U.S. Trade Deficit and the Impact of Changing Oil Prices

Changes from April 4, 2018 to January 30, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

U.S. Trade Deficit and the Impact of Changing Oil Prices

Contents

Figures

- Figure 1. Share of Petroleum and Non-Petroleum Products in the U.S. Trade Deficit

- Figure 2.

EnergyMonthly Petroleum Products Trade Deficit as a Share of Monthly Total U.S. Merchandise Trade Deficit - Figure 3. Average Monthly Quantity of U.S. Imports of Energy-Related Petroleum Products

- Figure 4. Value of U.S. Imports of Energy-Related Petroleum Products

- Figure 5. U.S. Import Price of Crude Oil

- Figure 6. Quantity, Value, and Price of Imported Crude Oil by the United States,

1973-20171995-2019

- Figure 7. Percent Change in Export and Import Goods Volumes; 1st Quarter 2016 to 3rd Quarter 2019 (2012 = 100)

Summary

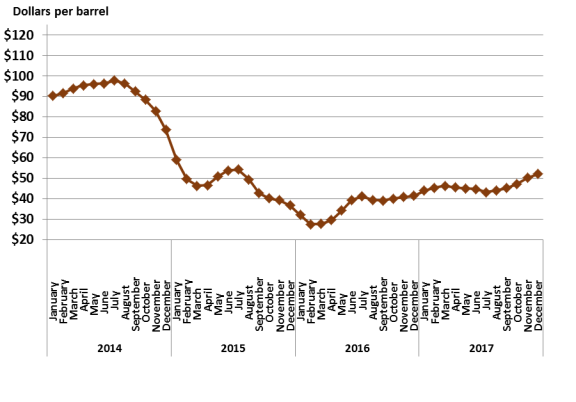

Imported petroleum prices fell from an average price of $91.23 per barrel of crude oil in 2014 to an average price of $32.60 per barrel in 2016, or a drop of more than 60%. This represents the lowest price per barrel of crude oil since early 2005. During 2017, the average monthly price per barrel of oil rose nearly 20% to reach an average of $52 per barrel by December 2017 and continued rising in 2018 to reach nearly $70 per barrel in early April 2018. Reflecting rising prices, the volume of crude oil imports for 2017 was nearly flat for the year compared with volume changes in 2016. The rise in the average price of a barrel of crude oil combined with a slight increase in the amount, or the volume, of oil imports in 2017 compared with 2016 resulted in a nearly 30% increase in the overall value of imported crude oil and a slight increase in the share of the total U.S. merchandise trade deficit that is associated with the trade deficit in energy imports.

In general, market demand for oil remains highly resistant to changes in oil prices and reflects the unique nature of the demand for and the supply of energy-related imports. Turmoil in the Middle East is an important factor that continues to create uncertainty in global petroleum markets and was one of the most important factors in causing petroleum prices to rise sharply in early 2011 and in 2012. A slowdown in the rate of growth in the Chinese economy, combined with a rising in raw material prices, an increase in the rate of economic growth among commodity-exporting developing economies, and improved prospects of growth among many of the major developed economies, all have pushed up demand for energy products. Fluctuations in U.S. energy production, uncertainty concerning oil production decisions by various members of the Organization of the Petroleum Exporting Countries (OPEC), and the potential impact of new Iranian supplies of oil also have worked to push up the global market price of oil. Oil futures markets in April 2018 indicate that oil traders expect crude oil prices to trend in the range of $63 per barrel through 2018, below early April 2018 market prices. At current prices and volumes, energy imports in 2018 are projected to rise to about $200 billion, or about $25 billion more than in 2017. This report provides an estimate of the initial impact of the changing oil prices on the nation's merchandise trade balance.

Background

According to data published by the Census Bureau of the U.S. Department of Commerce,1 the average price of imported petroleum products averaged about $46 per barrel in 2017, or an increase of 27% above the previous year. Oil futures markets in April 2018 indicate that oil traders expected crude oil prices to trend at about $63 per barrel through the end of 2018, below actual market prices of close to $70 per barrel reached in early April 2018.

Energy prices have fluctuated sharply over the past seven years, generally rising during the winter and spring months and then declining in the fall. In 2008, prior to the financial collapse, the average imported petroleum prices reached nearly $140 per barrel, before falling at a historic rate.2 During the economic recession in 2009, however, average petroleum prices fell each month between August 2008 and February 2009, but then reversed course and rose by 85% between February and December 2009, climbing to nearly $80 per barrel at times.

In 2012, the average price of imported petroleum rose 1% over the same period in 2011 to reach an average price of $101.07 per barrel. In 2013, oil prices averaged around $97 per barrel, falling to an average monthly price of about $91 per barrel in 2014. Average imported petroleum prices dropped throughout 2015, falling to an average price of $37 per barrel in December 2015. Average imported petroleum prices rose through much of 2017 and into 2018, rising to close to $70 per barrel in early April 2018, outpacing oil futures contacts. Imported energy products, primarily crude oil, account for about one-fourth of the total annual U.S. energy consumption, measured in btus.3

Turmoil in the Middle East, natural disasters, hurricanes, droughts, the rate of economic growth in Asia and Europe, the prospects of Iranian oil exports, and the impact of low oil prices on U.S. investment and production of petroleum and natural gas—the United States is now the world's largest combined producer of oil and natural gas—likely will continue to have a significant impact on the course of oil prices for the foreseeable future. As a result of changing petroleum prices, imported energy-related petroleum products accounted for a larger share of the U.S. trade deficit in 2006-2008 and 2010-2011.4

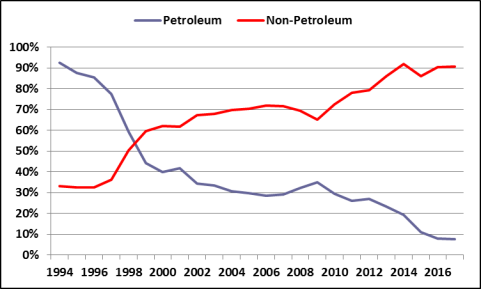

Crude oil comprises the largest share by far within the broad category of energy-related imports. Despite fluctuations in oil prices and sharp drops at times in the average annual price of imported crude oil and the decline in the role of imported crude oil in the value of the U.S. trade deficit, the trade deficit itself did not change appreciably. Instead, the composition of the trade deficit changed, with non-petroleum products replacing petroleum products, as indicated in Figure 1.

On December 13, 2019, petroleum prices rose in some markets to $65 per barrel amid concerns over cutbacks in production by the Organization of the Petroleum Exporting Countries (OPEC) and prospects of higher demand in 2020. Market oil prices also experienced a short run-up in early January 2020 in response to military actions by the United States and Iran, but returned to their pre-crisis levels within a few days. The combination of lower average petroleum import prices and lower average petroleum import volumes in the January-November period of 2019 resulted in a drop in the overall value of U.S. imports of petroleum products of about 17% compared with the same period in 2018. In general, market demand for petroleum products remains highly resistant to changes in prices and reflects the unique nature of the demand for and the supply of energy-related products. Turmoil in the Middle East continues to be an important factor that creates uncertainty in global petroleum markets. In addition, a slowdown in the rate of economic growth in China and India, combined with mixed data on economic growth and prospects for developed economies are creating uncertainties in the global petroleum market. The global market price of oil is also affected by fluctuations in U.S. energy production, uncertainty concerning oil production decisions by various members of OPEC, and the uncertain prospect of Iranian supplies of oil. Oil futures markets in January 2020 indicate that oil traders expect crude oil prices to move in a range of $56 to $60 dollars per barrel through 2020. This report provides an estimate of the initial impact of the changing energy prices on the nation's merchandise trade balance. The growth in U.S. exports of petroleum products has fundamentally altered the role of petroleum products in the U.S. trade deficit over the past decade. Notably, in September, October, and November 2019, the United States was a net exporter of petroleum products, the first time since such data were collected in the post-war period. Although the U.S. trade deficit is no longer dominated by changes in petroleum prices, the United States continues to experience overall merchandise trade deficits on a monthly and annual basis and continues to be a large net importer of crude oil, one component of the broad category of petroleum products. In September 2019, for instance, the United States imported 194 million barrels of crude oil and exported 3 million barrels. Petroleum products, however, once a key factor in determining the overall trade deficit, have been replaced by a net deficit (imports exceeding exports) of non-petroleum products, which has altered the composition of the trade deficit. Economists argue that the overall size of the U.S. trade deficit is determined by macroeconomic factors that affect interest rates, capital flows, and exchange rates. As a result, absent changes in the underlying macroeconomic factors, changes in prices and trade patterns alone, even for commodities as substantial a part of U.S. trade as petroleum, alter the composition of the U.S. trade account, but are unlikely to eliminate the merchandise trade deficit. According to data published by the U.S. Commerce Department's Census Bureau,1 the average price of imported crude oil was $53.48 per barrel through the January-November period in 2019, or a decrease of 9.0% from the equivalent period in 2018. Crude oil prices generally rise during the winter and spring months and then decline in the fall. Oil futures markets in January 2020 indicate that oil traders expect crude oil prices to move in the range of $56 to $60 per barrel in 2020. Average imported crude oil prices rose through much of 2017 and into 2018, rising to nearly $70 per barrel in early April 2018, exceeding the value of oil futures contacts. Imported energy products, primarily crude oil, account for about 15% of the total annual U.S. energy consumption, measured in btus.2 In contrast to crude oil, liquefied natural gas (LNG) prices tend to rise during the winter as consumers use natural gas to heat their homes. A mild start to the 2020 winter season in the United States and parts of Europe and Asia, however, is causing LNG inventories to rise. The rise in inventories combined with planned increases in capacity and export terminals in the United States and elsewhere that exceeds current demand forecasts, has pushed LNG prices in early January 2020 to annual lows.3 Energy prices can fluctuate sharply at times on a monthly and annual basis. For instance, prior to the financial collapse in 2008, the average price of imported crude oil reached nearly $140 per barrel, before falling at a historic rate.4 During the economic recession in 2009, however, average crude oil prices fell each month between August 2008 and February 2009, but then reversed course and rose by 85% between February and December 2009, climbing to nearly $80 per barrel at times. Turmoil in the Middle East, natural disasters, hurricanes, droughts, the rate of economic growth in Asia and Europe, the prospects of Iranian oil exports, and the impact of low oil prices on U.S. investment and production of petroleum and natural gas have led to the United States becoming the world's largest combined producer of oil and natural gas. The United States as the largest producer likely will continue to have a significant impact on the course of oil prices in global and domestic markets for the foreseeable future. Crude oil comprises the largest component by value within the broad category of energy-related imports. Despite fluctuations in oil prices and sharp drops at times in the average annual price of imported crude oil and the decline in the role of imported crude oil in the value of the U.S. trade deficit, the overall U.S. trade deficit has grown each year since 2013. Instead of the trade deficit declining with the diminished role of petroleum products, the composition of the trade deficit has changed, with the deficit in non-petroleum products replacing the deficit in petroleum products, as indicated in Figure 1.

Source: Created by CRS. Data from U.S. Department of Commerce, U.S. Census Bureau, Report FT900, U.S. International Trade in Goods and Services, Table 17, January 7, 2020. In isolation from other events, lower energy prices tend to aid the U.S. economy by lowering energy costs for businesses, increasing consumers' real incomes, and making the United States a more attractive destination for foreign investment. Foreign capital inflows, however, place upward pressure on the dollar against a broad range of other currencies. The impact of changing currency prices are mitigated for the United States, however, by the fact that oil in the global market is priced in dollars, so that both U.S. export and import prices of petroleum products (and prices more generally) tend to be affected in similar manners. Also, periods of volatility or uncertainty in the global economy can spur investors to seek out such safe haven currencies as the dollar, which tends to push up the international value of the dollar. To the extent that the additions to the merchandise trade deficit are returned to the U.S. economy as payment for additional U.S. exports or to acquire such assets as securities or U.S. businesses, the overall economic impact of the U.S. trade deficit could be mitigated further. In isolation from other events, lower energy prices tend to aid the U.S. economy by lowering energy costs for businesses, increasing consumers' real incomes, and making it a more attractive destination for foreign investment. Foreign capital inflows, however, place upward pressure on the dollar against a broad range of other currencies. Periods of volatility or uncertainty in the global economy also spur investors to seek out such safe currencies as the dollar, which tends to push up the international value of the dollar. To the extent that the additions to the merchandise trade deficit are returned to the U.S. economy as payment for additional U.S. exports or to acquire such assets as securities or U.S. businesses, the Exports and imports of petroleum products and changes in their prices have long had a large impact on the U.S. balance of payments, often serving as a major component in the U.S. trade deficit. Over the past decade, however, this has changed. Currently, petroleum prices are having less of an impact on the U.S. balance of payments primarily due to the growth in U.S. exports of petroleum products; in September, October, and November 2019, U.S. exports of petroleum products exceeded imports. While this represents a major step in achieving energy independence, the United States remains a major net importer of crude oil and questions remain about the sustainability of some U.S. energy exports. The share of petroleum products in the overall U.S. trade deficit has fallen from around 47% in December 2010 to -1.3% in November 2019. Recently, imported petroleum prices fell from an average of $58.86 per barrel of crude oil in 2018 to an average price of $53.48 per barrel in the January through November period of 2019, or a decline of 9.0%. Average prices rose to $60.00 per barrel in May 2019, following the annual trend of rising energy prices heading into the summer months, before declining in the fall and winter. Energy prices respond to both geopolitical events and to long-term economic trends in demand and supply of energy products.

Background

U.S. trade deficit could be mitigated further. Lower energy prices also are expected to aid consumers by increasing their real incomes and to aid some businesses. How consumers respond to lower energy costs, however, is problematic. InFor instance, in 2015, consumers reportedly responded to lower energy costs by slightly increasing their overall level of consumption and, but also by increasing thetheir saving rate and reducing credit card debt. In contrast, energy producers have responded at times to lower energy prices by curtailing new investments and by trimming payrolls, offsetting some of the stimulus to the economy provided by lower imported petroleum prices.5

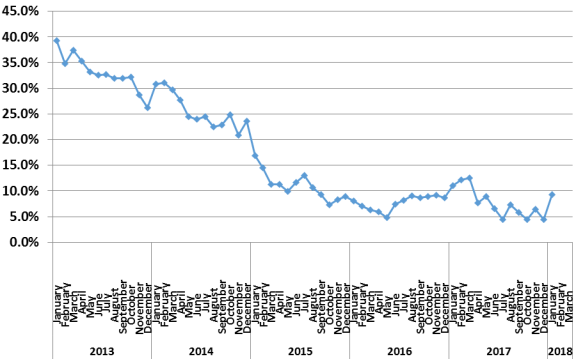

Oil prices in 2013 averaged less than those in 2012; combined with a decline in the volume of imported oil, this resulted in a decline in the role of energy imports in the nation's trade deficit from 40% of the overall deficit in 2012 to 33% in 2013, as indicated in Figure 2. By January 2018, energy imports had risen to account for about 9% of the total U.S. trade deficit from a share of 4% in December 2017, which stands at the lowest monthly share in over a decade.

In January 2018, energy imports accounted for about 9% of the total U.S. trade deficit, up from a share of 4% in December 2017, as indicated in Figure 2. As previously noted, in November 2019, the energy trade balance share of the overall U.S. trade deficit, or exports less imports expressed as a share of the overall U.S. trade deficit, turned positive, but is expressed as a negative share of -1.3 % of the overall U.S. trade deficit. Shares of the U.S. trade deficit customarily are expressed as positive numbers, however, the recent shift of the U.S. energy trade balance to a net surplus is expressed as a negative number, indicating that the share of the U.S. trade balance that represents trade in petroleum products has shifted to a positive factor in the overall U.S. trade deficit. This shift in the trade deficit represented by trade in petroleum products reduces the component of the trade deficit comprised of petroleum products and reflects the growth of exports of petroleum products in the U.S. balance of payments.

|

|

|

Recent Trends

Summary data from the Census Bureau for the change in the volume, or quantity, of energy-related petroleum imports and the change in the price, or the value, of those imports for 20162018 and 20172019, are presented in Table 1. The data indicate that during 20172018, the United States imported about 3.63over 3.5 billion barrels of energy-related petroleum products, down 4.8% in volume terms from the average amount imported in 2017. Energy imports in 2018, however, were valued at $211valued at $174 billion, up 2821% from $136 billion in 2016. On average, energy-related imports for 2017 were up 1.6% in volume terms from the average amount in 2016 and cost 27% more on average per barrel than similar imports during 2016. 175 billion in 2017, largely reflecting a 26% increase in the average import price of crude oil from 2017 to 2018. Data for 2019 indicate that the United States imported over 2.8 billion barrels of energy-related petroleum products in the January through November period, down 11.0% year-over-year. During the same period, average import prices for petroleum products were down 9%. The combination of lower average import prices and lower import volumes in January through November 2019 resulted in a value of imported petroleum of $164 billion, 17% less than the value of imported petroleum products during the comparable period in 2018.

In general, U.S. demand for oil imports responds slowly to changes in oil prices. According to various studies, U.S. demand for oil is correlated more closely towith changes in U.S. per capita income than to changes in oil prices.6 Data for 2016 indicate that the United States imported 3.58 billion barrels of energy-related petroleum products, 5.0% more than was imported in 2015, valued at $136 billion. Most importantly, the average price per barrel of crude oil in 2016 was $36 per barrel, down 34% from the average price of $47 per barrel in 2015. At current prices and volumes, energy imports in 2018 are projected to rise to about $200 billion, or about $25 billion more than in 2017.

Table 1. Summary Data of U.S. Imports of Energy-Related Petroleum Products, Including Oil (not seasonally adjusted)

|

January-December 2018 |

||||||

|

2016 |

2017 |

|||||

|

Quantity |

Value ($ billions) |

Quantity (millions of barrels) |

% change |

Value |

% change |

|

|

Total energy-related petroleum products |

3, |

$ |

3, |

|

$ |

|

|

Crude oil |

2, |

$ |

2, |

|

$ |

|

|

January | ||||||

2017 |

201 |

|||||

|

(Actual values) | (Estimated values) Jan.-Dec., Estimated |

|||||

|

Quantity |

Value |

Quantity |

% change |

Value |

% change |

|

|

Total energy-related petroleum products |

3, |

$ |

3, |

- |

$ |

|

|

Crude oil |

2878.6 |

$ |

2, |

- |

$ |

|

Source: U.S. Department of Commerce, U.S. Census Bureau, Report FT900, U.S. International Trade in Goods and Services, Table 17, March 7, 2018January 7, 2020.

Note: Estimates for January through December 20182019 were developed by CRS from data in January through November, 2019, 2018, and data for 20172018 published by the Census Bureau using a straight line extrapolation.

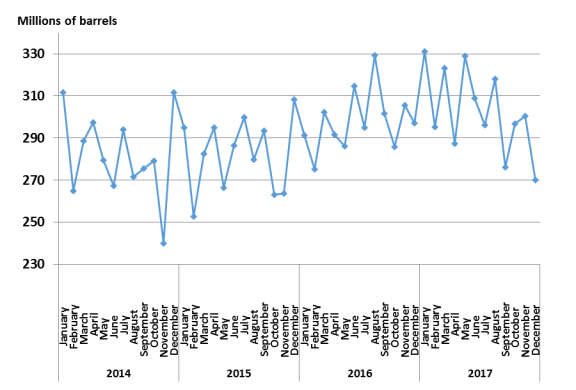

Oil Import Volumes

Commerce Department data indicate that in 2017, the quantitythe January-November 2019 period, the volume, or quantity, of energy-related petroleum products imported by the United States increased by 1.6% compared with such imports in 2016; year over year, crude oil imports rose by 2.6%. As Figure 3 shows, totaled 2.9 billion barrels, or 11% below the 3.2 billion barrels imported during the comparable period in 2018. On average, the United States imported 259 million barrels of petroleum products per month in 2019. As Figure 3 shows, average monthly imports of energy-related petroleum products can vary sharply at times on a monthly basis. In 2017, imports of energy-related petroleum products averaged about 303 million barrels per month, up 1.6% from the average of 298 million barrels per month in 2016. Through December 2017, average imports of crude oil, at 239 million barrels a month, were 2.8% above the same period in 2016. At 331 million barrels in January 2017 and 328 million average barrels per month in May 2017, imports of energy products reached their highest average monthly levels since 2013. In May 2019, for instance, the average monthly volume reached 290 million barrels, compared with the average monthly value of 227 million barrels in November 2019. In 2017, U.S. imports of energy products reached their highest average monthly levels since 2013, reaching an average of 331 million barrels in January 2017 and an average of 328 million barrels per month in May 2017.

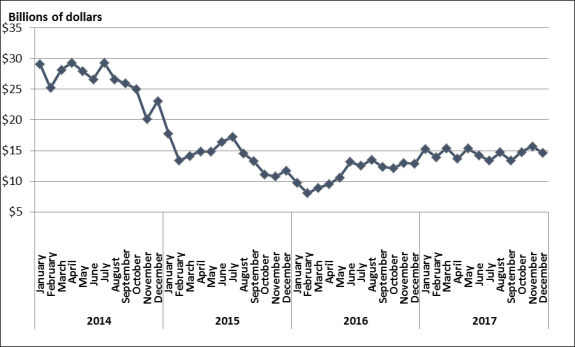

Oil Import Values

As indicated in Table 2, the nominal dollar value of energy-related petroleum products imports in 20172018 was $174211 billion, up 2821% from the value of energysimilar imports in 20162017, which accounted for aboutmore than 8% of the value of total U.S. merchandise imports. In previous periods, energy prices have varied sharply, occasionally not following the general trend of falling during the winter months, as indicated in Figure 4. As Table 2 shows, the average price of imported oil in 2017 was $46 a barrel, up 27% from an average price of $36 per barrel in 2016. In December 2017, the average price of imported oil stood at $52 per barrel. By January 2018, the average monthly price of an imported barrel of oil had risen to $55The average price of imported crude oil in 2018 was $58.22 a barrel, up 26% from an average price of $46 per barrel in 2017. In July 2018, the average price of imported oil stood at $64 per barrel, reflecting increased demand for petroleum products during the summer months. By January 2019, the average monthly price of an imported barrel of oil was $42, the lowest average monthly price recorded during 2019. The average price per barrel of crude oil in the January through November period in 2019 was $53 per barrel, down 8% from the comparable average price of $58 per barrel in 2018. At current prices and volumes, energy imports in 2019 are projected to equal about $175 billion, or about $36 billion less than in 2018.

On a monthly basis, energy import prices and, therefore, the total value of energy imports can vary, as indicated in Figure 4. Through 2017, the value of energy-related imports varied within a relatively narrow band, but experienced wider swings on a monthly basis in 2018 and 2019, reflecting changes in average monthly prices. From August 2018 to February 2019, for instance, the value of U.S. energy-related petroleum imports fell from around $20.8 billion to $11.6 billion, before rising again by August 2019.

Table 2. U.S. Imports of Energy-Related Petroleum Products, Including Crude Oil (not seasonally adjusted)

|

Period |

Total energy-related petroleum productsa |

Crude |

||||||

|

Quantity |

Value |

Quantity |

Thousands |

Value |

Unit price |

|||

|

2016 |

||||||||

|

Jan-Dec. |

3, |

$ |

2, |

7, |

$ |

$ |

||

|

January |

|

$9.8 |

|

7, |

$7.3 |

$32.05 |

||

|

February |

|

$8.0 |

214.9 |

7,411 |

$5.9 |

$27.49 |

||

|

March |

302.3 |

$8.9 |

243.9 |

7, |

$6.7 |

$27.67 |

||

|

April |

291.5 |

$9.5 |

228.9 |

7, |

$6.8 |

$29.53 |

||

|

May |

286.2 |

$10.6 |

223.4 |

7, |

$7.6 |

$34.19 |

||

|

June |

314.6 |

$13.2 |

244.8 |

8,159 |

$9.6 |

$39.38 |

||

|

July |

294.9 |

$12.5 |

|

7, |

$9.3 |

$41.02 |

||

|

August |

329.4 |

$13.5 |

256.6 |

8,279 |

$10.1 |

$39.38 |

||

|

September |

301.7 |

$12.4 |

238.5 |

7, |

$9.3 |

$39.01 |

||

|

October |

285.9 |

$12.1 |

224.6 |

7, |

|

$40.03 |

||

|

November |

305.7 |

$13.0 |

240.4 |

8,014 |

$9.8 |

$40.81 |

||

|

December |

297.1 |

$12.8 |

|

7,679 |

$9.9 |

$41.40 |

||

|

2017 |

||||||||

|

Jan- |

3,632.8 |

174.4 |

2, |

7,887 |

|

45.96 |

||

|

January |

331.2 |

|

258.9 |

8,353 |

11.4 |

43.94 |

||

|

February |

295.2 |

13.9 |

235.3 |

8,402 |

10.6 |

45.25 |

||

|

March |

323.3 |

|

|

8,383 |

12.0 |

46.26 |

||

|

April |

287.5 |

13.7 |

229.2 |

7,641 |

10.4 |

45.40 |

||

|

May |

329.0 |

15.4 |

265.0 |

8,548 |

11.9 |

45.03 |

||

|

June |

308.8 |

|

248.8 |

8,292 |

|

44.68 |

||

|

July |

296.3 |

|

235.1 |

7,585 |

10.2 |

43.20 |

||

|

August |

318.0 |

14.7 |

251.7 |

8,118 |

11.1 |

44.11 |

||

|

September |

276.3 |

13.4 |

210.5 |

7,017 |

9.5 |

45.16 |

||

|

October |

296.8 |

14.8 |

234.7 |

7,570 |

11.1 |

47.26 |

||

|

November |

300,5 |

15.7 |

235.6 |

7,852

|

13.7

|

185.7 6,190 |

11.8 |

50.10 |

|

December |

270.2 |

14. |

214.0 |

6, |

11.1 |

52. | ||

2018 |

||||||||

|

January |

310.3 |

17.6 |

240.9 |

7,772 |

13.2 |

54.76 |

||

Source: U.S. Department of Commerce, U.S. Census Bureau, Report FT900, U.S. International Trade in Goods and Services, Table 17, March 7, 2018January 7, 2020.

a. "Energy-related petroleum products" is a term used by the Census Bureau and includes crude oil, petroleum preparations, and liquefied propane and butane gas.

Oil Import Prices

Crude oil comprises the largest share of U.S. total energy-related petroleum products imports, accounting for 76% of such imports. Census Bureau data10 indicate that the price of imported crude oil can fluctuate on a daily and monthly basis, reflecting international political events and economic activity. As shown in Figure 5, average monthly crude oil import prices generally trended up during the 2016 through 2019 period and varied in a range between $27 and $64 per barrel between February 2016 and July 2018, after which average monthly imported oil prices fell to nearly $40 per barrel in January 2019. Since then, crude oil prices rose to about $60 per barrel on an average monthly basis in May 2019, before falling to about $52 per barrel on an average monthly imported price in October 2019energy-related petroleum products imports. As is apparent from Census Bureau data,7 the price of imported crude oil has fluctuated sharply at times. For instance, from January 2008 to June 2008, the average price of crude oil increased by 39%, rising from $84 per barrel to $117 per barrel. As shown in Figure 5, oil import prices varied in the general range of $90 and $108 per barrel between January 2012 and October 2014, after which imported oil prices have experienced a sharp drop. Crude oil prices rose from an average of $94 per barrel in January 2013 to $102 per barrel in September 2013, the highest average monthly value recorded up to that point in 2013, but fell to an average imported price of $91.34 in December 2013. In 2015, oil prices fell from $58.96 per barrel in January to $36.60 in December. During 2017, oil prices trended upward, rising from a monthly average of $43 per barrel to a monthly average $52 per barrel, the highest monthly average price since mid-2015.

|

|

Source: Created by CRS. Data from U.S. Department of Commerce, U.S. Census Bureau, Report FT900, U.S. International Trade in Goods and Services, Table 17, |

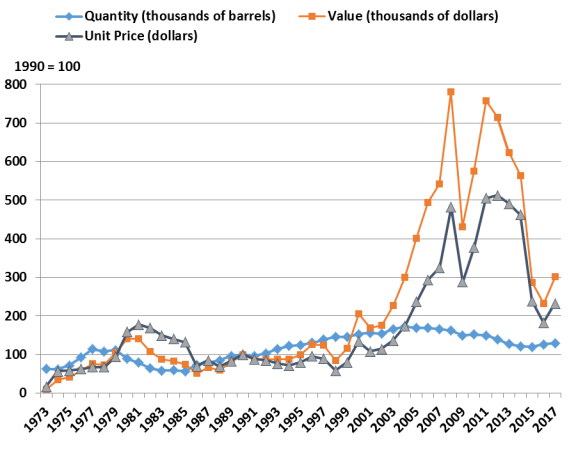

As previously indicated, the combination of changes in the volume, value, and prices of crude oil can have a large impact on the total value of U.S. imports and on the composition of the U.S. trade deficit. Figure 6 shows the annual amounts of the volume, value, and price of U.S. crude oil imports from 1973 to 20181995 to 2019, represented in index terms with 1990 as the base year. The data indicate that the overall volume of U.S. imports of crude oil increased by about 20% between 1990 and 2015 in index terms. The price of crude oil, represented by the average price of a barrel of crude oil on an annual basis, rose by about two and a half times between 1990 and 2015 in index terms. As a result, the total value of U.S. crude oil imports, representing the price per barrel times the number of barrels of crude oil on an annual basis, rose by about three times between 1990 and 2015 on an index number basisquantity, or volume, of U.S. imports of crude oil on an annual basis was about the same in 2019 as it was in 1995, despite large changes in both prices and the overall value of crude oil imports. As a result, changes in the overall value of crude oil imports largely reflects changes in the price per barrel of crude oil. A large run-up in crude oil prices prior to the 2008-2009 global financial crisis and then subsequent sharp decline as a result of the global economic recession had a similar effect on the overall value of crude oil imports.

The overall decline in the average price of energy-related imports has accompanied a drop in the imported volume of crude oil, potentially signaling important changes in the U.S. energy market. The United States has become the world's largest combined producer of oil and natural gas, which reduces the need for oil importshas reduced demand for imports of petroleum products as a whole. In addition, improvements in energy efficiency appear to be continuing; such improvements result in less energy being used to sustain a given level of economic activity. A slower rate of economic growth also has consequences for energy consumption in the economy and the role of imported energy products. Lower energy prices, however, are not a panacea for the U.S. economy as a whole. The U.S. energy sector has trimmedtended to trim employment and curtailedcurtail investment projects, which could pose problems for during periods of low crude oil prices, which potentially negatively affect future energy production. Lower energy prices also are negatively affectingaffect energy-exporting countries by reducing their rate of economic growth and their demand for imports; this, in turn, negatively affects countries with which they engage in international trade. A slowdown in global trade will have a slightly negative impact on the U.S. economy: exports and imports account for about 13% and 16%, respectively, of U.S. GDP.

Issues for Congress

The rise in the prices of energy imports in 2017 and early 2018, combined with a small increase in the total volume of energy imports, resulted in a larger contribution to the overall U.S. trade deficit in 2017 and 2018. The overall trade deficit, however, has stayed relatively flat. In previous periods, as energy imports declined, imports of non-energy goods increased. This trend is being reversed slightly with rising energy import prices. The average monthly price of imported oil continues to be volatile, making it difficult to determine when and at what level the price will stabilize in 2018. Oil futures markets seem to indicate a belief that the price will stabilize around $63 per barrel through 2018, although these contract prices are lagging behind market prices. The ubiquitous nature of oil in the economy generally means that changes in energy prices will affect the U.S. rate of inflation and the rate of economic growth. Various factors, dominated by events in the Middle East, a slowdown in the rate of economic growth in Asia and other developing economies, and an increase in natural gas production in the United States, combined in 2015 to push the cost of energy imports slightly lower than in 2014. The pace of economic growth in the United States tracked slightly above 3% in the second and third quarters of 2017, which may have affected both the level of oil imports and the price of such imports. The pace of economic growth has improved in Europe, Asia, and developing economies.

In September, October, and November 2019, U.S. exports of petroleum products exceeded imports, marking a notable change in the composition of U.S. trade and in the monthly trade balance in petroleum products. As a result, trade in petroleum products, which comprises the single largest commodity group in the U.S. trade deficit, shifted from a net contributor to the trade deficit to a net positive, effectively reducing this component of the trade deficit. The composition of the trade deficit has changed as petroleum products have been replaced by trade deficits in other commodities, mostly consumer and capital goods. Overall, however, the U.S. trade deficit in nominal terms has continued to rise. The impact of changes in petroleum prices on the U.S. balance of payments and on the economy generally are complicated by the fact that oil is priced in dollars in global energy markets so import and export prices tend to move in tandem, rather than in opposite directions as generally would be expected.Typically, energy import prices have followed a cyclical pattern as energy prices rise in the summer months and fall in the winter. The slowdown in the rate of economic growth in the United States and elsewhere in 2009 sharply reduced the demand for energy imports and caused oil prices to tumble from the heights they reached in July 2008. Two importantAnother view of the U.S. trade balance is presented in Figure 7, which is based on U.S. national income accounts data. These data represent percent changes in export and import volumes in index number terms with 2012 as the base year. The data indicate that on a quarterly basis, between the first quarter of 2016 and the third quarter of 2019, exports of petroleum products increased by 45%, while imports fell by 12%. In contrast, imports of capital and consumer goods each increased by about 20% in volume terms. In total, U.S. import volumes increased by about 12% and export volumes grew by about 10%. The difference in U.S. export and import volumes of petroleum products shows the growth in the United States as an energy exporter while U.S. domestic production filled a greater share of domestic energy demand, thereby reducing overall volumes of petroleum import.

have on the production of crude oil in the Gulf of Mexico and droughts in the midwesternMidwestern United States that can reduce the production of corn and, therefore, the availability of ethanol, which puts upward pressure on gasoline prices. Recently, the price of oil has been affected by increased energy production in the United States and a combination of global economic events, including the slowdown in the Chinese economy (most recently threatened by coronavirus) and the Indian economy; a sharp drop in commodity prices that has negatively affected commodity producers and their trading partners; the international exchange value of the dollar; an apparent agreement amongthe production of crude oil by OPEC oil producers to reduce production in order to drive up prices; and the prospects of a resumption of oil production in Iran, among other events.

The return to a positive rate of economic growth in the United States and globally placed upward pressure on the prices of energy imports and contributed to the share of imported energy in the United States' merchandise trade deficitcontinued turmoil in the Middle East, among other events.

Also, a slightly slower GDP growth rate in the United States in 2019, compared with 2018, and combined with international events added downward pressure on the average import price of crude oil. In turn, economic conditions in the United States and the growth in U.S. energy production reduced slightly U.S. demand for imported oil and the impact of imported petroleum products on the U.S. merchandise trade deficit. Despite this change in the net balance of trade in petroleum products, the U.S. trade deficit as a whole has increased as the composition of the trade deficit has changed. Some of the impact of this deficit could be offset if some of the dollars that accrue abroad are returned to the U.S. economy through increased purchases of U.S. goods and services or through purchases of such other assets as corporate securities or acquisitions of U.S. businesses. Some of the return in dollars likely will come through sovereign wealth funds, or funds controlled and managed by foreign governments, as foreign exchange reserves boost the dollar holdings of such funds. Such investments likely will add to concerns about the national security implications of foreign acquisitions of U.S. firms, especially by foreign governments, and to concerns about the growing share of outstanding U.S. Treasury securities that is owned by foreigners.

At times, slower-than-expected rates of economic growth in various regions of the world have reducedcan reduce slightly the global demand for oil and pushed downpetroleum products and exert downward pressure on the average price of energy imports. Increased energy production in the United States also reduced the amount of energy imports, which may well have contributed to other forces that have tended at times to draw downreduce the price of energy in world markets. Higher prices for energy importsenergy prices, however, may have been one contributing factor in factor spurring the economy to improve its energy efficiency, find alternative sources of energy, or search out additional supplies of energy. While lower energy costs should improve conditions for both producers and consumers, lower energy prices could dissuade energy producers from investing in new sources of energy, while the increase in consumers' real incomes from lower energy prices could either spur consumption, or could encourage consumers to use their extra income to increase saving and reduce debts.

Congress, through its direct role in making economic policysetting tax and spending policies and its oversight role over the Federal Reserve, could face the dilemma of a slower rate of economic growth, stagnant tax revenues, and falling prices. Traditionally, sluggish economic growth has been addressed through increased government spending and lowering interest rates to loosen credit and to stimulate investmentplays a major role in directing economic policy. With the U.S. economy operating at full employment at the end of 2017, such stimulative measures may push up the rate of inflation. The impact on the U.S. merchandise trade deficit also 2019, Congress may have to weigh the impact of maintaining current policies or adjusting policies to curtail the prospect of potential inflationary pressures. The impact of such policies on the U.S. trade deficit is not straightforward. While lower imported energy prices reduce the energy component of the trade accounts, the overall value of exports and imports is determined by a number of factors, including the international exchange value of the dollar, the domestic balance of saving and investment, and relative rates of growth in demand for exports and imports. Consequently, while the energy component of the U.S. trade deficit has fallen appreciably, the overall U.S. trade deficit has not. If the rate of growth in the U.S. economy, even at low rates, outpaces that of its trading partners, the overall trade deficit potentially worsens even with lower energy prices due to a relatively stronger U.S. demand for imports than foreign demand for U.S. exports and an inflow of foreign capital that puts upward pressure on the value of the dollar. Under such circumstances, Congress potentially could face pressure to examine the causes of the trade deficit and to address the underlying domestic macroeconomic factors that are generating that deficit.

Author Contact Information

Footnotes

| 1. |

U.S. Department of Commerce, U.S. Census Bureau, Report FT900, U.S. International Trade in Goods and Services, Table 17, |

|||

| 2. |

| |||

| 3. |

|

|||

| 4. |

For |

|||

| 5. |

Bureau of Economic Analysis, National Income and Product Accounts, Gross Domestic Product: Fourth Quarter and Annual 2015, January 29, 2016; Bureau of Economic Analysis, GDP and the Economy: Advance Estimates for the Fourth Quarter of 2015, February 2016. |

|||

| 6. |

Texas Oil Groups: Panhandling Ahead, The Financial Times, January 20, 2020.

Ibid. |

|||

|

|

10.

Bureau of Economic Analysis, Gross Domestic Product, Fourth Quarter and Year 2019, January 30, 2019. |

Report FT900, U.S. International Transactions in Goods and Services, Table 17, |