TPP Countries Sign New CPTPP Agreement without U.S. Participation

Changes from January 29, 2018 to March 9, 2018

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

On November 11, 2017March 8, 2018, the 11 remaining signatories of the Trans-Pacific Partnership (TPP) agreement, excluding the United States, announced the outlines of the signed the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). On January 23, 2018, the parties announced they had concluded negotiations on the CPTPP and plan to sign the pact in early March. The CPTPP. The CPTPP parties announced the outlines of the agreement in November 2017 and concluded the negotiations in January 2018. The CPTPP, which requires ratification by 6 of the 11 signatories to become effective, would be a vehicle to enact much of the TPP, signed by these countries and the United States in February 2016 and from which President Trump withdrew in January 2017. The withdrawal was the first action under the President's new trade policy approach, which includes a stated preference for bilateral free trade agreement (FTA) negotiations over multiparty agreements like TPP, a critical view of many existing U.S. FTAs, and a prominent focus on bilateral U.S. trade deficits as an indicator of the health of trade relationships. The Trump Administration has also been engaged, since August 2017, in a renegotiation of the North American Free Trade Agreement (NAFTA) with Canada and Mexico, two TPP signatories and CPTPP participants. On January 5, 2018, the Administration began official talks with South Korea on potential modifications to the U.S.-South Korea FTA (KORUS).

While the United States is not involved in CPTPP, the agreement has the potential to affect the economic well-being of certain U.S. stakeholders, as well as U.S. global economic leadership and long-standing U.S. promotion of an open, rules-based trading system. It also may strengthen perceptions of U.S. disengagement in Asia, which many analysts say could impact the U.S. ability to pursue other goals in the region. Congress, which oversees and sets objectives for the Administration in trade negotiations and passes legislation to implement U.S. FTAs, could play an important role in U.S. trade policy responses to the CPTPP. The United States has existing FTAs with six of the CPTPP members with many provisions similar to those in the new agreement, including near-complete tariff elimination. This suggests the most significant economic effects for the United States may relate to the five CPTPP members without a U.S. FTA (Brunei, Japan, Malaysia, New Zealand, and Vietnam). In January 2018, President Trump stated his Administration is open to negotiating an FTA collectively with these five countries. The new CPTPP would enter into force 60 days following the ratification of the agreement by 6 of its members.

Suspension of TPP Provisions

In order to preserve U.S. interest in the TPP, Japan, which is now leadingled the CPTPP negotiating process, has pushed for the CPTPP to suspend TPP provisions where consensus could not be reached, rather than amend them. The parties agreed to suspend 20 provisions, which primarily were sought by the United States and agreed to by other countries in return for access to U.S. markets. This was especially true in the area of intellectual property rights (IPR) where the CPTPP suspended provisions on

- patentability for inventions derived from plants;

- patents for new uses, processes, or methods of existing products (so-called evergreening);

- patent term adjustment for marketing and patent approval delays;

- protection of undisclosed test data for chemical and biological drugs;

- the author/creator life +70 year copyright term;

- legal liability and safe harbor provisions for internet service providers;

- circumvention and digital rights management; and

- protections of encryption and satellite program and cable signals.

In the investment chapter, investor-state-dispute-settlement (ISDS) is suspended with respect to investment screening (e.g., the criteria by which a party approves an investment), and also with respect to investment agreements between a host state government and an investor. These changes potentially could lead to a requirement to use domestic courts and apply domestic laws to resolve some investment disputes, counter to longstandinglong-standing U.S. objectives in bilateral investment treaties and FTAs. In e-commerce, the parties suspended the obligation to review de minimis tariff levels on express shipments. The parties also removed a provision to "promote compliance" with local labor laws in the procurement of goods or services, and one section of a provision related to the prohibition against illegal trade in wildlife. In the event of the return of the United States to the agreement, reinstatement of the suspended provisions would require consensus among the existing parties.

At the time the CPTPP outlines were announced in November, four issues remained unresolved, including (1) Canada's desire for a blanket cultural exclusion (rather than the narrower chapter-by-chapter exclusions in the TPP); (2) Malaysia's interest in exceptions to state-owned enterprise (SOE) commitments; (3) Brunei's interest in exceptions to the services and investment commitments relating to coal production; and (4) Vietnam's concerns over the applicability of dispute settlement procedures to certain labor commitments. Press reports state that Malaysia and Brunei's concerns were addressed through additional suspension of TPP commitments, while Vietnam reached agreement with the other parties through additional side letters. The Canadian government issued a statement that it resolved its concerns regarding flexibility to support "promotion, creation, distribution, and development of Canadian artistic expression and content," through bilateral side letters with the CPTPP countries. Canada also reached an agreement through side letters on, among other issues, automotive commitments relating to standards with Japan, and rules of origin with Australia and Malaysia.

Concerns over Effects on U.S. Export Competitiveness

U.S. stakeholders in export-oriented industries have raised concerns that an enacted CPTPP could disadvantage U.S. firms and workers in CPTPP markets. Tariff schedules are expected to remain consistent withCPTPP tariff commitments, which are based on the original TPP agreement, which would eventually result in the elimination of duties on more than 99% of tariff lines in each CPTPP country (95% for Japan), and a greater number of tariff reductions. For generally high-tariff products such as agricultural goods, this tariff differential on U.S. versus CPTPP country exports could be a significant factor in market competitiveness. For example, U.S. beef exports to Japan, which totaled more than $1.5 billion in 20162017, face a 38.5% tariff in the Japanese market. This tariff eventually would be reduced for CPTPP country exporters to 9%. Table 1 provides examples of high-value U.S. exports to the largest three CPTPP markets without an existing U.S. FTA, and the associated tariffs that would be eliminated for CPTPP countries. CPTPP also addresses nontariff barriers and establishes trade rules, but these commitments are typically applied in a nondiscriminatory manner and hence could still benefit U.S. trade even without U.S. participation.

|

Country |

Product (HTS Code) |

U.S. Exports ( |

Import Tariff |

Year Tariff Eliminated to CPTPP |

|||

|

Japan |

Beef ( |

|

38.5%* |

To 9% by Year 16 |

|||

|

Frozen Potatoes (HS 200410) |

|

Up to 13.6% |

Year 6 |

||||

|

Walnuts (HS 080232) |

|

10% |

Year 1 |

||||

|

Malaysia |

Self-adhesive Tape/Sheets |

|

|

Year |

|||

|

Table and Kitchen Glassware |

|

|

Year |

||||

|

Fresh Grapes (HS 080610) |

|

5% |

Year 1 |

||||

|

Vietnam |

Motor Vehicles |

|

|

Year |

|||

|

Soybean Flour/Meal |

|

|

Year |

||||

|

Chicken Cuts |

|

|

Year |

Source: CRS analysis using trade data from U.S. Census Bureau and TPP tariff elimination schedules.

Notes: Based on original TPP tariff commitments, which CPTPP countries have announced they will maintain. (*) U.S. beef exports to Japan currently face a 50% tariff due to a temporary safeguard measure. Japan's existing FTA partners, such as Australia, are exempt from the safeguard. HS refers to the harmonized schedule codes used for tariff classification purposes. A larger number of digits denotes greater specificity in the product classification. U.S. tariffs are imposed on imports based on 8-digit level classification; therefore product classifications at less than 8 digits may include multiple tariff lines with varying associated tariffs.

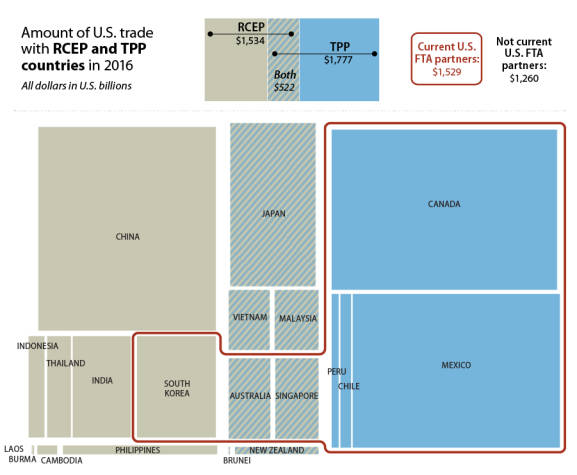

In addition to the CPTPP, several TPP countries are also participating in the Regional Comprehensive Economic Partnership (RCEP) (see members in Figure 1). While RCEP negotiations are less comprehensive than the CPTPP, if it were to move forward, RCEP could also potentially disadvantage U.S. exporters as tariffs are reduced among the members, which include all major U.S. trading partners in the region.

|

|

Source: CRS with data from the Bureau of Economic Analysis (BEA) and U.S. Census Bureau. Note: U.S. services trade data are not available for Laos, Burma, or Cambodia. |

Outlook and Implications

The CPTPP enters the trade agreement landscape at a time of uncertainty in the global trading system. Much of this uncertainty, felt particularly in Asia, reflects ambiguity in the direction of current and future U.S. trade policy goals and U.S. leadership in establishing international trade rules and institutions. Related to this is an ongoing contentious domestic debate over the costs and benefits of international trade and trade agreements. CPTPP has significant policy implications for the United States and Congress. The agreement includes long-standing objectives of U.S. FTAs such as broad tariff elimination and a "negative list" (more liberal) approach to services trade liberalization, as well as newer, largely U.S.-crafted commitments on digital trade and SOEs. The agreement, however, also suspends significant provisions to the original TPP on issues like IPR and investment that were U.S. priorities. Moving forward, the agreement may raise questions for U.S. policymakers, such as

- Were the United States to seek entry to the CPTPP, how difficult would it be to reestablish the suspended provisions?

- Will other countries seek to join the CPTPP? If so, how will this affect U.S. trade patterns with those countries?; and

- How

willwould U.S. absence from two major potential regional trade initiatives (CPTPP and RCEP) affect broader U.S. influence in the Asia-Pacific region?