Agriculture in the WTO: Rules and Limits on U.S. Domestic Support

Changes from September 6, 2018 to June 4, 2019

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Agriculture in the WTO: Rules and Limits on U.S. Domestic Support

Contents

- Introduction

- WTO Commitments May Influence Policy Choices

- Agreement on Agriculture (AoA)

- Domestic Support Categorization

- Domestic Support Notification

- Agreement on Subsidies and Countervailing Measures (SCM)

- WTO Dispute Settlement Understanding (DSU)

- Questions for Evaluating WTO Compliance of Domestic Farm Spending

- Question 1: Can This Measure Be Placed in the Green Box?

- Question 2: Can This Measure Be Placed in the Blue Box?

- Question 3: If Amber, Will Support Exceed 5% of Production Value?

- Question 4: Does Total Annual AMS Now Exceed $19.1 Billion?

- Question 5: Does Domestic Support Result in Significant Market Distortion in International Markets?

- Conclusion

Summary

Omnibus U.S. farm legislation—referred to as the farm bill—has typically been renewed every five or six years. Farm income and commodity pricerevenue support programs have been a part of U.S. farm bills since the 1930s. Each successive farm bill usually involves some modification or replacement of existing farm programs. A key question likely to be asked of every new farm proposal or program is how it will affect U.S. commitments under the World Trade Organization's (WTO's) Agreement on Agriculture (AoA) and its Agreement on Subsidies and Countervailing Measures (SCM).

The United States is currently committed, under the AoA, to spend no more than $19.1 billion annually on those domestic farm support programs most likely to distort trade—referred to as amber box programs and measured by the Aggregate Measure of Support (AMS). The AoA spells out the rules for countries to determine whether their policies—for any given year—are potentially trade distorting and how to calculate the costs.

The most recent U.S. notification to the WTO of domestic support outlays (made on May 1October 31, 2018) is for the 20152016 crop year. To date, the United States has never exceeded its $19.1 billion amber box spending limit. However, this has been achieved in some years (1999, 2000, and 2001) through judicious use of the de minimis exclusion described below.

An additional consideration for WTO compliance—the SCM rules governing adverse market effects resulting from a farm program—comes into play when a domestic farm policy effect spills over into international markets. The SCM details rules for determining when a subsidy is "prohibited" (e.g., certain export- and import-substitution subsidies) and when it is "actionable" (e.g., certain domestic support policies that incentivize overproduction and result in significant market distortion—whether as lower market prices or altered trade patterns). Because the United States is a major producer, consumer, exporter, and/or importer of most major agricultural commodities, the SCM is relevant for most major U.S. agricultural products. As a result, if a particular U.S. farm program is deemed to result in market distortion that adversely affects other WTO members—even if it is within agreed-upon AoA spending limits—then that program may be subject to challenge under the WTO dispute settlement procedures.

Designing farm programs that comply with WTO rules can avoid potential trade disputes. Based on AoA and SCM rules, U.S. domestic agricultural support can be evaluated against five specific successive questions to determine how it is classified under the WTO rules, whether total support is within WTO limits, and whether a specific program fully complies with WTO rules:

- Can a program's support outlays be excluded from the AMS total by being placed in the green box of minimally distorting programs?

- Can a program's support outlays be excluded from the AMS total by being placed in the blue box of production-limiting programs?

- If amber, will support be less than 5% of production value (either product-specific or non-product-specific) thus qualifying for the de minimis exclusion?

- Does the total, remaining annual AMS exceed the $19.1 billion amber box limit?

- Even if a program is found to be fully compliant with the AoA rules and limits, does its support result in price or trade distortion in international markets? If so, then it may be subject to challenge under SCM rules.

Introduction

Trade plays a critical role in the U.S. agricultural sector. The U.S. Department of Agriculture (USDA) estimates that exports account for about 20% of total U.S. agricultural production.1 Furthermore, given the substantial volume of its agricultural exports, the United States plays a significant role in many international agricultural markets. As a result, U.S. farm policy is often subject to intense scrutiny both for compliance with current World Trade Organization (WTO) rules and for its potential to diminish the breadth or impede the success of future multilateral negotiations. In part, this is because a farm bill locks in U.S. policy behavior for an extended period of time during which the United States would be unable to accept any new restrictions on its domestic support programs.

Farm income and commodityrevenue support programs have been a part of U.S. farm legislation since the 1930s.2 Today, these support programs are authorized as part of omnibus U.S. farm legislation—referred to as the farm bill—which has typically been renewed every five or six years. Each successive farm bill usually involves some modification or replacement of existing farm programs. The current omnibus farm bill, the Agricultural Improvement Act of 2018Act of 2014 (P.L. 113-79115-334; the 20142018 farm bill), which was signed into law on February 7, 2014, made several substantial changes to the previous December 20, 2018.2 The 2018 farm bill largely maintains the farm safety net of the 2008previous 2014 farm bill (P.L. 113-79) farm bill.3 The commodity programs of the 20142018 farm bill became operational with the 20142018 crop year. They are scheduled to expire on September 30, 20182023, or with the 20182023 crop year. Ultimately, the current farm bill will either be (1) replaced with new legislation, (2) temporarily extended, or (3) allowed to lapse and replaced with "permanent law"—a set of essentially mothballed provisions for the farm commodity programs that date from the 1930s and 1940s.4

WTO Commitments May Influence Policy Choices

A potential major constraint affecting U.S. agricultural policy choices is the set of commitments made as part of membership in the WTO.5 The WTO has three basic functions: (1) administering existing agreements, including those governing agriculture and trade;6 (2) serving as a negotiating forum for new trade liberalization; and (3) providing a mechanism to settle trade disputes among members.7 With respect to disciplines governing domestic agricultural support, two WTO agreements are paramount—the Agreement on Agriculture (AoA)8 and the Agreement on Subsidies and Countervailing Measures (SCM).9

The AoA sets country-specific aggregate spending limits on the most market-distorting policies. It also defines very general rules covering trade among member countries. In general, domestic policies or programs found to be in violation of WTO rules may be subject to challenge by another WTO member under the WTO dispute settlement process. If a WTO challenge is successful, the WTO remedy would likely imply the elimination, alteration, or amendment by Congress of the program in question to bring it into compliance. Since most governing provisions over U.S. farm programs are statutory, new legislation could be required to implement even minor changes to achieve compliance.10 As a result, designing farm programs that comply with WTO rules can avoid potential trade disputes.

This report provides a brief overview of the WTO commitments that are most relevant for U.S. domestic farm policy. A key question that many policymakers ask of virtually every new farm proposal is how it will affect U.S. commitments under the WTO. The answer depends not only on cost but also on the proposal's design and objectives, as described below.

Agreement on Agriculture (AoA)

Under the AoA, WTO member countries agreed to general rules regarding disciplines on domestic subsidies (as well as on export subsidies and market access). The AoA's goal was to provide a framework for the leading members of the WTO to make changes in their domestic farm policies to facilitate more open trade.

Domestic Support Categorization

The WTO's AoA categorizes and restricts agricultural domestic support programs according to their potential to distort commercial markets. Whenever a program payment influences a producer's behavior, it has the potential to distort markets (i.e., to alter the supply of a commodity) from the equilibrium that would otherwise exist in the absence of the program's influence. Those outlays that have the greatest potential to distort agricultural markets—referred to as amber box subsidies—are subject to spending limits.11 In contrast, more benign outlays (i.e., those that cause less or minimal market distortion) are exempted from spending limits under green box, blue box, de minimis, or special and differential treatment exemptions.12

The AoA contains detailed rules and procedures to guide countries in determining how to classify itstheir programs in terms of which are most likely to distort production and trade; in calculating their annual cost, measured by the Aggregate Measure of Support (AMS) index;13 and in reporting the total cost to the WTO. Specifically, the WTO uses a traffic light analogy to group programs:

- Green box programs are minimally or non-trade distorting and not subject to any spending limits.

- Blue box programs are described as production-limiting. They have payments that are based on either a fixed area or yield or a fixed number of livestock and are made on less than 85% of base production. As such, blue box programs are also not subject to any payment limits.

- Amber box programs are the most market-distorting programs and are subject to a strict aggregate, annual spending limit. The United States is subject to a spending limit of $19.1 billion in amber box outlays subject to certain de minimis exemptions.14

- De minimis exemptions are domestic support spending that is sufficiently small—relative to either the value of a specific product or total production—to be deemed benign. De minimis exemptions are limited by 5% of the value of production—either total or product-specific.15

- Prohibited (i.e., red box) programs include certain types of export and import subsidies and nontariff trade barriers that are not explicitly included in a country's WTO schedule or identified in the WTO legal texts.16

This report describes the AoA classifications in more detail below in the section titled "Questions for Evaluating WTO Compliance of Domestic Farm Spending."

Domestic Support Notification

To provide for monitoring and compliance of WTO policy commitments, each WTO member country is expected to routinely submit notification reports on the implementation of its various commitments. The WTO's Committee on Agriculture has the duty of reviewing progress in the implementation of individual member commitments based on member notifications. Furthermore, the WTO posts the notifications on its official website for all members to review.17 The most recent U.S. notification to the WTO of domestic support outlays (made on May 1October 31, 2018) is for the 20152016 crop year.

Agreement on Subsidies and Countervailing Measures (SCM)

To the extent that domestic farm policy effects spill over into international markets, U.S. farm programs are also subject to certain rules under the Agreement on Subsidies and Countervailing Measures (SCM).18 The SCM details rules for determining when a subsidy is "prohibited" (as in the case of certain export- and import-substitution subsidies) and when it is "actionable" (as in the case of certain domestic support policies that incentivize overproduction and result in significant market distortion—whether as lower market prices or altered trade patterns).19

The key aspect of SCM commitments is the degree to which a domestic support program engenders market distortion. Based on precedent from past WTO decisions, several criteria are important in establishing whether a subsidy could result in significant market distortions:

- The subsidy constitutes a substantial share of farmer returns or covers a substantial share of production costs.

- The subsidized commodity is important to world markets because it forms a large share of either world production or world trade.

- A causal relationship exists between the subsidy and adverse effects in the relevant market.

The SCM evaluates the "market distortion" of a program or policy in terms of its measurable market effects on the international trade and/or market price for the affected commodity:

- Did the subsidy displace or impede the import of a like product into the subsidizing member's domestic market?

- Did the subsidy displace or impede the exports of a like product by another WTO member country other than the subsidizing member?

- Did the subsidy (via overproduction and resultant export of the surplus) result in significant price suppression, price undercutting, or lost sales in the relevant commodity's international market?

- Did the subsidy result in an increase in the world market share of the subsidizing member?

For any farm program challenged under the SCM, a WTO dispute settlement panel reviews the relevant trade and market data and makes a determination of whether the particular program challenged resulted in a significant market distortion.20

Under WTO rules, challenged subsidies that are found to be prohibited by a WTO dispute settlement panel must be stopped or withdrawn "without delay" in accordance with a timetable laid out by the panel. Otherwise the member nation bringing the challenge may take appropriate countermeasures. Similarly, actionable subsidies, if successfully challenged, must be withdrawn or altered so as to minimize or eliminate the distorting aspect of the subsidy, again as laid out by a WTO panel or as negotiated between the two disputing parties.

WTO Dispute Settlement Understanding (DSU)

The WTO Understanding on Rules and Procedures Governing the Settlement of Disputes (DSU) provides a means for WTO members to resolve disputes arising under WTO agreements. WTO members must first attempt to settle their dispute through consultations, but if these fail, the member initiating the dispute may request that a panel examine and report on its complaint. The DSU provides for Appellate Body review of panel reports, panels to determine if a defending member has complied with an adverse WTO decision by the established deadline in a case, and possible retaliation if the defending member has failed to do so.

Since the WTO was established in 1995, 564575 complaints have been filed under the DSU, with nearly one-half (272276) involving the United States as a complainant or defendant.21 The Office of the United States Trade Representative represents the United States in WTO disputes.22

Questions for Evaluating WTO Compliance of Domestic Farm Spending

The United States is currently committed, under the AoA, to spend no more than $19.1 billion per year on amber box trade-distorting support. The WTO's AoA procedures for classifying and counting trade-distorting support are somewhat complex. However, four questions might be asked to determine whether a particular farm measure will cause total U.S. domestic support to be above or below the $19.1 billion annual AMS limit. A subsequent fifth question may be asked to ascertain whether AoA-compliant outlays are also SCM-compliant.

- 1. Can the measure be classified as a "green box" policy—one presumed to have the least potential for distorting production and trade and therefore not counted as part of the AMS?

- 2. Can it be classified as a "blue box" policy—that is, a production-limiting program that receives a special exemption and therefore is also not counted as part of the AMS?

- 3. If it is a potentially trade-distorting "amber box" policy, can support still be excluded from the AMS calculation under the so-called 5% de minimis exemption (explained later in more detail) because total support is no more than 5% of either

: - the value of total annual production if the support is non-product

- the value of annual production of a particular commodity if the support is specific to that commodity?

- 4. If such support exceeds the de minimis 5% threshold (and thus cannot be exempted), when it is added to all other forms of non-exempt amber box support is total U.S. AMS still beneath the $19.1 billion limit?

- 5. If a program is fully compliant with the AoA rules and limits, does its support result in price or trade distortion in international markets that, in turn, cause adverse effects upon another WTO member? If so, then it may be subject to challenge under SCM rules.

Question 1: Can This Measure Be Placed in the Green Box?

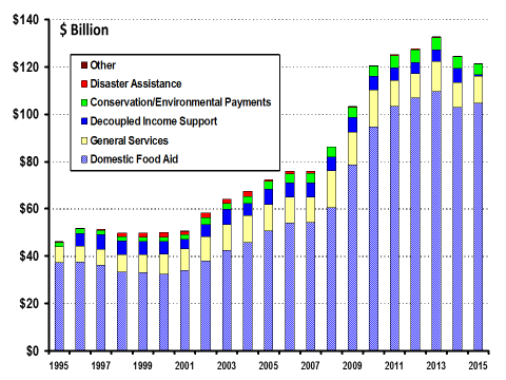

No limits are placed on green box spending, since it is considered to be minimally or non-trade distorting (Figure 1). To qualify for exemption in the green box, a program must meet two general criteria, as well as a set of policy-specific criteria relative to the different types of agriculture-related programs.23 The two general criteria are the following:

- 1. It must be a publicly funded government program (defined to include either outlays or forgone revenue) that does not involve transfers from consumers.

- 2. It must not have the effect of providing price support to producers.

In addition, every green-box-qualifying program must comply with at least one of the following criteria and conditions specific to the program itself:

- A "general service" benefitting the agricultural or rural community in general cannot involve direct payments to producers or processors. Such programs can include research; pest and disease control; training, extension, or advisory services; inspection services, including for health, safety, grading, or standardization; marketing and promotion services, including information advice and promotion (but not spending for unspecified purposes that sellers could use to provide price discounts or other economic benefits to purchasers); and generally available infrastructure such as utility, transportation, or port facilities, water supply facilities, or other capital works construction.

- Public acquisition (at current market prices) and stockholding of products for food security must be integral to a nationally legislated food security program and be financially transparent.

- Domestic food aid is to be based upon clearly defined eligibility and nutritional criteria, be financially transparent, and involve government food purchases at current market prices.

- "Decoupled" income support is to use clearly defined eligibility criteria in a specified, fixed base period; not be related in any way after the base period to (a) domestic or world prices, (b) type or volume of crop or livestock production, or (c) factors of production; and, further, not be contingent on any production in exchange for payments.

- Government financial participation in an income insurance or income safety net program shall define eligibility as agricultural income loss exceeding 30% of average gross income (or equivalent in net income terms) in the preceding three-year period (or preceding five-year period, excluding the highest and lowest years—the so-called Olympic average), with such payment compensating for less than 70% of the income loss in year of eligibility and payments based solely on income, not production, price, or inputs. Total annual payments under this and natural disaster relief (see next paragraph) cannot exceed 100% of a producer's total loss.

- Payments (whether direct or through government crop insurance) for natural disaster relief are to use eligibility based on formal government recognition of the disaster. Payments are to be determined by a production loss exceeding 30% of production in the preceding three-year (or five-year Olympic average) period; they are to apply only to losses of income, livestock, land, or other production factors; and they cannot exceed the total replacement cost or require specific future production. Total annual payments under this and the income insurance or safety net measure cannot exceed 100% of a producer's total loss.

- Structural adjustment through producer retirement shall tie eligibility to clearly defined criteria in programs to facilitate producers' "total and permanent" retirement from agricultural production or their movement into nonagricultural activities.

- Structural adjustment through resource retirement shall be determined through clearly defined programs designed to remove land, livestock, or other resources from marketable production with payments (a) conditioned on land being retired for at least three years and on livestock being permanently disposed, (b) not contingent upon any alternative specified use of such resources involving marketing agricultural production, and (c) not related to production type/quantity or to prices of products using remaining productive resources.

- Structural adjustment provided through investment aids must be determined by clearly defined criteria for programs assisting financial or physical restructuring of a producer's operations in response to objectively demonstrated structural disadvantages (and may also be based on a clearly defined program for "re-privatization" of agricultural land). The amount of payments (a) cannot be tied to type/volume of production or to prices in any year after the base period, (b) shall be provided only for a time period needed for realization of the investment in respect of which they are provided, (c) cannot be contingent on the required production of designated products (except to require participants not to produce a designated product), and (d) must be limited to the amount required to compensate for the structural disadvantage.

- Environmental program payments must have eligibility determined as part of a clearly defined government environmental or conservation program and must be dependent upon meeting specific program conditions, including conditions related to production methods or inputs. Payments must be limited to the extra costs (or loss of income) involved with program compliance.

- Regional assistance program payments shall be limited to producers in a clearly designated, contiguous geographic region with definable economic and administrative identity that are considered to be disadvantaged based on objective, clearly defined criteria in the law or regulation that indicate that the region's difficulties are more than temporary. Such payments in any year (a) shall not be related to or based on type/volume of production in any year after the base period (other than to reduce production) or to prices after the base period; (b) where related to production factors, must be made at a degressive rate above a threshold level of the factor concerned; and (c) must be limited to the extra costs or income loss involved in agriculture in the prescribed area.

In summary, the above measures are eligible for placement in the green box (i.e., exempted from AMS) so long as they (1) meet general criteria one and two above and (2) additionally comply with any criteria specific to the type of measure itself. If these conditions are satisfied, no further steps are necessary—the measure is exempt. However, if not, then the next step is to determine whether it qualifies for the blue box exemption.

|

|

Source: WTO, annual notifications of the United States through Note: Until 2008, crop insurance subsidies were calculated as "net indemnities" (equal to indemnities paid minus producer-paid premium) and notified as non-product-specific AMS. In 2008, USDA began notifying certain crop insurance outlays—including administrative costs, delivery-cost reimbursements, and underwriting losses—as green box "General Services," while notifying federal premium subsidies as non-product-specific AMS. In 2012, USDA again changed its notification strategy to notify federal premium subsidies as crop-specific AMS. |

Question 2: Can This Measure Be Placed in the Blue Box?

No limits are placed on blue box spending, in part because it contains safeguards to prevent program incentives from expanding production. To qualify for exemption in the blue box,24 a program must be a direct payment under a production-limiting program25 and must also either:

- be based on fixed areas and yields,

- be made on 85% or less of the base level of production, or

- if livestock payments, be made on a fixed number of head.

If these conditions are satisfied, the measure is exempt. However, if not, then it is considered to be an amber box policy, and the next step is to determine whether spending is above or below the 5% de minimis rate.

Question 3: If Amber, Will Support Exceed 5% of Production Value?

The AoA states that developed country members (including the United States), when calculating their total AMS, do not have to count the value of amber box programs whose total cost is small (or benign) relative to the value of either a specific commodity, if the program is commodity-specific, or the value of total production if the program is not commodity-specific.26 In other words, "amber box" (i.e., potentially trade-distorting) policies may be excluded under the following two de minimis exclusions:

- Product-specific domestic support, whereby it does not exceed 5% of the member's "total value of production of a basic agricultural product during the relevant year." Support provided through all of the measures specific to a product—not just a single measure in question—is tallied to determine whether the 5% level is exceeded. For example, the value of the

20152016 U.S. corn crop was $4951.3 billion, and 5% of that was $2.467565 billion.27 This compares with corn-specific AMS outlays of $2.362345 billion. Since it is below the 5% product-specific de minimis threshold, the entire $2.362345 billion was exempted from inclusion under the AMS limit for the marketing year20152016. In contrast, U.S. sugar support of $1.525 billion for20152016 easily exceeded its 5% product-specific de minimis of $133.2117.8 million (based on total sugar value of $2.74 billion) and, therefore, was counted against the AMS limit. - Non-product-specific domestic support, whereby it does not exceed 5% of the "value of the member's total agricultural production." All non-product-specific support is tallied to determine whether the 5% level is exceeded. For example, the value of

20152016 U.S. agricultural production was notified to the WTO as $372.7355.5 billion.28 The 5% threshold for non-product-specific support was $18.617.8 billion. The United States notified outlays of $8.27.4 billion for non-product-specific support in20152016. As a result, the entire $8.27.4 billion was exempted from inclusion under the AMS limit.

These provisions are known as the so-called de minimis clause. If the cost of any particular measure effectively boosts the total support above 5%, then all such support (not just the portion of support in excess of 5%) must be counted toward the U.S. total annual AMS.

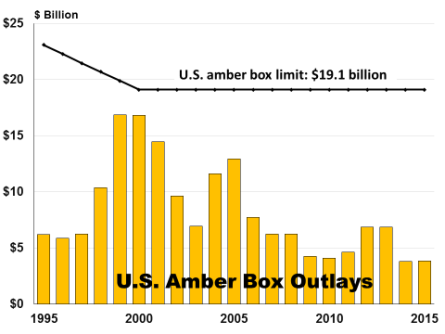

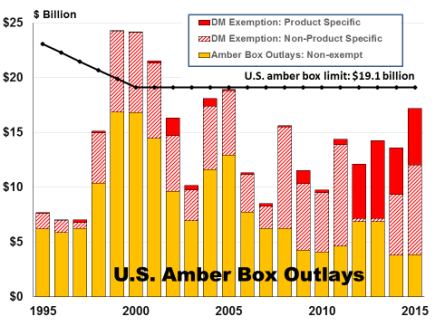

Question 4: Does Total Annual AMS Now Exceed $19.1 Billion?

Finally, all support that does not qualify for an exemption is added for the year. If total U.S. AMS does not exceed $19.1 billion, the WTO commitment is met (Figure 2). Through 2015, the most recent year for which the United States has made notifications to the WTO, the United States has never exceeded its $19.1 billion amber box spending limit. The closest approach was in 1999, when the United States notified a total AMS of $16.862 billion. However, the de minimis exemptions have been instrumental in helping the United States avoid exceeding its amber box limit in 1999, 2000, and 2001, when total AMS outlays prior to exemptions were $24.3 billion, $24.2 billion, and $21.5 billion, respectively (Figure 3).

The 20142018 farm bill includes a provision, Section 1601(d1701 (7 U.S.C. §9091(c)), that serves as a safety trigger for USDA to adjust program outlays (subject to notification being given to both the House and Senate agriculture committees) in such a way as to avoid breaching the AMS limit.

Question 5: Does Domestic Support Result in Significant Market Distortion in International Markets?

An additional consideration for WTO compliance—the SCM rules governing adverse market effects resulting from a domestic farm support program—comes into play when a domestic farm policy effect spills over into international markets. This is particularly relevant for the United States because it is a major producer, consumer, exporter, and/or importer of most major agricultural commodities—but especially of temperate field crops (which are the main beneficiaries of U.S. farm program support). If a particular U.S. farm program is deemed to result in market distortion that adversely affects other WTO members—even if it is compliant with all AoA commitments and agreed-upon spending limits—then that program may be subject to challenge under the WTO dispute settlement procedures. (Brazil's WTO case against U.S. cotton programs is a prime example of this.)29

Conclusion

The AoA's structure of varying spending limits across the amber, blue, and green boxes is intentional. By leaving no constraint on spending in the green box while imposing limits on amber box spending, the WTO implicitly encourages countries to design their domestic farm support programs to be green box compliant.30

Negotiations to further reform agricultural trade within the context of the WTO—referred to as the Doha Round of multilateral trade negotiations—began in 2001.31 In 2009, negotiations hit an impasse but resumed in 2011 when ministers agreed to concentrate on topics where progress was most likely to be made.32 They are not expected to be completed in the near future.

As U.S. lawmakers consider policy options for agriculture, other countries will likely be evaluating not only whether, in their view, these options will comply with the U.S. commitments under the AoA but also how they reflect on the U.S. negotiating position in WTO multilateral talks. The U.S. objective, in the past, has been for the negotiations to result in substantial reductions in trade-distorting support and for stronger rules that ensure that all production-related support is subject to discipline (to avoid costly and time-consuming challenges via the WTO Dispute Settlement process)33 while still preserving criteria-based "green box" policies that can support agriculture in ways that minimize trade distortions. At the same time, Congress might seek domestic farm policy measures that it can justify as AoA- and SCM-compliant.

|

Figure 2. U.S. Amber Box Outlays Subject to AMS Spending Limit |

|

|

Source: WTO, annual notifications of the United States through |

|

|

Source: WTO, annual notifications of the United States through Note: In the initial WTO agreement, "developed" countries made AMS reduction commitments from a 1986-1988 base period average by 20% in six equal installments during 1995-2000. Amber box spending limits have been fixed since 2000 at $19.1 billion. |

Author Contact Information

Footnotes

| 1. |

|

| 2. |

See CRS Report |

| 3. |

See CRS Report |

| 4. |

For example, see CRS Report R42442, Expiration and Extension of the 2008 Farm Bill. |

| 5. |

The WTO is a global rules-based, member-driven organization dealing with the rules of trade between nations. As of |

| 6. |

For a complete list of WTO agreements and their text, see WTO, The Legal Texts (Cambridge University Press and World Trade Organization, 1999), https://www.wto.org/english/docs_e/legal_e/legal_e.htm. |

| 7. |

See CRS In Focus IF10436, Dispute Settlement in the World Trade Organization: Key Legal Concepts. |

| 8. |

See CRS Report RL32916, Agriculture in the WTO: Policy Commitments Made Under the Agreement on Agriculture. |

| 9. |

See CRS Report RS22522, Potential Challenges to U.S. Farm Subsidies in the WTO: A Brief Overview. |

| 10. |

For example, see CRS Report |

| 11. |

These spending and subsidy commitments are detailed in each member's country schedule. For more information, see CRS Report RL32916, Agriculture in the WTO: Policy Commitments Made Under the Agreement on Agriculture. |

| 12. |

WTO special and differential treatment exemptions are reserved for "developing" countries and are thus not relevant for evaluating U.S. domestic farm policy. |

| 13. |

The AoA, Part I, Article 1(a), defines AMS as the annual level of support, expressed in monetary terms, provided for an agricultural product in favor of the producers of the basic agricultural product or non-product-specific support provided in favor of agricultural producers in general other than support provided under programs that qualify for exemption as described in the remainder of this report. |

| 14. |

For developed member countries, the AMS was to be reduced from a 1986-1988 base period average by 20% in six equal annual installments during 1995-2000. For the United States, the initial 1986-88 AMS base was $23.879 billion. This was lowered to $19.103 billion by 2000, where it has been fixed ever since. |

| 15. |

General domestic support (not specific to any one commodity, such as rural infrastructure or extension) that is below 5% of the value of total agricultural production is deemed sufficiently benign that it does not have to be included in the amber box. Similarly, support for a specific commodity (such as |

| 16. |

The term red box is not actually used by the WTO but is included here to complete the traffic light analogy. |

| 17. |

WTO, "WTO Documents Online," https://docs.wto.org/dol2fe/Pages/FE_Search/FE_S_S003.aspx. |

| 18. |

For details, see CRS Report RS22522, Potential Challenges to U.S. Farm Subsidies in the WTO: A Brief Overview. |

| 19. |

Part II: Prohibited Subsidies, Articles 3-4, and Part III: Actionable Subsidies, Articles 5-7, ASCM, WTO Legal Texts, http://www.wto.org/english/docs_e/legal_e/legal_e.htm. |

| 20. |

The final interpretation of significant is left to a WTO panel. However, two notable trade economists suggest that economic and statistical modeling can be used to show causal linkages between specific agricultural support policies and prejudicial market effects as measured by market share, quantity displacement, or price suppression. Richard H. Steinberg and Timothy E. Josling, "When the Peace Ends: The Vulnerability of EC and US Agricultural Subsidies to WTO Legal Challenge," Journal of International Economic Law, vol. 6, no. 2 (July 2003), pp. 369-417. |

| 21. |

WTO dispute settlement data as of |

| 22. |

See CRS |

| 23. |

The so-called green box is actually Annex 2 of the AoA, WTO Legal Texts. |

| 24. |

AoA, WTO Legal Texts, Article 6.5. |

| 25. |

An example of a production-limiting program is the now-abandoned U.S. target-price, deficiency-payment program that linked payments to land set-aside requirements. The target-price, deficiency-payment program was first established under the 1973 farm bill (the Agricultural and Consumer Protection Act of 1973; P.L. 93-86) and was terminated by the 1996 farm bill (The Federal Agriculture Improvement and Reform Act of 1996; P.L. 104-127). As a result, the United States only notified blue box payments under this program for 1995. |

| 26. |

AoA, WTO Legal Texts, Article 6.4. |

| 27. |

Data are from the U.S. notification to the WTO Committee on Agriculture, domestic support commitments (Table DS:1 and the relevant supporting tables) for the marketing year |

| 28. |

|

| 29. |

CRS Report R43336, The WTO Brazil-U.S. Cotton Case. |

| 30. |

Carl Zulauf and David Orden, U.S. Farm Policy and Risk Assistance: The Competing Senate and House Agriculture Committee Bills of July 2012, International Centre for Trade and Sustainable Development, http://www.ictsd.org. |

| 31. |

For more information, see CRS Report RS22927, WTO Doha Round: Implications for U.S. Agriculture. |

| 32. |

WTO, Agriculture Negotiations |

| 33. |

As exemplified by the recent U.S. challenge of China's domestic support for agricultural producers. WTO, Dispute Settlement cases, DS511: China—Domestic Support for Agricultural Producers, first initiated by the United States on September 13, 2016, https://www.wto.org/english/tratop_e/dispu_e/cases_e/ds511_e.htm. |