Federal Pell Grant Program of the Higher Education Act: Primer

Changes from November 28, 2018 to September 9, 2021

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Federal Pell Grant Program of the Higher Education Act: Primer

Contents

- Introduction

- Student Eligibility and Program Award Rules

- Student Eligibility

- Underlying Concepts and Award Rules

- Award Year

- Academic Year

- Payment Period

- Discretionary Base Maximum Award

- Mandatory Add-On Award

- Total Maximum Award

- Expected Family Contribution (EFC)

- Cost of Attendance (COA)

- Scheduled Award Rule

- Annual Award Rule

- Minimum Award

- Pell Grant Award Disbursements

- Year-Round (Summer) Pell Grants

- Maximum Pell Grant Lifetime Eligibility

- Institutional Role

- Description of Pell Grant Recipients and Participation

- Number of Recipients

- Income of Recipients

- Distribution of Pell Grant Recipients and Funds by Institutional Type

- Role of the Pell Grant

- Purchasing Power

- Receipt of Pell Grants and Other Aid

- Program Funding

- Role of Discretionary Funding

- Role of Mandatory Funding

- Summary of Recent and Projected Funding

- Discretionary Funding Shortfalls and Surpluses

- Policy Implications and Measures to Address Funding Shortfalls

- Reductions in Students' Awards and Recipient Caps Before 1992

- CBO Scoring Rule

- Reductions in Program Costs

- Supplementary Appropriations

- Policy Implications and Measures to Address Funding Surpluses

- Estimated Program Costs for Recent and Future Years

Figures

Tables

- Table 1. Pell Grant Award Amounts, AY2014-2015 through AY2018-2019

- Table 2. Federal Pell Grant Recipients, AY2011-2012 to AY2015-2016

- Table 3. Estimated Distribution of Pell Grant Recipients and Undergraduates not Receiving Pell Grants by Sector of Enrolling Institution, AY2015-2016

- Table 4. Pell Grant Aid, Student Loans, and Total Aid from All Sources as Average Percentages of Cost of Attendance for Undergraduate Students Who Have a Zero EFC and Received a Pell Grant, by Total Family Income (2014)

- Table 5. Pell Grant Funding (FY2012 to FY2021)

- Table 6. Annual and Cumulative Discretionary Funding Shortfalls in the Pell Grant Program, FY2009-FY2018

- Table 7. Estimated Pell Grant Program Costs, AY2012-2013 to AY2021-2022

- Table A-1. Pell Grant Award Amounts, AY1973-1974 and Subsequent Years

- Table B-1. Federal Pell Grant Recipients, AY1973-1974 to AY2015-2016

- Table C-1. Pell Grant Annual Funding: FY2008-FY2021

- Table D-1. Annual and Cumulative Discretionary Funding Shortfalls and Surpluses in the Pell Grant Program, FY1973-FY2018

Appendixes

- Appendix A. Historical Pell Grant Award Amounts

- Appendix B. Federal Pell Grant Recipients, AY1973-1974 to AY2015-2016

- Appendix C. Program Funding: FY2008-FY2021

- Appendix D. Annual and Cumulative Discretionary Funding Shortfalls and Surpluses in the Pell Grant Program, FY1973-FY2018

- Appendix E. Glossary/Acronyms

Summary

The federal Pell Grant program, authorized by Title IV of the Higher Education Act of 1965, as amended (HEA; P.L. 89-329), is the single largest source of federal grant aid supporting postsecondary education students. Pell Grants, and their predecessor, Basic Education Opportunity Grants, have been awarded since 1973. The program provided approximately $29 billion in aid to approximately 7.2 million undergraduate students in FY2017. Pell Grants are need-based aid that is intended to be the foundation for all need-based federal student aid awarded to undergraduates.

To be eligible for a Pell Federal Pell Grant Program of the Higher

September 9, 2021

Education Act: Primer

Cassandria Dortch

The federal Pel Grant program, authorized by Title IV of the Higher Education Act of

Specialist in Education

1965, as amended (HEA; P.L. 89-329), is the single largest source of federal grant aid

Policy

supporting postsecondary education students. Pel Grants, and their predecessor, Basic

Education Opportunity Grants, have been awarded since 1973. The program provided

approximately $27 bil ion in aid to approximately 6.3 mil ion undergraduate students in FY2020. Pel Grants are need-based aid that is intended to be the foundation for al need-based federal student aid awarded to undergraduates. Unlike loans, students do not repay Pel Grants.

Effective in award year 2023-2024, the FAFSA Simplification Act (FSA; Title VII of Division FF of P.L. 116-260, Consolidated Appropriations Act, 2021) makes several changes to the program. This report describes the Pel Grant program prior to award year 2023-2024.

To be eligible for a Pel Grant, an undergraduate student must meet several requirements. One key requirement is

Grant, an undergraduate student must meet several requirements. One key requirement is that the student and his or her family demonstrate financial need. Financial need is determined through the calculation of an expected family contribution (EFC), which is based on applicable family financial information provided on the Free Application for Federal Student Aid (FAFSA). Although there is no absolute income threshold that determines who is eligible or ineligible for Pell for Pel Grants, an estimated 95% of Pell Pel Grant recipients had a total family income at or below $60,000 in academic year 2015-20162017-2018. Other requirements include, but are not limited to, the student not having earned a bachelor'’s degree and being enrolled in an eligible program at an HEA HEA Title IV-participating institution of higher education for the purpose of earning a certificate or degree.

The maximum annual award a student may receive during an academic year is calculated in accordance with the Pell Pel Grant award rules. The student'’s scheduled award is the least of (1) the total maximum Pell Pel Grant minus the student'student’s EFC, or (2) Cost of Attendance (COA) minus EFC. For a student who enrolls on a less-than-full-time basis, the student'’s maximum annual award is the scheduled award ratably reduced. For FY2019FY2021 (academic year 2019-2020

2021-2022), the total maximum Pell Pel Grant is $6,195495. The COA is a measure of a student'’s educational expenses for the academic year. Qualified students who exhaust their scheduled award and remain enrolled beyond the academic year (e.g., enroll in a summer semester) during an award year receive a year-round or summer Pell Grant. With year-round Pell Grants, qualified studentsPel Grant such that they may receive up to 1½ scheduled grants in each award year. FinallyFinal y, a student may receive the value of no more than 12 full-time semesters (or the equivalent) of Pell Pel Grant awards over a lifetime.

The program is funded primarily through annual discretionary appropriations, although in recent years mandatory appropriations have played an increasing role in the programbut the HEA provides mandatory appropriations. The total maximum Pell Pel Grant is the sum of two components: the discretionary maximum award and the mandatory add-on award. The discretionary maximum award amount is funded by discretionary appropriations enacted in annual appropriations acts, and augmented by permanent and definite mandatory appropriations provided for in the HEA. For FY2019. For FY2021, the discretionary appropriation is $22.475 billionbil ion and the augmenting mandatory

funds total $1.370 billion170 bil ion. The mandatory add-on award amount is funded entirely by a permanent and indefinite mandatory appropriation of such sums as necessary, as authorized in the HEA. The mandatory add-on is estimated to require $6.077 billion in FY20195.412 bil ion in FY2021. Funding provided for the Pell Pel Grant program is exempt from sequestration.

The Pell

The Pel Grant program is often referred to as a quasi-entitlement because for the most part eligible students receive the Pell Pel Grant award level calculated for them without regard to available appropriations. In a given year, the discretionary appropriation level may be smallersmal er or larger than the actual cost to fund the discretionary

maximum award, despite the augmenting mandatory appropriation. When the discretionary appropriation is too smallsmal , the program carries a shortfall shortfal into the subsequent fiscal year. When the discretionary appropriation is too large, the program carries a surplus into the following fiscal year. Since FY2012, the program has maintained a surplus. The surplus has variably been used to increase Pell Grant awards, expand eligibility, and either fund other programs or reduce the national deficit.

Introduction

The Federal Pell had a surplus.

Congressional Research Service

link to page 5 link to page 6 link to page 6 link to page 8 link to page 8 link to page 8 link to page 9 link to page 9 link to page 9 link to page 10 link to page 10 link to page 10 link to page 11 link to page 12 link to page 12 link to page 12 link to page 13 link to page 14 link to page 15 link to page 15 link to page 15 link to page 16 link to page 17 link to page 17 link to page 18 link to page 20 link to page 21 link to page 21 link to page 22 link to page 22 link to page 24 link to page 25 link to page 26 link to page 26 link to page 28 link to page 28 link to page 28 link to page 29 link to page 29 link to page 30 link to page 13 Federal Pell Grant Program of the Higher Education Act: Primer

Contents

Introduction ................................................................................................................... 1 Student Eligibility and Program Award Rules ...................................................................... 2

Student Eligibility...................................................................................................... 2 Underlying Concepts and Award Rules ......................................................................... 4

Award Year.......................................................................................................... 4 Academic Year..................................................................................................... 4 Payment Period .................................................................................................... 5

Cost of Attendance (COA) ..................................................................................... 5 Discretionary Base Maximum Award ...................................................................... 5 Mandatory Add-On Award ..................................................................................... 6 Total Maximum Award.......................................................................................... 6 Expected Family Contribution (EFC) ...................................................................... 6

Scheduled Award Rule .......................................................................................... 7 Annual Award Rule .............................................................................................. 8 Minimum Award .................................................................................................. 8 Pel Grant Award Disbursements............................................................................. 8 Year-Round (Summer) Pel Grants .......................................................................... 9

Maximum Pel Grant Lifetime Eligibility ............................................................... 10

Institutional Role ..................................................................................................... 11

Description of Pel Grant Recipients and Participation ........................................................ 11

Number of Recipients............................................................................................... 11

Income of Recipients ............................................................................................... 12 Distribution of Pel Grant Recipients and Funds by Institutional Type.............................. 13

Role of the Pel Grant .................................................................................................... 13

Purchasing Power .................................................................................................... 14 Receipt of Pel Grants and Other Aid .......................................................................... 16

Program Funding .......................................................................................................... 17

Role of Discretionary Funding ................................................................................... 17 Role of Mandatory Funding ...................................................................................... 18 Summary of Recent and Projected Funding ................................................................. 18 Discretionary Funding Shortfal s and Surpluses............................................................ 20 Policy Implications and Measures to Address Funding Surpluses .................................... 21

Pursuing Other Policy Priorities............................................................................ 22 Expanding the Pel Grant Program ........................................................................ 22

Policy Implications and Measures to Address Funding Shortfal s .................................... 24

Reductions in Students’ Awards and Recipient Caps Before 1992 .............................. 24 CBO Scoring Rule.............................................................................................. 24 Reductions in Program Costs ............................................................................... 25

Supplementary Appropriations ............................................................................. 25

Estimated Program Costs for Recent and Future Years ........................................................ 26

Figures Figure 1. Example of Pel Grant Award Disbursement........................................................... 9

Congressional Research Service

link to page 14 link to page 14 link to page 19 link to page 19 link to page 9 link to page 16 link to page 17 link to page 17 link to page 20 link to page 20 link to page 20 link to page 23 link to page 25 link to page 25 link to page 30 link to page 32 link to page 34 link to page 36 link to page 39 link to page 39 link to page 32 link to page 34 link to page 36 link to page 39 link to page 39 link to page 42 link to page 42 Federal Pell Grant Program of the Higher Education Act: Primer

Figure 2. Example of Pel Grant Award Disbursement with Year-Round (Summer) Pel

Grant ........................................................................................................................ 10

Figure 3. Percentage of Tuition, Fees, Room, and Board Covered by the Total Maximum

Pel Grant, by Institutional Sector: AY1973-1974 to AY2019-2020 .................................... 15

Tables Table 1. Pel Grant Award Amounts, AY2017-2018 through AY2021-2022............................... 5 Table 2. Federal Pel Grant Recipients, AY2015-2016 to AY2019-2020 ................................. 12 Table 3. Estimated Distribution of Pel Grant Recipients and Undergraduates not

Receiving Pell Grants by Sector of Enrolling Institution, AY2015-2016 .............................. 13

Table 4. Pel Grant Aid, Student Loans, and Total Aid from Al Sources as Average

Percentages of Cost of Attendance for Undergraduate Students Who Have a Zero EFC and Received a Pel Grant, by Total Family Income (2014) ............................................... 16

Table 5. Pel Grant Funding (FY2017 to FY2026) .............................................................. 19 Table 6. Estimated Annual and Cumulative Discretionary Funding Shortfal s in

the Pel Grant Program, FY2017-FY2021 ...................................................................... 21

Table 7. Estimated Pel Grant Program Costs, AY2017-2018 to AY2026-2027 ........................ 26

Table A-1. Pel Grant Award Amounts, AY1973-1974 and Subsequent Years .......................... 28 Table B-1. Federal Pel Grant Recipients, AY1973-1974 and Subsequent Years ...................... 30 Table C-1. Pel Grant Annual Funding: FY2008-FY2021 .................................................... 32 Table D-1. Annual and Cumulative Discretionary Funding Shortfal s and Surpluses in

the Pel Grant Program, FY1973 and Subsequent Years .................................................... 35

Appendixes Appendix A. Historical Pell Grant Award Amounts............................................................. 28 Appendix B. Federal Pel Grant Recipients, AY1973-1974 and Subsequent Years ................... 30 Appendix C. Program Funding: FY2008-FY2021 .............................................................. 32 Appendix D. Annual and Cumulative Discretionary Funding Shortfal s and Surpluses in

the Pel Grant Program, FY1973 and Subsequent Years .................................................... 35

Appendix E. Glossary/Acronyms..................................................................................... 38

Contacts Author Information ....................................................................................................... 38

Congressional Research Service

Federal Pell Grant Program of the Higher Education Act: Primer

Introduction The Federal Pel Grant program, authorized by Title IV-A-1 of the Higher Education Act of 1965, (HEA; P.L. 89-329), as amended, is the single largest source of federal grant aid supporting

undergraduate students. The program provided approximately $29 billion 27 bil ion in aid to approximately 7.2 million undergraduate students in FY2017.1 Pell 6.3 mil ion undergraduate students in FY2020.1 Pel Grants are need-based aid that is intended to be the foundation for all al federal need-based student aid awarded to undergraduates. In award year 2015-2016, Pell Pel Grants represented 72% of all al federal undergraduate grant aid; 53% of federal, state, and institutional undergraduate need-based grant aid; and 28% of total grant aid for undergraduates coming from federal, state, institutional, and private sources.2

The2 Unlike loans,

students are not required to repay Pel Grants.

Prior to July 1, 2023, the discretionary statutory authority for the Pell Pel Grant program was authorized

reauthorized through FY2017.3 by the Higher Education Opportunity Act of 2008 (HEOA; P.L. 110-315). The discretionary authorization was extended through FY2018 under the General Education Provisions Act (GEPA), although the program has continued to receive appropriations.43 Effective July 1, 2023, the FAFSA Simplification Act (FSA; Title VII of Division FF of P.L. 116-260, Consolidated Appropriations Act, 2021) authorizes discretionary appropriations for FY2023

through FY2033.4 HEA also provides permanent mandatory program appropriations.

This report provides descriptions of key elements of the Pell Pel Grant program and information on recipient demographics, award levels, award value, program costs, and program funding.5 The prior to

the effective date of the FSA.5 For information on key changes authorized by the FSA that go into effect for award year 2023-2024, see CRS Report R46909, The FAFSA Simplification Act. The first section of the report addresses how the program works and describes the basic process for awarding Pell Pel Grants including the application process, student eligibility requirements, award rules and calculations, and the role of the institution of higher education (IHE) in the process. This section is followed by sectionsThe subsequent sections provide information on recipient characteristics and the role the program

plays in relation to other student aid.66 The report explains the complex Pell Pel Grant funding streams and their implications. FinallyFinal y, program costs and estimates are presented. In addition, the appendices provide historical Pell Pel Grant award amounts (Appendix A), Pell Grant recipient counts (Appendix B), recent and future program funding (Appendix C), surplus and shortfall Pel Grant recipient

1 U.S. Department of Education, Fiscal Year 2022 Budget, pp. O-4–O-5. 2 CRS analysis of AY2015-2016 data from the Department of Education, National Postsecondary Student Aid Study (NPSAS). T his survey, which is conducted about every four or more years, was most recently conducted for award year 2015-2016.

3 For more information on GEPA’s Contingent Extension of Programs, see CRS Report R41119, General Education Provisions Act (GEPA): Overview and Issues.

4 T he Department of Education has indicated that it is anticipating a phased implementation that would extend to award year 2024-25. Department of Education, Federal Student Aid, Beginning Phased Im plem entation of the FAFSA Sim plification Act (EA ID: GENERAL-21-39), June 11, 2021. 5 T his CRS report supersedes CRS Report 422446, Federal Pell Grant Program of the Higher Education Act: How the Program Works and Recent Legislative Changes. T he current report contains updated information.

6 T itle IV of HEA authorizes several student aid programs: Pell Grant program, Iraq and Afghanistan service grants, William D. Ford Federal Direct Loan (DL) Program, Federal Supplemental Educational Opportunity Grant (FSEOG) program, and Federal Work-Study (FWS) program. See CRS Report RL31618, Cam pus-Based Student Financial Aid Program s Under the Higher Education Act, and CRS Report R40122, Federal Student Loans Made Under the Federal Fam ily Education Loan Program and the William D. Ford Federal Direct Loan Program : Term s and Conditions for Borrowers.

Congressional Research Service

1

link to page 21 Federal Pell Grant Program of the Higher Education Act: Primer

counts (Appendix B), recent and future program funding (Appendix C), surplus and shortfal

levels (Appendix D), and acronyms commonly used in the report (Appendix E).

levels (Appendix D), and acronyms commonly used in the report (Appendix E).

Student Eligibility and Program Award Rules

This section of the report provides an overview of the structure of the Pell Pel Grant program and the process through which grants are made to students. It describes student eligibility, underlying concepts and award rules for determining students'’ grants, and the role played by postsecondary

institutions in the program.

Briefly, the Pell Pel Grant program provides grants (i.e., aid that does not have to be repaid) to financiallyfinancial y needy undergraduates. To apply for a Pell Pel Grant or any HEA Title IV student aid,

students must complete and submit the Free Application for Federal Student Aid (FAFSA), providing requested financial and other information.77 When the FAFSA is processed, the individual'individual’s expected family contribution (EFC) is calculated. The EFC is the amount expected to be contributed by the student and the student'’s family toward postsecondary education expenses for the upcoming academic year. After processing, each applicant receives a Student Aid Record

(SAR). Each institution of higher education (IHE) designated by the applicant on the FAFSA receives an Institutional Student Information Record (ISIR). The SAR and ISIR contain the

information submitted on the FAFSA and the individual's EFC.8

’s EFC.8

Institutions that receive valid SARs or valid ISIRs for eligible Pell Pel Grant applicants are required to disburse Pell Pel Grant funds to students who successfullysuccessful y enroll in approved coursework. Pell Pel Grants are portable aid, that is, the grant aid follows students to the eligible postsecondary education institutions in which they enroll. In addition, the Pell Pel Grant program is often referred to as a quasi-entitlement because for the most part eligible students receive the Pell Pel Grant award

level calculated for them without regard to available appropriations (for more on program funding, see the "“Program Funding”" section).99 The size of each student'’s grant is based, principallyprincipal y, on EFC, the total maximum Pell Pel Grant for the award year,1010 and the student's ’s

enrollment rate, but may not exceed the student'’s cost of attendance.

Student Eligibility

To be eligible for a Pell Pel Grant, a student must meet requirements that apply to HEA Title IV

student aid programs in general as well wel as requirements specific to the Pell Pel Grant program.11

11

Among the requirements generallygeneral y applicable to the HEA Title IV student aid programs for award

year (AY) 2021-2022 are the following:

7 T here are two ways to complete and submit a FAFSA for consideration of federal student aid. For instance, students and families may use FAFSA on the Web, which is an interactive online process. Alternatively, they may obtain a paper FAFSA from their financial aid office or other locations and submit it to the address listed on the form, although most applications are submitted electronically.

8 For more information on the FAFSA processes and calculation of EFC, see CRS Report R44503, Federal Student Aid: Need Analysis Form ulas and Expected Fam ily Contribution . 9 Student awards have not been reduced nor recipient caps imposed since AY1990-AY1991. 10 T he Pell Grant award year begins the first day of July in a given year and ends the last day of June the following year.

11 See Higher Education Act, as amended prior to the effective date of the FSA (hereinaft er referred to as HEA), Section 484 (34 C.F.R. part 668, subpart C) for general requirements and Section 401 (34 C.F.R. part 690, subpart A) for Pell Grant specific requirements.

Congressional Research Service

2

Federal Pell Grant Program of the Higher Education Act: Primer

year (AY) 2018-2019 are the following:

- Students must be accepted for enrollment or enrolled in an eligible

eligible institutioneligible institution of higher education for the purpose of earning a certificate or degree.12 - 12

Students must not be enrolled in an elementary or secondary school and must

have a high school diploma (or equivalent).

13 - 13

Students must meet citizenship requirements.

14 - Males must have registered with the selective service system when 18-25 years of age.

- 14 Students must maintain satisfactory academic progress while enrolled. Satisfactory academic progress requires a minimum grade point average (or its equivalent) and passing a minimum percentage of attempted credits or hours.

- Students must not be in default on a Title IV student loan, or have failed to repay or make an arrangement to repay an overpayment on a Title IV grant or loan, or be subject to a judgment lien for a debt owed to the United States. Students must have repaid any Title IV funds obtained fraudulently.

- Students may be disqualified for an unusual enrollment history—receiving HEA Title IV aid at multiple schools in the same semester, or receiving aid and withdrawing before earning any credit.

- Students may be disqualified for a period of time for a federal or state conviction for possession or sale of drugs while receiving HEA Title IV student aid.15

Specific eligibility requirements for the Pell Grant program include the following:

- Students must not have already completed the curriculum requirements of a bachelor's or higher degree.16

- Students must be enrolled in non-foreign institutions.

Students must be financially needy students as determined under the program'sSpecific eligibility requirements for the Pel Grant program include the following: Students must not have already completed the curriculum requirements of a bachelor’s or higher degree.15 Students must be enrolled in non-foreign institutions. 12 For purposes of the Pell Grant program, an eligible program requires at least 16 semester hours (or the equivalent) offered during a minimum of 15 weeks. Alternatively, an eligible program may be at least 8 semester hours (or the equivalent) offered during a minimum of 10 weeks, if an associate’s degree is required for admissions. One semester hour is an amount of student work defined by an institution and approved by the institution’s accrediting agency that is consistent with commonly accepted practice in postsecondary education and that approximates one hour of classroom or direct faculty instruction and at least two hours of out -of-class work each week for approximately 15 weeks. For information on HEA T itle IV eligible programs and eligible institutions, see CRS Report R43159, Institutional Eligibility for Participation in Title IV Student Financial Aid Program s. 13 T he equivalent of a high school diploma may include a general educational development (GED) certificate; the completion of an eligible homeschool program; or the completion of one of the ability to benefit alternatives and either being enrolled in an eligible career pathway program or being first enrolled in an eligible postsecondary program prior to July 1, 2012. T he ability to benefit may be demonstrated by passing an examination approved by ED to be eligible for federal student aid, or by successfully completing six credits or 225 clock hours of college work applicable to a certificate or degree offered by a postsecondary institution. A career pathway program is designed to combine occupational skills training, counseling, workforce preparation, high school completion, and postsecondary credential attainment. 14 In general, students must be U.S. citizens or permanent U.S. residents. Individuals with several other entrance statuses can qualify for aid. Individuals in the United States on a temporary basis, such as those with a student visa or an exchange visitor visa, are not eligible for federal student aid. Students with Deferred Action for Childhood Arrivals (DACA) status, conferred by the U.S. Citizenship & Immigration Services (USCIS) office in the Department of Homeland Security, are not eligible for HEA T itle IV aid. 15 Students with a bachelor’s degree may be enrolled at least half-time in a postbaccalaureate teacher education program . Half-time enrollment is at least 6 credit hours in a standard semester. A postbaccalaureate teacher education program does not lead to a graduate degree; is offered by a school that does not also offer a bachelor’s degree in education; and leads to certification or licensure necessary for employment as an elementary or secondary school teacher in the state. T o be eligible for a Pell Grant, the student enrolled in the postbaccalaureate teacher education program must be pursuing an initial teacher certification or licensing credential within the state. Congressional Research Service 3 Federal Pell Grant Program of the Higher Education Act: Primer Students must be financial y needy students as determined under the program’s award rules (see below). award rules (see below).- Students must not be incarcerated in a federal or state penal institution.

- Students must not be subject to an involuntary civil commitment following

incarceration for a sexual offense (as determined under the FBI

'’s Uniform Crime Reporting Program). -

Students with a significant

intellectual disabilityintel ectual disability must be accepted for enrollment or enrolled in a comprehensive transition and postsecondary program.17

16 Underlying Concepts and Award Rules

The amount of an eligible student's Pell student’s Pel Grant award is determined on the basis of a set of award rules. In general, these award rules are designed to ensure that the neediest students (as determined by their EFC) receive the highest Pell Pel Grant awards in each award year.1817 As need decreases or EFC increases, Pell Pel Grant awards decrease until they phase out completely. Students who demonstrate a level of need that falls between these two extremes are awarded Pell Grant aid on a sliding scale. Additionally, Pell Additional y, Pel Grant awards are prorated for students who attend on a less-than-full-time, full-

year basis. An important feature of the Pell Pel Grant award rules is that the grant is determined without consideration of any other financial assistance a student may be eligible to receive or may be receiving. This reflects the intention to make the Pell Pel Grant the foundation of federal need-based aid in a financial aid package. The Pell Grant award level is calculated without regard to other aid that may be awarded. Other HEA federal aid is added to the aid package after the Pell

Pel Grant is awarded.

Some of the underlying concepts associated with the Pell Pel Grant program, as well wel as the program's ’s award rules, are discussed below. In general, provisions are discussed as in effect for AY2018-2019.

the discussion reflects provisions in effect for

AY2021-2022.

Award Year

The HEA Award Year

The HEA Title IV award year begins the first day of July in a given year and ends the last day of June the following year. For example, award year (AY) 2018-20192021-2022 begins July 1, 20182021, and ends

June 30, 2019.

2022. Academic Year

The HEA Title IV academic year is an IHE-determined instructional unit. For credit hour programs, the academic year requires a minimum of 30 weeks of instructional time. For a clock hour program, the academic year requires a minimum of 26 weeks of instructional time. A full-

16 A student with a significant intellectual disability has a cognitive impairment, characterized by significant limitations in intellectual and cognitive functioning and significant limitations in adaptive behavior as expressed in conceptual, social, and practical adaptive skills; and is or was eligible for a free appropriate public education under the Individuals with Disabilities Education Act. For a description of the Individuals wit h Disabilities Education Act, see CRS Report R41833, The Individuals with Disabilities Education Act (IDEA), Part B: Key Statutory and Regulatory Provisions . Comprehensive transition and postsecondary (CT P) programs are not required to lead to a recognized credential (e.g., bachelor’s degree) or adhere to the same durational requirements that regular postsecondary programs must meet (e.g., a certain number of credit -bearing clock hours). Instead, CT P programs require students with intellectual disabilities to receive curriculum advising, participate at least part -time in courses or training with students who do not have intellectual disabilities, and prepare for gainful employment. A student with a significant intellectual disability in a CTP program does not require a high school diploma (or equivalent) and does not have to be enrolled for the purpose of obtaining a certificate or degree. A student with a significant intellectual disability in a CT P program must maintain satisfactory academic progress as determined by the school for the CT P program. 17 HEA §401.

Congressional Research Service

4

link to page 9 link to page 32 link to page 32 Federal Pell Grant Program of the Higher Education Act: Primer

hour program, the academic year requires a minimum of 26 weeks of instructional time. A full-time, full-academic-year student is expected to complete at least 24 semester hours, 36 quarter credit hours, or 900 clock hours. Each IHE establishes an academic year for each educational

program. There may be more than one academic year within an award year.

Payment Period

The payment period is an academic period or period of enrollment for which Pell Pel Grant aid is

disbursed. Each academic year must have at least two payment periods. For example, an IHE on a standard semester calendar may disburse Pell Pel Grant funds two times, once for each of two

semesters: fall fal and spring.

Cost of Attendance (COA)

For Pel Grant award purposes, the cost of attendance (COA) is an IHE-determined measure of

educational expenses for a student enrolled full-time for a full academic year. In general, it is the sum of (1) tuition and fees; (2) an al owance for books, supplies, transportation, and miscel aneous personal expenses; (3) an al owance for room and board; and (4) for a student with dependents, an al owance for costs expected to be incurred for dependent care.18 Institutions may use average costs for students at their school, rather than calculating actual expenses for each student. Average COA amounts must be based on the same category of students. For example,

institutions may establish separate averages by residency: in-state or out-of-state, or housing: on-

campus or off-campus.

Discretionary Base Maximum Award

Discretionary Base Maximum Award

The discretionary base maximum award is the amount specified in annual appropriations laws. For AY2018-2019

For AY2021-2022, the discretionary base maximum award is $5,035435. The annual appropriations laws also establish the amount of discretionary funding available to fund the discretionary base maximum award for the program for the corresponding award year. Table 1 presents the discretionary base maximum award for the last five years, andand Table A-1 provides a history of

discretionary base maximum award amounts since AY1973-1974.

Table 1. Pell Grant Award Amounts, AY2017-2018 through AY2021-2022

Discretionary

Award Year

Base Maximum

Mandatory Add-On

Total Maximum

(AY)

Award

Award

Award

2017-2018

$4,860

$1,060

$5,920

2018-2019

5,035

1,060

6,095

2019-2020

5,135

1,060

6,195

2020-2021

5,285

1,060

6,345

2021-2022

5,435

1,060

6,495

Sources: U.S. Department of Education, Department of Education Budget Tables, Congressional Action tables for FY2018-FY2021Table 1. Pell Grant Award Amounts, AY2014-2015 through AY2018-2019

|

Discretionary Base Maximum Award |

Mandatory Add-On Award |

Total Maximum Award |

|

2014-2015 |

$4,860 |

$870 |

$5,730 |

|

2015-2016 |

4,860 |

915 |

5,775 |

|

2016-2017 |

4,860 |

955 |

5,815 |

|

2017-2018 |

4,860 |

1,060 |

5,920 |

|

2018-2019 |

5,035 |

1,060 |

6,095 |

Sources: U.S. Department of Education, Department of Education Budget Tables, Congressional Action tables for FY2015-FY2018, downloaded from https://www2.ed.gov/about/overview/budget/tables.html?src=ct.

src=ct. Notes: For a history of Pell Pel Grant award amounts since AY1973-1974, seesee Table A-1.

Mandatory Add-On Award

18 T here are exceptions and allowable additions depending on the program of study, the student’s enrollment rate, whether the student has a disability, and the student’s living situation. See HEA §472.

Congressional Research Service

5

link to page 9 link to page 32 link to page 9 link to page 32 Federal Pell Grant Program of the Higher Education Act: Primer

Mandatory Add-On Award

The mandatory add-on award is an amount established by the HEA. ForSince AY2018-2019, the mandatory add-on award ishas been $1,060. The HEA provides permanent and indefinite mandatory appropriations to fund the mandatory add-on award. From AY2013-2014 through AY2017-2018, statutory provisions established a formula to annuallyannual y modify the mandatory add-

on amount to account for inflation. For AY2017-2018 and all al subsequent award years, the mandatory add-on amount remains the same in accordance with statutory provisions. Table 1 presents the mandatory add-on award for the most recent five years, andand Table A-1 provides a

history of mandatory add-on award amounts when provided since AY1973-1974.

Total Maximum Award

The total maximum award amount is the maximum Pell Pel Grant amount that a student may receive in an academic year. The total maximum award is the sum of the discretionary base maximum award and the mandatory add-on award. For AY2018-2019AY2021-2022, the total maximum award is $6,095495. Table 1 presents the total maximum award for the last five years, andand Table A-1 provides a

history of total maximum award amounts since AY1973-1974.

Expected Family Contribution (EFC)

The EFC is a numberdollar amount calculated in accordance with an HEA-defined methodology that is used to establish how much the student'’s family is expected to contribute to the student's ’s educational costs. The EFC is used in conjunction with COA to determine whether a student is eligible eligible for Title IV need-based aid (aid based on the student'’s and the student'’s family's ’s

financial need).19 Generally19 General y, a student with an EFC greater than the maximum Pell Grant will 90% of the maximum Pel Grant wil not be eligible for a Pell Grant for a Pel Grant, and a student with an EFC higher than their COA will wil not qualify for any federal need-based aid. The EFC calculation methodology differs for dependent students, independent students with no dependents other than a spouse, and independent students with one or more dependents other than a spouse. GenerallyGeneral y speaking, an independent student is an individual who is 24 years oldage 24 or over or meets another criterion specified in the HEA.2020 A student

under the age of 24 cannot qualify as independent on the basis of being financiallyfinancial y independent of his or her parents or not being claimed on the parents'’ tax return. The lowest EFC is $0, and there is no maximum EFC. The EFC is determined utilizing family and financial (income and asset)

information submitted by the aid applicant on the FAFSA.

Automatic (Auto) Zero EFC

Students who apply for federal student aid and meet certain qualifications automaticallyautomatical y receive a zero EFC ($0).2121 The qualifications are based on either the family'’s reporting income being below

a specified threshold or meeting other criteria.

Dependent students and independent students with dependents other than a spouse can qualify for an automatic zero EFC based on an AGI below a specified level and meeting other criteria.

19 For more information on the federal needs analysis methodology and calculation of EFC, see CRS Report R44503, Federal Student Aid: Need Analysis Form ulas and Expected Fam ily Contribution .

20 For HEA T itle IV aid purposes, an independent student is an individual who is at least 24 years of age by December 31 of the award year; is married; is a graduate or professional student; is a veteran of the U.S. Armed Forces or is currently serving on active duty in the military; has dependents other than a spouse; has been in foster care, an orphan, or a ward of the court (anytime since the age of 13); is an emancipated minor or in legal guardianship as determined by a court; is an unaccompanied, homeless youth or self-supporting, at risk of being homeless; or is deemed independent by a financial aid officer for other unusual circum stances. See HEA §480(d). 21 One of the benefits of qualifying for an automatic zero EFC is that it may reduce the number of questions the student

Congressional Research Service

6

Federal Pell Grant Program of the Higher Education Act: Primer

To qualify for an auto zero, the parents of the dependent student or the independent student (and spouse, as appropriate) must have an adjusted gross income (AGI) below a specific threshold and meet one of three additional criteria. The AGI threshold is $2527,000 for AY2018-2019.22AY2021-2022.22 The additional criteria are receipt of means-tested benefits from other federal programs, eligibility to file or having filed certain federal income tax returns, andor having been a dislocated worker. Independent students without dependents other than a spouse are not eligible for an automatic

zero based on their financial situation.

Zero EFC

An otherwise Pell Pel Grant-eligible student whose parent or guardian was a member of the U.S. Armed Forces and died as a result of performing military service in Iraq or Afghanistan after September 11, 2001, receives an automaticdies under specified circumstances receives a zero EFC provided the student was under 24 years old or was enrolled at an IHE at the time of the parent’s or guardian'’s death.23 The specified circumstances occur when

the parent or guardian was

a member of the U.S. Armed Forces and died as a result of performing military

service in Iraq or Afghanistan after September 11, 2001,24 or

actively serving as a public safety officer and died in the line of duty while

performing as a public safety officer.25

The zero EFC is used to award al HEA Title IV aid. A Pel Grant so awarded to the child of a

public safety officer is referred to as the Fallen Heroes Scholarship.

In cases where a student does not qualify for an automatic zero or zero EFC, the student may stil qualify for a calculated zero EFC on the basis of the full EFC formula and information provided

on the FAFSA.

s death.23

In cases where a student does not qualify for an automatic zero, the student may still qualify for a calculated zero EFC on the basis of the full EFC formula and information provided on the FAFSA.

Cost of Attendance (COA)

For Pell Grant award purposes, the cost of attendance (COA) is an IHE-determined measure of educational expenses for a student enrolled full-time for a full academic year. In general, it is the sum of (1) tuition and fees; (2) an allowance for books, supplies, transportation, and miscellaneous personal expenses; (3) an allowance for room and board; and (4) for a student with dependents, an allowance for costs expected to be incurred for dependent care.24 Institutions may use average costs for students at their school, rather than calculating actual expenses for each student. Average COA amounts must be based on the same category of students. For example, institutions may establish separate averages by residency: in-state or out-of-state, or housing: on-campus or off-campus.

Scheduled Award Rule

Scheduled Award Rule

The scheduled award is the maximum Pell Pel Grant aid a full-time, full-academic-year student can receive. In accordance with the HEA, the scheduled award is the least of (1) the total maximum Pell Pel Grant minus the student'’s EFC, or (2) Cost of Attendance (COA) minus EFC.2526 Most students are awarded Pell Pel Grant aid based on the first condition of this rule (i.e., Pell Pel Grant Award = Total Maximum Pell Pel Grant – EFC), since the total maximum Pell Pel Grant award available to a

student in an award year is typicallytypical y less than the student'’s COA at the attending institution. For example, a student with a zero EFC would be eligible for a scheduled Pell Pel Grant award that is

equivalent to the total maximum award, as long as the amount did not exceed the student'’s COA.

must answer when completing the FAFSA. HEA §479(c). 22 U.S. Department of Education, 2021-2022 Federal Student Aid Handbook, p. AVG-48. 23 See HEA §473(b). 24 For students who are not eligible for Pell Grants due to their EFC and who had a parent or guardian die as a result of military service in Iraq or Afghanistan after September 11, 2001, non -need-based grants called Iraq and Afghanistan Service Grants (IASG) are available. T he amount of the IASG is the same as the Pell Grant the student would be eligible for if he or she had a zero EFC. IASG payments are adjusted like Pell Grants for students who are enrolled less than full time, but unlike Pell Grants, these non -need-based grants do not count as estimated financial assistance. In addition, IASG is subject to sequestration.

25 A public safety officer is as defined in 42 U.S.C. §3796b or an eligible fire police officer. See HEA §473(b)(5). 26 T he HEA prohibits the Pell Grant from exceeding the difference between the COA and the EFC. T his precludes the awarding of a Pell Grant in excess of what a student might need to cover the COA after taking the EFC into account.

Congressional Research Service

7

link to page 13 Federal Pell Grant Program of the Higher Education Act: Primer

Annual Award Rule

Annual Award Rule

The annual award is the maximum Pell Pel Grant aid a full-academic-year student can receive at the student'student’s enrollment rate.2627 The HEA requires ED to annuallyannual y publish a schedule of annual award amounts that are proportionallyproportional y reduced scheduled awards for students who are not enrolled full-time for the full academic year.2728 In practice, ED publishes four disbursement schedules: full-

time; less than full-time, but at least ¾ -time; less than ¾-time, but at least ½-time; and less than ½-time. Each schedule provides a table of annual award amounts by COA increments and EFC increments. The annual award for a student enrolledenrol ed at least ½-time in a clock-hour or non-term

credit-hour program is taken from the full-time disbursement schedule.

Minimum Award

The minimum Pell Pel Grant award is the smallestsmal est annual award amount for which a student must qualify to receive a Pell Pel Grant award. In other words, a student must qualify for at least this minimum amount to be eligible for the program. The minimum award is 10% of the total

maximum award. For AY2018-2019AY2021-2022, the minimum Pell Pel Grant award is $610650, or 10% of $6,095.28

495.29

Alternatively, the minimum Pell Pel Grant award may be conceptualized as a maximum EFC. To qualify for a Pell Pel Grant award, a student'’s EFC must be no more than 90% of the total maximum award. In AY2018-2019AY2021-2022, a student with an EFC above $5,486846, or 90% of $6,095495 rounded to the

nearest whole number, would not be eligible for a Pell Grant.

for a Pel Grant. Pell Grant Award Disbursements

Pell

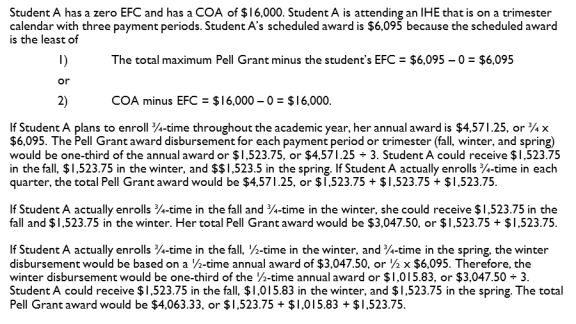

Pel Grant aid awards are disbursed in each payment period for which a student is eligible. Pell Pel Grants must be paid out in installmentsinstal ments over the academic year. In general, the annual award amount is proportionallyproportional y divided among each payment period in the academic year.2930 Each academic year must have at least two payment periods. For example at an IHE on a traditional

semester calendar in AY2018-2019AY2021-2022, a full-time, full-academic-year student with a zero EFC could receive $3,047247.50 in the fall fal semester and $3,047247.50 in the spring semester. SeeSee Figure 1 for an

example of Pell Pel Grant award disbursements.

27 T he annual award for a student in a clock-hour or nonterm credit -hour program is always the scheduled award even if the student is attending less than full time. 28 In recent years, ED has published the Federal Pell Grant Payment and Disbursement Schedules as a Dear Colleague Letter (DCL). For the 2021-2022 Federal Pell Grant Payment and Disbursement Schedules, see https://fsapartners.ed.gov/knowledge-center/library/dear-colleague-letters/2021-01-22/2021-2022-federal-pell-grant-payment -and-disbursement -schedules.

29 T he actual minimum award differs because ED uses midpoints for both the expected family contribution (EFC) and the cost of attendance (COA) in the scheduled award rule. ED’s Federal Pell Grant Payment and Disbursement Schedules group COA and EFC in approximately $100 increments and calculate the award levels for each increment based on the increment midpoints. 30 T he proportional division takes into consideration the number of weeks of each payment period and the number of full-time credit or clock hours in each payment period in comparison to the academic year definition.

Congressional Research Service

8

link to page 14

Federal Pell Grant Program of the Higher Education Act: Primer

Figure 1. Example of Pell Grant Award Disbursement

Grant award disbursements.

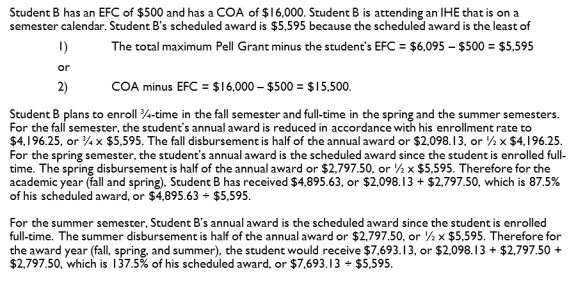

her enrol ment rate. Year-Round (Summer ) Pell Grants

Since award year 2017-2018,3031 qualified students may receive up to 1½ scheduled Pell Pel Grants, or up to 150% of the scheduled award, in each award year.3132 To qualify for the additional funds, a Pell Pel Grant-eligible student must be enrolled at least ½-time in a payment period after receiving

most or all al of the student'’s scheduled award in previous payment periods of the award year. For example at an IHE on a traditional semester calendar in award year 2018-20192021-2022, a full-time, full-academic-year student with a zero EFC could receive $3,047247.50 in the fall fal semester, $3,047247.50 in the spring semester, and $3,047247.50 in the summer semestersemester. Figure 2 provides an additional example.

her enrol ment rate. Maximum Pell Grant Lifetime Eligibility

The HEA establishes a maximum cumulative lifetime eligibility cap on Pell Pel Grant aid.3233 Over her

lifetime, a student may receive the value of no more than 12 full-time semesters (or the equivalent) of Pell Pel Grant awards or six scheduled awards.33 Pell 34 Pel Grant lifetime eligibility used (LEU) at a closed school from which the student did not graduate does not count toward the

lifetime cap—the eligibility used is restored.34

35

33 T he HEOA amendments introduced lifetime eligibility limitations for Pell Grants. Effective for students who received their first Pell Grant on or after July 1, 2008, cumulative Pell Grant lifetime eligibility was limited to 18 full-time semesters (or the equivalent). T he Consolidated Appropriations Act, 2012 (P.L. 112-74) reduced the cumulative lifetime eligibility for Pell Grant aid from 18 semesters to 12 semesters starting in AY2012-2013. Any Pell Grant aid received prior to AY2012-2013 is included in a student’s lifetime limit. 34 For example, students who consistently enroll half-time in standard terms throughout their progression to a bachelor’s degree could receive Pell Grant aid for 24 semesters, or 12 years. Students who consistently enroll full-time in standard terms throughout their degree progression to a bachelor’s degree could receive Pell Grant aid for 12 semesters, or six years. T his change does not affect the measurement of full-time enrollment for the purposes of federal student aid, which is currently 12 semester hours (or the equivalent for non -standard terms).

35 HEA §437(c)(3).

Congressional Research Service

10

link to page 16 link to page 34 Federal Pell Grant Program of the Higher Education Act: Primer

Institutional Role Institutional Role

To be eligible for the HEA Title IV programs, including the Pell Pel Grant program, an IHE must

meet several statutory and regulatory eligibility criteria. For a description of institutional eligibility eligibility requirements, see CRS Report R43159, Institutional Eligibility for Participation in Title IV Student Financial Aid Programs.3536 The IHE may be a public or private nonprofit IHE, a private for-profit (sometimes referred to as proprietary) postsecondary institution, or a

postsecondary vocational institution.

An eligible institution'

An eligible institution’s role in administering the Pell Pel Grant program primarily involves reviewing and verifying information submitted by students on the FAFSA, calculating awards, disbursing awards, adjusting awards to ensure students do not receive more assistance than they

are eligible for, record keeping, and reporting to ED.

An eligible institution calculates a student's Pell ’s Pel Grant disbursement using the award rules. GenerallyGeneral y, institutions credit a student'’s account with the Pell Pel Grant disbursement payment to

meet unpaid tuition, fees, room, and board; any remaining Pell Pel Grant funds are paid directly to

the student to cover other living expenses.

ED makes funds available to schools so that they can disburse Pell Pel Grant awards. In addition, the Pell Pel Grant program pays participating institutions an administrative cost allowanceal owance of $5 per

enrolled recipient.

Description of Pell Grant Recipients and Participation

Participation This section provides descriptive statistics of Pell Pel Grant recipients (numbers and characteristics) and the institutions that they attend. The data may inform discussion regarding the extent to which the program achieves the policy goal of improving access to higher education for financially

financial y needy individuals.

Number of Recipients

The Pell Pel Grant program reaches a significant portion of undergraduates each year. In AY2015-2016, the latest year for which data are available, 39% of all al undergraduates were estimated to have received Pell Pel Grants.3637 Table 2 shows the number of Pell Pel Grant recipients over the most recent five years, from AY2011-2012 to AY2015-2016, as well AY2015-2016 to AY2019-2020, as wel as the annual change and annual percentage change during this time. The number of Pell Pel Grant recipients has declined from almost 9.5 million in AY2011-2012 to over 7.5 million in AY2015-2016. Table B-1 displays Pell Grant over 7.6 mil ion in AY2015-2016 to over 6.7 mil ion in AY2019-2020. Table B-1 displays Pel Grant

36 See also HEA T itles I and IV. 37 CRS analysis of AY2015-2016 data from the National Postsecondary Student Aid Study (NPSAS). A CRS analysis of AY2003-2004, AY2007-2008, and AY2011-2012 NPSAS data shows that the percentage of all undergraduates estimated to have received Pell Grants in each of these academic years was 27%, 28%, and 41%, respectively.

Congressional Research Service

11

link to page 34 Federal Pell Grant Program of the Higher Education Act: Primer

recipients since AY1973-1974. It is important to note that myriad factors,38recipients since AY1973-1974. It is important to note that myriad factors,37 including the labor

market, can affect the number of Pell Pel Grant recipients in any given award year.

|

Award Year |

Pell Grant Recipients |

|

% Change |

|

2011-2012 |

9,444,000 |

136,000 |

1.46% |

|

2012-2013 |

8,959,000 |

(486,000) |

(5.14%) |

|

2013-2014 |

8,663,000 |

(296,000) |

(3.30%) |

|

2014-2015 |

8,316,000 |

(347,000) |

(4.0%) |

|

2015-2016 |

7,660,000 |

(655,000) |

(7.9%) |

Source: U.S. Department of Education, AY2015-2016 Pell Grant End-of-Year Report.

Note: Recipient figures rounded to the nearest thousand. Numbers in parentheses are negative numbers. For a history of Pell Grant award amounts since AY1973-1974, see Table B-1.

Income of Recipients

Since Pell Income of Recipients Since Pel Grant awards are heavily dependent on EFC levels and the complex EFC formula can yield different EFCs for students with similar incomes, there is no absolute income threshold that determines who is eligible or ineligible for a Pell Pel Grant award. Nevertheless, Pell Pel Grant recipients are primarily low-income. In AY2016-2017AY2017-2018, an estimated 95% of Pell Pel Grant recipients had a total family income38income39 at or below $60,000.3940 Independent Pell Pel Grant recipients'’ income is generally general y

lower than their dependent counterparts. As a point of reference, median household income for all al

U.S. households with or without students was $57,230 in 2015 and $59,039 in 2016.40

62,626 in 2017 and $63,179 in 2018.41

It is important to note, however, that a small smal percentage of Pell Pel Grant awards go to mid- and high-

income families. For the most part, these awards are smallersmal er than the average Pell Pel Grant award for all al students and are typicallytypical y provided to dependent students from families whow ho have multiple

students enrolled in postsecondary education at the same time.41

Distribution of Pell Grant Recipients and Funds by Institutional Type

The types of institutions in which Pell Grant recipients enroll may not reflect the overall enrollment patterns of undergraduate students who do not receive Pell 42

38 Such factors include, but are not limited to, (1) amendments to the HEA that affect the federal need analysis calculation and Pell Grant award rules; (2) changes in the maximum grant level specified in annual appropriations bills; (3) trends in enrollment at postsecondary institutions; (4) demographic factors; and (5) macroeconomic and microeconomic variables.

39 T otal family income is defined here as the adjusted gross income (if a tax filer), any taxable income (if not a tax filer), and any non-taxable income.

40 T able 003 of the AY2017-2018 Pell Grant End-of-Year Report. 41 Semega, Jessica, Melissa Kollar, John Creamer, and Abinash Mohanty, U.S. Census Bureau, Current Population Reports, P60-266(RV), Incom e and Poverty in the United States: 2018 , U.S. Government Printing Office, Washington, DC, 2020.

42 According to T able 003 of the AY2017-2018 Pell Grant End-of-Year Report, 4,701 Pell Grant recipients, or 0.1% of the total recipient population, had a family income of $100,000 or more. In cases where the family has more t han one student enrolled in or accepted to college for the award year, the EFC is reduced to account for the number of students expected to be enrolled in the upcoming year.

Congressional Research Service

12

link to page 17 link to page 17 link to page 17 Federal Pell Grant Program of the Higher Education Act: Primer

Distribution of Pell Grant Recipients and Funds by Institutional Type The types of institutions in which Pel Grant recipients enroll may not reflect the overal enrollment patterns of undergraduate students who do not receive Pel Grants. For example, a larger proportion of Pell Pel Grant recipients attend private for-profit institutions than do students not receiving Pell GrantsPel Grants. Table 3 shows the AY2015-2016 enrollment distribution by institutional

sector of undergraduates who do not receive a Pell Pel Grant and undergraduates who do receive Pell Pel Grants. Each group is disaggregated for dependent and independent students. For both independent and dependent students, the share of Pell Pel Grant recipients attending private-for profit institutions was more than double the share of undergraduate students who do not receive Pell Pel Grants attending such institutions. One possible explanation for this disparity is that for-profit institutions may target marketing to low-income students.4243 Most undergraduates, whether receiving Pell

receiving Pel Grants or not, attend public four-year or public two-year institutions. For example, over half of independent Pell Pel Grant recipients attend either public four-year (22.0%) or public

two-year (32.5%) institutions.

Table 3. Estimated Distribution of Pell Grant Recipients and Undergraduates not

Receiving Pell Grants by Sector of Enrolling Institution, AY2015-2016

Dependent Undergraduates

Independent Undergraduates

% Not

% Not

Type and Control of

% Pell Grant

Receiving Pell

% Pell Grant

Receiving Pell

Institution

Recipients

Grant

Recipients

Grant

Public four-year

40.5

40.2

22.0

22.9

Private nonprofit four-year

14.1

17.6

11.8

11.0

Public two-year

27.7

29.0

32.5

49.2

Private for-profita

6.4

2.4

21.6

8.3

Other or more than one institutionb

11.2

10.9

12.1

8.6

Total

100.0

100.0

100.0

100.0

Source: CRS estimates from 2015-2016 NPSAS. Notes: Due to rounding, sum of column entries Receiving Pell Grants by Sector of Enrolling Institution, AY2015-2016

|

Dependent Undergraduates |

Independent Undergraduates |

|||

|

Type and Control of Institution |

% Pell Grant Recipients |

% Not Receiving Pell Grant |

% Pell Grant Recipients |

% Not Receiving Pell Grant |

|

Public four-year |

40.5 |

40.2 |

22.0 |

22.9 |

|

Private nonprofit four-year |

14.1 |

17.6 |

11.8 |

11.0 |

|

Public two-year |

27.7 |

29.0 |

32.5 |

49.2 |

|

6.4 |

2.4 |

21.6 |

8.3 |

|

11.2 |

10.9 |

12.1 |

8.6 |

|

Total |

100.0 |

100.0 |

100.0 |

100.0 |

Source: CRS estimates from 2015-2016 NPSAS.

Notes: Due to rounding, sum of column entries may not equal column totals.

a. may not equal column totals. a. Private for-profit institutions are sometimes referred referred to as proprietary institutions.

b. b. The other or more than one institution category is for students who attended an institution that is not a

public four-year, private nonprofit four-year, public two-year, or private for-profit institution and for students who attended more than one eligible institution during the year.

Role of the Pell Grant

The Pell Pel Grant is intended to function as the foundation of federal need-based aid for financially financial y needy undergraduates. As described earlier, other financial aid received by a student is not taken

43 “How For-Profit Colleges Sell ‘Risky Education’ T o T he Most Vulnerable,” NPR, March 27, 2017; Elizabeth A. Harris, “New York City Consumer Agency Investigating Four For-Profit Colleges,” The New York Times, April 2, 2015; and Caroline Simon, “For-Profit Colleges’ T eachable Moment: ‘T errible Outcomes Are Very Profitable’,” Forbes, March 19, 2018.

Congressional Research Service

13

link to page 19 Federal Pell Grant Program of the Higher Education Act: Primer

into account in determining a student’s Pel into account in determining a student's Pell Grant. This section explores the role Pell Pel Grants and

other sources of aid play in helping students meet postsecondary costs.

Purchasing Power

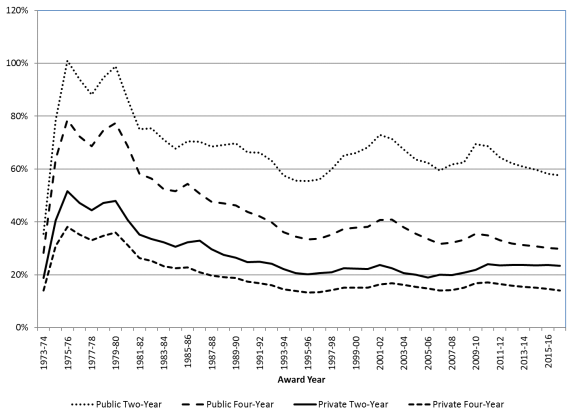

The total maximum Pell Pel Grant, available to students with a zero EFC who enroll on a full-time, full-year basis, is often used as a gauge of the Pell Pel Grant program'’s level of support in each year. Figure 3 compares the total maximum grant to average undergraduate tuition, fees, room, and board charges (base educational costs) at public two-year, public four-year, private two-year, and

private four-year institutions between AY1973-1974 and AY2016-2017AY2019-2020. It is evident that the maximum was at its peak relative to these average charges during the 1970s. Since the 1990s, the extent to which the total maximum Pell Pel Grant covers average base educational costs has been variable; however, despite some increases, the total maximum Pell Pel Grant has lost ground relative to average base educational costs at public four-year institutions. In AY2016-2017AY2019-2020, the total maximum grant ($5,8156,195) covered approximately 5856% of the average base educational costs at

public two-year institutions, 3029% at public four-year institutions, 23% at private two-year

institutions, and 14% at private four-year institutions.43

It is also important to note that in all al sectors of higher education, published tuition, fees, and room and board have consistently risen more rapidly than average prices in the economy for a number of years. An analysis of the purchasing power of the Pell Pel Grant maximum award, therefore, could also include an examination of why published prices at institutions of higher education have risen

at such a rapid rate and what is the role of federal student aid, including Pell Pel Grants, in

contributing to rising published prices.44

45

45 For more information on college prices and potential explanations for escalating college prices, see CRS Report R43692, Overview of the Relationship between Federal Student Aid and Increases in College Prices.

Congressional Research Service

15

link to page 20 link to page 20 link to page 21 link to page 21 link to page 21 link to page 21 Federal Pell Grant Program of the Higher Education Act: Primer

Receipt of Pell Grants and Other Aid The Pel Receipt of Pell Grants and Other Aid

The Pell Grant is intended to be the foundation of federal need-based student aid from Title IV of

the HEA.4546 In AY2015-2016, an estimated 16% of Pell Pel Grant recipients relied on a Pell Pel Grant as their only source of aid from all al sources, and 34% of Pell Pel Grant recipients did not receive other HEA

HEA Title IV aid funds.46

Most Pell 47

Most Pel Grant recipients (84%) participate in other student aid programs. For those Pell Pel Grant recipients with a zero EFC, Table 4 shows estimates of the average percentage of cost of attendance (COA) covered by their Pell Pel Grant award, their loans from all al sources, and their total aid package in AY2015-2016, by total family income. This table allowsal ows for examination of the extent to which Pell Grants and other aid helped Pell Pel Grant recipients with a zero EFC meet their

COA.4748 Table 4 shows, for example, that among all Pell al Pel Grant recipients, Pell Pel Grant aid covered, on average, 27.1% of the COA and all al loan sources covered, on average, an additional 20.3% of the COA for these recipients. For Pell Pel Grant recipients, total aid from all al sources supplies less

than two-thirds (62.9%) of the COA, on average.

Table 4. Pell Grant Aid, Student Loans, and Total Aid from All Sources as Average

Percentages of Cost of Attendance for Undergraduate Students Who Have a Zero

EFC and Received a Pell Grant, by Total Family Family Income (2014)

(AY2015-2016)

Pell Grant

All Loansa as

Total Aidb

Aid as a

a

as a

Percentage

Percentage

Percentage

of COA

of COA

of COA

Al Zero EFC Pel (AY2015-2016)

|

Pell Grant Aid as a Percentage of COA |

All Loansa as a Percentage of COA |

Total Aidb as a Percentage of COA |

|

|

All Zero EFC Pell Grant Recipients |

27.1% |

20.3% |

62.9% |

|

Total Family Income (Dependent)c |

|||

|

Less than $20,000 |

29.7% |

15.0% |

63.8% |

|

$20,000 to $29,999 |

29.6% |

15.9% |

66.6% |

|

$30,000 to $49,999 |

27.7% |

14.7% |

67.3% |

|

$50,000 or more |

NR |

NR |

NR |

|

Total Family Income (Independent)d |

|||

|

Less than $20,000 |

25.6% |

23.6% |

61.7% |

|

$20,000 to $29,999 |

25.9% |

24.6% |

62.2% |

|

$30,000 to $49,999 |

25.8% |

22.1% |

61.8% |

|

$50,000 or more |

25.5% |

24.8% |

62.2% |

Source: CRS estimates Grant Recipients

27.1%

20.3%

62.9%

Total Family Income (Dependent)c

Less than $20,000

29.7%

15.0%

63.8%

$20,000 to $29,999

29.6%

15.9%

66.6%

$30,000 to $49,999

27.7%

14.7%

67.3%

$50,000 or more

NR

NR

NR

Total Family Income (Independent)d

Less than $20,000

25.6%

23.6%

61.7%

$20,000 to $29,999

25.9%

24.6%

62.2%

$30,000 to $49,999

25.8%

22.1%

61.8%

$50,000 or more

25.5%

24.8%

62.2%

Source: CRS estimates from 2015-2016 NPSAS. from 2015-2016 NPSAS.

Notes: NR means reporting standards were not met. COA means cost of attendance.

a. All loans column includes federal loans to students, state loans, institutional loans, Direct

46 Federal need-based student aid from the HEA is defined here as Pell Grants, Federal Supplemental Educational Opportunity Grants (FSEOG), Federal Work -Study earnings, and Direct Subsidized Loans.

47 CRS estimates from 2015-2016 NPSAS. 48 T he cost of attendance is the sum of tuition and fees and non-tuition expenses for students who attended only one institution. T he cost is adjusted to accommodate private alternative loans that may exceed total aid ( federal, state, institutional, and private financial aid received by the student in the form of grants, loans, work-study assistance, or other types of aid).

Congressional Research Service

16

link to page 9 link to page 32 link to page 36 Federal Pell Grant Program of the Higher Education Act: Primer

a. Al loans column includes federal loans to students, state loans, institutional loans, Direct PLUS loans to

PLUS loans to parents, and other private commercial or alternative loans. Data include loan amounts for Pell Grant recipients Pel Grant recipients who did not borrow as well as wel as those who did borrow.

b.

b. Total aid includes all al federal, state, institutional, and private financial aid received by the student in theth e form

of grants, loans, work-study assistance, or other types of aid.

c.

c. Includes income of dependent student and parents.

d. d. Includes income of independent student and spouse when applicable.

Program Funding

This section of the report reviews the latest Pell Pel Grant program funding trends and reviews Pell Pel Grant funding sources and procedures. As a quasi entitlement that makes grant payments to eligible students who apply for aid and enroll in eligible programs notwithstanding the appropriation level available in any one year, the program may operate with a surplus or shortfall of discretionary funding. Funding provided for the Pell Grant program is exempt from sequestration, pursuant to provisions included in Section 255(h) of the Balanced Budget and Emergency Deficit Control Act of 1985 (BBEDCA, Title II of P.L. 99-177, as amended). Given the somewhat unique funding characteristics of this program, this section of the report explores funding concepts, funding levels, and insight into how shortfalls and surpluses of discretionary funding in the program have been addressed.

The Pell The program has somewhat unique funding characteristics because of the mix of discretionary and mandatory funding, the 2006 budget scoring rule, and its

ability to carry over a surplus or shortfal of discretionary funding to subsequent fiscal years. This

section explores these concepts and the effect that they have on appropriations acts.

The Pel Grant program since approximately FY2008 has been funded through three funding streams. A discretionary appropriation is the primary source of funds for the discretionary award amounts. There are two mandatory funding streams. The smallersmal er mandatory funding stream augments the discretionary appropriations to fund the discretionary award level. Therefore, a portion of the discretionary award level is funded through mandatory appropriations. A larger mandatory appropriation funds the mandatory add-on award amounts. Recent and historical

discretionary maximum award levels and mandatory add-on award levels are shown inin Table 1 and and Appendix A, respectively. Appendix C presents the three distinct funding streams and

enacting legislation since FY2008.

Funding provided for the Pel Grant program is exempt from sequestration, pursuant to provisions included in Section 255(h) of the Balanced Budget and Emergency Deficit Control Act of 1985

(BBEDCA, Title II of P.L. 99-177, as amended).

Role of Discretionary Funding Role of Discretionary Funding

Annual discretionary appropriation billsappropriations bil s provide the largest portion of funding for the Pell Pel Grant program, and this funding typicallytypical y remains available for use for two fiscal years. An annual appropriation is usuallyusual y available for obligation on October 1 of the fiscal year for which the appropriation is made and remains available for obligation through September 30 of the following fiscal year.4849 Thus, while FY2018FY2021 funds are provided withfor the purpose of supporting awards made

from July 1, 20182021, to June 30, 20192022, these funds are available for obligation from October 1, 20172020, to September 30, 20192022, and may support multiple award years. This multiyear availability allowsal ows the discretionary appropriation to operate at a surplus or shortfall shortfal in any given year. In addition, this multiyear availability al ows the program to operate as a quasi entitlement, making grant payments to eligible students who apply for aid and enroll in eligible programs

notwithstanding the appropriation level available in any onein any given year. As mentioned earlier, annual discretionary appropriation billsbil s also establish the base discretionary maximum grant for each eac h applicable award year.

49 T he annual appropriation for the Pell Grant program is available immediately upon enactment at any point on or after October 1. In the event the annual appropriation is not enacted at the beginning of the fiscal year, a continuing resolution typically provides prorated funding for the program until an appropriation measure is enacted.

Congressional Research Service

17

link to page 23 link to page 23 link to page 39 Federal Pell Grant Program of the Higher Education Act: Primer

Role of Mandatory Funding

Specified Role of Mandatory Funding

Specified Mandatory Appropriations to Augment Discretionary Funding

The SAFRA Act (enacted as part of the Health Care and Education Reconciliation Act of 2010; P.L. 111-152), the FY2011 Continuing Appropriations Act (P.L. 112-10), the Budget Control Act