Iran Conflict and the Strait of Hormuz: Oil and Gas Market Impacts

Changes from August 6, 2018 to August 4, 2025

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Iran's Threats, the Strait of Hormuz, and Oil Markets: In Brief

Iran Conflict and the Strait of Hormuz: Oil and Gas Market Impacts

Updated August 4, 2025 (R45281)Contents

- Introduction

- Jump to Main Text of Report

Contents

- Introduction

Congressional Interest - The Strait of Hormuz

-

- The Importance of the Strait of Hormuz for Global Energy Markets

- Oil: Still of Greatest Importance

- Natural Gas: A New Consideration

The United States and Sanctions -

- Iran's Perspective

- U.S. Confidence in Keeping the Strait Open

Figures

Tables

Table A-Iran's Perspective - Iranian Options Regarding the Strait

- Oil and Natural Gas Market Considerations

Introduction

The exchanges of threats between members of the governments of Iran and the United States, including the presidents of both countries, have again raised the specter of an interruption of1. Selected Iran-Related Events and Oil Price Changes

Summary

Conflict in June 2025 involving Iran, Israel, and the United States raised the specter of interrupted shipping through the Strait of Hormuz (the Strait), a key waterway in the Persian Gulf (Gulf). The Strait, which borders Iran and Oman, is a key waterway, particularly for the transit of oil and natural gas to world markets. In the first half of 2018, approximately 18 million barrels per day (bpd) of crude oil and condensate, almost 4 million bpd of petroleum products, and over 300 million cubic meters per day in liquefied natural gas (LNG) exited the Strait. Iran accounted for about 10% of oil and 0% of the natural gas through the Strait. In a speech on July 22, Iranian President Rouhani stated, "We are the…guarantor of security of the waterway of the region throughout the history. Don't play with the lion's tail; you will regret it."1 (Western reporting took the reference to the waterway to mean the Strait of Hormuz, which is the narrow waterway that forms the entrance to the Persian Gulf from the Gulf of Oman and ultimately the Arabian Sea. See Figure 1). To which President Trump tweeted, "NEVER, EVER, THREATEN THE UNITED STATES AGAIN OR YOU WILL SUFFER CONSEQUENCES THE LIKES OF WHICH FEW THROUGHOUT HISTORY HAVE EVER SUFFERED BEFORE…"2 Earlier, on July 3, President Rouhani stated, "The Americans have claimed they want to completely stop Iran's oil exports. They don't understand the meaning of this statement, because it has no meaning for Iranian oil not to be exported, while the region's oil is exported."3

This is not the first time Iran's leaders have threatened to close or hinder shipping through the Strait of Hormuz. Prior to sanctions targeting Iran's oil exports in 2011/12, Iranian leaders threatened to close the Strait of Hormuz.4 Press reports that Iran is about to begin a large naval exercise in and around the Strait in early August 2018 is likely to inflame tensions further.

Congressional Interest

With the U.S. withdrawal from the Joint Comprehensive Plan of Action (JCPOA) on May 8, 2018, there may be increased potential for Congress to consider legislation regarding sanctions on Iran. A number of bills, mostly prior to the May 8 withdrawal, have been introduced in the 115th Congress targeting aspects of Iran's leadership, military, and economy.

The Strait of Hormuz

Iran's extensive Persian Gulf coast and its military capabilities have long given Iran the potential ability to project power throughout the region, including over energy trade. Iran's threatened and actual attempts to disrupt energy commerce in the Gulf have carried strategic benefits and risks for Tehran, including by bringing Iran into direct conflict with the United States in 1987-1988. After initially rising, oil and natural gas prices have returned to levels below where they were at the beginning of the June 2025 conflict (on June 13) and also lower than when the United States carried out strikes against Iranian nuclear sites (on June 21). The drop in prices may indicate that market participants assess that Iran will not curtail supply by closing the Strait. On June 23, 2025, Iran's parliament voted in support of closing the Strait; a final decision would require approval by Iran's Supreme National Security Council and Supreme Leader. Iran has the military capacity—using mines, speed boats, submarines, shore-based cruise missiles, aircraft, and other systems—to disrupt the flow of commercial shipping into and out of the Persian Gulf. There also appears to be a consensus that the U.S. military has the capacity to counter Iran's forces and restore the flow of shipping, if necessary. However, such an effort would likely take some time—days, weeks, or perhaps months—particularly if a large number of Iranian mines needed to be cleared from the Gulf. Iran does not appear to have taken steps to actively attempt to disrupt the Strait's shipping during the June 2025 conflict with Israel; it remains unclear whether Iran was unwilling or unable to do so. On June 21, the United States bombed Iranian nuclear sites. Following the bombing, on June 23, Iran's parliament voted in support of closing the Strait of Hormuz; a final decision would require approval by Iran's Supreme National Security Council and Supreme Leader.4 Congress is interested in any potential closure or threat of closure of the Strait of Hormuz because such a closure could impact global oil and natural gas prices, among other impacts. Congressional concern has risen in the wake of the June 2025 conflict as regional stability remains uncertain. This concern could prompt congressional oversight regarding the possible consequences of a Strait closure and related U.S. policy options, including military action or sanctions. On June 24, the military's role in keeping the Strait open was raised in a Senate confirmation hearing.5 In 1987-1988, U.S. military operations in the Gulf to counter Iranian threats to international shipping prompted congressional action, including multiple hearings. Some Members of Congress also introduced legislation at that time to require Administration reports on U.S. military plans in the Gulf (Section 8 of P.L. 100-71) and to call for U.S. partners to reimburse the United States for military operations in the Gulf (H.Res. 249 and S.J.Res. 213). The June 2025 conflict, which did not include active Gulf maritime hostilities as was the case in 1987-1988, did not prompt similar congressional action. The Strait of Hormuz is the narrow waterway that forms the entrance to the Persian Gulf from the Gulf of Oman and ultimately the Arabian Sea. At its narrowest point, it is 22 nautical miles wide and falls within Iranian and Omani territorial waters. There are two shipping lanes through the Strait, one in each direction. Each is two miles wide and they are separated by a two-mile buffer.

Source: S&P Global subscription service. Notes: Locations of icons are indicative and are not precise locations. Icons may also represent an oil or natural gas complex with additional infrastructure or multiple units. LNG = liquefied natural gas. Oil production, trade, and refining in the Middle East are critically important for global oil markets. The region hosts more than 30% of world crude oil production, more than 90% of standby crude oil production capacity, and approximately 11% of refining capacity.6 Further, more than 40% of global crude oil exports and more than 20% of oil product exports depart from countries located in the broader Middle East region.7 Most of these oil exports are loaded in the Gulf and transit the Strait of Hormuz for delivery to buyers in Asia, including China, India, South Korea, and Japan. However, oil supply disruptions in the Middle East region could affect oil prices throughout the world, including crude oil and gasoline prices in the United States. The magnitude of actual price effects, and the resulting impacts on inflation and broader economic conditions, would be a function of the size and duration of an actual supply disruption; the ability to reroute oil exports from the region; and the ability of spare production capacity, emergency response measures, and commercial inventories elsewhere to compensate for Middle East supply losses. During calendar year 2024, approximately 20 million barrels per day of oil (crude oil and petroleum products) moved through the Strait of Hormuz.8 These volumes represented approximately 27% of global maritime oil trade and roughly 20% of world petroleum liquids consumption in 2024.9 Middle East oil supply disruptions could take many forms, including threats to oil production and trade; kinetic attacks on oil production, storage, refining, pipeline, and export infrastructure; targeted attacks on oil tankers; and attempts to halt oil transit through the Strait. While each scenario could affect oil supply and prices in various ways, prohibiting all oil shipments through the Strait of Hormuz would materially affect global oil supply and could result in rapid price escalation for crude oil and petroleum products as buyers looked to source oil from other suppliers, commercial inventories were drawn down, and markets sought price equilibrium. Exactly how long prices might remain elevated would be determined by the duration of an effective closure of the Strait, including the time necessary for oil tankers and insurance providers to regain confidence operating in the region. While the likelihood of a complete closure is uncertain, a sustained 20-million-barrels-per-day oil supply disruption could motivate several international market and government responses. First, Middle East oil exporters could look to bypass the Strait by rerouting oil movements. For example, Saudi Arabia could maximize throughput on the East-West crude oil pipeline to the Red Sea, and the United Arab Emirates could maximize throughput on the Abu Dhabi crude oil pipeline to the Gulf of Oman. While analyst assessments vary, the U.S. Energy Information Administration estimates that, combined, these pipelines currently have approximately 2.6 million barrels per day of available capacity.10 Second, global spare production capacity—generally defined as the potential increase in production volumes that can be made available within 30 days and sustained for 90 days—could be activated.11 As of May 2025, the International Energy Agency (IEA)12 estimates available spare crude oil production capacity of approximately 5.4 million barrels per day.13 However, more than 90% of spare production capacity is located in Middle East countries that export crude oil through the Strait, thereby limiting the effectiveness of this standby source of supply to address oil trade disruptions in the region. Third, government-controlled strategic oil stocks could be activated and drawn down as a means of calming markets by providing supplemental supply. Finally, market participants could withdraw crude oil and petroleum products from commercial inventories. With respect to sudden and acute oil supply disruptions, the IEA administers a collective emergency response system for IEA member countries in accordance with the Agreement on an International Energy Program (IEP), a multilateral voluntary agreement established in the wake of the 1973 energy crisis. The United States is an IEA member and IEP participant. The collective response system includes a variety of measures intended to either increase oil supply or restrain oil demand.14 One pillar of the response system is a requirement that all member countries maintain government-controlled oil stocks equal to 90 days of net imports during the previous calendar year. IEA government-controlled stocks were more than 1.2 billion barrels at the end of the first quarter of 2025, including approximately 400 million barrels of crude oil held in the U.S. Strategic Petroleum Reserve (SPR).15 The President of the United States has authority to unilaterally direct a drawdown and sale of SPR crude oil to address severe energy supply interruptions.16 However, emergency SPR drawdowns are typically coordinated with the IEA. Government-controlled emergency oil stocks are supplemented by obligated industry stocks, consistent with country-level stockholding policies. Obligated industry stocks are estimated at approximately 900 million barrels.17 According to IEA analysis, the maximum achievable drawdown rate for IEA oil stocks (i.e., government-controlled and obligated industry stocks) could be as much as 24 million barrels per day for two months.18 Drawdown rates quickly decline thereafter and emergency stocks would be exhausted in approximately six months.19 A prolonged disruption of Middle East oil trade would create oil market conditions for which there is no historical precedent. The efficacy of emergency response measures could be tested up to their design limits. Oil prices would likely experience significant upward price pressure. Exactly how high and for how long prices might be elevated is uncertain and would be determined by the amount of time needed to normalize Middle East oil trade. Although natural gas is more of a local or regional commodity than oil, with 72% of natural gas being consumed in the country that produced it, natural gas has been moving toward becoming a more global commodity like oil. Trade in natural gas is almost evenly split between exports by pipeline (52%) and as liquefied natural gas (LNG). The entry of the United States as an LNG exporter, beginning in 2016, from the lower 48 states changed the way LNG is bought, sold, and priced around the world. During past conflicts in which the shipment of energy products was at risk, the main focus was the oil market, with minor consideration for natural gas. However, over the last few years, geopolitical events—such as Russia's invasion of Ukraine—have highlighted the importance of natural gas in the global economy. Approximately 22% of the world's LNG exports need to transit the Strait, primarily from Qatar and the United Arab Emirates (UAE).20 Most Qatari exports are destined for Asian markets, including China (24%).21

June 2025 Source: Bloomberg data subscription service. Notes: June 19, 2025, was a holiday in the United States, so no price data were collected on that day. European prices rose after the Israeli attacks, almost rising to a new high for the month on June 23. In the wake of the U.S. attacks on June 21, European prices fell steadily for the rest of the month, finishing June lower than where they began. Asian natural gas prices fell on the day of Israel's first bombing, then rose and reached their peak on June 24, the day after the U.S. raids. Prices in Asia at the end of June were still above where they were at the beginning of June, but they had declined from their peak. With prices being down in the three regions, relative to the middle of June when the war started, the markets seem to indicate that buyers and sellers do not expect natural gas supply to be curtailed because of the conflicts. That said, there are many factors that affect prices and that may push prices higher or lower. An important consideration for natural gas, should the Strait be closed in some way, is that most major gas-consuming countries do not have a strategic natural gas reserve in the same way they have a strategic reserve for oil. A decrease in the flow of natural gas could not be mitigated by a release from a strategic natural gas reserve. Output could be increased from liquefaction plants at LNG terminals outside of the Persian Gulf, but most LNG terminals already operate at a very high percent of capacity because of the cost of construction. Escalatory sanctions targeting Iran and its energy sector have sometimes contributed to U.S.-Iranian frictions in or near the Strait of Hormuz.25 For example, tensions flared amid President Trump's announcement in 2018 (via Executive Order [E.O.] 13846) that the United States would no longer participate in the Joint Comprehensive Plan of Action (JCPOA) and that U.S. sanctions suspended to implement the JCPOA would be reinstated.26 Reimposed sanctions included those related to the Iranian energy, shipping, and shipbuilding sectors and certain activity involving petroleum, petroleum products, or petrochemical products from Iran.27 Subsequently, in 2019, the U.S. Department of the Treasury announced sanctions on multiple senior Islamic Revolutionary Guards Corps (IRGC) commanders for having threatened to close the Strait of Hormuz and having engaged in "destabilizing and provocative naval actions in and around the Strait of Hormuz."28 Most recently, in late 2024, the Secretary of the Treasury added the petroleum and petrochemical sectors of the Iranian economy to the list of sectors subject to sanctions under E.O. 13902 (2020).29 Secondary sanctions under E.O. 13902 can reach third parties operating or supporting movement of Iranian oil to the People's Republic of China (PRC or China) and other countries.30 Hundreds of entities in Iran and other countries have been targeted by U.S. sanctions for their role in the export of Iranian oil. Although broad authority exists to sanction Iran's energy sector, variations in sanctions enforcement or other considerations may affect the practical effects of such sanctions on Iran's economy (and, in turn, Iran's potential willingness to threaten the status or security of the Strait of Hormuz).31 In a social media post on June 24, 2025, President Trump wrote that the People's Republic of China was not prohibited from purchasing Iranian oil, raising the question of whether U.S. sanctions would be relaxed.32 Earlier, in February 2025, President Trump issued National Security Presidential Memorandum (NSPM) 2, directing a "maximum pressure" campaign against Iran that, among other goals, seeks "to drive Iran's export of oil to zero, including exports of Iranian crude to the People's Republic of China."33 China is the primary importer of Iranian oil. U.S. sanctions targets in 2025 have included purported PRC-based "teapot" oil refineries; "shadow fleet" vessels that move Iranian oil through deceptive shipping practices; operators of a PRC-based port terminal; and Hong Kong-based front companies that broker Iranian oil shipments.34 Iran has the longest coastline of the eight countries that border the Persian Gulf, and its exclusive economic zone on the Gulf is nearly twice the size of the next largest country's. Iran's extensive Persian Gulf coast and its military capabilities have given Iran the potential ability to project power throughout the region, including by threatening the free flow of energy resources. Iran's threatened and actual attempts to disrupt energy commerce in the Gulf have carried strategic benefits and risks for Iran, including by sometimes bringing Iran into direct conflict with the United States. In the late 1980s, toward the end of the 1980-1988 Iran-Iraq War, Iranian forces laid mines throughout the Persian Gulf, including in the Strait of Hormuz, as part of the so-called "tanker war." With the conflict largely stalemated on land, Iranian and Iraqi forces each attacked the other nation's energy infrastructure in the Gulf, as well as tankers carrying oil from the other nation and from third countries. The United States sought to deter such attacks and guarantee the free flow of energy commerce through the Gulf in a series of military operations, including the following: Since U.S.-Iran tensions again began to rise in the late 2000s, Iranian leaders have at various points raised the prospect of responding to U.S. sanctions or military action by disrupting shipping in the Strait of Hormuz.36 Iran has two parallel militaries: the Artesh, or regular military, and the Islamic Revolutionary Guard Corps (IRGC), which has a more ideological character and direct role in regime security. Each entity has its own naval forces—the Artesh has the Islamic Republic of Iran Navy (IRIN), and the IRGC has the IRGC Navy (IRGCN). These naval forces have in the past been seen as competing with each other.37 In a 2007 reorganization, the IRGCN was assigned sole responsibility for the Persian Gulf; the IRIN was assigned responsibility for waters beyond the Gulf; and the two forces were assigned shared responsibility for the Strait of Hormuz (with both forces maintaining bases on or near the Strait).38 Iran could attempt to disrupt shipping through the Strait by various means, including the following: Some discount the prospect of Iran "closing" the Strait, given Iran's own use of the waterway to export oil (mostly to China).46 Nearly all of Iran's oil exports are transported by sea and originate in the Gulf (largely at Kharg Island, Iran's primary oil terminal). Iran would not be able to quickly reroute trade through ports outside the Strait or via overland trade routes. It is possible that, depending on how Iran might seek to disrupt shipping, the Strait could still be navigable for Iran's own vessels; "closure" might not necessarily constitute a physical or other impediment that Iran would impose on itself. For example, Iran could possibly bring about the effective closure of the Strait without the actual use of military force. Threats or other public statements intended to deter tankers from transiting the Strait could accomplish much the same objective if tankers and other actors in the oil trade conclude that the potential costs of Iranian attacks exceed the potential benefits of transiting the Strait, regardless of any military actions that Iran might or might not take.47 Iranian threats that have the effect of cutting off shipping through the Strait, even if not accompanied by Iranian military action, could prompt U.S. military action to restore confidence in tankers' ability to safely transit the Strait. The desire to avoid the risk of U.S. military actions seems to be a probable reason for Iran to choose not to close the Strait. Iran may also want to avoid alienating its Gulf neighbors (with which Iran has improved relations in recent years) and its own oil customers. Iranian disruptions to the export of other Gulf states' energy resources, to China and other countries, could strain Iran's ties with all parties. Still, some speculate that if Iran were to perceive that it had "nothing to lose," in the context of U.S. or Israeli strikes on Iran's own petroleum export capabilities, it could attempt to close the Strait.48 Iran's June 2025 conflict with Israel and the United States—including Israeli airstrikes throughout the country on senior military leaders and strategic sites, U.S. airstrikes against Iran's nuclear facilities, and veiled or direct threats against the life of the Supreme Leader—raised concerns among some observers that Iranian leaders might attempt to close the Strait. Yet Iran does not appear to have done so during the conflict, despite having reportedly taken some actions that U.S. officials interpreted as preparations to mine the Strait.49 It remains unclear what kinds of strategic conclusions U.S. and other policymakers could draw from these circumstances. Iranian leaders may have been unable to take action to close the Strait, given blows to Iran's ballistic missile capabilities, its military chain of command (including the deaths of senior IRGC commanders and the reported inaccessibility of the Supreme Leader, who was in hiding), and its air defenses, which were unable to prevent Israeli air forces from achieving what Israeli leaders described as "air superiority" in Iran's airspace. Alternatively, Iran's leaders could have concluded that closure was achievable but not advisable, possibly due to assessments that those risks to regime stability from the conflict were less than the risks of closure as described above. Iranian strategic calculations in future conflict scenarios could be shaped by factors such as the extent of Israeli and/or U.S. military involvement, Iran's own military capabilities, perceived existential threats to the Islamic Republic, the risk tolerance of future Iranian political or military leaders, and Iran's relations with China and other countries. Among observers who track Iran's armed forces, there appears to be a general consensus that Iran has the military capacity to seriously affect maritime commerce transiting the Strait.50 There also appears to be consensus that the U.S. military has the capacity to counter Iran's forces and restore the flow of shipping in the event of Iranian attempts to disrupt the Strait.51 The effort would likely take some time—days, weeks, or perhaps months—particularly if a large number of Iranian mines needed to be cleared from the Gulf. However, U.S. forces are presumably monitoring for mine deployment and might interrupt such an initiative by Iran before a large number of mines could be deployed. Such intervention, in turn, could run the risk of more extensive military engagement. An Iranian attempt to close the Gulf to shipping could take many forms, as could a U.S. and coalition military response. In a military confrontation between Iran and the United States and other countries over the flow of shipping into and out of the Gulf, events could unfold and culminate rapidly, within a few hours or days, or more slowly, over a period of weeks or months. There might be multiple rounds of Iranian initiatives and U.S. and coalition responses, with quieter periods in between. During such events, there might be few or no moments when the Gulf would be fully closed (i.e., no ships entering or leaving) or fully open (i.e., ships entering or leaving with no risk of Iranian harassment or attack). The confrontation would carry a risk of escalating to a wider military conflict between Iran and the United States and coalition partners. A June 19, 2025, press report stated The Navy has four minesweepers in the Persian Gulf, each with 100 sailors aboard who have been based in Bahrain and are trained in how to deal with underwater hazards. Should Iran place mines in the Strait of Hormuz or other parts of the Persian Gulf, a small Navy contingent in Bahrain called Task Force 56 would respond. Usually led by a senior explosive ordnance disposal officer, the task force would take advantage of technologies like autonomous underwater vehicles that can scan the seafloor with sonar much more quickly than the last time Iranian mines threatened the strait. And while the Navy has been experimenting with underwater robots to destroy mines, the task force will still need to deploy small teams of explosive ordnance disposal divers for the time-consuming and dangerous task of approaching each mine underwater and carefully placing charges to destroy it.52 Other scenarios could involve different assets and strategic approaches by Iran, the United States, or other regional actors. Confrontations between U.S. and Iranian forces could escalate into wider military conflict and/or lead to diplomatic engagement, or end without definitive resolution. Event Price Changes Commentary Prior Month Next Month 0.1% 0.5% The monthly oil price did not change substantially prior to this conflict and even a month after it began. However, six months into the conflict oil prices were up 11%. "Tanker War" begins, 3/27/1984 -0.2% -0.9% Re-flagged Bridgeton hits a mine (Operation Earnest Will), 7/24/1987 -1.6% -1.1%The Strait of Hormuz is the narrow waterway that forms the entrance to the Persian Gulf from the Gulf of Oman and ultimately the Arabian Sea. At its narrowest pointRoughly 27% of the world's crude oil and petroleum products maritime trade goes through the Strait. Additionally, 22% of global liquefied natural gas (LNG) trade passes through the Strait. The Strait's role as a critical conduit for oil and natural gas resources to reach global markets establishes its importance to the global economy. Key issues for U.S. policymakers include the potential for Iran to attempt to close the Strait to maritime commerce in connection with future military conflict in the region, and the possibility that doing so could disrupt markets and expand conflict further.

Introduction

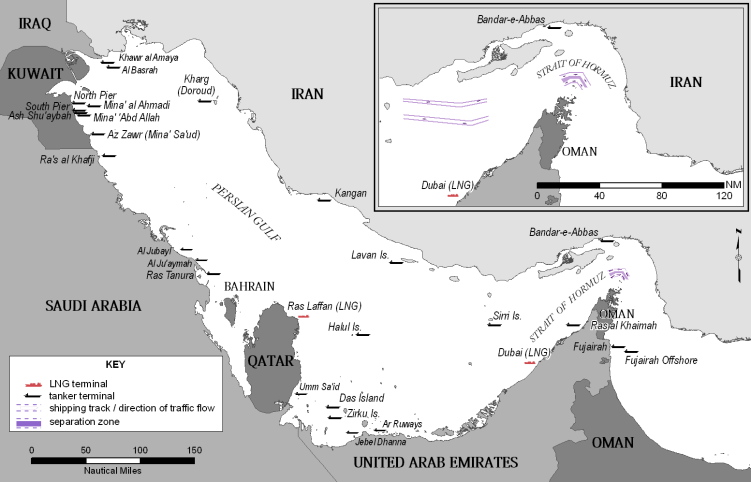

Conflict in June 2025 involving Iran, Israel, and the United States increased speculation about the ramifications of conflict in the region for the Strait of Hormuz (the Strait).1 The Strait is a key waterway for the transit of oil and natural gas to world markets. It sits at the entry point to the Persian Gulf (Gulf) from the Gulf of Oman; Iran lies to its north and Oman to its south.2 (See Figure 1.)

Historically, Iran has claimed to be the overseer of the Strait with the ability to "close" the Strait, and it has threatened to do so several times over the past two decades.3 It is not clear what closing the Strait could mean in the current situation. The Strait has never been completely closed, but Iran mined it in the 1980s, prompting U.S. military action, and has periodically harassed and attacked ships transiting the narrow waterway. (See the Appendix for additional information about events involving Iran and the impacts of those events on oil prices.) Unless and until clear alternatives to the Strait develop with significant capacity for moving Gulf oil, natural gas, and other commodities to world markets, the importance of the Strait for the global economy cannot be diminished.

The Strait of Hormuz is a key transit point for global oil and natural gas markets. The narrowness of the Strait, lack of alternative seaborne routes, limited land-based bypass capacity, and historical vulnerabilities during conflicts have made it a prominent chokepoint for oil and natural gas shipping. It would be challenging to replace volumes of both commodities if the Strait were closed, particularly in the short term.

Oil: Still of Greatest Importance

Start of Iran-Iraq War, 9/23/1980a

The "tanker war" included 44 attacks by Iran against tankers from other nations over the course of nine months. During this time, prices remained close to the March 27 price or lower, dropping 14% by the end of the period. The large drop was more reflective of the global oil market than the uncertainty created by the tanker war. Supply levels remained high during the time period, while demand was growing slowly.b

it is 22 nautical miles wide and falls within Iranian and Omani territorial waters. There are two shipping lanes through the Strait, one in each direction. Each is two miles wide and they are separated by a two-mile buffer.

The United States and Sanctions5

On May 8, 2018, President Trump announced that the United States would no longer participate in the Joint Comprehensive Plan of Action (JCPOA) and that all U.S. secondary sanctions suspended to implement the JCPOA would be reinstated after a maximum "wind-down period" of 180 days (November 4, 2018). The U.S. sanctions that are going back into effect target all of Iran's core economic sectors. The Administration has indicated it will not look favorably on requests by foreign governments or companies for exemptions to allow them to avoid penalties for continuing to do business with Iran after that time.6

It remains uncertain whether reinstated U.S. sanctions based on the U.S. unilateral exit from the JCPOA will damage Iran's economy to the extent sanctions did during 2012-2015, when the global community was aligned in pressuring Iran. During that timeframe, Iran's economy shrank by 9% per year, crude oil exports fell from about 2.5 million bpd to about 1.1 million bpd, and Iran could not repatriate more than $120 billion in Iranian reserves held in banks abroad. JCPOA sanctions relief enabled Iran to increase its oil exports to nearly pre-sanctions levels, regain access to foreign exchange reserve funds and reintegrate into the international financial system, achieve about 7% yearly economic growth, attract foreign investments in key sectors, and buy new passenger aircraft. The sanctions relief reportedly contributed to Iranian President Hassan Rouhani's reelection in the May 19, 2017, vote. Yet, perceived economic grievances still sparked protests in Iran from December 2017 to January 2018.

The announced resumption of U.S. secondary sanctions has begun to harm Iran's economy because numerous major companies have announced decisions to exit the Iranian market rather than risk being penalized by the United States.7 As an indicator of the effects, the value of Iran's currency sharply declined in June 2018, and some economic-based domestic unrest flared in concert. Smaller demonstrations and unrest have simmered since. If the European Union and other countries are unwilling or unable to keep at least the bulk of the economic benefits of the JCPOA flowing to Iran, there is substantial potential for Iranian leaders to decide to cease participating in the JCPOA.

Iran's Perspective

Threats of U.S. sanctions that could reduce Iran's oil export earnings is a key impetus to Iran's threats to close the Strait of Hormuz. Historically, United Nations and multilateral sanctions had sought to reduce Iran's ability to develop its nuclear program by undermining its ability to develop its energy sector—targeting investment and financial linkages—but not directly targeting Iran's ability to export oil.8 This changed in 2012.

Due to its own dependence on commerce through the Strait, Iran may be unlikely to attempt to close the waterway, but rather to shape the international debate on Iran policy. Oil exports are vital to the Iranian government's fiscal health and the Iranian economy as a whole. Iran relies on the Strait not only for its oil exports, averaging about 2.2 million bpd in the first half of 2018, but also for the imports of some needed food and medical products. Iran could attempt to re-route imports through ports outside the Strait, such as Jask, or via established overland trade routes through Pakistan or Iraq. In 2016, the International Monetary Fund (IMF) estimated Iran's oil exports account for between 50% and 60% of total exports and almost 15% of GDP.9 The latter shows that Iran has a relatively diversified economy. However, many experts see Iran's warnings regarding the Strait of Hormuz as a reiteration of its long-held position to defend its oil exports. This implies that the likelihood that Iran might attempt to close the Strait increases if a broad embargo on purchases of Iran's oil emerges, either from countries complying with U.S. secondary sanctions or reinstating their own.

By threatening traffic through the Straits, Iran may risk alienating other nations, including its neighbors and customers, almost all of whom opposed the U.S. exit from the JCPOA and still want to engage economically with Iran. Most of the oil from the Persian Gulf, including from Iran, goes to Asian nations, with India and China being Iran's largest oil customers. Within weeks of the United States withdrawing from the JCPOA and stating its intention to reimpose sanctions, India's Foreign Minister Sushma Swaraj was quoted saying, "India follows only U.N. sanctions, and not unilateral sanctions by any country."10 China has also indicated that it may not comply with the U.S. request to halt all imports from Iran.11 Turkey, Iran's fourth largest oil importer, reportedly told U.S. officials it will not comply, as well.12

Iranian Options Regarding the Strait

Outright Closure. An outright closure of the Strait of Hormuz, a major artery of the global oil market, would be an unprecedented disruption of global oil supply and would likely contribute to higher global oil prices. However, at present, experts assess this to be a low probability event. Moreover, were this to occur, it is not likely to be prolonged. U.S. Secretary of Defense James Mattis asserted on July 27 that Iran's doing so would trigger a military response from the United States and others to preserve the freedom of navigation in that waterway.13 The U.S. response could reach beyond simply reestablishing Strait transit.

Harassment and/or Infrastructure Damage. Iran could harass tanker traffic through the Strait through a range of measures without necessarily shutting down all traffic. This took place during the Iran-Iraq war in the 1980s. Also, critical energy production and export infrastructure could be damaged as a result of military action by Iran, the United States, or other actors. Harassment or infrastructure damage could contribute to lower exports of oil from the Persian Gulf, greater uncertainty around oil supply, higher shipping costs, and consequently higher oil prices. However, harassment also runs the risk of triggering a military response and alienating Iran's remaining oil customers.

Continued Threats. Iranian officials could continue to make threatening statements without taking action. Alternately, Iran could conduct naval exercises in the waterway that raise tensions, whether or not any offensive action is planned. Cable News Network reported that the Islamic Revolutionary Guard Corps (IRGC) Navy, which is responsible for Iran's defense of the Strait, plans a naval exercise in the Strait in early August, involving dozens of Iran's small boats.14 The statements and maneuvers could still raise energy market tensions and contribute to higher oil prices, though only to the degree that oil market participants take such threats seriously.

Oil and Natural Gas Market Considerations

The Strait of Hormuz is a key route of the global oil market. Persian Gulf oil exporters—Iraq, Kuwait, Saudi Arabia, the United Arab Emirates (UAE), and Qatar—shipped almost 22 million bpd of oil and products through the Strait in the first half of 2018, which is roughly 24% of the global oil market.15 On average, 33 oil and LNGs tankers exited the Persian Gulf through the Strait each day with most of the crude oil and natural gas going to Asian countries, including China, Japan, India, and South Korea. According to the U.S. Energy Information Administration (EIA), the United States imported 1.7 million bpd of crude oil from Persian Gulf countries in 2017, less than 10% of U.S. consumption and no natural gas. Separately, about 28% of the world's liquefied natural gas (LNG) trade, equal to about 3% of global natural gas consumption, moves through the Strait each year.16 This primarily entails exports from Qatar to Europe and Asia.

The Persian Gulf is also home to the world's spare oil production capacity. Some members of the Organization of the Petroleum Exporting Countries (OPEC), primarily Saudi Arabia, hold spare capacity as a result of their market management strategy. Kuwait and the United Arab Emirates hold small amounts of spare capacity as well. Spare capacity is viewed as a cushion to the oil market which can be used to offset supply disruptions. However, given its location, this spare capacity might not be available to offset a disruption to the Strait of Hormuz.

There are alternative oil pipeline routes to bypass the Strait, but not enough to account for all the oil that transits the Strait. According to EIA, there are three pipelines that transport oil from Saudi Arabia and the United Arab Emirates that go around the Strait—East-West Pipeline and Abqaiq-Yanbu Natural Gas Liquids Pipeline from Saudi Arabia, and the Abu Dhabi Crude Oil Pipeline from the UAE. As of 2016, when EIA last reported on these pipelines, the East-West Pipeline and the Abu Dhabi Crude Oil Pipeline could take additional volumes of oil, approximately 2.9 million bpd and 1.0 million bpd, respectively. This would leave approximately 18 million bpd stranded should the Strait of Hormuz be closed.

A disruption of oil through the Strait of Hormuz could significantly affect global oil prices. Though most of the oil that flows through the Strait goes to Asia, the oil market is globally integrated and a disruption anywhere can contribute to higher oil prices everywhere. For example, a disruption of oil exported from the Persian Gulf to Asia would leave Asian refineries bidding for oil from alternative sources. While actual disruptions and perceived disruption risks in the past have contributed to prices being higher than they might have otherwise been, actual Iran-related events since 1980 have not necessarily resulted in clear and significant price increases ex-post (see able 1). Additionally, oil prices tend to quickly experience large price movements when supply deficits are in the 1.5 million bpd and 2 million bpd range. A supply deficit of 18 million bpd to 22 million bpd, an amount the market has never had to deal with, would likely result in significant upward pressure on prices. The numerous variables affecting the price of oil at any given time can make it difficult to estimate what specific change in price is due to a specific event. Nonetheless, reductions or threatened reductions to supply do tend to push oil prices up.

Key uncertainties for the impact of a disruption include how much global oil supply was reduced, risks of further reductions, and duration of the disruption. Risk of damage to oil production and export facilities in the Persian Gulf would also be of concern. Given limited bypass options, outright closure of the Strait would represent an unprecedented disruption to global oil supply and would likely cause a substantial increase in oil prices. However, as suggested above, outright closure may be unlikely, and even if it occurred, might not persist for very long.

In the event of a disruption, consumer countries would likely release strategic stocks to offset the impact on oil supply. As of May 2018, the United States held 660 million barrels of crude oil in the Strategic Petroleum Reserve (SPR),17 a government held stockpile of crude oil to be used to offset supply disruptions.18 The United States coordinates use of its SPR with other members of the International Energy Agency (IEA), which include Japan, Germany, South Korea, and other members of the Organization for Economic Cooperation and Development (OECD). Some non-IEA countries, such as China, also hold strategic stocks, and may or may not coordinate with an IEA member release. Oil importing members of the IEA have an obligation to hold oil stocks equal to at least 90 days-worth of net imports. As of April 2018, IEA member countries held about 4.4 billion barrels of crude oil and refined products in inventory, of which 1.6 billion are held by governments.19 If drawn down at the maximum rate technically possible, these government-held stocks could be delivered to the market at an average rate of 10.4 million bpd of crude oil and 4 million bpd of products in the first month of an IEA collective action, diminishing thereafter.20 (The rate diminishes as stocks are depleted.) By offsetting the loss of supply, a strategic stock release could blunt the impact a disruption can have on oil prices.

|

Event |

Price Changes |

Commentary |

|||

|

Prior Month |

Next Month |

||||

|

0.1% |

0.5% |

The monthly oil price did not change much prior to this conflict beginning and even a month into it. However, six months into the conflict oil prices were up 11%. |

||

|

"Tanker War" begins, 3/27/1984 |

-0.2% |

-0.9% |

| ||

|

Re-flagged Bridgeton hits a mine (Operation Earnest Will), 7/24/1987 |

-1.6% |

-1.1% |

| ||

Operation Praying Mantis, 4/18/1988 |

10.7% |

-4.6% |

10.7% -4.6% | ||

Iran arms Strait of Hormuz, 3/28/1995 |

2.5% |

4.9% |

2.5% 4.9% | ||

Iran threatens the Strait, 12/28/2011 |

1.0% |

0.2% |

1.0% 0.2% | ||

United States withdraws from JCPOA, 5/8/2018 |

3.5% |

-0.9% |

3.5% -0.9% | ||

Source: U.S. Energy Information Administration, Annual Oil Market Chronology, http://www.eia.gov/emeu/cabs/AOMC/8089.html.

U.S. assassination of Gen. Qasem Soleimani, 1/3/2020 12.2% -20.5% The killing of General Soleimani put upward pressure on oil prices, as it increased uncertainty about Middle East oil production and exports. By the month after the assassination, prices had dropped significantly. Israel bombs Iran, 6/13/2025 8.5% -4.4% The rise in prices likely reflected a variety of pressures from tensions in the Middle East, tariffs, and other market uncertainties. After the initial Israeli attacks, which were followed by the U.S. attack on Iran's nuclear facilities, prices jumped by approximately $5 per barrel. However, after the end of conflict, the market quickly returned prices to pre-attack levels or lower.Notes:

Source: U.S. Energy Information Administration (EIA), Annual Oil Market Chronology (discontinued publication). Crude prices are NYMEX West Texas Intermediate crude prices (daily) except 1980, which is refiners acquisition cost of crude reported by EIA (monthly).

Notes: OPEC = Organization of the Petroleum Exporting Countries. JCPOA = Joint Comprehensive Plan of Action. A negative Prior Month price indicates that average 30-day price prior to the action datadate was greater than the price on the action date and therefore negative. A negative Next Month price means that the price on the action date was greater than the average 30-day price following the action date.

.

a. Although there were events leading up to September 23, 1980, that contributed to hostilities, this date is used as a start date to the military conflict.

b. U.S. Energy Information Administration (EIA)

b. EIA, Short-Term Energy Outlook, DOE/EIA-0202(84/3Q), Washington, DC, August 1984, p. 12, http://www.eia.gov/forecasts/steo/archives/3Q84.pdf.

c. EIA, Short-Term Energy Outlook, DOE/EIA-0202(87/4Q), Washington, DC, October 1987, p. 9, http://www.eia.gov/forecasts/steo/archives/4Q87.pdf.

d. EIA, Short-Term Energy Outlook, DOE/EIA-0202(88/2Q), Washington, DC, April 1988, p. 7, http://www.eia.gov/forecasts/steo/archives/2Q88.pdf.

Author Contact Information

Footnotes

| 1. |

Office of the President of Iran, press release, July 22, 2018, http://www.president.ir/en/105359. |

| 2. |

Joshua Berlinger, "Trump Tweets Explosive Threat to Iran," CNN, July 23, 2018, https://www.cnn.com/2018/07/23/politics/trump-iran-intl/index.html. Capitalization is not for emphasis. |

| 3. |

Silke Koltrowitz, "Iran's Rouhani Hints at Threat to Neighbors' Exports if Oil Sales Halted," Reuters, July 3, 2018, online edition. |

| 4. |

J. David Goodman. "Iran Warns U.S. Aircraft Carrier Not to Return to Gulf and a Strategic Strait." New York Times, January 4, 2012. |

| 5. |

This section is drawn from the work of CRS analyst [author name scrubbed]. For additional information on Iran sanctions and the U.S. withdrawal, see CRS Report RS20871, Iran Sanctions, by [author name scrubbed], or CRS Report R43333, Iran Nuclear Agreement and U.S. Exit, by [author name scrubbed] and [author name scrubbed]. |

| 6. |

See, for example, Brian Hook, "Briefing with an Iran Diplomacy Update," Department of State, July 2, 2018, https://www.state.gov/r/pa/prs/ps/2018/07/283669.htm. |

| 7. |

For additional information, see CRS In Focus IF10916, Efforts to Preserve Economic Benefits of the Iran Nuclear Deal, by [author name scrubbed], [author name scrubbed], and [author name scrubbed]. |

| 8. |

Import of Iranian oil into the United States has been prohibited by U.S. law since 1995, but measures to end or reduce imports in Europe and other major markets are new. |

| 9. |

Selim Cakir, Magali Pinat, and Chady Ell-Khoury, et al., Islamic Republic of Iran, International Monetary Fund, IMF Country Report No. 18/94, March 29, 2018, p. 11. |

| 10. |

Nidhi Verma, "India Says It Only Follows U.N. Sanctions, Not U.S. Sanctions on Iran," Reuters, May 28, 2018, online edition, https://www.reuters.com/article/us-india-iran/india-says-it-only-follows-u-n-sanctions-not-u-s-sanctions-on-iran-idUSKCN1IT0WJ. |

| 11. |

Tetshushi Takahashi and Ryo Nakamura, "China to Ignore US Demand for Iran Oil Ban," Nikkei Asian Review, June 28, 2018, online edition, https://asia.nikkei.com/Economy/Trade-tensions/China-to-ignore-US-demand-for-Iran-oil-ban. |

| 12. |

David O'Byrne, "Turkey Informed US It Will Not Comply with Iran Sanctions," S&P Global Platts, July 24, 2018, online edition, https://www.spglobal.com/platts/en/market-insights/latest-news/natural-gas/072418-turkey-informed-us-it-will-not-comply-with-iran-sanctions-report. |

| 13. |

|

| 14. |

Barbara Starr, Cable News Network, August 2, 2018, https://www.state.gov/r/pa/prs/ps/2018/07/283669.htm. |

| 15. |

Ranjith Raja and Giorgos Beleris, Strait of Hormuz: The Aorta of Global Oil Flows, Thomson Reuters, Dubai, July 2018, p. 3. |

| 16. |

Based on data from the BP Statistical Review of World Energy, http://www.bp.com/statisticalreview. |

| 17. |

Department of Energy, SPR Quick Facts and FAQs, https://www.energy.gov/fe/services/petroleum-reserves/strategic-petroleum-reserve/spr-quick-facts-and-faqs. |

| 18. |

For more background the SPR, see CRS Report R42460, The Strategic Petroleum Reserve: Authorization, Operation, and Drawdown Policy, by [author name scrubbed]. |

| 19. |

International Energy Agency, Oil Market Report, July 12, 2018, p. Table 4, https://www.iea.org/media/omrreports/tables/2018-07-12.pdf. |

| 20. |

International Energy Agency, Fact Sheet: IEA Stocks and Drawdown Capacity, February 25, 2011, http://www.iea.org/files/Potential_IEA_Stockdraw_Capacity.pdf. |

Footnotes

For additional information on the conflict between Iran and Israel, see CRS In Focus IF13032, Israel-Iran Conflict, U.S. Strikes, and Ceasefire, by Clayton Thomas and Jim Zanotti.

Prior to his trip to the Middle East in May 2025, President Trump raised the idea of renaming the Persian Gulf to the Arabian Gulf.

J. David Goodman, "Iran Warns U.S. Aircraft Carrier Not to Return to Gulf," New York Times, January 4, 2012.

U.S. Congress, Senate Committee on Armed Services, Hearing to Consider the Nominations of: Vice Admiral Charles B. Cooper II, USN to Be Admiral and Commander, United States Central Command; and Lieutenant General Alexus G. Grynkewich, USAF to Be General and Commander, United States European Command and Supreme Allied Commander, Europe, 119th Cong., 1st sess., June 24, 2025, 1:36:28, https://www.armed-services.senate.gov/hearings/to-consider-the-nominations-of_vice-admiral-charles-b-cooper-ii-usn-to-be-admiral-and—commander-united-states-central-command-and—lieutenant-general-alexus-g-grynkewich-usaf-to-be-general—and-commander-united-states-european-command-and—supreme-allied-commander-europe.

Crude oil production data from Energy Institute, "Statistical Review of World Energy," 73rd ed., 2024. Spare production capacity data from International Energy Agency, Oil Market Report, July 11, 2025.

For additional information, see CRS Infographic IG10044, Middle East Oil, by Phillip Brown.

Candace Dunn and Justine Barden, "Amid Regional Conflict, the Strait of Hormuz Remains Critical Oil Chokepoint," Today in Energy, U.S. Energy Information Administration, June 16, 2025.

Dunn and Barden, "Amid Regional Conflict, the Strait of Hormuz Remains Critical Oil Chokepoint."

Dunn and Barden, "Amid Regional Conflict, the Strait of Hormuz Remains Critical Oil Chokepoint."

U.S. Energy Information Administration, "Energy and Financial Markets: What Drives Crude Oil Prices?," accessed June 30, 2025, https://www.eia.gov/finance/markets/crudeoil/supply-opec.php.

For additional information about the International Energy Agency (IEA), see http://www.iea.org.

IEA, Oil Market Report, June 17, 2025.

IEA, "Oil Security and Emergency Response: Ensuring Quick and Effective Response to Major Supply Interruptions," May 17, 2024, https://www.iea.org/about/oil-security-and-emergency-response.

For additional information, see CRS Insight IN12542, Strategic Petroleum Reserve: Inventory Outlook and Policy Considerations, by Phillip Brown.

See 42 U.S.C. §6241(d).

IEA, Costs and Benefits of Emergency Stockholding, 2018.

IEA, Costs and Benefits of Emergency Stockholding, 2018.

IEA, Costs and Benefits of Emergency Stockholding, 2018.

Energy Institute, 2025 Statistical Review of World Energy, June 26, 2025, p. 44, https://www.energyinst.org/statistical-review.

For additional information, see CRS Infographic IG10046, Middle East Natural Gas, by Michael Ratner.

June 21, 2025, was a Saturday, so there would not have been daily prices until Monday, June 23, because daily markets are generally not open on weekends.

See Executive Order (E.O.) 12613 of October 29, 1987, "Prohibiting Imports from Iran," 52 Federal Register 41940, October 30, 1987; E.O. 12957 of March 15, 1995, "Prohibiting Certain Transactions with Respect to the Development of Iranian Petroleum Resources," 60 Federal Register 14615, March 17, 1995; E.O. 12959 of May 6, 1995, "Prohibiting Certain Transactions with Respect to Iran," 60 Federal Register 24757, May 9, 1995; E.O. 13059 of August 19, 1997, "Prohibiting Certain Transactions with Respect to Iran," 62 Federal Register 44531, August 21, 1997.

See E.O. 12957 (1995). For key statutory provisions, see the Iran and Libya Sanctions Act of 1996 (P.L. 104-172, as amended; 50 U.S.C. §1701 note); Iran Threat Reduction and Syria Human Rights Act of 2012 (P.L. 112-158, as amended); Comprehensive Iran Sanctions, Accountability, and Divestment Act of 2010 (P.L. 111-195, as amended, including §§104 and 202, codified at 22 U.S.C. §§8513 and 8532); Section 1245(d) of the National Defense Authorization Act for Fiscal Year 2012 (P.L. 112-81; 22 U.S.C. §8513a(d)); Section 1244 of the Iran Freedom and Counter-Proliferation Act of 2012 (Division A, Title XII, Subtitle D, of P.L. 112-239; 22 U.S.C. §8803); and Section 3 of the Stop Harboring Iranian Petroleum (SHIP) Act (Division J of P.L. 118-50; 22 U.S.C. §8572).

See, for example, J. David Goodman, "Iran Warns U.S. Aircraft Carrier Not to Return to Gulf," New York Times, January 3, 2012; and Quint Forgey, "Trump Levels New Sanctions Against Iran," Politico, June 24, 2019.

See, for example, Radio Farda, "Iran Guards Commander Threatens to Block Strait of Hormuz," February 26, 2019.

E.O. 13846 of August 6, 2018, "Reimposing Certain Sanctions with Respect to Iran," 83 Federal Register 38939, August 7, 2018.

U.S. Department of the Treasury, "Treasury Targets Senior IRGC Commanders Behind Iran's Destructive and Destabilizing Activities," June 24, 2019, https://home.treasury.gov/news/press-releases/sm716.

E.O. 13902 of January 10, 2020, "Imposing Sanctions with Respect to Additional Sectors of Iran," 85 Federal Register 2003, January 14, 2020; U.S. Department of the Treasury, Office of Foreign Assets Control (OFAC), "Publication of an Iran-Related Determination," 89 Federal Register 91262, November 19, 2024.

See OFAC, Sanctions Advisory: Guidance for Shipping and Maritime Stakeholders on Detecting and Mitigating Iranian Oil Sanctions Evasion, April 16, 2025, https://ofac.treasury.gov/media/934236/download?inline.

See also CRS In Focus IF12952, Iran's Petroleum Exports to China and U.S. Sanctions, coordinated by Clayton Thomas.

See, for example, OFAC, "Treasury Imposes Additional Sanctions on Iran's Shadow Fleet as Part of Maximum Pressure Campaign," press release, February 24, 2025; OFAC, "Treasury Sanctions Network Supporting Iran's Oil Exports," press release, March 20, 2025; OFAC, "Treasury Increases Pressure on Chinese Importers of Iranian Oil," press release, April 16, 2025; OFAC, "Treasury Increases Pressure on Firms Importing Iranian Oil," May 8, 2025; and OFAC, "Treasury Targets Global Network Shipping Iranian Oil, Funding Iran's Military and Terrorist Activities," press release, May 13, 2025.

Samuel Cox, "H-108-1: No Higher Honor—The Road to Operation Praying Mantis, 18 April 1988," Naval History and Heritage Command, April 13, 2018.

See, for example, Iran International, "Iran Can Block Strait of Hormuz, IRGC Navy Chief Says," February 9, 2025; Arsalan Shahla and Ladane Nasseri, "Iran Raises Stakes in U.S. Showdown with Threat to Close Hormuz," Bloomberg, April 22, 2019; BBC News, "Iran Threatens to Block Strait of Hormuz Oil Route," December 28, 2011; Borzou Daragahi, "Iran Threatens to Block Persian Gulf Oil Lanes," Los Angeles Times, June 29, 2008.

Christopher Harmer, Iranian Naval and Maritime Strategy, Institute for the Study of War, June 2013.

Office of Naval Intelligence, Iranian Naval Forces: A Tale of Two Navies, February 2017; Nicholas Carl, "The Growing Iranian Threat Around the Strait of Hormuz," Critical Threats, September 22, 2020.

Defense Intelligence Agency, Iran Military Power: Ensuring Regime Survival and Securing Regional Dominance, August 2019; Atlantic Council, "Four Questions (and Expert Answers) About Iran's Threats to Close the Strait of Hormuz," June 23, 2025.

Iran's shore-based anti-ship cruise missiles are sometimes also referred to as coastal defense cruise missiles (CDCMs).

Farzin Nadimi, The IRGC and the Persian Gulf Region in a Period of Contested Deterrence, Middle East Institute, November 2021.

Janatan Sayeh, "Iran Strengthens Its Military in the Persian Gulf," Foundation for Defense of Democracies, March 25, 2025.

James Genn, "Israel Strikes Iranian Naval Base in Bandar Abbas's Strategic Southern Port," Jerusalem Post, June 22, 2025.

United States Central Command, "IRGCN Interaction with U.S. Naval Vessels in the North Arabian Gulf," April 27, 2021.

See, for example, Evan Halper et al., "Iran Eyes Closure of Strait of Hormuz, a Crucial Choke Point for the World's Oil Supply," Washington Post, June 23, 2025.

Joshua Minchin, "'Could They? Yes. Will They? Probably Not': Doubts over Iran's Strait of Hormuz Threat," Lloyd's List, April 10, 2024.

Clayton Seigle, "How War with Iran Could Disrupt Energy Exports at the Strait of Hormuz," Center for Strategic and International Studies, June 23, 2025.

Gram Slattery and Phil Stewart, "Exclusive: Iran Made Preparations to Mine the Strait of Hormuz, US Sources Say," Reuters, July 1, 2025.

See, for example, Jonathan Schroden, "A Strait Comparison: Lessons from the Dardanelles for a Strait of Hormuz Closure," War on the Rocks, June 30, 2025.

See, for example, Helene Cooper et al., "In Crisis with Iran, U.S. Military Officials Focus on Strait of Hormuz," New York Times, June 19, 2025, https://www.nytimes.com/2025/06/19/us/politics/iran-us-military-strait-of-hormuz.html.

Helene Cooper et al., "In Crisis with Iran, U.S. Military Officials Focus on Strait of Hormuz," New York Times, June 19, 2025, https://www.nytimes.com/2025/06/19/us/politics/iran-us-military-strait-of-hormuz.html.