Farm Bills: Major Legislative Actions, 1965-2024

Changes from June 29, 2018 to September 21, 2018

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Contents

Summary

The farm bill provides an opportunity for Congress to address agricultural and food issues comprehensively about every five years. Over time, farm bills have tended to become more complicated and politically sensitive. As a result, the timeline for reauthorization has become less certain, and in general recent farm bills have taken longer to enact than in previous decades. Recent farm bills, beginning with the 2008 farm bill (P.L. 110-246), have been subject to various developments that have delayed enactment, such as insufficient votes to pass the House floor, presidential vetoes, andor short-term extensions.

The 2014 farm bill took more than 21 months from introductionIn 2018, a farm bill reauthorization was reported from the House Agriculture Committee on April 18 (H.R. 2). An initial floor vote on passage on May 18 failed in the House 198-213, but floor procedures allowed that vote to be reconsidered (H.Res. 905). The House passed H.R. 2 in a second vote of 213-211 on June 21, 2018. In the Senate, the Agriculture Committee reported its bill (S. 3042) on June 13 by a vote of 20-1. The Senate passed its bill as an amendment to H.R. 2 by a vote of 86-11 on June 28, 2018. Conference proceedings officially began on September 5, 2018.

By comparison, the 2014 farm bill took more than 21 months from introduction to enactment and spanned the 112th and 113th Congresses. The House rejected a bill in 2013 and then passed separate farm and nutrition assistance components before procedurally recombining them for conference with the Senate. Somewhat similarly, the 2008 farm bill took more than a year to enact and was complicated by revenue provisions from another committee of jurisdiction, temporary extensions, and vetoes.

Whether the House or Senate proceeds first in committee or on the floor is also not always predictable. Both the 2008 farm bill and the 2002 farm bill were extended before their successors were enacted.

In 2018, a farm bill reauthorization was reported from the House Agriculture Committee on April 18 (H.R. 2). An initial floor vote on passage on May 18 failed in the House 198-213, but floor procedures allowed that vote to be reconsidered (H.Res. 905). The House passed H.R. 2 in a second vote of 213-211 on June 21, 2018. In the Senate, the Agriculture Committee reported its bill (S. 3042) on June 13 by a vote of 20-1. The Senate passed its bill as an amendment to H.R. 2 by a vote of 86-11 on June 28, 2018.

Expiration a few months later at the end of a calendar year matters mostly for the farm commodity programs. In the event that the current farm law would expire without replacement legislation or an extension, the first commodity to be affected would be dairy, whose crop year begins on January 1, 2019.

Most farm bills have been introduced in the first session of a two-year Congress (the odd-numbered year). Of three farm bills that were introduced in the second session—like the 2018 farm bill proposals—the 1970 and 1990 farm bills were enacted during a lame duck Congress in late November of the same year, and the 2014 farm bill was the first farm bill to start in one Congress (2012), remain unfinished, and require reintroduction in a subsequent Congress.

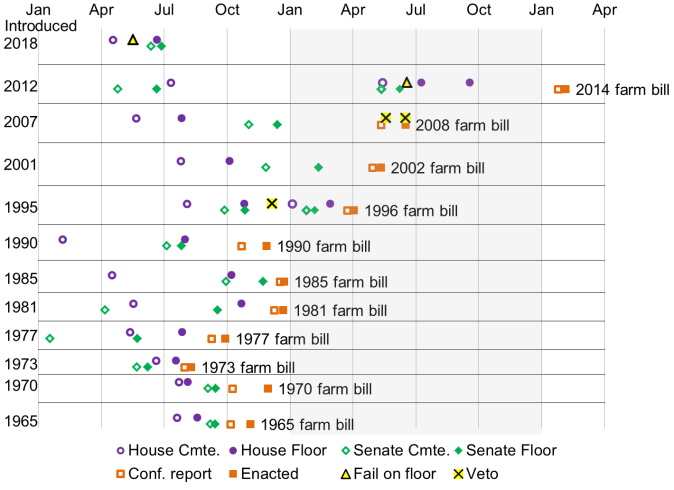

This report examines the major legislative milestones for the last 11 farm bills covering 53 years and illustrates trends that may provide useful background and context as the current farm bill debate proceeds.

The farm bill provides an opportunity for Congress to address agricultural and food issues comprehensively about every five years.1 Over time, farm bills have tended to become more complicated and politically sensitive. This has made the timeline for reauthorization less certain. Recent farm bills have been subject to developments that have delayed enactment, such as insufficient votes to pass the House floor, presidential vetoes, and short-term extensions.

For example, the 1973 farm bill was enacted less than three months after being introduced. In contrast, the 2014 farm bill took more than 21 months from introduction to enactment, spanning the 112th and 113th Congresses.2 The House rejected a bill in 2013 and then passed separate farm and nutrition assistance components—the first time a chamber-passed farm bill reauthorization did not include a nutrition title since nutrition became part of the farm bill in 1973. The House later procedurally recombined them for conference with the Senate.

Both the 2002 and 2008 farm bills had expired for about three months (from October through December in 2007 and 2012) before extensions were enacted. In each case, the fiscal year began under a continuing resolution for appropriations. The extensions of the 2002 farm bill were for relatively short periods totaling about five months during final House-Senate negotiations. However, the extension of the 2008 farm bill in 2013 was for a full year, since the 112th Congress had ended and it was necessary to reintroduce farm bill legislation in the 113th Congress.

In 2018, a farm bill reauthorization was reported from the House Agriculture Committee on April 18 (H.R. 2). An initial floor vote on passage on May 18 failed in the House 198-213, but procedures allowed that vote to be reconsidered (H.Res. 905). The House passed H.R. 2 in a second vote of 213-211 on June 21, 2018. In the Senate, the Agriculture Committee reported its bill (S. 3042) on June 13 by a vote of 20-1. The Senate passed its bill as an amendment to H.R. 2 by a vote of 86-11 on June 28, 2018. This is the first time since at least 1965 that both chambers completed floor action before the end of June.

Conference proceedings officially began September 5, 2018.This report examines the major legislative milestones for the last 11 farm bills over 53 years, a period representing modern farm bills with growing complexity. It discusses trends that may provide historical perspective as the current farm bill debate proceeds. Table 1 contains a history of major legislative action on farm bills since 1965. Figure 1 shows the dates on a timeline for each farm bill from introduction to enactment. The consequences of expiration of a farm bill,3 as well as its content, are discussed in other CRS reports.4

Timelines for Enactment, Extension, and Vetoes

Parts of a farm bill are authorized for a period of fiscal years and therefore expire at the end of the fiscal year (September 30) in the year of the farm bill's expiration. Other parts are authorized for crop years or calendar years. TheDifferent parts of a farm bill are authorized for different periods of time. Fiscal years, calendar years, and crop years can be important to different programs. Programs authorized by the 2014 farm bill (the Agricultural Act of 2014, P.L. 113-79) generally expiresexpire either at the end of FY2018 and(September 30, 2018) or with the 2018 crop year, which varies among crops and, for dairy,for dairy is the end of the calendar year.

|

Figure 1. Major Legislative Actions on Farm Bills, 2018-1965 |

|

|

Source: CRS, using http://www.congress.gov. |

Timeline Relative to Fiscal Years

Expiration at the end of a fiscal year (September 30) matters for programs with fiscal year authorizations. These programs include certain nutrition, conservation, and trade programs; various agricultural programs, excluding the Title I commodity programs; and many authorizations for discretionary appropriations. Although the Supplemental Nutrition Assistance Program is authorized by fiscal year, it can continue to operate with an appropriation.Enacting farm bills after the end of the fiscal year (in which a farm bill expired) is commonplace. In the past 53 years, only the 1973 and 1977 farm bills were enacted before the September 30 expiration date for most programs.

Timeline Relative to Calendar Years

Farm bills in 1965, 1970, 1981, 1985, and 1990 were enacted by December 31—within three months of the end of the fiscal year but before spring-planted crops that would be covered by the new law were planted. The most recent four farm bills (1996, 2002, 2008, and 2014) have been enacted later in the year—in April (1996), May (2002), June (2008), and February (2014)—but still prior to the first crop covered by the farm bill was harvested.

Timeline Relative to the Two-Year Congress

programs that would have been affected by the fiscal year.5

The 1981, 1985, and 1990 farm bills were enacted within three months after the final fiscal year for which programs were authorized had ended. The 1996 farm bill was enacted in April 1996 following the September 30, 1995, expiration of some of the authorizations in the 1990 farm bill.6 The 2008 and 2014 farm bills were enacted well after their original September 30 expirations and following the enactment of extensions.

Timeline Relative to Calendar YearsExpiration at the end of a calendar year matters mostly for the farm commodity programs—which are traditionally Title I of recent farm bills—and particularly the dairy program, because it would be the first to revert to "permanent law" on January 1.7 The farm commodity programs are tied to a crop year—that is, the year in which a crop is harvested. If the suspension of permanent law were to expire, thereby reactivating commodity programs authorized by permanent law for the 2019 crop year, the first commodity to be affected by would be dairy, whose crop year begins on January 1, 2019.

All farm bills since 1965—except those in 2014 and 2008—have been enacted before December 31 in the year of their expirations.8 For the 2014 farm bill, the previous 2008 farm bill was extended for one year in 2013, but that extension expired for five weeks before the 2014 bill was enacted in February 2014. For the 2008 farm bill, several short-term extensions of the 2002 farm bill from December 2007 to May 2008 prevented permanent law from becoming effective. Timeline Relative to the Two-Year Congressional Term Since 1965, eight out of 11 enacted farm bills were introducedSince 1965, eight out of 11 enacted farm bills were introduced in the first session of a two-year Congress (the odd-numbered year); the exceptions are the 1970, 1990, and 2014 farm bills.5 The 2014 farm bill, which was introduced in 2012, was the first to start in one Congress, remain unfinished, and require reintroduction in a subsequent Congress. Enactment of the past five farm bills (1990-2014) have been in the second session (the even-numbered year), although, except for the 1990 farm bill, some action had occurred in the prior year. Only the 1970 and 1990 farm bills were enacted after an election during a lame duck Congress in late November.

House or Senate Action First

The House and Senate have taken turns in initiating action on a farm bill. Since 1965, the Senate was first to mark up farm bills in 1973, 1977, 1981, 2012, and 2013. The House was first to mark up bills in 1965, 1970, 1985, 1990, 1995 (and 1996), 2001, 2007, and 2018.

Short-Term Extensions

Extensions of a prior farm bill while its successor is being written have been atypical, though the past two reauthorizations have involved extensions. Only the 2002 and 2008 farm bills have required extensions in 2007-2008 and 2013, respectively, as their successors were being written.6

When the 2002 farm bill expired, portions of it were extended six times for less than a year total beginning in December 2007. The first of those extensions continued authority for many expiring programs for about three months.711 Because final agreement was pending, five more extensions—ranging from a week to a month—were needed. With a few exceptions, these extensions continued all 2002 farm bill provisions that were in effect on September 30, 2007. Dairy and sugar programs were included, as were price support loan programs for wool and mohair. But the direct, counter-cyclical, and marketing loan programs for the 2008 crop year for all other supported commodities (i.e., the primary supported commodities such as feed grains, oilseeds, wheat, rice, cotton, and peanuts) were specifically not extended.812 Moreover, the first extension in December 2007 did not address permanent law, but the second and subsequent extensions in 2008 did extend the 2002 farm bill's suspension of permanent law.9

When the 2008 farm bill expired on September 30, 2012, the continuing resolution providing appropriations (P.L. 112-175, §§101, 111) continued discretionary programs, the Supplemental Nutrition Assistance Program (SNAP), and certain related nutrition programs. Certain other mandatory programs—such as the Market Assistance Program and the Conservation Reserve Program—ceased to operate insofar as new activity.1014 On January 2, 2013, the entire 2008 farm bill, as it existed on September 30, 2012, was extended for the 2013 fiscal year and the 2013 crop year (P.L. 112-240). This avoided reverting to permanent law for the farm commodity programs, which was imminent for the dairy programs.

The situation from October to December 2013 somewhat repeated the end of 2012. Most of the discretionary parts of the farm bill expired again on October 1, 2013. Some programs ceased new operations, while others were able to continue under appropriations. For SNAP and the discretionary programs, farm bill expiration coupled with the two-week lapse during October 2013 of FY2014 appropriations (the "government shutdown") did create difficulties in operating some farm bill programs. From January 1, 2014, until enactment of the 2014 farm bill on February 7, 2014, the dairy program had technically reverted to permanent law, though federal officials did not implement it, since a conference agreement was imminent.

Presidential Vetoes

Presidential vetoes of farm bills are not common. Since 1965, only the 2008 farm bill has been vetoed as stand-alone measure; it was vetoed twice. A 1995 farm bill was vetoed as part of a larger budget reconciliation package.11

President George W. Bush vetoed the 2008 farm bill (H.R. 2419). When Congress overrode the veto to enact P.L. 110-234, it accidentally enrolled the law without Title III (the trade title). Congress immediately reintroduced the same bill with the trade title (H.R. 6124). President Bush vetoed this version as well, and Congress again overrode the veto to enact P.L. 110-246, a complete 2008 farm bill that included the trade title. The overrides in 2008 were the only time that a farm bill was enacted as a result of a veto override.

President Clinton vetoed a 1995 budget reconciliation package that included the first version of what became the 1996 farm bill, but the veto was not due to the farm bill itself but rather the controversial nature of the reconciliation bill in which the farm bill was embedded.

Implications for Congress

As farm bill reauthorization has tended to become more complex and engender greater political sensitivity, the process of enacting a new farm bill prior to the expiration of the existing law has become more difficult. As stakeholders in the farm bill have become more diverse, more people are affected by the legislative uncertainty around this process. This lack of certainty may translate into questions about the availability of future program benefits, some of which may affect agricultural production decisions or market uncertainty for agricultural commodities.

|

Conference Report Approval |

|||||||||

|

House Cmte. |

House Passage |

Senate Cmte. |

Senate Passage |

Conf. Report |

House Passage |

Senate Passage |

Public Law |

||

|

2018 farm bill (115th Congress) Agriculture and Nutrition Act of 2018 Would cover 2019-2023 crops or until 9/30/2023 |

4/18/2018 Vote of 2620 5/3/2018 H.Rept. 115-661 |

5/18/2018 H.R. 2 Initial vote failed by 198-213 Reconsider under H.Res. 905 6/21/2018 Passed by vote of 213-211 |

6/13/2018 Vote of |

6/28/2018 Vote of |

— |

— |

— |

— |

|

|

Agricultural Act of 2014 (113th Congress) Covers 2014-2018 crops or until 9/30/2018 |

5/15/2013 H.R. 1947 Vote of 3610 5/29/2013 H.Rept. 113-92 |

6/20/2013 H.R. 1947 Failed by 195-234 7/11/2013 H.R. 9/19/2013 H.R. 3102 Nutrition part vote of 217-210 9/28/2013 H.Res. 361 combines House bills |

5/14/2013 S. 954 Vote of 15-5 9/4/2013 S.Rept. 113-88 |

6/10/2013 S. 954 Vote of |

1/27/2014 |

1/29/2014 Vote of 251-166 |

2/4/2014 Vote of |

2/7/2014 |

|

|

Agriculture Reform, Food, and Jobs Act (112th Congress) |

7/11/2012 H.R. 6083 Vote of 3511 9/13/2012 H.Rept. 112-669 |

— |

4/26/2012 S. 3240 Vote of 8/28/2012 S.Rept. 112-203 |

6/21/2012 S. 3240 Vote of |

— |

— |

— |

— |

|

|

Early extension: |

Extended five conservation programs of the 2008 farm bill through FY2014 (AMA, CSP, EQIP, FPP, and WHIP). |

11/18/2011 |

|||||||

|

Extension: |

One-year extension of the 2008 farm bill until 9/30/2013 and for the 2013 crop year (dairy price support extended until 12/31/2013, and MILC extended until 9/30/2013). Did not provide funding for programs without mandatory baseline. |

1/2/2013 P.L. 112-240 Title VII |

|||||||

|

2008 farm bill Food, Conservation, and Energy Act of 2008 Covers 2008-2012 crops or until 9/30/2012 |

5/22/2007 H.R. 2419 Introduced 7/23/2007 H.Rept. 110-256 |

7/27/2007 Vote of 231-191 |

11/2/2007 S. 2302 |

12/14/2007 Amdt. to H.R. 2419 Vote of |

5/13/2008 |

5/14/2008 Vote of 318-106 |

5/15/2008 Vote of 8115 |

5/21/2008 Enrolling error omits Title III Vetoed |

|

|

5/21/2008 Passed over veto 316-108 |

5/22/2008 Passed over veto 82-13 |

5/22/2008 |

|||||||

|

Re-passed as new bill w/ |

5/22/2008 H.R. 6124 Vote of 306-110 |

6/5/2008 H.R. 6124 Vote of 7715 |

6/18/2008 Vetoed |

||||||

|

6/18/2008 Passed over veto 317-109 |

6/18/2008 Passed over veto 80-14 |

6/18/2008 |

|||||||

|

Early extensions: |

Extended the early-expiring MILC program of the 2002 farm bill for two years from 9/2005 through 8/2007 and two conservation programs (EQIP and Conservation Security Program) until FY2010. |

2/8/2006 |

|||||||

|

Extensions: |

Extended parts of the 2002 farm bill until 3/15/2008 but did not extend the direct and counter-cyclical farm commodity programs. See Division A, §751. |

12/26/2007 |

|||||||

|

Continued extension until 4/18/2008 and added extension of suspension of permanent law. |

3/14/2008 |

||||||||

|

Continued extension until 4/25/2008. |

4/18/2008 |

||||||||

|

Continued extension until 5/2/2008. |

4/25/2008 |

||||||||

|

Continued extension until 5/16/2008. |

5/2/2008 |

||||||||

|

Continued extension until 5/23/2008. |

5/18/2008 |

||||||||

|

2002 farm bill Farm Security and Rural Investment Act Covers 2002-2007 crops or until 9/30/2007 |

7/26/2001 8/2/2001 H.Rept. 107-191 |

10/5/2001 Vote of 291-120 |

11/27/2001 12/7/2001 S.Rept. 107-117 |

2/13/2002 Amdt. to H.R. 2646 Vote of |

5/1/2002 |

5/2/2002 Vote of 280-141 |

5/8/2002 Vote of 64-35 |

5/13/2002 |

|

|

1996 farm bill Federal Agriculture Improvement and Reform Act of 1996 Covers 1996-2002 crops or until 9/30/2002 |

1/5/1996 H.R. 2854 introduced Vote of 29-17 2/9/1996 |

2/29/1996 Vote of 270-155 |

1/26/1996 S. 1541 introduced |

2/7/1996 S. 1541 Vote of 3/12/1996 Amdt. to H.R. 2854 Voice vote |

3/25/1996 |

3/29/1996 H.R. 2854 Vote of 318-89 |

3/28/1996 H.R. 2854 Vote of |

4/4/1996 |

|

|

Balanced Budget Act of 1995 |

10/26/1995 |

10/26/1995 H.R. 2491 Vote of 227-203 |

10/28/1995 S. 1357 includes Senate bill |

10/28/1995 Amdt. to H.R. 2491 Vote of |

11/16/1995 |

11/20/1995 H.R. 2491 Vote of 235-192 |

11/17/1995 H.R. 2491 Vote of |

12/6/1995 Vetoed |

|

|

Freedom to Farm Act |

8/4/1995 H.R. 2195 introduced 9/20/1995 fails cmte. |

— |

9/28/1995 unnumber-ed bill |

— |

— |

— |

— |

— |

|

|

Extension: |

More than a year before expiration, extended the dairy program of the 1990 farm bill until 1996 and extended programs for wheat, feed grains, cotton, rice, peanuts, wool, and mohair until 1997 and honey until 1998. |

8/10/1993 |

|||||||

|

1990 farm bill Food, Agriculture, Conservation, and Trade Act of 1990 Covers 1991-1995 crops or until 9/30/1995 |

2/5/1990 H.R. 3950 introduced 7/3/1990 H.Rept. 101-569 |

8/1/1990 Vote of 327-91 |

7/6/1990 |

7/27/1990 Vote of |

10/22/1990 |

10/23/1990 Vote of 318-102 |

10/25/1990 Vote of |

11/28/1990 |

|

|

1985 farm bill Food Security Act of 1985 Covers 1986-1990 crops or until 9/30/1990 |

4/17/1985 H.R. 2100 introduced 9/13/1985 H.Rept. 99-271 |

10/8/1985 Vote of 282-141 |

9/30/1985 |

11/23/1985 Vote of |

12/17/1985 |

12/18/1985 Vote of 325-96 |

12/18/1985 Vote of |

12/23/1985 |

|

|

1981 farm bill Agriculture and Food Act of 1981 Covers 1982-1985 crops or until 9/30/1985 |

5/18/1981 H.R. 3603 introduced 5/19/1981 H.Rept. 97-106 |

10/22/1981 Vote of 192-160 |

4/7/1981 S. 884 introduced 5/27/1981 S.Rept. 97-126 |

9/18/1981 Vote of |

12/9/1981 12/10/1981 S.Rept. 97-290 |

12/16/1981 Vote of 205-203 |

12/10/1981 Vote of |

12/22/1981 |

|

|

1977 farm bill Food and Agriculture Act of 1977 Covers 1978-1981 crops or until 9/30/1981 |

5/13/1977 H.R. 7171 introduced 5/16/1977 H.Rept. 95-348 |

7/28/1977 Amdt. to S. 275 Vote of 294-114 |

1/18/1977 S. 275 introduced 5/16/1977 S.Rept. 95-180 |

5/24/1977 Vote of |

9/9/1977 |

9/16/1977 Vote of 283-107 |

9/9/1977 Vote of |

9/29/1977 |

|

|

1973 farm bill Agriculture and Consumer Protection Act Covers 1974-1977 crops or until 6/30/1977 |

6/20/1973 H.R. 8860 introduced 6/27/1973 H.Rept. 93-337 |

7/19/1973 Amdt. to S. 1888 Vote of 226-182 |

5/23/1973 S. 1888 introduced |

6/8/1973 Vote of |

7/31/1973 |

8/3/1973 Vote of 252-151 |

7/31/1973 Vote of |

8/10/1973 |

|

|

1970 farm bill Agricultural Act of 1970 Covers 1971-1973 crops |

7/23/1970 H.R. 18546 H.Rept. 91-1329 |

8/5/1970 H.R. 18546 Vote of 212-171 |

9/4/1970 Amdt. to H.R. 18546 S.Rept. 91-1154 |

9/15/1970 Amdt. to H.R. 18546 Vote of |

10/9/1970 H.Rept. 91-1594 |

10/13/1970 H.R. 18546 Vote of 191-145 |

11/19/1970 H.R. 18546 Vote of |

11/30/1970 P.L. 91-524 |

|

|

Extension: |

More than a year before expiration, extended the 1965 farm bill for one-year until 12/31/1970. |

10/11/1968 P.L. 90-559 |

|||||||

|

1965 farm bill Food and Agricultural Act Covers 1966-1969 crops |

7/20/1965 H.R. 9811 H.Rept. 89-631 |

8/19/1965 H.R. 9811 Vote of 221-172 |

9/7/1965 Amdt. to H.R. 9811 S.Rept. 89-687 |

9/14/1965 Amdt. to H.R. 9811 Vote of |

10/6/1965 H.Rept. 89-1123 |

10/8/1965 H.R. 9811 Vote of 219-150 |

10/12/1965 H.R. 9811 Voice vote |

11/4/1965 P.L. 89-321 |

|

Source: CRS, using http://www.congress.gov. Includes only major legislative actions. Excludes subsequent revisions, such as in budget reconciliation, except for extensions as noted.

Author Contact Information

Footnotes

| 1. |

See CRS In Focus IF10187, Farm Bill Primer: What Is the Farm Bill? |

||||

| 2. |

These dates span only the official introduction of a bill marked up by committee until the President signed the bill. They do not include background hearings before committee markup, which would extend the timeline. |

||||

| 3. |

For example, expiration of the 2008 farm bill as the 2014 farm bill was being developed is discussed in CRS Report R42442, Expiration and Extension of the 2008 Farm Bill. | ||||

| 4. |

|

||||

| 5. |

| ||||

| 6.

|

|

While the 1996 farm bill was not pressured by the expiration of farm commodity programs in the 1990 farm bill—since budget reconciliation in 1993 had extended them through the 1996 and 1997 crop years (see footnote 8)—some of the original FY1995 expiration dates for food stamps, certain conservation programs, and various authorizations of appropriations continued unchanged and were not extended by the reconciliation act. 7.

|

|

Permanent law refers to non-expiring farm commodity programs that are generally from the 1938 and 1949 farm bills. The temporary suspension of permanent law is included as a section in all recent farm bills. If the suspension of permanent law were to expire at the end of a crop year, the permanent law provisions would take effect unless a new farm bill, or an extension of the most recent bill, continues the suspension. For more details about permanent law and its consequences, see the heading on permanent law in CRS Report R42442, Expiration and Extension of the 2008 Farm Bill. |

The 1965 farm bill was extended for one year, but that extension occurred more than a year before expiration and before the reauthorization process had begun in 1970. The 1996 and 2002 farm bills may appear to have been delayed by being reintroduced (1996) or going through the new year into May (2002), but their predecessors did not require extensions. |

|

|

Technically, the bill that became the 2014 farm bill (H.R. 2642) was introduced in 2013 (the first session of the 113th Congress), but many consider it a reintroduction of the bills started in 2012 (the second session of the 112th Congress). 10.

|

|

See also footnote 8. |

"Except as otherwise provided in this Act ... authorities provided under the Farm Security and Rural Investment Act of 2002 ... (and for mandatory programs at such funding levels), as in effect on September 30, 2007, shall continue, and the Secretary of Agriculture shall carry out the authorities, until March 15, 2008." P.L. 110-161, §751. |

|

|

Other programs that were not included in the extensions were peanut storage payments, agricultural management assistance, community food projects, the rural broadband program, value-added market development grants, federal procurement of biobased products, the biodiesel fuel education program, and the renewable energy systems program. |

|||||

|

Permanent law refers to nonexpiring provisions in Agriculture Adjustment Act of 1938 and the Agriculture Act of 1949 that are temporarily suspended by each modern farm bill. The commodity support provisions of permanent law are inconsistent with today's farming, marketing, and trade agreements and potentially costly to the federal government. See CRS Report RL34154, Possible Expiration (or Extension) of the 2002 Farm Bill. |

|||||

|

See CRS Report R42442, Expiration and Extension of the 2008 Farm Bill. |

|||||

|

Prior to 1965, the first veto of a farm bill was in 1956, when President Eisenhower vetoed H.R. 12, the first version of the Agricultural Act of 1956. |