State Minimum Wages: An Overview

Changes from November 1, 2019 to October 16, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Contents

- Introduction

- The FLSA Minimum Wage

- Enterprise Coverage

- Individual Coverage

- FLSA Minimum Wage Rates

- Minimum Wage Policies in the States

- Rates and Mechanisms of Adjustment

- Rates

- Mechanisms for Future Adjustments

- Legislatively Scheduled Increases

- Indexing to Inflation

- Reference to the Federal Rate

- Trends in State Minimum Wages

Figures

Tables

Summary

The Fair Labor Standards Act (FLSA), enacted in 1938, is the federal law that establishes the general minimum wage that must be paid to all covered workers. While the FLSA mandates broad minimum wage coverage, states have the option of establishing minimum wage rates that are different from those set in it. Under the provisions of the FLSA, an individual is generally covered by the higher of the state or federal minimum wage.

As of 2020, minimum wage rates are above the federal rate of $7.25 per hour in 29 states and the District of Columbia, ranging from $1.31 to $7.75 above the federal rate. Another 14 states have minimum wage rates equal to the federal rate. The remaining 7 states have minimum wage rates below the federal rate or do not have a state minimum wage requirement. In the states with no minimum wage requirements or wages lower than the federal minimum wage, only individuals who are not covered by the FLSA are subject to those lower rates.

In any given year, the exact number of states with a minimum wage rate above the federal rate may vary, depending on the interaction between the federal rate and the mechanisms in place to adjust the state minimum wage. Adjusting minimum wage rates is typically done in one of two ways: (1) legislatively scheduled rate increases that may include one or several increments; (2) a measure of inflation to index the value of the minimum wage to the general change in prices.

Of the 29 states and the District of Columbia with minimum wage rates above the federal rate, 5 currently have no scheduled increases beyond 2020, 7 states have legislatively scheduled rate increases only after 2020, and 17 states and the District of Columbia have scheduled increases through a combination of planned increases and current- or future-year indexation of state minimum wage rates to a measure of inflation. In addition, currently six states—California, Connecticut, Illinois, Maryland, Massachusetts, New Jersey—and the District of Columbia have scheduled rate increases to $15.00 per hour at some point between 2020 and 2025.

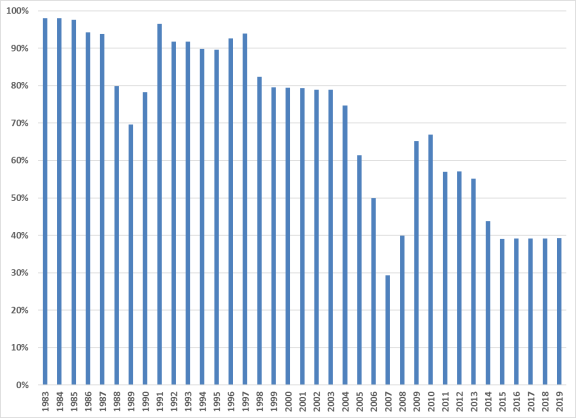

Because the federal and state minimum wage rates change at various times and in various increments, the share of the labor force for which the federal rate is the binding wage floor has changed over time. Since 1981, there have been three series of increases in the federal minimum wage rate—1990-1991, 1996-1997, and 2007-2009. During that same period, there have been numerous changes in state minimum wage policies. As a result of those interactions, the share of the U.S. civilian labor force living in states in which the federal minimum wage is the floor has fluctuated but generally declined, and is about 39% as of 2019.

Introduction

The Fair Labor Standards Act (FLSA), enacted in 1938, is the federal legislation that establishes the general minimum wage that must be paid to all covered workers.1 The FLSA mandates broad minimum wage coverage. It also specifies certain categories of workers who are not covered by general FLSA wage standards, such as workers with disabilities or certain youth workers.

In 1938, the FLSA established a minimum wage of $0.25 per hour. The minimum wage provisions of the FLSA have been amended numerous times since then, typically to expand coverage or raise the wage rate. Since its establishment, the minimum wage rate has been raised 22 separate times.2 The most recent change was enacted through P.L. 110-28 in 2007, which increased the minimum wage from $5.15 per hour to its current rate of $7.25 per hour in three steps (the final step occurring in 2009).

States generally have three options in setting their minimum wage policies: (1) they can set their own minimum wage provisions that differ from those in the FLSA, (2) they can explicitly tie their minimum wage provisions to the FLSA, or (3) they can include no specific minimum wage provisions in state law.

This report begins with a brief discussion of FLSA minimum wage coverage. It then provides a summary of state minimum wage laws, followed by an examination of rates and mechanisms of adjustments in states with minimum wage levels above the FLSA rate (Table 1 provides summary data). Next, the report discusses the interaction of federal and state minimum wages over time, and finally, the Appendix provides detailed information on the major components of minimum wage policies in all 50 states and the District of Columbia.

The state policies covered in this report include currently effective policies and policies enacted with an effective date at some point in 2020. While most states' scheduled state minimum wage rate changes (due to inflation adjustments or statutorily scheduled changes) occurred on January 1 of each year, a few states have rate increases scheduled for later in the year. Effective dates of rate increases are noted in Table 1 and in the Appendix.

The FLSA Minimum Wage

The FLSA extends two types of minimum wage coverage to individuals: "enterprise coverage" and "individual coverage."3 An individual is covered if they meet the criteria for either category.

Enterprise Coverage

To be covered by the FLSA at the enterprise or business level, an enterprise must have at least two employees and annual sales or "business done" of at least $500,000. Annual sales or business done includes all business activities that can be measured in dollars. Thus, for example, retailers are covered by the FLSA if their annual sales are at least $500,000.4 In non-sales cases, a measure other than sales must be used to determine business done. For example, for enterprises engaged in leasing property, gross amounts paid by tenants for property rental will be considered business done for purposes of determining enterprise coverage.

In addition, regardless of the dollar volume of business, the FLSA applies to hospitals or other institutions primarily providing medical or nursing care for residents; schools (preschool through institutions of higher education); and federal, state, and local governments.

Thus, regardless of how enterprise coverage is determined (by business done or by specified institutional type), all employees of a covered enterprise are considered to be covered by the FLSA.

Individual Coverage

Although an enterprise may not be subject to minimum wage requirements if it has less than $500,000 in annual sales or business done, employees of the enterprise may be covered if they are individually engaged in interstate commerce or in the production of goods for interstate commerce. To be engaged in interstate commerce—the definition of which is fairly broad—employees must produce goods (or have indirect input to the production of those goods) that will be shipped out of the state of production, travel to other states for work, make phone calls or send emails to persons in other states, handle records that are involved in interstate transactions, or provide services to buildings (e.g., janitorial work) in which goods are produced for shipment outside of the state.5

While individual coverage is broad under the FLSA, there are also specific exemptions from the federal rate, including individuals with disabilities; youth workers; tipped workers; and executive, administrative, and professional workers, among others.6

FLSA Minimum Wage Rates

In 1938, the FLSA established a minimum wage of $0.25 per hour. The minimum wage provisions of the FLSA have been amended numerous times since then, typically for the purpose of expanding coverage or raising the wage rate. Since its establishment, the minimum wage rate has been raised 22 separate times. The most recent change was enacted in 2007 (P.L. 110-28), which increased the minimum wage from $5.15 per hour to its current rate of $7.25 per hour in three steps. On July 18, 2019, the House passed H.R. 582, which would increase the federal minimum wage to $15 per hour by 2025, index the rate to changes in the median hourly wage, and phase out subminimum wages for tipped workers, youth, and individuals with disabilities.7

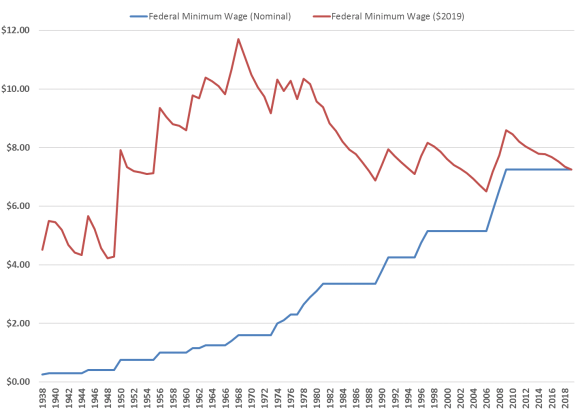

Figure 1 shows the nominal and real (inflation-adjusted) value of the federal minimum wage from its enactment in 1938 through 2019. The real value of the minimum wage generally rose from 1938 to 1968, after which it has generally fallen in real terms, with some brief increases in value following periodic statutory rate changes. From an initial rate of $0.25 per hour in 1938 ($4.51 in inflation-adjusted terms), the minimum wage increased to $1.60 per hour in 1968 ($11.70 in inflation-adjusted terms), a peak value to date. The real value of the minimum wage has fallen by $1.35 since it was increased to $7.25 in 2009.

|

|

Notes: The inflation-adjusted minimum wage is expressed in 2019 dollars based on the Consumer Price Index for All Urban Consumers (CPI-U), U.S. City Average. The CPI-U value for 2019 is the semi-annual average for the first half of 2019. |

Minimum Wage Policies in the States

State policymakers may also choose to set labor standards that are different from federal statutes. The FLSA establishes that if a state enacts minimum wage, overtime, or child labor laws more protective of employees than those provided in the FLSA, then state law applies. In the case of minimum wages, this means FLSA-covered workers are entitled to the higher state minimum wage in those states with rates above the federal minimum. On the other hand, FLSA-covered workers would receive the FLSA minimum wage in states that have set minimum wages lower than the federal rate. Given the generally broad minimum wage coverage of the FLSA, it is likely that most workers in states with minimum wages below the federal rate are covered by the FLSA rate.

In 2020, the range of state minimum wage rates is as follows:

- 29 states and the District of Columbia have enacted minimum wage rates above the federal rate of $7.25 per hour;

- 2 states have minimum wage rates below the federal rate;

- 5 states have no state minimum wage requirement; and

- the remaining 14 states have minimum wage rates equal to the federal rate.8

In the states with no minimum wage requirements or wages lower than the federal minimum wage, only individuals who are not covered by the FLSA are subject to those lower rates.

The Appendix provides detailed information on state minimum wage policy in all 50 states and the District of Columbia, including the legislation authorizing the state minimum wage and the relevant legislative language regarding the rate and mechanism of adjustment.

The remainder of this report focuses on states with minimum wages above the federal rate.

Rates and Mechanisms of Adjustment

In states with minimum wage rates above the federal rate, variation occurs mainly across two dimensions: the rate and the mechanism of adjustment to the rate. This section (including data in Table 1) summarizes these two dimensions for the states with rates currently above the federal minimum. State rates range from $1.31 to $7.75 above the federal rate, with a majority of these states using some sort of inflation measure to index the state minimum wage.

Rates

In the 29 states and the District of Columbia with minimum wage rates above the federal rate in 2020, minimum hourly rates range from $8.56 per hour in Florida to $13.50 per hour in Washington and $15.00 in the District of Columbia. Of the states with minimum wage rates above $7.25:

- 8 states have rates between $1.00 and $2.00 per hour above the federal rate;

- 8 states have rates between $2.00 and $3.00 per hour above the federal rate;

- 4 states have rates between $3.00 and $4.00 per hour above the federal rate;

- 9 states and the District of Columbia have rates greater than $4.00 per hour above the federal rate (i.e., $11.26 or higher).

In these 29 states and the District of Columbia, the unweighted average minimum wage is $10.64 per hour and the most common minimum wage rate is $12.00 per hour (Arizona, Connecticut, Maine, Oregon, and Colorado). In addition, currently six states—California, Connecticut, Illinois, Maryland, Massachusetts, New Jersey—and the District of Columbia have scheduled rate increases to $15.00 per hour at some point between 2020 and 2025.

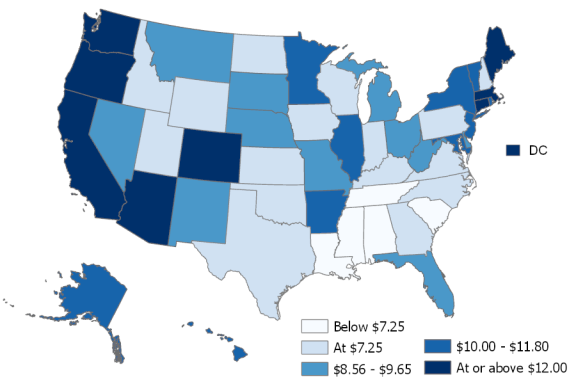

Figure 2 shows the geographic and rate dispersion of state minimum wages. In terms of coverage, a majority of the civilian labor force is in states with a minimum wage rate above the federal rate of $7.25. Specifically, the 29 states and the District of Columbia with minimum wage rates above $7.25 represent about 61% of the total civilian labor force, which means the federal rate is the wage floor in states representing 39% of the labor force.9

|

|

Source: CRS analysis of U.S. Department of Labor data.

|

Mechanisms for Future Adjustments

In any given year, the exact number of states with a minimum wage rate above the federal rate may vary, depending on what mechanism is in place to adjust the state minimum wage. Some states specifically set rates above the federal rate. Other states have rates above the federal minimum wage because the state minimum wage rate is indexed to a measure of inflation or is increased in legislatively scheduled increments, and thus the state rate changes even if the federal minimum wage stays unchanged.

Below are the two main approaches to regulating the adjustment of state minimum wage rates in states with rates above the federal minimum: legislatively scheduled increases and indexing to inflation.10 In this section, states are counted by the primary method of adjustment. While most states use only one of these methods, some states combine a series of scheduled increases followed by indexing the state rate to a measure of inflation. In these cases, states are counted as "indexing to inflation," as that is the long-term mechanism of adjustment in place.

Legislatively Scheduled Increases

If a state adopts a minimum wage higher than the federal rate, the state legislature may specify a single rate in the enacting legislation and then choose not to address future rates. In these cases, the only mechanism for future rate changes is future legislative action. Alternatively, a state may specify future rates in legislation through a given date. Rhode Island in 2017, for example, set a rate of $10.10 per hour beginning January 1, 2018, and $10.50 beginning January 1, 2019. After the final increase, the rate will remain at $10.50 per hour until further legislative action. This is the same approach taken in the most recent federal minimum wage increase (P.L. 110-28), which increased the minimum wage from $5.15 an hour in 2007 to $7.25 per hour in 2009 in three phases. Of the 29 states and the District of Columbia with minimum wage rates above the federal rate, 5 currently have no scheduled increases beyond 2020, while Arkansas, Illinois, Maryland, Massachusetts, Michigan, Nevada, and New Mexico have legislatively scheduled rate increases after 2020.11

Indexing to Inflation

If a minimum wage rate is established as a fixed amount and not increased, its value will erode over time due to inflation.12 For this reason, several states have attempted to maintain the value of the minimum wage over time by indexing the rate to some measure of inflation. This mechanism provides for automatic changes in the minimum wage over time and does not require legislative action to make annual adjustments.

Currently, 6 states index state minimum wages to a measure of inflation. In addition, another 11 states and the District of Columbia are scheduled in a future year to index state minimum wage rates to a measure of inflation. Thus, of the total of 17 states and the District of Columbia that currently or are scheduled to index minimum wage rates,

- 6 states—Arizona, Montana, New York, Oregon, South Dakota, and Vermont—index the state minimum wage to the national Consumer Price Index for All Urban Consumers (CPI-U);

- 5 states—California, Missouri, New Jersey, Ohio, and Washington—index the state minimum wage to the national Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W);

- 2 states—Alaska and Colorado—and the District of Columbia use a subnational version of the CPI-U to index the state minimum wage;

- 2 states—Florida and Maine—use a regional version of the CPI-W to index the minimum wage;

- 1 state (Minnesota) uses the implicit price deflator for Personal Consumption Expenditures (PCE) to index the minimum wage; and

- 1 state (Connecticut) uses the Employment Cost Index (ECI) to index the minimum wage.

Reference to the Federal Rate

While scheduled increases and indexation are the two main ways that states adjust their minimum wage rates, a few states also add a reference to the federal minimum wage rate as a possible mechanism of adjustment. Thus any time the federal rate changes, the state rate may change.13 Currently, Alaska, Connecticut, the District of Columbia, and Massachusetts use this federal reference to supplement their primary mechanisms of adjusting state minimum wage rates.

- In Alaska, the state minimum wage rate is indexed to the CPI-U for Anchorage Metropolitan Statistical Area. However, Alaska state law requires that the state minimum wage must be at least $1.00 per hour higher than the federal rate. So it is possible that a federal wage increase could trigger an increase in the Alaska minimum wage, but the main mechanism is indexation to inflation.

- Connecticut state law requires that the state rate must be increased to one-half of one percent more than federal rate in the event that the federal rate increases above Connecticut's minimum wage.

- The District of Columbia's minimum wage rate is the higher of the level required by the District of Columbia statute or the federal rate plus $1.00. Starting in 2021, the District of Columbia minimum wage will be indexed to inflation and the reference to the federal rate will no longer be in effect.

- While Massachusetts law includes scheduled rate increases in the minimum wage through 2023, the law also requires that the state rate must be at least $0.50 above federal minimum wage rate.

Table 1. Summary of States with Enacted Minimum Wage Rates Above $7.25

As of January 1, 2020 (unless otherwise noted)

|

State |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

|

Alaska |

$9.89 |

$10.19 |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

|

Arizona |

$11.00 |

$12.00 |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

|

Arkansas |

$9.25 |

$10.00 |

$11.00 |

$11.00 |

$11.00 |

$11.00 |

$11.00 |

|

$12.00 |

$13.00 |

$14.00 |

$15.00 |

CPI-W |

CPI-W |

CPI-W |

|

Colorado |

$11.10 |

$12.00 |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

|

$11.00 |

$12.00 |

$13.00 |

$14.00 |

$15.00 |

ECI |

ECI |

|

$9.25 |

$9.25 |

$9.25 |

$9.25 |

$9.25 |

$9.25 |

$9.25 |

|

$14.00 |

$15.00 |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

|

Florida |

$8.46 |

$8.56 |

CPI-W |

CPI-W |

CPI-W |

CPI-W |

CPI-W |

|

Hawaii |

$10.10 |

$10.10 |

$10.10 |

$10.10 |

$10.10 |

$10.10 |

$10.10 |

|

Illinois |

$8.25 |

$10.00 |

$11.00 |

$12.00 |

$13.00 |

$14.00 |

$15.00 |

|

Maine |

$11.00 |

$12.00 |

CPI-W |

CPI-W |

CPI-W |

CPI-W |

CPI-W |

|

$10.10 |

$11.00 |

$11.75 |

$12.50 |

$13.25 |

$14.00 |

$15.00 |

|

Massachusetts |

$12.00 |

$12.75 |

$13.50 |

$14.25 |

$15.00 |

$15.00 |

$15.00 |

|

$9.45 |

$9.65 |

$9.87 |

$10.10 |

$10.33 |

$10.56 |

$10.80 |

|

$9.86 |

$10.00 |

PCE |

PCE |

PCE |

PCE |

PCE |

|

Missouri |

$8.60 |

$9.45 |

$10.30 |

$11.15 |

$12.00 |

CPI-W |

CPI-W |

|

Montana |

$8.50 |

$8.65 |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

|

Nebraska |

$9.00 |

$9.00 |

$9.00 |

$9.00 |

$9.00 |

$9.00 |

$9.00 |

|

$8.25 |

$9.00 |

$9.75 |

$10.50 |

$11.25 |

$12.00 |

$12.00 |

|

New Jersey |

$10.00 |

$11.00 |

$12.00 |

$13.00 |

$14.00 |

$15.00 |

CPI-W |

|

New Mexico |

$7.50 |

$9.00 |

$10.50 |

$11.50 |

$12.00 |

$12.00 |

$12.00 |

|

$11.10 |

$11.80 |

$12.50 |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

|

Ohio |

$8.55 |

$8.70 |

CPI-W |

CPI-W |

CPI-W |

CPI-W |

CPI-W |

|

$11.25 |

$12.00 |

$12.75 |

$13.50 |

CPI-U |

CPI-U |

CPI-U |

|

Rhode Island |

$10.50 |

$10.50 |

$10.50 |

$10.50 |

$10.50 |

$10.50 |

$10.50 |

|

South Dakota |

$9.10 |

$9.30 |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

|

Vermont |

$10.78 |

$10.96 |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

|

Washington |

$12.00 |

$13.50 |

CPI-W |

CPI-W |

CPI-W |

CPI-W |

CPI-W |

|

West Virginia |

$8.75 |

$8.75 |

$8.75 |

$8.75 |

$8.75 |

$8.75 |

$8.75 |

Source: Minimum wage rates are from U.S. Dept. of Labor, http://www.dol.gov/whd/minwage/america.htm and state websites; Adjustment mechanisms are from state websites and National Conference of State Legislatures, http://www.ncsl.org/research/labor-and-employment/state-minimum-wage-chart.aspx.

Notes: In Table 1, cells with "CPI-U," "CPI-W," or "PCE" indicate that the state minimum rate is indexed to the relevant inflation measure in those years.

a. The minimum wage for California in Table 1 is for large employers, which are defined as any employer employing 26 or more employees. For employers with 25 or fewer employees, the minimum wage in 2020 is $12.00 per hour and is scheduled to reach $15.00 on January 1, 2023.

b. The effective dates for minimum wage increases in Connecticut are October 1, 2019; September 1, 2020; August 1, 2021; July 1, 2022; and June 1, 2023. Starting on January 1, 2024, and each January thereafter, the minimum wage is scheduled to be increased by changes in the Employment Cost Index (ECI).

c. The minimum wage in Delaware was $8.75 per hour from January 1, 2019, through September 30, 2019. As of October 1, 2019, the minimum wage is $9.25 per hour.

d. The minimum wage in the District of Columbia is $14.00 per hour through June 30, 2020. The new rate of $15.00 in the District of Columbia is scheduled to go into effect July 1, 2020. Future rate increases begin on July 1.

e. The minimum wage for Maryland in Table 1 is for large employers, which are defined as any employer employing 15 or more employees. For employers with 14 or fewer employees, the minimum wage in 2020 is $11.00 per hour and is scheduled to reach $15.00 on July 1, 2026.

f. As of March 29, 2019, the minimum wage was $9.45 per hour. Future rate increases begin on January 1. The minimum wage is scheduled to increase to $12.05 by January 1, 2030.

g. The minimum wage for Minnesota in Table 1 is for large employers, which are defined as enterprises "whose annual gross volume of sales made or business done is not less than $500,000 (exclusive of excise taxes at the retail level that are separately stated) and covered by the Minnesota Fair Labor Standards Act." The minimum wage for small employers (defined as enterprises "whose annual gross volume of sales made or business done is less than $500,000") is $8.15 as of January 1, 2020.

h. Nevada maintains a two-tier minimum wage system. The minimum wage for Nevada in Table 1 is for workers who do not receive qualified health benefits from their employer. The minimum wage for workers receiving qualified health benefits is $1.00 less per hour. Annual adjustments occur on July 1 of each year.

i. The state of New York has four minimum wage rates—large employers in New York City, small employers in New York City, New York City suburbs, and the Remainder of the State—each with different scheduled rate increases. Following scheduled increases for large employers (11 or more employees) in New York City, small employers (10 or fewer employees) in New York City, and New York City suburbs to $15 per hour (in 2019, 2020, and 2022, respectively), the minimum wage rate for the Remainder of the State becomes indexed in 2022 from its scheduled rate of $12.50 at that time and remains indexed until it reaches $15 per hour. Indexation is not applied to the other three New York rates after they reach $15 per hour. The rate in Table 1 is for the Remainder of the State (outside of New York City and Nassau, Suffolk, and Westchester counties). Future rate increases begin on December 31. See Table A-1 for details.

j. The state of Oregon has three minimum wage rates—Standard, Portland Metro, and Nonurban Counties—each with different scheduled rate increases. The rate in Table 1 is the Standard rate. Future rate increases begin on July 1. See Table A-1 for details.

Trends in State Minimum Wages

Because federal and state minimum wages do not change in regular intervals or by regular increments, the number of states and the share of the labor force covered by higher minimum wages changes annually. In general, during periods in which the federal minimum wage remains constant, more states enact higher minimum wages and the share of the workforce for which the federal rate serves as the floor likewise decreases. When the federal rate increases, some state rates become equal to or less than the federal rate.

Table 1 presents a snapshot of minimum wage rates in the 29 states and the District of Columbia with minimum wages above the federal rate from 2019 through 2025, while Figure 3 shows the changes in the coverage of the federal minimum wage.14 Specifically, Figure 3 plots the percentage of the civilian labor force residing in states in which the federal wage serves as the floor.15 If no state had a minimum wage above the federal rate, then the federal minimum wage would be the floor for states in which 100% of the labor force resides. Similarly, if every state had a minimum wage above the current rate of $7.25, then the federal rate would not be binding for the labor force. Instead the interaction of federal and state rates has led to the federal minimum wage playing a fluctuating, but generally decreasing, role in establishing a wage floor for the civilian labor force, particularly during periods in which the federal rate is not increased.

The Share of the U.S. Labor Force Residing in States with the Federal Minimum Wage as the Floor |

|

|

Examining the specific time periods around changes in the federal minimum wage (see Figure 1 for the history of federal minimum wage rate changes), data in Figure 3 show a general trend toward a lower share of the labor force being covered by the federal minimum wage only. Federal rate increases in 2007 through 2009 mitigated this reduction, as did earlier changes in the federal rate.

- In the period from 1983 through 1989, the federal minimum wage remained constant at $3.35 per hour. Prior to the federal increases in 1990 and 1991, the number of states with higher minimum wages rose from 3 in 1984 to 16 in 1989 and the share of the U.S. civilian labor force in states for which the federal rate was the floor fell from 98% to 70%.

- Following a two-step federal increase in 1990 and 1991 from $3.35 to $4.25 per hour, the number of states with higher minimum wages fell to 8 in 1992, which meant that the federal rate was the floor for states comprising 92% of the civilian labor force.

- The next federal minimum wage increase occurred in two steps in 1996 and 1997, increasing from $4.25 to $5.15 per hour. Prior to that increase, in 1995, there were 10 states, representing 10% of the civilian labor force, with minimum wages above the federal rate. After the second increase in 1997, the number of states with higher minimum wages dropped to 8, but the share of the labor force in states for which the federal rate served as a floor decreased to 82%.

- The federal minimum wage did not increase after 1997 until 2007. During much of that period the number of states with higher minimum wages stayed somewhat steady, increasing from 8 (comprising 18% of the civilian labor force) in 1998 to 12 (comprising 21% of the civilian labor force) in 2003. However, by 2006, 22 states representing 50% of the civilian labor force had minimum wage rates above the federal rate. This increase was due in part to a few populous states, such as Florida, Michigan, and New York, adopting minimum wage rates above the federal rate in this period.

- Following the three-step increase in the federal minimum wage from $5.15 to the current $7.25 (2007-2009), 15 states, comprising 33% of the civilian labor force, had rates above the federal minimum wage in 2010. By 2019, this rose to 29 states and the District of Columbia, which means that the federal rate is the wage floor in states representing 39% of the civilian labor force.

Appendix. Selected Characteristics of State Minimum Wage Policies

For the 29 states and the District of Columbia with state minimum wage rates above the federal rate as of 2020, Table 1 and much of the text above summarizes information on those states' minimum wage policies, highlighting minimum wage rates and mechanisms used to establish and adjust wage rates. As discussed previously, for those states with current or scheduled minimum wages above the federal rate, three main mechanisms are in place to adjust future rates: (1) scheduled increases, (2) indexation to inflation, or (3) reference to the federal rate plus an add-on (i.e., a state minimum wage is a percentage or dollar amount above the federal rate). For the 21 states with minimum wage rates equal to or below the federal rate, however, there are no mechanisms in place to move rates above the federal rate. Thus, the main difference within this group of states is the relationship of the state rate, if any, to the federal rate.

For those 21 states with minimum wages equal to or below the federal rate, the state rate may be set in four ways:16

- No state minimum wage provisions: In five states—Alabama, Louisiana, Mississippi, South Carolina, and Tennessee—there are no provisions for state minimum wage rates. In practice, this means that most workers in these states are covered by the FLSA minimum wage provisions since coverage is generally broad.

- State minimum wage provisions with no reference to the FLSA: Five states have state minimum wage rates but do not reference the FLSA. Two of these states—Georgia and Wyoming—have state rates below $7.25, while three of these states—Kansas, North Dakota, and Wisconsin—have rates equal to $7.25. However, because there is no reference to the FLSA rate or other provision for adjustment in any of these states, the state rate does not change unless the state policy is changed.

- State minimum wage equals the FLSA rate: Six states—Idaho, Indiana, New Hampshire, Oklahoma, Texas, and Virginia—set the state rate equal to the FLSA rate. Thus, when the FLSA rate changes, the state rates in these six states change to equal the FLSA rate.

State minimum wage equals FLSA rate if FLSA is greater: In four states—Iowa, Kentucky, North Carolina, and Pennsylvania—the state rate is specified separately but includes a provision to equal the FLSA rate if the latter is above the state specified rate.

Table A-1 provides detailed information about minimum wage policies in the 50 states and the District of Columbia, including those summarized in a more concise manner in Table 1.

|

State |

|

Pertinent Language and Notes |

|

|

Alabama |

No state minimum wage law |

n/a |

|

|

Alaska |

"(a) Except as otherwise provided for in law, an employer shall pay to each employee a minimum wage, as established herein, for hours worked in a pay period, whether the work is measured by time, piece, commission or otherwise. An employer may not apply tips or gratuities bestowed upon employees as a credit toward payment of the minimum hourly wage required by this section. Tip credit as defined by the Fair Labor Standards Act of 1938 as amendment does not apply to the minimum wage established by this section. Beginning with the passage of this Act, the minimum wage shall be $8.75 per hour effective January 1, 2015, $9.75 per hour effective January 1, 2016 and thereafter adjusted annually for inflation. The adjustment shall be calculated each September 30, for the proceeding January-December calendar year, by the Alaska Department of Labor and Workforce Development, using 100 percent of the rate of inflation based on the Consumer Price Index for all urban consumers for the Anchorage metropolitan area, compiled by the Bureau of Labor Statistics, United States Department of Labor; the department shall round the adjusted minimum hourly wage up to the nearest one cent; the adjusted minimum hourly wage shall apply to work performed beginning on January 1 through December 31 of the year for which it is effective. (d)If the minimum wage determined under (a) of this section is less than one dollar over the federal minimum wage, the Alaska minimum wage shall be set at one dollar over the federal minimum wage. This amount shall be adjusted in subsequent years by the method established in (a) of this section." |

||

|

Arizona |

"A. Employers shall pay employees no less than the minimum wage, which shall be not less than: 1. $10 on and after January 1, 2017. 2. $10.50 on and after January 1, 2018. 3. $11 on and after January 1, 2019. 4. $12 on and after January 1, 2020. B. The minimum wage shall be increased on January 1, 2021 and on January 1 of successive years, by the increase in the cost of living. The increase in the cost of living shall be measured by the percentage increase as of August of the immediately preceding year over the level as of August of the previous year of the consumer price index (all urban consumers, U.S. city average for all items) or its successor index as published by the U.S. department of labor or its successor agency, with the amount of the minimum wage increase rounded to the nearest multiple of five cents." |

||

|

Arkansas |

"(a)(3) Beginning January 1, 2019, every employer shall pay each of his or her employees wages at the rate of not less than nine dollars and twenty-five cents ($9.25) per hour, beginning January 1, 2020 the rate of not less than ten dollars ($10.00) per hour and beginning January 1, 2021 the rate of not less than eleven dollars ($11.00) per hour except as otherwise provided in this subchapter." |

||

|

California |

"Notwithstanding any other provision of this part, on and after July 1, 2014, the minimum wage for all industries shall be not less than nine dollars ($9.00) per hour, and on and after January 1, 2016, the minimum wage for all industries shall be not less than ten dollars ($10.00) per hour. (1) For any employer who employs 26 or more employees, the minimum wage shall be as follows: (A) From January 1, 2017, to December 31, 2017, inclusive,—ten dollars and fifty cents ($10.50) per hour. (B) From January 1, 2018, to December 31, 2018, inclusive,—eleven dollars ($11) per hour. (C) From January 1, 2019, to December 31, 2019, inclusive,—twelve dollars ($12) per hour. (D) From January 1, 2020, to December 31, 2020, inclusive,—thirteen dollars ($13) per hour. (E) From January 1, 2021, to December 31, 2021, inclusive,—fourteen dollars ($14) per hour. (F) From January 1, 2022, and until adjusted by subdivision (c)—fifteen dollars ($15) per hour. (2) For any employer who employs 25 or fewer employees, the minimum wage shall be as follows: (A) From January 1, 2018, to December 31, 2018, inclusive,—ten dollars and fifty cents ($10.50) per hour. (B) From January 1, 2019, to December 31, 2019, inclusive,—eleven dollars ($11) per hour. (C) From January 1, 2020, to December 31, 2020, inclusive,—twelve dollars ($12) per hour. (D) From January 1, 2021, to December 31, 2021, inclusive—thirteen dollars ($13) per hour. (E) From January 1, 2022, to December 31, 2022, inclusive,—fourteen dollars ($14) per hour. (F) From January 1, 2023, and until adjusted by subdivision (c)—fifteen dollars ($15) per hour. c) (1) Following the implementation of the minimum wage increase specified in subparagraph (F) of paragraph (2) of subdivision (b), on or before August 1 of that year, and on or before each August 1 thereafter, the Director of Finance shall calculate an adjusted minimum wage. The calculation shall increase the minimum wage by the lesser of 3.5 percent and the rate of change in the averages of the most recent July 1 to June 30, inclusive, period over the preceding July 1 to June 30, inclusive, period for the United States Bureau of Labor Statistics nonseasonally adjusted United States Consumer Price Index for Urban Wage Earners." |

||

|

Colorado |

"Effective January 1, 2017, Colorado's minimum wage is increased to $ 9.30 per hour and is increased annually by $ 0.90 each January 1 until it reaches $ 12 per hour effective January 2020, and thereafter is adjusted annually for cost of living increases, as measured by the Consumer Price Index used for Colorado. This minimum wage shall be paid to employees who receive the state or federal minimum wage." |

||

|

Connecticut |

Connecticut State Statutes Section 31-58, Connecticut House Bill No. 5004, Public Act No. 19-4 |

"…effective January 1, 2014, not less than eight dollars and seventy cents per hour, and effective January 1, 2015, not less than nine dollars and fifteen cents per hour, and effective January 1, 2016, not less than nine dollars and sixty cents per hour, and effective January 1, 2017, not less than ten dollars and ten cents per hour, and effective October 1, 2019, not less than eleven dollars per hour, and effective September 1, 2020, not less than twelve dollars per hour, and effective August 1, 2021, not less than thirteen dollars per hour, and effective July 1, 2022, not less than fourteen dollars per hour, and effective June 1, 2023, not less than fifteen dollars per hour. On October 15, 2023, and on each October fifteenth thereafter, the Labor Commissioner shall announce the adjustment in the minimum fair wage which shall become the new minimum fair wage and shall be effective on January first immediately following. On January 1, 2024, and not later than each January first thereafter, the minimum fair wage shall be adjusted by the percentage change in the employment cost index, or its successor index, for wages and salaries for all civilian workers, as calculated by the United States Department of Labor, over the twelve-month period ending on June thirtieth of the preceding year, rounded to the nearest whole cent." |

|

|

Delaware |

"(a) Except as may otherwise be provided under this chapter, every employer shall pay to every employee in any occupation wages of a rate: (1) Not less than $7.75 per hour effective June 1, 2014; and (2) Not less than $8.25 per hour effective June 1, 2015; (3) Not less than $8.75 per hour effective January 1, 2019; (4) Not less than $9.25 per hour effective October 1, 2019. Upon the establishment of a federal minimum wage in excess of the state minimum wage, the minimum wage in this State shall be equal in amount to the federal minimum wage, except as may otherwise be provided under this chapter." |

||

|

The District of Columbia |

"(5)(A) Except as provided in subsection (h) of this section and subparagraph (B) of this paragraph, the minimum hourly wage required to be paid to an employee by an employer shall be as of: (i) July 1, 2016: $11.50; (ii) July 1, 2017: $12.50; (iii) July 1, 2018: $13.25; (iv) July 1, 2019: $14.00; and (v) July 1, 2020: $15.00. (B) If the minimum wage set by the United States government pursuant to the Fair Labor Standards Act ("U.S. minimum wage") is greater than the minimum hourly wage currently being paid pursuant to subparagraph (A) of this paragraph, the minimum hourly wage paid to an employee by an employer shall be the U.S. minimum wage plus $1. (6)(A) Except as provided in subsection (h) of this section, beginning on July 1, 2021, and no later than July 1 of each successive year, the minimum wage provided in this subsection shall be increased in proportion to the annual average increase, if any, in the Consumer Price Index for All Urban Consumers in the Washington Metropolitan Statistical Area published by the Bureau of Labor Statistics of the United States Department of Labor for the previous calendar year. Any increase under this paragraph shall be adjusted to the nearest multiple of $.05." |

||

|

Florida |

"Beginning September 30, 2005, and annually on September 30 thereafter, the Department of Economic Opportunity shall calculate an adjusted state minimum wage rate by increasing the state minimum wage by the rate of inflation for the 12 months prior to September 1. In calculating the adjusted state minimum wage, the Department of Economic Opportunity shall use the Consumer Price Index for Urban Wage Earners and Clerical Workers, not seasonally adjusted, for the South Region or a successor index as calculated by the United States Department of Labor. Each adjusted state minimum wage rate shall take effect on the following January 1, with the initial adjusted minimum wage rate to take effect on January 1, 2006." |

||

|

Georgia |

"(a) Except as otherwise provided in this Code section, every employer, whether a person, firm, or corporation, shall pay to all covered employees a minimum wage which shall be not less than $5.15 per hour for each hour worked in the employment of such employer." |

||

|

Hawaii |

"(a) Except as provided in section 387-9 and this section, every employer shall pay to each employee employed by the employer, wages at the rate of not less than: (1) $6.25 per hour beginning January 1, 2003; (2) $6.75 per hour beginning January 1, 2006; (3) $7.25 per hour beginning January 1, 2007; (4) $7.75 per hour beginning January 1, 2015; (5) $8.50 per hour beginning January 1, 2016; (6) $9.25 per hour beginning January 1, 2017; and (7) $10.10 per hour beginning January 1, 2018." |

||

|

Idaho |

"MINIMUM WAGES. (1) Except as hereinafter otherwise provided, no employer shall pay to any of his employees any wages computed at a rate of less than seven dollars and twenty-five cents ($7.25) per hour for employment. The amount of the minimum wage shall conform to, and track with, the federal minimum wage. 4) No political subdivision of this state, as defined by section 6-902, Idaho Code, shall establish by ordinance or other action minimum wages higher than the minimum wages provided in this section." |

||

|

Illinois |

"From July 1, 2010 through December 31, 2019 every employer shall pay to each of his or her employees who is 18 years of age or older in every occupation wages of not less than $8.25 per hour, and from January 1, 2020 through June 30, 2020, every employer shall pay to each of his or her employees who is 18 years of age or older in every occupation wages of not less than $9.25 per hour, and from July 1, 2020 through December 31, 2020 every employer shall pay to each of his or her employees who is 18 years of age or older in every occupation wages of not less than $10 per hour, and from January 1, 2021 through December 31, 2021 every employer shall pay to each of his or her employees who is 18 years of age or older in every occupation wages of not less than $11 per hour, and from January 1, 2022 through December 31, 2022 every employer shall pay to each of his or her employees who is 18 years of age or older in every occupation wages of not less than $12 per hour, and from January 1, 2023 through December 31, 2023 every employer shall pay to each of his or her employees who is 18 years of age or older in every occupation wages of not less than $13 per hour, and from January 1, 2024 through December 31, 2024, every employer shall pay to each of his or her employees who is 18 years of age or older in every occupation wages of not less than $14 per hour; and on and after January 1, 2025, every employer shall pay to each of his or her employees who is 18 years of age or older in every occupation wages of not less than $15 per hour." |

||

|

Indiana |

"(h) Except as provided in subsections (c) and (j), every employer employing at least two (2) employees during a work week shall, in any work week in which the employer is subject to this chapter, pay each of the employees in any work week beginning on or after June 30, 2007, wages of not less than the minimum wage payable under the federal Fair Labor Standards Act of 1938, as amended (29 U.S.C. 201 et seq.)." |

||

|

Iowa |

"1. a. The state hourly wage shall be at least $6.20 as of April 1, 2007, and $7.25 as of January 1, 2008. b. Every employer, as defined in the federal Fair Labor Standards Act of 1938, as amended to January 1, 2007, shall pay to each of the employer's employees, as defined in the federal Fair Labor Standards Act of 1938, as amended to January 1, 2007, the state hourly wage stated in paragraph "a", or the current federal minimum wage, pursuant to 29 U.S.C. § 206, as amended, whichever is greater." |

||

|

Kansas |

"Except as otherwise provided in the minimum wage and maximum hours law, every employer shall pay to each employee wages at a rate as follows: (1) Prior to January 1, 2010, employee wages shall be paid at a rate of not less than $2.65 an hour; and (2) on and after January 1, 2010, employee wages shall be paid at a rate of not less than $7.25 an hour." |

||

|

Kentucky |

"Except as may otherwise be provided by this chapter, every employer shall pay to each of his employees wages at a rate of not less than five dollars and eighty-five cents ($5.85) an hour beginning on June 26, 2007, not less than six dollars and fifty-five cents ($6.55) an hour beginning July 1, 2008, and not less than seven dollars and twenty-five cents ($7.25) an hour beginning July 1, 2009. If the federal minimum hourly wage as prescribed by 29 U.S.C. sec. 206(a)(1) is increased in excess of the minimum hourly wage in effect under this subsection, the minimum hourly wage under this subsection shall be increased to the same amount, effective on the same date as the federal minimum hourly wage rate." |

||

|

Louisiana |

No state minimum wage law |

||

|

Maine |

"1. Minimum wage. The minimum hourly wage is $7.50 per hour. Starting January 1, 2017, the minimum hourly wage is $9.00 per hour; starting January 1, 2018, the minimum hourly wage is $10.00 per hour; starting January 1, 2019, the minimum hourly wage is $11.00 per hour; and starting January 1, 2020, the minimum hourly wage is $12.00 per hour. On January 1, 2021 and each January 1st thereafter, the minimum hourly wage then in effect must be increased by the increase, if any, in the cost of living. The increase in the cost of living must be measured by the percentage increase, if any, as of August of the previous year over the level as of August of the year preceding that year in the Consumer Price Index for Urban Wage Earners and Clerical Workers, CPI-W, for the Northeast Region, or its successor index, as published by the United States Department of Labor, Bureau of Labor Statistics or its successor agency, with the amount of the minimum wage increase rounded to the nearest multiple of 5¢. If the highest federal minimum wage is increased in excess of the minimum wage in effect under this section, the minimum wage under this section is increased to the same amount, effective on the same date as the increase in the federal minimum wage, and must be increased in accordance with this section thereafter." |

||

|

Maryland |

§3–413. (a)(1) In this section the following words have the meanings indicated. (2) "Employer" includes a governmental unit. (3) "Small employer" means an employer that employs 14 or fewer employees. (b) Except as provided in subsection (d) of this section and §§ 3–413.1 and 3–414 of this subtitle, each employer shall pay: (1) to each employee who is subject to both the federal Act and this subtitle, at least the greater of: (i) the minimum wage for that employee under the federal Act; or (ii) the State minimum wage set under subsection (c) of this section; and (2) to each other employee who is subject to this subtitle, at least the greater of: (i) the highest minimum wage under the federal Act; or (ii) the State minimum wage set under subsection (c) of this section. (c)(1) Subject to § 3–413.1 of this subtitle and except as provided in paragraph (2) of this subsection, the State minimum wage rate is: (i) for the 12–month period beginning July 1, 2017, $9.25 per hour; (ii) for the 18–month period beginning July 1, 2018, $10.10 per hour; (iii) for the 12–month period beginning January 1, 2020, $11.00 per hour; (iv) for the 12–month period beginning January 1, 2021, $11.75 per hour; (v) for the 12–month period beginning January 1, 2022, $12.50 per hour; (vi) for the 12–month period beginning January 1, 2023, $13.25 per hour; (vii) for the 12–month period beginning January 1, 2024, $14.00 per hour; and (viii) beginning January 1, 2025, $15.00 per hour. (2) Subject to § 3–413.1 of this subtitle, the State minimum wage rate for a small employer is: (i) for the 18–month period beginning July 1, 2018, $10.10 per hour; (ii) for the 12–month period beginning January 1, 2020, $11.00 per hour; (iii) for the 12–month period beginning January 1, 2021, $11.60 per hour; (iv) for the 12–month period beginning January 1, 2022, $12.20 per hour; (v) for the 12–month period beginning January 1, 2023, $12.80 per hour; (vi) for the 12–month period beginning January 1, 2024, $13.40 per hour; (vii) for the 12–month period beginning January 1, 2025, $14.00 per hour; (viii) for the 6–month period beginning January 1, 2026, $14.60 per hour; and (ix) beginning July 1, 2026, $15.00 per hour. |

||

|

Massachusetts |

Massachusetts Session Laws 2018, Chapter 121, amended MA General Laws Chapter 151, Section 1. | "A wage of less than $12.00 per hour, in any occupation, as defined in this chapter, shall conclusively be presumed to be oppressive and unreasonable ... Notwithstanding the provisions of this section, in no case shall the minimum wage rate be less than $.50 higher than the effective federal minimum rate." "SECTION 17. Section 1 of chapter 151 of the General Laws, as appearing in the 2016 Official Edition, is hereby amended by striking out, in line 6, the figure '$11.00' and inserting in place thereof the following figure:- $12.00. SECTION 18. Said section 1 of said chapter 151 is hereby further amended by striking out the figure '$12.00', inserted by section 17, and inserting in place thereof the following figure:- $12.75. SECTION 19. Said section 1 of said chapter 151 is hereby further amended by striking out the figure '$12.75', inserted by section 18, and inserting in place thereof the following figure:- $13.50. SECTION 20. Said section 1 of said chapter 151 is hereby further amended by striking out the figure '$13.50', inserted by section 19, and inserting in place thereof the following figure:- $14.25. SECTION 21. Said section 1 of said chapter 151 is hereby further amended by striking out the figure '$14.25', inserted by section 20, and inserting in place thereof the following figure:- $15.00. … SECTION 32. Sections 6, 11, 18 and 23 shall take effect on January 1, 2020. SECTION 33. Sections 7, 12, 19, 24 and subsection (a) of section 2 of chapter 175M of the General Laws shall take effect on January 1, 2021. SECTION 35. Sections 8, 13, 20 and 25 shall take effect on January 1, 2022. SECTION 36. Sections 9, 14, 16, 21 and 26 shall take effect on January 1, 2023. | |

|

Michigan |

Michigan Compiled Laws 408.934 |

Sec. 4. (1) Subject to the exceptions specified in this act, the minimum hourly wage rate is: (a) Before September 1, 2014, $7.40. (b) Beginning September 1, 2014, $8.15. (c) Beginning January 1, 2016, $8.50. (d) Beginning January 1, 2017, $8.90. (e) Beginning January 1, 2018, $9.25. (f) In calendar year 2019, or a subsequent calendar year as described in subsection (2), $9.45. (g) In calendar year 2020, or a subsequent calendar year as described in subsection (2), $9.65. (h) In calendar year 2021, or a subsequent calendar year as described in subsection (2), $9.87. (i) In calendar year 2022, or a subsequent calendar year as described in subsection (2), $10.10. (j) In calendar year 2023, or a subsequent calendar year as described in subsection (2), $10.33. (k) In calendar year 2024, or a subsequent calendar year as described in subsection (2), $10.56. (l) In calendar year 2025, or a subsequent calendar year as described in subsection (2), $10.80. (m) In calendar year 2026, or a subsequent calendar year as described in subsection (2), $11.04. (n) In calendar year 2027, or a subsequent calendar year as described in subsection (2), $11.29. (o) In calendar year 2028, or a subsequent calendar year as described in subsection (2), $11.54. (p) In calendar year 2029, or a subsequent calendar year as described in subsection (2), $11.79. (q) In calendar year 2030, or a subsequent calendar year as described in subsection (2), $12.05. (2) An increase in the minimum hourly wage rate as prescribed in subsection (1) does not take effect if the unemployment rate for this state, as determined by the Bureau of Labor Statistics, United States Department of Labor, is 8.5% or greater for the calendar year preceding the calendar year of the prescribed increase. An increase in the minimum hourly wage rate as prescribed in subsection (1) that does not take effect pursuant to this subsection takes effect in the first calendar year following a calendar year for which the unemployment rate for this state, as determined by the Bureau of Labor Statistics, United States Department of Labor, is less than 8.5%." |

|

|

Minnesota |

"(a) For purposes of this subdivision, the terms defined in this paragraph have the meanings given them. (1) 'Large employer' means an enterprise whose annual gross volume of sales made or business done is not less than $500,000 (exclusive of excise taxes at the retail level that are separately stated) and covered by the Minnesota Fair Labor Standards Act, sections 177.21 to 177.35. (2) 'Small employer' means an enterprise whose annual gross volume of sales made or business done is less than $500,000 (exclusive of excise taxes at the retail level that are separately stated) and covered by the Minnesota Fair Labor Standards Act, sections 177.21 to 177.35. (b) Except as otherwise provided in sections 177.21 to 177.35: (1) every large employer must pay each employee wages at a rate of at least: (i) $8.00 per hour beginning August 1, 2014; (ii) $9.00 per hour beginning August 1, 2015; (iii) $9.50 per hour beginning August 1, 2016; and (iv) the rate established under paragraph (f) beginning January 1, 2018; and (2) every small employer must pay each employee at a rate of at least: (i) $6.50 per hour beginning August 1, 2014; (ii) $7.25 per hour beginning August 1, 2015; (iii) $7.75 per hour beginning August 1, 2016; and (iv) the rate established under paragraph (f) beginning January 1, 2018. (f) No later than August 31 of each year, beginning in 2017, the commissioner shall determine the percentage increase in the rate of inflation, as measured by the implicit price deflator, national data for personal consumption expenditures as determined by the United States Department of Commerce, Bureau of Economic Analysis during the 12-month period immediately preceding that August or, if that data is unavailable, during the most recent 12-month period for which data is available. The minimum wage rates in paragraphs (b), (c), (d), and (e) are increased by the lesser of: (1) 2.5 percent, rounded to the nearest cent; or (2) the percentage calculated by the commissioner, rounded to the nearest cent. A minimum wage rate shall not be reduced under this paragraph. The new minimum wage rates determined under this paragraph take effect on the next January 1." |

||

|

Mississippi |

No state minimum wage law |

n/a |

|

|

Missouri |

"2. The minimum wage shall be increased or decreased on January 1, 2008, and on January 1 of successive years, by the increase or decrease in the cost of living. On September 30, 2007, and on each September 30 of each successive year, the director shall measure the increase or decrease in the cost of living by the percentage increase or decrease as of the preceding July over the level as of July of the immediately preceding year of the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) or successor index as published by the U.S. Department of Labor or its successor agency, with the amount of the minimum wage increase or decrease rounded to the nearest five cents." 3. Except as may be otherwise provided pursuant to sections 290.500 to 290.530, and notwithstanding subsection 1* of this section, effective January 1, 2019, every employer shall pay to each employee wages at the rate of not less than $8.60 per hour, or wages at the same rate or rates set under the provisions of federal law as the prevailing federal minimum wage applicable to those covered jobs in interstate commerce, whichever rate per hour is higher. Thereafter, the minimum wage established by this subsection shall be increased each year by $.85 per hour, effective January 1 of each of the next four years, until it reaches $12.00 per hour, effective January 1, 2023. Thereafter, the minimum wage established by this subsection shall be increased or decreased on January 1, 2024, and on January 1 of successive years, per the method set forth in subsection 2** of this section. If at any time the federal minimum wage rate is above or is thereafter increased above the minimum wage then in effect under this subsection, the minimum wage required by this subsection shall continue to be increased pursuant to this subsection ***, but the higher federal rate shall immediately become the minimum wage required by this subsection and shall be increased or decreased per the method set forth in subsection 2** for so long as it remains higher than the state minimum wage required and increased pursuant to this subsection. |

||

|

Montana |

| ||

|

Nebraska |

"Except as otherwise provided in this section and section 48-1203.01, every employer shall pay to each of his or her employees a minimum wage of: (a) Seven dollars and twenty-five cents per hour through December 31, 2014; (b) Eight dollars per hour on and after January 1, 2015, through December 31, 2015; and (c) Nine dollars per hour on and after January 1, 2016." |

||

|

Nevada |

For current text, see Nevada AB 456, 2019 Chapter 591, Section 1.5 | Each employer shall pay to each employee of the employer a wage of not less than: (a) Beginning July 1, 2019: (1) If the employer offers health benefits to the employee in the manner described in Section 16 of Article 15 of the Nevada Constitution, $7.25 per hour worked. (2) If the employer does not offer health benefits to the employee in the manner described in Section 16 of Article 15 of the Nevada Constitution, $8.25 per hour worked. (b) Beginning July 1, 2020: (1) If the employer offers health benefits to the employee in the manner described in Section 16 of Article 15 of the Nevada Constitution, $8.00 per hour worked. (2) If the employer does not offer health benefits to the employee in the manner described in Section 16 of Article 15 of the Nevada Constitution, $9.00 per hour worked. (c) Beginning July 1, 2021: (1) If the employer offers health benefits to the employee in the manner described in Section 16 of Article 15 of the Nevada Constitution, $8.75 per hour worked. (2) If the employer does not offer health benefits to the employee in the manner described in Section 16 of Article 15 of the Nevada Constitution, $9.75 per hour worked. (d) Beginning July 1, 2022: (1) If the employer offers health benefits to the employee in the manner described in Section 16 of Article 15 of the Nevada Constitution, $9.50 per hour worked. (2) If the employer does not offer health benefits to the employee in the manner described in Section 16 of Article 15 of the Nevada Constitution, $10.50 per hour worked. (e) Beginning July 1, 2023: (1) If the employer offers health benefits to the employee in the manner described in Section 16 of Article 15 of the Nevada Constitution, $10.25 per hour worked. (2) If the employer does not offer health benefits to the employee in the manner described in Section 16 of Article 15 of the Nevada Constitution, $11.25 per hour worked. (f) Beginning July 1, 2024: (1) If the employer offers health benefits to the employee in the manner described in Section 16 of Article 15 of the Nevada Constitution, $11.00 per hour worked. (2) If the employer does not offer health benefits to the employee in the manner described in Section 16 of Article 15 of the Nevada Constitution, $12.00 per hour worked. | |

|

New Hampshire |

"Unless otherwise provided by statute, no person, firm, or corporation shall employ any employee at an hourly rate lower than that set forth in the federal minimum wage law, as amended." |

||

|

New Jersey |

"5. a. Except as provided in subsections c., d., e. and g. of this section, each employer shall pay to each of his employees wages at a rate of not less than $8.85 per hour as of January 1, 2019 and, on January 1 of 2020 and January 1 of each subsequent year, the minimum wage shall be increased by any increase in the consumer price index for all urban wage earners and clerical workers (CPI-W) as calculated by the federal government for the 12 months prior to the September 30 preceding that January 1, except that any of the following rates shall apply if it exceeds the rate determined in accordance with the applicable increase in the CPI-W for the indicated year: on July 1, 2019, the minimum wage shall be $10.00 per hour; on January 1, 2020, the minimum wage shall be $11.00 per hour; and on January 1 of each year from 2021 to 2024, inclusive, the minimum wage shall be increased from the rate of the preceding year by $1.00 per hour. If the federal minimum hourly wage rate set by section 6 of the federal "Fair Labor Standards Act of 1938" (29 U.S.C. s.206), or a successor federal law, is raised to a level higher than the State minimum wage rate set by this subsection, then the State minimum wage rate shall be increased to the level of the federal minimum wage rate and subsequent increases based on increases in the CPI-W pursuant to this section shall be applied to the higher minimum wage rate. |

||

|

New Mexico |

(Effective January 1, 2020. 2019, ch. 114, § 2.) A. Except as provided in Subsection B or D of this section, an employer shall pay to an employee a minimum wage rate of: (1) prior to January 1, 2020, at least seven dollars fifty cents ($7.50) an hour; (2) beginning January 1, 2020 and prior to January 1, 2021, at least nine dollars ($9.00) an hour; (3) beginning January 1, 2021 and prior to January 1, 2022, at least ten dollars fifty cents ($10.50) an hour; (4) beginning January 1, 2022 and prior to January 1, 2023, at least eleven dollars fifty cents ($11.50) an hour; and (5) on and after January 1, 2023, at least twelve dollars ($12.00) an hour. | ||

|

New York |

New York Labor Law, Minimum Wage Act, Article 19, Section 652 |

(a) New York City. (i) Large employers. Every employer of eleven or more employees shall pay to each of its employees for each hour worked in the city of New York a wage of not less than: … $15.00 per hour on and after December 31, 2018, or, if greater, such other wage as may be established by federal law pursuant to 29 U.S.C. section 206 or its successors or such other wage as may be established in accordance with the provisions of this article. (ii) Small employers. Every employer of ten or less employees shall pay to each of its employees for each hour worked in the city of New York a wage of not less than: .. $13.50 per hour on and after December 31, 2018, $15.00 per hour on and after December 31, 2019, or, if greater, such other wage as may be established by federal law pursuant to 29 U.S.C. section 206 or its successors or such other wage as may be established in accordance with the provisions of this article. (b) Remainder of downstate. Every employer shall pay to each of its employees for each hour worked in the counties of Nassau, Suffolk and Westchester a wage not less than: .. $12.00 per hour on and after December 31, 2018, $13.00 per hour on and after December 31, 2019, $14.00 per hour on and after December 31, 2020, $15.00 per hour on and after December 31, 2021, or, if greater, such other wage as may be established by federal law pursuant to 29 U.S.C. section 206 or its successors or such other wage as may be established in accordance with the provisions of this article. (c) Remainder of state. Every employer shall pay to each of its employees for each hour worked outside of the city of New York and the counties of Nassau, Suffolk, and Westchester, a wage of not less than: .. $11.10 on and after December 31, 2018, $11.80 on and after December 31, 2019, $12.50 on and after December 31, 2020, and on each following December thirty-first, a wage published by the commissioner on or before October first, based on the then current minimum wage increased by a percentage determined by the director of the budget in consultation with the commissioner, with the result rounded to the nearest five cents, totaling no more than fifteen dollars, where the percentage increase shall be based on indices including, but not limited to, (i) the rate of inflation for the most recent twelve month period ending June of that year based on the consumer price index for all urban consumers on a national and seasonally unadjusted basis (CPI-U), or a successor index as calculated by the United States department of labor, (ii) the rate of state personal income growth for the prior calendar year, or a successor index, published by the bureau of economic analysis of the United States department of commerce, or (iii) wage growth; or, if greater, such other wage as may be established by federal law pursuant to 29 U.S.C. section 206 or its successors or such other wage as may be established in accordance with the provisions of this article. |

|

|

North Carolina |

"Every employer shall pay to each employee who in any workweek performs any work, wages of at least six dollars and fifteen cents ($6.15) per hour or the minimum wage set forth in paragraph 1 of section 6(a) of the Fair Labor Standards Act, 29 U.S.C. 206(a)(1), as that wage may change from time to time, whichever is higher, except as otherwise provided in this section." |

||

|

North Dakota |

"Except as otherwise provided under this chapter and rules adopted by the commissioner, every employer shall pay to each of the employer's employees: a. Effective on the effective date of this section, a wage of at least five dollars and eighty-five cents per hour; b. Effective twelve months after the effective date of this section, a wage of at least six dollars and fifty-five cents per hour; and c. Effective twenty-four months after the effective date of this section, a wage of at least seven dollars and twenty-five cents per hour." |

||

|

Ohio |

"On the thirtieth day of each September, beginning in 2007, this state minimum wage rate shall be increased effective the first day of the following January by the rate of inflation for the twelve month period prior to that September according to the consumer price index or its successor index for all urban wage earners and clerical workers for all items as calculated by the federal government rounded to the nearest five cents." |

||

|

Oklahoma |

"Except as otherwise provided in the Oklahoma Minimum Wage Act, no employer within the State of Oklahoma shall pay any employee a wage of less than the current federal minimum wage for all hours worked." |

||

|

Oregon |

Oregon Revised Statutes 653.025 (see Oregon Laws 2016, Chap. 12) |

"(1) Except as provided in subsections (2) and (3) of this section, ORS 652.020 and the rules of the Commissioner of the Bureau of Labor and Industries issued under ORS 653.030 and 653.261, for each hour of work time that the employee is gainfully employed, no employer shall employ or agree to employ any employee at wages computed at a rate lower than:… (f) From July 1, 2019, to June 30, 2020, $11.25. (g) From July 1, 2020, to June 30, 2021, $12. (h) From July 1, 2021, to June 30, 2022, $12.75. (i) From July 1, 2022, to June 30, 2023, $13.50. (j) After June 30, 2023, beginning on July 1 of each year, a rate adjusted annually for inflation as described in subsection (5) of this section. (2) If the employer is located within the urban growth boundary of a metropolitan service district organized under ORS chapter 268, … (d) From July 1, 2019, to June 30, 2020, $12.50. (e) From July 1, 2020, to June 30, 2021, $13.25. (f) From July 1, 2021, to June 30, 2022, $14. (g) From July 1, 2022, to June 30, 2023, $14.75. (h) After June 30, 2023, $1.25 per hour more than the minimum wage determined under subsection (1)(j) of this section. (3) If the employer is located within a nonurban county as described in ORS 653.026… (d) From July 1, 2019, to June 30, 2020, $11. (e) From July 1, 2020, to June 30, 2021, $11.50. (f) From July 1, 2021, to June 30, 2022, $12. (g) From July 1, 2022, to June 30, 2023, $12.50. (h) After June 30, 2023, $1 per hour less than the minimum wage determined under subsection (1)(j) of this section. (4) The commissioner shall adopt rules for determining an employer's location under subsection (2) of this section. (5)(a) The Oregon minimum wage shall be adjusted for inflation as provided in paragraph (b) of this subsection. (b) No later than April 30 of each year, beginning in 2023, the commissioner shall calculate an adjustment of the wage amount specified in subsection (1)(j) of this section based upon the increase, if any, from March of the preceding year to March of the year in which the calculation is made in the U.S. City Average Consumer Price Index for All Urban Consumers for All Items as prepared by the Bureau of Labor Statistics of the United States Department of Labor or its successor. (c) The wage amount as adjusted under this subsection shall be rounded to the nearest five cents. (d) The wage amount as adjusted under this subsection becomes effective as the new Oregon minimum wage amount, replacing the minimum wage amount specified in subsection (1)(j) of this section, on July 1 of the year in which the calculation is made. |

|

|

Pennsylvania |

"Except as may otherwise be provided under this act: (a) Every employer shall pay to each of his or her employees wages for all hours worked at a rate of not less than: (1) Two dollars sixty-five cents ($2.65) an hour upon the effective date of this amendment. (2) Two dollars ninety cents ($2.90) an hour during the year beginning January 1, 1979. (3) Three dollars ten cents ($3.10) an hour during the year beginning January 1, 1980. (4) Three dollars thirty-five cents ($3.35) an hour after December 31, 1980. (5) Three dollars seventy cents ($3.70) an hour beginning February 1, 1989, and thereafter. (6) Five dollars fifteen cents ($5.15) an hour beginning September 1, 1997. (7) Six dollars twenty-five cents ($6.25) an hour beginning January 1, 2007. (8) Seven dollars fifteen cents ($7.15) an hour beginning July 1, 2007. (a.1) If the minimum wage set forth in the Fair Labor Standards Act of 1938 (52 Stat. 1060, 29 U.S.C. §201 et seq.) is increased above the minimum wage required under this section, the minimum wage required under this section shall be increased by the same amounts and effective the same date as the increases under the Fair Labor Standards Act, and the provisions of subsection (a) are suspended to the extent they differ from those set forth under the Fair Labor Standards Act." |

||

|

Rhode Island |

"(a) Every employer shall pay to each of his or her employees: commencing July 1, 1999, at least the minimum wage of five dollars and sixty five cents ($5.65) per hour. Commencing September 1, 2000, the minimum wage is six dollars and fifteen cents ($6.15) per hour. (b) Commencing January 1, 2004, the minimum wage is six dollars and seventy-five cents ($6.75) per hour. (c) Commencing March 1, 2006, the minimum wage is seven dollars and ten cents ($7.10) per hour. (d) Commencing January 1, 2007, the minimum wage is seven dollars and forty cents ($7.40) per hour. (e) Commencing January 1, 2013, the minimum wage is seven dollars and seventy-five cents ($7.75) per hour. (f) Commencing January 1, 2014, the minimum wage is eight dollars ($8.00) per hour. (g) Commencing January 1, 2015, the minimum wage is nine dollars ($9.00) per hour. (h) Commencing January 1, 2016, the minimum wage is nine dollars and sixty cents ($9.60) per hour. (i) Commencing January 1, 2018, the minimum wage is ten dollars and ten cents ($10.10) per hour. (j) Commencing January 1, 2019, the minimum wage is ten dollars and fifty cents ($10.50) per hour." |

||

|

South Carolina |

No state minimum wage law |

n/a |

|

|

South Dakota |

South Dakota Code 60-11-3; 11-3.2 |

"Every employer shall pay to each employee wages at a rate of not less than eight dollars and fifty cents an hour." "Beginning January 1, 2016, and again on January 1 of each year thereafter, the minimum wage provided by § 60-11-3 shall be adjusted by the increase, if any, in the cost of living. The increase in the cost of living shall be measured by the percentage increase as of August of the immediately preceding year over the level as measured as of August of the previous year of the Consumer Price Index (all urban consumers, U.S. city average for all items) or its successor index as published by the U.S. Department of Labor or its successor agency, with the amount of the minimum wage increase, if any, rounded up to the nearest five cents. In no case shall the minimum wage be decreased. The Secretary of the South Dakota Department of Labor and Regulation or its designee shall publish the adjusted minimum wage rate for the forthcoming year on its internet home page by October 15 of each year, and it shall become effective on January 1 of the forthcoming year." |

|

|

Tennessee |

No state minimum wage law |

n/a |

|

|

Texas |

"Except as provided by Section 62.057, an employer shall pay to each employee the federal minimum wage under Section 6, Fair Labor Standards Act of 1938 (29 U.S.C. Section 206)." |

||

|

Utah |

"Minimum wage—Commission to review and modify minimum wage. (1)(a) The minimum wage for all private and public employees within the state shall be $3.35 per hour. (b) Effective April 1, 1990, the minimum wage shall be $3.80 per hour. (2)(a) After July 1, 1990, the commission may by rule establish the minimum wage or wages as provided in this chapter that may be paid to employees in public and private employment within the state. (b) The minimum wage, as established by the commission, may not exceed the federal minimum wage as provided in 29 U.S.C. Sec. 201 et seq., the Fair Labor Standards Act of 1938, as amended, in effect at the time of implementation of this section." |

||

|

Vermont |

"(a) An employer shall not employ any employee at a rate of less than $9.15. Beginning on January 1, 2016, an employer shall not employ any employee at a rate of less than $9.60. Beginning on January 1, 2017, an employer shall not employ any employee at a rate of less than $10.00. Beginning on January 1, 2018, an employer shall not employ any employee at a rate of less than $10.50, and beginning on January 1, 2019 and on each subsequent January 1, the minimum wage rate shall be increased by five percent or the percentage increase of the Consumer Price Index, CPI-U, U.S. city average, not seasonally adjusted, or successor index, as calculated by the U.S. Department of Labor or successor agency for the 12 months preceding the previous September 1, whichever is smaller, but in no event shall the minimum wage be decreased. The minimum wage shall be rounded off to the nearest $0.01. … If the minimum wage rate established by the U.S. government is greater than the rate established for Vermont for any year, the minimum wage rate for that year shall be the rate established by the U.S. government." |

||

|

Virginia |

"Every employer shall pay to each of his employees wages at a rate not less than the federal minimum wage and a training wage as prescribed by the U.S. Fair Labor Standards Act (29 U.S.C. § 201 et seq.)." |

||

|

Washington |