Escalating U.S. Tariffs: Affected Trade

Changes from September 12, 2019 to October 24, 2019

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

The trade practices of U.S. trading partners and the U.S. trade deficit are a focus of the Trump Administration. Citing these and other concerns, the President has imposed unilateral tariff increases under three U.S. laws:

- (1) Section 201 of the Trade Act of 1974 on U.S. imports of washing machines and solar products;

- (2) Section 232 of the Trade Expansion Act of 1962 on U.S. imports of steel and aluminum, and potentially motor vehicles/parts and titanium sponge (the President decided not to impose tariffs on uranium imports, after an investigation); and

- (3) Section 301 of the Trade Act of 1974 on U.S. imports from China.

In May 2019, in response to concerns over immigration, the President also proposed an additional 5% tariff on imports from Mexico under the International Emergency Economic Powers Act (IEEPA), but subsequently suspended the proposed tariffs indefinitely citing an agreement reached with Mexico. This product focuses on unilateral tariff actions by the Administration, and does not include recently imposed increased tariffs on U.S. imports from the European Union (EU), which were sanctioned by a WTO dispute settlement panel. For aFor a timeline of recent actions, see CRS Insight IN10943, Escalating U.S. Tariffs: Timeline. The Administration has stated that it is using existing and proposed tariffs for a range of purposes, including as leverage for trade negotiations with affected trading partners, such as China, Japan, and the European Union (EU)EU, and, as noted, to influence Mexico's immigration policies. While tariffs may benefit a limited number of import-competing firms, they also increase costs for downstream users of imported products and consumers and may have broader negative effects on the U.S. economy, as well as several policy implications.

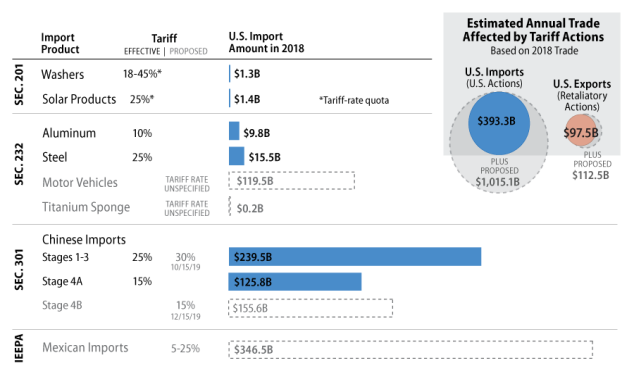

The multiple tariff increases applied to date, ranging from 10% to 45%, affect approximately 1516% of U.S. annual imports. This amounts to $393.3396.4 billion of imports using 2018 annual data; notably, the tariffs went into effect at various times in 2018 and 2019 (Figure 1). Section 301 tariffs on U.S. imports from China account for more than 90% of trade affected by the Administration's tariff actions. While the Administration has taken some steps to reduce the scale of imports affected by the tariffs (i.e., by exempting Canada and Mexico from the steel and aluminum duties and creating processes by which certain products may be excluded), the general trend ishas been an escalation of tariff actions.

In the spring and summer of 2019, the Administration implemented and proposed a series of additional tariff actions, significantly expanding the share of U.S. trade potentially affected. In AugustSince May, the Administration announced new Section 301 tariffs of 10% on approximately $300 billion of U.S. imports from China. In response, China announced retaliatory measures on approximately $75 billion of U.S. exports, most of which are additional tariffs on U.S. exports already subject to Chinese retaliation. The Administration countered by proposing to increase all U.S. Section 301 tariffs by 5%: from 25% to 30% on the existing approximately $250 billion of imports subject to stage 1-3 tariffs, to take effect on October 1, 2019 (now delayed until October 15, 2019); and from 10% to 15% on the new stage 4A and 4B tariff lists, effective September 1 and December 15 (Figure 1). In addition, President Trump declared U.S. motor vehicle imports a national security threat, particularly from the EU and Japan, granting him authority to impose tariff increases on such imports. has escalated its Section 301 tariffs on China by increasing stage 3 tariffs on Chinese goods from 10% to 25%, such that $238 billion of annual U.S. imports from China now face an additional 25% tariff, and announcing plans for additional stage 4 tariffs of 15% covering nearly all remaining bilateral imports (Figure 1). The first phase of stage 4 tariffs took effect on September 1, and the second phase (stage 4B), which covers mostly consumer goods, is to take effect on December 15. In response to this escalation, China also increased its stage 3 tariffs, imposed Stage 4A retaliatory tariffs of 5-10% on September 1, and is to impose additional stage 4B tariffs of 5-10% on December 15, as well as reinstate suspended auto tariffs. In addition to these actions affecting trade with China, in May, President Trump declared U.S. motor vehicle imports, particularly from the EU and Japan, a national security threat under Section 232, granting him authority to impose tariff increases on such imports. (U.S. auto and parts imports from the EU and Japan totaled $119.0 billion in 2018.) The President also proposed an additional 5% to 25% tariff on all imports from Mexico (now indefinitely suspended). In total, these proposed actions would potentially affect over $1 trillion of U.S. imports, or 40% of the annual total.

More recently, two events suggest a potential reduction to the threat of further escalations. On October 7, the Administration signed a limited trade agreement with Japan, which did not specifically address auto trade but likely lessened the prospect of new tariffs. On October 11, the President announced near completion of an initial agreement with China, and indefinitely suspended a proposed 5% increase of all stage 1-3 tariffs, which was to occur on October 15. The Administration hopes to finalize the agreement by mid-November, and it remains unclear whether this proposed agreement will affect existing tariffs or scheduled December tariff increases.

|

|

Sources: CRS calculations with data from U.S. Census Bureau sourced through Global Trade Atlas. Notes: Based on annual 2018 import values. Excludes exempted countries. Motor vehicle and parts import figure includes only U.S. imports from the European Union and Japan, which were the focus of the President's proclamation declaring motor vehicle imports a national security threat. Tariff-rate quotas (TRQs) are a form of import restriction in which one tariff applies up to a specific quantity or value of imports and a higher tariff applies above that threshold. |

As tariffs act as a tax on foreign-produced goods, they distort price signals, potentially leading to less efficient consumption and production patterns, which may ultimately reduce U.S. and global economic growth rates. As of August 29October 2, 2019, the United States collected $35.941 billion from the additional taxes paid by U.S. importers, according to U.S. Customs and Border Protection. Increasing tariffs also createcreates a general environment of economic uncertainty, potentially dampening business investment and creating a further drag on growth. Preliminary research, for example, suggests the increase in trade policy uncertainty may have reduced aggregate U.S. investment by 1% or more in 2018. Estimates of the tariffs' overall economic effects vary, depending on modeling assumptions and the specific set of tariffs considered. Most studies, however, predict declines in GDP growth: the Congressional Budget Office estimated that the tariffs in effect as of July 25, 2019, would lower U.S. GDP by roughly 0.3 percent by 2020 below a baseline without the tariffs; considering also recently proposed actions, the IMF estimated that the tariffs would reduce global GDP in 2020 by 0.5 percent.

Retaliation amplifies the potential effects of the U.S. tariff measures. Retaliatory tariffs in effect, in response to both Section 232 and Section 301 actions, cover approximately $97.5 billion of U.S. annual exports, based on 2018 export data (Table 1). This amount is scheduled to increase to $112.56 billion, if China implements its recently announced plans to impose additional tariffs on December 15 and to reinstate additional tariffs on U.S. cars and auto parts. China, like the United States, however, has also begun granting limited tariff exclusions, lessening somewhat the scale of U.S. exports affected by retaliatory tariff measures. Retaliatory tariffs broaden the scope of U.S. industries potentially harmed, targeting those reliant on export markets and sensitive to price fluctuations, such as agricultural commodities. Some U.S. manufacturers have announced plans to shift production to other countries in order to avoid the tariffs on U.S. exports. Lost market access resulting from the retaliatory tariffs may compound concerns raised by many U.S. exporters that the United States increasingly faces higher tariffs than some competitors in foreign markets as other countries conclude trade liberalization agreements, such as the recently-enacted EU-Japan FTA and the TPP-11 agreement, which include major U.S. trade partners, such as Canada, the EU, Japan, and Mexico. Adverse effects could grow if a tit-for-tat process of retaliation continues and the scale of trade affected increases.

|

Retaliatory Trade Action |

Affected U.S. Exports (millions, 2018) |

Additional Tariff |

Effective Date |

|

|

Section 232 |

EU |

$2, |

10-25% |

June 25, 2018 |

|

$2,522 |

15-25% |

Apr. 2, 2018 |

||

|

$1,771 |

4-70% |

June 21, 2018 |

||

|

$1, |

10-50% |

June 16, 2019 |

||

|

$ |

25-40% |

Aug. 6, 2018c |

||

|

Total Exports Affected by Section 232 Retaliation |

$9, |

|||

|

Section 301 |

$12,896 |

25% |

July 6, 2018 |

|

|

$11,595 |

25% |

Aug. 23, 2018 |

||

|

$59, |

5-10%/ |

Sept. 24, 2018/ |

||

|

$25,463 |

5-10% |

Sept. 1, 2019 |

||

|

China—Stage 4Be (proposed) |

$41, |

5-10% |

Dec. 15, 2019 |

|

|

China—Reinstated Auto Tariffs (proposed) |

$11,720 |

5-25% |

Dec. 15, 2019 |

|

|

Total Exports Affected by Section 301 Retaliationf |

$ |

|||

|

Total and Proposed Exports Affected by Section 301 Retaliationf |

$106, |

|||

|

Overall Total Exports Affected by Retaliationg |

$97, |

|||

|

Overall Total and Proposed Exports Affected by Retaliationg |

$112, |

|||

Sources: CRS calculations based on import data of U.S. trade partner countries sourced from Global Trade Atlas and tariff details from WTO or government notifications.

Notes: Canada and Mexico withdrew their retaliation after the Trump Administration exempted both countries from the Section 232 steel and aluminum duties.

a. India's retaliatory tariffs were initially announced at the WTO in June 2018, with tariffs ranging from 10%-50%, but were repeatedly postponed. India's latest announcement appears to remove 2 of the 30 products from its initial list and may affect retaliatory tariff rates.

b. Russia published its list of retaliatory tariff rates and products on July 6, 2018. The tariffs appear to have gone into effect within 30 days of publication.

c. Export calculation excludes auto tariffs suspended until December 15, 2019.

d. China's retaliatory tariffs in response to U.S. stage 3 Section 301 tariffs initially ranged from 5-10%. In response to the Trump Administration's increase of Section 301 stage 3 tariffs to 25% on May 10, China increase its retaliatory tariffs on certain products to 20% and 25%.

e. China's Stage 4 retaliation includes new tariffs on 1,600 products and also increases the tariff rates of nearly 3,450 products that are already subject to retaliatory tariffs.

f. Total exports adjusted to account for tariff lines affected by multiple stages of China's retaliation to Section 301 tariffs.

g. Total exports adjusted to account for tariff lines affected by China's retaliation to both Section 232 and Section 301 tariffs.

Many Members of Congress, U.S. businesses, interest groups, and trade partners, including major allies, have weighed in on the President's actions. While some U.S. stakeholders support the President's use of unilateral trade actions to the extent they result in a more level playing field for U.S. firms, many have raised concerns, including the chairman of the Senate Finance committee, who stated that the President's proposed tariffs on Mexico are a "misuse of presidential tariff authority." Several Members have introduced legislation that would constrain the President's authority (e.g., H.R. 723, S. 287, S. 365, and S. 899), while other Members and the Administration have advocated for increasing this authority (e.g., H.R. 764). As it debates the Administration's import restrictions, Congress may consider the following:

- Delegation of Authority. Among these statutes, only Section 201 requires an affirmative finding by an independent agency (the ITC) before the President may restrict imports. Section 232 and Section 301 investigations are undertaken by the Administration, giving the President broad discretion in their use. Are additional congressional checks on such discretion necessary?

- Economic Implications and Escalation. The Administration's tariffs imposed to date cover

1516% of annual U.S. goods imports; proposed tariffs could potentially increase this to 40%. Negative effects of the tariffs may be substantial for individual firms reliant either on imports subject to the U.S. tariffs or exports facing retaliatory measures.The potential drag on economic growth could be significant if tit-for-tat action escalatesMost studies suggest the tariffs now in effect will reduce U.S. and global economic growth. What are the Administration's ultimate objectives from the tariff increases and do potential benefits justify potential costs? - International Trading System and U.S. Foreign Relations. While the Administration argues that the imposition of U.S. import restrictions is within its rights under international trade agreement obligations, including at the World Trade Organization (WTO), U.S. trade partners disagree and have initiated dispute proceedings, and begun retaliating. The United States has initiated its own dispute proceedings arguing that retaliatory countermeasures violate trade agreement obligations. What are the risks to the international trading system and to broader U.S. foreign policy goals of continued unilateral action and economic confrontation?