nor a 2018 income tax return was filed, the law allows the IRS to use information from their 2019 Social Security or Railroad Retirement Benefit Statement (SSA-1099 or RRB-1099, respectively), which the IRS has indicated it will do. To expedite payments, the law allows the recovery rebates to be delivered electronically to any account which the taxpayer had authorized to receive a tax refund or other federal payment on or after January 1, 2018. Otherwise, paper checks would be issued.

To expedite payments, the law allows the recovery rebates to be delivered electronically to any account that the taxpayer had authorized to receive a tax refund or other federal payment on or after January 1, 2018. Otherwise, paper checks will be issued. If, when taxpayers file their 2020 income tax returns in 2021, they find that the advanced credit is greater than the actual credit, then they would not be required to repay the excess credit. In contrast, if the advanced credit is less than the actual creditAs previously discussed, the direct payments are structured as a new one-time refundable tax credit that would, without an advancing provision, be claimed on 2020 federal income tax returns, increasing federal tax refunds next year (when 2020 income tax returns will be filed). However, because the law includes an advancing provision, the IRS will issue these payments this year, not next (similar to how direct payments were structured in 2008). To facilitate implementation, the law directs the IRS to use information from a 2019 income tax return, or if not available, a 2018 income tax return, to calculate the payment amount (with special exceptions for nonfilers who were either Social Security beneficiaries or SSI recipients as described above).

The advancing provision allows many eligible recipients to receive the payment in 2020, as opposed to next year. Receiving a recovery rebate in 2020 will not affect a taxpayer's 2020 income tax liability or tax refund. In addition, if, when taxpayers file their 2020 income tax returns in 2021, they find that the advanced credit is greater than the actual credit (e.g., they had a qualifying child based on their 2019 income tax return, but not on their 2020 return), then they will not be required to repay the excess credit. In contrast, if the advanced credit is less than the actual credit (e.g., a qualifying child was born in 2020, and so was not listed on their 2019 return), then taxpayers will, then taxpayers would be able to claim the difference (as an increased refund) on their 2020 income tax returns.

Nonfilers

Under current law, taxpayers with gross income less than the standard deduction amount are not required to file a federal income tax return. Hence, many low-income individuals and families, including workers without children who do not receive benefits like the EITC or child credit, may not have filed a 2018 or 2019 income tax return. As such, these individuals and families (excluding Social Security beneficiaries, SSI recipients, and recipients of VA benefits, discussed above) would not receive these rebates in 2020, unless they manually provided information to the IRS via their nonfiler portalon their 2020 income tax returns.

Nonfilers

Under current law, taxpayers with gross income less than the standard deduction amount are not required to file a federal income tax return. In addition, public cash assistance for low-income populations, such as Supplemental Security Income, is generally not considered gross income under a limited general welfare exclusion. Hence, many low-income individuals and families whose income is largely from public assistance may not have filed a 2018 or 2019 income tax return. As such, these individuals and families would not receive these rebates in 2020, unless they filed a 2019 or 2018 return, which both policymakers and the IRS are encouraging people to do.