Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

Changes from March 1, 2018 to December 7, 2020

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

Contents

- Introduction

- Child and Dependent Care Tax Credit

- Did P.L. 115-97 modify child and dependent care tax benefits?

- Eligibility for the Credit

- Qualifying Expenses

- Qualifying Individual

- Earned Income Test

- Filing Status

- Calculating the Credit Amount

- Limitations Based on Earned Income

- Exclusion for Employer-Sponsored Child and Dependent Care Benefits

- Interaction Between the CDCTC and Exclusion for Employer-Sponsored Child and Dependent Care

- Data on the CDCTC

- Income Level of CDCTC Claimants/Average Credit Amount

- A Brief Overview of Major Legislative Changes to the CDCTC

- Average Credit Amount Over Time

- Types of Qualifying Individuals Claimed for the Credit

- Percentage of Taxpayers with Children Who Claim the CDCTC

- Data on the Exclusion of Employer-Sponsored Child and Dependent Care

Figures

Tables

- Table 1. Typical Expenses that May Qualify for the Child and Dependent Care Credit

- Table 2. Credit Rate and Maximum Credit Amount

- Table 3. Distribution of Taxpayers and Credit Dollars and Average Credit Amount by Adjusted Gross Income (AGI), 2015

- Table 4. Distribution of Taxpayers and Credit Dollars by Age of Qualifying Individuals Claimed for CDCTC, 2015

- Table 5. Percentage of Workers with Access to Employer-Sponsored Child and Dependent Care, 2017

- Table A-1. Tests for Qualifying Child and Qualifying Relative

Summary

Two tax provisions subsidize the child and dependent care expenses of working parents: the child and dependent care tax credit (CDCTC) and the exclusion for employer-sponsored child and dependent care. (Note these provisions were not changed by P.L. 115-97.)

The child and dependent care tax credit is a nonrefundable tax credit that reduces a taxpayer's federal income tax liability based on child and dependent care expenses incurred. The policy objective is to assist taxpayers who work or who are looking for work. A taxpayer must meet a variety of eligibility criteria Child and Dependent Care Tax Benefits: How

December 7, 2020

They Work and Who Receives Them

Margot L. Crandall-Hollick

Two tax provisions subsidize the child and dependent care expenses of working parents: the child

Acting Section Research

and dependent care tax credit (CDCTC) and the exclusion for employer-sponsored child and

Manager

dependent care.

Conor F. Boyle

The Child and Dependent Care Credit (CDCTC)

Analyst in Social Policy

The CDCTC is a nonrefundable tax credit that reduces a taxpayer’s federal income tax liability

based on child and dependent care expenses incurred by taxpayers who work or are looking for work. The CDCTC is calculated by multiplying the amount of qu alifying expenses—a maximum

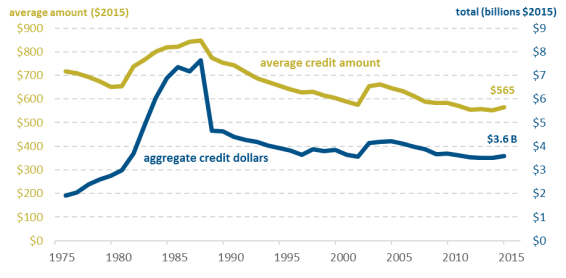

of $3,000 if the taxpayer has one qualifying individual, and up to $6,000 if the taxpayer has two or more qualifying individuals—by the appropriate credit rate. The credit rate varies by the taxpayer’s adjusted gross income (AGI), with a maximum credit rate of 35% that declines, as AGI increases, to 20% for taxpayers with AGI above $43,000 (see the figure below). Even though the credit formula is more generous toward lower-income taxpayers (due to the higher credit rate), many lower-income taxpayers receive little or no credit because the credit is nonrefundable, as illustrated in the table on the next page.

Child and Dependent Care Credit Rate and Amount by Income, 2020

Married couple with two qualifying children and $6,000 of qualifying expenses

Source: The Internal Revenue Code (IRC). For more information, see Figure 1.

A taxpayer must meet a variety of eligibility criteria in order to claim the CDCTC, including incurring qualifying child and dependent care expenses for aone or more qualifying individual and have earned income. These three terms are defined below:

Qualifying expenses:creditCDCTC are generally defined as expenses incurred for the care of a qualifying individual so that a taxpayer (and their spouse, if filing jointly) can work or look for work.(Married taxpayers who do not file a joint return are ineligible for the credit).Qualifying individual: A qualifying individual A qualifying individual for the CDCTC is either (1) the taxpayer'’s dependent child under 13 years of age for the entire year or (2) the taxpayer'’s spouse or dependent who is incapable of caring forhimself or herself.Earnedthemselves. Earned income: A taxpayer must have earned income to claim the credit. For married couples, both spouses must have earnings unless one is a student or incapable of self-care.

The CDCTC is calculated by multiplying the amount of qualifying expenses—a maximum of $3,000 if the taxpayer has one qualifying individual, and up to $6,000 if the taxpayer has two or more qualifying individuals—by the appropriate credit rate. The credit rate depends on the taxpayer's adjusted gross income (AGI), with a maximum credit rate of 35% declining, as AGI increases, to 20% for taxpayers with AGI above $43,000. Even though the credit formula—due to the higher credit rate—is more generous toward lower-income taxpayers, many lower-income taxpayers receive little or no credit since the credit is nonrefundable.

CDCTC data indicate several key aspects of this tax benefit. First, middle- and upper-middle-income taxpayers claim the majority of tax credit dollars. Second, at most income levels the average credit amount is between $500 and $600. Lower-income taxpayers receive less than the average amount. Third, the credit is used almost exclusively for the care of children under 13 years old (as opposed to older dependents). About 12% of taxpayers with children claim the CDCTC. This participation rate is significantly lower for lower-income taxpayers.

Distribution of Taxpayers, Credit Dollars,

and Average Credit Amount by Adjusted Gross Income (AGI), 2018

% of All Returns

Adjusted Gross

% of All

Claiming

% of Aggregate

Average Credit

Income (AGI)

Returns

CDCTC

CDCTC Dollars

Amount

$0-under $15K

21.2%

0.3%

0.1%

$124

$15K-under $25K

12.9%

5.3%

3.1%

$347

$25K-under $50K

23.7%

22.3%

23.7%

$623

$50K-under $75K

14.0%

15.2%

15.1%

$583

$75K-under $100K

8.9%

13.2%

13.8%

$613

$100K-under $200K

13.8%

30.2%

31.1%

$603

$200K-under $500K

4.5%

11.6%

11.1%

$564

$500K+

1.1%

1.9%

2.0%

$611

All Taxpayers

100.0%

100.0%

100.0%

$586

Source: IRS Statistics of Income (SOI) 2018, Table 3.3.

Exclusion for Employer-Sponsored Child and Dependent Care/Dependent Care FSAs In addition to the CDCTC, taxpayers can exclude from their income up to $5,000 of employer-sponsored child and dependent care benefits, often as a flexible spending account. Many taxpayers receive the exclusion in the form of a dependent care flexible spending arrangement (FSA). Eligibility rules and definitions of the exclusion are virtually identical to those of the credit. However, this is one major difference—the $5,000 limit between the exclusion and the CDCTC is that the $5,000 maximum for the exclusion applies irrespective of the number of qualifying individuals. Taxpayers can claim both the exclusion and the tax credit, but not for the same out of -of-pocket child and dependent care expenses. In addition, for every dollar of employer-sponsored child and dependent care excluded from income, the taxpayer must reduce the maximum amount of qualifying expenses claimed for the CDCTC.

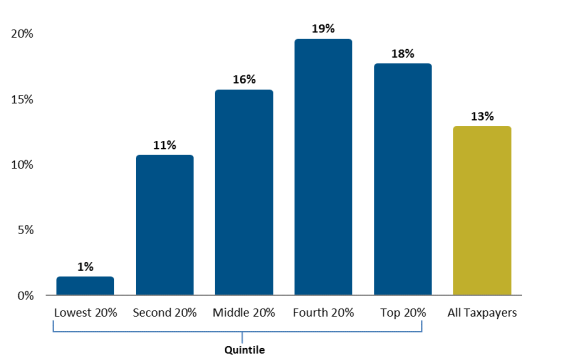

The aggregate data for the CDCTC indicate several key aspects of this tax benefit. First, middle- and upper-middle-income taxpayers claim the majority of tax credit dollars. Second, at most income levels the average credit amount is between $500 and $600. Lower-income taxpayers receive less than the average amount. Third, the credit is used almost exclusively for the care of children under 13 years old (as opposed to older dependents). On average 13% of taxpayers with children claim the credit. This participation rate is significantly lower for lower-income taxpayers.

Data from the Bureau of Labor Statistics indicate that about 40% of employees have access to a child and dependent care flexible spending account, while 11% have access to other types of employer-sponsored childcare. Overall, these data indicate that these benefits are more widely available to higher-compensated employees at larger establishments.

Introduction

There are two tax provisions that subsidize the child and dependent care expenses of working parents: the child and dependent care tax credit (CDCTC) and the exclusion for employer-sponsored child and dependent care. This report provides a general overview of these two tax benefits, focusing on eligibility requirements and benefit calculation. The report also includes some summary data on these benefits which highlight some of the characteristics of claimants.

Child and Dependent Care Tax Credit

|

The child and dependent care tax credit is a nonrefundable tax credit that reduces a taxpayer's federal income tax liability

Data from the Bureau of Labor Statistics (BLS) indicate that about 43% of employees have access to a child and dependent care flexible spending account, while 11% have access to other types of employer-sponsored child care. Overall, these data indicate that these benefits are more widely available to higher-compensated employees at larger establishments. Data from the IRS based on W-2 information returns, however, suggest actual use of these benefits is relatively low. The most recent data available indicate about 1.5 million taxpayers received tax-free employer-sponsored dependent care benefits in 2017. In comparison, during the same year there were about 153 million returns filed, and 6.5 million included the CDCTC.

Congressional Research Service

link to page 6 link to page 6 link to page 6 link to page 7 link to page 7 link to page 10 link to page 10 link to page 10 link to page 12 link to page 14 link to page 14 link to page 15 link to page 15 link to page 16 link to page 17 link to page 18 link to page 19 link to page 20 link to page 22 link to page 12 link to page 19 link to page 21 link to page 8 link to page 11 link to page 17 link to page 17 link to page 20 link to page 20 link to page 22 link to page 22 link to page 24 link to page 26 Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

Contents

Introduction ................................................................................................................... 1 Child and Dependent Care Tax Credit ................................................................................ 1

Eligibility for the Credit.............................................................................................. 1

Qualifying Individual............................................................................................ 2 Qualifying Expenses ............................................................................................. 2 Earned Income Test .............................................................................................. 5 Filing Status ........................................................................................................ 5

Calculating the Credit Amount..................................................................................... 5

Limitations Based on Earned Income ...................................................................... 7

Exclusion for Employer-Sponsored Child and Dependent Care Benefits .................................. 9

Dependent Care Flexible Spending Arrangements........................................................... 9 Interaction Between the CDCTC and Exclusion for Employer-Sponsored Child and

Dependent Care .................................................................................................... 10

Data on the CDCTC ...................................................................................................... 11

Income Level of CDCTC Claimants and Average Credit Amount .................................... 12 Average Credit Amount over Time ............................................................................. 13 Types of Qualifying Individuals Claimed for the Credit ................................................. 14 Percentage of Taxpayers with Children Who Claim the CDCTC ..................................... 15

Data on the Exclusion of Employer-Sponsored Child and Dependent Care ............................. 17

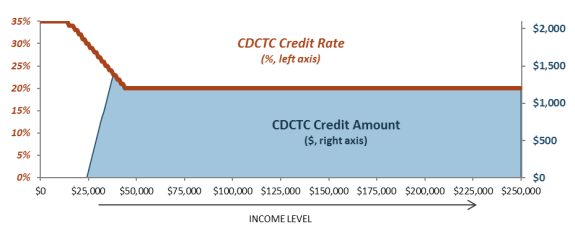

Figures Figure 1. Child and Dependent Care Credit Rate and Amount, by Income Level ....................... 7 Figure 2. Real Aggregate Credit Dollars and Average Credit Amount, 1976-2018................... 14 Figure 3. Percentage of Taxpayers with Children Who Claim the CDCTC, 2018 ..................... 16

Tables Table 1. Typical Expenses that May Qualify for the Child and Dependent Care Credit ............... 3 Table 2. Credit Rate and Maximum Credit Amount .............................................................. 6 Table 3. Distribution of Taxpayers, Credit Dollars, and Average Credit Amount by

Adjusted Gross Income (AGI), 2018 ............................................................................. 12

Table 4. Distribution of Taxpayers and Credit Dollars by Age of Qualifying Individuals

Claimed for CDCTC, 2017 .......................................................................................... 15

Table 5. Percentage of Civilian Workers with Access to Employer-Sponsored Child and

Dependent Care, 2020 ................................................................................................. 17

Table A-1. Tests for Qualifying Child and Qualifying Relative ............................................. 19 Table B-1. Impact of the CDCTC on Income Tax Liability After the TCJA ............................ 21

Congressional Research Service

link to page 24 link to page 25 link to page 25 link to page 27 Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

Appendixes Appendix A. What Is a “Dependent” for Tax Purposes? ...................................................... 19 Appendix B. Evaluating the Impact of the CDCTC After the Tax Cuts and Jobs Act

(TCJA; P.L. 115-97) ................................................................................................... 20

Contacts Author Information ....................................................................................................... 22

Congressional Research Service

Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

Introduction There are two tax provisions that subsidize the child and dependent care expenses of working parents: the child and dependent care tax credit (CDCTC) and the exclusion for employer-sponsored child and dependent care.1 This report provides a general overview of these two tax benefits, focusing on eligibility requirements and benefit calculation. The report also includes

summary data on these benefits that highlight several characteristics of claimants.

Child and Dependent Care Tax Credit The child and dependent care tax credit is a nonrefundable tax credit that reduces a taxpayer’s federal income tax liability based on child and dependent care expenses incurred so the taxpayer can work or look for work.32 Since the credit (sometimes referred to as the child care credit or the CDCTC) is nonrefundable, the amount of the credit cannot exceed a taxpayer'’s federal income tax liability. Taxpayers with little or no federal income tax liability—including many low-income taxpayers—generally

taxpayers—general y receive little if any benefit from nonrefundable credits like the CDCTC.

Eligibility for the Credit

To claim the child and dependent care credit, a taxpayer must meet a variety of eligibility criteria. The taxpayer must have qualifying expenses for a qualifying individual, have earned income, and

file taxes with an allowableal owable filing status. These terms are defined briefly below.

Qualifying individual: A qualifying individual for the CDCTC is either (1) the

taxpayer’s dependent child under 13 years of age, or (2) the taxpayer’s spouse or dependent who is incapable of caring for themself.

are defined briefly below.

- Qualifying expenses: Qualifying expenses are

generallygeneral y defined as expenses incurred for the care of a qualifying individual'’s dependent, child under 19 years old, spouse, or the parent of a qualifying child. Taxpayers claiming the CDCTCgenerallygeneral y must provide the name, address, and taxpayer identification number of any person or organization that provides care for a qualifying individual. - Qualifying individual: A qualifying individual for the CDCTC is either (1) the taxpayer's dependent child under 13 years of age, or (2) the taxpayer's spouse or dependent who is incapable of caring for himself or herself.

Earned income Earned income: A taxpayer must have earned income to claim the credit. The amount of qualifying expenses claimed for the credit cannot be greater than thetaxpayer'taxpayer’s earned income for the year (or the earned income of the lower-earning spouse in the case of married taxpayers). For married couples filing jointly, both spouses must have earnings unless one is either a student or incapable of self-care.Taxes Taxes filed with an allowable filingstatusstatus: Taxpayers aregenerallygeneral y ineligible for the CDCTC if they file their taxes as"“married filing separately."

Qualifying Expenses

Qualifying expenses for the credit are generally defined as expenses for the care of a qualifying individual ”

1 T he two tax provisions discussed in this report are available to qualifying families. T here is another tax benefit for child care available to employers under Internal Revenue Code (IRC) §45F, which is beyond the scope of this report.

2 IRC §21.

Congressional Research Service

1

link to page 24 Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

Qualifying Individual

For the purposes of the child and dependent care credit, a qualifying individual is a

Young child: The taxpayer’s dependent child under 13 years of age.3 Spouse incapable of caring for themselves: The taxpayer’s spouse who is

physical y or mental y incapable of self-care and has lived with the taxpayer for more than half the year. Incapable of self-care means that the individual cannot care for their own hygiene or nutritional needs or requires full-time attention for their own safety or the safety of others.4

Other dependents incapable of caring for themselves: An individual who is

physical y or mental y incapable of self-care (as defined above), lived with the

taxpayer for more than half of the year, and is general y the taxpayer’s dependent.5 Examples of individuals who may fal into this category include adult children who cannot care for themselves and elderly relatives who live with the taxpayer.

The taxpayer must provide the taxpayer identification number—either a SSN, ITIN, or adoption taxpayer identification number (ATIN)—of each qualifying individual for whom they claim the

CDCTC. Failure to do so can result in the denial of the credit.

Qualifying Expenses

Qualifying expenses for the credit are general y defined as expenses for the care of a qualifying individual so that a taxpayer (and their spouse, if filing jointly) can work or look for work.6 An so that a taxpayer (and their spouse, if filing jointly) can work or look for work.4 An expense is not considered work-related merely because a taxpayer paid or incurred the expense while working or looking for work. The purpose of the expense must be to enable the taxpayer to work or look for work. Whether an expense has such a purpose is dependent on the facts and

circumstances of each particular case. TheseQualifying expenses can include those for providing care for a qualifying individual or individuals both in andmay include costs for a qualifying

individual’s care provided in or outside the taxpayer'’s home.

In-home Care Expenses

In-home care expenses include costs of care provided in the taxpayer'’s home such as the cost of a nanny to look after a child or a housekeeper to look after an elderly parent. The payroll taxes

associated with these services, as well wel as meals and lodging provided to the caregiver as part of their employment, may be qualifying expenses. For household services that are in part for the

3 T he dependent child must be the taxpayer’s “qualifying child” for purposes of claiming the personal exemption with the additional requirement that the child be 12 years or younger when the qualifying expenses were paid or incurred. For more information on what a “ qualifying child” is for the personal exemption, see Appe ndix A. Although the personal exemption was effectively suspended from 2018 through 2025, the definition of a “ qualifying child” for the personal exemption is still in effect.

4 26 C.F.R. §1.21-1(b)(4). 5 T echnically, the individual must either be (a) t he taxpayer’s dependent; or (b) an individual who the taxpayer could have claimed as a dependent except that (1) the individual has gross income that equals or exceeds the personal exemption amount (which would have been $4,300 in 2021 if personal exemptions were not suspended, according to the IRS), or (2) the individual files a joint return, or (3) the individual (or their spouse, if filing jointly) could be claimed as a dependent on another taxpayer’s return. 6 For the purposes of the credit, this includes full-time work, part-time work, and self-employment.

Congressional Research Service

2

Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

their employment, may be qualifying expenses. For household services that are in part for the care of qualifying individuals and in part for other purposes, generallygeneral y only the portion for the

care of a qualifying individual can be applied toused in determining the credit.5

7 Out-of-home Care Expenses

There are different

Several types of care provided outside the taxpayer'’s home that may be considered qualifying expenses for the purposes of the credit. To qualify, the care must be provided to the taxpayer's ’s

dependent child under age 13 or another qualifying person who regularly spends at least eight hours each day in the taxpayer'’s home (in other words, a nonchild dependent must generallygeneral y live with the taxpayer even if that dependent spends the day at a care facility). This means, for example, that care provided at a live-in nursing home for a taxpayer'’s parent or spouse is not a qualifying expense. Common types of qualifying out-of-home care expenses include the following:

-

following:

Dependent care center: Care provided at a

"“dependent care center"” can be considered a qualifying expense only if the center complies withallal state and local regulations. A dependent care center is defined as a facility that provides care for more than six people (other than those who may reside at the facility) and receives a payment or grant for providing care services. Pre-K education/Before- and after-school care Prekindergarten (Pre-K) education/before- and after-school care: Expenses:Expensesfor education below the kindergarten level (e.g., nursery school or preschool) may be qualifying expenses for the credit. Treasury regulations provide that expenses for education at the kindergarten level or higher do not qualify for the credit, and neitherdoesdo summer schoolornor tutoring expenses.68 However, before- or after-school care of a child in kindergarten or higher grades may be a qualifying expense.Day camp Day camp: Day camp may be a qualifying expense. However, overnight camp is not a qualifying expense.-

Transportation: Transportation by a care provider (i.e., not the taxpayer) to take

a qualifying individual

7

|

Child |

Other Dependent |

|

|

In-Home Care |

|

|

|

Outside-the-Home Care |

|

|

Source: Congressional Research Service based on information found in 26 C.F.R. §1.21. §1.21.

Note: The expense must meet all al other criteria, including being paid or incurred so that the taxpayer can work or look for work. Whether an expense actuallyactual y qualifies for the credit will wil depend on the facts and circumstances of each particular case.

Rules Regarding Payments Made to Relatives Who Provide Care

Payments made to a relative for child and dependent care are generally eligible general y eligible for the credit. However, payments made to the following types of relatives would not be eligible for the

CDCTC.

Taxpayer' Taxpayer’s dependent:theThe relative is the taxpayer's dependent (i.e., the taxpayer or spouse is eligible to claim the relative for the dependent exemption).- ’s dependent.10 Child under 19 years old:

theThe relative is the taxpayer'’s child and under 19 years old (irrespective of whether they are the taxpayer'’s dependent). -

Spouse:

theThe relative is the taxpayer'’s spouse at any time during the year. - Parent of a qualifying child: The relative is the parent of the qualifying child

for whom the expenses are incurred.

8

11

Care Provider ID Test

Identification (ID) Test

Taxpayers claiming the CDCTC generallygeneral y must provide the name, address, and taxpayer

identification number of any individual or entity that provides care for a qualifying individual , or the IRS may deny the taxpayer'’s claim for the credit. Taxpayer identification numbers for individuals individuals are either Social Security numbers (SSNs) or individual taxpayer identification numbers (ITINs). Entities'’ taxpayer identification numbers are generallygeneral y employer identification numbers (EINs). Taxpayers are only required to provide the name and address (i.e., not the ITIN)

of a care provider that is a tax-exempt 501(c)(3) organization. If a care provider refuses to provide information (e.g., an individual does not wish to provide the taxpayer with their SSN), the taxpayer can generally still general y stil claim the credit if they exercise due diligence in attempting to obtain

the information and keep a record of their attempt to secure this information.9

Qualifying Individual

For the purposes of the child and dependent care credit, a qualifying individual is a

Young child: The taxpayer's dependent child under 13 years of age. Specifically, the child must be the taxpayer's "qualifying child" for purposes of claiming the personal exemption with the additional requirement that the child be 12 years or younger when the qualifying expenses were paid or incurred. (For more information on what a "qualifying child" is for the personal exemption, see theAppendix. Note that while the personal exemption is zero dollars from 2018 through 2025, the definition of a "qualifying child" for the personal exemption is still in effect. )- Spouse incapable of caring for themselves: The taxpayer's spouse who is physically or mentally incapable of self-care and has lived with the taxpayer for more than half the year. Incapable of self-care means that the individual cannot care for their own hygiene or nutritional needs or requires full-time attention for their own safety or the safety of others.10

- Other dependents incapable of caring for themselves: An individual who is physically or mentally incapable of self-care (as defined above), lived with the taxpayer for more than half of the year, and is either

a. The taxpayer's dependent (i.e., the taxpayer could claim a personal exemption for the individual); or is

b. An individual who the taxpayer could have claimed as a dependent (for the personal exemption) except that

i. He or she has gross income that equals or exceeds the personal exemption amount,

ii. He or she files a joint return, or

iii. The taxpayer (or their spouse, if filing jointly) could be claimed as a dependent on another taxpayer's return.

Examples of individuals who may fall into this category include adult children who cannot care for themselves, as well as elderly relatives who live with the taxpayer.

The taxpayer must provide the taxpayer identification number—either a Social Security number (SSN), individual taxpayer identification number (ITIN), or adoption taxpayer identification number (ATIN)—of each qualifying individual for whom they claim the CDCTC. Failure to do so can result in the denial of the credit.

12

10 T he taxpayer or spouse is eligible to claim the relative as a dependent for the personal exemption. T he personal exemption (IRC §151) and the definition of a dependent eligible for the personal exemption (IRC §152) remain in the current Internal Revenue Code. However, from 2018 through the end of 2025, the personal exemption am ount is zero.

11 In this case, the qualifying child is defined specifically as the taxpayer’s dependent child under the age of 13. 12 Generally, a taxpayer will obtain the identifying information from a child and dependent care provider by asking the provider to fill out IRS Form W-10. T axpayers then provide the information to the IRS by filling out the Form 2441, which is used to claim the credit. According to the IRS, if the care provider refuses to provide a taxpayer identification number or other information, the taxpayer should “ Claim the childcare expenses on Form 2441, Child and Dependent Care Expenses, and provide the care provider’s information you have available (such as name and address). Write ‘See Attached Statement ’ in the columns missing information. Explain on the attached statement that you requested the

Congressional Research Service

4

link to page 13 link to page 13 link to page 11 Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

Earned Income Test

Earned Income Test

In order to claim the credit, a taxpayer (and if married, their spouse) must have earned income during the year. For taxpayers who do not work as a result of the taxpayer (or if married, their spouse) being incapable of self-care or a full-time student, special rules apply in calculating their annual earned income (see "“Deemed Income in Cases Where an Individual is Incapable of Self-

Care or a Full-Time Student.").

”). Earned income includes wages, salaries, tips, other taxable employee compensation, and net earnings from self-employment. In general only earned income that is taxable (i.e., wages, salaries, and tip income) is considered for this test. Hence nontaxable compensation like foreign earned income and Medicaid waiver payments does not count as earned income. However, taxpayers can elect to include nontaxable combat pay as earned income when claiming the credit.

Filing Status

Generally

General y, taxpayers who file their federal income taxes as single, head of household, or married

filing jointly are eligible to claim the credit,1113 while those who file using the status "“married filing separately"separately” are ineligible for the credit. However, in certain cases, taxpayers who use the filing status "“married filing separately"” may be eligible for the credit if they live apart from their spouse for more than half the year and care for a qualifying individual.12 14 (Spouses who are legally legal y

separated are generallygeneral y not considered married for tax purposes.)

Calculating the Credit Amount

The amount of the CDCTC is calculated by multiplying the amount of qualifying expenses, after

applying the dollar limits and earned income limits (discussed below), by the appropriate credit rate. Since the credit is nonrefundable, the actual amount of the credit claimed cannot exceed the taxpayer'

taxpayer’s income tax liability.

The credit rate used to calculate the credit is based on the taxpayer'’s adjusted gross income (AGI).15 The credit rate is set at a maximum of 35% for taxpayers with AGI under $15,000. The credit rate then declines by one percentage point for each $2,000 (or fraction thereof) above $15,000 of AGI, until the credit rate reaches its statutory minimum of 20% for taxpayers with AGI over $43,000. This credit rate schedule is illustrated inil ustrated in Table 2. The AGI brackets associated

with each credit rate are not adjusted annuallyannual y for inflation and have been unchanged since 2001

(when they were last changed by legislation).

provider’s identifying number, but the provider did not give it to you. T his statement supports use of due diligence in trying to secure the identifying information for the claim.” Internal Revenue Service, Tax Products IRS Tax map 2016, Childcare Credit, Other Credits - Child and Dependent Care Credit & Flexible Benefit Plans, https://taxmap.ntis.gov/taxmap/faqs/faq_07-001.htm#TXMP220d2ed0. 13 A qualifying widow(er) with a dependent child is also an eligible filing status to claim the credit. 14 Specifically, a married individual living apart from their spouse may be eligible for the credit if th ey fulfill the following requirements: (1) file a separate return from their spouse; (2) have a qualifying individual (for the purposes of the credit) who lives with them for more than half the year in their home; (3) pay more than half the cost of maintaining their home for the year; (4) and their spouse does not live with them in their home for the last six months of the year. 15 Adjusted gross income, as defined in IRC §62. For more information, see CRS Report RL30110, Federal Individual Incom e Tax Term s: An Explanation, by Mark P. Keightley.

Congressional Research Service

5

link to page 12 Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

Table 2. Credit Rate and Maximum Credit Amount

By Adjusted Gross Income (AGI)

Maximum Statutory Credit Amount

Adjusted Gross

Two or More

Income (AGI)

One Child

Children

( > - ≤)

Credit Rate

($3,000 max expenses) ($6,000 max expenses)

$0-$15,000

35%

$1,050

$2,100

$15,000 - $17,000

34%

$1,020

$2,040

$17,000 - $19,000

33%

$990

$1,980

$19,000 - $21,000

32%

$960

$1,920

$21,000 - $23,000

31%

$930

$1,860

$23,000 - $25,000

30%

$900

$1,800

$25,000 - $27.000

29%

$870

$1,740

$27,000 - $29,000

28%

$840

$1,680

$29,000 - $31,000

27%

$810

$1,620

$31,000 - $33,000

26%

$780

$1,560

$33,000 - $35,000

25%

$750

$1,500

$35,000 - $37,000

24%

$720

$1,440

$37,000 - $39,000

23%

$690

$1,380

$39,000 - $41,000

22%

$660

$1,320

$41,000 - $43,000

21%

$630

$1,260

$43,000+

20%

$600

$1,200

Source: IRS Publication 503 and Internal Revenue Code (IRC) §21. Note: None of the parameters for inflation.

|

Maximum Statutory Credit Amount |

|||

|

Credit Rate |

|

|

|

$0-$15,000 |

35% |

$1,050 |

$2,100 |

|

$15,000 - $17,000 |

34% |

$1,020 |

$2,040 |

|

$17,000 - $19,000 |

33% |

$990 |

$1,980 |

|

$19,000 - $21,000 |

32% |

$960 |

$1,920 |

|

$21,000 - $23,000 |

31% |

$930 |

$1,860 |

|

$23,000 - $25,000 |

30% |

$900 |

$1,800 |

|

$25,000 - $27.000 |

29% |

$870 |

$1,740 |

|

$27,000 - $29,000 |

28% |

$840 |

$1,680 |

|

$29,000 - $31,000 |

27% |

$810 |

$1,620 |

|

$31,000 - $33,000 |

26% |

$780 |

$1,560 |

|

$33,000 - $35,000 |

25% |

$750 |

$1,500 |

|

$35,000 - $37,000 |

24% |

$720 |

$1,440 |

|

$37,000 - $39,000 |

23% |

$690 |

$1,380 |

|

$39,000 - $41,000 |

22% |

$660 |

$1,320 |

|

$41,000 - $43,000 |

21% |

$630 |

$1,260 |

|

$43,000+ |

20% |

$600 |

$1,200 |

Source: IRS Publication 503 and Internal Revenue Code (IRC) §21.

Note: None of the parameters of the child and dependent care tax credit are adjusted for inflation.

of the child and dependent care tax credit are adjusted for inflation.

The maximum amount of expenses that can be multiplied by the credit rate is $3,000 if the taxpayer has one qualifying individual and $6,000 if the taxpayer has two or more qualifying

individuals. These amounts are not adjusted annuallyannual y for inflation, and have not changed since 2001 (when they were last changed by legislation) for inflation. For taxpayers with two or more qualifying individuals, the maximum expense threshold is per taxpayer irrespective of actual child and dependent care expenses ofassociated with each qualifying individual. Hence, if a taxpayer has two qualifying individuals, and they have incurred no qualifying expenses for one individual and

$6,000 for the other, they can claim a credit forbased on up to $6,000 of qualifying expenses.

Even though the credit formula—due to the higher credit rate—is more generous toward lower-income taxpayers, many lower-income taxpayers receive little or no credit since the credit is

nonrefundable, as illustrated inil ustrated in Figure 1.

Congressional Research Service

6

Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

Figure 1. Child and Dependent Care Credit Rate and Amount, by Income Level

Married couple with two qualifying children and $6,000 of qualifying expenses

Figure 1.

|

|

Source: Notes: This is a stylized example of a married |

Limitations Based on Earned Income

In addition to the maximum dollar amount of qualifying expenses, as previously discussed, there are additional limits on the amount of annual work-related expenses used to calculate the credit. Specifically, qualifying expenses used to claim the credit cannot be more than

-

the taxpayer

'’s earned income for the year (for unmarried taxpayers) or - the lower-earning spouse

'’s earned income for the year (for married taxpayers).

Congressional Research Service

7

Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

For example, if an unmarried taxpayer had two qualifying individuals and $6,000 of qualifying expenses but $4,000 of earned income, the maximum amount of expenses that could be applied

toward the credit would be $4,000.

If an individual (either an unmarried taxpayer or each spouse among married taxpayers) does not have earnings for each month of a calendar year, they can calculate their total earned income for the year by summing up their earnings for those months in which they do have earned income. (Among married taxpayers, both spouses may need to calculate their earned income for the year to determine which spouse is the lower-earning spouse. Total expenses cannot be more than the

earned income of the lower-earning spouse.) For example, if an unmarried taxpayer (or the lower-earning spouse of a two-earner couple) earned $500 for three months of the year, and did not work the remaining nine months of the year, their earned income for the purposes of the earned income limitation would be $1,500 and they could not use more than $1,500 of child and

dependent care when calculating the credit.

Deemed Income in Cases Where an Individual is Incapable of Self-Care or a Full-Time Student.

If an individual (either an unmarried taxpayer or one spouse among married taxpayers) has little

or no earnings for each month of a calendar year because they are incapable of self-care or are a full-time student, they will wil calculate their earned income differently. For months in which an individual w hich an individual does not have earnings and is also incapable of self-care or a full-time student, their earned income for that month equals a "deemed"“deemed” amount (instead of equaling zero). Specifically, Specifical y, their earned income is "deemed"“deemed” to be $250 per month if they have one qualifying individual or

or $500 per month if they have two or more qualifying individuals.1316 If an individual—either an unmarried taxpayer, or if married, the lower-earning spouse of a two-earner couple—is either a full-time student or not able to care for themselves for the entire year, they may be eligible (depending on their actual expenses) to apply the maximum amount of expenses when calculating the credit. SpecificallySpecifical y, $250 and $500 multiplied by 12 months will wil result in an annual amount of

earned income of $3,000 if they have one qualifying individual or $6,000 if they have two or more qualifying individuals—the statutory maximum amount of qualifying expenses for the

credit.

Among a

For married couplecouples, only one spouse in any given month can be "deemed"“deemed” to have earned income ($250 per month for one qualifying individual or $500 per month for two or more qualifying individuals) as a result of being incapable of self-care or being a full-time student. This implies that if both spouses are incapable of self-care or full-time students simultaneously for every month in a year, the couple will wil ultimately be ineligible for the credit. In this scenario only

one spouse would be considered as having earned income, and hence the couple would be ineligible

ineligible for the credit.

16 For example, if an unmarried taxpayer earned $500 for three months of the year, and did not work the remaining nine months of the year because they were a full-time student and they had one qualifying individual, their earned income for the purposes of the earned income limitation would be $1,500 ($500 x three months) plus $2,250 ($250 x nine months) which equals $3,750. Since this is more than the statutory maxim um of $3,000 per one qualifying individual, the maximum amount of $3,000 is applicable. Congressional Research Service 8 Child and Dependent Care Tax Benefits: How They Work and Who Receives Them Exclusion for Employer-Sponsored Child and Dependent Care Benefits

In addition to the CDCTC, workers can exclude from their wages up to $5,000 of employer-sponsored child and dependent care benefits.1417 Since the value of these benefits is excluded from

wages, it is not subject to income or payroll taxes.

As a result of the exclusion, workers owe less in income and payroll taxes. For example, a worker subject to a 22% income tax rate (and 7.65% payroll tax rate) who has $1,000 of employer-sponsored dependent care expenses would save $296.50 in federal taxes from the exclusion rather than paying out of pocket (i.e., with after-tax

dollars).18

The exclusion of employer-sponsored care uses similar definitions and eligibility rules as the CDCTC. However, one key difference is that when a worker uses the exclusion, the $5,000 maximum applies irrespective of the number of qualifying individuals. For example, a family

with one qualifying child and a family with two qualifying children c ould both use the exclusion to set aside up to $5,000 on a pretax basis for child care. With the child and dependent care credit, there are separate limits based on the number of qualifying individuals ($3,000 for one qualifying individual, $6,000 for two or more qualifying individuals).19 In addition, married taxpayers who file their returns as married filing separately are eligible to benefit from this exclusion, whereas

these married separate filers are ineligible for the CDCTC.

Employer-sponsored child and dependent care benefits can be provided in various forms,

including

Employer-sponsored child and dependent care benefits can be provided in various forms, including

- direct payments by an employer to a child care or adult day care provider,

- on-site child or dependent care offered by an employer,

- employer reimbursement of employee child care costs, and

- flexible spending

accountsarrangements (FSAs) thatallowal ow employees to set aside a portion of their salary on a pretax basis (i.e., under a"“cafeteria plan"”) to be used for qualifying child and dependent care expenses. Survey data from the Bureau of Labor Statistics suggest that dependent care FSAs are more frequently offered to workers than are other forms of employer-sponsored dependent care (comparable IRS data are not available).20 Dependent Care Flexible Spending Arrangements Dependent care FSAs must meet the requirements of both Internal Revenue Code (IRC) Section 129, which governs employer-sponsored dependent care benefits broadly, and IRC Section 125, which governs cafeteria plans. As with most other benefits offered as part of a cafeteria plan, workers typical y determine the amount they wish to contribute to a dependent care FSA at the beginning of a plan year. Plan years are usual y annual periods during which workers may 17 IRC §129. Among other criteria, employer-sponsored child and dependent care must be provided under a written plan which meets certain conditions. 18 T his total includes $220 in federal income taxes and $76.50 in Social Security and Medicare payroll taxes. 19 IRC §21(c). 20 Bureau of Labor Statistics, National Compensation Survey: Employee Benefits in the United States, March 2019, T ables 39 and 40. For purposes of this survey, employer-sponsored child care is defined as a workplace program that “provides for either the full or partial cost of caring for an employee’s children in a nursery, day care center, or a baby sitter in facilities either on or off the employer’s premises.” Congressional Research Service 9 Child and Dependent Care Tax Benefits: How They Work and Who Receives Them contribute to and be reimbursed from an FSA. Once a worker has set the amount they wish to contribute to an FSA for a plan year, changes are al owed only in limited circumstances (like the birth of a child or marriage). Dependent care FSA contributions are subject to a “use-or-lose” rule, whereby workers forfeit any unused contributions remaining in their FSA at the end of the plan year. The “use-or-lose” rule ensures that workers cannot use an FSA to defer compensation (and the taxes paid on that compensation) to a future date, which is general y prohibited under IRC Section 125.for qualifying expenses.

The eligibility rules and definitions of the exclusion are similar to those of the credit. However, there is one key difference. Specifically, the $5,000 limit applies irrespective of the number of qualifying individuals. For example, a family with one qualifying child or two qualifying children can both set aside a maximum $5,000 on a pretax basis for child care. With the child and dependent care credit there are separate limits based on the number of qualifying individuals ($3,000 for one qualifying individual, $6,000 for two or more qualifying individuals).15 In addition, married taxpayers who file their returns as married filing separately are eligible to benefit from this exclusion, while they are ineligible for the credit.

Interaction Between the CDCTC and Exclusion for Employer-Sponsored Child and Dependent Care

Taxpayers can claim both the exclusion and the tax credit, but not for the same out-of-pocket child and dependent care expenses. For every pretax (i.e., excluded) dollar of employer-sponsored child and dependent care, the taxpayer must reduce the maximum amount of qualifying expenses for the creditCDCTC (up to $3,000 for one child, $6,000 for two or more children). For example, if a family had one child, $10,000 in annual child care expenses, and contributed $5,000 annually to their employer'sannual y to a

dependent care FSA, the family could not claim the CDCTC.1621 The amount of pretax dollars in the FSA ($5,000) would eliminate the maximum amount of expenses that could be applied to the credit ($3,000). If in the same year, the family had a second child, and all al else remained the same, they could claim $5,000 tax-free through their FSA and claim the remaining allowableal owable expense of

$1,000 ($6,000 maxmaximum for two or more children, minus $5,000 in the FSA) for the CDCTC.

21 Employer-sponsored child and dependent care must be provided under a written plan which meets certain conditions. Note that under a cafeteria plan, employees have the choice not to accept the exclusion, and hence could apply additional child and dependent care expenses toward the credit. However, in practice, most taxpayers will receive a greater marginal benefit from the exclusion than the credit. For example, if a taxpayer has $100,000 of adjusted gross income (AGI) and is subject to a marginal income tax rate of 25% and 7.65% of payroll taxes, they would reduce their tax bill by 32.65 (25+7.65) cents for every dollar put in the FSA. In comparison, the credit would lower their tax bill by 20 cents for every dollar applied toward the credit.

Congressional Research Service

10

link to page 15 link to page 15 Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

A Brief Overview of Major Legislative Changes to Child and Dependent Care Tax

Benefits

1976: P.L. 94-455 enacted the nonrefundable child and dependent care credit.22 The credit formula was 20% of eligible expenditures subject to a maximum level of expenditures of $2,000 for one qualifying individual and $4,000 for two or more qualifying individuals. These amounts were not adjusted for inflation. 1981: P.L. 97-34 created the current “sliding-scale” credit rate whereby the credit rate decreases as income increases. The sliding scale began at 30% for taxpayers with adjusted gross income of $10,000 or less, with the rate reduced by one percentage point for each $2,000 (or fraction thereof) above $10,000 until the lowest rate of 20% was reached at $28,000 of income. The law also increased the maximum expenditures from $2,000 to $2,400 for one qualifying individual and from $4,000 to $4,800 for two or more qualifying individuals.23 The law also enacted the exclusion for employer-sponsored child and dependent care. 1986: P.L. 99-514 limited the dol ar amount of the exclusion to $5,000 per taxpayer. 1988: P.L. 100-485 created a dol ar-for-dol ar reduction in the amount of expenses eligible for the CDCTC for amounts excluded under an employer-sponsored dependent care assistance program (see “Interaction Between the CDCTC and Exclusion for Employer-Sponsored Child and Dependent Care”). 2001: P.L. 107-16 modified the sliding scale credit rate. The top credit rate was increased from 30% to 35% and the income level for this credit rate was increased from $10,000 to $15,000. The law also increased the maximum expenditures from $2,400 to $3,000 for one qualifying individual and from $4,800 to $6,000 for two or more qualifying individuals. These amounts were not indexed for inflation. These were temporary changes scheduled to expire at the end of 2010. 2010: P.L. 111-312 extended the 2001 changes for 2011 and 2012. 2012: P.L. 112-240 made the 2001 changes permanent.

Data on the CDCTC Data on the CDCTC

The aggregate data for the child and dependent care credit indicateil ustrate several key aspects of this tax benefit.

Income levelbenefit. Income level of CDCTC claimantsof CDCTCclaimants: Middle- and upper-middle-income taxpayers claim the majority of tax credit dollars.Average credit amount Average credit amount: At most income levels the average credit amount is between $500 and $600. Lower-income taxpayers receive less than the average amount. Average credit amount over timeamount.Average credit amount over time: Over the past 30 years, the average real (i.e., adjusted for inflation) credit amount per taxpayer has steadily declined and lost about one-third of its value.Types of qualifying individuals claimed Types of qualifying individuals claimed for the creditfor thecredit: While the credit isavailableavailable for the care expenses of nonchild dependents (disabled family members or elderly parents), the credit is used almost exclusively for the care of children under 13 years old.Percentage of taxpayers with children that claim Percentage of taxpayers with children that claim the CDCTC: While the credit is claimed almost exclusively for the care of children, on average1312% of 22 Before the enactment of the child and dependent care credit, “taxpayers could claim as an itemized deduction certain expenses incurred for the care of a child or a disabled dependent or spouse up to $4,800 a year. T he maximum deduction was reduced by one dollar for every two dollars of income in excess of $35,000.” Joint Committee on T axation, Tax Legislation Enacted in the 94th Congress, October 1976, JCS-31-76, pp. 123-124. This itemized deduction was originally enacted in 1954. P.L. 94-455 converted the deduction to a credit. 23 Joint Committee on T axation, General Explanation of the Economic Recovery Act if 1981, December 31, 1981, JCS-71-81. Congressional Research Service 11 link to page 17 Child and Dependent Care Tax Benefits: How They Work and Who Receives Them% oftaxpayers with children claim the credit. This participation rate is significantly lower for lower-income taxpayers.

Income Level of CDCTC Claimants/ and Average Credit Amount

The CDCTC tends to be claimed by middle- and upper-middle-income taxpayers. Comparatively few claimants are low-income or very high-income, as illustrated inil ustrated in Table 3. For most taxpayers, the average credit amount is between $500 and $600, although low-income taxpayers that do claim the CDCTC tend to receive a smallersmal er tax credit. Few lower-income taxpayers benefit from

the CDCTC, since the credit is nonrefundable. As previously discussed, a nonrefundable credit is limited to the taxpayer'’s income tax liability. Hence, taxpayers with little to no income tax liability—including low-income taxpayers—receive little to no benefit from nonrefundable

credits like the CDCTC.

For some taxpayers, especiallyespecial y higher-income taxpayers, the amount of their CDCTC will wil be affected by the amount of tax-free employer-sponsored child care they receive. If a taxpayer's ’s marginal tax rate is greater than the applicable credit rate, the taxpayer will wil receive a larger tax savings from claiming the exclusion rather than the credit (in addition, the exclusion lowers their

payroll taxes). For example, $100 of employer-sponsored child care saved in an FSA would lower a taxpayer'’s income tax bill bil by $35 if they were in the 35% tax bracket.1724 The tax savings associated with applying that $100 to the CDCTC would, by contrast, be $20. Hence, if employer-sponsored child care is offered by their employer, a taxpayer may claim this benefit first and apply any remaining eligible expenses (if applicable)1825 toward the credit, lowering their

credit amount in comparison to if the exclusion was not available.

Table 3. Distribution of Taxpayers and, Credit Dollars

,

and Average Credit Amount by Adjusted Gross Income (AGI), 2015

2018

Adjusted |

% of All Returns |

% of All Returns Claiming CDCTC |

% of Aggregate CDCTC Dollars |

Average Credit Amount |

|

$0-under $15K |

23.8% |

0.1% |

<0.1% |

$121 |

|

$15K-under $25K |

14.1% |

6.3% |

3.9% |

$349 |

|

$25K-under $50K |

23.5% |

23.8% |

24.4% |

$578 |

|

$50K-under $75K |

13.3% |

16.4% |

16.4% |

$565 |

|

$75K-under $100K |

8.5% |

14.4% |

14.6% |

$574 |

|

$100K-under $200K |

12.3% |

28.5% |

30.1% |

$597 |

|

$200K-under $500K |

3.6% |

9.0% |

9.0% |

$566 |

|

$500K+ |

0.9% |

1.4% |

1.5% |

$620 |

|

All Taxpayers |

100.0% |

100.0% |

100.0% |

$565 |

Source: IRS Statistics of Income (SOI) 2015 Gross

% of All Returns

% of Aggregate

Average Credit

Income (AGI)

% of All Returns

Claiming CDCTC

CDCTC Dollars

Amount

$0-under $15K

21.2%

0.3%

0.1%

$124

$15K-under $25K

12.9%

5.3%

3.1%

$347

$25K-under $50K

23.7%

22.3%

23.7%

$623

$50K-under $75K

14.0%

15.2%

15.1%

$583

$75K-under $100K

8.9%

13.2%

13.8%

$613

$100K-under $200K

13.8%

30.2%

31.1%

$603

$200K-under $500K

4.5%

11.6%

11.1%

$564

$500K+

1.1%

1.9%

2.0%

$611

All Taxpayers

100.0%

100.0%

100.0%

$586

Source: IRS Statistics of Income (SOI) 2018, Table 3.3.

Some low- and moderate-income taxpayers may have received a smal er benefit from the

CDCTC after enactment of P.L. 115-97 (often referred to as the Tax Cuts and Job Act or TCJA), which went into effect in 2018. Although the law did not directly modify CDCTC, other changes

24 In 2018, a married couple filing jointly would be in the 35% bracket if their taxable income was over $400,000 but not over $600,000. T his taxpayer’s applicable credit rate for the CDCT C would be 20%. 25 If a taxpayer has one child, and receives $5,000 in tax-free employer-sponsored child care from their employer, they will have $0 of qualifying expenses for the CDCT C.

Congressional Research Service

12

link to page 25 link to page 16 link to page 16 link to page 19 link to page 16 link to page 16 link to page 19 link to page 11 link to page 16 link to page 16 Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

made by the law—specifical y those made to a different credit, the child tax credit (CTC)—effectively mean that some low- and moderate-income families owe the same amount of income taxes with or without the CDCTC. In other words, some low- and moderate-income families may no longer receive a net benefit from the credit. The Tax Policy Center found that between 2017 and 2018 the share of taxpayers with incomes between $20,000 and $30,000 who benefited from the CDCTC fel from 5% to 2%. Similarly, for taxpayers with income between $30,000 and

$40,000, the share of taxpayers who benefited from the CDCTC fel from 9% to 6%. For more

information, see Appendix B.

Average Credit Amount over Time , Table 3.3.

|

Average Credit Amount Over Time

The CDCTC was enacted in 1976. Subsequent legislative changes increased the size of the credit by increasing the maximum amount of allowableal owable expenses and the credit rate (see "“A Brief

Overview of Major Legislative Changes to the CDCTC").

Child and Dependent Care Tax Benefits”).

Between 1976 and 1988, the average credit amount and aggregate amount of the credit steadily increased, as illustrated inincreased in real (i.e., inflation adjusted) dollars, as il ustrated in Figure 2. Beginning in 1989, both the average and aggregate credit amount began to decline, with a sharp drop in the aggregate

amount claimed. This decline over such a short time period may be due to measures adopted by the IRS to reduce improper claims of tax benefits, as well wel as legislative changes. First, beginning in 1987, taxpayers were required to provide the Social Security numbers (SSNs) of dependents on their federal income tax returns.2126 Second, beginning in 1989, taxpayers had to provide the caregiver'caregiver’s taxpayer ID number (generallygeneral y for individuals, their SSNs).2227 According to one IRS researcher, "“What probably happened in most cases is that people were paying their babysitter off

the books, and their babysitter would not provide their Social Security numbers or go on the books, so the family had to choose between finding a new babysitter, or giving up the credit."23 Finally”28 Final y, in 1988, Congress enacted a provision as part of P.L. 100-485 (see " “A Brief Overview of Major Legislative Changes to the CDCTC" Child and Dependent Care Tax Benefits”) that required taxpayers to reduce the amount of expenses applied to the credit by amounts received under the exclusion.

This may have resulted in a substantial reduction in the amount of expenses many taxpayers

applied toward the credit, and hence a smaller credit.

smal er credit.

Since 1988, the real average value of the CDCTC has steadily fallen (seefal en (see Figure 2). This trend

may be driven by several factors. First, as previously discussed, the parameters of the credit, including the maximum amount of qualifying expenses and the income brackets for each applicable credit rate (seesee Table 2) are not indexed for inflation. The last time the credit rate and maximum level of expenses was increased was in 2001 as part of the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA; P.L. 107-16 ). Before EGTRRA the parameters of

the credit had not been increased since 1981 (see " “A Brief Overview of Major Legislative Changes to the CDCTC" Child and Dependent Care Tax Benefits”). If the credit as enacted in 1976 had been adjusted annuallyannual y for inflation, the $800 maximum credit amount in 1976 would have equaled more than $3,300 in 2015.24for two or more children in

26 In 1987, seven million fewer children were claimed as dependents on federal income tax returns according to data summarized by Jeffrey Liebman. Jeffrey Liebman, “Who are the Ineligible EIT C Recipients?” National Tax Journal, vol. 53, no. 4 (December 2000), p. 1171.

27 P.L. 100-485. 28 John Szilagyi, an IRS researcher quoted in T amar Lewin, “I.R.S. Sees Evidence of Wide T ax Cheating on Child Care,” The New York Times, January 6, 1991.

Congressional Research Service

13

link to page 20

Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

1976 would have equaled more than $3,500 in 2018.29 Hence, inflation has eroded a substantial

amount of the credit’s value.

Hence, inflation has eroded a substantial amount of the value of the credit.

Types of Qualifying Individuals Claimed for the Credit

Administrative data from the Internal Revenue Service, summarized inin Table 4, indicate that the

CDCTC is used primarily for the care expenses of children under 13 years old.

29 T his amount was calculated using the inflation calculator from the Bureau of Labor Statistics. T his calculator is available at https://data.bls.gov/cgi-bin/cpicalc.pl.

Congressional Research Service

14

link to page 7 link to page 7 link to page 21 Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

Table 4. Distribution of Taxpayers and Credit Dollars by

Age of Qualifying Individuals Claimed for CDCTC, 2015

|

Tax Returns |

Total Credit Dollars |

|||

2017

Tax Returns

Total Credit Dollars

Age of Qualifying |

Number |

Percent |

Billions $ |

Percent |

|

Exclusively under 13 years old |

6,090,135 |

96.0% |

$3.44 |

96.0% |

|

Exclusively 13 years old or older |

142,135 |

2.2% |

$0.06 |

1.7% |

|

Mix of over and under 13 years old |

112,055 |

1.8% |

$0.08 |

2.3% |

|

Total |

6,344,325 |

100.0% |

$3.59 |

100.0% |

Source: Data provided to CRS from the Internal Revenue Service, Statistics of Income (SOI). Data available to congressional clients from the author upon request.

upon request. Notes: Items may not sum due to rounding.

Few taxpayers claim the CDCTC for older dependents. This may be a result of several factors. First, most dependents are children. For example, in 2015, over 83 million dependent exemptions were claimed for children, while approximately 13 million were claimed for older dependents2017, over 83 mil ion dependents were

children, while approximately 11 mil ion were older (including parents).30 (including parents).25 Second, the definition of qualifying expenses excludes many expenses incurred for older dependents. For example, if older dependents are being cared for by a stay-at-home taxpayer, any expenses incurred for their care will wil not be considered qualifying expenses (sincebecause the caregiver is not considered to be working or looking for work). In addition, certain eldercare expenses, like nursing home

expenses, are not considered qualifying expenses for the CDCTC sincebecause the individual being cared for is not living with the taxpayer for at least eight hours each day (see "Qualifying Expenses").

“Qualifying Expenses”). Percentage of Taxpayers with Children Who Claim the CDCTC

Data from the Tax Policy Center (TPC) indicate that on average about 1312% of taxpayers with children claim the child and dependent care credit, as illustrated inil ustrated in Figure 3.2631 A greater proportion of higher-income taxpayers with children claim the credit than lower-income

taxpayers. One possible explanation for why relatively few families with children claim the credit is that they do not have childcarechild care expenses (perhaps because their children are older). Another possible explanation is that care expenses that are incurred are not considered qualifying expenses for the credit. For example, families with a stay-at-home parent would generallygeneral y be ineligible for the CDCTC. In addition, families that pay paying an older child to look after a younger child after school would not be considered qualifying expenses. Finallywould not be able to claim those expenses for the CDCTC. Final y, families eligible for the exclusion and with

only one child may benefit more from the exclusion and simply not claim the credit.

for employer-provided dependent care and

simply not claim the CDCTC.

30 Internal Revenue Service, Individual Income T ax Returns Line Item Estimates, 2017, Publication 1304, Table 2.3. 31 It is important to note that children as defined by the T ax Policy Center in this example are children for whom that taxpayer can claim a dependent exemption or for whom th at taxpayer can claim the child tax credit or earned income tax credit (EIT C). Some of these children will not be qualifying individuals for the purposes of the CDCT C, because, for example, they are 13 years or older.

Congressional Research Service

15

Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

Figure 3. Percentage of Taxpayers with Children Who Claim the CDCTC, 2018

By Income Quintile

|

|

Source: Urban-Brookings Tax Policy Center Microsimulation Notes: Each quintile contains 20% of the population ranked by expanded cash income (ECI). |

32 Percentages are rounded to the nearest whole number. For purposes of this figure, taxpayers with children may include certain children who are not qualifying individuals for the CDCTC, including children 13 years old and older.

Fewer lower-income families with children benefit from the CDCTC, sincebecause the credit is nonrefundable. A nonrefundable credit is limited to the taxpayer'’s income tax liability. Taxpayers

with little to no income tax liability, including low-income taxpayers, hence receive little to no

benefit from nonrefundable credits.

32 For distributional analyses, the T ax Policy Center (T PC) uses an income concept called “expanded cash income” (ECI). ECI is a broad measure of pretax income, and is used both to rank tax units in distribution tables and to calculate effective tax rates. According to the T PC, “We define ECI as adjusted gross income (AGI) plus: above-the-line adjustments (e.g., IRA deductions, student loan interest, self-employed health insurance deduction, etc.), employer-paid health insurance and other nontaxable fringe benefits, employee and employer contributions to tax -deferred retirement savings plans, tax-exempt interest, nontaxable Social Security benefits, nontaxable pension and retirement income, accruals within defined benefit pension plans, inside buildup within defined contribution retirement accounts, cash and cash-like (e.g., SNAP) transfer income, employer’s share of payroll taxes, and imputed corporate income tax liability.” For more information, see T ax Policy Center, TPC’s Microsim ulation Model FAQ, http://www.taxpolicycenter.org/resources/tpcs-microsimulation-model-faq. T he income percentile classes used in this table are based on the income distribution for the entire population and contain an equal number of people, not tax units. T he incomes used are adjusted for family size by dividing by the square root of the number of people in the tax unit. T he r esulting percentile breaks are (in 2018 dollars): 20% $25,100; 40% $49,300; 60% $85,900; 80% $153,300 .

Congressional Research Service

16

link to page 22 link to page 22 link to page 22 Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

Data on the Exclusion of Employer-Sponsored Child and Dependent Care Survey data from the Bureau of Labor Statistics (BLS) indicate that about 43% of employees have access to child and dependent care flexible spending accounts, while 11% have access to

employer-sponsored child care.33benefit from nonrefundable credits.

Data on the Exclusion of Employer-Sponsored Child and Dependent Care

Administrative data from the IRS on the exclusion of employer-sponsored child and dependent care—comparable to the data on CDCTC—are unavailable. However, survey data from the Bureau of Labor Statistics indicate that about 41% of employees have access to child and dependent care flexible spending accounts, while 11% have access to employer-sponsored childcare.28 (Access means that these accounts are available to workers for their use. However, actual use of these accounts may be lower than these access rates.) The survey also found that availability of these benefits differed based on a variety of factors, including the average wage paid to the employee and size of employer, as summarized inin Table 5. Overal Overall, the data indicate that these benefits are more

widely available to more highly compensated employees and employees at larger establishments.

Table 5. Percentage of Civilian Workers with Access to

Employer-Sponsored Child and Dependent Care, 2017

2020

Access to Dependent

Care Flexible Spending

Access to Employer-

Account (FSA)a

Provided Child Care

Average Wageb

Lowest 10%

13%

5%

Lowest 25%

20%

5%

Second 25%

40%

8%

Third 25%

52%

13%

Highest 25%

65%

20%

Highest 10%

68%

23%

Size of Employer

1-49 workers

21%

5%

50-99 workers

37%

7%

100-499 workers

51%

9%

500 workers or more

71%

25%

Source: Bureau of Labor Statistics, National Compensation Survey: Employee |

Access to Employer- Provided Child Care |

|

| ||

|

Lowest 10% |

13% |

2% |

|

Lowest 25% |

19% |

4% |

|

Second 25% |

39% |

9% |

|

Third 25% |

51% |

12% |

|

Highest 25% |

63% |

20% |

|

Highest 10% |

66% |

22% |

|

Size of Employer |

||

|

1-49 workers |

20% |

4% |

|

50-99 workers |

33% |

7% |

|

100-499 workers |

49% |

10% |

|

500 workers or more |

72% |

26% |

Source: Bureau of Labor Statistics, National Compensation Survey: Employee Benefits in the United States, March 20172020, Tables 4039 and 40. and 41.

Notes: These results are for civilian employees only.

a. employees only. a. These data reflect access to FSAs provided as part of a Section 125 cafeteria plan.

b. Surveyed occupations are classified into wage categories based on the average wage for the occupation

which may include workers with earnings both above and below the threshold.

Appendix. What Is a "Dependent" for the Purposes of the Personal Exemption?

The BLS data provide information on dependent care benefits that are available to workers. Data

from the IRS based on W-2 information returns, however, suggest actual use of these benefits is relatively low. The most recent data available indicate about 1.5 mil ion taxpayers received tax-free employer-sponsored dependent care benefits in 2017.34 In comparison, during the same year

33 Bureau of Labor Statistics, National Compensation Survey: Employee Benefits in the United States, March 2020, T ables 39 and 40. For purposes of this survey, employer-sponsored child care is defined as a workplace program that “provides for either the full or partial cost of caring for an employee’s children in a nursery, day care center, or a baby sitter in facilities either on or off the employer’s premises.” 34 Internal Revenue Service, SOI Tax Stats - Individual Information Return Form W-2 Statistics, T able 5A,

Congressional Research Service

17

Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

there were about 153 mil ion returns filed, 6.5 mil ion of which included the CDCTC.35 Results from one recent survey of low- and moderate-income taxpayers suggest that low employee participation in dependent care FSAs may be due to (1) employees’ confusion about the rules governing dependent care FSAs, (2) employees’ difficulties in determining whether they would benefit from participating in a dependent care FSA, and (3) employees confounding dependent care FSAs with similar plans such as health FSAs and health savings accounts (HSAs).36 In

addition, a recent study on participation in health FSAs found evidence that employees may be particularly concerned about the risk of losing unused funds at the end of the plan year (the “use

or lose” rule) when determining whether to participate in a FSA.37

https://www.irs.gov/statistics/soi-tax-stats-individual-information-return-form-w2-statistics. 35 Internal Revenue Service, SOI Tax Stats - Individual Statistical Tables by Size of Adjusted Gross Income, T able 3.3, https://www.irs.gov/statistics/soi-tax-stats-individual-statistical-tables-by-size-of-adjusted-gross-income.

36 Ellen Frank-Miller, Sophia Fox-Dichter, and Sloane Wolter, Dependent Care FSAs: The Uneven Playing Field for Em ployers and Workers, Washington University in St. Louis Social Policy Institute White Paper , 19-01, https://openscholarship.wustl.edu/cgi/viewcontent.cgi?article=1002&context=spi_research. 37 James H. Cardon, “Status quo bias in flexible spending account usage,” Journal of Behavioral and Experimental Econom ics, vol. 81, 2019, https://doi.org/10.1016/j.socec.2019.05.007.

Congressional Research Service

18

link to page 24 Child and Dependent Care Tax Benefits: How They Work and Who Receives Them

Appendix A. What Is a “Dependent” for Tax Purposes? Prior to enactment of P.L. 115-97, taxpayers could subtract from their adjusted gross income (AGI) the standard deduction or sum of their itemized deductions (whichever is greater) and the

appropriate number of personal exemptions for themselves, their spouse (if married), and their dependents.

dependents.

For 2017, the personal exemption amount was $4,050 per person. Under P.L. 115-97, the personal exemption amount was reduced to zero from 2018 through the end of 2025. While the personal exemption is not in effect from 2018 through 2025, the definition of dependent for the exemption

was retained and other provisions in the tax code still stil refer to this definition.

A dependent is either (1) a qualifying child or (2) a qualifying relative. There are several tests to determine whether an individual is a taxpayer'’s qualifying child or relative, outlined inin Table A-1. An individual must fulfil al these requirements to be considered a qualifying child or qualifying relative (e.g., an individual must fulfil the relationship, residence, age, support, and joint return test

to be considered a qualifying child for tax purposes).

Table A-1. Tests for Qualifying Child and Qualifying Relative

Qualifying Child

Qualifying Relative

Relationship: The child is the taxpayer’s son,

1. Member of Household or Relationship: The

daughter, stepchild, foster child, brother, sister, half-

individual must be either (a) a member of the

brother, half-sister, stepbrother, stepsister, or a

taxpayer’s household for the entire year, or (b) if they

descendant of any of them.

do not live with the taxpayer, a relative of the taxpayer.a

Residence: The child must have lived with the

Gross Income Test: The individual’s gross income

taxpayer for more than half the year.

Table A-1.

|

Qualifying Child |

Qualifying Relative |

|

Relationship: The child is the taxpayer's son, daughter, stepchild, foster child, brother, sister, half-brother, half-sister, stepbrother, stepsister, or a descendant of any of them. |

|

|

Residence: The child must have lived with the taxpayer for more than half the year. |

|