Social Security: The Lump-Sum Death Benefit

Changes from July 11, 2018 to November 14, 2019

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Social Security: The Lump-Sum Death Benefit

Contents

Summary

When a Social Security-insured worker dies, the surviving spouse who was living with the deceased is entitled to a one-time lump-sum death benefit of $255. If they were living apart, the surviving spouse can still receive the lump sum under certain conditions. If there is no such spouse, the payment can be made to a child who meets certain requirements. In the majority of deaths, however, no payment is made.

The lump-sum death benefit was once an important part of Social Security benefits to survivors. Between 1937 and 1939, the lump- sum was the only benefit available to survivors of insured workers who died before 65 years old, and before 1952, the $255 amount waswas greater than three times the maximum monthly benefits payable under Social Security. However, because the lump-sum death benefit has been capped at $255 for the past eight decades, inflation has eroded its value. At the same time, the real value of other Social Security benefits has increased. The total payment onof lump-sum death benefits in 20162018 was about $204207 million, less than 0.03approximately 0.02% of total Social Security (Old-Age, Survivors, and Disability Insurance) benefit payments.

The erosion of the value of the lump-sum death benefit's eroding value has brought about various proposals to change it, including some recent congressional proposals that would have increased the benefit amount. Several presidential budget proposals have also proposed changes, ranging from eliminating the provision to changing eligibility rules. None of these proposals were enacted into law.

Introduction

Following the death of a worker beneficiary or other insured worker,1 Social Security makes a lump-sum death benefit payment of $255 to the eligible surviving spouse or, if there is no spouse, to eligible surviving dependent children.2 In 20162018, such payments were made for about 782,300794,909 deaths, for a total of about $204207 million in benefit payments.3 The death payment was capped at $255 in 1954, and since 1982, almost all payments have equaled $255, so the real (inflation-adjusted) value of the benefit now declines each year.

History of the Lump-Sum Death Benefit

Monthly survivors benefits were not included in the original Social Security Act of 1935 (P.L. 74-271), but the program did include a lump-sum benefit that would be paid if a worker died before the retirement age of 65.4 That provision provided some benefits to families who otherwise would have paid Social Security taxes but received no benefits. The benefit equaled 3.5% of the worker's covered earnings—those earnings that were subject to the Social Security payroll tax. Those payments were made from 1937 through 1939.

When monthly survivors benefits were added to the program in 1939 via the Social Security Amendments of 1939 (P.L. 76-379), a limited version of the lump-sum death benefit was retained. It was paid only when no survivors benefits were paid on the basis of the deceased worker's earnings record. When made, the payment equaled six times the primary insurance amount (PIA).5 The payment was made to a family member or to an individual who helped pay for the funeral.

In 1950, eligibility for the payment was expanded to include cases where survivors benefits were also paid "so that survivors benefits need not be diverted for payment of burial expenses of an insured worker."6 The benefit was therefore paid in nearly every death of a Social Security-insured worker. The 1950 legislation (P.L. 81-734) also sharply increased the PIA (and therefore increased regular monthly benefit levels). To maintain the lump-sum benefit steady at the level before 1950at its pre-1950 level, the formula was changed to equal three times the PIA, rather than six times.

The Social Security Amendments of 1954 (P.L. 83-761) kept the formula of three times the PIA but capped the benefit at $255, which was approximately three times the maximum PIA payable under Social Security in 1952. By 1974, the minimum PIA had reached $85, or one-third of the $255 cap, so the lowest possible lump-sum benefit also reached $255. As a result, the lump-sum death payment has been unindexed since 1973, 7 and nearly all lump-sum benefits have been $255 since (because some payments are based on PIAs from earlier years, some payments were slightly lower). In 1974, the average payment per worker was $254.64, and payments have averaged $255 since 1982.8 Currently, the payment may be lower if the deceased was covered by a foreign system with which the United States has an agreement to integrate benefits, known as a totalization agreement.9

Finally, in 1981, the Omnibus Budget Reconciliation Act of 1981 (P.L. 97-35) restricted eligibility for the lump-sum payment to limited categories of survivors.10 That change reduced the number of payments made by nearly half, from 1.57 million in 1980 to about 808,000 in 1982.

Current Eligibility Rules

If a surviving spouse is living with the worker at the time of death, the benefit is paid to the spouse. If the worker and the spouse were living apart, the spouse couldcan still receive the lump-sum death payment if the spouse was already receiving benefits based on the worker's record or became eligible for survivors benefits upon the worker's death. If there is no eligible spouse, the benefit is paid to a child (or children) who is receiving or is eligible to receive monthly benefits on the worker's record.11 If there are multiple eligible children, the benefit is split evenly among them. When there are no eligible survivors, no death benefit is paid.

Number of Benefit Payments and Total Spending

In 20162018, the Social Security Administration (SSA) paid about $204207 million in lump-sum benefits for 782,300794,909 deaths.12 Because the $255 payment was split between multiple recipients in some cases, the agency made a total of 821,575832,746 payments. The number of payments is projected to remain at about the same level during the next few years; thus total spending will also remain at approximately the same dollar level.

For most deaths, no lump-sum death benefit is paid. In 20162018, fewer than 4240% of the deaths among insured workers resulted in lump-sum death benefit payments.13 One possible reason wasis that, for many deaths, there was no eligible family member to receive the death payment.

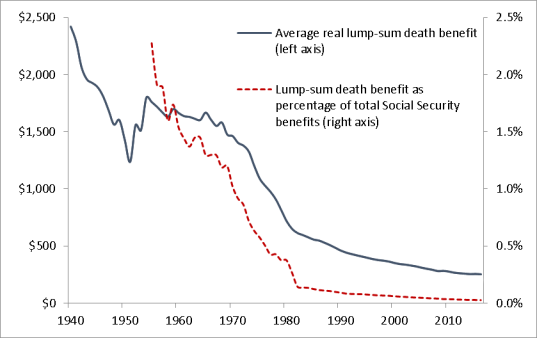

The real value of the lump-sum death benefit's real value has declined significantly since it was introduced. For example, in 1954, the average lump-sum nominal death benefit per worker was $208, which would have been equivalent to about $1,800 in 2016almost $1,900 in 2018 dollars.14 In recent decades, inflation has caused the real value of the $255 payment to continue to decline, as shown in Figure 1.

Total spending on the lump-sum death benefit as a share of total Social Security benefit payments has generally been declining over the years since 1937 (see Figure 1). In the 1960s, the lump-sum death benefit accounted for more than 1% of Social Security benefit outlays, but that share declined to about 0.38% in 1980. In 1981, the Omnibus Budget Reconciliation Act (P.L. 97-35), which restricted eligibility for the lump-sum payment to limited categories of survivors, decreased the total lump-sum death benefit by nearly half from $394 million in 1980 to $203 million in 1982. Consequently, the share of lump-sum death benefit to's share of total Social Security benefits further dropped to 0.15% in 1982. Since then, the share has declined steadily and reached about 0.0302% in 20162018. Under current law, the share will likely continue to decrease as payments on the lump-sum death benefit remain relatively stable and payments on other benefits continue to increase steadily. The share of the total lump-sum death benefit to's share of total Social Security benefits (indexed to wages) havehas declined faster than the real value of the lump-sum death benefitlump sum's real value (indexed to prices), mainly because Social Security benefits are linked to national wage levels, which are increasing faster than price levels.

SSA estimated in 2016 that the annual administrative costs of the lump-sum death benefitlump-sum death benefit's annual administrative costs were about $10 million.15 SSA also projected that more lump-sum death benefits would be paid out as the number of baby boomer deaths increases; SSA projects that in 2024, almost 900,000 lump-sum death benefits will be paid out, costing $217 million.16

Proposals to Change or Eliminate the Lump-Sum Death Benefit

Over the years, various proposals would have changed or eliminated the death benefit. In 1979, President Carter's budget described it as "largely an anachronism" and proposed replacing it with a similar benefit that would be paid only if the deceased or the surviving spouse were eligible for Supplemental Security Income, a program that provides cash benefits to aged, blind, or disabled persons with limited income and assets.17 Under that proposal, only about 30,000 recipients would have received a benefit each year.18

The 1979 Advisory Council on Social Security recommended that the benefit be increased to three times the PIA, but no more than $500. A significant minority of the council favored the Carter proposal of targeting the benefit to those with the greatest need, but with a higher benefit of perhaps $625. The council found that the benefit "provides valuable assistance at a time of special financial need. The monthly survivors benefits under Social Security are designed to meet regular recurring costs, whereas the lump-sum death payment is designed to meet the expenses of a final illness and funeral."19 In 20142017, the median cost of an adult funeral with viewing and burial was around $7,200$7,360,20 and the lump-sum death benefit was fixed at $255 per worker. Although the benefit was once linked to burial expenses and is sometimes still referred to as a "burial benefit," it no longer has any legal connection with funeral expenses.21

President Bush's FY2007 budget proposed eliminating the benefit, arguing that it "no longer provides meaningful monetary benefit for survivors" and that it results in high administrative costs.22 The $15 million estimated annual administrative cost at the time was about 7% of lump-sum death benefit outlays. Administrative costs for the entire Social Security program are less than 1% of benefit outlays.

Some proposals would have increased the benefit. For example, in the 110th Congress, H.R. 341 proposed expanding eligibility for the benefit to insured workers upon the death of their uninsured spouses. In the 111th Congress, the Social Security Death Benefit Increase Act of 2010 (H.R. 6388) would have increased the benefit from $255 to $332, and the BASIC Act (H.R. 5001) would have increased it to 47% of the worker's PIA. In the 114th Congress, the Social Security Lump-Sum Death Benefit Improvement and Modernization Act of 2015 (H.R. 1109) proposed an increase ofincreasing the benefit to $1,000. In addition, in the 115th Congress, H.R. 5302 and S. 1739 (BASIC Act) proposed to increaseincreasing the lump-sum death benefit to 50% of the worker's PIA. None of these proposals have been enacted into law.

Author Contact Information

Acknowledgments

The original report was written by former CRS analyst Noah Meyerson.

Footnotes

| 1. |

An insured worker is one who has worked enough in employment subject to Social Security payroll taxes to qualify for benefits. |

| 2. |

The surviving spouse and dependent children may be eligible for survivors benefits, as well; for more on survivors benefits, see CRS Report RS22294, Social Security Survivors Benefits. |

| 3. |

Social Security Administration (SSA), Annual Statistical Supplement, 201 |

| 4. |

For more details, see Larry DeWitt, The History & Development of the Lump Sum Death Benefit, Social Security Administration, Historian's Office, Research Note #2, June 1996, updated September 7, 2006, at http://www. |

| 5. |

The primary insurance amount (PIA) is the benefit a person would receive if he or she elects to begin receiving retirement benefits at full retirement age. The PIA is a calculated based on lifetime covered (Social Security payroll taxed) earnings. For a background on Social Security benefit computation, see CRS Report R42035, Social Security Primer. |

| 6. |

U.S. Congress, House Committee of Conference, Social Security Amendments of 1950, committee print, 81st Cong., 2nd sess., August 1, 1950, H.Rept. 2771, p. 107, http://ssa.gov/history/pdf/Downey%20PDFs/Social%20Security%20Amendments%20of%201950%20Vol%203.pdf. |

| 7. |

Social Security Administration (SSA), Social Security Trustee Report, 2018, available at https://www.ssa.gov/OACT/TR/2018/tr2018.pdf. |

| 8. |

SSA, Annual Statistical Supplement, 201 |

| 9. |

SSA, Program Operations Manual System, GN 01701.220: Lump-Sum Death Payment (LSDP) in Totalization Claims, at https://secure.ssa.gov/apps10/poms.nsf/lnx/0201701220. |

| 10. |

Before 1981, if no spouse or child of the deceased worker was eligible |

| 11. |

To receive benefits, the child must be a dependent of the worker, unmarried, and (1) younger than 18 years old or a full-time elementary or secondary school student and had not attained the age of 19 or (2) under a disability that began before the age of 22. |

| 12. |

SSA, Annual Statistical Supplement, 201 |

| 13. |

In |

| 14. |

Real value of the average benefit is calculated using Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). |

| 15. |

SSA, Office of the Inspector General, Informational Report: Lump-sum Death Benefit, July 2016, at https://oig.ssa.gov/sites/default/files/audit/full/pdf/A-08-16-50108.pdf. |

| 16. |

Ibid. |

| 17. |

For more information on Supplemental Security Income, see CRS In Focus IF10482, Supplemental Security Income (SSI). |

| 18. |

|

| 19. |

1979 Advisory Panel on Social Security, Social security financing and benefits, December 1979, pp. 173-175. |

| 20. |

National Funeral Directors Association, "Statistics," accessed January 30, 2017, at http://www.nfda.org/news/statistics. |

| 21. |

Larry DeWitt, The History & Development of the Lump Sum Death Benefit, Social Security Administration, Historian's Office, Research Note #2, June 1996, updated September 7, 2006, at http://www.ssa.gov/history/lumpsum.html. |

| 22. |

Office of Management and Budget, Budget of the United States Government, Fiscal Year 2007, February 2006, p. 290, at http://www.gpo.gov/fdsys/pkg/BUDGET-2007-BUD/pdf/BUDGET-2007-BUD-29.pdf. |