Iran Sanctions

Changes from July 12, 2019 to September 10, 2019

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Contents

- Overview and Objectives

- Blocked Iranian Property and Assets

- Executive Order 13599 Impounding Iran-Owned Assets

Sanctions for Iran'Iran Sanctions Updated September 10, 2019 Congressional Research Service https://crsreports.congress.gov RS20871 SUMMARY Iran Sanctions Successive Administrations have used sanctions extensively against Iran to try to change Iran’s behavior. Sanctions have had a substantial effect on Iran’s economy but little observable effect on Iran’s pursuit of core strategic objectives. Iran has provided support for regional armed factions, developed ballistic missiles, and expanded its conventional weapons development programs during periods when international sanctions were in force, when they were suspended, and after U.S. sanctions were reimposed in late 2018. RS20871 September 10, 2019 Kenneth Katzman Specialist in Middle Eastern Affairs During 2012-2015, when the global community was relatively united in pressuring Iran, Iran’s economy shrank as its crude oil exports fell by more than 50%, and Iran had limited ability to utilize its $120 billion in assets held abroad. Iran accepted the 2015 multilateral nuclear accord (Joint Comprehensive Plan of Action, JCPOA), which provided Iran broad relief through the waiving of relevant sanctions, revocation of relevant executive orders (E.O.s), and the lifting of U.N. and EU sanctions. Remaining in place were a general ban on U.S. trade with Iran and U.S. sanctions on Iran’s support for regional governments and armed factions, its human rights abuses, its efforts to acquire missile and advanced conventional weapons capabilities, and the Islamic Revolutionary Guard Corps (IRGC). Under U.N. Security Council Resolution 2231, which enshrined the JCPOA, nonbinding U.N. restrictions on Iran’s development of nuclear-capable ballistic missiles and a binding ban on its importation or exportation of arms remain in place for several years. JCPOA sanctions relief enabled Iran to increase its oil exports to nearly pre-sanctions levels, regain access to foreign exchange reserve funds and reintegrate into the international financial system, achieve about 7% yearly economic growth (2016-17), attract foreign investment, and buy new passenger aircraft. The sanctions relief contributed to Iranian President Hassan Rouhani’s reelection in the May 19, 2017, vote. Sanctions are at the core of Trump Administration policy to apply “maximum pressure” on Iran, with the stated purpose of compelling Iran to negotiate a revised JCPOA that takes into account U.S. concerns beyond Iran’s nuclear program. On May 8, 2018, President Trump announced that the United States would no longer participate in the JCPOA and U.S. secondary sanctions were reimposed by November 6, 2018. The reinstatement of U.S. sanctions has driven Iran’s economy into recession as major companies exit the Iranian economy rather than risk being penalized by the United States. Iran’s oil exports have decreased dramatically, particularly after the Administration in May 2019 ended sanctions excerptions for the purchase of Iranian oil. In the summer of 2019, the Administration has sanctioned numerous entities that are supporting Iran’s remaining oil trade. The value of Iran’s currency has declined sharply, and there has been some unrest. The European Union and other countries are trying to keep the economic benefits of the JCPOA flowing to Iran in order to persuade Iran to remain in the accord. In January 2019, the European countries created a trading mechanism (Special Purpose Vehicle) that presumably can increase trade with Iran by circumventing U.S. secondary sanctions, and the EU countries are contemplating providing Iran with $15 billion in credits, secured by future oil deliveries, to fuel that trading mechanism. On May 3, 2019, the Administration ended some waivers for foreign governments to provide technical assistance to some JCPOA-permitted aspects of Iran’s nuclear program, but it extended other waivers in August 2019. The economic difficulties and other U.S. pressure measures have prompted Iran to cease performing some of the nuclear commitments of the JCPOA, and contributed to Iranian leaders’ apparent decision to attack and interfere with some commercial shipping in the Persian Gulf. But, at least for now, Iran is refusing to begin talks with the United States on a revised JCPOA. See also CRS Report R43333, Iran Nuclear Agreement and U.S. Exit, by Paul K. Kerr and Kenneth Katzman; and CRS Report R43311, Iran: U.S. Economic Sanctions and the Authority to Lift Restrictions, by Dianne E. Rennack. Congressional Research Service Iran Sanctions Contents Overview and Objectives ................................................................................................................ 1 Blocked Iranian Property and Assets ............................................................................................... 1 Executive Order 13599 Impounding Iran-Owned Assets.......................................................... 3 Sanctions for Iran’s Support for Armed Factions and Terrorist Groups .......................................... 4 Sanctions Triggered by Terrorism List Designation .................................................................. 4 Exception for U.S. Humanitarian Aid ................................................................................. 5 Sanctions on States “Not Cooperating”s Support for Armed Factions and Terrorist Groups- Sanctions Triggered by Terrorism List Designation

- Exception for U.S. Humanitarian Aid

- Sanctions on States "Not Cooperating" Against Terrorism

- Executive Order 13224 Sanctioning Terrorism-Supporting Entities

- Use of the Order to Target Iranian Arms Exports

- Application of CAATSA to the Revolutionary Guard

- Implementation

- Foreign Terrorist Organization Designations

Other Sanctions on Iran's "Malign"Against Terrorism ...................................................... 6 Executive Order 13224 Sanctioning Terrorism-Supporting Entities ......................................... 6 Use of the Order to Target Iranian Arms Exports ............................................................... 6 Application of CAATSA to the Revolutionary Guard ........................................................ 6 Implementation ................................................................................................................... 7 Foreign Terrorist Organization Designations ............................................................................ 7 Other Sanctions on Iran’s “Malign” Regional Activities .......................................................... 7Regional Activities- Executive Order 13438 on Threats to Iraq

'’s Stability ........................................................ 7 Executive Order 13572 on Repression of the Syrian People. ............................................. 8s Stability - Executive Order 13572 on Repression of the Syrian People.

- The Hizballah International Financing Prevention Act (P.L. 114-102) and

1595, P.L. 115-272). - Ban on U.S. Trade and Investment with Iran

- JCPOA-Related Easing and Reversal

- What U.S.-Iran Trade Is Allowed or Prohibited?

- Application to Foreign Subsidiaries of U.S. Firms

- Sanctions on Iran's Energy Sector

- The Iran Sanctions Act (and triggers added by other laws)

Key Sanctions "Triggers"s Energy Sector................................................................................................. 12 The Iran Sanctions Act ............................................................................................................ 12 Key Sanctions “Triggers” Under ISA ............................................................................... 13 Mandate and Time Frame to Investigate ISA Violations .................................................. 16 Interpretations of ISA and Related Laws .......................................................................... 17 Implementation of Energy-Related Iran Sanctions ........................................................... 19Under ISA- Mandate and Time Frame to Investigate ISA Violations

- Interpretations of ISA and Related Laws

- Implementation of Energy-Related Iran Sanctions

- Iran Oil Export Reduction Sanctions: Section 1245 of the FY2012 NDAA

'’s Central Bank ............................................................. 21 Implementation/SREs Issued and Ended .......................................................................... 22 Iran Foreign Bank Account “Restriction” Provision......................................................... 23 Sanctions on Auto Production and Minerals Sectors..................................................................... 24 Executive Order 13645/13846: Iran’s Central Bank - Implementation/SREs Issued and Ended

- Iran Foreign Bank Account "Restriction" Provision

- Sanctions on Auto Production and Minerals Sectors

Executive Order 13645/13846: Application of ISA and Other Sanctions to Iran's Automotive Sector, Rials Automotive Sector, Rial Trading, and PreciousStones-

Stones ................................................................................................................................... 24

Executive Order 13871 on Iran

'’s Minerals and Metals Sectors - .............................................. 25 Sanctions on Weapons of Mass Destruction, Missiles, and Conventional Arms Transfers

- ........... 25 Iran-Iraq Arms Nonproliferation Act and Iraq Sanctions Act

- Implementation

- ................................................. 26

Implementation ................................................................................................................. 26

Banning Aid to Countries that Aid or Arm Terrorism List States: Anti-Terrorism and

Effective Death Penalty Act of 1996 - Implementation

- Proliferation-Related Provision of the Iran Sanctions Act

- Iran-North Korea-Syria Nonproliferation Act

- Implementation

- Executive Order 13382 on Proliferation-Supporting Entities

- Implementation

- Arms Transfer and Missile Sanctions: The Countering America

'’s Adversaries through - Implementation

- Foreign Aid Restrictions for Named Suppliers of Iran

- Sanctions on "Countries of Diversion Concern"

- Financial/Banking Sanctions

- Targeted Financial Measures

- Ban on Iranian Access to the U.S. Financial System/Use of Dollars

- Recent Developments

- Punishments/Fines Implemented against Some Banks.

CISADA: Sanctioning Foreign Banks That Conduct Transactions with Sanctioned................................................................................ 28 Implementation ................................................................................................................. 29 Foreign Aid Restrictions for Named Suppliers of Iran............................................................ 30 Sanctions on “Countries of Diversion Concern”..................................................................... 31 Financial/Banking Sanctions ......................................................................................................... 31 Targeted Financial Measures ................................................................................................... 31 Ban on Iranian Access to the U.S. Financial System/Use of Dollars ...................................... 32 Recent Developments ....................................................................................................... 32 Punishments/Fines Implemented against Some Banks. .................................................... 32 CISADA: Sanctioning Foreign Banks That Conduct Transactions with Sanctioned Iranian Entities ..................................................................................................................... 33 Implementation ................................................................................................................. 34 Iran Designated a Money-Laundering Jurisdiction/FATF ....................................................... 34 FATF ................................................................................................................................. 35 Use of the SWIFT System ....................................................................................................... 35Iranian Entities- Implementation

- Iran Designated a Money-Laundering Jurisdiction/FATF

- FATF

- Use of the SWIFT System

- Cross-Cutting Secondary Sanctions: The Iran Freedom and Counter-Proliferation Act

(IFCA) - Implementation

- Executive Order 13608 on Sanctions Evasion

- Sanctions on Iran's Cyber and Transnational Criminal Activities

- Executive Order 13694

- Executive Order 13581

- Implementation of E.O. 13694 and 13581

- Divestment/State-Level Sanctions

- Sanctions to Support Democracy and Human Rights in Iran

- Expanding Internet and Communications Freedoms

Countering Censorship of the Internet: CISADA,s Cyber and Transnational Criminal Activities................................................. 37 Executive Order 13694 ........................................................................................................... 38 Executive Order 13581 ........................................................................................................... 38 Implementation of E.O. 13694 and 13581 ........................................................................ 38 Divestment/State-Level Sanctions................................................................................................. 38 Sanctions to Support Democracy and Human Rights in Iran ........................................................ 39 Expanding Internet and Communications Freedoms .............................................................. 39 Countering Censorship of the Internet: CISADA, E.O. 13606, and E.O. 13628 .............. 39 Laws and Actions to Promote Internet Communications by Iranians ............................... 40 Measures to Sanction Human Rights Abuses/Promote Civil Society ..................................... 40 Sanctions on Iran’E.O. 13606, and E.O. 13628- Laws and Actions to Promote Internet Communications by Iranians

- Measures to Sanction Human Rights Abuses and Promote Civil Society

- Sanctions on Iran's Leadership

- Executive Order 13876

- U.N. Sanctions

- Resolution 2231 and U.N. Sanctions Eased

- Sanctions Application under Nuclear Agreements

- Sanctions Eased by the JPA

- Sanctions Easing under the JCPOA and U.S. Reimposition

- U.S. Laws and Executive Orders Affected by the JCPOA

- U.S. Sanctions that Remained in Place during JCPOA and Since

- International Implementation and Compliance

- European Union (EU)

- EU Divestment in Concert with Reimposition of U.S. Sanctions

- European Special Purpose Vehicle/INSTEX

- EU Antiterrorism and Anti-proliferation Actions

- SWIFT Electronic Payments System

- China and Russia

- Russia

- China

- Japan/Korean Peninsula/Other East Asia

- North Korea

- Taiwan and Singapore

- South Asia

- India

- Pakistan

- Turkey/South Caucasus

- Turkey

- Caucasus and Caspian Sea

- Persian Gulf States and Iraq

- Iraq

- Syria and Lebanon

- World Bank and WTO

- WTO Accession

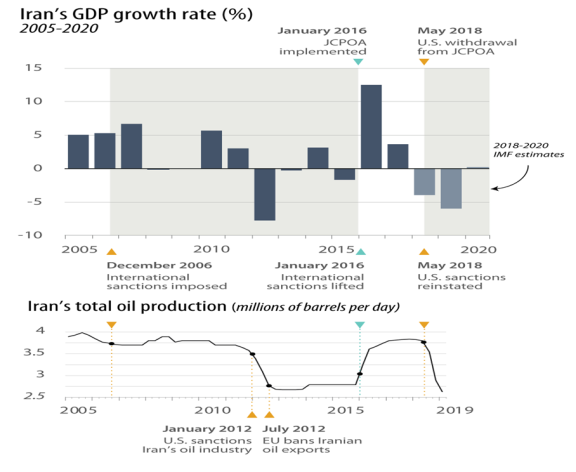

- Effectiveness of Sanctions on Iranian Behavior

Effect on Iran's Leadership ............................................................................................... 42 Executive Order 13876 ..................................................................................................... 42 U.N. Sanctions ............................................................................................................................... 42 Resolution 2231 and U.N. Sanctions Eased ............................................................................ 43 Sanctions Application under Nuclear Agreements ........................................................................ 45 Sanctions Eased by the JPA..................................................................................................... 45 Sanctions Easing under the JCPOA and U.S. Reimposition ................................................... 45 U.S. Laws and Executive Orders Affected by the JCPOA ............................................... 46 U.S. Sanctions that Remained in Place during JCPOA and Since .................................... 48 International Implementation and Compliance ............................................................................. 49 European Union (EU) ............................................................................................................. 49 EU Divestment in Concert with Reimposition of U.S. Sanctions..................................... 50 European Special Purpose Vehicle/INSTEX and Credit Line Proposal ........................... 51 EU Antiterrorism and Anti-proliferation Actions.............................................................. 52 SWIFT Electronic Payments System ................................................................................ 52 Congressional Research Service Iran Sanctions China and Russia ..................................................................................................................... 52 Russia ................................................................................................................................ 52 China ................................................................................................................................. 53 Japan/Korean Peninsula/Other East Asia ................................................................................ 54 North Korea ...................................................................................................................... 55 Taiwan and Singapore ....................................................................................................... 55 South Asia ............................................................................................................................... 55 India .................................................................................................................................. 55 Pakistan ............................................................................................................................. 56 Turkey/South Caucasus ........................................................................................................... 56 Turkey ............................................................................................................................... 56 Caucasus and Caspian Sea ................................................................................................ 57 Persian Gulf States and Iraq .................................................................................................... 58 Iraq .................................................................................................................................... 59 Syria and Lebanon................................................................................................................... 59 World Bank and WTO ............................................................................................................. 60 WTO Accession ................................................................................................................ 60 Effectiveness of Sanctions on Iranian Behavior ............................................................................ 60 Effect on Iran’s Nuclear Program and Strategic Capabilities ................................................. 60 Effects on Iran’s Nuclear Program and Strategic Capabilities- Effects on Iran's Regional Influence

- Political Effects

- Economic Effects

- Iran's Economic Coping Strategies

- Effect on Energy Sector Development

- Human Rights-Related Effects

- Humanitarian Effects

- Air Safety

- Post-JCPOA Sanctions Legislation

- Key Legislation in the 114th Congress

- Iran Nuclear Agreement Review Act (P.L. 114-17)

- Visa Restriction

- Iran Sanctions Act Extension

- Reporting Requirement on Iran Missile Launches

- 114th Congress Legislation Not Enacted

- The Trump Administration and Major Iran Sanctions Legislation

- The Countering America's Adversaries through Sanctions Act of 2017 (CAATSA, P.L. 115-44)

Legislation in the 115ths Regional Influence ....................................................................................... 61 Political Effects ....................................................................................................................... 62 Economic Effects .................................................................................................................... 62 Iran’s Economic Coping Strategies .................................................................................. 64 Effect on Energy Sector Development .................................................................................... 66 Human Rights-Related Effects ................................................................................................ 66 Humanitarian Effects............................................................................................................... 67 Air Safety .......................................................................................................................... 68 Post-JCPOA Sanctions Legislation ............................................................................................... 68 Key Legislation in the 114th Congress .................................................................................... 68 Iran Nuclear Agreement Review Act (P.L. 114-17) .......................................................... 68 Visa Restriction ................................................................................................................. 69 Iran Sanctions Act Extension ............................................................................................ 69 Reporting Requirement on Iran Missile Launches ........................................................... 70 Other 114th Congress Legislation ...................................................................................... 70 The Trump Administration and Major Iran Sanctions Legislation .......................................... 71 The Countering America’s Adversaries through Sanctions Act of 2017 (CAATSA, P.L. 115-44).................................................................................................................... 71 Legislation in the 115th Congress Not Enacted ................................................................. 71 116th Congress ................................................................................................................... 73 Other Possible U.S. and International Sanctions ..................................................................... 73 Figures Figure 1. Economic Indicators ...................................................................................................... 65 Congressional Research Service Iran Sanctions Tables Table 1. Iran Crude Oil Sales ........................................................................................................ 24 Table 2. Major Settlements/Fines Paid by Banks for Violations ................................................... 33Congress Not Enacted- 116th Congress

- Other Possible U.S. and International Sanctions

Figures

Tables

- Table 1. Iran Crude Oil Sales

- Table 2. Major Settlements/Fines Paid by Banks for Violations

- Table 3. Summary of Provisions of U.N. Resolutions on Iran Nuclear Program (1737,

- ...................................................................................................... 44

Table A-1. Comparison Between U.S., U.N., and EU and Allied Country Sanctions (Prior

to Implementation Day) - Table B-1. Post-1999 Major Investments in Iran's Energy Sector

- Table C-1. Entities Sanctioned Under U.N. Resolutions and EU Decisions

Summary

Successive Administrations have used sanctions extensively to try to change Iran's behavior. Sanctions have had a substantial effect on Iran's economy but little, if any, observable effect on Iran's conventional defense programs or regional malign activities. During 2012-2015, when the global community was relatively united in pressuring Iran, Iran's economy shrank as its crude oil exports fell by more than 50%, and Iran had limited ability to utilize its $120 billion in assets held abroad.

The 2015 multilateral nuclear accord (Joint Comprehensive Plan of Action, JCPOA) provided Iran broad relief through the waiving of relevant sanctions, revocation of relevant executive orders (E.O.s), and the lifting of U.N. and EU sanctions. Remaining in place were a general ban on U.S. trade with Iran and U.S. sanctions on Iran's support for regional governments and armed factions, its human rights abuses, its efforts to acquire missile and advanced conventional weapons capabilities, and the Islamic Revolutionary Guard Corps (IRGC). Under U.N. Security Council Resolution 2231, which enshrined the JCPOA, nonbinding U.N. restrictions on Iran's development of nuclear-capable ballistic missiles and a binding ban on its importation or exportation of arms remain in place for several years.

JCPOA sanctions relief enabled Iran to increase its oil exports to nearly pre-sanctions levels, regain access to foreign exchange reserve funds and reintegrate into the international financial system, achieve about 7% yearly economic growth (2016-17), attract foreign investment, and buy new passenger aircraft. The sanctions relief contributed to Iranian President Hassan Rouhani's reelection in the May 19, 2017, vote. However, the economic rebound did not prevent sporadic unrest from erupting in December 2017. And, Iran has provided support for regional armed factions, developed ballistic missiles, and expanded its conventional weapons development programs during periods when international sanctions were in force, when they were suspended, and after U.S. sanctions were reimposed in late 2018.

The Trump Administration has made sanctions central to efforts to apply "maximum pressure" on Iran's regime. On May 8, 2018, President Trump announced that the United States would no longer participate in the JCPOA and U.S. secondary sanctions were reimposed by November 6, 2018. The reinstatement of U.S. sanctions has driven Iran's economy into recession as major companies exit the Iranian economy rather than risk being penalized by the United States. Iran's oil exports have decreased significantly, the value of Iran's currency has declined sharply, and unrest has continued, although not to the point where the regime is threatened. But, the European Union and other countries are trying to keep the economic benefits of the JCPOA flowing to Iran in order to persuade Iran to remain in the accord. To that end, in January 2019 the European countries created a trading mechanism (Special Purpose Vehicle) that presumably can increase trade with Iran by circumventing U.S. secondary sanctions. On November 5, 2018, the Administration granted 180-day "Significant Reduction Exceptions" (SREs) to eight countries—enabling them to import Iranian oil without penalty as long as they continue to reduce purchases of Iranian oil. On April 22, 2019, the Administration announced it would not renew any SREs when they expire on May 2, 2019, instead seeking to drive Iran's oil exports as close to zero as possible. On May 3, 2019, the Administration ended some waivers for foreign governments to provide technical assistance to some JCPOA-permitted aspects of Iran's nuclear program. The economic difficulties and other U.S. pressure measures have prompted Iran to cease performing some of the nuclear commitments of the JCPOA.

See also CRS Report R43333, Iran Nuclear Agreement and U.S. Exit, by Paul K. Kerr and Kenneth Katzman; and CRS Report R43311, Iran: U.S. Economic Sanctions and the Authority to Lift Restrictions, by Dianne E. Rennack.

Overview and Objectives

Overview and Objectives

Sanctions have been a significant component of U.S. Iran policy since Iran'’s 1979 Islamic

Revolution that toppled the Shah of Iran, a U.S. ally. In the 1980s and 1990s, U.S. sanctions were

intended to try to compel Iran to cease supporting acts of terrorism and to limit Iran'’s strategic

power in the Middle East more generally. After the mid-2000s, U.S. and international sanctions

focused largely on ensuring that Iran'’s nuclear program is for purely civilian uses. During 2010-201520102015, the international community cooperated closely with a U.S.-led and U.N.-authorized

sanctions regime in pursuit of the goal of persuading Iran to agree to limits to its nuclear program.

Still, sanctions against Iran have multiple objectives and address multiple perceived threats from

Iran simultaneously.

This report analyzes U.S. and international sanctions against Iran. CRS has no way to

independently corroborate whether any individual or other entity might be in violation of U.S. or

international sanctions against Iran. The report tracks "implementation"“implementation” of the various U.S. laws

and executive orders as designations and imposition of sanctions. Some sanctions require the

blocking of U.S.-based property of sanctioned entities. CRS has not obtained information from

the executive branch indicating that such property has been blocked, and it is possible that

sanctioned entities do not have any U.S. assets that could be blocked.

The sections below are grouped by function, in the chronological order in which these themes

have emerged.1

1 Blocked Iranian Property and Assets

Post-JCPOA Status: Iranian Assets Still Frozen, but Some Issues Resolved

U.S. sanctions on Iran were first imposed during the U.S.-Iran hostage crisis of 1979-1981, in the

form of executive orders issued by President Jimmy Carter blocking nearly all Iranian assets held

in the United States. These included E.O. 12170 of November 14, 1979, blocking all Iranian

government property in the United States, and E.O 12205 (April 7, 1980) and E.O. 12211 (April

17, 1980) banning virtually all U.S. trade with Iran. The latter two orders were issued just prior to

the failed April 24-25, 1980, U.S. effort to rescue the U.S. Embassy hostages held by Iran.

President Jimmy Carter also broke diplomatic relations with Iran on April 7, 1980. The trade-relatedtraderelated orders (12205 and 12211) were revoked by Executive Order 12282 of January 19, 1981,

following the "“Algiers Accords"” that resolved the U.S.-Iran hostage crisis. Iranian assets still

frozen are analyzed below.

U.S.-Iran Claims Tribunal

The Accords established a "“U.S.-Iran Claims Tribunal"” at the Hague that continues to arbitrate

cases resulting from the 1980 break in relations and freezing of some of Iran'’s assets. All of the

4,700 private U.S. claims against Iran were resolved in the first 20 years of the Tribunal, resulting

in $2.5 billion in awards to U.S. nationals and firms.

On November 13, 2012, the Administration published in the Federal Register (Volume 77, Number 219) “Policy

Guidance” explaining how it implements many of the sanctions, and in particular defining what products and chemicals

constitute “petroleum,” “petroleum products,” and “petrochemical products” that are used in the laws and executive

orders discussed below. See http://www.gpo.gov/fdsys/pkg/FR-2012-11-13/pdf/2012-27642.pdf.

1

Congressional Research Service

1

Iran Sanctions

The major government-to-government cases involved Iranian claims for compensation for

hundreds of foreign military sales (FMS) cases that were halted in concert with the rift in U.S.-Iran relations when the Shah'’s government fell in 1979. In 1991, the George H. W. Bush

Administration paid $278 million from the Treasury Department Judgment Fund to settle FMS

cases involving weapons Iran had received but which were in the United States undergoing repair

and impounded when the Shah fell.

On January 17, 2016, (the day after the JCPOA took effect), the United States announced it had

settled with Iran for FMS cases involving weaponry the Shah was paying for but that was not

completed and delivered to Iran when the Shah fell. The Shah'’s government had deposited its

payments into a DOD-managed "“Iran FMS Trust Fund,"” and, after 1990, the Fund had a balance

of about $400 million. In 1990, $200 million was paid from the Fund to Iran to settle some FMS

cases. Under the 2016 settlement, the United States sent Iran the $400 million balance in the

Fund, plus $1.3 billion in accrued interest, paid from the Department of the Treasury's "Judgment Fund."’s “Judgment

Fund.” In order not to violate U.S. regulations barring direct U.S. dollar transfers to Iranian

banks, the funds were remitted to Iran in late January and early February 2016 in foreign hard

currency from the central banks of the Netherlands and of Switzerland. Some remaining claims

involving the FMS program with Iran remain under arbitration at the Tribunal.

Other Iranian Assets Frozen

Iranian assets in the United States are blocked under several provisions, including Executive

Order 13599 of February 2010. The United States did not unblock any of these assets as a

consequence of the JCPOA.

-

About $1.9 billion in blocked Iranian assets are bonds belonging to Iran

'’s Central -

About $50 million of Iran

'’s assets frozen in the United States consists of Iranian2 - 2

Among other frozen Iranian assets are real estate holdings of the Assa Company,

's’s Bank Melli in a 36-story office building in New York City and several other

Use of Iranian Assets to Compensate U.S. Victims of Iranian Terrorism

There are a total of about $46 billion in court awards that have been made to victims of Iranian

terrorism. These include the families of the 241 U.S. soldiers killed in the October 23, 1983,

2

http://www.treasury.gov/resource-center/sanctions/Documents/tar2010.pdf.

Congressional Research Service

2

Iran Sanctions

bombing of the U.S. Marine barracks in Beirut. U.S. funds equivalent to the $400 million balance

in the DOD account (see above) have been used to pay a small portion of these judgments. The

Algiers Accords apparently precluded compensation for the 52 U.S. diplomats held hostage by

Iran from November 1979 until January 1981. The FY2016 Consolidated Appropriation (Section

404 of P.L. 114-113) set up a mechanism for paying damages to the U.S. embassy hostages and

other victims of state-sponsored terrorism using settlement payments paid by various banks for

concealing Iran-related transactions, and proceeds from other Iranian frozen assets.

In April 2016, the U.S. Supreme Court determined the Central Bank assets, discussed above,

could be used to pay the terrorism judgments, and the proceeds from the sale of the frozen real

estate assets mentioned above will likely be distributed to victims of Iranian terrorism as well.3 3

On the other hand, in March 2018, the U.S. Supreme Court ruled that U.S. victims of an Iran-sponsoredIransponsored terrorist attack could not seize a collection of Persian antiquities on loan to a

University of Chicago museum to satisfy a court judgment against Iran.

Other past financial disputes include the errant U.S. shoot-down on July 3, 1988, of an Iranian

Airbus passenger jet (Iran Air flight 655), for which the United States paid Iran $61.8 million in

compensation ($300,000 per wage-earning victim, $150,000 per non-wage earner) for the 248

Iranians killed. The United States did not compensate Iran for the airplane itself, although

officials involved in the negotiations told CRS in November 2012 that the United States later

arranged to provide a substitute used aircraft to Iran.

For more detail on the use of Iranian assets to compensate victims of Iranian terrorism, see CRS

Report RL31258, Suits Against Terrorist States by Victims of Terrorism Victims of Terrorism, by Jennifer K. Elsea and

CRS Legal Sidebar LSB10104, It Belongs in a Museum: Sovereign Immunity Shields Iranian

Antiquities Even When It Does Not Protect Iran, by Stephen P. Mulligan.

Executive Order 13599 Impounding Iran-Owned Assets

Post-JCPOA Status: Still in Effect

Executive Order 13599, issued February 5, 2012, directs the blocking of U.S.-based assets of

entities determined to be "“owned or controlled by the Iranian government."” The order was issued

to implement Section 1245 of the FY2012 National Defense Authorization Act (P.L. 112-81) that

imposed secondary U.S. sanctions on Iran'’s Central Bank. The order requires that any U.S.-based

assets of the Central Bank of Iran, or of any Iranian government-controlled entity, be blocked by

U.S. banks. The order goes beyond the regulations issued pursuant to the 1995 imposition of the

U.S. trade ban with Iran, in which U.S. banks are required to refuse such transactions but to return

funds to Iran. Even before the issuance of the rder, and in order to implement the ban on U.S.

trade with Iran (see below) successive Administrations had designated many entities as "“owned or

controlled by the Government of Iran."

”

Numerous designations have been made under Executive Order 13599, including the June 4,

2013, naming of 38 entities (mostly oil, petrochemical, and investment companies) that are

components of an Iranian entity called the "“Execution of Imam Khomeini'’s Order"” (EIKO).4 4

“U.S. Court Reverses Record Forfeiture Order over Iran Assets.” Associated Press. July 21, 2016.

http://global.factiva.com/hp/printsavews.aspx?pp=Print&hc=Publication; and Department of Treasury announcement

of June 4, 2013.

3

4

Congressional Research Service

3

Iran Sanctions

EIKO was characterized by the Department of the Treasury as an Iranian leadership entity that

controls "“massive off-the-books investments."

”

Implementation of the U.S. JCPOA Withdrawal.Withdrawal. To implement the JCPOA, many 13599-designated13599designated entities specified in the JCPOA (Attachment 3) were "delisted"“delisted” from U.S. secondary

sanctions (no longer considered "“Specially Designated Nationals,"” SDNs), and referred to as "

“designees blocked solely pursuant to E.O 13599."5”5 That characterization permitted foreign

entities to conduct transactions with the listed entities without U.S. sanctions penalty but

continued to bar U.S. persons (or foreign entities owned or controlled by a U.S. person) from

conducting transactions with these entities. In concert with the U.S. withdrawal from the JCPOA,

virtually all of the 13599-designated entities that were delisted as SDNs were relisted as SDNs on

November 5, 2018.6

6

Civilian Nuclear Entity Exception. The Atomic Energy Organization of Iran (AEOI), and 23 of its

subsidiaries, were relisted under E.O. 13599 but they were not relisted as entities subject to

secondary sanctions (SDNs) under E.O. 13382. This listing decision was made in order to

facilitate continued IAEA and EU and other country engagement with Iran'’s civilian nuclear

program under the JCPOA.77 The May 2019 ending of some waivers for nuclear technical

assistance to Iran modified this stance somewhat (see subhead on waivers and exceptions under

the JCPOA, below).

Sanctions for Iran'’s Support for Armed Factions and

Terrorist Groups

Most of the U.S.-Iran hostage crisis sanctions were lifted upon release of the hostages in 1981.

The United States began imposing sanctions against Iran again in the mid-1980s for its support

for regional groups committing acts of terrorism. The Secretary of State designated Iran a "state “state

sponsor of terrorism"” on January 23, 1984, following the October 23, 1983, bombing of the U.S.

Marine barracks in Lebanon by elements that established Lebanese Hezbollah. This designation

triggers substantial sanctions on any nation so designated.

None of the laws or executive ordersorders in this section were waived or revoked to implement the

JCPOA. No entities discussed in this section were "delisted" “delisted” from sanctions under the JCPOA.

the JCPOA.

Sanctions Triggered by Terrorism List Designation

The U.S. naming of Iran as a "“state sponsor of terrorism"”—commonly referred to as Iran's ’s

inclusion on the U.S. "“terrorism list"”—triggers several sanctions. The designation is made under

the authority of Section 6(j) of the Export Administration Act of 1979 (P.L. 96-72, as amended),

sanctioning countries determined to have provided repeated support for acts of international

terrorism. The sanctions triggered by Iran'’s state sponsor of terrorism designation are as follows:

-

Restrictions on sales of U.S. dual use items. The restriction—a presumption of

-

Ban on direct U.S. financial assistance and arms sales to Iran. Section 620A of

insuranceguarantees, and Ex-Im Bank -

Requirement to oppose multilateral lending. U.S. officials are required to vote

-

Withholding of U.S. foreign assistance to countries that assist or sell arms to

terrorism list countriesterrorism list countries. Under Sections 620G and 620H of the Foreign -

Withholding of U.S. Aid to Organizations

ThatThat Assist Iran. Section 307 of the

Exception for U.S. Humanitarian Aid

The terrorism list designation, and other U.S. sanctions laws barring assistance to Iran, do not bar

U.S. disaster aid. The United States donated $125,000, through relief agencies, to help victims of

two earthquakes in Iran (February and May 1997); $350,000 worth of aid to the victims of a June

22, 2002, earthquake; and $5.7 million in assistance for victims of the December 2003 earthquake

in Bam, Iran, which killed 40,000. The U.S. military flew 68,000 kilograms of supplies to Bam.

Congressional Research Service 5 Iran Sanctions Requirements for Removal from Terrorism List

Terminating the sanctions triggered by Iran

If the country

If the |

Sanctions on States "“Not Cooperating"” Against Terrorism

Section 330 of the Anti-Terrorism and Effective Death Penalty Act (P.L. 104-132) added a

Section 40A to the Arms Export Control Act that prohibits the sale or licensing of U.S. defense

articles and services to any country designated (by each May 15) as "“not cooperating fully with

U.S. anti-terrorism efforts."” The President can waive the provision upon determination that a

defense sale to a designated country is "“important to the national interests"” of the United States.

Every May since the enactment of this law, Iran has been designated as a country that is "“not fully cooperating"

cooperating” with U.S. antiterrorism efforts. However, the effect of the designation is largely

mooted by the many other authorities that prohibit U.S. defense sales to Iran.

Executive Order 13224 Sanctioning Terrorism-Supporting Entities

Executive Order 13324 (September 23, 2001) mandates the freezing of the U.S.-based assets of

and a ban on U.S. transactions with entities determined by the Administration to be supporting

international terrorism. This order was issued two weeks after the September 11, 2001, attacks on

the United States, under the authority of the IEEPA, the National Emergencies Act, the U.N.

Participation Act of 1945, and Section 301 of the U.S. Code, initially targeting Al Qaeda.

Use of the Order to Target Iranian Arms Exports

E.O. 13224 is not specific to Iran and does not explicitly target Iranian arms exports to

movements, governments, or groups in the Middle East region. However, successive

Administrations have used the order—and the orders discussed immediately below—to sanction

such Iranian activity by designating persons or entities that are involved in the delivery or receipt

of such weapons shipments. Some persons and entities that have been sanctioned for such activity

have been cited for supporting groups such as the Afghan Taliban organization and the Houthi

rebels in Yemen, which are not named as terrorist groups by the United States.

Application of CAATSA to the Revolutionary Guard

Section 105 of the Countering America'’s Adversaries through Sanctions Act (CAATSA, P.L. 115-4411544, signed on August 2, 2017), mandates the imposition of E.O. 13324 penalties on the Islamic

Revolutionary Guard Corps (IRGC) and its officials, agents, and affiliates by October 30, 2017

(90 days after enactment). The IRGC was named as a terrorism-supporting entity under E.O

13224 within that deadline. The Treasury Department made the designation of the IRGC as a

terrorism-supporting entity under that E.O. on October 13, 2017.

Implementation

Congressional Research Service

6

Iran Sanctions

Implementation

No entities designated under E.O. 13224 were delisted to implement the JCPOA. Numerous Iran-relatedIranrelated entities, including members of Iran-allied organizations such as Lebanese Hezbollah and

Iraqi Shia militias, have been designated under the order since JCPOA implementation, as shown

in the tables at the end of this report.

Foreign Terrorist Organization Designations

Sanctions similar to those of E.O. 13224 are imposed on Iranian and Iran-linked entities through

the State Department authority under Section 219 of the Immigration and Nationality Act

(8.U.S.C. 1189) to designate an entity as a Foreign Terrorist Organization (FTO). In addition to

the sanctions of E.O. 13224, any U.S. person (or person under U.S. jurisdiction) who "knowingly “knowingly

provides material support or resources to an FTO, or attempts or conspires to do so"” is subject to

fine or up to 20 years in prison. A bank that commits such a violation is subject to fines.

Implementation: The following organizations have been designated as FTOs for acts of terrorism

on behalf of Iran or are organizations assessed as funded and supported by Iran:

-

Islamic Revolutionary Guard Corps (IRGC). Designated April 8, 2019. See

Iran'Iran’s Revolutionary Guard Named a TerroristOrganizationOrganization, by Kenneth Katzman. On April 22, 2019, the State Department8 - Lebanese Hezbollah

Kata'8 Lebanese Hezbollah Kata’ib Hezbollah. Iran-backed Iraqi Shi'’a militia.HamasHamas. Sunni, Islamist Palestinian organization that essentially controls the- Palestine Islamic Jihad. Small Sunni Islamist Palestinian militant group

-

Al Aqsa Martyr

'’s Brigade. Secular Palestinian militant group. -

Popular Front for the Liberation of Palestine-General Command

(PFLP-GC(PFLPGC). Leftwing secular Palestinian group based mainly in Syria. -

Al Ashtar Brigades. Bahrain militant opposition group

Other Sanctions on Iran's "Malign"’s “Malign” Regional Activities

Some sanctions have been imposed to try to curtail Iran'’s destabilizing influence in the region.

Executive Order 13438 on Threats to Iraq'’s Stability

-

8

Issued on July 7, 2007, the order blocks U.S.-based property of persons who are

"“have committed, or pose a significant risk"” acts of violence that threaten the peace and stability of Iraq, or'’s parliament and political structure.

Executive Order 13572 on Repression of the Syrian People.

-

Issued on April 29, 2011, the order blocks the U.S.-based property of persons

The Hizballah International Financing Prevention Act (P.L. 114-102) and

Hizballah International Financing Prevention Amendments Act of 2018 (S. 1595, S.

1595, P.L. 115-272).

- ).

The latter Act was signed by President Trump on October 23, 2018—the

25th("(“CISADA,"” see below), excludes from the U.S. financial system any bank that-based property of and U.S. transactions with any"“agency or instrumentality of a"” that conducts joint operations with or provides financing or arms to

Ban on U.S. Trade and Investment with Iran

Status: Trade ban eased for JCPOA, but back in full effect on August 6, 2018

In 1995, the Clinton Administration expanded U.S. sanctions against Iran by issuing Executive

Order 12959 (May 6, 1995) banning U.S. trade with and investment in Iran. The order was issued

under the authority primarily of the International Emergency Economic Powers Act (IEEPA, 50

U.S.C. 1701 et seq.),99 which gives the President wide powers to regulate commerce with a foreign

country when a "”state of emergency"” is declared in relations with that country. E.O. 12959

superseded Executive Order 12957 (March 15, 1995) barring U.S. investment in Iran'’s energy

sector, which accompanied President Clinton'’s declaration of a "“state of emergency"” with respect

to Iran. Subsequently, E.O 13059 (August 19, 1997) added a prohibition on U.S. companies' ’

knowingly exporting goods to a third country for incorporation into products destined for Iran.

Each March since 1995, the U.S. Administration has renewed the "“state of emergency"” with

respect to Iran. IEEPA gives the President the authority to alter regulations to license transactions

with Iran—regulations enumerated in Section 560 of the Code of Federal Regulations (Iranian

Transactions Regulations, ITRs).

9

The executive order was issued not only under the authority of IEEPA but also the National Emergencies Act (50

U.S.C. 1601 et seq.; §505 of the International Security and Development Cooperation Act of 1985 (22 U.S.C. 2349aa9) and §301 of Title 3, United States Code.

Congressional Research Service

8

Iran Sanctions

Section 103 of the Comprehensive Iran Sanctions, Accountability, and Divestment Act of 2010

(CISADA, P.L. 111-195) codified the trade ban and reinstated the full ban on imports that had

earlier been relaxed by April 2000 regulations. That relaxation allowed importation into the

United States of Iranian nuts, fruit products (such as pomegranate juice), carpets, and caviar. U.S.

imports from Iran after that time were negligible.1010 Section 101 of the Iran Freedom Support Act (

(P.L. 109-293) separately codified the ban on U.S. investment in Iran, but gives the President the

authority to terminate this sanction with presidential notification to Congress of such decision 15

days in advance (or 3 days in advance if there are "“exigent circumstances").

”).

JCPOA-Related Easing and Reversal

In accordance with the JCPOA, the ITRs were relaxed to allow U.S. importation of the Iranian

luxury goods discussed above (carpets, caviar, nuts, etc.), but not to permit general U.S.-Iran

trade. U.S. regulations were also altered to permit the sale of commercial aircraft to Iranian

airlines that are not designated for sanctions. The modifications were made in the Departments of

State and of the Treasury guidance issued on Implementation Day and since.1111 In concert with the

May 8, 2018, U.S. withdrawal from the JCPOA, the easing of the regulations to allow for

importation of Iranian carpets and other luxury goods was reversed on August 6, 2018.

What U.S.-Iran Trade Is Allowed or Prohibited?

The following provisions apply to the U.S. trade ban on Iran as specified in regulations (Iran

Transaction Regulations, ITRs) written pursuant to the executive orders and laws discussed above

and enumerated in regulations administered by the Office of Foreign Assets Control (OFAC) of

the Department of the Treasury.

-

Oil Transactions. All U.S. transactions with Iran in energy products are banned.

"swaps"“swaps” of Caspian Sea oil with Iran. These swaps -

Transshipment and Brokering. The ITRs prohibit U.S. transshipment of

-

10

Imports were mainly of artwork for exhibitions around the United States, which are counted as imports even though

the works return to Iran after the exhibitions conclude.

11 The text of the guidance is at https://www.treasury.gov/resource-center/sanctions/Programs/Documents/

implement_guide_jcpoa.pdf.

Congressional Research Service

9

Iran Sanctions

Iranian Luxury Goods. Pursuant to the JCPOA, Iranian luxury goods, such as

-

Shipping Insurance. Obtaining shipping insurance is crucial to Iran

'’s expansion'’s ability to obtain reinsurance for Iran's’s shipping after Implementation Day. On January 16, 2017, the Obama1212 However, this waiver -

Civilian Airline

SalesSales. The ITRs have always permitted the licensing of goods'’s largest state-owned airline, Iran Air,"delisted" from“delisted” from sanctions.1313 A March 2016 general license allowed for U.S. aircraft and parts("(“dual use items"”) to Iran also require a waiver of the relevant provision of the - In April 2019, OFAC

granted a license for Franco-Italian aircraft maker ATR to supply spare parts

(with U.S. content) to the five new ATR aircraft delivered to Iran in 2018.14

Personal Communications

, Remittances, Remittances, and Publishing. The ITRs permit -

Information Technology Equipment. CISADA exempts from the U.S. ban on

2013, OFAC issued a general license for the exportation to Iran of goods (such as cell phones) and services, on a fee basis, that enhance the ability of the Iranian12 Shipping insurers granted the waiver include Assuranceforeningen Skuld, Skuld Mutual Protection and Indemnity Association, Ltd. (Bermuda), Gard P and I Ltd. (Bermuda), Assuranceforeningen Gard, the Britannia Steam Ship Insurance Association Limited, The North of England Protecting and Indemnity Association Ltd., the Shipowners’ Mutual Protection and Indemnity Association (Luxembourg), the Standard Club Ltd., the Standard Club Europe Ltd., The Standard Club Asia, the Steamship Mutual Underwriting Association Ltd. (Bermuda), the Swedish Club, United Kingdom Mutual Steam Ship Assurance Association Ltd. (Bermuda), United Kingdom Mutual Steam Ship Association Ltd. (Europe), and the West of England Ship Owners Mutual Insurance Association (Luxembourg). 13 Reuters, February 21, 2014; “Exclusive: Boeing Says Gets U.S. License to Sell Spare Parts to Iran,” Reuters, April 4, 2014. 14 Tasnim news agency. August 14, 2019. Congressional Research Service 10 Iran Sanctions 2013, OFAC issued a general license for the exportation to Iran of goods (such as cell phones) and services, on a fee basis, that enhance the ability of the Iranian people to access communication technology.people to access communication technology. - Food and Medical Exports. Since April 1999, sales to Iran by U.S. firms of food

"“general license"” (no specific license application required).201614201615 to include"food"“food” that can be licensed for sale to Iran,and that definitionwhich excludes15 The definition addresses information in a 2010 article that OFAC had approved exports to Iran of condiments such as food additives and body-building supplements that have uses other than purely nutritive.16 - 16

Humanitarian and Related Services. Donations by U.S. residents directly to

'’ obtaining a specific OFAC license. On September 10, 2013, the Department of -

Payment Methods, Trade Financing, and Financing Guarantees. U.S. importers

including with U.S. dollars. However, U.S. fundsbut the payment cannot go directly tobutand must instead pass through third-country banks. In accordance'’ provisions that transactions that are incidental to an approvedpresumably in the form of a letter of credit from a non-but the financing must not come from an Iranian bank.((P.L. 106-387) bans the use of official credit guarantees (such as the Ex-Im Bank)'’s continued inclusion on the terrorism list, and the JCPOA did

Application to Foreign Subsidiaries of U.S. Firms

The ITRs do not ban subsidiaries of U.S. firms from dealing with Iran, as long as the subsidiary is not "controlled"

not “controlled” by the parent company. Most foreign subsidiaries are legally considered foreign

persons subject to the laws of the country in which the subsidiaries are incorporated. Section 218

of the Iran Threat Reduction and Syrian Human Rights Act (ITRSHRA, P.L. 112-158) holds "controlled"

15

16

https://www.treasury.gov/resource-center/sanctions/OFAC-Enforcement/Pages/20161222.aspx?platform=hootsuite.

https://www.treasury.gov/resource-center/sanctions/Programs/Documents/gl_food_exports.pdf.

Congressional Research Service

11

Iran Sanctions

“controlled” foreign subsidiaries of U.S. companies to the same standards as U.S. parent firms,

defining a controlled subsidiary as (1) one that is more than 50% owned by the U.S. parent; (2)

one in which the parent firm holds a majority on the Board of Directors of the subsidiary; or (3)

one in which the parent firm directs the operations of the subsidiary. There is no waiver provision.

JCPOA Regulations and Reversal. To implement the JCPOA, the United States licensed "controlled"

“controlled” foreign subsidiaries to conduct transactions with Iran that are permissible under

JCPOA (almost all forms of civilian trade). The Obama Administration asserted that the President

has authority under IEEPA to license transactions with Iran, the ITRSHRA notwithstanding. This

was implemented with the Treasury Department'’s issuance of "“General License H: Authorizing

Certain Transactions Relating to Foreign Entities Owned or Controlled by a United States

Person."17”17 With the Trump Administration reimposition of sanctions, the licensing policy ("

(“Statement of Licensing Policy,"” SLP) returned to pre-JCPOA status on November 5, 2018.

Waiver Authority |

Sanctions on Iran'’s Energy Sector

Status: Energy sanctions waived for JCPOA, back in effect November 5, 2018

In 1996, Congress and the executive branch began a long process of pressuring Iran'’s vital energy

sector in order to deny Iran the financial resources to support terrorist organizations and other

armed factions or to further its nuclear and WMD programs. Iran'’s oil sector is as old as the

petroleum industry itself (early 20th20th century), and Iran'’s onshore oil fields are in need of

substantial investment. Iran has 136.3 billion barrels of proven oil reserves, the third largest after

Saudi Arabia and Canada. Iran has large natural gas resources (940 trillion cubic feet), exceeded

only by Russia. However, Iran'’s gas export sector is still emerging—most of Iran'’s gas is injected

into its oil fields to boost their production. The energy sector still generates about 20% of Iran's ’s

GDP and as much as 30% of government revenue.

The Iran Sanctions Act (and triggers added by other laws)

This sections includes sanctions triggers under the Act that were added by laws enacted

subsequent to the original version.

The Iran Sanctions Act (ISA) has been a pivotal component of U.S. sanctions against Iran's ’s

energy sector. Since its enactment in 1996, ISA'’s provisions have been expanded and extended to

other Iranian industries. ISA sought to thwart Iran'’s 1995 opening of the sector to foreign

17

https://www.treasury.gov/resource-center/sanctions/Programs/Documents/implement_guide_jcpoa.pdf.

Congressional Research Service

12

Iran Sanctions

investment in late 1995 through a "“buy-back"” program in which foreign firms gradually recoup

their investments as oil and gas is produced. It was first enacted as the Iran and Libya Sanctions

Act (ILSA, P.L. 104-172, signed on August 5, 1996) but was later retitled the Iran Sanctions Act

after it terminated with respect to Libya in 2006. ISA was the first major "“extra-territorial sanction"

sanction” on Iran—a sanction that authorizes U.S. penalties against third country firms.

Key Sanctions "Triggers"“Triggers” Under ISA

ISA consists of a number of "triggers"“triggers”—transactions with Iran that would be considered

violations of ISA and could cause a firm or entity to be sanctioned under ISA'’s provisions. The

triggers, as added by amendments over time, are detailed below:

Trigger 1 (Original Trigger): "Investment"“Investment” To Develop Iran'’s Oil and Gas Fields

The core trigger of ISA when first enacted was a requirement that the President sanction

companies (entities, persons) that make an "investment"18“investment”18 of more than $20 million19million19 in one year

in Iran'’s energy sector.2020 The definition of "investment"“investment” in ISA (§14 [9]) includes not only equity

and royalty arrangements but any contract that includes "“responsibility for the development of

petroleum resources"” of Iran. The definition includes additions to existing investment (added by

P.L. 107-24) and pipelines to or through Iran and contracts to lead the construction, upgrading, or

expansions of energy projects (added by CISADA).

Trigger 2: Sales of WMD and Related Technologies, Advanced Conventional

Weaponry, and Participation in Uranium Mining Ventures

This provision of ISA was not waived under the JCPOA.

The Iran Freedom Support Act (P.L. 109-293, signed September 30, 2006) added Section 5(b)(1)

of ISA, subjecting to ISA sanctions firms or persons determined to have sold to Iran (1) "

“chemical, biological, or nuclear weapons or related technologies"” or (2) "“destabilizing numbers

and types"” of advanced conventional weapons. Sanctions can be applied if the exporter knew (or

had cause to know) that the end-user of the item was Iran. The definitions do not specifically

include ballistic or cruise missiles, but those weapons could be considered "“related technologies" ”

or, potentially, a "“destabilizing number and type"” of advanced conventional weapon.

The Iran Threat Reduction and Syria Human Rights Act (ITRSHRA, P.L. 112-158, signed August

10, 2012) created Section 5(b)(2) of ISA subjecting to sanctions entities determined by the

Administration to participate in a joint venture with Iran relating to the mining, production, or

transportation of uranium.

Implementation: No ISA sanctions have been imposed on any entities under these provisions.

18

As amended by CISADA (P.L. 111-195), these definitions include pipelines to or through Iran, as well as contracts

to lead the construction, upgrading, or expansions of energy projects. CISADA also changes the definition of

investment to eliminate the exemption from sanctions for sales of energy-related equipment to Iran, if such sales are

structured as investments or ongoing profit-earning ventures.

19 Under §4(d) of the original act, for Iran, the threshold dropped to $20 million, from $40 million, one year after

enactment, when U.S. allies did not join a multilateral sanctions regime against Iran. P.L. 111-195 explicitly sets the

threshold investment level at $20 million. For Libya, the threshold was $40 million, and transactions subject to

sanctions included export to Libya of technology banned by Pan Am 103-related Security Council Resolutions 748

(March 31, 1992) and 883 (November 11, 1993).

20 The original ISA definition of energy sector included oil and natural gas, and CISADA added to that definition

liquefied natural gas (LNG), oil or LNG tankers, and products to make or transport pipelines that transport oil or LNG.

Congressional Research Service

13

Iran Sanctions

Trigger 3: Sales of Gasoline to Iran

Trigger 3: Sales of Gasoline to Iran

Section 102(a) of the Comprehensive Iran Sanctions, Accountability, and Divestment Act of 2010

(CISADA, P.L. 111-195, signed July 1, 2010) amended Section 5 of ISA to exploit Iran's ’s

dependency on imported gasoline (40% dependency at that time). It followed legislation such as

P.L. 111-85 that prohibited the use of U.S. funds to fill the Strategic Petroleum Reserve with

products from firms that sell gasoline to Iran; and P.L. 111-117 that denied Ex-Im Bank credits to

any firm that sold gasoline or related equipment to Iran. The section subjects the following to

sanctions:

-

Sales to Iran of over $1 million worth (or $5 million in a one year period) of

-

Sales to Iran of equipment or services (same dollar threshold as above) which

'’s oil refineries or port operations.

Trigger 4: Provision of Equipment or Services for Oil, Gas, and Petrochemicals Production

Petrochemicals Production

Section 201 of the Iran Threat Reduction and Syria Human Rights Act of 2012 (ITRSHA, P.L.

112-158, signed August 10, 2012) codified an Executive Order, 13590 (November 21, 2011), by

adding Section 5(a)(5 and 6) to ISA sanctioning firms that

-

provide to Iran $1 million or more (or $5 million in a one-year period) worth of

-

provide to Iran $250,000 (or $1 million in a one year period) worth of goods or

2121 This provision was not altered by the JPA.

Trigger 5: Transporting Iranian Crude Oil

Section 201 of the ITRSHRA amends ISA by sanctioning entities the Administration determines

-

owned a vessel that was used to transport Iranian crude oil. The section also

a][7]a][7] to ISA).This. This sanction does not apply in cases of transporting oil to countries that have -

participated in a joint oil and gas development venture with Iran, outside Iran, if

a][4] to ISA).

a][4] to ISA).

A definition of chemicals and products considered “petrochemical products” is found in a Policy Guidance

statement. See Federal Register, November 13, 2012, http://www.gpo.gov/fdsys/pkg/FR-2012-11-13/pdf/201227642.pdf.

21

Congressional Research Service

14

Iran Sanctions

Iran Threat Reduction and Syria Human Rights Act (ITRSHRA): ISA Sanctions

for insuring Iranian oil entities, purchasing Iranian bonds, or engaging in

transactions with the IRGC

Separate provisions of the ITRSHR Act—which do not amend ISA——require the application of

ISA sanctions (5 out of the 12 sanctions on the ISA sanctions menu) on any entity that

-

provides insurance or reinsurance for the National Iranian Oil Company (NIOC)

-

purchases or facilitates the issuance of sovereign debt of the government of Iran,

-

assists or engages in a significant transaction with the IRGC or any of its

waswas not

Implementation

Implementation. Section 312 of ITRSHRA required an Administration determination, within 45

days of enactment (by September 24, 2012) whether NIOC and NITC are IRGC agents or

affiliates. The determination would subject financial transactions with NIOC and NITC to

sanctions under CISADA (prohibition on opening U.S.-based accounts). On September 24, 2012,

the Department of the Treasury determined that NIOC and NITC are affiliates of the IRGC. On

November 8, 2012, the Department of the Treasury named NIOC as a proliferation entity under

Executive Order 13382—a designation that, in accordance with Section 104 of CISADA, bars

any foreign bank determined to have dealt directly with NIOC (including with a NIOC bank

account in a foreign country) from opening or maintaining a U.S.-based account.

Sanctions on dealings with NIOC and NITC were waived in accordance with the interim nuclear

deal and the JCPOA, and designations of these entities under Executive Order 13382 were

rescinded in accordance with the JCPOA. These entities were "relisted"“relisted” again on November 5,

2018.

Executive Order 13622/13846: Sanctions on the Purchase of Iranian Crude Oil

and Petrochemical Products, and Dealings in Iranian Bank Notes

Status: Revoked (by E.O. 13716) but waswas put back into effect by E.O. 13846 of August 6, 2018

Executive Order 13622 (July 30, 2012) imposed specified sanctions on the ISA sanctions menu,

and bars banks from the U.S. financial system, for the following activities (EE.O. 13622 diddid not

amend ISA itself):

- ):

the purchase of oil, other petroleum, or petrochemical products from Iran.

2222 The -

transactions with the National Iranian Oil Company (NIOC) or Naftiran

A definition of what chemicals and products are considered “petroleum products” for the purposes of the order are in

the policy guidance issued November 13, 2012, http://www.gpo.gov/fdsys/pkg/FR-2012-11-13/pdf/2012-27642.pdf.

22

Congressional Research Service

15

Iran Sanctions

E.O. 13622 also blocked U.S.-based property of entities determined to have

-

assisted or provided goods or services to NIOC, NICO, the Central Bank of

-

assisted the government of Iran in the purchase of U.S. bank notes or

E.O. 13622 sanctions do not apply if the parent country of the entity has received an oil

importation exception under Section 1245 of P.L. 112-81, discussed below. An exception also is

provided for projects that bring gas from Azerbaijan to Europe and Turkey, if such project was

initiated prior to the issuance of the order.

Mandate and Time Frame to Investigate ISA Violations

In the original version of ISA, there was no firm requirement, and no time limit, for the

Administration to investigate potential violations and determine that a firm has violated ISA's ’s

provisions. The Iran Freedom Support Act (P.L. 109-293, signed September 30, 2006) added a

provision calling for, but not requiring, a 180-day time limit for a violation determination.23 23

CISADA (Section 102[g][5]) mandated that the Administration begin an investigation of potential

ISA violations when there is "“credible information"” about a potential violation, and made

mandatory the 180-day time limit for a determination of violation.

The Iran Threat Reduction and Syria Human Rights Act (P.L. 112-158) defines the "credible information"“credible

information” needed to begin an investigation of a violation to include a corporate announcement

or corporate filing to its shareholders that it has undertaken transactions with Iran that are

potentially sanctionable under ISA. It also says the President maymay (not mandatory) use as credible

information reports from the Government Accountability Office and the Congressional Research

Service. In addition, Section 219 of ITRSHRA requires that an investigation of an ISA violation

begin if a company reports in its filings to the Securities and Exchange Commission (SEC) that it

has knowingly engaged in activities that would violate ISA (or Section 104 of CISADA or

transactions with entities designated under E.O 13224 or 13382, see below).

ISA Sanctions Menu

Once a firm is determined to be a violator, the original version of ISA required the imposition of

1. denial of Export-Import Bank loans, credits, or credit guarantees for U.S. exports to the sanctioned entity 2. denial of licenses for the U.S. export of military or militarily useful technology to the entity (original ISA) 3. denial of U.S. bank loans exceeding $10 million in one year to the entity (original ISA)

4. if the entity is a financial institution, a prohibition on its service as a primary dealer in U.S. government bonds; 5. prohibition on U.S. government procurement from the entity (original ISA) 6. prohibitions in transactions in foreign exchange by the entity (added by CISADA) 7. prohibition on any credit or payments between the entity and any U.S. financial institution (added by CISADA)

8. prohibition of the sanctioned entity from acquiring, holding, using, or trading any U.S.-based property which the

9. restriction on imports from the sanctioned entity, in accordance with the International Emergency Economic

10. a ban on a U.S. person from investing in or purchasing significant amounts of equity or debt instruments of a

11. exclusion from the United States of corporate officers or controlling shareholders of a sanctioned firm (added

12. imposition of any of the ISA sanctions on principal offices of a sanctioned firm (added by ITRSHRA).

Mandatory Sanction: Prohibition on Contracts with the U.S. Government CISADA (§102[b]) added a requirement

Executive Order 13574 of May 23, 2011 and E.O. 13628 of October 9, 2012 |

Oversight

Oversight

Several mechanisms for Congress to oversee whether the Administration is investigating ISA

violations were added by ITRSHRA. Section 223 of that law required a Government

Accountability Office report, within 120 days of enactment, and another such report a year later,

on companies that have undertaken specified activities with Iran that might constitute violations

of ISA. Section 224 amended a reporting requirement in Section 110(b) of CISADA by requiring

an Administration report to Congress every 180 days on investment in Iran'’s energy sector, joint

ventures with Iran, and estimates of Iran'’s imports and exports of petroleum products. The GAO

reports have been issued; there is no information available on whether the required

Administration reports have been issued as well.

Interpretations of ISA and Related Laws

The sections below provide information on how some key ISA provisions have been interpreted

and implemented.

Application to Energy Pipelines

ISA'

ISA’s definition of "investment"“investment” that is subject to sanctions has been consistently interpreted by

successive Administrations to include construction of energy pipelines to or through Iran. Such

pipelines are deemed to help Iran develop its petroleum (oil and natural gas) sector. This

interpretation was reinforced by amendments to ISA in CISADA, which specifically included in

the definition of petroleum resources "“products used to construct or maintain pipelines used to

transport oil or liquefied natural gas."” In March 2012, then-Secretary of State Clinton made clear

Congressional Research Service

17

Iran Sanctions

that the Obama Administration interprets the provision to be applicable from the beginning of

pipeline construction.24

24 Application to Crude Oil Purchases

/Shipments

ISA does not sanction purchasing crude oil from Iran, but other laws, such as the Iran Freedom

and Counterproliferation Act (IFCA, discussed below) and executive orders, do.

Application to Purchases from Iran of Natural Gas

No U.S. sanction

requires any country or person to actually seize, intercept, inspect on the high seas, or impound

any Iranian ship suspected of carrying oil or other cargo subject to sanctions.

However, as discussed further elsewhere in this paper, as of August 2019, the Trump

Administration has begun using various terrorism-related provisions to some Iranian oil

shipments. The Administration has argued that the shipments were organized by and for the

benefit of Iran’s Islamic Revolutionary Guard Corps (IRGC). On September 4, 2019, the Treasury

Department’s Office of Foreign Assets Control (OFAC) updated its sanctions guidance to state

that “bunkering services” (port operational support) for Iranian oil shipments could subject firms

and individuals involved in such support to U.S. sanctions.

Application to Purchases from Iran of Natural Gas

ISA and other laws, such as IFCA, exclude from sanction purchases of natural gas from Iran or

natural gas transactions with Iran. However: construction of gas pipelinespipelines involving Iran is

subject to ISA sanctions.

Exception for Shah Deniz and other Gas Export Projects

The effective dates of U.S. sanctions laws and orders exclude long-standing joint natural gas

projects that involve some Iranian firms—particularly the Shah Deniz natural gas field and

related pipelines in the Caspian Sea. These projects involve a consortium in which Iran'’s Naftiran

Intertrade Company (NICO) holds a passive 10% share, and includes BP, Azerbaijan'’s natural gas

firm SOCAR, Russia'’s Lukoil, and other firms. NICO was sanctioned under ISA and other

provisions (until JCPOA Implementation Day), but an OFAC factsheet of November 28, 2012,

stated that the Shah Deniz consortium, as a whole, is not determined to be "“a person owned or

controlled by"” the government of Iran and transactions with the consortium are permissible.

Application to Iranian Liquefied Natural Gas Development

The original version of ISA did not apply to the development by Iran of a liquefied natural gas

(LNG) export capability. Iran has no LNG export terminals, in part because the technology for

such terminals is patented by U.S. firms and unavailable for sale to Iran. CISADA specifically

included LNG in the ISA definition of petroleum resources and therefore made subject to

sanctions LNG investment in Iran, supply of LNG tankers to Iran, and construction of pipelines

linking to Iran.

Application to Private Financing but Not Official Credit Guarantee Agencies

The definitions of investment and other activity that can be sanctioned under ISA include