The Payments in Lieu of Taxes (PILT) Program: An Overview

Changes from March 9, 2020 to March 17, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Contents

- Introduction to the Payments in Lieu of Taxes (PILT) Program

- PILT Authorizations and Appropriations

- PILT Payments Under Section 6902

- Entitlement Lands

- Calculating Section 6902 Payments

- PILT Payments Under Sections 6904 and 6905

- Section 6904 Payments

- Section 6905 Payments

- Issues for Congress

Figures

Summary

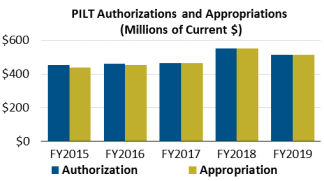

The Payments in Lieu of Taxes (PILT; 31 U.S.C. §§6901-6907) program provides compensation for certain tax-exempt federal lands, known as entitlement lands. PILT payments are made annually to units of general local government—typically counties—that contain entitlement lands. PILT was first enacted in 1976 (P.L. 94-565) and later recodified in 1982 (P.L. 97-258). PILT is administered by the Office of the Secretary in the Department of the Interior (DOI), which is responsible for the calculation and disbursement of payments. PILT has most commonly been funded through annual discretionary appropriations, though Congress has authorized mandatory funding for PILT in certain years, which has replaced or supplemented discretionary appropriations. Since the start of the program in the late 1970s, PILT payments have totaled approximately $9.2 billion (in current dollars). From FY2015 through FY2019, authorized PILT payments averaged $489 million each year and appropriations for PILT payments averaged $485 million each year.

Although several federal programs exist to compensate counties and other local jurisdictions for the presence of federal lands within their boundaries, PILT applies to the broadest array of land types. Entitlement lands under PILT include lands administered by the Bureau of Land Management, the National Park Service, the U.S. Fish and Wildlife Service, all in the DOI; lands administered by the U.S. Forest Service in the Department of Agriculture; federal water projects; some military installations; and selected other lands. Nearly 2,000 counties and other local units of government received an annual PILT payment in FY2019.

PILT comprises three separate payment mechanisms, which are named after the sections of law in which they are authorized: Section 6902 (31 U.S.C. §6902), Section 6904 (31 U.S.C. §6904), and Section 6905 (31 U.S.C. §6905). Section 6902 payments are the broadest of the three. They account for nearly all of the funding disbursed under the PILT program and are made to all but a few of the counties receiving PILT funding. In contrast, Section 6904 and Section 6905 payments are provided only under selected circumstances, account for a small fraction of PILT payments, and are made to a minority of counties (most of which also receive Section 6902 payments). In addition, whereas Section 6902 payments are provided each year based on the presence of entitlement lands, most payments under Section 6904 and Section 6905 are provided only for a short duration after certain land acquisitions.

Section 6902 payments are determined based on a multipart formula (31 U.S.C. §6903). Payments are calculated according to several factors, including (1) the number of entitlement acres present within a local jurisdiction; (2) a per-acre calculation determined by one of two alternatives (Alternative A, also called the standard rate, or Alternative B, also called the minimum provision); (3) a population-based maximum payment (ceiling); (4) selected prior-year payments made to the counties pursuant to certain other federal compensation programs; and (5) the amount appropriated to cover the payments. Section 6904 and Section 6905 payments are provided to counties after the federal acquisition of specific types of entitlement lands (Section 6904) or entitlement lands located in specific areas (Section 6905) and are based on the fair market value of the acquisitions. If the appropriated amount is insufficient to cover the total payment amounts authorized in Sections 6902, 6904, and 6905, payments are prorated in proportion to the authorized rate. Annual discretionary appropriations bills generally also have included additional provisions dictating the terms of payments.

PILT is of perennial interest to many Members of Congress and stakeholders throughout the country, and many local governments consider PILT payments to be an integral part of their annual budgets. In contemplating the future of PILT, Congress may consider topics and legislation related to the eligibility of various federal lands for entitlement under PILT (such as Indian lands or other lands currently excluded from compensation), amendments to the formula for calculating payments (especially under Section 6902), and issues related to funding PILT, among other matters.

Introduction to the Payments in Lieu of Taxes (PILT) Program

The Payments in Lieu of Taxes (PILT) program provides compensation for certain entitlement lands that are exempt from state and local taxes. These lands include selected federal lands administered by the Bureau of Land Management, the National Park Service, and the U.S. Fish and Wildlife Service, all in the Department of the Interior (DOI); lands administered by the U.S. Forest Service in the Department of Agriculture; federal water projects; dredge disposal areas; and some military installations.1 Enacted in 1976,2 PILT is the broadest—in terms of federal land types covered—of several federal programs enacted to provide compensation to state or local governments for the presence of tax-exempt federal lands within their jurisdictions.3

PILT was enacted in response to a shift in federal policy from one that prioritized disposal of federal lands—one in which federal ownership was considered to be temporary—to one that prioritized retention of federal lands, in perpetuity, for public benefit.4 This shift began in the late 19th century and continued into the 20th century. Along with this shift came the understanding that, because these lands were exempt from state and local taxation and were no longer likely to return to the tax base in the foreseeable future, some compensation should be provided to the impacted local governments. Following several decades of commissions, studies, and proposed legislation, Congress passed PILT to at least partially ameliorate this hardship.5 PILT payments generally can be used for "any governmental purpose,"6 which could include assisting local governments with paying for local services, such as "firefighting and police protection, construction of public schools and roads, and search-and-rescue operations."7

The Office of the Secretary in DOI is responsible for the calculation and disbursement of payments under PILT.8 Payments under PILT are made annually to units of general local government—typically counties, though other types of governmental units also may be used (hereinafter, counties refers to units of general local government)—containing entitlement lands. PILT comprises three separate payment mechanisms: Section 6902, Section 6904, and Section 6905 payments, all named for the sections of law in which they are authorized.9 Section 6902 payments account for nearly all payments made through PILT. The Section 6902 authorized payment amount for each county is calculated according to a statutory formula that is subject to a maximum payment based on the county's population (see "PILT Payments Under Section 6902").10 The remaining payments are provided through Section 6904 and Section 6905 under selected circumstances and typically are limited in duration. Through FY2019, PILT payments have totaled approximately $9.2 billion (in current dollars).11

Members of Congress routinely consider amending PILT within both appropriations and authorizing legislation. For example, legislation in the 116th Congress would amend how PILT appropriations are provided and would change how payments are calculated under Section 6902.12 In addition, Members of Congress may address issues related to which federal lands should be eligible for payments under PILT.

This report provides an overview of the PILT payment program and includes sections on

- PILT's authorization and appropriations, which discusses the history of how Congress has provided funding for PILT;

- Section 6902 payments, which includes a breakdown of how Section 6902 payments are calculated;

- Section 6904 and Section 6905 payments, which outlines what situations result in payments under these mechanisms; and

- issues for Congress, which discusses several topics that have been or may be of interest to Members of Congress when considering the future of PILT.

|

Selected Terms Used in This Report Authorized payment: the amount a county is eligible to receive based on the formula/requirements specified in statute, prior to any reductions for administrative costs or due to insufficient appropriations. Entitlement lands: statutorily defined federally owned lands that are exempt from state and local taxes and are eligible to be the basis for determining a county's eligibility for PILT payments. This term is defined in statute at 31 U.S.C. §6901(1). Full statutory calculation: the sum of authorized payments under Section 6902, Section 6904, and Section 6905 for all counties in a given year. Inflation: used here to refer to the statutorily required annual adjustment to the per-acre payment rates and the population payment rate. The adjustment is made to reflect changes in the Consumer Price Index published by the Bureau of Labor Statistics of the Department of Labor for the previous 12 months ending June 30. This provision is required pursuant to 31 U.S.C. §6903(d). Per-acre payment rates: one of the two dollar amounts that are multiplied by the number of acres of entitlement land as part of the formula to calculate the authorized payment under Section 6902 (31 U.S.C. §6903(b)(1). These rates are adjusted annually for inflation. In FY2019, the per-acre payment rates were $2.77 per acre for Alternative A and $0.39 per acre for Alternative B. Population-based ceiling: the maximum payment a county is eligible to receive under Section 6902. This figure is calculated by multiplying the county's population (as rounded or not rounded, pursuant to statute [31 U.S.C. §6903(c)(1)]) by the applicable population payment rate. Population payment rate: the dollar amount that is multiplied by a county's population to determine the population-based ceiling, as provided in statute (31 U.S.C. §6903(c)(2)). The population payment rate declines with increasing population. This rate is adjusted for inflation. Prior-year payments: payments received by a county for federally owned lands in its jurisdiction through certain federal compensation programs other than PILT. These programs refer to one of the "payment law[s]" listed in statute (31 U.S.C. §6903(a)(1)). Prorated payment: the actual payment received by a county when appropriated funds are insufficient to cover the authorized payments. The prorated payment is determined by the amount appropriated for PILT that is available to cover payments and is proportional to the authorized payment for each county. Unit of general local government (hereinafter, referred to as county): jurisdictional entity eligible to receive payments under PILT. These entities are most often counties but may include other jurisdictional units such as parishes, boroughs, census areas, the District of Columbia, Guam, Puerto Rico, and the Virgin Islands. This term is defined in statute at 31 U.S.C. §6901(2). Notes: These terms are defined as used in this report and may be used differently elsewhere. Further, these terms may not be defined in statute, except where noted. |

PILT Authorizations and Appropriations

Congress has funded PILT through both discretionary and mandatory appropriations at various times since the program was first authorized. Some stakeholders and policymakers have routinely expressed concern about changes in the appropriations source, both the process of switching between mandatory and discretionary appropriations and the uncertainty that may accompany such changes.

From 1982 to 2008, Section 6906 provided an "Authorization of Appropriations" for PILT, which stated, "Necessary amounts may be appropriated to the Secretary of the Interior to carry out [PILT]."13 Further, it clarified that "amounts are available only as provided in appropriation laws."14 Congress amended this language in 2008 and changed the section title from "Authorization of Appropriations" to "Funding."15 Further, Congress changed the text to read

For each of fiscal years 2008 through 2012-

(1) each county or other eligible unit of local government shall be entitled to payment under this chapter; and

(2) sums shall be made available to the Secretary of the Interior for obligation or expenditure in accordance with this chapter.16

This amendment effectively changed PILT funding from being discretionary to being mandatory for the years specified (see Table 1 for PILT funding since FY2005). Since 2008, Congress has amended Section 6906 several times by changing the fiscal year in the first line through both annual discretionary appropriations laws and other legislative vehicles (Table 1).

|

Fiscal Year |

Statute |

Funding Type |

Total Authorized Amount (millions) |

Total Appropriated Amount (millions) |

% Appropriateda |

||||||

|

FY2005 |

Discretionary |

|

|

|

|||||||

|

FY2006 |

Discretionary |

|

|

|

|||||||

|

FY2007 |

Discretionary |

|

|

|

|||||||

|

FY2008-FY2012 |

Mandatory |

|

|

100% |

|||||||

|

FY2013 |

Mandatory |

|

|

|

|||||||

|

FY2014 |

Mandatory |

|

|

100% |

|||||||

|

FY2015 |

Discretionary |

|

|

|

|||||||

|

Mandatory |

|

|

|

|||||||

|

FY2016 |

Discretionary |

|

|

|

|||||||

|

FY2017 |

Discretionary |

|

|

|

|||||||

|

FY2018 |

|

|

|

100% |

|||||||

|

FY2019 |

|

|

|

100% |

|||||||

|

FY2020 |

|

|

|

100% |

Source: CRS, with data from listed public laws and relevant annual reports, available at https://www.doi.gov/pilt/resources/annual-reports.

Notes: Appropriated amounts may include rescissions as provided in relevant statutes.

a. This column represents the percentage of the authorized amount that was appropriated for a given year. Even for years in which 100% of the authorized amount was appropriated, counties may have received a prorated payment due to part of the appropriation being set aside for uses other than payments (e.g., for administration).

b. PILT appropriations in FY2013 were impacted by sequestration pursuant to the Balanced Budget and Emergency Deficit Control Act (2 U.S.C. §§900 et seq.), as amended by the Budget Control Act of 2011 (P.L. 112-25).

c. For FY2015 PILT payments, Congress provided $70 million in mandatory appropriations for PILT (P.L. 113-291). This appropriation was split, with $33 million to be provided in FY2015 and $37 million to be available in October 2015, which, while paid in FY2016, was for FY2015 payments. Of the $70 million in mandatory appropriations, the $37 million available in October 2015 (FY2016) was subject to sequestration, which reduced the appropriated amount to $34.5 million.

d. For FY2018, FY2019, and FY2020, PILT appropriations were provided for in the annual discretionary appropriations laws. However, for these years, instead of setting the appropriations amount, these laws amended 31 U.S.C. §6906 ("Funding"), whichfunding was provided by amending 31 U.S.C. §6906 ("Funding") each fiscal year. As a result, the funding for PILT was treated as mandatory spending in these years. These amendments required funding for PILT for each of these years to be provided at the amount of the full statutory calculation.

e. Although appropriations for PILT payments were enacted at the full statutory level pursuant to Section 115 of Title 1 of Division D in P.L. 116-94, the exact amount that will be appropriated will not be known until it is calculated by the DOI in FY2020.

PILT was funded through discretionary appropriations from its enactment through FY2007. Since FY2008, Congress has provided funding for PILT through both discretionary and mandatory appropriations (Table 1). From FY2008 through FY2014, Congress authorized mandatory funding for PILT through several laws.17 Since FY2015, funding has been provided, at least partially, through the annual discretionary appropriations process. In FY2015, PILT received both discretionary and mandatory appropriations.18 In both FY2016 and FY2017For FY2016 through FY2020, Congress funded PILT directly through the annual discretionary appropriations process.19 In FY2018, FY2019, and FY2020, Congress funded PILT through the discretionary appropriations processappropriations process. In FY2016 and FY2017, the appropriations laws provided specific funding levels for PILT, which was treated as discretionary spending.19 In FY2018, FY2019, and FY2020, the appropriations laws provided funding for PILT by amending the authority provided in 31 U.S.C. §6906, which required that funding be provided in those years at the level ofwas treated as mandatory spending.20 In each of these three years, funding was provided for PILT at the full statutory calculation.20 levels.

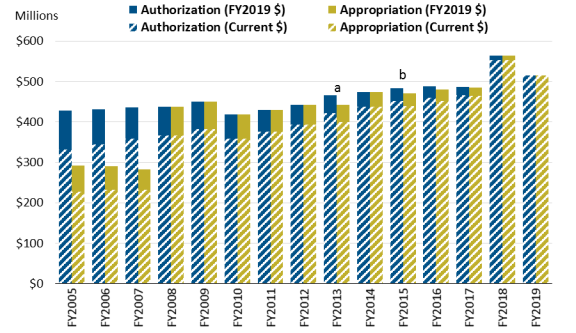

Since FY2008, Congress has funded PILT through discretionary and mandatory appropriations in different years, usingprovided funding for PILT through both one-year and multiyear appropriations. Congress's actions have resulted in full funding and partial funding in different years (Table 1 and Figure 1). These types of changes from year to year may have implications for counties that rely on PILT funding as part of their annual budgets.

|

Figure 1. PILT Authorizations and Appropriations, FY2005-FY2019 (in current and inflation-adjusted FY2019 dollars) |

|

|

Source: CRS, with data from PILT National Summaries, FY2005 through FY2019. Notes: Inflation-adjusted FY2019 dollars were calculated using Bureau of Economic Analysis, Implicit Price Deflators for Gross Domestic Product, Table 1.1.9, Revised December 20, 2019, at https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=2. Quarterly deflators were converted into annual, fiscal year deflators by averaging the fourth quarter from the preceding year with the first three quarters of the fiscal year (e.g., FY2019 deflator equals the average of 2018 Q4 deflator and 2019 Q1, Q2, and Q3 deflators). In Figure 1, letters a (FY2013) and b (FY2015) refer to the FY2013 appropriations and part of the FY2015 ($37 million of the mandatory appropriation authorized by Congress) appropriations that were subject to sequestration pursuant to the Balanced Budget and Emergency Deficit Control Act (2 U.S.C. §§900 et seq.), as amended by the Budget Control Act of 2011 (P.L. 112-25). |

In addition to appropriating funding for the program, Congress routinely provides other guidance on PILT within the annual appropriations process, such as minimum payment thresholds, set-asides for program administration, and provisions for prorating payments.21 When appropriated funding is insufficient to cover the full amount for authorized payments under Sections 6902, 6904, and 6905, counties typically receive a proportional payment known as a prorated payment (Figure 1 shows the disparity between the authorized amount and the appropriated amount in recent years). Even in years in which appropriations are set equal to 100% of the full statutory calculation, payments to counties may be prorated if funding is set aside for purposes other than payments, such as administration.

PILT Payments Under Section 6902

Section 6902 payments are provided to units of local government jurisdictions (referred to as counties in this report) across the United States to compensate for the presence of entitlement lands within their boundaries. Section 6902 payments also are provided to the District of Columbia, Guam, Puerto Rico, and the Virgin Islands.22 Section 6902 payments account for nearly all of the payments made under PILT. In FY2019, 99.85% of all PILT payments were made through Section 6902.23 Further, more counties are eligible for Section 6902 payments than either Section 6904 or Section 6905 payments. In FY2019, of the 1,931 counties that received PILT payments, 1,927 received payments under Section 6902, and 134 received payments under Section 6904 and/or Section 6905 (130 counties received payments under both Section 6902 and Section 6904 and/or Section 6905).24

Entitlement Lands

There are nine categories of federal lands identified as entitlement lands in the PILT statute.25

- 1. Lands in the National Park System

- 2. Lands in the National Forest System

- 3. Lands administered by the Bureau of Land Management (BLM)

- 4. Lands in the National Wildlife Refuge System (NWRS) that are withdrawn from the public domain

- 5. Lands dedicated to the use of federal water resources development projects26

- 6. Dredge disposal areas under the jurisdiction of the U.S. Army Corps of Engineers

- 7. Lands located in the vicinity of Purgatory River Canyon and Piñon Canyon, CO, that were acquired after December 31, 1981, to expand the Fort Carson military reservation

- 8. Lands on which are located semi-active or inactive Army installations used for mobilization and for reserve component training

- 9. Certain lands acquired by DOI or the Department of Agriculture under the Southern Nevada Public Land Management Act (P.L. 105-263)

Of these categories, the first three (National Park System, National Forest System, and lands administered by BLM) largely account for all of the lands managed by the relevant agencies. The remaining categories are either lands tied to specific laws or actions (categories 7 and 9, above) or lands that represent a subset of the lands administered by a particular agency. For example, entitlement lands that are included within the NWRS (category 4) only account for lands within the system that have been withdrawn from the public domain, which excludes lands that have been purchased as additions to the NWRS.27 Further, lands administered by the U.S. Fish and Wildlife Service that are not included in the NWRS are not included within the definition of entitlement lands. Similarly, lands in the other categories (5, 6, and 8, above) may not include all, or even the majority of, lands administered by particular agencies or departments.

Calculating Section 6902 Payments

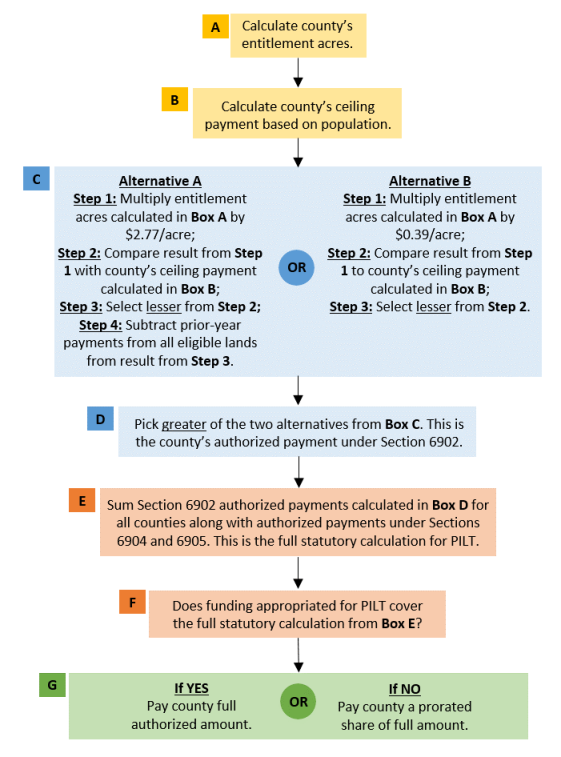

Section 6902 payments are determined based on a multipart formula (see Figure 2). The DOI Office of the Secretary calculates PILT payments according to several factors, including

- the number of entitlement acres;

- a per-acre calculation determined by one of two alternatives (Alternative A, also called the standard rate, or Alternative B, also called the minimum provision);

- a population-based maximum payment (ceiling);

- certain prior-year payments pursuant to other compensation programs; and

- the amount available to cover PILT payments.

To calculate a particular county's PILT payment, the DOI Office of the Secretary first must collect data from several federal agencies and the county's state to answer the following questions:

- How many acres of eligible lands are in the county?

- What is the population of the county?

- What was the increase in the Consumer Price Index for the 12 months ending the preceding June 30?

- What were the prior year's payments, if any, for the county under the other payment programs of federal agencies?28

- Does the state have any laws requiring the payments from other federal land payment laws to be passed through to other local government entities, such as school districts, rather than stay with the county government?

|

Figure 2. Steps in Calculating PILT Section 6902 Payments (FY2019 Rates) |

|

|

Sources: CRS, based on PILT statute (31 U.S.C. §§6901-6907). Payment rates for FY2019 can be found in Department of the Interior, Fiscal Year 2019 Payments In Lieu of Taxes, National Summary, June 2019, p. 9, at https://www.doi.gov/sites/doi.gov/files/uploads/2019_national_summary_pilt_0.pdf. Note: For more information on Box B (ceiling payments), see Figure 3. |

The first step in calculating a county's Section 6902 payment is to determine the number of entitlement acres within the county (Figure 2, Box A).29

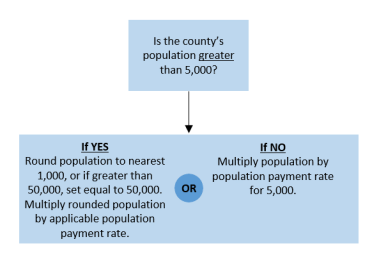

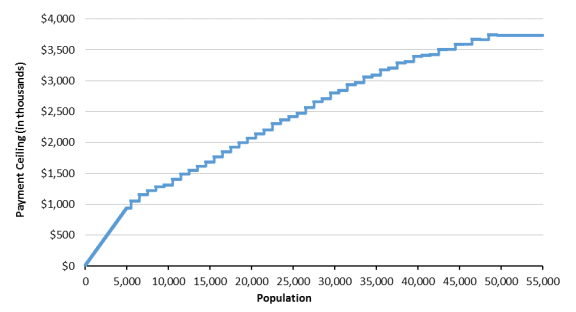

The next step is to calculate the population-based ceiling by multiplying the county's population by the population payment rate (Figure 2, Box B). County population data are provided by the U.S. Census Bureau. For this calculation, counties with different populations are treated differently (Figure 3):

- For counties with populations smaller than 5,000, a county's actual population is used in the calculation.

- For counties with populations larger than 5,000, a county's population is rounded to the nearest 1,000, and this rounded population is used in the calculation.

- All counties with populations greater than 50,000, regardless of their actual populations, are considered to have a population equal to 50,000 for the purposes of calculating the ceiling.

The population payment rate generally declines as population increases in 1,000 person increments (per statute), although the population-based ceiling generally increases (Figure 4).30 However, this is not always the case. For example, in FY2019, payment rates for several populations are the same despite increasing populations, such as the rates for populations of 26,000; 27,000; and 28,000, which are all $94.98. Further, some payment ceilings do not increase with increasing populations. For example, counties with populations of 50,000 have a lower ceiling than those with populations of 49,000 (49,000 × $76.33 = $3,740,170; and 50,000 × $74.63 = $3,731,500, or $8,670 less for the more populous county).

The population payment rate is adjusted annually for inflation based on the change in the Consumer Price Index for the 12 months ending on the preceding June 30.31 For FY2019, the population payment rates ranged from $186.56 per person for counties with populations of 5,000 or fewer to $74.63 per person for counties with populations of 50,000 or greater.32

|

|

Source: CRS, with information from 16 U.S.C. §6903. |

|

|

Source: CRS, with data from Department of the Interior, Fiscal Year 2019 Payments In Lieu of Taxes, National Summary, June 2019, p. 14, at https://www.doi.gov/sites/doi.gov/files/uploads/2019_national_summary_pilt_0.pdf. Notes: Ceiling calculations for counties with populations greater than 5,000 are based on the county's population rounded to the nearest 1,000 (e.g., a county with a population of 8,499 would be credited with a population of 8,000, whereas a county with a population of 8,500 would be credited with a population of 9,000). Counties cannot be credited with a population above 50,000 (i.e., all counties with populations greater than 50,000 are, for the purposes of the ceiling calculation, treated as if they have a population of 50,000). The National Summary FY2019 contains the per capita payment rates for the FY2019 payments. |

The next step is to calculate the payment level under alternatives A and B (Figure 2, Box C). Alternative A has a higher per-acre payment rate than Alternative B, but Alternative A is subject to a deduction for prior-year payments. Prior-year payments are those payments from the federal payment programs listed in statute:33

- the Act of June 20, 1910 (ch. 310, 36 Stat. 557);

- Section 33 of the Bankhead-Jones Farm Tenant Act (7 U.S.C. §1012);

- the Act of May 23, 1908 (16 U.S.C. §500), or the Secure Rural Schools and Community Self-Determination Act of 2000 (16 U.S.C. §§7101 et seq.);

- Section 5 of the Act of June 22, 1948 (16 U.S.C. §§577g-577g–1);

- Section 401(c)(2) of the Act of June 15, 1935 (16 U.S.C. §715s(c)(2));

- Section 17 of the Federal Power Act (16 U.S.C. §810);

- Section 35 of the Act of February 25, 1920 (30 U.S.C. §191);

- Section 6 of the Mineral Leasing Act for Acquired Lands (30 U.S.C. §355);

- Section 3 of the Act of July 31, 1947 (30 U.S.C. §603); and

- Section 10 of the Act of June 28, 1934 (known as the Taylor Grazing Act) (43 U.S.C. §315i).

However, if a state has a pass-through law that requires some or all of these prior-year payments to be paid directly to a sub-county recipient (e.g., a school district), these payments are not deducted from subsequent PILT payments in the following year.34

Alternative B is calculated using a lower per-acre payment rate, but prior-year payments are not deducted. For FY2019, the per-acre payment rates were $2.77 per acre of entitlement land for Alternative A and $0.39 per acre of entitlement land for Alternative B. If the per-acre payment (number of acres multiplied by the per-acre payment rate) calculated under either alternative is greater than the population-based ceiling, then the population-based ceiling replaces the calculated amount.35

Once each alternative is calculated, the greater of the two is the Section 6902 authorized payment for the county (Figure 2, Box D).

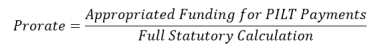

The Section 6902 authorized payments are calculated for every county, and this amount is added to the Section 6904 and Section 6905 authorized payments (for more information on Sections 6904 and 6905, see "PILT Payments Under Sections 6904 and 6905"). This summed amount is the full statutory calculation for a given fiscal year (Figure 2, Box E). DOI compares the full statutory calculation with the amount appropriated and available for PILT payments to determine whether Congress has provided adequate funding to cover the full statutory calculation (Figure 2, Box F).36 If sufficient funding is available, each county receives its authorized amount;37 if funding is insufficient, each county receives a prorated payment that is proportional to its authorized payment (Figure 2, Box G).38

The full statutory calculation and the amount available for PILT payments determine proration. Although there are additional adjustments made in the PILT proration calculation resulting from small idiosyncrasies related to the requirements for PILT payments—namely, the requirement of a minimum threshold of $100 for PILT payments39—the proration is fundamentally the ratio of the appropriated funding available for PILT payments to the full statutory calculation:

As a result, counties may receive less than their authorized PILT payment in years when appropriated funding is insufficient to cover the full statutory calculation. This scenario can occur even when total PILT appropriations match the full statutory calculation; this has been the case in years with mandatory appropriations, when part of the appropriated amount is set aside for a use other than county payments.40 For example, laws providing appropriations for PILT routinely have allowed DOI to retain a small portion of PILT appropriations for administrative expenses.

PILT Payments Under Sections 6904 and 6905

Section 6904 and Section 6905 payments account for a small fraction of total PILT payments.41 In FY2019, these payments were made to 134 counties and accounted for 0.15% of PILT payments ($750,605 of $514.7 million in total payments made).42 Once a county receives Section 6904 and Section 6905 payments, it is to disburse payments to governmental units and school districts within the county in proportion to the amount of property taxes lost because of the federal ownership of the entitled lands, as enumerated under these sections.43 County units and school districts may use these payments for any governmental purpose.

Section 6904 Payments

Section 6904 authorizes the Secretary of the Interior to make payments to counties that contain certain lands, or interests in lands, that are part of the National Park System and National Forest Wilderness Areas.44 However, Section 6904 specifies that these lands, or interests, are eligible only if (1) they have been acquired by the U.S. government for addition to these systems and (2) they were subject to local property taxes in the five-year period prior to this acquisition. Payment under Section 6904 is calculated as 1% of the fair market value of the land at the time it was acquired, not to exceed the amount of property taxes levied on the property during the fiscal year prior to its acquisition. Further, Section 6904 payments are made annually only for the five fiscal years after the land, or interest, is acquired by the U.S. government, unless otherwise mandated by law.

Section 6905 Payments

Section 6905 authorizes the Secretary of the Interior to make payments to counties that contain lands, or interests, that are part of the Redwood National Park and are owned by the U.S. government or that are acquired by the U.S. government in the Lake Tahoe Basin under the Act of December 23, 1980.45 Section 6905 payments are paid at a rate of (1) 1% of the fair market value of the acquired land or interests or (2) the amount of taxes levied on the land in the year prior to acquisition, whichever is lesser. Payments on these lands continue for five years or until payments have totaled 5% of the fair market value of the land.46

Issues for Congress

PILT is of perennial interest to many in Congress and to stakeholders throughout the country. County governments are particularly interested in the certainty of PILT payments, as well as in how payments are calculated, because many consider PILT payments to be an integral part of their annual budgets. Congressional and stakeholder interests include questions of how PILT should be funded, what lands should be included as entitlement lands, and how authorized payment levels are calculated under PILT, among others.

Congress annually addresses questions of how funding should be provided to PILT. Congress has funded PILT through both mandatory and discretionary appropriations (see "PILT Authorizations and Appropriations"). More often than not, PILT funding has been provided through the discretionary appropriations process for one fiscal year at a time. Although PILT has consistently received funding since its enactment, the appropriations process has created uncertainty among some stakeholders about the level of annual funding.47 Stakeholders also have asserted that greater certainty, in terms of both the guarantee of funding and the amount of funding (i.e., full statutory calculation) would be better.48

Members of Congress typically contemplate the implications and tradeoffs of discretionary versus mandatory spending and may have different views than the counties that receive PILT payments. Congress, for example, may weigh its discretion to review and fund PILT on an annual basis through the appropriations process against the certainty of funding for specific activities that accompany mandatory appropriations.49 Several bills have been introduced to amend how PILT is funded. For example, legislation has been introduced in the 116th Congress that would require mandatory funding for PILT for either a set period of time (e.g., 10 additional years) or indefinitely.50

The question of which lands should be eligible for PILT payments is also of interest to many Members and stakeholders. In law, entitlement lands are restricted to the listed federal land types (see "Entitlement Lands"). However, this definition does not fully encompass the types of lands that are held by the federal government, nor does it account for the full suite of lands that are exempt from state and local taxes. Although some of these other lands may receive compensation through other federal programs, not all do, which may cause financial hardships for counties that otherwise might receive revenue through taxation. To address this concern, some Members of Congress have contemplated amending the definition of entitlement lands under PILT. For example, past Congresses have introduced legislation that would have amended PILT by expanding the definition of entitlement land to include

- land "that is held in trust by the United States for the benefit of a federally recognized Indian tribe or an individual Indian";51

- lands under the jurisdiction of the Department of the Defense, other than those already included in PILT;52

- lands acquired by the federal government for addition to the National Wildlife Refuge System;53 and

- lands administered by the Department of Homeland Security, 54 among others.

Amending the definition of entitlement lands could have several implications. Adding additional acres of entitlement lands could increase the authorized amount of payments under PILT, which likely would benefit those states with the added lands but not states that lack additional lands. This, in turn, could influence how Congress elects to fund PILT. Additional entitled lands may be eligible for other compensation programs, which could further affect PILT payments.

The authorized payment level under Section 6902, which accounts for nearly all payments under PILT, is calculated pursuant to the statutory requirements. This section has remained largely unchanged since it was amended in 1994 to add the requirement to adjust for inflation, among other changes.55 The inflation adjustment clause has resulted in increasing payment and ceiling rates since that time.56 Congress routinely considers whether the current formula is the best means of calculating payments under PILT or whether the formula should be amended. For example, in the 116th Congress, bills have been introduced that would adjust the payment structure for counties with a population of less than 5,000.57 This adjustment would have implications for how population or area would be incorporated into calculating PILT payments and whether PILT payments were provided in an equitable manner.

PILT is of interest to a large number of counties and other state and local entities across the country, and it may remain of interest to many Members of Congress. In addition to the above issues, Congress may consider other issues related to PILT and how the program fits into the landscape of federal programs that compensate for the presence of tax-exempt federal lands.

Author Contact Information

Footnotes

| 1. |

31 U.S.C. §§6901-6907. Implementing regulations for the Payments in Lieu of Taxes (PILT) program are provided at 43 C.F.R. Part 44. |

| 2. |

PILT was originally enacted in 1976 through P.L. 94-565. In 1982, PILT was "revised, codified, and enacted" in Title 31 of the U.S. Code pursuant to Chapter 69 of P.L. 97-258. PILT has been amended multiple times. |

| 3. |

Although PILT is the broadest of these compensatory programs, it is not the oldest, and PILT provides compensation for defined entitlement lands only (31 U.S.C. §6901(1)). Other programs may include additional lands as defined by those programs. Several of those programs may be partially offset in PILT through the consideration of prior-year payments. Those programs are listed at 31 U.S.C. §6903(a)(1). |

| 4. |

For more information, see Public Land Law Review Commission, One Third of the Nation's Land: A Report to the President and to the Congress, June 1970, pp. 235-241. This report was produced pursuant to P.L. 88-606. |

| 5. |

For more information, see U.S. Congress, House Committee on Interior and Insular Affairs, Payments In Lieu of Taxes Act, report to accompany H.R. 9719, 94th Cong., 2nd sess., May 7, 1976, H.Rept. 94-1106; and U.S. Congress, Senate Committee on Interior and Insular Affairs, Providing for Payments to Local Governments Based upon the Amount of Certain Public Lands Within the Boundaries of Each Such Government, report to accompany H.R. 9719, 94th Cong., 2nd sess., September 20, 1976, S.Rept. 94-1262. |

| 6. |

31 U.S.C. §6902(a), 31 U.S.C. §6904(b), and 31 U.S.C. §6905(a) and (b)(3). However, both §6904 and §6905 require that certain funds provided through these sections are made available to school districts and other local governmental units within the local jurisdiction. |

| 7. |

For more information, see Department of the Interior (DOI), Fiscal Year 2019 Payments In Lieu of Taxes, National Summary, June 2019, p. 1, at https://www.doi.gov/sites/doi.gov/files/uploads/2019_national_summary_pilt_0.pdf (hereinafter, National Summary FY2019). |

| 8. |

Although the DOI Office of the Secretary administers the payments, it relies upon data from federal agencies within and outside of DOI (e.g., the federal land management agencies and the Census Bureau in the Department of Commerce) and state agencies to calculate the annual payments. |

| 9. |

These sections refer to 31 U.S.C. §§6902, 6904, and 6905. |

| 10. |

PILT payments may be subject to additional requirements provided in appropriations laws. For example, provisions for prorated payments, set-aside, and minimum payments were all included in Title I of Division D in P.L. 116-94 for FY2020. |

| 11. |

National Summary FY2019, p. 1. |

| 12. |

For example, see S. 2480, H.R. 3043, S. 2108, and H.R. 3716 in the 116th Congress. |

| 13. |

31 U.S.C. §6906, prior to the enactment of P.L. 110-343. Between 1976 and 1982, the authorization of appropriations from PILT was codified at 31 U.S.C. §1607 and read, "There are authorized to be appropriated for carrying out the provisions of this Act such sums as may be necessary: Provided, That, notwithstanding any other provision of this Act no funds may be made available except to the extent provided in advance in appropriations." P.L. 94-565, §7. |

| 14. |

31 U.S.C. §6906, prior to the enactment of P.L. 110-343. |

| 15. |

P.L. 110-343, Div. C, Title VI, §601(c)(1). |

| 16. |

P.L. 110-343, Div. C, Title VI, §601(c)(1). |

| 17. |

P.L. 110-343, P.L. 112-141, and P.L. 113-79. |

| 18. |

P.L. 113-235 and P.L. 113-291. |

| 19. |

P.L. 114-113 and P.L. 115-31. |

| 20. |

P.L. 115-141, P.L. 116-6, and P.L. 116-94. |

| 21. |

For example, in FY2020, provisions were included in Title I of Division D in P.L. 116-94 that specified that no payment is to be made if the authorized payment is less than $100; to authorize DOI to retain up to $400,000 from the authorized payment for administrative expenses; to allow for payments to be reduced proportionally if the appropriated amount is insufficient; and to correct for prior over- or underpayments. Although similar provisions have routinely been included in appropriations acts, the specific text of these provisions has varied. |

| 22. |

31 U.S.C. §6901(2). |

| 23. |

National Summary FY2019, p. 7. |

| 24. |

National Summary FY2019, Schedule 1. Four counties received payments under §6904 and/or §6905 but did not receive §6902 payments: Berkshire County, MA; Windsor County, VT; Beaufort County, SC; and Hancock County, ME. |

| 25. |

31 U.S.C. §6901(1). |

| 26. |

Most of these lands are under the jurisdiction of the Bureau of Reclamation. |

| 27. |

Public domain lands "refers to public lands the United States obtained title to through treaty, purchase, or annexation that have never left federal ownership." For more information public domain and acquired lands, see U.S. Fish and Wildlife Service, Statistical Data Tables for Fish &Wildlife Service Lands (as of 9/30/2019), at https://www.fws.gov/refuges/land/PDF/2019_Annual_Report_Data_Tables(508-Compliant).pdf. |

| 28. |

Prior-year payment programs that may affect PILT payments are listed at 16 U.S.C. §6903(a)(1). |

| 29. |

National Summary FY2019, p. 115. As noted, the number of acres is provided to the Office of the Secretary by the various federal agencies that administer the entitlement lands. |

| 30. |

Even though the population payment rate declines as county population size increases, payment ceilings generally are higher for counties with larger populations. For example, in FY2019, the population payment rate for a population of 5,000 was $186.56 and the rate for a population of 6,000 was $174.71, a decrease of $11.85 for the more populous county. When multiplied by the population, however, the ceiling is higher for the county with the larger population: 5,000 × $186.56 = $932,800, versus 6,000 × $174.71 = $1,048,260, or $115,460 more for the more populous county. |

| 31. |

31 U.S.C. §6903(d). |

| 32. |

The per capita payment rates are included in the PILT national summary each year. For example, the National Summary FY2019, p. 14, includes the payment rates for FY2019. |

| 33. |

31 U.S.C. §6903(a)(1). |

| 34. |

National Summary FY2019, p. 9. According to DOI Only the amount of Federal land payments actually received by units of government in the prior fiscal year is deducted. If a unit receives a Federal land payment but is required by State law to pass all or part of it to financially and politically independent school districts, or to any other single or special purpose district, payments are considered to have not been received by the unit of local government and are not deducted from the Section 6902 payment. |

| 35. |

If the population-based ceiling replaces the per-acre calculation under Alternative A, prior-year payments are then deducted from the population-based ceiling to determine the final amount for Alternative A. |

| 36. |

Congress provides funding for PILT through either discretionary or mandatory appropriations, or both, in any given year. See "PILT Authorizations and Appropriations" for more information. |

| 37. |

Payments may be subject to any additional provisions included in appropriations language, such as minimum payment thresholds or adjustments for under- or overpayments in previous years. PILT provisions in appropriations laws generally have required a minimum payment threshold of $100. For example, the FY2019 appropriations language included a $100 minimum payment clause (P.L. 116-6, Division E, Title I). In FY2019, 202 counties had an authorized payment of less than $100; these counties did not receive payments, per the FY2019 appropriations language. |

| 38. |

The provision for a prorated payment is not included in the PILT statutory language (31 U.S.C. §§6901-6907), but it has been included in certain appropriations legislation for PILT. |

| 39. |

The requirement of a minimum threshold of $100 for PILT payments is routinely included in appropriations language related to PILT (e.g., for FY2020, Title I of Division D in P.L. 116-94) and also is in regulation (43 C.F.R. §44.51). |

| 40. |

A set-aside for administrative expenses routinely has been included in PILT appropriations language. For example, DOI is allowed to retain up to $400,000 of the appropriations for PILT for administrative expenses in FY2020 (Title I of Division D in P.L. 116-94). |

| 41. |

31 U.S.C. §§6904 and 6905. |

| 42. |

National Summary FY2019, p. 7. This source reports §6904 and §6905 payments together, and further disaggregation is not possible from the information provided. |

| 43. |

43 C.F.R. §44.50. |

| 44. |

31 U.S.C. §6904. For more information on the National Park System, see CRS Report R41816, National Park System: What Do the Different Park Titles Signify?, by Laura B. Comay. For more information on wilderness areas, see CRS Report RL31447, Wilderness: Overview, Management, and Statistics, by Anne A. Riddle and Katie Hoover. |

| 45. |

31 U.S.C. §6905. The Act of December 23, 1980 is P.L. 96-586. |

| 46. |

43 C.F.R. §44.40. Payments may extend beyond five years when taxes levied in the year prior to acquisition account for less than 1% of the fair market value of the acquired land. However, any portion of a payment not made because Congress did not appropriate sufficient funds is not deferred to later payments. |

| 47. |

National Association of Counties (NACo), Provide Full Mandatory Funding for the Payments in Lieu of Taxes (PILT) Program, September 1, 2019, at https://www.naco.org/resources/provide-full-mandatory-funding-payments-lieu-taxes-pilt-program. |

| 48. |

NACo, Counties to Congress: Reauthorize the Secure Rural Schools (SRS) program and fully fund Payments in Lieu of Taxes (PILT), April 11, 2017, at https://www.naco.org/blog/counties-congress-reauthorize-secure-rural-schools-srs-program-and-fully-fund-payments-lieu. |

| 49. |

For more information, see CRS Report R44582, Overview of Funding Mechanisms in the Federal Budget Process, and Selected Examples, by Jessica Tollestrup. |

| 50. |

S. 2480 would require mandatory PILT funding through FY2029, and H.R. 3043 would require mandatory PILT funding indefinitely. |

| 51. |

For example, H.R. 7251 in the 110th Congress. |

| 52. |

For example, H.R. 4710 in the 113th Congress. |

| 53. |

For example, S. 2626 in the 113th Congress. |

| 54. |

For example, H.R. 543 in the 112th Congress. |

| 55. |

P.L. 103-397 amended 31 U.S.C. §6903 in several ways. Since then, §6903 has been amended once; P.L. 106-393 amended the definition of payment law at 31 U.S.C. §6903(a)(1)(C). That amendment added the Secure Rural Schools and Community Self-Determination Act of 2000 (16 U.S.C. §§7101 et seq.) to the list of payment laws, which are included in determining prior-year payments. |

| 56. |

P.L. 103-397 added the requirement to adjust for inflation. |

| 57. |