COVID-19 and Direct Payments to Individuals: Summary of the 2020 Recovery Rebates/Economic Impact Payments in the CARES Act (P.L. 116-136)

Changes from March 27, 2020 to March 30, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

H.R. 748, which passed in the Senate on March 25, proposesThe Coronavirus Aid, Relief, and Economic Security Act (CARES Act; P.L. 116-136), which was signed into law by President Trump on March 27, 2020, includes direct payments to individuals—referred to as "2020 recovery rebates." This Insight provides a brief overview of the proposed 2020 recovery rebates included in H.R. 748. se direct payments. (These payments are virtually identical to those included in bill text circulated on March 22, 2020.)

The proposed 2020 recovery rebates equal $1,200 per person ($2,400 for married taxpayers filing a joint tax return) and $500 per child. These amounts would phase down for higher-income taxpayers. These payments are structured as tax credits automatically advanced to households in 2020 if they filed a 2019 income tax return and wouldwill be received as a direct deposit or check by mail. If a 2019 return hadhas not been filed, rebates wouldwill be advanced automatically based on 2018 return information. Social Security and Railroad Retirement recipients who did not file an income tax return wouldwill have the credit automatically advanced in 2020 based on information on their 2019 Social Security or Railroad Retirement Benefit Statement.

Otherwise eligible individuals who did not file a 2019 or 2018 income tax return and did not receive a 2019 Social Security or Railroad Retirement benefit statement wouldwill generally not receive the benefit in 2020. In order to receive the benefit in 2020, these individuals wouldwill need to file a 2019 (or 2018) income tax returnreturn. Alternatively, they couldcan file and claim this benefit on their 2020 tax return next year.

Credit Amount

The proposed credit equals $1,200 per person ($2,400 for married joint filers) for eligible individuals. Generally, an eligible individual is any individual excluding (1) nonresident aliens, (2) individuals who can be claimed as a dependent by another taxpayer, and (3) an estate or trust.

Individuals eligible for the credit wouldwill receive an additional $500 for each child that qualifies for the child tax credit—generally a taxpayer's dependent child that is aged 16 or younger.

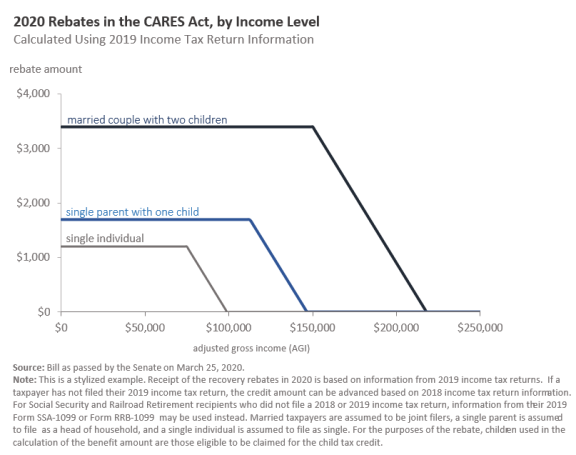

The total proposed credit phases out at a rate of 5% of adjusted gross income (AGI) above $75,000 ($112,500 for head of household filers and $150,000 for married joint returns). An illustration of the amount of the rebate by income level is provided in the figure belowFigure 1.

|

(calculated using 2019 income tax return information) Source: Coronavirus Aid, Relief, and Economic Security Act (CARES Act; P.L. 116-136), as enacted on March 27, 2020. Notes: This is a stylized example. Receipt of the recovery rebates in 2020 is based on information from 2019 income tax returns. If a taxpayer has not filed their 2019 income tax return, the credit amount can be advanced based on 2018 income tax return information. For Social Security and Railroad Retirement recipients who did not file a 2018 or 2019 income tax return, information from their 2019 Form SSA-1099 or Form RRB-1099 may be used instead. Married taxpayers are assumed to be joint filers, a single parent is assumed to file as a head of household, and a single individual is assumed to file as single. For the purposes of the rebate, children used in the calculation of the benefit amount are those eligible to be claimed for the child tax credit. As with any tax refund, these payments would

Figure 1. 2020 Rebates in the CARES Act, by Income Level

As with any tax refund, these payments do not count as income or resources for a 12-month period in determining eligibility for, or the amount of assistance provided by, any federally funded public benefit program. In addition, these payments

wouldare not be taxable.

The proposed credit would becredit is a fixed amount until income reaches the phaseout level. Lower-income taxpayers with little or no income tax liability would beare eligible for a tax credit equal in dollar value to that received by middle-income and upper-middle-income taxpayers. Hence, as a percentage of income, this rebate would beis largest for the lowest-income recipients. The tax credit would phasephases out at the upper end of the distribution as shown in the figure above.

Estimates by the Congressional Research Service and the Tax Policy Center suggest these payments wouldwill provide significant benefits to eligible low- and middle-income households.

Other Features of the Proposed 2020 Recovery Rebates

- SSN Requirement: Taxpayers

would be required tomust provide a Social Security number (SSN) for themselves, their spouse (if married filing jointly), and any child for whom they claim the $500 child credit. Adoption taxpayer ID numbers (ATINs) are also acceptable for adopted children. Taxpayers who provide an individual taxpayer identification number (ITIN)would beare ineligible for the credit. Hence, married couples in which one spouse has an SSN and another has an ITINwouldare generallybeineligible for the credit. - The

bill would relaxlaw relaxes these ID requirements for married joint filers in which at least one spouse is a member of the Armed Forces. In those cases, only one spouse must provide an SSN. - Public Awareness Campaign: The

bill would instructlaw instructs the Treasury Secretary, in coordination with the Commissioner of Social Security and the heads of other relevant federal agencies, to provide information about the payment to individuals who may not have filed a 2019 or 2018 income tax return. - Notice to Taxpayers: The

bill would requirelaw requires that individuals identified as eligible to receive a payment be sent a notice that provides them with information on the amount of the payment, how it will be delivered (direct deposit/paper check), and a phone number at the Internal Revenue Service (IRS) to call if the payment is not received. - Nonresident Aliens: The credit

wouldis notbeavailable to nonresident aliens. - Territories: The

billlaw includes a provision requiring the U.S. Treasury to make payments to individuals in the territories (mirror code and non-mirror code) equal to the aggregate amount of credits claimed by their residents. Many territorial residents will claim the rebate under a version of the provision administered via the territorial government, rather than the IRS.

- Past-Due Debts: The credit cannot be reduced for certain unpaid debts, including debts owed to a federal agency (but excluding child support), past-due state income taxes, federal taxes, or unemployment compensation debts.

- Appropriations: The

bill would appropriatelaw includes an appropriation of $617.35 million in FY2020 for the administration of these payments.

Advancing the Proposed 2020 Recovery Rebates

The bill wouldlaw automatically advances the credit, which wouldwill be received as a direct deposit or a check by mail. The advancing provision would allowallows taxpayers to receive this credit before 2020 tax returns are filed in early 2021.

The advanced credit amount wouldwill be estimated by the IRS based on taxpayers' 2019 income tax return information (if the taxpayer did not file a 2019 income tax return, 2018 income tax return information couldcan be used instead). For Social Security and Railroad Retirement recipients, if neither a 2019 nor a 2018 income tax return were filed, then information from their 2019 Social Security or Railroad Retirement Benefit Statement (SSA-1099 or RRB-1099, respectively) couldcan be used instead. To expedite payments, the bill would allowlaw allows the recovery rebates to be delivered electronically to any account which the taxpayer had authorized to receive a tax refund or other federal payment on or after January 1, 2018. Otherwise, paper checks would be issued.

If, when taxpayers file their 2020 income tax returns in 2021, they find that the advanced credit is greater than the actual credit, then they would not be required to repay the excess credit. In contrast, if the advanced credit is less than the actual credit, then taxpayers would be able to claim the difference on their 2020 income tax returns.

Nonfilers

TaxpayersUnder current law, taxpayers with gross income less than the standard deduction amount are not required to file a federal income tax return. In generaladdition, public cash assistance for low-income populations, such as Supplemental Security Income, is generally not considered gross income under a limited general welfare exclusion. Hence, many low-income individuals and families whose income is largely from public assistance may not have filed a 2018 or 2019 income tax return and as such, would not receive these rebates in 2020 (they could receive it in 2020 if they filed a 2019 return). A 2017 study found that "nonfilers" were more likely to be either seniors or recipients of public assistance compared to those who filed a tax return.