The Temporary Assistance for Needy Families (TANF) Block Grant: Responses to Frequently Asked Questions

Changes from January 4, 2019 to January 15, 2019

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

The Temporary Assistance for Needy Families (TANF) Block Grant: Responses to Frequently Asked Questions

Contents

- Introduction

- Funding and Expenditures

- What is TANF's Funding Status?

- Is Legislation Before Congress to Fund TANF for FY2019?

- How Are State TANF Programs Funded?

- How Much Has the Value of the TANF Basic Block Grant Changed Over Time?

- How Have States Used TANF Funds?

- How Much of the TANF Grant Has Gone Unspent?

- The Caseload

- How Many Families Receive TANF- or MOE-Funded Benefits and Services?

- How Many Families and People Currently Receive TANF- or MOE-Funded "Assistance"?

- How Does the Current Assistance Caseload Level Compare with Historical Levels?

- What Are the Characteristics of Families Receiving TANF Assistance?

- TANF Cash Benefits: How Much Does a Family Receive in TANF Cash Per Month?

- TANF Work Participation Standards

- What Is the TANF Work Participation Standard States Must Meet?

- Have There Been Changes in the Work Participation Rules Enacted Since the 1996 Welfare Reform Law?

- What Work Participation Rates Have the States Achieved?

- How Many Jurisdictions Did Not Meet the All-Families Standard?

- Have States Met the Two-Parent Work Participation Standard?

Figures

- Figure 1. Uses of TANF Funds by Spending Category, FY2017

- Figure 2. Number of Families Receiving Cash Assistance, July 1959-September 2017

- Figure 3. Characteristics of Assistance Families, Selected Years FY1988 to FY2016

- Figure 4. TANF Cash Assistance Maximum Monthly Benefit Amounts for a Single Parent Family with Two Children, 50 States and the District of Columbia, July 2016

- Figure 5. National Average TANF Work Participation Rate for All Families, FY2002-FY2017

- Figure 6. States that Met or Did Not Meet the TANF All-Families Work Participation Standard: FY2006-FY2017

- Figure 7. Two-Parent TANF Work Participation Standard, Status by State: FY2006-FY2017

Tables

- Table 1. TANF Basic Block Grant Funding in Nominal and Constant Dollars

- Table 2. TANF Assistance Caseload: September 2017

- Table A-1. Trends in the Cash Assistance Caseload: 1961 to 2016

- Table A-2. Families Receiving AFDC/TANF Assistance by Family Category, Selected Years, FY1988 to FY2016

- Table B-1. Use of FY2017 TANF and MOE Funds by Category

- Table B-2. Use of FY2017 TANF and MOE Funds by Category as a Percentage of Total Federal TANF and State MOE Funding

- Table B-3. Unspent TANF Funds at the End of FY2017

- Table B-4. Number of Families, Recipients, Children, and Adults Receiving TANF Assistance by State, September 2017

- Table B-5. Number of Needy Families with Children Receiving Assistance by State, September of Selected Years

- Table B-6. TANF Assistance Families by Number of Parents by State: September 2017

Summary

15, 2019

Needy Families (TANF) Block Grant:

Gene Falk

Responses to Frequently Asked Questions

Specialist in Social Policy

The Temporary Assistance for Needy Families (TANF) block grant funds a wide range of benefits and services for low-income families with children. TANF was created in the

1996 welfare reform law (P.L. 104-193). This report responds to some frequently asked questions about TANF; it does not describe TANF rules (see, instead, CRS Report RL32748, The Temporary Assistance for Needy Families (TANF) Block Grant: A Primer on TANF Financing and Federal Requirements, by [author name scrubbed]).

Gene Falk).

TANF Funding and Expenditures. TANF provides fixed funding for the 50 states, the District of Columbia, the territories, and American Indian tribes. The basic block grant totalstotals $16.5 billion per year. States are also required in total to contribute, from their own funds, at least $10.3 billion annually under a maintenance-of-effort (MOE) requirement.

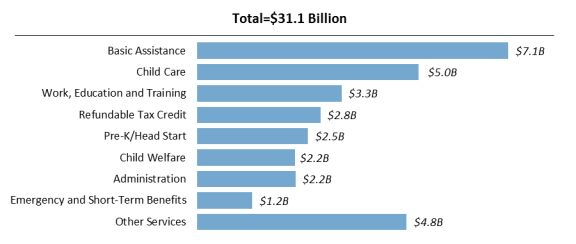

Though TANF is best known for funding cash assistance payments for needy families with children, the block grant and MOE funds are used for a wide variety of benefits and activities. In FY2017, expenditures on basic assistance totaled $7.1 billion—23% of total federal TANF and MOE dollars. Basic assistance is often—but not exclusively—paid as cash. In addition to funding basic assistance, TANF also contributes funds for child care and services for children who have been, or are at risk of being, abused and neglected. Some states also count expenditures in prekindergarten programs toward the MOE requirement.

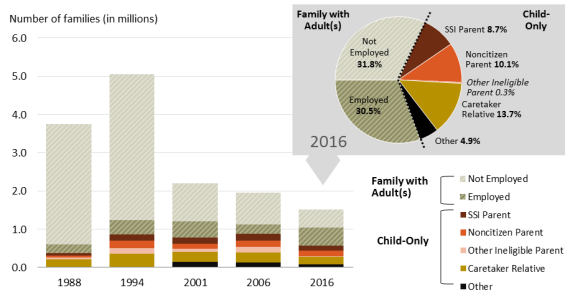

The TANF Assistance Caseload. A total of 1.4 million families, composed of 3.4 million recipients, received TANF- or MOE-funded assistance in September 2017. The bulk of the "recipients"“recipients” were children—2.5 million in that month. The assistance caseload is heterogeneous. The type of family once thought of as the "typical" “typical” assistance family—one with an unemployed adult recipient—accounted for 32% of all families on the rolls in FY2016. Additionally, 31% of cash assistance families had an employed adult, while 38% of all TANF families were "“child-only"” and had no adult recipient. Child-only families include those with disabled adults receiving Supplemental Security Income (SSI), adults who are nonparents (e.g., grandparents, aunts, uncles) caring for children, and families consisting of citizen children and ineligible noncitizen parents.

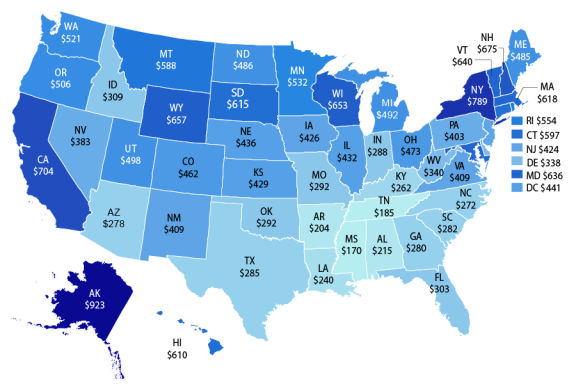

Cash Assistance Benefits. TANF cash benefit amounts are set by states. In July 2016, the maximum monthly benefit for a family of three ranged from $923 in Alaska to $170 in Mississippi. In all states, the maximum TANF cash assistance amount for this sized family was less than 50% of poverty-level income.

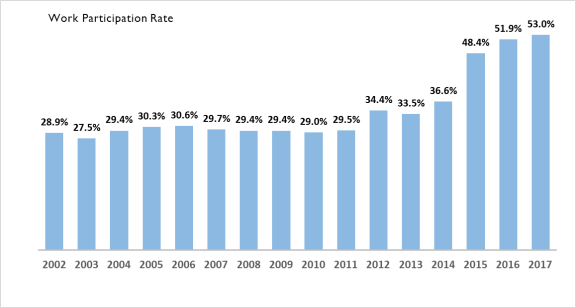

Work Requirements. TANF'’s main federal work requirement is actually a performance measure that applies to the states. States determine the work rules that apply to individual recipients. TANF law requires states to engage 50% of all families and 90% of two-parent families with work-eligible individuals in work activities, though these standards can be reduced by "“credits."” Therefore, the effective standards states face are often less than the 50% or 90% targets, and vary by state. In FY2017, states achieved, on average, an all-family participation rate of 53.0% and a two-parent rate of 69.5%. In FY2017, two jurisdictions did not meet the all-family participation standard: Nevada and Guam. This is a reduction from FY2012, when 16 states did not meet that standard. In FY2017, nine jurisdictions did not meet the two-parent standard. States that do not meet work standards are at risk of being penalized by a reduction in their block grant.

Introduction

Congressional Research Service

link to page 5 link to page 5 link to page 5 link to page 5 link to page 5 link to page 6 link to page 7 link to page 8 link to page 8 link to page 8 link to page 9 link to page 9 link to page 9 link to page 11 link to page 12 link to page 13 link to page 13 link to page 14 link to page 14 link to page 14 link to page 15 link to page 18 link to page 8 link to page 10 link to page 12 link to page 13 link to page 13 link to page 15 link to page 15 link to page 17 link to page 17 link to page 19 link to page 19 link to page 6 link to page 9 The Temporary Assistance for Needy Families (TANF) Block Grant: FAQs

Contents

Introduction ..................................................................................................................................... 1 Funding and Expenditures ............................................................................................................... 1

What is TANF’s Funding Status? .............................................................................................. 1 Is Legislation Before Congress to Fund TANF for FY2019? ................................................... 1 How Are State TANF Programs Funded? ................................................................................. 1 How Much Has the Value of the TANF Basic Block Grant Changed Over Time? ................... 2 How Have States Used TANF Funds? ...................................................................................... 3 How Much of the TANF Grant Has Gone Unspent? ................................................................ 4

The Caseload ................................................................................................................................... 4

How Many Families Receive TANF- or MOE-Funded Benefits and Services? ....................... 4 How Many Families and People Currently Receive TANF- or MOE-Funded

“Assistance”? ......................................................................................................................... 5

How Does the Current Assistance Caseload Level Compare with Historical Levels? ............. 5 What Are the Characteristics of Families Receiving TANF Assistance? .................................. 7

TANF Cash Benefits: How Much Does a Family Receive in TANF Cash Per Month? .................. 8 TANF Work Participation Standards ............................................................................................... 9

What Is the TANF Work Participation Standard States Must Meet? ........................................ 9 Have There Been Changes in the Work Participation Rules Enacted Since the 1996

Welfare Reform Law? .......................................................................................................... 10

What Work Participation Rates Have the States Achieved? .................................................... 10 How Many Jurisdictions Did Not Meet the All-Families Standard? ........................................ 11 Have States Met the Two-Parent Work Participation Standard? ............................................. 14

Figures Figure 1. Uses of TANF Funds by Spending Category, FY2017 .................................................... 4 Figure 2. Number of Families Receiving Cash Assistance, July 1959-September 2017 ................. 6 Figure 3. Characteristics of Assistance Families, Selected Years FY1988 to FY2016 .................. 8 Figure 4. TANF Cash Assistance Maximum Monthly Benefit Amounts for a Single Parent

Family with Two Children, 50 States and the District of Columbia, July 2016 ........................... 9

Figure 5. National Average TANF Work Participation Rate for All Families,

FY2002-FY2017 ......................................................................................................................... 11

Figure 6. States that Met or Did Not Meet the TANF All-Families Work Participation

Standard: FY2006-FY2017 ........................................................................................................ 13

Figure 7. Two-Parent TANF Work Participation Standard, Status by State:

FY2006-FY2017 ........................................................................................................................ 15

Tables Table 1. TANF Basic Block Grant Funding in Nominal and Constant Dollars ............................... 2 Table 2. TANF Assistance Caseload: September 2017 .................................................................... 5

Congressional Research Service

link to page 20 link to page 22 link to page 22 link to page 23 link to page 26 link to page 26 link to page 29 link to page 30 link to page 30 link to page 32 link to page 32 link to page 34 link to page 20 link to page 23 The Temporary Assistance for Needy Families (TANF) Block Grant: FAQs

Table A-1. Trends in the Cash Assistance Caseload: 1961 to 2016 ............................................... 16 Table A-2. Families Receiving AFDC/TANF Assistance by Family Category, Selected

Years, FY1988 to FY2016 .......................................................................................................... 18

Table B-1. Use of FY2017 TANF and MOE Funds by Category .................................................. 19 Table B-2. Use of FY2017 TANF and MOE Funds by Category as a Percentage of Total

Federal TANF and State MOE Funding ..................................................................................... 22

Table B-3. Unspent TANF Funds at the End of FY2017 ............................................................... 25 Table B-4. Number of Families, Recipients, Children, and Adults Receiving TANF

Assistance by State, September 2017 ......................................................................................... 26

Table B-5. Number of Needy Families with Children Receiving Assistance by State,

September of Selected Years ...................................................................................................... 28

Table B-6. TANF Assistance Families by Number of Parents by State: September 2017 ............ 30

Appendixes Appendix A. Supplementary Tables .............................................................................................. 16 Appendix B. State Tables .............................................................................................................. 19

Contacts Author Information ....................................................................................................................... 32

Congressional Research Service

link to page 23 The Temporary Assistance for Needy Families (TANF) Block Grant: FAQs

Introduction This report provides responses to frequently asked questions about the Temporary Assistance for Needy Families (TANF) block grant. It is intended to serve as a quick reference to provide easy access to information and data. Appendix B presents a series of tables with state-level data. This report does not provide information on TANF program rules (for a discussion of TANF rules, see CRS Report RL32748, The Temporary Assistance for Needy Families (TANF) Block Grant: A Primer on TANF Financing and Federal Requirements, by [author name scrubbed]).

Gene Falk). Funding and Expenditures

What is TANF'’s Funding Status?

TANF is a mandatory spending program administered by the Department of Health and Human Services (HHS). Funding for TANF is not provided through the regular annual appropriations bill for HHS. Rather, TANF funding is directly appropriated in Section 403(a) of the Social Security Act. Most recently, provisions extending TANF funding through December 21, 2018, were contained in the FY2019 continuing resolution (P.L. 115-245, as amended by P.L. 115-298). As of the date of this report, no further extension of TANF appropriations has been enacted, resulting in a gap in TANF funding.

States received their first quarter of FY2019 TANF grants under the funding extension provisions contained in the continuing resolution. However, absent the enactment of law, the federal government cannot make its second quarter (beginning on January 1, 2019) or subsequent quarterly TANF grant awards to the states. HHS has issued guidance to the states clarifying that they may use unspent, previously awarded federal funds to continue their state TANF programs during the funding lapse. Additionally, a state may spend its own funds within the state TANF program, which, absent subsequent enactment of law to the contrary, may be counted toward the FY2019 TANF state spending requirement (the maintenance of effort, or MOE, requirement).

Is Legislation Before Congress to Fund TANF for FY2019?

On On January 14, 2019, the House passed legislation (H.R. 430) that would fund TANF through June 30, 2019. H.R. 430 is a stand-alone bill that only would extend funding for TANF and certain related programs, such as mandatory child care. The bill would permit states to receive their quarterly TANF grants for the 2nd quarter (January through March) and 3rd quarter (April through June) of FY2019. Additional legislation would be required to pay TANF grants in the final quarter (July through September) of FY2019.

Earlier, on January 3, 2019, the House passed legislation (H.R. 21) that would fund federal government activities that had their funding lapse in December 2018, including TANF. H.R. 21 would fund TANF for the remainder of FY2019, as well as for FY2020. It would also require states to report on employment outcomes of TANF assistance recipients.

How Are State TANF Programs Funded?

TANF programs are funded through a combination of federal and state funds. In FY2018, TANF has two federal grants to states. The bulk of the TANF funding is in a basic block grant to the states, totaling $16.5 billion for the 50 states, the District of Columbia, Puerto Rico, Guam, the

Congressional Research Service

RL32760 · VERSION 164 · UPDATED

1

link to page 6 The Temporary Assistance for Needy Families (TANF) Block Grant: FAQs

Virgin Islands, and American Indian tribes. There is also a contingency fund available that provides extra federal funds to states that meet certain conditions.

Additionally, states are required to expend a minimum amount of their own funds for TANF and TANF-related activities under what is known as the maintenance of effort (MOE) requirement. States are required to spend at least 75% of what they spent in FY1994 on TANF'’s predecessor programs. The minimum MOE amount, in total, is $10.3 billion per year for the 50 states, the District of Columbia, and the territories.

How Much Has the Value of the TANF Basic Block Grant Changed Over Time?

TANF was created in the 1996 welfare reform law, the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA, P.L. 104-193). A TANF basic block grant amount—both nationally and for each state—was established in the 1996 welfare reform law. The amount established in that law for the 50 states, District of Columbia, territories, and tribes was $16.6 billion in total. From FY1997 through FY2016, that amount remained the same. It was not adjusted for changes that occur over time, such as inflation, the size of the TANF assistance caseload, or changes in the poverty population. During this period, the real (inflation-adjusted) value of the block grant declined by one-third (33.1%). Beginning with FY2017, the state family assistance grant was reduced by 0.33% from its historical levels to finance TANF-related research and technical assistance. The reduced block grant amount is $16.5 billion.

Table 1 shows the state family assistance grant, in both nominal (actual) and real (inflation-adjusted) dollars for each year, FY1997 through FY2018. In real (inflation-adjusted) terms, the FY2018 block grant was 36% below its value in FY1997.

Table 1. TANF Basic Block Grant Funding in Nominal and Constant Dollars

(In billions of $)

(In billions of $)

|

Fiscal Year |

|

State Family Assistance Grant Constant 1997 Dollars |

Cumulative Percentage Change |

|

1997 |

$16.567 |

$16.567 |

|

|

1998 |

16.567 |

16.306 |

-1.6% |

|

1999 |

16.567 |

15.991 |

-3.5 |

|

2000 |

16.567 |

15.498 |

-6.5 |

|

2001 |

16.567 |

15.020 |

-9.3 |

|

2002 |

16.567 |

14.792 |

-10.7 |

|

2003 |

16.567 |

14.456 |

-12.7 |

|

2004 |

16.567 |

14.124 |

-14.7 |

|

2005 |

16.567 |

13.680 |

-17.4 |

|

2006 |

16.567 |

13.190 |

-20.4 |

|

2007 |

16.567 |

12.893 |

-22.2 |

|

2008 |

16.567 |

12.345 |

-25.5 |

|

2009 |

16.567 |

12.382 |

-25.3 |

|

2010 |

16.567 |

12.182 |

-26.5 |

|

2011 |

16.567 |

11.859 |

-28.4 |

|

2012 |

16.567 |

11.585 |

-30.1 |

|

2013 |

16.567 |

11.394 |

-31.2 |

|

2014 |

16.567 |

11.217 |

-32.3 |

|

2015 |

16.567 |

11.179 |

-32.5 |

|

2016 |

16.567 |

11.082 |

-33.1 |

|

2017 |

16.512 |

10.820 |

-34.7 |

|

2018 |

16.512 |

10.564 |

-36.2 |

Source: Congressional Research Service (CRS) based on data from the U.S. Department of Health and Human Services (HHS), and the U.S. Department of Labor, Bureau of Labor Statistics (BLS).

Notes: Constant dollars were computed using the Consumer Price Index for all Urban Consumers (CPI-U).

How Have States Used TANF Funds?

Figure 1 shows the uses of federal TANF grants to states and state MOE funds in FY2017. In FY2017, a total of $31.1 billion of both federal TANF and state MOE expenditures were either expended or transferred to other block grant programs. Basic assistance—ongoing benefits to families to meet basic needs—represented 23% ($7.1 billion) of total FY2017 TANF and MOE dollars.

TANF is a major contributor of child care funding. In FY2017, $5 billion (16% of all TANF and MOE funds) were either expended on child care or transferred to the child care block grant (the Child Care and Development Fund, or CCDF). TANF work-related activities (including education and training) were the third-largest TANF and MOE spending category at $3.3 billion, or 11% of total TANF and MOE funds. TANF also helps low-wage parents by helping to finance state refundable tax credits, such as state add-ons to the Earned Income Tax Credit (EITC). TANF and MOE expenditures on refundable tax credits in FY2017 totaled $2.8 billion, or 9% of total TANF and MOE spending.

TANF is also a major contributor to the child welfare system, which provides foster care, adoption assistance, and services to families with children who either have experienced or are at risk of experiencing child abuse or neglect, spending about $2.2 billion on such activities. TANF and MOE funds also help fund state prekindergarten (pre-K) programs, with total FY2017 expenditures for that category also at $2.5 billion. TANF and MOE funds are also used for short-term and emergency benefits and a wide range of other social services.

For state-specific information on the use of TANF funds, see Table B-1 andand Table B-2.

How Much of the TANF Grant Has Gone Unspent?

TANF law permits states to "reserve"“reserve” unused funds without time limit. This permits flexibility in timing of the use of TANF funds, including the ability to "save"“save” funds for unexpected occurrences that might increase costs (such as recessions or natural disasters).

At the end of FY2017 (September 30, 2017, the most recent data currently available), a total of $5.1 billion of federal TANF funding remained neither transferred nor spent. However, some of these unspent funds represent monies that states had already committed to spend later. At the end of FY2017, states had made such commitments to spend—that is, had obligated—a total of $1.8 billion. At the end of FY2017, states had $3.3 billion of "“unobligated balances."” These funds are available to states to make new spending commitments. Table B-3 shows unspent TANF funds by state.

by state. The Caseload

How Many Families Receive TANF- or MOE-Funded Benefits and Services?

This number is not known. Federal TANF reporting requirements focus on families receiving only ongoing assistance. There is no complete reporting on families receiving other TANF benefits and services.

Congressional Research Service

RL32760 · VERSION 164 · UPDATED

4

link to page 9 link to page 30 link to page 10 The Temporary Assistance for Needy Families (TANF) Block Grant: FAQs

Assistance is defined as benefits provided to families to meet ongoing, basic needs.11 It is most often paid in cash. However, some states use TANF or MOE funds to provide an "“earnings supplement"supplement” to working parents added to monthly Supplemental Nutrition Assistance Program (SNAP) allotments. These "“earnings supplements"” are paid separately from the regular TANF cash assistance program. Additionally, TANF MOE dollars are used to fund food assistance for immigrants barred from regular SNAP benefits in certain states. These forms of nutrition aid meet an ongoing need, and thus are considered TANF assistance.

As discussed in a previous section of this report, TANF basic assistance accounts for about 24% of all TANF expenditures. Therefore, the federal reporting requirements that pertain to families receiving "assistance"“assistance” are likely to undercount the number of families receiving any TANF-funded benefit or service.

How Many Families and People Currently Receive TANF- or MOE-Funded “Assistance”? Funded "Assistance"?

Table 2 provides assistance caseload information. A total of 1.4 million families, composed of 3.4 million recipients, received TANF- or MOE-funded assistance in September 2017. The bulk of the “recipients”the "recipients" were children—2.5 million in that month. (The September 2017 data exclude Puerto Rico.) For state-by-state assistance caseloads, seesee Table B-4.

Table 2. TANF Assistance Caseload: September 2017

Families

1,354,901

Recipients

3,410,086

Child Recipients

2,481,584

Adult Recipients

928,502

Table 2. TANF Assistance Caseload: September 2017

|

Families |

1,354,901 |

|

Recipients |

3,410,086 |

|

Child Recipients |

2,481,584 |

|

Adult Recipients |

928,502 |

Source: Congressional Research Service (CRS) based on data from the U.S. Department of Health and Human Services (HHS).

Notes: TANF cash assistance caseload includes families receiving assistance in state-funded programs counted toward the TANF maintenance of effort (MOE) requirement.

How Does the Current Assistance Caseload Level Compare with Historical Levels?

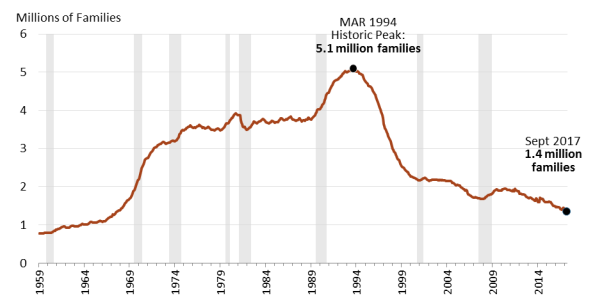

Figure 2 provides a long-term historical perspective on the number of families receiving assistance from TANF or its predecessor program, from July 1959 to September 2017. The shaded areas of the figure represent months when the national economy was in recession. Though the health of the national economy has affected the trend in the cash assistance caseload, the long-term trend in receipt of cash assistance does not follow a classic countercyclical pattern. Such a pattern would have the caseload rise during economic slumps, and then fall again during periods of economic growth. Factors other than the health of the economy (demographic trends, policy changes) also have influenced the caseload trend.

The figure shows two periods of sustained caseload increases: the period from the mid-1960s to the mid-1970s and a second period from 1988 to 1994. The number of families receiving 1 The definition of TANF assistance is not in statute. However, because the statutory language has most TANF requirements triggered by a family receiving “assistance,” the Department of Health and Human Services (HHS) regulations define assistance at 45 C.F.R. §260.31. Congressional Research Service RL32760 · VERSION 164 · UPDATED 5 link to page 20 link to page 32 The Temporary Assistance for Needy Families (TANF) Block Grant: FAQs assistance peaked in March 1994 at 5.1 million families. The assistance caseload fell rapidly in the late 1990s (after the 1996 welfare reform law) before leveling off in 2001. In 2004, the caseload began another decline, albeit at a slower pace than in the late 1990s. During the recent 2007-2009 recession and its aftermath, the caseload began to rise from 1.7 million families in August 2008, peaking in December 2010 at close to 2.0 million families. By September 2017, the assistance caseload had declined to 1.4 million families.

Figure 2. Number of Families Receiving Cash Assistance, July 1959-September 2017 |

|

Source: Congressional Research Service (CRS) with data from the U.S. Department of Health and Human Services (HHS). Notes: Shaded areas denote months when the national economy was in recession. Information represents families receiving cash assistance from Aid to Dependent Children (ADC), Aid to Families with Dependent Children (AFDC), and TANF. For October 1999 through September 2017, includes families receiving assistance from Separate State Programs (SSPs) with expenditures countable toward the TANF maintenance of effort requirement. |

Table B-5 shows recent trends in the number of cash assistance families by state.

Congressional Research Service RL32760 · VERSION 164 · UPDATED 6 link to page 12 The Temporary Assistance for Needy Families (TANF) Block Grant: FAQs What Are the Characteristics of Families Receiving TANF Assistance?

Before PRWORA, the "typical"“typical” family receiving assistance has been headed by a single parent (usually the mother) with one or two children. That single parent has also typically been unemployed. However, over the past 20 years the assistance caseload decline has occurred together with a major shift in the composition of thethe rolls. Figure 3 shows the change in the size and composition of the assistance caseload under both AFDC (1988 and 1994) and TANF. In FY1988, an estimated 84% of AFDC families were headed by an unemployed adult recipient. In FY2016, families with an unemployed adult recipient represented 32% of all cash assistance families. This decline occurred, in large part, as the number of families headed by unemployed adult recipients declined more rapidly than other components of the assistance caseload. In FY1994, a monthly average of 3.8 million families per month who received AFDC cash assistance had adult recipients who were not working. In FY2016, a monthly average of 485,000 families per month had adult recipients or work-eligible individuals, with no adult recipient or work-eligible individual working.

With the decline in families headed by unemployed adults, the share of the caseload represented by families with employed adults and "“child only"” families has increased. In FY2016, families with employed adult recipients represented 31% of all assistance families. This category includes families in "“earnings supplement"” programs separate from the regular TANF cash assistance program. "“Child-only"” families are those where no adult recipient receives benefits in their own right; the family receives benefits on behalf of its children. The share of the caseload that was child-only in FY2016 was 38%. In FY2016, families with a nonrecipient, nonparent relative (grandparents, aunts, uncles) represented 14% of all assistance families. Families with ineligible, noncitizen adults or adults who have not reported their citizenship status made up 11% of the assistance caseload in that year. Families where the parent received Supplemental Security Income (SSI) and the children received TANF made up 9% of all assistance families in FY2016.

TANF Cash Benefits: How Much Does a Family Receive in TANF Cash Per Month?

There are no federal rules that help determine the amount of TANF cash benefits paid to a family. (There are also no federal rules that require states to use TANF to pay cash benefits, though all states do so.) Benefit amounts are determined solely by the states.

Most states base TANF cash benefit amounts on family size, paying larger cash benefits to larger families on the presumption that they have greater financial needs. The maximum monthly cash benefit is usually paid to a family that receives no other income (e.g., no earned or unearned income) and complies with program rules. Families with income other than TANF often are paid a reduced benefit. Moreover, some families are financially sanctioned for not meeting a program requirement (e.g., a work requirement), and are also paid a lower benefit.

Figure 4 shows the maximum monthly TANF cash benefit by state for a single mother caring for two children (family of three) in July 2016.22 The benefit amounts shown are those for a single-parent family with two children.33 For a family of three, the maximum TANF benefit paid in July 2016 varied from $170 per month in Mississippi to $923 per month in Alaska. The map shows a

2 States are not required to report to the federal government their cash assistance benefit amounts in either the TANF state plan (under Section 402 of the Social Security Act) or in annual program reports (under Section 411 of the Social Security Act). The benefit amounts shown are from the “Welfare Rules Database,” maintained by the Urban Institute and funded by the Department of Health and Human Services (HHS).

3 Some states vary their benefit amounts for other family types such as two-parent families or “child-only” cases. States also vary their benefits by other factors such as housing costs and substate geography.

Congressional Research Service

RL32760 · VERSION 164 · UPDATED

8

The Temporary Assistance for Needy Families (TANF) Block Grant: FAQs

regional pattern to the maximum monthly benefit paid, with lower benefit amounts in the South than in other regions. In all states, the maximum TANF cash assistance amount for this sized family was less than 50% of poverty-level income.4

TANF Work Participation Standards

TANF'’s main federal work requirement is actually a performance measure that applies to the states, rather than individual recipients. States determine the work rules that apply to individual recipients.

What Is the TANF Work Participation Standard States Must Meet?

The TANF statute requires states to have 50% of their caseload meet standards of participation in work or activities—that is, a family member must be in specified activities for a minimum 4 In 2016, the HHS poverty guidelines for the contiguous 48 states and the District of Columbia for a family of three was $1,680 per month. Higher poverty lines applied in Alaska ($2,100 per month for a family of three) and Hawaii ($1,933 per month for a family of three).

Congressional Research Service

RL32760 · VERSION 164 · UPDATED

9

The Temporary Assistance for Needy Families (TANF) Block Grant: FAQs

number of hours.5number of hours.5 There is a separate participation standard that applies to the two-parent portion of a state'’s caseload, requiring 90% of the state'’s two-parent caseload to meet participation standards.

However, the statutory work participation standards are reduced by a "“caseload reduction credit." ” The caseload reduction credit reduces the participation standard one percentage point for each percentage point decline in a state'’s caseload. Additionally, under a regulatory provision, a state may get "extra"“extra” credit for caseload reduction if it spends more than required under the TANF MOE. Therefore, the effective standards states face are often less than the 50% and 90% targets, and vary by state and by year.

States that do not meet the TANF work participation standard are at risk of being penalized through a reduction in their block grant. However, penalties can be forgiven if a state claims, and the Secretary of HHS finds, that it had "“reasonable cause"” for not meeting the standard. Penalties can also be forgiven for states that enter into "“corrective compliance plans,"” and subsequently meet the work standard.

Have There Been Changes in the Work Participation Rules Enacted Since the 1996 Welfare Reform Law?

The 50% and 90% target standards that states face, as well as the caseload reduction credit, date back to the 1996 welfare reform law. However, the Deficit Reduction Act of 2005 (DRA, P.L. 109-171) made) made several changes to the work participation rules effective in FY2007:

-

The caseload reduction credit was changed to measure caseload reduction from

FY2005, rather than the original law

'’s FY1995. -

The work participation standards were broadened to include families receiving

cash aid in

"“separate state programs."” Separate state programs are programs run with state funds, distinct from a state's "’s “TANF program,"” but with expenditures countable toward the TANF MOE. -

HHS was instructed to provide definition to the allowable TANF work activities

listed in law. HHS was also required to define what is meant by a

"“work-eligible"” individual, expanding the number of families that are included in the work participation calculation. - States were required to develop plans and procedures to verify work activities.

The American Recovery and Reinvestment Act of 2009 (ARRA, P.L. 111-5),), a law enacted in response to the sharp economic downturn of 2007-2009, held states "harmless"“harmless” for caseload increases affecting the work participation standards for FY2009 through FY2011. It did so by allowing states to "freeze"“freeze” caseload reduction credits at pre-recession levels through the FY2011 standards.

What Work Participation Rates Have the States Achieved?

HHS computes two work participation rates for each state that are then compared with the effective (after-credit) standard to determine if it has met the TANF work standard. An "all-families"“all-

5 Families without a work-eligible individual are excluded from the participation rate calculation. It excludes families where the parent is a nonrecipient (for example, disabled receiving Supplemental Security Income or an ineligible noncitizen) or the children in the family are being cared for by a nonparent relative (e.g., grandparent, aunt, uncle) who does not receive assistance on his or her behalf.

Congressional Research Service

RL32760 · VERSION 164 · UPDATED

10

link to page 15 link to page 17

The Temporary Assistance for Needy Families (TANF) Block Grant: FAQs

families” work participation rate is computed and compared with the all-families effective standard (50% minus the state'’s caseload reduction credit). HHS also computes a two-parent work participation rate that is compared with the two-parent effective standard (90% minus the state'state’s caseload reduction credit).

Figure 5 shows the national average all-families work participation rate for FY2002 through FY2017. For the period FY2002 through FY2011, states achieved an average all-families work participation rate hovering around 30%. The work participation rate increased since then. In FY2016, it exceeded 50% for the first time since TANF was established. However, it is important to note that the increase in the work participation rate has not come from an increase in the number of recipients in regular TANF assistance programs who are either working or in job preparation activities. This increase stems mostly from states creating new "“earnings supplement" ” programs that use TANF funds to aid working parents in the Supplemental Nutrition Assistance Program (SNAP, formerly food stamps) or who have left the regular TANF assistance programs for work.6

for work.6

How Many Jurisdictions Did Not Meet the All-Families Standard?

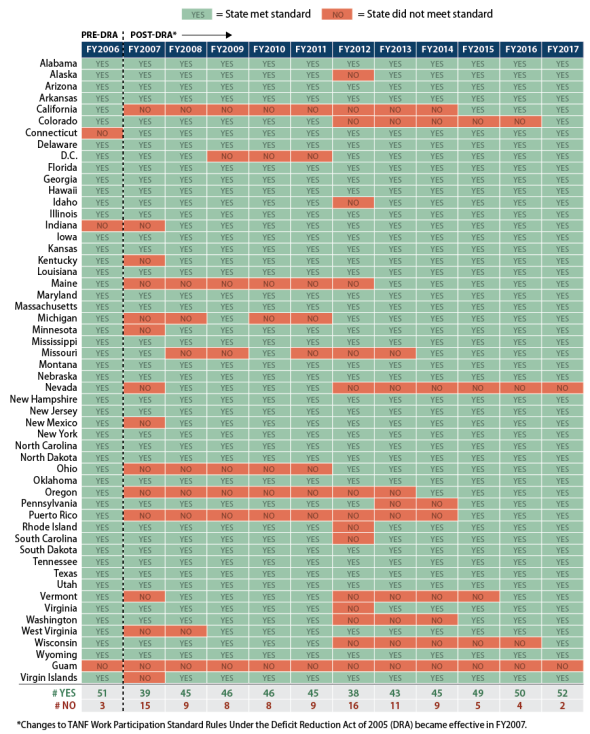

Figure 6 shows which states did not meet the TANF all-families work participation standards from FY2006 through FY2017. Before FY2007, the first year that DRA was effective, only a few jurisdictions did not meet TANF all-families work participation standards. However, in FY2007, 15 jurisdictions did not meet the all-families standard. This number declined to 9 in FY2008 and 8 in FY2009.

6 See CRS In Focus IF10856, Temporary Assistance for Needy Families: Work Requirements.

Congressional Research Service

RL32760 · VERSION 164 · UPDATED

11

The Temporary Assistance for Needy Families (TANF) Block Grant: FAQs

In FY2012, despite the uptick in the national average work participation rate, 16 states did not meet the all-family standard, the largest number of states that did not meet their participation standards in any one year since the enactment of TANF. FY2012 was the year that ARRA's "freeze"’s “freeze” of the caseload reduction credit expired, and states were generally required to meet higher standards than in previous years.

The number of jurisdictions that did not meet the all-families standard declined over the FY2012 to FY2017 period. In FY2017, two jurisdictions did not meet the all-family participation standard: Nevada and Guam.

Congressional Research Service RL32760 · VERSION 164 · UPDATED 13 link to page 19 The Temporary Assistance for Needy Families (TANF) Block Grant: FAQs Have States Met the Two-Parent Work Participation Standard?

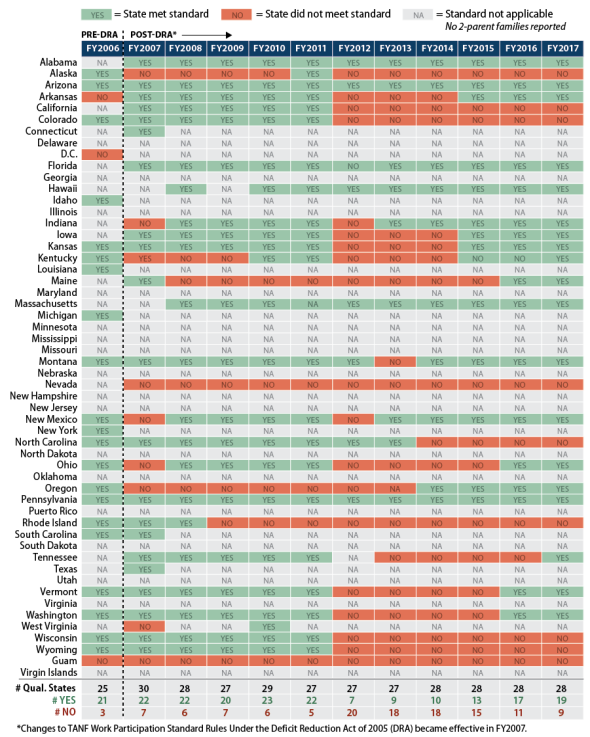

In addition to meeting a work standard for all families, TANF also imposes a second standard—90%—for the two-parent portion of its cash assistance caseload. This standard can also be lowered by caseload reduction.

Figure 7 shows whether each state met its two-parent work participation standard for FY2006 through FY2017. However, the display on the table is more complex than that for reporting whether a state met or did not meet its "“all family"” rate.

A substantial number of states have reported no two-parent families subject to the work participation standard. These states are denoted on the table with an "“NA,"” indicating that the two-parent standard was not applicable to the state in that year. Before the changes made by the DRA were effective, a number of states had their two-parent families in separate state programs that were not included in the work participation calculation. When DRA brought families receiving assistance in separate state programs into the work participation rate calculations, a number of states moved these families into solely state-funded programs. These are state-funded programs with expenditures not countable toward the TANF maintenance of effort requirement, and hence are outside of TANF'’s rules.

For states with two-parent families in their caseloads, the table reports "Yes"“Yes” for states that met the two-parent standard, and "No"“No” for states that did not meet the two-parent standard. Of the 28 jurisdictions that had two-parent families in their FY2017 TANF work participation calculation, 19 met the standard and 9 did not.

Appendix A.

Supplementary Tables

Supplementary Tables

Table A-1. Trends in the Cash Assistance Caseload: 1961 to 2016

TANF Child Recipients

As a

As a

Percentage Percentage

Families

Recipients

Adults

Children

of All

of All Poor

Year

(millions)

(millions)

(millions)

(millions)

Children

Children

1961

0.873

3.363

0.765

2.598

3.7%

14.3%

1962

0.939

3.704

0.860

2.844

4.0

15.7

1963

0.963

3.945

0.988

2.957

4.1

17.4

1964

1.010

4.195

1.050

3.145

4.3

18.6

1965

1.060

4.422

1.101

3.321

4.5

21.5

1966

1.096

4.546

1.112

3.434

4.7

26.5

1967

1.220

5.014

1.243

3.771

5.2

31.2

1968

1.410

5.702

1.429

4.274

5.9

37.8

1969

1.696

6.689

1.716

4.973

6.9

49.7

1970

2.207

8.462

2.250

6.212

8.6

57.7

1971

2.763

10.242

2.808

7.435

10.4

68.5

1972

3.048

10.944

3.039

7.905

11.1

74.9

1973

3.148

10.949

3.046

7.903

11.2

79.9

1974

3.219

10.847

3.041

7.805

11.2

75.0

1975

3.481

11.319

3.248

8.071

11.8

71.2

1976

3.565

11.284

3.302

7.982

11.8

76.2

1977

3.568

11.015

3.273

7.743

11.6

73.9

1978

3.517

10.551

3.188

7.363

11.2

72.8

1979

3.509

10.312

3.130

7.181

11.0

68.0

1980

3.712

10.774

3.355

7.419

11.5

63.2

1981

3.835

11.079

3.552

7.527

11.7

59.2

1982

3.542

10.358

3.455

6.903

10.8

49.6

1983

3.686

10.761

3.663

7.098

11.1

50.1

1984

3.714

10.831

3.687

7.144

11.2

52.3

1985

3.701

10.855

3.658

7.198

11.3

54.4

1986

3.763

11.038

3.704

7.334

11.5

56.0

1987

3.776

11.027

3.661

7.366

11.5

56.4

1988

3.749

10.915

3.586

7.329

11.4

57.8

1989

3.798

10.992

3.573

7.419

11.5

57.9

1990

4.057

11.695

3.784

7.911

12.1

57.9

1991

4.497

12.930

4.216

8.715

13.2

59.8

Congressional Research Service

RL32760 · VERSION 164 · UPDATED

16

The Temporary Assistance for Needy Families (TANF) Block Grant: FAQs

TANF Child Recipients

As a

As a

Percentage Percentage

Families

Recipients

Adults

Children

of All

of All Poor

Year

(millions)

(millions)

(millions)

(millions)

Children

Children

1992

4.829

13.773

4.470

9.303

13.9

59.9

1993

5.012

14.205

4.631

9.574

14.1

60.0

1994

5.033

14.161

4.593

9.568

13.9

61.7

1995

4.791

13.418

4.284

9.135

13.1

61.5

1996

4.434

12.321

3.928

8.600

12.3

58.7

1997

3.740

10.376

NA

NA

10.0

50.1

1998

3.050

8.347

NA

NA

8.1

42.9

1999

2.578

6.924

NA

NA

6.7

39.4

2000

2.303

6.143

1.655

4.479

6.1

38.1

2001

2.192

5.717

1.514

4.195

5.7

35.3

2002

2.187

5.609

1.479

4.119

5.6

33.6

2003

2.180

5.490

1.416

4.063

5.5

31.3

2004

2.153

5.342

1.362

3.969

5.4

30.2

2005

2.061

5.028

1.261

3.756

5.1

28.9

2006

1.906

4.582

1.120

3.453

4.6

26.7

2007

1.730

4.075

0.956

3.119

4.2

23.2

2008

1.701

4.005

0.946

3.059

4.1

21.6

2009

1.838

4.371

1.074

3.296

4.4

21.2

2010

1.919

4.598

1.163

3.435

4.6

20.9

2011

1.907

4.557

1.149

3.408

4.6

20.9

2012

1.852

4.402

1.104

3.298

4.4

20.3

2013

1.726

4.042

0.993

3.050

4.1

19.1

2014

1.650

3.957

1.007

2.950

4.0

18.9

2015

1.609

4.126

1.155

2.971

4.0

20.4

2016

1.488

3.785

1.044

2.741

3.7

20.6

Table A-1. Trends in the Cash Assistance Caseload: 1961 to 2016

|

TANF Child Recipients |

||||||

|

Year |

Families (millions) |

Recipients (millions) |

Adults (millions) |

Children (millions) |

As a Percentage of All Children |

As a Percentage of All Poor Children |

|

1961 |

0.873 |

3.363 |

0.765 |

2.598 |

3.7% |

14.3% |

|

1962 |

0.939 |

3.704 |

0.860 |

2.844 |

4.0 |

15.7 |

|

1963 |

0.963 |

3.945 |

0.988 |

2.957 |

4.1 |

17.4 |

|

1964 |

1.010 |

4.195 |

1.050 |

3.145 |

4.3 |

18.6 |

|

1965 |

1.060 |

4.422 |

1.101 |

3.321 |

4.5 |

21.5 |

|

1966 |

1.096 |

4.546 |

1.112 |

3.434 |

4.7 |

26.5 |

|

1967 |

1.220 |

5.014 |

1.243 |

3.771 |

5.2 |

31.2 |

|

1968 |

1.410 |

5.702 |

1.429 |

4.274 |

5.9 |

37.8 |

|

1969 |

1.696 |

6.689 |

1.716 |

4.973 |

6.9 |

49.7 |

|

1970 |

2.207 |

8.462 |

2.250 |

6.212 |

8.6 |

57.7 |

|

1971 |

2.763 |

10.242 |

2.808 |

7.435 |

10.4 |

68.5 |

|

1972 |

3.048 |

10.944 |

3.039 |

7.905 |

11.1 |

74.9 |

|

1973 |

3.148 |

10.949 |

3.046 |

7.903 |

11.2 |

79.9 |

|

1974 |

3.219 |

10.847 |

3.041 |

7.805 |

11.2 |

75.0 |

|

1975 |

3.481 |

11.319 |

3.248 |

8.071 |

11.8 |

71.2 |

|

1976 |

3.565 |

11.284 |

3.302 |

7.982 |

11.8 |

76.2 |

|

1977 |

3.568 |

11.015 |

3.273 |

7.743 |

11.6 |

73.9 |

|

1978 |

3.517 |

10.551 |

3.188 |

7.363 |

11.2 |

72.8 |

|

1979 |

3.509 |

10.312 |

3.130 |

7.181 |

11.0 |

68.0 |

|

1980 |

3.712 |

10.774 |

3.355 |

7.419 |

11.5 |

63.2 |

|

1981 |

3.835 |

11.079 |

3.552 |

7.527 |

11.7 |

59.2 |

|

1982 |

3.542 |

10.358 |

3.455 |

6.903 |

10.8 |

49.6 |

|

1983 |

3.686 |

10.761 |

3.663 |

7.098 |

11.1 |

50.1 |

|

1984 |

3.714 |

10.831 |

3.687 |

7.144 |

11.2 |

52.3 |

|

1985 |

3.701 |

10.855 |

3.658 |

7.198 |

11.3 |

54.4 |

|

1986 |

3.763 |

11.038 |

3.704 |

7.334 |

11.5 |

56.0 |

|

1987 |

3.776 |

11.027 |

3.661 |

7.366 |

11.5 |

56.4 |

|

1988 |

3.749 |

10.915 |

3.586 |

7.329 |

11.4 |

57.8 |

|

1989 |

3.798 |

10.992 |

3.573 |

7.419 |

11.5 |

57.9 |

|

1990 |

4.057 |

11.695 |

3.784 |

7.911 |

12.1 |

57.9 |

|

1991 |

4.497 |

12.930 |

4.216 |

8.715 |

13.2 |

59.8 |

|

1992 |

4.829 |

13.773 |

4.470 |

9.303 |

13.9 |

59.9 |

|

1993 |

5.012 |

14.205 |

4.631 |

9.574 |

14.1 |

60.0 |

|

1994 |

5.033 |

14.161 |

4.593 |

9.568 |

13.9 |

61.7 |

|

1995 |

4.791 |

13.418 |

4.284 |

9.135 |

13.1 |

61.5 |

|

1996 |

4.434 |

12.321 |

3.928 |

8.600 |

12.3 |

58.7 |

|

1997 |

3.740 |

10.376 |

NA |

NA |

10.0 |

50.1 |

|

1998 |

3.050 |

8.347 |

NA |

NA |

8.1 |

42.9 |

|

1999 |

2.578 |

6.924 |

NA |

NA |

6.7 |

39.4 |

|

2000 |

2.303 |

6.143 |

1.655 |

4.479 |

6.1 |

38.1 |

|

2001 |

2.192 |

5.717 |

1.514 |

4.195 |

5.7 |

35.3 |

|

2002 |

2.187 |

5.609 |

1.479 |

4.119 |

5.6 |

33.6 |

|

2003 |

2.180 |

5.490 |

1.416 |

4.063 |

5.5 |

31.3 |

|

2004 |

2.153 |

5.342 |

1.362 |

3.969 |

5.4 |

30.2 |

|

2005 |

2.061 |

5.028 |

1.261 |

3.756 |

5.1 |

28.9 |

|

2006 |

1.906 |

4.582 |

1.120 |

3.453 |

4.6 |

26.7 |

|

2007 |

1.730 |

4.075 |

0.956 |

3.119 |

4.2 |

23.2 |

|

2008 |

1.701 |

4.005 |

0.946 |

3.059 |

4.1 |

21.6 |

|

2009 |

1.838 |

4.371 |

1.074 |

3.296 |

4.4 |

21.2 |

|

2010 |

1.919 |

4.598 |

1.163 |

3.435 |

4.6 |

20.9 |

|

2011 |

1.907 |

4.557 |

1.149 |

3.408 |

4.6 |

20.9 |

|

2012 |

1.852 |

4.402 |

1.104 |

3.298 |

4.4 |

20.3 |

|

2013 |

1.726 |

4.042 |

0.993 |

3.050 |

4.1 |

19.1 |

|

2014 |

1.650 |

3.957 |

1.007 |

2.950 |

4.0 |

18.9 |

|

2015 |

1.609 |

4.126 |

1.155 |

2.971 |

4.0 |

20.4 |

|

2016 |

1.488 |

3.785 |

1.044 |

2.741 |

3.7 |

20.6 |

Source: Congressional Research Service (CRS), based on data from the U.S. Department of Health and Human Services (HHS) and the U.S. Census Bureau.

Notes: NA denotes not available. During transition reporting from AFDC to TANF, caseload statistics on adult and child recipients were not collected. For those years, TANF children as a percent of all children and percent of all poor children were estimated by HHS and published in Welfare Indicators and Risk Factors, Annual Report to Congress, Table TANF 2, p. A-7. See http://aspe.hhs.gov/hsp/14/indicators/rpt_indicators.pdf.

.

Congressional Research Service

RL32760 · VERSION 164 · UPDATED

17

The Temporary Assistance for Needy Families (TANF) Block Grant: FAQs

Table A-2. Families Receiving AFDC/TANF Assistance by Family Category, Selected

Years, FY1988 to FY2016

AFDC

TANF

1988

1994

2001

2006

2016

Number of Families Receiving Assistance

Adult Recipient or Work-Eligible Parent/Not Working

3,136,566

3,798,997

992,445

825,490

484,959

Adult Recipient or Work-Eligible Parent/Working

243,573

378,620

420,794

259,001

465,199

Child-Only/SSI Parent

59,988

171,391

171,951

176,670

132,338

Child-Only/Noncitizen Parent

47,566

184,397

125,900

153,445

153,717

Child-Only/Other Ineligible Parent

51,764

146,227

91,447

158,113

4,775

Child-Only/Caretaker Relative

188,598

328,290

255,984

261,944

208,202

Child-Only/Unknown

19,897

38,341

143,834

122,738

74,410

Totals

3,747,952

5,046,263

2,202,356

1,957,402

1,523,600

Percentage of All Families Receiving Assistance

Adult Recipient or Work-Eligible Parent/Not Working

83.7%

75.3%

45.1%

42.2%

31.8%

Adult Recipient or Work-Eligible Parent/Working

6.5

7.5

19.1

13.2

30.5

Child-Only/SSI Parent

1.6

3.4

7.8

9.0

8.7

Child-Only/Noncitizen Parent

1.3

3.7

5.7

7.8

10.1

Child-Only/Other Ineligible Parent

1.4

2.9

4.2

8.1

0.3

Child-Only/Caretaker Relative

5.0

6.5

11.6

13.4

13.7

Child-Only/Unknown

0.5

0.8

6.5

6.3

4.9

Totals

100.0

100.0

100.0

100.0

100.0

Years, FY1988 to FY2016

|

AFDC |

TANF |

||||

|

|

1988 |

1994 |

2001 |

2006 |

2016 |

|

Number of Families Receiving Assistance |

|||||

|

Adult Recipient or Work-Eligible Parent/Not Working |

3,136,566 |

3,798,997 |

992,445 |

825,490 |

484,959 |

|

Adult Recipient or Work-Eligible Parent/Working |

243,573 |

378,620 |

420,794 |

259,001 |

465,199 |

|

Child-Only/SSI Parent |

59,988 |

171,391 |

171,951 |

176,670 |

132,338 |

|

Child-Only/Noncitizen Parent |

47,566 |

184,397 |

125,900 |

153,445 |

153,717 |

|

Child-Only/Other Ineligible Parent |

51,764 |

146,227 |

91,447 |

158,113 |

4,775 |

|

Child-Only/Caretaker Relative |

188,598 |

328,290 |

255,984 |

261,944 |

208,202 |

|

Child-Only/Unknown |

19,897 |

38,341 |

143,834 |

122,738 |

74,410 |

|

Totals |

3,747,952 |

5,046,263 |

2,202,356 |

1,957,402 |

1,523,600 |

|

Percentage of All Families Receiving Assistance |

|||||

|

Adult Recipient or Work-Eligible Parent/Not Working |

83.7% |

75.3% |

45.1% |

42.2% |

31.8% |

|

Adult Recipient or Work-Eligible Parent/Working |

6.5 |

7.5 |

19.1 |

13.2 |

30.5 |

|

Child-Only/SSI Parent |

1.6 |

3.4 |

7.8 |

9.0 |

8.7 |

|

Child-Only/Noncitizen Parent |

1.3 |

3.7 |

5.7 |

7.8 |

10.1 |

|

Child-Only/Other Ineligible Parent |

1.4 |

2.9 |

4.2 |

8.1 |

0.3 |

|

Child-Only/Caretaker Relative |

5.0 |

6.5 |

11.6 |

13.4 |

13.7 |

|

Child-Only/Unknown |

0.5 |

0.8 |

6.5 |

6.3 |

4.9 |

|

Totals |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

Source: Congressional Research Service (CRS) tabulations of the FY1988 and FY1994 AFDC Quality Control (QC) data files and the FY2001, FY2006, and FY2016 TANF National Data Files.

Notes: FY2001 through FY2016 data include families receiving assistance from separate state programs (SSPs) with expenditures countable toward the TANF maintenance of effort (MOE) requirement. For FY2016, TANF

families with an adult recipient include those families with "“work-eligible"” nonrecipient parents. These include nonrecipient parents who have been time-limited or sanctioned off the rolls, but the family continues to receive a reduced benefit. For FY2001 and FY2006, such families cannot be identified and are classified as "“child-only” families.

Congressional Research Service

RL32760 · VERSION 164 · UPDATED

18

Appendix B. child-only" families.

State Tables Table B-1. Use of FY2017 TANF and MOE Funds by Category

(Dollars in millions)

Work,

Education,

Emergency and

Pre-

Basic

Administrative

and

Refundable

Short-Term

Child

K/Head

State

Assistance

Costs

Training

Child Care Tax Credit

Benefits

Welfare

Start

Other

Totals

Alabama

$22.318

$26.710

$5.349

$5.679

$0.000

$36.833

$32.240

$41.648

$40.208

$210.984

Alaska

58.114

6.024

8.397

8.879

0.000

0.000

0.000

0.000

4.985

86.399

Arizona

37.732

43.656

1.443

0.000

0.000

10.369

147.105

0.000

119.624

359.929

Arkansas

5.948

18.829

13.920

8.032

0.000

5.368

0.231

105.196

4.811

162.335

California

2539.250

573.786

1620.135

615.700

0.000

237.887

0.000

0.000

1010.169

6596.928

Colorado

89.927

23.474

10.687

11.929

77.489

31.389

46.532

74.851

43.716

409.995

Connecticut

52.352

46.885

12.037

41.764

0.000

18.646

61.273

83.561

171.132

487.651

Delaware

17.421

4.736

7.063

67.490

0.000

2.724

0.000

0.000

15.160

114.595

District of

121.650

8.398

37.991

59.532

28.928

51.110

0.000

0.000

9.299

316.909

Columbia

Florida

163.180

83.371

46.314

318.206

0.000

0.934

242.113

0.000

80.542

934.661

Georgia

86.540

20.570

11.265

22.183

0.000

0.085

257.554

0.000

90.828

489.024

Hawaii

39.957

16.540

52.170

4.972

0.000

0.425

1.294

0.000

84.876

200.233

Idaho

7.871

7.519

2.549

15.025

0.000

11.750

1.327

1.475

1.713

49.229

Illinois

43.419

0.184

18.685

596.459

47.254

0.916

221.080

58.586

79.217

1065.801

Indiana

16.714

23.452

182.300

112.404

28.904

0.546

15.520

0.000

131.405

511.244

Iowa

37.166

8.206

11.799

58.254

26.505

0.253

62.264

0.000

22.299

226.746

Kansas

13.920

14.568

1.594

6.673

48.347

0.071

22.980

14.437

50.495

173.086

Kentucky

170.762

14.601

29.380

38.815

0.000

0.000

0.000

0.000

15.474

269.032

CRS-19

Work,

Education,

Emergency and

Pre-

Basic

Administrative

and

Refundable

Short-Term

Child

K/Head

State

Assistance

Costs

Training

Child Care Tax Credit

Benefits

Welfare

Start

Other

Totals

Louisiana

19.191

18.079

26.153

10.214

14.671

9.471

33.144

45.991

35.029

211.945

Maine

25.693

3.138

0.310

14.888

7.561

4.162

7.683

0.415

28.130

91.980

Maryland

115.787

31.019

31.450

8.397

152.582

26.370

20.035

55.962

55.808

497.410

Massachusetts

207.063

36.557

174.674

327.404

174.125

103.873

8.311

0.000

66.263

1,098.270

Michigan

133.132

53.908

5.417

26.586

45.440

66.929

81.665

186.193

649.995

1,249.266

Minnesota

98.144

46.341

57.751

173.904

160.076

27.478

0.000

5.700

19.524

588.918

Mississippi

8.585

4.572

33.655

27.660

0.000

0.000

12.859

0.000

43.971

131.302

Missouri

42.341

7.317

19.813

64.380

0.000

59.191

102.816

0.000

60.586

356.444

Montana

26.080

7.451

6.282

10.495

0.000

2.195

3.187

0.000

9.708

65.397

Nebraska

26.603

5.383

14.079

23.489

35.062

0.000

2.836

0.000

0.290

107.742

Nevada

39.108

9.559

1.362

17.887

0.000

0.000

0.000

0.000

34.465

102.382

New

18.987

11.041

5.403

15.118

0.000

2.213

3.662

0.000

17.081

73.505

Hampshire

New Jersey

99.529

52.403

77.142

159.671

354.819

16.630

0.000

560.009

58.912

1,379.114

New Mexico

55.422

5.073

18.259

30.528

74.623

0.000

0.895

17.600

84.412

286.811

New York

1,455.625

389.219

147.068

355.940

1,410.980

219.797

290.559

467.685

361.475

5,098.348

North Carolina

41.570

43.356

4.785

194.900

0.000

5.077

125.782

115.709

44.926

576.104

North Dakota

4.070

4.422

4.070

1.102

0.000

0.019

17.270

0.000

1.274

32.226

Ohio

246.989

117.873

87.008

424.009

0.000

53.852

11.099

0.000

191.421

1,132.250

Oklahoma

42.603

11.274

10.776

48.668

0.000

3.536

15.999

12.079

29.282

174.217

Oregon

89.263

39.235

16.558

12.911

1.467

32.130

12.811

12.001

87.605

303.981

Pennsylvania

186.912

79.850

98.385

488.909

0.000

15.459

0.000

154.677

169.790

1,193.982

Rhode Island

24.435

5.434

10.869

41.679

19.129

26.237

27.334

0.800

10.171

166.088

CRS-20

Work,

Education,

Emergency and

Pre-

Basic

Administrative

and

Refundable

Short-Term

Child

K/Head

State

Assistance

Costs

Training

Child Care Tax Credit

Benefits

Welfare

Start

Other

Totals

South Carolina

38.231

24.983

14.782

4.085

0.000

0.000

0.000

26.794

54.010

162.886

South Dakota

13.813

2.581

3.866

0.803

0.000

3.174

1.958

0.000

3.057

29.254

Tennessee

62.597

22.152

9.618

18.976

0.000

0.000

0.000

61.668

1.377

176.387

Texas

50.837

77.601

82.284

0.000

0.000

32.166

284.108

342.674

59.966

929.636

Utah

25.289

8.863

26.555

21.438

0.000

4.419

3.676

5.501

33.702

129.443

Vermont

15.230

6.631

2.696

30.996

19.013

1.360

5.508

0.000

15.842

97.276

Virginia

68.485

31.387

38.944

32.558

0.371

5.269

0.000

0.000

84.885

261.900

Washington

143.608

88.021

145.004

222.086

0.000

56.731

0.000

61.125

315.382

1,031.957

West Virginia

26.753

15.010

0.461

15.321

0.000

19.584

35.656

0.000

26.644

139.428

Wisconsin

85.911

24.187

27.486

208.262

69.700

38.553

4.484

0.000

122.860

581.443

Wyoming

6.706

6.481

3.508

1.554

0.000

3.399

0.000

1.016

4.952

27.615

Totals

7,068.836

2,231.910

3,279.551

5,026.817

2,797.046

1,248.578 2,224.848

2,513.354 4,758.747

31,149.686

(Dollars in millions)

|

State |

Basic Assistance |

Administrative Costs |

Work, Education, and Training |

Child Care |

Refundable Tax Credit |

Emergency and Short-Term Benefits |

Child Welfare |

Pre-K/Head Start |

Other |

Totals |

|

Alabama |

$22.318 |

$26.710 |

$5.349 |

$5.679 |

$0.000 |

$36.833 |

$32.240 |

$41.648 |

$40.208 |

$210.984 |

|

Alaska |

58.114 |

6.024 |

8.397 |

8.879 |

0.000 |

0.000 |

0.000 |

0.000 |

4.985 |

86.399 |

|

Arizona |

37.732 |

43.656 |

1.443 |

0.000 |

0.000 |

10.369 |

147.105 |

0.000 |

119.624 |

359.929 |

|

Arkansas |

5.948 |

18.829 |

13.920 |

8.032 |

0.000 |

5.368 |

0.231 |

105.196 |

4.811 |

162.335 |

|

California |

2539.250 |

573.786 |

1620.135 |

615.700 |

0.000 |

237.887 |

0.000 |

0.000 |

1010.169 |

6596.928 |

|

Colorado |

89.927 |

23.474 |

10.687 |

11.929 |

77.489 |

31.389 |

46.532 |

74.851 |

43.716 |

409.995 |

|

Connecticut |

52.352 |

46.885 |

12.037 |

41.764 |

0.000 |

18.646 |

61.273 |

83.561 |

171.132 |

487.651 |

|

Delaware |

17.421 |

4.736 |

7.063 |

67.490 |

0.000 |

2.724 |

0.000 |

0.000 |

15.160 |

114.595 |

|

District of Columbia |

121.650 |

8.398 |

37.991 |

59.532 |

28.928 |

51.110 |

0.000 |

0.000 |

9.299 |

316.909 |

|

Florida |

163.180 |

83.371 |

46.314 |

318.206 |

0.000 |

0.934 |

242.113 |

0.000 |

80.542 |

934.661 |

|

Georgia |

86.540 |

20.570 |

11.265 |

22.183 |

0.000 |

0.085 |

257.554 |

0.000 |

90.828 |

489.024 |

|

Hawaii |

39.957 |

16.540 |

52.170 |

4.972 |

0.000 |

0.425 |

1.294 |

0.000 |

84.876 |

200.233 |

|

Idaho |

7.871 |

7.519 |

2.549 |

15.025 |

0.000 |

11.750 |

1.327 |

1.475 |

1.713 |

49.229 |

|

Illinois |

43.419 |

0.184 |

18.685 |

596.459 |

47.254 |

0.916 |

221.080 |

58.586 |

79.217 |

1065.801 |

|

Indiana |

16.714 |

23.452 |

182.300 |

112.404 |

28.904 |

0.546 |

15.520 |

0.000 |

131.405 |

511.244 |

|

Iowa |

37.166 |

8.206 |

11.799 |

58.254 |

26.505 |

0.253 |

62.264 |

0.000 |

22.299 |

226.746 |

|

Kansas |

13.920 |

14.568 |

1.594 |

6.673 |

48.347 |

0.071 |

22.980 |

14.437 |

50.495 |

173.086 |

|

Kentucky |

170.762 |

14.601 |

29.380 |

38.815 |

0.000 |

0.000 |

0.000 |

0.000 |

15.474 |

269.032 |

|

Louisiana |

19.191 |

18.079 |

26.153 |

10.214 |

14.671 |

9.471 |

33.144 |

45.991 |

35.029 |

211.945 |

|

Maine |

25.693 |

3.138 |

0.310 |

14.888 |

7.561 |

4.162 |

7.683 |

0.415 |

28.130 |

91.980 |

|

Maryland |

115.787 |

31.019 |

31.450 |

8.397 |

152.582 |

26.370 |

20.035 |

55.962 |

55.808 |

497.410 |

|

Massachusetts |

207.063 |

36.557 |

174.674 |

327.404 |

174.125 |

103.873 |

8.311 |

0.000 |

66.263 |

1,098.270 |

|

Michigan |

133.132 |

53.908 |

5.417 |

26.586 |

45.440 |

66.929 |

81.665 |

186.193 |

649.995 |

1,249.266 |

|

Minnesota |

98.144 |

46.341 |

57.751 |

173.904 |

160.076 |

27.478 |

0.000 |

5.700 |

19.524 |

588.918 |

|

Mississippi |

8.585 |

4.572 |

33.655 |

27.660 |

0.000 |

0.000 |

12.859 |

0.000 |

43.971 |

131.302 |

|

Missouri |

42.341 |

7.317 |

19.813 |

64.380 |

0.000 |

59.191 |

102.816 |

0.000 |

60.586 |

356.444 |

|

Montana |

26.080 |

7.451 |

6.282 |

10.495 |

0.000 |

2.195 |

3.187 |

0.000 |

9.708 |

65.397 |

|

Nebraska |

26.603 |

5.383 |

14.079 |

23.489 |

35.062 |

0.000 |

2.836 |

0.000 |

0.290 |

107.742 |

|

Nevada |

39.108 |

9.559 |

1.362 |

17.887 |

0.000 |

0.000 |

0.000 |

0.000 |

34.465 |

102.382 |

|

New Hampshire |

18.987 |

11.041 |

5.403 |

15.118 |

0.000 |

2.213 |

3.662 |

0.000 |

17.081 |

73.505 |

|

New Jersey |

99.529 |

52.403 |

77.142 |

159.671 |

354.819 |

16.630 |

0.000 |

560.009 |

58.912 |

1,379.114 |

|

New Mexico |

55.422 |

5.073 |

18.259 |

30.528 |

74.623 |

0.000 |

0.895 |

17.600 |

84.412 |

286.811 |

|

New York |

1,455.625 |

389.219 |

147.068 |

355.940 |

1,410.980 |

219.797 |

290.559 |

467.685 |

361.475 |

5,098.348 |

|

North Carolina |

41.570 |

43.356 |

4.785 |

194.900 |

0.000 |

5.077 |

125.782 |

115.709 |

44.926 |

576.104 |

|

North Dakota |

4.070 |

4.422 |

4.070 |

1.102 |

0.000 |

0.019 |

17.270 |

0.000 |

1.274 |

32.226 |

|

Ohio |

246.989 |

117.873 |

87.008 |

424.009 |

0.000 |

53.852 |

11.099 |

0.000 |

191.421 |

1,132.250 |

|

Oklahoma |

42.603 |

11.274 |

10.776 |

48.668 |

0.000 |

3.536 |

15.999 |

12.079 |

29.282 |

174.217 |

|

Oregon |

89.263 |

39.235 |

16.558 |

12.911 |

1.467 |

32.130 |

12.811 |

12.001 |

87.605 |

303.981 |

|

Pennsylvania |

186.912 |

79.850 |

98.385 |

488.909 |

0.000 |

15.459 |

0.000 |

154.677 |

169.790 |

1,193.982 |

|

Rhode Island |

24.435 |

5.434 |

10.869 |

41.679 |

19.129 |

26.237 |

27.334 |

0.800 |

10.171 |

166.088 |

|

South Carolina |

38.231 |

24.983 |

14.782 |

4.085 |

0.000 |

0.000 |

0.000 |

26.794 |

54.010 |

162.886 |

|

South Dakota |

13.813 |

2.581 |

3.866 |

0.803 |

0.000 |

3.174 |

1.958 |

0.000 |

3.057 |

29.254 |

|

Tennessee |

62.597 |

22.152 |

9.618 |

18.976 |

0.000 |

0.000 |

0.000 |

61.668 |

1.377 |

176.387 |

|

Texas |

50.837 |

77.601 |

82.284 |

0.000 |

0.000 |

32.166 |

284.108 |

342.674 |

59.966 |

929.636 |

|

Utah |

25.289 |

8.863 |

26.555 |

21.438 |

0.000 |

4.419 |

3.676 |

5.501 |

33.702 |

129.443 |

|

Vermont |

15.230 |

6.631 |

2.696 |

30.996 |

19.013 |

1.360 |

5.508 |

0.000 |

15.842 |

97.276 |

|

Virginia |

68.485 |

31.387 |

38.944 |

32.558 |

0.371 |

5.269 |

0.000 |

0.000 |

84.885 |

261.900 |

|

Washington |

143.608 |

88.021 |

145.004 |

222.086 |

0.000 |

56.731 |

0.000 |

61.125 |

315.382 |

1,031.957 |

|

West Virginia |

26.753 |

15.010 |

0.461 |

15.321 |

0.000 |

19.584 |

35.656 |

0.000 |

26.644 |

139.428 |

|

Wisconsin |

85.911 |

24.187 |

27.486 |

208.262 |

69.700 |

38.553 |

4.484 |

0.000 |

122.860 |

581.443 |

|

Wyoming |

6.706 |

6.481 |

3.508 |

1.554 |

0.000 |

3.399 |

0.000 |

1.016 |

4.952 |

27.615 |

|

Totals |

7,068.836 |

2,231.910 |

3,279.551 |