The Child Tax Credit: How It Works and Who Receives It

Changes from May 15, 2018 to June 22, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Contents

- Introduction

- Current Law

- Detailed Overview of Current Credit

- Maximum Credit per Child

- The Nonrefundable $500 Credit for Non-Child Tax Credit Dependents

- Maximum Additional Child Tax Credit (ACTC) per Child, the Refundability Threshold and Refundability Rate

- The Phaseout Threshold and Phaseout Rate

- Definition of a Qualifying Child

- ID Requirements to Claim the Child Tax Credit

- Disallowance of the Credit Due to Fraud or Reckless Disregard of the Rules

- Data on the Child Tax Credit

- Total Child Tax Credit Dollars, 1998-2015

- Total Child Tax Credit Dollars by Income Level

- Share of Taxpayers with Children Receiving the Child Tax Credit

- Average Child Tax Credit Amount

Figures

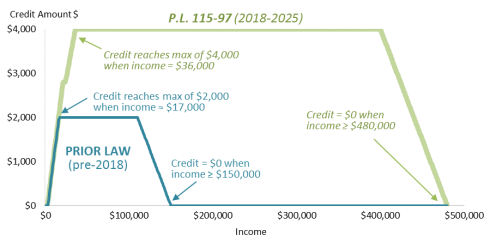

- Figure 1. The Child Tax Credit for a Married Couple with Two Children by Income Level, Before and After P.L. 115-97

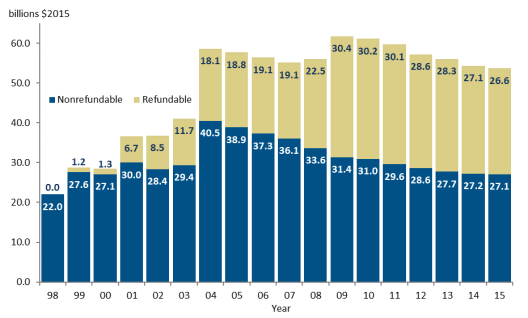

- Figure 2. Total Real Child Tax Credit Dollars, 1998-2015

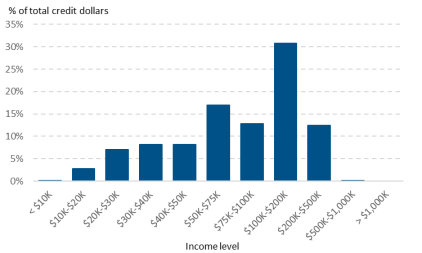

- Figure 3. Estimated Share of Total Child Tax Credit Dollars by Income Level, 2018

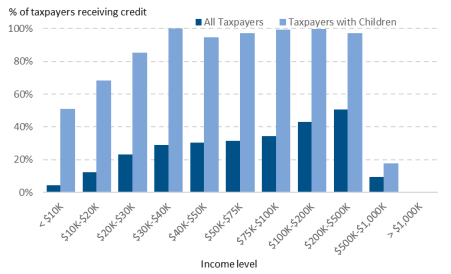

- Figure 4. Estimated Share of All Taxpayers and Taxpayers with Children Receiving the Child Tax Credit by Income Level, 2018

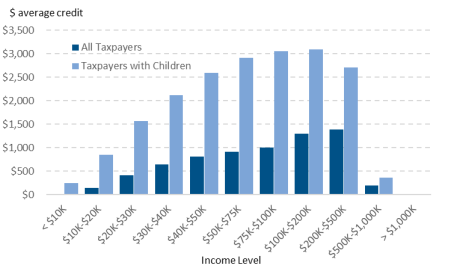

- Figure 5. Estimated Average Child Tax Credit Amount by Income Level for All Taxpayers and Taxpayers with Children, 2018

Summary

The Child Tax Credit: Current Law

Updated June 22, 2020

Congressional Research Service

https://crsreports.congress.gov

R41873

SUMMARY

The Child Tax Credit: Current Law

This report provides an overview of the child tax credit under current law, including temporary

changes made by the 2017 tax revision (P.L. 115-97).

).

R41873

June 22, 2020

Margot L. Crandall-Hollick

Acting Section Research

Manager

When calculating the total amount of federal income taxes owed, eligible taxpayers can reduce

their federal income tax liability by the amount of the child tax credit. Currently, eligible families

that claim the child tax credit can subtract up to $2,000 per qualifying child from their federal

income tax liability. The maximum amount of credit a family can receive is equal to the number

of qualifying children in a family multiplied by $2,000. If a family'’s tax liability is less than the

value of their child tax credit, they may be eligible for a refundable credit calculated using the earned income formula. Under

this formula, a family is eligible for a refund equal to 15% of their earnings in excess of $2,500, up to the maximum amount

of the refundable portion of the credit. The maximum amount of the refundable portion of the credit is $1,400 per qualifying

child. The credit phases out for single parents with income over $200,000 and married couples with income over $400,000.

Many of these parameters are scheduled to expire at the end of 2025 under P.L. 115-97.

.

The child tax credit was created in 1997 by the Taxpayer Relief Act of 1997 ( P.L. 105-34) to help ease the financial burden

that families incur when they have children. Like other tax credits, the child tax credit reduces tax liability dollar for dollar of do llar of

the value of the credit. Initially the child tax credit was a nonrefundable credit for most families. A nonrefundable tax credit

can only reduce a taxpayer'’s income tax liability to zero, while a refundable tax credit can exceed a taxpayer'’s income tax

liability, providing a cash payment to low-income taxpayers who owe little or no income tax.

Since it was first enacted, the child tax credit has undergone significant changes. Most recently at the end of 2017, Congress Congres s

expanded the credit, especially for middle- and upper-income taxpayers, by doubling the credit amount and more than

tripling the income level at which the credit begins to phase out. AdditionalAdditionally, although comparatively more modest, changes

were made to the refundable portion of the credit as well, including increasing the refundable credit amount from $1,000 to

$1,400 per child and lowering the refundability threshold from $3,000 to $2,500. These changes are scheduled to be in effect

from 2018 through the end of 2025.

Estimates from the IRS indicate that the total dollar amount of the child tax credit has increased significantly since enactment

from approximately $22 billion to $5451 billion for 2017. These estimates do not include the impact of recent legislative

changes made by P.L. 115-97, which will, all else being equal, expand the total cost of this tax benefit.

The Tax Policy Center (TPC) estimated the distribution of the child tax credit by income level for 20182019 under current law

(including the changes made by P.L. 115-97) and found that the majority of child tax credit dollars will go to taxpayers with

more than $75,000 of income, with nearly one-third of the benefit going to taxpayers with income between $100,000 and

$200,000. In comparison, a relatively small share will go to very-low-income or very-high-income taxpayers. TPC also

estimated that the vast majority of taxpayers with children will receive the child tax credit. AboutSlightly less than half of the

lowest-income taxpayers with children will receive the credit and no taxpayers with children and income over $1 million will

receive the credit. Finally, TPC estimated that taxpayers with income between $100,000 and $200,000 will on average

receive the largest credit of over $3,000. Taxpayers with children and income under $20,000 will receive on average a credit

of less than $1,000, while the wealthiest taxpayers with children will receive on average a credit of $10.

Introduction

Congressional Research Service

The Child Tax Credit: Current Law

Contents

Introduction ................................................................................................................... 1

Current Law ................................................................................................................... 1

Detailed Overview of Current Credit ............................................................................ 2

Maximum Credit per Child .................................................................................... 2

The Nonrefundable $500 Credit for Non-Child Tax Credit Dependents......................... 3

Maximum Additional Child Tax Credit (ACTC) per Child, the Refundability

Threshold and Refundability Rate ........................................................................ 3

The Phaseout Threshold and Phaseout Rate .............................................................. 4

Definition of a Qualifying Child .................................................................................. 4

ID Requirements to Claim the Child Tax Credit.............................................................. 5

Disallowance of the Credit Due to Fraud or Reckless Disregard of the Rules ...................... 5

Data on the Child Tax Credit............................................................................................. 5

Total Child Tax Credit Dollars, 1998-2017 .................................................................... 6

Total Child Tax Credit Dollars by Income Level ............................................................. 8

Share of Taxpayers with Children Receiving the Child Tax Credit ..................................... 9

Average Child Tax Credit Amount.............................................................................. 10

Figures

Figure 1 Child Tax Credit Amount by Income Level ............................................................. 2

Figure 2. Total Real Child Tax Credit Dollars, 1998-2017...................................................... 7

Figure 3. Estimated Share of Total Child Tax Credit Dollars by Income Level, 2019.................. 8

Figure 4. Estimated Share of Taxpayers with Children and All Taxpayers Receiving the

Child Tax Credit by Income Level, 2019........................................................................ 10

Figure 5. Estimated Average Child Tax Credit Amount by Income Level for Taxpayers

with Children and All Taxpayers, 2019 .......................................................................... 11

Tables

Table 1. Overview of Key Aspects of the Child Tax Credit Under Current Law......................... 1

Contacts

Author Information ....................................................................................................... 12

Congressional Research Service

The Child Tax Credit: Current Law

Introduction

The child tax credit was created in 1997 by the Taxpayer Relief Act of 1997 (P.L. 105-34) to help

ease the financial burden that families incur when they have children. Like other tax credits, the

child tax credit reduces tax liability dollar for dollar of the value of the credit. Initially the child

tax credit was a nonrefundable credit for most families. A nonrefundable tax credit can only

reduce a taxpayer'’s income tax liability to zero, while a refundable tax credit can exceed a taxpayer'

taxpayer’s income tax liability, providing a cash payment primarily to low -income taxpayers who

owe little or no income tax. Over the past 20 years, legislative changes have significantly changed

the credit, transforming it from a generally nonrefundable credit available only to the middle and

upper-middle class, to a refundable credit that more low -income families are eligible to claim.

This report provides an overview of the credit under current law and also provides some summary

data on these benefits. For a complete legislative history of the credit, see CRS Report R45124,

The Child Tax Credit: Legislative History, by [author name scrubbed].

Current Law

, by Margot L. Crandall-Hollick.

Current Law

The child tax credit allows taxpayers to reduce their federal income tax liability (the income taxes

owed before tax credits are applied) by up to $2,000 per qualifying child. If the value of the credit

exceeds the amount of tax a family owes, the family may be eligible to receive a full or partial

refund of the difference. The refundable portion of the credit is sometimes referred to as the

additional child tax credit or ACTC. The total amount of their refund is calculated as 15% (the

refundability rate) of earnings that exceed $2,500 (the refundability threshold), up to the

maximum amount of the refundable portion of the credit ($1,400 per child).

The credit phases out for higher-income taxpayers. The child tax credit can offset a taxpayer's ’s

Alternative Minimum Tax (AMT) liability. Currently, the maximum credit per child, refundability

threshold, and phaseout thresholds are not indexed for inflation. From 2018 to 2025, the

maximum amount of the ACTC is indexed for inflation. Table 1 provides an overview of key

provisions of the child tax credit under current law and how they will change, beginning in 2026,

as scheduled under P.L. 115-97.

|

Parameter |

|

Pre-2018/Post 2025 |

|

Maximum credit per child |

$2,000 |

$1,000 |

2018-2025

Post 2025a

Maximum credit per child

$2,000

$1,000

Maximum refundable |

$1,400 |

$1,000 |

|

Refundability Threshold |

$2,500 |

$3,000 |

|

Refundability Rate |

15% |

15% |

|

Phaseout Threshold |

|

|

|

Phaseout Rate |

5% |

5% |

|

Offset AMT tax liability |

YES |

YES |

Source: Internal Revenue Code, 26 U.S.C. §24.

Note: The refundable portion of the child tax credit is often referred to as the additional child tax credit or ACTC.

ACTC.

a. Absent legislative action, many of the changes made to the child tax credit by P.L. 115-97 will expire and the

credit parameters will revert to pre-2018 levels.

b.

The phaseout threshold for married taxpayers that file separate returns is $200,000 from 2018 -2025. Pre2018/post 2025, the phaseout threshold for married taxpayers that file separate returns is/will be $55,000 .

Detailed Overview of Current Credit

Detailed Overview of Current Credit

Each of the key parameters of the child tax credit as in effect from 2018-2025 through the end of 2025

is described in more detail below. The legislative changes made to the child tax credit by P.L.

115-97 have significantly expanded the child tax credit, especially for upper-income taxpayers, as

illustrated in Figure 1.

|

|

Figure 1. Figure 1 Child Tax Credit Amount by Income Level Source: Internal Revenue Code (IRC) Section 24.

Notes: This is a stylized example assuming the taxpayer has one qualifying child. In actuality, the ACTC is |

Maximum Credit per Child

Eligible families can claim a child tax credit and reduce their federal income tax liability by up to

$2,000 per qualifying child.1 1 The maximum credit a family can receive is equal to the number of

qualifying children a taxpayer has, multiplied by $2,000. For example, a family with two

qualifying children may be eligible for a $4,000 credit. Families may receive the child tax credit

as a reduction in tax liability (the nonrefundable portion of the credit), a refundable credit (the

1

T he child tax credit can be found in Section 24 of the Intern al Revenue Code (26 U.S.C. §24).

Congressional Research Service

2

The Child Tax Credit: Current Law

amount of the credit in excess of tax liability), or a combination of both.2 2 The refundable portion

of the credit—the ACTC—is discussed in the subsequent section.

|

Beginning in 2026, the maximum amount of the credit is scheduled to revert to $1,000 per qualifying child.

Maximum Additional Child Tax Credit (ACTC) per Child, the Refundability Threshold and Refundability Rate

For taxpayers with little or no federal income tax liability, they will be eligible for little if any of the nonrefundable portion of the child tax credit. Instead, they may be eligible to receive the child tax credit as a refundable credit. The refundable portion of the child tax credit is often referred to as the additional child tax credit or ACTC. The amount of the refundable child tax credit is generally calculated using the "earned income formula"5 up to the maximum ACTC amount of $1,400 per qualifying child.

Under the earned income formula, a taxpayer may claim an ACTC equal to 15% of the family's earned income in excess of $2,500, up to the maximum ACTC amount (i.e., up to $1,400 multiplied by the number of qualifying children). The $2,500 amount is referred to as the refundability threshold; the 15% is referred to as the refundability rate. If a taxpayer's earnings are below the refundability threshold, they are ineligible for the ACTC. For every dollar of earnings above this amount, the value of the taxpayer's ACTC increases by 15 cents, up to the maximum amount of the credit ($1,400 per qualifying child). For purposes of calculating the ACTC, earned income is defined as wages, tips,

and other compensation included in gross income. It also includes net self-employment income

(self-employment income after deduction of one-half of Social Security payroll taxes paid by a

self-employed individual).

Beginning in 2026, the refundability threshold is scheduled to increase to $3,000 and the

maximum ACTC per child (the amount that exceeds income tax liability) is scheduled to decrease

to $1,000 per child.

The Phaseout Threshold and Phaseout Rate

The child tax credit phases out for higher-income families. The $2,000-per-child value of the

credit falls by a certain amount as a family'’s income rises. Specifically, for every $1,000 of

modified adjusted gross income (MAGI)6 6 above a threshold amount, the credit falls by $50—or

effectively by 5% of MAGI above the threshold. The threshold amount depends on a taxpayer's ’s

filing status, and equals $200,000 for single parents and married taxpayers filing separate returns,

and $400,000 for married taxpayers filing joint returns. The actual income level at which the

credit is entirely phased out (i.e., equals zero) depends on the number of qualifying children a

taxpayer has. Generally, it takes $40,000 of MAGI above the phaseout threshold to completely

phase out $2,000 of credit. For example, the credit will completely phase out for a married couple

with two children if their MAGI exceeds $480,000 (see Figure 1).

. Definition of a Qualifying Child

In order to claim the child tax credit, a taxpayer'’s child must be considered "“a qualifying child" ”

and meet several requirements, which may differ from eligibility requirements for other child-relatedchildrelated tax benefits:

-

1. The child must be under 17 years of age

during the entire year for which the taxpayer claims the credit (for example, if the child was 16.5 years on December 31, 2017, the taxpayer could claim the credit on their 2017 federal income tax return). - by the end of the year. (In other words, if

the child turns 17 years old on December 31, 2020, the taxpayer cannot claim

them as a qualifying child for the child tax credit on their 2020 income tax

return.)

2. The child must be eligible to be claimed as a dependent on the taxpayer

'’s return.7 37 Specifically: a. The child must be the taxpayer'’s son, daughter, grandson, granddaughter,taxpayer.4. The child must live at the same principal residence as the taxpayer for moretaxpayer. 6 With respect to the child tax credit, modified adjusted gross income (MAGI) is equal to Adjusted Gross Income (AGI) increased by foreign earned income of U.S. Citizens abroad, including income earned in Guam, American Samoa, the Northern Mariana Islands, and Puerto Rico. For more information on AGI see CRS Report RL30110, Federal Individual Income Tax Terms: An Explanation, by Mark P. Keightley and Jeffrey M. Stupak; and CRS Report RL32808, Overview of the Federal Tax System , by Molly F. Sherlock and Donald J. Marples. 7 See the definition of a qualifying child for he dependent exemption in IRC 152(c). From 2018 to 2025, due to the temporary suspension of the dependent exemption enacted as part of P.L. 115-97, taxpayers may no longer claim their children as dependents for purposes of the dependent exemption, although this does not affect eligibility for the credit and the definition of a dependent remains unchanged by the law. IRC Section 151(d)(5)(B). Congressional Research Service 4 The Child Tax Credit: Current Law b. The child must live at the same principal residence as the taxpayer for more than half the year for which the taxpayer wishes to claim the credit. cthan half the year for which the taxpayer wishes to claim the credit.5. The child cannot provide more than half of their own support during the taxyear.6. The child must be a U.S. citizen or national. If they are not a U.S. citizen or

8

The age and citizenship requirements for a qualifying child for the child tax credit differ from the

definition of qualifying child used for other tax benefits and can cause confusion among

taxpayers. For example, a taxpayer'’s 18-year-old child may meet all the requirements for a

qualifying child for the EITC, but will be too old to be eligible for the child tax credit.

ID Requirements to Claim the Child Tax Credit

The statute requires that taxpayers who intend to claim the child tax credit provide a valid

taxpayer identification number (TIN) for each qualifying child on their federal income tax return.

Under a temporary change in effect from 2018 through the end of 2025, the child'’s TIN must be a

work-authorized Social Security number (SSN). The SSN must be issued before the due date of

the tax return. Failure to provide the child'’s SSN may result in the taxpayer being denied the

credit (both the nonrefundable and refundable portions of the credit).

Absent any legislative changes, beginning in 2026, a valid TIN for qualifying children will

include individual taxpayer identification numbers (ITINs) and Social Security numbers (SSNs).

ITINs are issued by the Internal Revenue Service (IRS) to noncitizens who do not have and are

not eligible to receive SSNs. ITINs are supplied solely so that noncitizens are able to comply with

federal tax law, and do not affect immigration status.

In addition, in order to claim the child tax credit in a given tax year, the taxpayer must also

provide their own taxpayer identification number that must be issued before the due date of the

tax return. This is a permanent ID requirement that is not scheduled to expire.

Disallowance of the Credit Due to Fraud or Reckless Disregard of

the Rules

A tax filer is barred from claiming the child tax credit for a period of 10 years after the IRS makes

a final determination to reduce or disallow a tax filer'’s child tax credit because that individual

made a fraudulent child tax credit claim. A tax filer is barred from claiming the child tax credit for

a period of two years after the IRS determines that the individual made a child tax credit claim "

“due to reckless and intentional disregard of [the] rules"” of the child tax credit, but that disregard

was not found to be due to fraud.8

9 Data on the Child Tax Credit

Estimates from the Internal Revenue Service (IRS) and Tax Policy Center highlight several key

aspects of the child tax credit:

The 8 9 The total dollar amount of the child tax credit has grown over time: DataIn 2018In 2019, the majority of the tax benefitwill gowent to taxpayers with income:: The Tax Policy Center (TPC) estimates that the2018 will go2019 went to taxpayers with more than910 In comparison, a relatively smallwill gowent to very-low-income or very-high-income taxpayers.In 2018, overIn 2019, approximately 90% of taxpayers with childrenandand income betweenwill receivereceived the child tax credit. The Tax Policy Centerwill receivereceived the child tax credit in20182019. About half of thelowest-income taxpayers will receivelowestincome taxpayers received the credit and virtually no taxpayers with children andwill receivereceived the credit.In 2018In 2019, taxpayers with income between $100,000 and $200,000willon averagereceiveon average received the largest credit. The Tax Policy Center (TPC) estimates thatwillon averagereceivereceived a credit of over $3,000 in20182019. Taxpayers with children with incomewill receivereceived on average a credit of less than $1,000, while thewill receivereceived on average a credit of $10.

Total Child Tax Credit Dollars, 1998-2015

2017

IRS estimates of the amount of total child tax credit dollars (inflation adjusted to 20152017 dollars)

received by taxpayers indicate that this tax benefit has more than doubled in size since enactment,

from aggregate receipt of $22 billion in 1998 to approximately $5451 billion in 20152017, as illustrated

in Figure 2.

10

T he T ax Policy Center measure of income used in their analysis expanded cash income (ECI) which is defined as

cash income plus (1) tax-exempt employee and employer contributions to health insurance and other fringe benefits, (2)

employer contributions to tax-preferred retirement accounts, (3) income earned within retirement accounts, and (4)

food stamps. For more information, see http://www.taxpolicycenter.org/resources/income-measure-used-distributionalanalyses-tax-policy-center.

Congressional Research Service

6

The Child Tax Credit: Current Law

, as illustrated in Figure 2.

A significant component in the growth of the child tax credit has been the growth in the

refundable portion of the credit, which now comprises approximately half of child tax credit

dollars received by taxpayers. (For an overview of the legislative changes that have influenced

the expansion of both the refundable and nonrefundable portions of the credit, see CRS Report

R45124, The Child Tax Credit: Legislative History, by [author name scrubbed].) The most , by Margot L. Crandall-Hollick.) The most

recent IRS data available are for the 20152017 tax year (i.e., 20152017 income tax returns filed in 2016), 2018),

and hence do not include the impact of the legislative changes made to the credit by P.L. 115-97. .

As previously discussed, these legislative changes are currently scheduled to be in effect from

2018 through the end of 2025. The Joint Committee on Taxation has estimated that the

modification to the child tax credit formula will cost an estimated $573.4 billion between 2018

and 2026, or on average $64 billion a year.10 11 (These estimates include the budgetary cost of the

$500 nonrefundable credit for non-child tax-credit-eligible dependents.) JCT also estimates that

the new SSN requirement will save $29.8 billion between 2018 and 2026, or on average $3

billion per year.

Joint Committee on T axation, Estimated Budget Effects of the Conference Agreement for HR.1, the “Tax Cuts and Jobs Act”, December 18, 2017, JCX-67-17. 11 Congressional Research Service 7 The Child Tax Credit: Current Law Total Child Tax Credit Dollars by Income Level

The Tax Policy Center (TPC) estimated the distribution of aggregate child tax credit by income level11 for 2018

level for 2019 under current law (i.e., including the changes made by P.L. 115-97).).12 These

estimates include the $500 credit for non-child tax-credit-eligible dependents. TPC estimates that

nearly one-third of all child tax credit dollars (31%) will go30.5%) went to taxpayers with income between

$100,000 and $200,000, as illustrated in Figure 3.

Slightly more than one. One-quarter of all child tax credit dollars (26.5%) will go

(25.0%) went to taxpayers with income under $50,000.

Lower-income taxpayers will generally receive a credit of $1,400 or less per child, depending on their

earnings. In contrast, higher-income taxpayers with sufficient income tax liability will receive a credit

of $2,000 per child. For example, a single parent with two children and $15,000 of income will be is

eligible for a $1,875 credit (received entirely as the refundable child credit or ACTC), less than

the maximum ACTC for two children of $2,800 (2x $1,400) and less than the maximum credit for

two children of $4,000 (2 x $2,000). The highest-income taxpayers willdo not receive a credit due to

the credit phaseout.

Figure 3. Estimated Share of Total Child Tax Credit Dollars by Income Level, 2019

Source: Tax Policy Center Model T20-0091.

Notes: Income is defined as expanded cash income (ECI), which equals cash income plus certain other taxexempt forms of income and benefits like food stamps. These estimates include the $500 credit for non -child-tax

credit eligible dependents.

For the purposes of these estimates that T ax Policy Center uses a broad measure of pretax income called “expanded

cash income” or ECI. ECI equals cash income plus (1) tax -exempt employee and employer contributions to health

insurance and other fringe benefits, (2) employer contributions to tax-preferred retirement accounts, (3) income earned

within retirement accounts, and (4) food stamps. According to T PC, “[t]he primary motivation for adopting this broader

income measure was to characterize differences in the economic status of individual taxpayers more completely and

accurately.” For more information, see http://www.taxpolicycenter.org/resources/income-measure-used-distributionalanalyses-tax-policy-center.

12

Congressional Research Service

8

The Child Tax Credit: Current Law

Share of Taxpayers with Children Receiving the Child Tax Credit

Share of Taxpayers with Children Receiving the Child Tax Credit

TPC estimated the share of all taxpayers and taxpayers with children that would receive the child tax credit in 2018taxpayers with children and all taxpayers that received the child tax

credit in 2019. The estimates indicate that among taxpayers with children, almost all taxpayers will receive

received the child tax credit. More than 90% of taxpayers with children and income between

$40,000 and $500,000 will receivereceived the child tax credit. In contrast, aboutless than half (5147.8%) of

taxpayers with children and income under $10,000 will receivereceived the child tax credit in 2018, and less than one-fifth (182019, and

about one-third (38.6%) of taxpayers with children and income between $500,000 and $1 million will receive

received the credit, as illustrated in Figure 4. .

Fewer low-income families with children will benefit from the child tax credit since taxpayers with

income under $2,500 (the refundability threshold) willare not be eligible for the refundable portion of

the credit. In contrast, due to the phaseout of the credit at higher income levels, virtually no

taxpayers with children and income over $1 million will beare currently eligible to claim it.

Congressional Research Service

9

The Child Tax Credit: Current Law

Figure 4. Estimated Share of Taxpayers with Children and All Taxpayers

Receiving the Child Tax Credit by Income Level, 2019

Source: Tax Policy Center Model T20-0091.

Notes: eligible to claim it.

child tax credit or earned income tax credit (EITC).

Average Child Tax Credit Amount

TPC estimated the average child tax credit amount by income level for all taxpayers and taxpayers with children in 2018taxpayers with children

and all taxpayers in 2019. Their estimates indicate that taxpayers with children and income

between $100,000 and $200,000 will receivereceived the largest credit on average—an estimated $3,100. 040.

Taxpayers with children and income under $20,000 will receivereceived on average a credit of less than

Congressional Research Service

10

The Child Tax Credit: Current Law

$1,000, while the wealthiest taxpayers with children (income over $1 million) will on average receive

received a credit of $10.

Lower-income taxpayers are eligible to receive a credit of up to $1,400 per child, although they

may receive less depending on their earned income. In contrast, higher-income taxpayers, with

sufficient income tax liability, will beare eligible for up to a $2,000 credit per child. The highest-income

taxpayers will beare ineligible for the credit due to the phaseout.

Author Contact Information

Footnotes

| 1. |

The child tax credit can be found in Section 24 of the Internal Revenue Code (26 U.S.C. §24). |

| 2. |

Importantly, even if the credit both reduces tax liability and then is received as a refund, the total value of the nonrefundable and refundable portion of the credit cannot exceed $2,000 per child multiplied by the number of qualifying children. Hence, if a family with two children and a $1,500 tax liability is eligible for a $2,000 child tax credit, $1,500 of their credit will reduce their tax liability to zero (the nonrefundable portion) and the family may receive up to $500 of child tax credit as a refundable credit, depending on their income. |

| 3. |

The original title of the law, the Tax Cuts and Jobs Act, was stricken before final passage because it violated what is known as the Byrd rule, a procedural rule that can be raised in the Senate when bills, like the tax bill, are considered under the process of reconciliation. The actual title of the law is "To provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018." For more information on the Byrd rule, see CRS Report RL30862, The Budget Reconciliation Process: The Senate's "Byrd Rule", by [author name scrubbed] |

| 4. |

For more information on the changes made to the tax code by P.L. 115-97, see CRS Report R45092, The 2017 Tax Revision (P.L. 115-97): Comparison to 2017 Tax Law, coordinated by [author name scrubbed] and [author name scrubbed]. |

| 5. |

Families with three or more children may choose to calculate the refundable portion of the child tax credit using an alternative formula. If the amount calculated under the alternative formula is larger than the refundable credit calculated under the earned income formula, the larger credit can be claimed. The alternative formula is calculated as the excess of a taxpayer's payroll taxes (including one-half of any self-employment taxes) over their earned income tax credit (EITC), not to exceed the maximum credit amount. However, lower-income taxpayers will often pay less in payroll taxes than they will receive in the EITC. This is because payroll taxes are equal to 7.65% of earnings, while the EITC equals up to 45% of earnings. |

| 6. |

With respect to the child tax credit, modified adjusted gross income (MAGI) is equal to Adjusted Gross Income (AGI) increased by foreign earned income of U.S. Citizens abroad, including income earned in Guam, American Samoa, the Northern Mariana Islands, and Puerto Rico. For more information on AGI see CRS Report RL30110, Federal Individual Income Tax Terms: An Explanation, by [author name scrubbed] and [author name scrubbed]; and CRS Report RL32808, Overview of the Federal Tax System, by [author name scrubbed] and [author name scrubbed]. |

| 7. |

From 2018 to 2025, due to the temporary suspension of the dependent exemption enacted as part of P.L. 115-97, taxpayers may no longer claim their children as dependents for purposes of the dependent exemption, although this does not affect eligibility for the credit and the definition of a dependent remains unchanged by the law. IRC Section 151(d)(5)(B). |

| 8. |

See IRC Section 24(g). |

| 9. |

The Tax Policy Center measure of income used in their analysis expanded cash income (ECI) which is defined as cash income plus (1) tax-exempt employee and employer contributions to health insurance and other fringe benefits, (2) employer contributions to tax-preferred retirement accounts, (3) income earned within retirement accounts, and (4) food stamps. For more information, see http://www.taxpolicycenter.org/resources/income-measure-used-distributional-analyses-tax-policy-center. |

| 10. |

Joint Committee on Taxation, Estimated Budget Effects of the Conference Agreement for HR.1, the "Tax Cuts and Jobs Act", December 18, 2017, JCX-67-17. |

| 11. |

For the purposes of these estimates that Tax Policy Center uses a broad measure of pretax income called "expanded cash income" or ECI. ECI equals cash income plus (1) tax-exempt employee and employer contributions to health insurance and other fringe benefits, (2) employer contributions to tax-preferred retirement accounts, (3) income earned within retirement accounts, and (4) food stamps. According to TPC, "[t]he primary motivation for adopting this broader income measure was to characterize differences in the economic status of individual taxpayers more completely and accurately." For more information, see http://www.taxpolicycenter.org/resources/income-measure-used-distributional-analyses-tax-policy-center. |