State Minimum Wages: An Overview

Changes from February 28, 2018 to January 25, 2019

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

Contents

- Introduction

- The FLSA Minimum Wage

- Enterprise Coverage

- Individual Coverage

- FLSA Minimum Wage Rates

- Minimum Wage Policies in the States

- Rates and Mechanisms of Adjustment

- Rates

- Mechanisms for Future Adjustments

- Legislatively Scheduled Increases

- Indexing to Inflation

- Reference to the Federal Rate

- Trends in State Minimum Wages

Figures

Tables

Summary

The Fair Labor Standards Act (FLSA), enacted in 1938, is the federal legislation that establishes the general minimum wage that must be paid to all covered workers. While the FLSA mandates broad minimum wage coverage, states have the option of establishing minimum wage rates that are different from those set in it. Under the provisions of the FLSA, an individual is generally covered by the higher of the state or federal minimum wage.

As of 2018, 29 states and the District of Columbia have 2019, minimum wage rates are above the federal rate of $7.25 per hour, with rates in 29 states and the District of Columbia, ranging from $0.25 to $6.0075 above the federal rate. TwoAnother 14 states have minimum wage rates below the federal rate and five states have no state minimum wage requirement. The remaining 14 states have minimum wage rates equal to the federal rateequal to the federal rate. The remaining 7 states have minimum wage rates below the federal rate or do not have a state minimum wage requirement. In the states with no minimum wage requirements or wages lower than the federal minimum wage, only individuals who are not covered by the FLSA are subject to those lower rates.

In any given year, the exact number of states with a minimum wage rate above the federal rate may vary, depending on the interaction between the federal rate and the mechanisms in place to adjust the state minimum wage. Adjusting minimum wage rates is typically done in one of two ways: (1) legislatively scheduled rate increases that may include one or several increments; (2) a measure of inflation to index the value of the minimum wage to the general change in prices.

Of the 29 states and the District of Columbia with minimum wage rates above the federal rate, 109 currently have no scheduled increases beyond 2018, while 92019, 3 states have legislatively scheduled rate increases after 2018. A total of 112019, and 17 states and the District of Columbia currently, or will in a future year, indexhave scheduled increases through a combination of planned increases and current- or future-year indexation of state minimum wage rates to a measure of inflation.

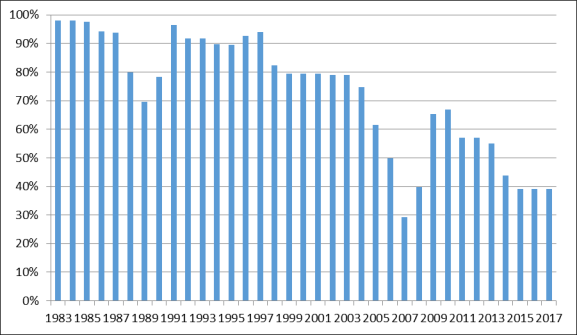

Because the federal and state minimum wage rates change at various times and in various increments, the share of the labor force for which the federal rate is the binding wage floor has changed over time. Since 1981, there have been three series of increases in the federal minimum wage rate—1990-1991, 1996-1997, and 2007-2009. During that same period, there have been numerous changes in state minimum wage policies. As a result of those interactions, the share of the U.S. civilian labor force living in states in which the federal minimum wage is the floor has fluctuated but generally declined, and is about 39% as of 20172018.

Introduction

The Fair Labor Standards Act (FLSA), enacted in 1938, is the federal legislation that establishes the general minimum wage that must be paid to all covered workers.1 The FLSA mandates broad minimum wage coverage. It also specifies certain categories of workers who are not covered by general FLSA wage standards, such as workers with disabilities or certain youth workers.

In 1938, the FLSA established a minimum wage of $0.25 per hour. The minimum wage provisions of the FLSA have been amended numerous times since then, typically to expand coverage or raise the wage rate. Since its establishment, the minimum wage rate has been raised 22 separate times.2 The most recent change was enacted through P.L. 110-28 in 2007, which increased the minimum wage from $5.15 per hour to its current rate of $7.25 per hour in three steps (the final step occurring in 2009).

States generally have three options in setting their minimum wage policies: (1) they can set their own minimum wage provisions that differ from those in the FLSA, (2) they can explicitly tie their minimum wage provisions to the FLSA, or (3) they can include no specific minimum wage provisions in state law.

This report begins with a brief discussion of FLSA minimum wage coverage. It then provides a summary of state minimum wage laws, followed by an examination of rates and mechanisms of adjustments in states with minimum wage levels above the FLSA rate (Table 1 provides summary data). Next, the report discusses the interaction of federal and state minimum wages over time, and finally, the Appendix provides detailed information on the major components of minimum wage policies in all 50 states and the District of Columbia.

The state policies covered in this report include currently effective policies and policies enacted with an effective date at some point in 20182019. While most states' scheduled state minimum wage rate changes (due to inflation adjustments or statutorily scheduled changes) occurred on January 1 of each year, a few states have rate increases scheduled for later in the year. Effective dates of rate increases are noted in Table 1 and in the Appendix.

The FLSA Minimum Wage

The FLSA extends two types of minimum wage coverage to individuals: "enterprise coverage" and "individual coverage."3 An individual is covered if they meet the criteria for either category.

Enterprise Coverage

To be covered by the FLSA at the enterprise or business level, an enterprise must have at least two employees and annual sales or "business done" of at least $500,000. Annual sales or business done includes all business activities that can be measured in dollars. Thus, for example, retailers are covered by the FLSA if their annual sales are at least $500,000.4 In non-sales cases, a measure other than sales must be used to determine business done. For example, for enterprises engaged in leasing property, gross amounts paid by tenants for property rental will be considered business done for purposes of determining enterprise coverage.

In addition, regardless of the dollar volume of business, the FLSA applies to hospitals or other institutions primarily providing medical or nursing care for residents; schools (preschool through institutions of higher education); and federal, state, and local governments.

Thus, regardless of how enterprise coverage is determined (by business done or by specified institutional type), all employees of a covered enterprise are considered to be covered by the FLSA.

Individual Coverage

Although an enterprise may not be subject to minimum wage requirements if it has less than $500,000 in annual sales or business done, employees of the enterprise may be covered if they are individually engaged in interstate commerce or in the production of goods for interstate commerce. To be engaged in interstate commerce—the definition of which is fairly broad—employees must produce goods (or have indirect input to the production of those goods) that will be shipped out of the state of production, travel to other states for work, make phone calls or send emails to persons in other states, handle records that are involved in interstate transactions, or provide services to buildings (e.g., janitorial work) in which goods are produced for shipment outside of the state.5

While individual coverage is broad under the FLSA, there are also specific exemptions from the federal rate, including individuals with disabilities; youth workers; tipped workers; and executive, administrative, and professional workers, among others.6

FLSA Minimum Wage Rates

In 1938, the FLSA established a minimum wage of $0.25 per hour. The minimum wage provisions of the FLSA have been amended numerous times since then, typically for the purpose of expanding coverage or raising the wage rate. Since its establishment, the minimum wage rate has been raised 22 separate times. The most recent change was enacted in 2007 (P.L. 110-28), which increased the minimum wage from $5.15 per hour to its current rate of $7.25 per hour in three steps.

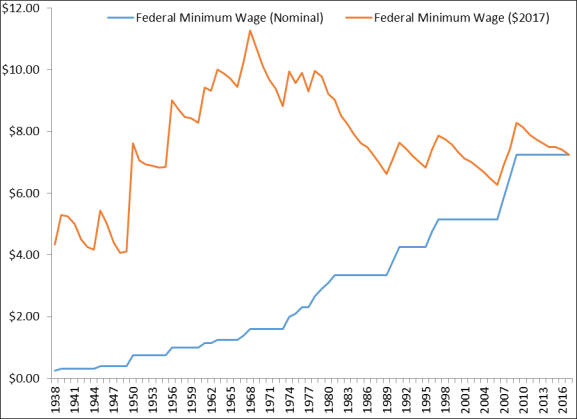

Figure 1 shows the nominal and real (inflation-adjusted) value of the federal minimum wage from its enactment in 1938 through 20172018. The real value of the minimum wage generally rose from 1938 to 1968, after which it has generally fallen in real terms, with some brief increases in value following periodperiodic statutory rate changes. From an initial rate of $0.25 per hour in 1938 ($4.25 in real43 in inflation-adjusted terms), the minimum wage increased to $1.60 per hour in 1968 ($11.27 in real terms). Following the increases from 2007 to 2009 (from $5.15 to $7.25 per hour), the inflation-adjusted minimum wage has fallen by just over a dollar per hour50 in inflation-adjusted terms, a peak value to date). The real value of the minimum wage has fallen by $1.20 since it was increased to $7.25 in 2009.

| 2018 |

|

|

Source: Notes: The inflation-adjusted minimum wage is expressed in |

Minimum Wage Policies in the States

State policymakers may also choose to set labor standards that are different from federal statutes. The FLSA establishes that if a state enacts minimum wage, overtime, or child labor laws more protective of employees than those provided in the FLSA, then state law applies. In the case of minimum wages, this means FLSA-covered workers are entitled to the higher state minimum wage in those states with rates above the federal minimum. On the other hand, FLSA-covered workers would receive the FLSA minimum wage in states that have set minimum wages lower than the federal rate. Given the generally broad minimum wage coverage of the FLSA, it is likely that most workers in states with minimum wages below the federal rate are covered by the FLSA rate.

In 20182019, the range of state minimum wage rates is as follows:

- 29 states and the District of Columbia have enacted minimum wage rates above the federal rate of $7.25 per hour;

- 2 states have minimum wage rates below the federal rate;

- 5 states have no state minimum wage requirement; and

- the remaining 14 states have minimum wage rates equal to the federal rate.7

In the states with no minimum wage requirements or wages lower than the federal minimum wage, only individuals who are not covered by the FLSA are subject to those lower rates.

The Appendix provides detailed information on state minimum wage policy in all 50 states and the District of Columbia. Specifically, it includes each state's rate; the year and method of enactment; the mechanism, if any, used to adjust the minimum wage;, including the legislation authorizing the state minimum wage; and the relevant legislative language regarding the rate and mechanism of adjustment.

The remainder of this report focuses on states with minimum wages above the federal rate.

Rates and Mechanisms of Adjustment

In states with minimum wage rates above the federal rate, variation occurs mainly across two dimensions: the rate and the mechanism of adjustment to the rate. This section (including data in Table 1) summarizes these two dimensions for the states with rates currently above the federal minimum. State rates range from $0.25 to $6.0075 above the federal rate, with a majority of these states using some sort of inflation measure to index the state minimum wage.

Rates

In the 29 states and the District of Columbia with minimum wage rates above the federal rate in 20182019, minimum hourly rates range from $7.50 per hour in New Mexico to $11.5012.00 per hour in Massachusetts and Washington and $13.2514.00 in the District of Columbia. Of the states with minimum wage rates above $7.25:

63 states have minimum wages within $1 of the federal rate of $7.25 per hour;810 states have rates between $1.00 and $2.00 per hour above the federal rate; and1516 states and the District of Columbia have rates greater than $2.00 per hour above the federal rate (i.e., $9.26 or higher).

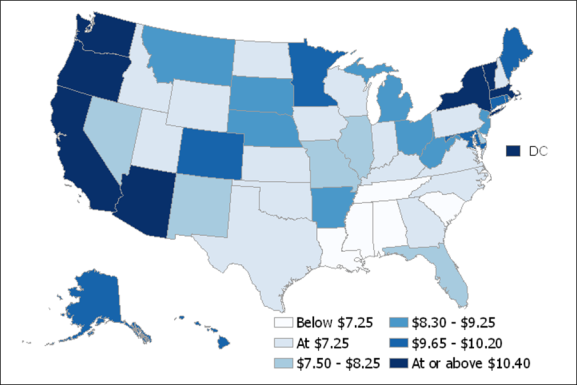

Figure 2 shows the geographic and rate dispersion of state minimum wages. In terms of coverage, a majority of the civilian labor force is in states with a minimum wage rate above the federal rate of $7.25. Specifically, the 29 states and the District of Columbia with minimum wage rates above $7.25 represent about 61% of the total civilian labor force, which means the federal rate is the wage floor in states representing 39% of the labor force.8

|

Figure 2. State Minimum Wage Rates Rates in 2018 |

|

|

Source: CRS analysis of U.S. Department of Labor data. Notes: Rates in Figure 2 are either currently in effect or are scheduled to be in effect at some point in |

Mechanisms for Future Adjustments

In any given year, the exact number of states with a minimum wage rate above the federal rate may vary, depending on what mechanism is in place to adjust the state minimum wage. Some states specifically set rates above the federal rate. Other states have rates above the federal minimum wage because the state minimum wage rate is indexed to a measure of inflation or is increased in legislatively scheduled increments, and thus the state rate changes even if the federal minimum wage stays unchanged.

Below are the two main approaches to regulating the adjustment of state minimum wage rates in states with rates above the federal minimum: legislatively scheduled increases and indexing to inflation.9 In this section, states are counted by the primary method of adjustment. While most states use only one of these methods, some states combine a series of scheduled increases followed by indexing the state rate to a measure of inflation. In these cases, states are counted as "indexing to inflation," as that is the long-term mechanism of adjustment in place.

Legislatively Scheduled Increases

If a state adopts a minimum wage higher than the federal rate, the state legislature may specify a single rate in the enacting legislation and then choose not to address future rates. In these cases, the only mechanism for future rate changes is future legislative action. Alternatively, a state may specify future rates in legislation through a given date. Rhode Island in 2017, for example, set a rate of $10.10 per hour beginning January 1, 2018, and $10.50 beginning January 1, 2019. After the final increase, the rate will remain at $10.50 per hour until further legislative action. This is the same approach taken in the most recent federal minimum wage increase (P.L. 110-28), which increased the minimum wage from $5.15 an hour in 2007 to $7.25 per hour in 2009 in three phases. Of the 29 states and the District of Columbia with minimum wage rates above the federal rate, 109 currently have no scheduled increases beyond 2018, while only Rhode Island has a2019, while Arkansas, Massachusetts, and Michigan have legislatively scheduled rate increaseincreases after 20182019.10

Indexing to Inflation

If a minimum wage rate is established as a fixed amount and not increased, its value will erode over time due to inflation.11 For this reason, several states have attempted to maintain the value of the minimum wage over time by indexing the rate to some measure of inflation. This mechanism provides for automatic changes in the minimum wage over time and does not require legislative action to make annual adjustments.

Currently, 9nine states index state minimum wages to a measure of inflation. In addition, another 9eight states and the District of Columbia willare scheduled in a future year to index state minimum wage rates to a measure of inflation. Thus, of the total of 1817 states and the District of Columbia that currently or willare scheduled to index minimum wage rates,

- seven states—Arizona, Montana, Nevada, New York, Oregon, South Dakota, and Vermont—index the state minimum wage to the national Consumer Price Index for All Urban Consumers (CPI-U);

- five states—California, Missouri, New Jersey, Ohio, and Washington—index the state minimum wage to the national Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W);12

threetwo states—Alaska, Colorado, and Michiganand Colorado—and the District of Columbia use asub-nationalsubnational version of the CPI-U to index the state minimum wage;- two states—Florida and Maine—use a regional version of the CPI-W to index the minimum wage; and

- one state (Minnesota) uses the implicit price deflator for personal consumption expenditures (PCE) to index the minimum wage.

Reference to the Federal Rate

While scheduled increases and indexation are the two main ways that states adjust their minimum wage rates, a few states also add a reference to the federal minimum wage rate as a possible mechanism of adjustment. Thus any time the federal rate changes, the state rate may change.13 Currently, Alaska, Connecticut, the District of Columbia, and Massachusetts use this federal reference to supplement their primary mechanisms of adjusting state minimum wage rates.

- In Alaska, the state minimum wage rate is indexed to the CPI-U for Anchorage Metropolitan Statistical Area. However, Alaska state law requires that the state minimum wage must be at least $1.00 per hour higher than the federal rate. So it is possible that a federal wage increase could trigger an increase in the Alaska minimum wage, but the main mechanism is indexation to inflation.

- Although Connecticut

law includesdoes not currently include scheduled rate increases in the minimum wagethrough 2017, Connecticut state law requires that the state rate must exceed the federal minimum wage rate by 0.5% if the federal rate becomes greater than or equal to the state rate. - The District of Columbia's minimum wage rate is the higher of the level required by the District of Columbia statute or the federal rate plus $1.00. Starting in 2021, the

theDistrict of Columbia minimum wage will be indexed to inflation and the reference to the federal rate will no longer be in effect. - While Massachusetts law includes scheduled rate increases in the minimum wage through

20172023, the law also requires that the state rate must be at least $0.50 above federal minimum wage rate.

Table 1. Summary of States with Enacted Minimum Wage Rates Above $7.25

As of January 1, 2018

Future rate changes occur January 12019 (unless otherwise noted)

|

State |

2017 | 2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

|

Alaska |

$9. |

$9. |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

|

Arizona | $10.00 |

$10.50 |

$11.00 |

$12.00 |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

|

Arkansas |

$8.50 |

$ |

$ |

$ |

$ |

$ |

$ | $8.50 |

|

Californiaa |

$ |

|

$12.00 |

$13.00 |

$14.00 |

$15.00 |

CPI-W |

CPI-W |

|

Colorado | $9.30 |

$10.20 |

$11.10 |

$12.00 |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

|

Connecticut |

$10.10 |

$10.10 |

$10.10 |

$10.10 |

$10.10 |

$10.10 |

$10.10 |

$10.10 |

|

Delaware |

$8.25 |

$8.25 |

$ |

$ |

$ |

$ |

$ |

$ |

|

The District of Columbia | $12.50 |

$13.25 |

$14.00 |

$15.00 |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

|

Florida |

$8. |

$8. |

CPI-W |

CPI-W |

CPI-W |

CPI-W |

CPI-W | CPI-W |

|

Hawaii |

$ |

|

$10.10 |

$10.10 |

$10.10 |

$10.10 |

$10.10 |

$10.10 |

|

Illinois |

$8.25 |

$8.25 |

$8.25 |

$8.25 |

$8.25 |

$8.25 |

$8 |

|

|

Maine |

$ |

|

$11.00 |

$12.00 |

CPI-W |

CPI-W |

CPI-W |

CPI-W |

|

Maryland | $9.25 |

$10.10 |

$10.10 |

$10.10 |

$10.10 |

$10.10 |

$10.10 |

$10.10 |

|

Massachusetts |

$11.00 |

$ |

$ |

$ | $11.00 |

$ |

$ |

$ |

|

Michigan e |

$ |

$9. |

CPI-U |

CPI-U |

CPI-U | CPI-U |

CPI-U |

CPI-U |

|

Minnesota |

$9. |

$9. | PCE |

PCE |

PCE |

PCE |

PCE |

PCE |

|

Missouri |

$7. |

$ | CPI-W |

CPI-W |

CPI-W |

CPI-W |

CPI-W |

CPI-W |

|

Montana |

$8. |

$8. |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

|

Nebraska |

$9.00 |

$9.00 |

$9.00 |

$9.00 |

$9.00 |

$9.00 |

$9.00 |

$9.00 |

|

Nevada |

$8.25 |

$8.25 |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

|

New Jersey |

$8. |

$8. | CPI-W |

CPI-W |

CPI-W |

CPI-W |

CPI-W |

CPI-W |

|

New Mexico |

$7.50 |

$7.50 |

$7.50 |

$7.50 |

$7.50 |

$7.50 |

$7.50 |

$7.50 |

|

New York | $9.70 |

$10.40 |

$11.10 |

$11.80 |

$12.50 |

CPI-U |

CPI-U |

CPI-U |

|

Ohio |

$8. |

$8. |

CPI-W |

CPI-W |

CPI-W |

CPI-W |

CPI-W | CPI-W |

|

Oregon | $10.25 |

$10.75 |

$11.25 |

$12.00 |

$12. |

$ |

$13.50 |

CPI-U |

|

Rhode Island | $9.60 |

$10.10 |

$10.50 |

$10.50 |

$10.50 |

$10.50 |

$10.50 |

$10.50 |

|

South Dakota |

$8. |

$ | CPI-U |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

|

Vermont |

$10. |

$10. |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

CPI-U |

|

Washington |

$11.00 Washington |

$11.50 |

$12.00 |

$13.50 |

CPI-W |

CPI-W |

CPI-W |

CPI-W |

|

West Virginia |

$8.75 |

$8.75 |

$8.75 |

$8.75 |

$8.75 |

$8.75 |

$8 |

|

Source: Minimum wage rates are from U.S. Dept. of Labor, http://www.dol.gov/whd/minwage/america.htm and state websites; Adjustment mechanisms are from state websites and National Conference of State Legislatures, http://www.ncsl.org/research/labor-and-employment/state-minimum-wage-chart.aspx.

Notes: In Table 1, cells with "CPI-U," "CPI-W," or "PCE" indicate that the state minimum rate is indexed to the relevant inflation measure in those years.

a. The minimum wage for California in Table 1 is for large employers, which are defined as any employer employing 26 or more employees. For employers with 25 or fewer employees, the minimum wage in 2018 is $10.502019 is $11.00 per hour and is scheduled to reach $15.00 on January 1, 2023.

b. The minimum wage in Delaware is $8.75 per hour from January 1, 2019, through September 30, 2019. As of October 1, 2019, the minimum wage is $9.25 per hour.

c per hour.

b. The minimum wage in the District of Columbia is $12.5013.25 per hour through June 30, 20182019. The new rate of $13.2514.00 in the District of Columbia is scheduled to go into effect July 1, 20182019. Future rate increases begin on July 1.

cd. The minimum wage in Marylandof $10.10 in Maryland went into effect July 1, 2018.

e. The minimum wage in Michigan is $9.25 per hour through June 30, 2018. The new rate of $10.10 in Maryland is scheduled to go into effect July 1, 2018.

dMarch 28, 2019. As of March 29, 2019, the minimum wage is $9.45 per hour.

f. The minimum wage for Minnesota in Table 1 is for large employers, which are defined as enterprises "whose annual gross volume of sales made or business done is not less than $500,000 (exclusive of excise taxes at the retail level that are separately stated) and covered by the Minnesota Fair Labor Standards Act." SmallThe minimum wage for small employers (defined as enterprises "whose annual gross volume of sales made or business done is less than $500,000") must pay a minimum wage of $7.87 per hour. The minimum wage in Minnesota is $9.65 per hour for large employers and $7.87 per hour for small employers untilis $8.04 as of January 1, 2019.

eg. Nevada maintains a two-tier minimum wage system. The minimum wage for workers who do not receive qualified health benefits from their employer is $8.25 per hour, while the minimum wage for workers receiving qualified health benefits is $7.25 per hour. An annual adjustment, if any, occurs on July 1 of each year and is the greater of the amount of increases in the federal minimum wage over $5.15 or the cumulative inflation since December 31, 2004.

fh. The state of New York has four minimum wage rates—large employers in New York City, small employers in New York City, New York City suburbs, and the Remainder of the State—each with different scheduled rate increases. Following scheduled increases for large employers (11 or more employees) in New York City, small employers (10 or fewer employees) in New York City, and New York City suburbs to $15 per hour (in 2018, 2019, and 20212019, 2020, and 2022, respectively), the minimum wage rate for the Remainder of the State becomes indexed in 20212022 from its scheduled rate of $12.50 at that time and remains indexed until it reaches $15 per hour. Indexation is not applied to the other three New York rates after they reach $15 per hour. The rate in Table 1 is for the Remainder of the State (outside of New York City and Nassau, Suffolk, and Westchester counties.). Future rate increases begin on December 31. See AppendixTable A-1 for details.

gi. The state of Oregon has three minimum wage rates—Standard, Portland Metro, and Nonurban Counties—each with different scheduled rate increases. The rate in Table 1 is the Standard rate. Future rate increases begin on July 1. See AppendixTable A-1 for details.

Trends in State Minimum Wages

Because federal and state minimum wages do not change in regular intervals or by regular increments, the number of states and the share of the labor force covered by higher minimum wages changes annually. In general, during periods in which the federal minimum wage remains constant, more states enact higher minimum wages and the share of the workforce for which the federal rate serves as the floor likewise decreases. When the federal rate increases, some state rates become equal to or less than the federal rate.

Table 1 presents a snapshot of minimum wage rates in the 29 states and the District of Columbia with minimum wages above the federal rate from 20172018 through 2024, while Figure 3 shows the changes in the coverage of the federal minimum wage.14 Specifically, Figure 3 plots the percentage of the civilian labor force residing in states in which the federal wage serves as the floor.15 If no state had a minimum wage above the federal rate, then the federal minimum wage would be the floor for states in which 100% of the labor force resides; similarly. Similarly, if every state had a minimum wage above the current rate of $7.25, then the federal rate would not be binding for the labor force. Instead the interaction of federal and state rates has led to the federal minimum wage becomingplaying a fluctuating, but generally decreasing, role in establishing a wage floor for the civilian labor force, particularly during periods in which the federal rate is not increased.

|

Figure 3. How Binding is the Federal Minimum Wage? The Share of the U.S. Labor Force Residing in States with the Federal Minimum Wage as the Floor |

|

|

Source: CRS analysis of Tax Policy Center, State Minimum Wage Rates: 1983-2014, Washington, DC, http://www.taxpolicycenter.org/taxfacts/displayafact.cfm?Docid=603; U.S. Department of Labor, Wage and Hour Division, Changes in Basic Minimum Wages in Non-Farm Employment Under State Law: Selected Years 1968-2013, Washington, DC, http://www.dol.gov/whd/state/stateMinWageHis.htm, and Bureau of Labor Statistics, Monthly Labor Review, Washington, DC, multiple years. Notes: Prior to 1993, the District of Columbia did not have a broad minimum wage covering the general population. Thus for periods prior to 1993, this report uses a weighted average of occupation-specific minimum wages, as reported in David Neumark and Olena Nizalova, Minimum Wage Effects in the Longer Run, National Bureau of Economic Research, Working Paper 10656, Cambridge, MA, March 2006, http://www.nber.org/papers/w10656. Based on this data, the District of Columbia has maintained a minimum wage above the federal rate for the entire 1983- |

Examining the specific time periods around changes in the federal minimum wage (see Figure 1 for the history of federal minimum wage rate changes), data in Figure 3 showsshow a general trend toward a lower share of the labor force being covered by the federal minimum wage only. Federal rate increases in 2007 through 2009 mitigated this reduction, as did earlier changes in the federal rate.

- In the period from 1983 through 1989, the federal minimum wage remained constant at $3.35 per hour. Prior to the federal increases in 1990 and 1991, the number of states with higher minimum wages rose from 3 in 1984 to 16 in 1989 and the share of the U.S. civilian labor force in states for which the federal rate was the floor fell from 98% to 70%.

- Following a two-step federal increase in 1990 and 1991 from $3.35 to $4.25 per hour, the number of states with higher minimum wages fell to 8 in 1992, which meant that the federal rate was the floor for states comprising 92% of the civilian labor force.

- The next federal minimum wage increase occurred in two steps in 1996 and 1997, increasing from $4.25 to $5.15 per hour. Prior to that increase, in 1995, there were 10 states, representing 10% of the civilian labor force, with minimum wages above the federal rate.

Immediately followingAfter the second increase in 1997, the number of states with higher minimum wages dropped to 8, but the share of the labor force in states for which the federal rate served as a floor decreased to 82%. - The federal minimum wage did not increase after 1997 until 2007. During much of that period the number of states with higher minimum wages stayed somewhat steady, increasing from 8 (comprising 18% of the civilian labor force) in 1998 to 12 (comprising 21% of the civilian labor force) in 2003. However, by 2006, 22 states representing 50% of the civilian labor force had minimum wage rates above the federal rate. This increase was due in part to a few populous states, such as Florida, Michigan, and New York, adopting minimum wage rates above the federal rate in this period.

- Following the three-step increase in the federal minimum wage from $5.15 to the current $7.25 (2007-2009), 15 states, comprising 33% of the civilian labor force, had rates above the federal minimum wage in 2010. By

20172019, this rose to 29 states and the District of Columbia, which means that the federal rate is the wage floor in states representing 39% of the civilian labor force.

Appendix. Selected Characteristics of State Minimum Wage Policies

For the 29 states and the District of Columbia with state minimum wage rates above the federal rate as of 20182019, Table 1 and much of the text above summarizes information on those states' minimum wage policies, highlighting minimum wage rates and mechanisms used to establish and adjust wage rates. As discussed previously, for those states with current or scheduled minimum wages above the federal rate, three main mechanisms are in place to adjust future rates: (1) scheduled increases, (2) indexation to inflation, or (3) reference to the federal rate plus an add-on (i.e., a state minimum wage is a percentage or dollar amount above the federal rate). For the 21 states with minimum wage rates equal to or below the federal rate, however, there are no mechanisms in place to move rates above the federal rate. Thus, the main difference within this group of states is the relationship of the state rate, if any, to the federal rate.

For those 21 states with minimum wages equal to or below the federal rate, the state rate may be set in four ways:16

- No state minimum wage provisions: In five states—Alabama, Louisiana, Mississippi, South Carolina, and Tennessee—there are no provisions for state minimum wage rates. In practice, this means that most workers in these states are covered by the FLSA minimum wage provisions since coverage is generally broad.

- State minimum wage provisions with no reference to the FLSA: Five states have state minimum wage rates but do not reference the FLSA. Two of these states—Georgia and Wyoming—have state rates below $7.25, while three of these states—Kansas, North Dakota, and Wisconsin—have rates equal to $7.25. However, because there is no reference to the FLSA rate or other provision for adjustment in any of these states, the state rate does not change unless the state policy is changed.

- State minimum wage equals the FLSA rate: Six states—Idaho, Indiana, New Hampshire, Oklahoma, Texas, and Virginia—set the state rate equal to the FLSA rate. Thus, when the FLSA rate changes, the state rates in these six states change to equal the FLSA rate.

- State minimum wage equals FLSA rate if FLSA is greater: In four states—Iowa, Kentucky, North Carolina, and Pennsylvania—the state rate is specified separately but includes a provision to equal the FLSA rate if the latter is above the state specified rate.

Table A-1 provides detailed information about minimum wage policies in the 50 states and the District of Columbia, including those summarized in a more concise manner in Table 1.

Table A-1. Selected State Minimum Wage Policies

As of January 1, State Pertinent Language and Notes Alabama No state minimum wage law n/a Alaska20182019 (unless otherwise noted)

State Legislation or Policy Citation

(unless otherwise noted)

|

State |

State Minimum Wage Rate |

|

Mechanism of Setting State Rate |

Mechanism for Future Adjustments |

|

Pertinent Language and Notes |

||||||||||

|

Alabama |

None |

n/a |

None |

None |

No state minimum wage law |

n/a |

||||||||||

|

Alaska |

$9.80 |

2014 / 2017 |

State specified rate of $9.75 on January 1, 2016, followed by adjustment on January 1, 2017, and each successive January 1. |

Inflation: Indexed to CPI-U, Anchorage Metropolitan Area as of January 1, 2017. The Alaska minimum wage must be at least $1 above FLSA wage rate. |

AS 23.10.065 reads: "(a) Except as otherwise provided for in law, an employer shall pay to each employee a minimum wage, as established herein, for hours worked in a pay period, whether the work is measured by time, piece, commission or otherwise. An employer may not apply tips or gratuities bestowed upon employees as a credit toward payment of the minimum hourly wage required by this section. Tip credit as defined by the Fair Labor Standards Act of 1938 as amendment does not apply to the minimum wage established by this section. Beginning with the passage of this Act, the minimum wage shall be $8.75 per hour effective January 1, 2015, $9.75 per hour effective January 1, 2016 and thereafter adjusted annually for inflation. The adjustment shall be calculated each September 30, for the proceeding January-December calendar year, by the Alaska Department of Labor and Workforce Development, using 100 percent of the rate of inflation based on the Consumer Price Index for all urban consumers for the Anchorage metropolitan area, compiled by the Bureau of Labor Statistics, United States Department of Labor; the department shall round the adjusted minimum hourly wage up to the nearest one cent; the adjusted minimum hourly wage shall apply to work performed beginning on January 1 through December 31 of the year for which it is effective. (d)If the minimum wage determined under (a) of this section is less than one dollar over the federal minimum wage, the Alaska minimum wage shall be set at one dollar over the federal minimum wage. This amount shall be adjusted in subsequent years by the method established in (a) of this section." |

|||||||||||

|

Arizona |

$10.50 |

2016 / 2018 |

State specified rate of $10.00 on January 1, 2017 |

Scheduled increases: $11.00 (1/1/19) $12.00 (1/1/20) Indexed to CPI-U, U.S. City Average as of January 1, 2021. |

"A. Employers shall pay employees no less than the minimum wage, which shall be not less than: 1. $10 on and after January 1, 2017. 2. $10.50 on and after January 1, 2018. 3. $11 on and after January 1, 2019. 4. $12 on and after January 1, 2020. B. The minimum wage shall be increased on January 1, 2021 and on January 1 of successive years, by the increase in the cost of living. The increase in the cost of living shall be measured by the percentage increase as of August of the immediately preceding year over the level as of August of the previous year of the consumer price index (all urban consumers, U.S. city average for all items) or its successor index as published by the U.S. department of labor or its successor agency, with the amount of the minimum wage increase rounded to the nearest multiple of five cents." |

|||||||||||

|

Arkansas |

$8.50 |

2014 / 2017 |

State specified rate of $8.50 on January 1, 2017. |

Scheduled increases: None |

Arkansas Code |

"Beginning January 1, 2015, every employer shall pay each of his or her employees' wages at the rate of not less than seven dollars and fifty cents ($7.50) per hour, beginning January 1, 2016 the rate of not less than eight dollars ($8.00) per hour and beginning January 1, 2017 the rate of not less than eight dollars and fifty cents ($8.50) per hour except as otherwise provided in this subchapter." | ||||||||||

|

California |

$11.00/10.50 |

2013 / 2018 |

State specified rate of $10.50 on January 1, 2017; $10.00 for employer with 25 employees or less. |

Scheduled increases: $12.00 (1/1/19) $13.00 (1/1/20) $14.00 (1/1/21) $15.00 (1/1/22) Indexed to CPI-U, Colorado as of 1-1-23. The governor can temporarily pause incremental increases if state forecasts budget deficit of more than 1% of annual revenue. Small employers: Minimum wage increases are delayed by one year for employers with 25 or fewer employees. Rate increases to $10.50 (1/1/18) and is increased by $1.00 incrementally each year until $15.00 (1/1/23) | Note: In 2018 Arkansas Issue 5 amended 11-4-210 to include the following paragraph: "(3)(A) Beginning January 1, 2019, every employer shall pay each of his or her employees wages at the rate of not less than nine dollars and twenty-five cents ($9.25) per hour, beginning January 1, 2020 the rate of not less than ten dollars ($10.00) per hour and beginning January 1, 2021 the rate of not less than eleven dollars ($11.00) per hour except as otherwise provided in this subchapter." California |

"Notwithstanding any other provision of this part, on and after July 1, 2014, the minimum wage for all industries shall be not less than nine dollars ($9.00) per hour, and on and after January 1, 2016, the minimum wage for all industries shall be not less than ten dollars ($10.00) per hour. (1) For any employer who employs 26 or more employees, the minimum wage shall be as follows: (A) From January 1, 2017, to December 31, 2017, inclusive,—ten dollars and fifty cents ($10.50) per hour. (B) From January 1, 2018, to December 31, 2018, inclusive,—eleven dollars ($11) per hour. (C) From January 1, 2019, to December 31, 2019, inclusive,—twelve dollars ($12) per hour. (D) From January 1, 2020, to December 31, 2020, inclusive,—thirteen dollars ($13) per hour. (E) From January 1, 2021, to December 31, 2021, inclusive,—fourteen dollars ($14) per hour. (F) From January 1, 2022, and until adjusted by subdivision (c)—fifteen dollars ($15) per hour. (2) For any employer who employs 25 or fewer employees, the minimum wage shall be as follows: (A) From January 1, 2018, to December 31, 2018, inclusive,—ten dollars and fifty cents ($10.50) per hour. (B) From January 1, 2019, to December 31, 2019, inclusive,—eleven dollars ($11) per hour. (C) From January 1, 2020, to December 31, 2020, inclusive,—twelve dollars ($12) per hour. (D) From January 1, 2021, to December 31, 2021, inclusive—thirteen dollars ($13) per hour. (E) From January 1, 2022, to December 31, 2022, inclusive,—fourteen dollars ($14) per hour. (F) From January 1, 2023, and until adjusted by subdivision (c)—fifteen dollars ($15) per hour. c) (1) Following the implementation of the minimum wage increase specified in subparagraph (F) of paragraph (2) of subdivision (b), on or before August 1 of that year, and on or before each August 1 thereafter, the Director of Finance shall calculate an adjusted minimum wage. The calculation shall increase the minimum wage by the lesser of 3.5 percent and the rate of change in the averages of the most recent July 1 to June 30, inclusive, period over the preceding July 1 to June 30, inclusive, period for the United States Bureau of Labor Statistics nonseasonally adjusted United States Consumer Price Index for Urban Wage Earners." |

||||||||||

|

Colorado |

$10.20 |

2006 / 2018 |

State specified rate of $9.30 on January 1, 2017, followed by scheduled increases. |

Scheduled increases: $11.10 (1/1/19) $12.00 (1/1/20)

Indexed to CPI-U Colorado as of July 1, 2021. |

"Effective January 1, 2017, Colorado's minimum wage is increased to $ 9.30 per hour and is increased annually by $ 0.90 each January 1 until it reaches $ 12 per hour effective January 2020, and thereafter is adjusted annually for cost of living increases, as measured by the Consumer Price Index used for Colorado. This minimum wage shall be paid to employees who receive the state or federal minimum wage." |

|||||||||||

|

Connecticut |

$10.10 |

2013 / 2017 |

State specified rate of $8.70 on January 1, 2014, followed by scheduled increases. |

Scheduled increases: None State rate must exceed federal minimum wage rate by 0.5% if the federal rate becomes greater than or equal to the state rate. |

"Effective January 1, 2014, not less than eight dollars and seventy cents per hour, and effective January 1, 2015, not less than nine dollars and fifteen cents per hour, and effective January 1, 2016, not less than nine dollars and sixty cents per hour, and effective January 1, 2017, not less than ten dollars and ten cents per hour or one-half of one per cent rounded to the nearest whole cent more than the highest federal minimum wage, whichever is greater." |

|||||||||||

|

Delaware |

$8.25 |

2014 / 2015 |

State specified rate of 8.25 on June 1, 2015. |

Scheduled increases: None State rate must match federal minimum wage rate if the latter is greater. |

|

"(a)

(3) Not less than $8.75 per hour effective January 1, 2019; (4) Not less than $9.25 per hour effective October 1, 2019.

|

||||||||||

|

The District of Columbia |

$13.25 |

2016 / 2018 |

State specified rate of $12.50 on July 1, 2017, followed by adjustment on July 1, 2018, and each successive July 1. |

Scheduled increases: $14.00 (7/1/19) $15.00 (7/1/20) Indexed to CPI-U, Washington Metro Area as of 7-1-21. Note: the minimum wage is the greater of the scheduled increases or the FLSA rate plus $1. |

"(5)(A) Except as provided in subsection (h) of this section and subparagraph (B) of this paragraph, the minimum hourly wage required to be paid to an employee by an employer shall be as of: (i) July 1, 2016: $11.50; (ii) July 1, 2017: $12.50; (iii) July 1, 2018: $13.25; (iv) July 1, 2019: $14.00; and (v) July 1, 2020: $15.00. (B) If the minimum wage set by the United States government pursuant to the Fair Labor Standards Act ("U.S. minimum wage") is greater than the minimum hourly wage currently being paid pursuant to subparagraph (A) of this paragraph, the minimum hourly wage paid to an employee by an employer shall be the U.S. minimum wage plus $1. (6)(A) Except as provided in subsection (h) of this section, beginning on July 1, 2021, and no later than July 1 of each successive year, the minimum wage provided in this subsection shall be increased in proportion to the annual average increase, if any, in the Consumer Price Index for All Urban Consumers in the Washington Metropolitan Statistical Area published by the Bureau of Labor Statistics of the United States Department of Labor for the previous calendar year. Any increase under this paragraph shall be adjusted to the nearest multiple of $.05." |

|||||||||||

|

Florida |

$8.10 |

2004; 2005 / 2017 |

State specified rate of $6.15 on May 2, 2005, followed by adjustment on January 1, 2006, and each successive January 1. |

Inflation: Indexed to CPI-W, South Region as of January 1, 2006. |

"Beginning September 30, 2005, and annually on September 30 thereafter, the Department of Economic Opportunity shall calculate an adjusted state minimum wage rate by increasing the state minimum wage by the rate of inflation for the 12 months prior to September 1. In calculating the adjusted state minimum wage, the Department of Economic Opportunity shall use the Consumer Price Index for Urban Wage Earners and Clerical Workers, not seasonally adjusted, for the South Region or a successor index as calculated by the United States Department of Labor. Each adjusted state minimum wage rate shall take effect on the following January 1, with the initial adjusted minimum wage rate to take effect on January 1, 2006." |

|||||||||||

|

Georgia |

$5.15 |

2001 / 2001 |

State specified rate of $5.15 in 2001. |

None |

Georgia Code 34-4 |

"(a) Except as otherwise provided in this Code section, every employer, whether a person, firm, or corporation, shall pay to all covered employees a minimum wage which shall be not less than $5.15 per hour for each hour worked in the employment of such employer." |

||||||||||

|

Hawaii |

$10.10 |

2014 / 2018 |

State specified rate of $9.25 on January 1, 2017. |

Scheduled increases: None |

"(a) Except as provided in section 387-9 and this section, every employer shall pay to each employee employed by the employer, wages at the rate of not less than: (1) $6.25 per hour beginning January 1, 2003; (2) $6.75 per hour beginning January 1, 2006; (3) $7.25 per hour beginning January 1, 2007; (4) $7.75 per hour beginning January 1, 2015; (5) $8.50 per hour beginning January 1, 2016; (6) $9.25 per hour beginning January 1, 2017; and (7) $10.10 per hour beginning January 1, 2018." Note: This is language from legislation signed into law in May 2014, but a 2005 law had already set the state minimum wage at $7.25, effective January 1, 2007. | |||||||||||

|

Idaho |

$7.25 |

2016 / 2016 |

State specified rate of $7.25 in 2016. |

Next FLSA minimum wage rate change. |

Idaho |

"MINIMUM WAGES. (1) Except as hereinafter otherwise provided, no employer shall pay to any of his employees any wages computed at a rate of less than seven dollars and twenty-five cents ($7.25) per hour for employment. The amount of the minimum wage shall conform to, and track with, the federal minimum wage. 4) |

||||||||||

|

Illinois |

$8.25 |

2006 / 2010 |

State specified rate of $8.25 on July 1, 2010. |

None |

"On and after July 1, 2010 every employer shall pay to each of his or her employees who is 18 years of age or older in every occupation wages of not less than $8.25 per hour." |

|||||||||||

|

Indiana |

$7.25 |

2007 / 2009 |

State specified rate equal to FLSA rate on July 1, 2007, thereafter equaling the FLSA rate. |

Next FLSA minimum wage rate change. |

"(h) Except as provided in subsections (c) and (j), every employer employing at least two (2) employees during a work week shall, in any work week in which the employer is subject to this chapter, pay each of the employees in any work week beginning on or after June 30, 2007, wages of not less than the minimum wage payable under the federal Fair Labor Standards Act of 1938, as amended (29 U.S.C. 201 et seq.)." |

|||||||||||

|

Iowa |

$7.25 |

2007 / 2008 |

State specified rate of $7.25 on January 1, 2008. |

State rate must match federal minimum wage rate if the latter is greater. |

"1. a. The state hourly wage shall be at least $6.20 as of April 1, 2007, and $7.25 as of January 1, 2008. b. Every employer, as defined in the federal Fair Labor Standards Act of 1938, as amended to January 1, 2007, shall pay to each of the employer's employees, as defined in the federal Fair Labor Standards Act of 1938, as amended to January 1, 2007, the state hourly wage stated in paragraph "a", or the current federal minimum wage, pursuant to 29 U.S.C. § 206, as amended, whichever is greater." |

|||||||||||

|

Kansas |

$7.25 |

2009 / 2010 |

State specified rate of $7.25 on January 1, 2010. |

None |

"Except as otherwise provided in the minimum wage and maximum hours law, every employer shall pay to each employee wages at a rate as follows: (1) Prior to January 1, 2010, employee wages shall be paid at a rate of not less than $2.65 an hour; and (2) on and after January 1, 2010, employee wages shall be paid at a rate of not less than $7.25 an hour." |

|||||||||||

|

Kentucky |

$7.25 |

2007 / 2009 |

State specified rate of $7.25 on July 1, 2009. |

State rate must match federal minimum wage rate if the latter is greater. |

"Except as may otherwise be provided by this chapter, every employer shall pay to each of his employees wages at a rate of not less than five dollars and eighty-five cents ($5.85) an hour beginning on June 26, 2007, not less than six dollars and fifty-five cents ($6.55) an hour beginning July 1, 2008, and not less than seven dollars and twenty-five cents ($7.25) an hour beginning July 1, 2009. If the federal minimum hourly wage as prescribed by 29 U.S.C. sec. 206(a)(1) is increased in excess of the minimum hourly wage in effect under this subsection, the minimum hourly wage under this subsection shall be increased to the same amount, effective on the same date as the federal minimum hourly wage rate." |

|||||||||||

|

Louisiana |

None |

n/a |

None |

None |

No state minimum wage law |

|||||||||||

|

Maine |

$10.00 |

2015 / 2018 |

State specified rate of $9.00. |

Scheduled increases: $11.00 (1/1/19) $12.00 (1/1/20) Indexed to CPI-W, Northeast Region as of January 1, 2021. Note: the minimum wage is the greater of the scheduled increases or the FLSA rate. | Maine |

"1. |

||||||||||

|

Maryland |

$10.10 |

2014 / 2018 |

State specified rate of $9.25 on July 1, 2017. |

Scheduled increases: None State rate must match federal minimum wage if the latter is greater. |

"(b) In general.—Except as provided in subsection (d) of this section and § 3-414 of this subtitle, each employer shall pay: (1) to each employee who is subject to both the federal Act and this subtitle, at least the greater of: (i) the minimum wage for that employee under the federal Act; or; (ii) the State minimum wage rate set under subsection (c) of this section; and (2) each other employee who is subject to this subtitle, at least: (i) the greater of: 1. the highest minimum wage under the federal Act; or 2. the State minimum wage rate set under subsection (c) of this section; or (ii) a training wage under regulations that the Commissioner adopts that include the conditions and limitations authorized under the federal Fair Labor Standards Amendments of 1989. (c) State minimum wage.—The State minimum wage rate is: (1) for the 6-month period beginning January 1, 2015, $8.00 per hour; (2) for the 12-month period beginning July 1, 2015, $8.25 per hour; (3) for the 12-month period beginning July 1, 2016, $8.75 per hour; (4) for the 12-month period beginning July 1, 2017, $9.25 per hour; and (5) beginning July 1, 2018, $10.10 per hour." Note: This is language from legislation signed into law in May 2014, but a 2005 law had already set the state minimum wage at $7.25, effective January 1, 2007. | |||||||||||

|

Massachusetts |

$11.00 |

2014 / 2017 |

State specified rate of $11.00 on January 1, 2017, subject to a minimum of $0.50 higher than the FLSA rate. |

State rate must be at least $0.50 above federal minimum wage rate. |

"A wage of less than $9.00 per hour, in any occupation, as defined in this chapter, shall conclusively be presumed to be oppressive and unreasonable ... Notwithstanding the provisions of this section, in no case shall the minimum wage rate be less than $.50 higher than the effective federal minimum rate." |

|||||||||||

|

Michigan |

$9.25 |

2014 / 2018 |

State specified rate of $8.90 on January 1, 2017. |

Scheduled increases: Indexed to CPI-U, Midwest region as of January 1, 2019. This annual adjustment is limited to 3.5% increase and does not take effect if the state unemployment rate in the prior year was 8.5% or greater. |

"Sec. 4. (1) Subject to the exceptions specified in this act, the minimum hourly wage rate is: (a) Before September 1, 2014, $ 7.40. (b) Beginning September 1, 2014, $ 8.15. (c) Beginning January 1, 2016, $ 8.50. (d) Beginning January 1, 2017, $ 8.90. (e) Beginning January 1, 2018, $ 9.25. (2) Every January beginning in January 2019, the state treasurer shall adjust the minimum wage by an amount determined by the state treasurer at the end of the preceding calendar year to reflect the average annual percentage change in the consumer price index for the most recent 5-year period for which data are available. As used in this subsection, "consumer price index" means the most comprehensive index of consumer prices available for the midwest region from the bureau of labor statistics of the United States department of labor. The wage and hours division of the department of licensing and regulatory affairs shall post the adjusted minimum wage on its website by February 1 of the year it is calculated, and the adjusted rate is effective beginning April 1 of that year. An annual increase under this subsection shall not exceed 3.5%. (3) An increase in the minimum hourly wage rate as prescribed in subsection (2) does not take effect if the unemployment rate determined by the bureau of labor statistics, United States department of labor, for this state is 8.5% or greater for the year preceding the year of the prescribed increase." |

|||||||||||

|

Minnesota |

|

2014 / 2018 |

State specified rate of $9.50 on August 1, 2016. |

Inflation: Indexed to the lesser of inflation (implicit price deflator, personal consumer expenditures) or 2.5% as of January 1, 2018. | "(1) every large employer must pay each employee wages at a rate of at least: (i) $ 8.00 per hour beginning August 1, 2014; (ii) $ 9.00 per hour beginning August 1, 2015; (iii) $ 9.50 per hour beginning August 1, 2016; and (iv) the rate established under paragraph (f) beginning January 1, 2018;

|

Massachusetts Massachusetts General Laws Chapter 151, Section 1 Massachusetts Session Laws Chapter 121 "A wage of less than $9.00 per hour, in any occupation, as defined in this chapter, shall conclusively be presumed to be oppressive and unreasonable ... Notwithstanding the provisions of this section, in no case shall the minimum wage rate be less than $.50 higher than the effective federal minimum rate." "SECTION 17. Section 1 of chapter 151 of the General Laws, as appearing in the 2016 Official Edition, is hereby amended by striking out, in line 6, the figure '$11.00' and inserting in place thereof the following figure:- $12.00. SECTION 18. Said section 1 of said chapter 151 is hereby further amended by striking out the figure '$12.00', inserted by section 17, and inserting in place thereof the following figure:- $12.75. SECTION 19. Said section 1 of said chapter 151 is hereby further amended by striking out the figure '$12.75', inserted by section 18, and inserting in place thereof the following figure:- $13.50. SECTION 20. Said section 1 of said chapter 151 is hereby further amended by striking out the figure '$13.50', inserted by section 19, and inserting in place thereof the following figure:- $14.25. SECTION 21. Said section 1 of said chapter 151 is hereby further amended by striking out the figure '$14.25', inserted by section 20, and inserting in place thereof the following figure:- $15.00."

|

Michigan

|

Michigan Compiled Laws 408.934 (as approved by Public Act 368 of 2018)

|

In 2018, Michigan Public Act 368 amended Michigan Compiled Law 408.934. "Sec. 3. An employer shall not pay any employee at a rate that is less than prescribed in this act. Sec. 4. (1) Subject to the exceptions specified in this act, the minimum hourly wage rate is: (a) Before September 1, 2014, $7.40. (b) Beginning September 1, 2014, $8.15. (c) Beginning January 1, 2016, $8.50. (d) Beginning January 1, 2017, $8.90. (e) Beginning January 1, 2018, $9.25. (f) In calendar year 2019, or a subsequent calendar year as described in subsection (2), $9.45. (g) In calendar year 2020, or a subsequent calendar year as described in subsection (2), $9.65. (h) In calendar year 2021, or a subsequent calendar year as described in subsection (2), $9.87. (i) In calendar year 2022, or a subsequent calendar year as described in subsection (2), $10.10. (j) In calendar year 2023, or a subsequent calendar year as described in subsection (2), $10.33. (k) In calendar year 2024, or a subsequent calendar year as described in subsection (2), $10.56. (l) In calendar year 2025, or a subsequent calendar year as described in subsection (2), $10.80. (m) In calendar year 2026, or a subsequent calendar year as described in subsection (2), $11.04. (n) In calendar year 2027, or a subsequent calendar year as described in subsection (2), $11.29. (o) In calendar year 2028, or a subsequent calendar year as described in subsection (2), $11.54. (p) In calendar year 2029, or a subsequent calendar year as described in subsection (2), $11.79. (q) In calendar year 2030, or a subsequent calendar year as described in subsection (2), $12.05. (2) An increase in the minimum hourly wage rate as prescribed in subsection (1) does not take effect if the unemployment rate for this state, as determined by the Bureau of Labor Statistics, United States Department of Labor, is 8.5% or greater for the calendar year preceding the calendar year of the prescribed increase. An increase in the minimum hourly wage rate as prescribed in subsection (1) that does not take effect pursuant to this subsection takes effect in the first calendar year following a calendar year for which the unemployment rate for this state, as determined by the Bureau of Labor Statistics, United States Department of Labor, is less than 8.5%."

|

Minnesota

|

"(a) For purposes of this subdivision, the terms defined in this paragraph have the meanings given them. (1) 'Large employer' means an enterprise whose annual gross volume of sales made or business done is not less than $500,000 (exclusive of excise taxes at the retail level that are separately stated) and covered by the Minnesota Fair Labor Standards Act, sections 177.21 to 177.35. (2) 'Small employer' means an enterprise whose annual gross volume of sales made or business done is less than $500,000 (exclusive of excise taxes at the retail level that are separately stated) and covered by the Minnesota Fair Labor Standards Act, sections 177.21 to 177.35. (b) Except as otherwise provided in sections 177.21 to 177.35: (1) every large employer must pay each employee wages at a rate of at least: (i) $8.00 per hour beginning August 1, 2014; (ii) $9.00 per hour beginning August 1, 2015; (iii) $9.50 per hour beginning August 1, 2016; and (iv) the rate established under paragraph (f) beginning January 1, 2018; and (2) every small employer must pay each employee at a rate of at least: (i) $6.50 per hour beginning August 1, 2014; (ii) $7.25 per hour beginning August 1, 2015; (iii) $7.75 per hour beginning August 1, 2016; and (iv) the rate established under paragraph (f) beginning January 1, 2018. (f) No later than August 31 of each year, beginning in 2017, the commissioner shall determine the percentage increase in the rate of inflation, as measured by the implicit price deflator, national data for personal consumption expenditures as determined by the United States Department of Commerce, Bureau of Economic Analysis during the 12-month period immediately preceding that August or, if that data is unavailable, during the most recent 12-month period for which data is available. The minimum wage rates in paragraphs (b), (c), (d), and (e) are increased by the lesser of: (1) 2.5 percent, rounded to the nearest cent; or (2) the percentage calculated by the commissioner, rounded to the nearest cent. A minimum wage rate shall not be reduced under this paragraph. The new minimum wage rates determined under this paragraph take effect on the next January 1." |

|||||

|

Mississippi |

None |

n/a |

None |

None |

No state minimum wage law |

n/a |

||||||||||

|

Missouri |

$7.70 |

2006 / 2017 |

State specified rate of $6.50 on January 1, 2007, followed by adjustment on January 1, 2008, and each successive January 1. |

Inflation: CPI-W |

|

|

n/a Missouri |

"2. The minimum wage shall be increased or decreased on January 1, 2008, and on January 1 of successive years, by the increase or decrease in the cost of living. On September 30, 2007, and on each September 30 of each successive year, the director shall measure the increase or decrease in the cost of living by the percentage increase or decrease as of the preceding July over the level as of July of the immediately preceding year of the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) or successor index as published by the U.S. Department of Labor or its successor agency, with the amount of the minimum wage increase or decrease rounded to the nearest five cents." Note: A 2017 law prohibits cities and other local areas from setting a minimum wage higher than the state minimum wage. (HB1194, 2017) | |||||||||

|

Montana |

$8.30 |

2006 / 2018 |

State specified rate of higher of $6.15 or FLSA rate, followed by adjustment on January 1, 2007, and each successive January 1. |

Inflation: CPI-U, U.S. City Average |

"No later than September 30 of each year, an adjustment of the wage amount specified in subsection (1) must be made based upon the increase, if any, from August of the preceding year to August of the year in which the calculation is made in the consumer price index, U.S. city average, all urban consumers, for all items, as published by the bureau of labor statistics of the United States department of labor." |

|||||||||||

|

Nebraska |

$9.00 |

2014 / 2016 |

State specified rate of $9.00 on January 1, 2016. |

Scheduled increases: None |

"Except as otherwise provided in this section and section 48-1203.01, every employer shall pay to each of his or her employees a minimum wage of: (a) Seven dollars and twenty-five cents per hour through December 31, 2014; (b) Eight dollars per hour on and after January 1, 2015, through December 31, 2015; and (c) Nine dollars per hour on and after January 1, 2016." |

|||||||||||

|

Nevada |

|

2006 / 2017 |

State specified rate of $5.15 (or $6.15 with no health insurance) in 2006, followed by adjustment on July 1, 2007, and each successive July 1. |

Inflation: CPI-U, U.S. City Average. State rate is the greater of $5.15 ($6.15) plus the cumulative inflation since 12/31/04 (subject to a maximum annual increase of 3%) or the increases in the federal minimum wage over $5.15. | "3. Except as may be otherwise provided pursuant to sections 290.500 to 290.530. and notwithstanding subsection ( 1) of this sect ion. effective January I. 2019, every employer s hall pay to each employee wages at the rate of not less than $8.60 per hour, or wages at the same rate or rates set under the provisions of federal law as the prevailing federal minimum wage applicable to those covered jobs in interstate commerce. whichever rate per hour is higher. Thereafter, the minimum wage established by this subsection shall be increased each year by $.85 per hour, effective January I of each of the next four years, until it reaches $ 12.00 per hour, effective January I, 2023. Thereafter, the minimum wage established by this subsection shall be increased or decreased on January I, 2024, and on January I of successive years, per the method set forth in subsection (2) of this section. If at any time the federal minimum wage rate is above or is thereafter increased above the minimum wage then in effect under this subsection, the minimum wage required by this subsection shall continue to be increased pursuant to this subsection (3), but the higher federal rate shall immediately become the minimum wage required by this subsection and shall be increased or decreased per the method set forth in subsection (2) for so long as it remains higher than the state minimum wage required and increased pursuant to this subsection." Note: A 2017 law prohibits cities and other local areas from setting a minimum wage higher than the state minimum wage. (HB1194, 2017) Montana Nebraska "Except as otherwise provided in this section and section 48-1203.01, every employer shall pay to each of his or her employees a minimum wage of: (a) Seven dollars and twenty-five cents per hour through December 31, 2014; (b) Eight dollars per hour on and after January 1, 2015, through December 31, 2015; and (c) Nine dollars per hour on and after January 1, 2016." Nevada "Sec. 16. Payment of minimum compensation to employees. [See below for future possible provisions.] | |||||||||||

|

New Hampshire |

$7.25 |

2007 / 2008 |

State specified rate equal to FLSA rate on July 1, 2007, thereafter equaling the FLSA rate. |

Next FLSA minimum wage rate change. |

"Unless otherwise provided by statute, no person, firm, or corporation shall employ any employee at an hourly rate lower than that set forth in the federal minimum wage law, as amended." Note: This is language from the current statute as revised by 2011 legislation, but a 2007 law had already set the state minimum wage at $7.25. |

|||||||||||

|

New Jersey |

$8.60 |

2013 / 2018 |

State specified rate of $8.25 on January 1, 2014, followed by adjustment on each successive January 1. |

Inflation: CPI-W State rate must match federal minimum wage if the latter is greater. |

Note: In 2017, the Nevada Legislature passed File No. 42 (Senate Joint Resolution 6). This Act will be effective if the Nevada Legislature approves the provisions in 2019; and the provisions are ratified by Nevada voters in the 2020 election. "Sec. 16. Payment of minimum compensation to employees; incremental annual increase. [Effective November 24, 2020, if the provisions of Senate Joint Resolution No. 6 (2017) are agreed to and passed by the 2019 Legislature and approved and ratified by the voters at the 2020 General Election.] 1. Except as otherwise provided in this section, each employer shall pay a wage to each employee of not less than the hourly rate set forth in this subsection. Beginning on January 1, 2021, the rate must be nine dollars and forty cents ($9.40) per hour worked. Beginning on January 1, 2022, this rate must be increased on January 1 of each year by one dollar and fifteen cents ($1.15) per hour worked until the rate is fourteen dollars ($14.00) per hour worked. 2. If, at any time, the federal minimum wage is higher than the rate set forth in subsection 1, each employer must pay a wage to each employee of not less than the hourly rate set forth in the federal minimum wage. 3. The Legislature may establish by law a minimum wage that an employer must pay to each employee that is higher than the hourly rate set forth in subsection 1 or 2."

|

New Hampshire

|

|

"Unless otherwise provided by statute, no person, firm, or corporation shall employ any employee at an hourly rate lower than that set forth in the federal minimum wage law, as amended." New Jersey |

"A wage rate of not less than the rate required by that act, or $8.25 per hour, whichever is more. On the September 30 next following the date of the approval of this amendment, and on September 30 of each subsequent year, the State minimum wage rate shall be increased, effective the following January 1, by any increase during the one year prior to that September 30 in the consumer price index for all urban wage earners and clerical workers (CPI-W) as calculated by the federal government." |

|||||||

|

New Mexico |

$7.50 |

2007 / 2009 |

State specified rate of $7.50 on January 1, 2009. |

None |

"An employer shall pay an employee the minimum wage rate of six dollars fifty cents ($ 6.50) an hour. As of January 1, 2009, an employer shall pay the minimum wage rate of seven dollars fifty cents ($7.50) an hour." |

|||||||||||

|

New York |

$10.40 |

2013 / 2017 |

State specified rate of $9.70 on December 31, 2016. |

Scheduled increases: $11.10 (12/31/18) $11.80 (12/31/19) $12.50 (12/31/20) Indexed to CPI-U, U.S. City Average as of December 31, 2021, until rate reaches $15.00. State rate must match federal minimum wage rate if the latter is greater. Note: The New York minimum wage varies based on geographic location, and in NYC by employer size. | New York Codes, Rules, and Regulations Title 12, Section 141-1.3 |

"(a) For all employees except janitors in residential buildings, the basic minimum hourly rate shall be, for each hour worked in: (1) New York City for: (i) Large employers of 11 or more employees: $11.00 per hour on and after December 31, 2016; $13.00 per hour on and after December 31, 2017; $15.00 per hour on and after December 31, 2018; (ii) Small employers of 10 or fewer employees: $10.50 per hour on and after December 31, 2016; $12.00 per hour on and after December 31, 2017; $13.50 per hour on and after December 31, 2018; $15.00 per hour on and after December 31, 2019; (2) Remainder of downstate (Nassau, Suffolk and Westchester counties): $10.00 per hour on and after December 31, 2016; $11.00 per hour on and after December 31, 2017; $12.00 per hour on and after December 31, 2018; $13.00 per hour on and after December 31, 2019; $14.00 per hour on and after December 31, 2020; $15.00 per hour on and after December 31, 2021; (3) Remainder of State (outside of New York City and Nassau, Suffolk and Westchester counties): $9.70 per hour on and after December 31, 2016; $10.40 per hour on and after December 31, 2017; $11.10 per hour on and after December 31, 2018; $11.80 per hour on and after December 31, 2019; $12.50 per hour on and after December 31, 2020. (4) If a higher wage is established by Federal law pursuant to 29 U.S.C. section 206 or its successors, such wage shall apply." |

||||||||||

|

North Carolina |

$7.25 |

2006 / 2009 |

State specified rate of higher of $6.15 or FLSA rate. |

State rate must match federal minimum wage rate if the latter is greater. |

"Every employer shall pay to each employee who in any workweek performs any work, wages of at least six dollars and fifteen cents ($6.15) per hour or the minimum wage set forth in paragraph 1 of section 6(a) of the Fair Labor Standards Act, 29 U.S.C. 206(a)(1), as that wage may change from time to time, whichever is higher, except as otherwise provided in this section." |

|||||||||||

|

North Dakota |

$7.25 |

2007 / 2009 |

State specified rate of $7.25 on July 24, 2009. |

None |

"Except as otherwise provided under this chapter and rules adopted by the commissioner, every employer shall pay to each of the employer's employees: a. Effective on the effective date of this section, a wage of at least five dollars and eighty-five cents per hour; b. Effective twelve months after the effective date of this section, a wage of at least six dollars and fifty-five cents per hour; and c. Effective twenty-four months after the effective date of this section, a wage of at least seven dollars and twenty-five cents per hour." |

|||||||||||

|

Ohio |

$8.30 |

2006 / 2018 |

State specified rate of $6.85 on January 1, 2007, followed by adjustment on each successive January 1. |

Inflation: CPI-W |

"On the thirtieth day of each September, beginning in 2007, this state minimum wage rate shall be increased effective the first day of the following January by the rate of inflation for the twelve month period prior to that September according to the consumer price index or its successor index for all urban wage earners and clerical workers for all items as calculated by the federal government rounded to the nearest five cents." |

|||||||||||

|

Oklahoma |

$7.25 |

1983 / 2009 |

State specified rate equal to FLSA rate on November 1, 1983, thereafter equaling the FLSA rate. |

Next FLSA minimum wage rate change. |

"Except as otherwise provided in the Oklahoma Minimum Wage Act, no employer within the State of Oklahoma shall pay any employee a wage of less than the current federal minimum wage for all hours worked." |

|||||||||||

|

Oregon |

$10.75 |

2003 / 2018 |

State specified rate of $10.25 on January 1, 2017, followed by adjustment on each successive January 1. |

Scheduled increases: $11.25 (7/1/19) $12.00 (7/1/20) $12.75 (7/1/21) $13.50 (7/1/22) Indexed to CPI-U, U.S. City Average as of July 1, 2023. | Oregon Revised Statutes 653.025 (see Oregon Laws 2016, Chap. 12) |

"Standard Wage: (b) [For calendar years after 2003] From January 1, 2004, to June 30, 2016, a rate adjusted for inflation as calculated by the commissioner. (c) From July 1, 2016, to June 30, 2017, $9.75. (d) From July 1, 2017, to June 30, 2018, $10.25. (e) From July 1, 2018, to June 30, 2019, $10.75. (f) From July 1, 2019, to June 30, 2020, $11.25. (g) From July 1, 2020, to June 30, 2021, $12. (h) From July 1, 2021, to June 30, 2022, $12.75. (i) From July 1, 2022, to June 30, 2023, $13.50. (j) After June 30, 2023, beginning on July 1 of each year, a rate adjusted annually for inflation as described in subsection (5) of this section. Note: The Oregon 2016 law also clarifies different incremental increased minimum wages rates for metropolitan areas and rural areas. (Oregon Laws 2016, Chap. 12) | ||||||||||

|

Pennsylvania |

$7.25 |

2006 / 2009 |

State specified rate of $7.15 on July 1, 2007. |

State rate must match federal minimum wage rate if the latter is greater. |

Metropolitan Service District (Portland): (2) If the employer is located within the urban growth boundary of a metropolitan service district organized under ORS chapter 268, except as provided by ORS 652.020 and the rules of the commissioner issued under ORS 653.030 and 653.261, for each hour of work time that the employee is gainfully employed, no employer shall employ or agree to employ any employee at wages computed at a rate lower than: (a) From July 1, 2016, to June 30, 2017, $9.75. (b) From July 1, 2017, to June 30, 2018, $11.25. (c) From July 1, 2018, to June 30, 2019, $12. (d) From July 1, 2019, to June 30, 2020, $12.50. (e) From July 1, 2020, to June 30, 2021, $13.25. (f) From July 1, 2021, to June 30, 2022, $14. (g) From July 1, 2022, to June 30, 2023, $14.75. (h) After June 30, 2023, an employer described in this subsection shall pay an employee no less than $1.25 per hour more than the minimum wage determined under subsection (1)(j) of this section. Nonurban County: (3) If the employer is located within a nonurban county as described in section 2 of this 2016 Act, except as provided by ORS 652.020 and the rules of the commissioner issued under ORS 653.030 and 653.261, for each hour of work time that the employee is gainfully employed, no employer shall employ or agree to employ any employee at wages computed at a rate lower than: (a) From July 1, 2016, to June 30, 2017, $9.50. (b) From July 1, 2017, to June 30, 2018, $10. (c) From July 1, 2018, to June 30, 2019, $10.50. (d) From July 1, 2019, to June 30, 2020, $11. (e) From July 1, 2020, to June 30, 2021, $11.50. (f) From July 1, 2021, to June 30, 2022, $12. (g) From July 1, 2022, to June 30, 2023, $12.50. (h) After June 30, 2023, an employer described in this subsection shall pay an employee no less than $1 per hour less than the minimum wage determined under subsection (1)(j) of this section." Note: The Oregon 2016 Act clarified different incremental increased minimum wages rates for metropolitan district and nonurban areas. (Oregon Laws 2016, Chap. 12) Pennsylvania |