School Meals Programs and Other USDA Child Nutrition Programs: A Primer

Changes from October 11, 2017 to August 24, 2018

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

School Meals Programs and Other USDA Child Nutrition Programs: A Primer

Contents

- Introduction and Background

- Authorization and Reauthorization

- Program Administration: Federal, State, and Local

Administration - Funding Overview

- Open-Ended, Appropriated Entitlement Funding

- Other Federal Funding

- State, Local, and Participant Funds

- Child Nutrition Programs at a Glance

- Related Resources on Child Nutrition Programs and Policies

- School Meals Programs

- General Characteristics

- School Meals Eligibility Rules

- Income Eligibility

- Categorical Eligibility

- Community Eligibility Provision (CEP)

National School Lunch Program (NSLP): Program-Specific Data and Policies- School Breakfast Program (SBP)

: Program-Specific Data and Policies - Other Child Nutrition Programs

- Child and Adult Care Food Program (CACFP)

- CACFP at Centers

- CACFP for Day Care Homes

- Summer Meals

: Provided through Several Authorities - Summer Food Service Program (SFSP)

- School Meals' Seamless Summer Option

- Summer EBT for Children

(SEBTC or "Summer EBT"): An Alternative to SFSP or Seamless Summer Option SitesDemonstration

- Special Milk Program (SMP)

- Fresh Fruit and Vegetable Program (FFVP)

Support forOther Topics After-School Meals and Snacks: CACFP, NSLP Options- Related Programs, Initiatives, and Support Activities

- Selected Current Issues

in the USDA Child Nutrition Programs - Regulations

Updatingon Nutrition Standards - Updated Nutrition Standards for Lunch and Breakfast

(Final Rule, January 26, 2012) -

New Nutrition Standards for All Foods Sold in Schools

(Final Rule, July 29, 2016) - Updated Nutrition Standards for CACFP (Final Rule, April 25, 2016)

- Updated Nutrition Standards for CACFP

- Alternatives to "Congregate Feeding" in

the Summer Food Service ProgramSummer Meals

- Current Law and Policy

- Congressional Proposals

- President Obama's FY2017 Budget Proposals

- FY2018 President's Budget

- Unpaid Meal Charges and "Lunch Shaming"

Figures

- Figure 1. Federal, State, and Local Administration of

Child NutritionSchool Meal Programs - Figure 2. Overview of Certification for Free and Reduced-Price School Meals

- Figure 3. National School Lunch Program,

FY2016FY2017 Participationand Spending - Figure 4. School Breakfast Program,

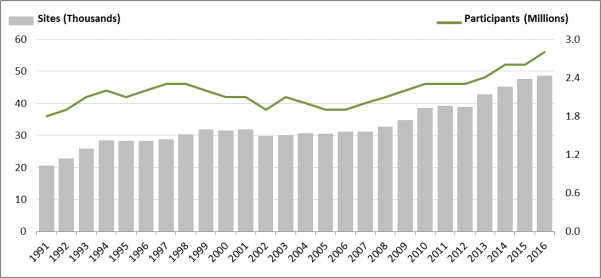

FY2016FY2017 ParticipationParticipation and Spending - Figure 5. SFSP Participants and Meal Sites FY1991-FY2016

Tables

- Table 1. Child Nutrition Programs at a Glance

- Table 2. Income Eligibility Guidelines for a Family of Four for

National School Lunch Program (NSLP) and School Breakfast Program (SBP) in the 48 States and DCNSLP and SBP

- Table 3.

FY2015 and FY2016FY2016 and FY2017 Federal Expendituresforon Child Nutrition Programs - Table A-1. Acronyms

- Table B-1.

National School Lunch Program, MealsReimbursement Rates, NSLP: Lunches

- Table B-2.

National School Lunch Program,Reimbursement Rates, NSLP: After-School Snacks - Table B-3.

School Breakfast ProgramReimbursement Rates, SBP

- Table B-4.

Value ofCommodity Food Assistance, NSLP and CACFP (Centers) - Table B-5.

Child and Adult Care Food Program (CACFP),Reimbursement Rates, CACFP: Child Care Centers, At-Risk After-School Programs - Table B-6.

Child and Adult Care Food Program (CACFP),Reimbursement Rates, CACFP: Child Care Homes - Table B-7.

Summer Food Service Program (SFSP)Reimbursement Rates, SFSP

- Table B-8.

Special Milk ProgramReimbursement Rates, SMP

Summary

"ChildThe "child nutrition programs" is an overarching term used to describe refer to the U.S. Department of Agriculture's Food and Nutrition Service (USDA-FNS) programs that provide food for children in school or institutional settings. The best known programs, which serve the largest number of children, are the school meals programs: the National School Lunch Program (NSLP) and the School Breakfast Program (SBP). The child nutrition programs also include the Child and Adult Care Food Program (CACFP), which provides meals and snacks in day care and after school settings; the Summer Food Service Program (SFSP), providingwhich provides food during the summer months; the Special Milk Program (SMP), supportingwhich supports milk for schools that do not participate in NSLP or SBP; and the Fresh Fruit and Vegetable Program (FFVP), which funds fruit and vegetable snacks in select elementary schools.

Funding: The vast majority of the child nutrition programs account is considered mandatory spending, with trace amounts of discretionary funding for certain related activities. Referred to as open-ended, "appropriated entitlements," funding is provided through the annual appropriations process; however, the level of spending is controlled by benefit and eligibility criteria in federal law and dependent on the resulting levels of participation. Federal cash funding (in the form of per-meal reimbursements)elementary schools.

This report presents an overview of the benefits and services these programs and related activities provide as well as participation and funding information. The report emphasizes details for the school meals programs and provides an orientation to the operations of the other programs.

The child nutrition programs are largely open-ended, "appropriated entitlements," meaning that the funding is appropriated through the annual appropriations process, but the level of spending is dependent on participation and the benefit and eligibility rules in federal law. Additionally, recipients of appropriated entitlements may have legal recourse if Congress does not appropriate the necessary funding. Federal cash funding and USDA commodity food support is guaranteed to schools and other providers based on the number of meals or snacks served, who is served and participant category (e.g., free meals for poor children get higher subsidies), and legislatively established (and inflation-indexed) per-meal reimbursement (subsidy) rates. In FY2016, federal spending on these programs totaled over $22 billion. The vast majority of the child nutrition programs account is considered mandatory spending, with trace amounts of discretionary funding for certain related activities.

Participation: The child nutrition programs serve children of varying ages and in different institutional settings. The NSLP and SBP have the broadest reach, serving qualifying children of all ages in school settings. Other child nutrition programs serve more-narrow populations. CACFP, for example, provides meals and snacks to children in early childhood and after-school settings among other venues. Programs generally provide some subsidy for all food served but a larger federal reimbursement for food served to children from low-income households. Administration: Responsibility for child nutrition programs is divided between the federal government, states, and localities. The state agency and type of local provider differs by program. In the NSLP and SBP, schools and school districts ("school food authorities") administer the program. Meanwhile, SFSP (and sometimes CACFP) uses a model in which sponsor organizations handle administrative responsibilities for a number of sites that serve meals. The underlying laws covering the child nutrition programs were last reauthorized in 2010 in the Healthy, Hunger-Free Kids Act of 2010 (HHFKA, P.L. 111-296). The 2010 legislation made significant changes in child nutrition programs—.

homesproviders. The law also required an update to school meal nutrition guidelines as well as new guidelines for food served outside the meal programs (e.g., snacks sold in vending machines and cafeteria a la carte lines).

Current Issues: vending machines and cafeteria a la carte lines). USDA updated the nutrition guidelines for school meals, and these changes have been gradually implemented in school meals. Participating schools are currently subject to USDA rules that add nutrition guidelines for the non-meal foods sold in schools. Further information on the 2010 reauthorization's provisions can be found in CRS Report R41354, Child Nutrition and WIC Reauthorization: P.L. 111-296; however, some provisions will be discussed as part of this report's program overview.

The 114th Congress began but did not complete a 2016 child nutrition reauthorization (see CRS Report R44373, Tracking the Next Child Nutrition Reauthorization: An Overview). As of the date of this report, there has been no significant reauthorization activity legislative activity with regard to reauthorization in the 115th Congress. However, the vast majority of operations and activities continue with funding provided by appropriations laws. Current issues in the child nutrition programs for policymakers include the implementation of new and updated nutrition standards, alternatives to the "congregate feeding" requirement in the SFSP, and schools' efforts to collect unpaid school meal fees (stigmatizing practices are sometimes called "lunch shaming").

in the 115th Congress.

Introduction and Background

The federal child nutrition programs provide assistance to schools and other institutions in the form of cash, commodity food, and administrative support (such as technical assistance and administrative cost aidfunding) based on the provision of meals and snacks to children.1 In general, these programs were created (and amended over time) to both improve children's nutrition and provide support to the agriculturalagriculture economy.

Today, the child nutrition programs refer primarily to the following meal, snack, and milk reimbursement programs (these and other acronyms are listed in Appendix A):2

- National School Lunch Program (NSLP) (Richard B. Russell National School Lunch Act (42 U.S.C. 1751 et seq.));

- School Breakfast Program (SBP) (Child Nutrition Act, Section 4 (42 U.S.C. 1773));

- Child and Adult Care Food Program (CACFP) (Richard B. Russell National School Lunch Act, Section 17 (42 U.S.C. 1766));

- Summer Food Service Program (SFSP) (Richard B. Russell National School Lunch Act, Section 13 (42 U.S.C. 1761)); and

- Special Milk Program (SMP) (Child Nutrition Act, Section 3 (42 U.S.C. 1772)).

The programs provide financial support and/or foods to the institutions that prepare meals and snacks served outside of the home (unlike other food assistance programs such as the Supplemental Nutrition Assistance Program [SNAP, formerly the Food Stamp Program] where benefits are used to purchase food for home consumption). Though exact eligibility rules and pricing vary by program, in general the amount of federal reimbursement is greater for meals served to qualifying low-income individuals or at qualifying institutions, although most programs provide some subsidy for all food served. Participating children receive subsidized meals and snacks, which may be free or at reduced price. Forthcoming sections discuss how program-specific eligibility rules and funding operate.

This report describes how each program operates under current law, focusing on eligibility rules, participation, and funding. This introductory section describes some of the background and principles that generally apply to all of the programs; subsequent sections go into further detail on the workings of each.

Unless stated otherwise, participation and funding data come from USDA-FNS's "Keydata Reports."3

Authorization and Reauthorization

The child nutrition programs are most often dated back to Congress'sthe 1946 passageenactment of the National School Lunch Act, which created the National School Lunch Program, albeit in a different form than it operates today.4 Most of the child nutrition programs do not date back to 1946; they were added and amended in the decades to follow, as policymakers expanded child nutrition programs' institutional settings and meals provided. : The Special Milk Program was created in 1954, regularly extended, and made permanent in 1970.5

.5 The School Breakfast Program was piloted in 1966, regularly extended, and eventually made permanent in 1975.6

A program for child care settings and summer programs was piloted in 1968, with separate programs authorized in 1975 and then made permanent in 1978.7 These are now the Child and Adult Care Food Program8 and Summer Food Service Program.

The Fresh Fruit and Vegetable Program began as a pilot in 2002, was made permanent in 2004, and was expanded nationwide in 2008.9.9

The programs are now authorized under three major federal statutes: the Richard B. Russell National School Lunch Act (originally enacted as the National School Lunch Act in 1946), the Child Nutrition Act (originally enacted in 1966), and Section 32 of the act of August 24, 1935 (7 U.S.C. 612c).10 Congressional jurisdiction over the underlying three laws has typically been exercised by the Senate Agriculture, Nutrition, and Forestry Committee; the House Education and the Workforce Committee; and, to a limited extent (relating to commodity food assistance and Section 32 issues), the House Agriculture Committee.

Congress periodically reviews and reauthorizes expiring authorities under these laws. The child nutrition programs were most recently reauthorized in 2010 through the Healthy, Hunger-Free Kids Act of 2010 (HHFKA, P.L. 111-296); some of the authorities created or extended in that law expired on September 30, 2015.11 NOTE: WIC (the Special Supplemental Nutrition Program for Women, Infants, and Children) is also typically reauthorized with the child nutrition programs. WIC is not one of the child nutrition programs and is not discussed in this report.12

The 114th Congress began but did not complete a 2016 child nutrition reauthorization (see CRS Report R44373, Tracking the Next Child Nutrition Reauthorization: An Overview). As of the date of this report, the committees of jurisdiction have not conducted reauthorization hearings or markups in the 115th Congress.

Program Administration: Federal, State, and Local Administration

The U.S. Department of Agriculture's Food and Nutrition Service (USDA-FNS) administers the programs at the federal level. The programs are operated by a wide variety of local public and private providers, and the degree of direct state involvement varies by program and state. In rare instances, the federal government (via USDA-FNS) takes the place of state agencies (e.g., where a state has chosen not to operate a specific program or where there is a state prohibition on aiding private schools)differs by program and state.13 At the state level, education, health, social services, and agriculture departments all have roles; at a minimum, they are responsible for approving and overseeing local providers such as schools, summer program sponsors, and child care centers and day care homes, as well as making sure they receive the federal support they are due. At the local level, program benefits are provided to millions of children (e.g., there were 30.40 million in the National School Lunch Program, the largest of the programs, in FY2016FY2017), through some 100,000 public and private schools and residential child care institutions, nearly 200170,000 child care centers and family day care homes, and nearlyjust over 50,000 summer program sites.

All programs are available in the 50 states and the District of Columbia. Virtually all operate in Puerto Rico, Guam, and the Virgin Islands (and, in differing versions, in the Northern Marianas and American Samoa).14

Funding Overview

This section summarizes the nature and extent to which the programs' funding is mandatory and discretionary, including a discussion of appropriated entitlement status. Table 3 lists child nutrition program and related expenditures.

Open-Ended, Appropriated Entitlement Funding

Most spending for child nutrition programs is provided in annual appropriations acts to fulfill the legal financial obligation established by the authorizing laws. That is, the level of spending for such programs, referred to as appropriated mandatory spending, is not controlled through the annual appropriations process, but instead is derived from the benefit and eligibility criteria specified in the authorizing laws. The appropriated mandatory funding is treated as mandatory spending. Further, if Congress does not appropriate the funds necessary to fund the program, eligible entities may have legal recourse.15 Congress considers the Administration's forecast for program needs in its appropriations decisions. That funding is not capped and fluctuates based on the reimbursement rates and the number of meals/snacks served in the programs.

In the meal service programs, such as the National School Lunch Program, School Breakfast Program, summer programs, and assistance for child care centers and day care homes, federal aid is provided in the form of statutorily set subsidies (reimbursements) paid for each meal/snack served that meets federal nutrition guidelines. Although all (including full-price) meals/snacks served by participating providers are subsidized, those served free or at a reduced price to lower-income children are supported at higher rates. All federal meal/snack subsidy rates are indexed annually (each July) for inflation, as are the income eligibility thresholds for free and reduced-price meals/snacks.16 Subsequent sections will discuss how a specific program's eligibility and reimbursements work, but all rates are adjusted for inflation each school year.

Concept of a REIMBURSABLE MEAL in the Child Nutrition Programs Reimbursable Meals A "reimbursable meal" (or snack in the case of some programs) is a phrase used by USDA, state, and other child nutrition policy and program operators to indicate a meal (or snack) that meets federal requirements and thereby qualifies for meal reimbursement. In general, a meal or snack that is reimbursable means that it is

|

In the meal service programs, such as the National School Lunch Program, School Breakfast Program, summer programs, and assistance for child care centers and day care homes, federal aid is provided in the form of statutorily set subsidies (reimbursements) paid for each meal/snack served that meets federal nutrition guidelines. Although all (including full-price) meals/snacks served by participating providers are subsidized, those served free or at a reduced price to lower-income children are supported at higher rates. All federal meal/snack subsidy rates are indexed annually (each July) for inflation, as are the income eligibility thresholds for free and reduced-price meals/snacks.18 Subsequent sections discuss how a specific program's eligibility and reimbursements work. Cash Reimbursements and Commodity Foods

1920

Meal and snack service entails non-foodnonfood costs. Federal child nutrition per-meal/snack subsidies may be used to cover local providers' administrative and operating costs. However, the separate direct federal payments for administrative/operating costs ("State Administrative Expenses," discussed in the "Related Programs, Initiatives, and Support Activities" section) are limited) are limited to expense grants to state oversight agencies, a small set-aside of funds for state audits of child care sponsors, and special administrative payments to sponsors of summer programs and family day care homes.

Other Federal Funding

In addition to the open-ended, appropriated entitlement funds summarized above, the child nutrition programs' funding also includes certain other mandatory funding21 and a limited amount of discretionary funding. Some of the activities discussed in "Related Programs, Initiatives, and Support Activities," such as Team Nutrition, are provided for with discretionary funding.

Aside from the annually appropriated funding, the child nutrition programs are also supported by certain permanent appropriations and transfers—notably. Notably, funding for the Fresh Fruit and Vegetable Program, which is funded by a transfer from USDA's Section 32 program, a permanent appropriation of 30% of the previous year's customs receipts.

State, Local, and Participant Funds

Federal subsidies do not necessarily cover the full cost of the meals and snacks offered by providers. States and localities contribute tohelp cover program costs—, as do children's families (by paying charges for non-freenonfree or reduced-price meals/snacks). There is a non-federalnonfederal cost-sharing requirement for the school meals programs (discussed below), and some states supplement school funding through additional state per-meal reimbursements or other prescribed financing arrangements.2022

Child Nutrition Programs at a Glance

The subsequentSubsequent sections of this report delve into the details of how each of the child nutrition programs support the service of meals and snacks in institutional settings; however, it may be helpful for policymakers to begin with a broader perspective of primary program elements as they consider policy objectives and related proposals. Table 1 is a simplified look at the different programs, subtracting much of the nuance and detailed rules that the subsequent sections discuss. In particular, this table displays each program'sfirst, it is useful to take a broader perspective of primary program elements. Table 1 is a top-level look at the different programs that displays distinguishing characteristics (what meals are provided, in what settings, to what ages) and recent program spending (in order to see the relative cost of the programs).

|

Program |

Authorizing Statute (Year First Authorized) |

Distinguishing Characteristics |

|

|

Maximum Daily Snack/Mealsa |

|

|

National School Lunch Program |

Richard B. Russell National School Lunch Act (1946) |

|

$13,569

|

$13.6 billion |

30. |

One meal and snack per child |

|

School Breakfast Program |

Child Nutrition Act (1966) |

|

$4,213

|

$4.3 billion |

14. |

Generally one breakfast per child, with some flexibility |

|

Child and Adult Care Food Program (child care |

Richard B. Russell National School Lunch Act (1968) |

|

$3,519 $3.5 billion (includes at-risk after-school spending, described below) |

4. |

Two meals and one snack, or one meal and two snacks per participant |

|

|

|

Richard B. Russell National School Lunch Act (1994) |

|

(Not available; included in CACFP total above) |

1. |

One meal and one snack per child |

|

|

Summer Food Service Program |

Richard B. Russell National School Lunch Act (1968) |

|

$478

|

$485 million |

2. |

Lunch and breakfast or lunch and one snack per child Exception: maximum of three meals for camps or programs that serve primarily migrant children |

|

Special Milk Program |

Child Nutrition Act (1954) |

| $9

|

$8 million |

|

Not specified |

|

Fresh Fruit and Vegetable Program |

Richard B. Russell National School Lunch Act (2002) |

|

$ |

Not available |

Not applicable |

Source: Except where noted, participation and funding data from USDA-FNS Keydata December 2015May 2018 report, which contains data through October 2015.

a. These maximums are provided in the authorizing law for CACFP and SFSP, but specified only in regulations (7 C.F.R. 210.10(a), 220.9(a)) for NSLP and SBP.

b. At-risk after-school snacks and meals are part of CACFP law and CACFP funding, but differ in their rules and the age of children served.

c. Based only on July 20152017 participation data.

d. Data from p. 32-64 of FY201858 of FY2019 USDA-FNS Congressional Budget Justification.

e. Obligations data displayed on p. 32-15 of FY201814 of FY2019 USDA-FNS Congressional Budget Justification.

Related Resources on Child Nutrition Programs and Policies

Links to Resources

Other relevant CRS reports in this area include21

- 23CRS In Focus IF10266, An Introduction to Child Nutrition Reauthorization

; - CRS Report R42353, Domestic Food Assistance: Summary of Programs

; - CRS Report R41354, Child Nutrition and WIC Reauthorization: P.L. 111-296

; (summarizes the Healthy, Hunger-Free Kids Act of 2010)

- CRS Report R44373, Tracking the Next Child Nutrition Reauthorization: An Overview

; - CRS Report R44588, Agriculture and Related Agencies: FY2017 Appropriations

; - CRS Report RL34081, Farm and Food Support Under USDA's Section 32 Program

.

Further information about child nutrition programs also may be found at Other relevant resources include USDA-FNS's website, httphttps://www.fns.usda.gov/school-meals/child-nutrition-programs

USDA-FNS's Healthy, Hunger-Free Kids Act page,://www.fns.usda.gov/cnd/.

CRS Report R41354, Child Nutrition and WIC Reauthorization: P.L. 111-296 (also listed above), summarizes the most recent reauthorization section-by-section. Although the Senate version of the legislation became law, the report also includes differences from the House committee's bill. USDA Resources:

Federal Register |

School Meals Programs

This section discusses the school meals programs: the National School Lunch Program (NSLP) and the School Breakfast Program (SBP). Principles and concepts common to both programs are discussed first; subsections then discuss features and data unique to the NSLP and SBP, respectively.

General Characteristics

The federal school meals programs provide federal support in the form of cash assistance and USDA commodity foods; both are provided according to statutory formulas based on the number of reimbursable meals served in schools. The subsidized meals are served by both public and private nonprofit elementary and secondary schools and residential child care institutions (RCCIs)2224 that opt to enroll and guarantee to offer free or reduced-price meals to eligible low-income children. Both cash and commodity support to participating schools isare calculated based on the number and price of meals served (e.g., lunch or breakfast, free or full price), but once the aid is received by the school it is used to support the overall school meal service budget, as determined by the school. This report focuses on the federal reimbursements and funding, but it should be noted that some states have provided state financing through additional state-specific funding.23

Federal law does not require schools to participate in the school meals programs. However, some states have mandated that schools provide lunch and/or breakfast, and some of these states require that their schools do so through NSLP and/or SBP.2426 The program is open to public and private schools. Based on USDA-FNS and National Center for Education Statistics data, it can be estimated that in school year 2013-2014, an estimated 91% of public schools and 16% of private schools participated in NSLP, while 84% of public schools and 8% of private schools participated in SBP.25

A reimbursable meal requires compliance with federal school nutrition standards, which have changed throughout the history of the program based on nutritional science and children's nutritional needs. Food items not served as a complete meal meeting nutrition standards (e.g., a la carte offerings) are not reimbursable meals, and therefore are not eligible for federal per-meal, per-snack reimbursements. Following rulemaking to implement P.L. 111-296 provisions, the standards for reimbursable meals were updated in January 2012, and USDA also has provided nutrition standards for the non-mealnonmeal foods served in schools during the school day (see "Selected Current Issues in the USDA Child Nutrition Programs" for more on these policies).

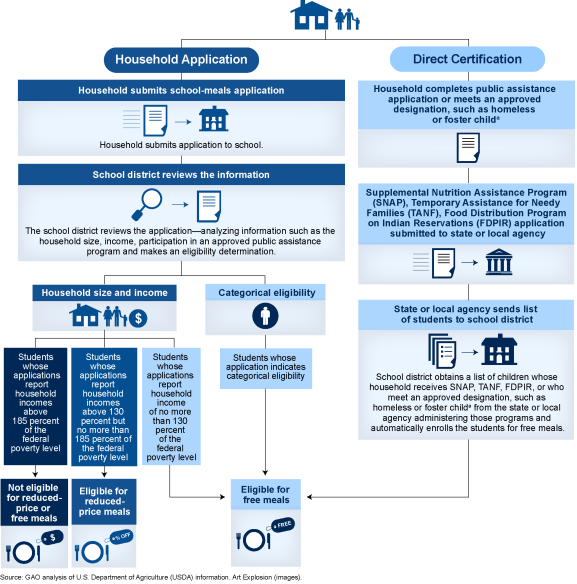

USDA-FNS administers the school meals programs federally, and state agencies (typically state departments of education) oversee and transmit reimbursements through agreements with school food authorities (SFAs) (typically local educational agencies [LEAs](LEAs); usually these are school districts). Figure 1 provides an overview of the roles and relationships between these levels of government.

There is a cost-sharing requirement for the programs, which amounts to a contribution of approximately $200 million from the states.2627 There also are states that choose to supplement federal reimbursements with their own state reimbursements.2728

|

Figure 1. Federal, State, and Local Administration of |

|

|

Source: Government Accountability Office (GAO), GAO-14-262, p. 47. |

School Meals Eligibility Rules

The school meals programs and related funding do not serve only low-income children. All students can receive a meal at a NSLP- or SBP-participating school, but how much the child pays for the meal and/or how much of a federal reimbursement the state receives will depend largely on whether the child qualifies for a "free," "reduced-price," or "paid" (i.e., advertised price) meal. Both NSLP and SBP use the same household income eligibility criteria and categorical eligibility rules. States and schools receive the largest reimbursements for free meals, smaller reimbursements for reduced-price meals, and the smallest (but still some federal financial support) for the full-price meals.

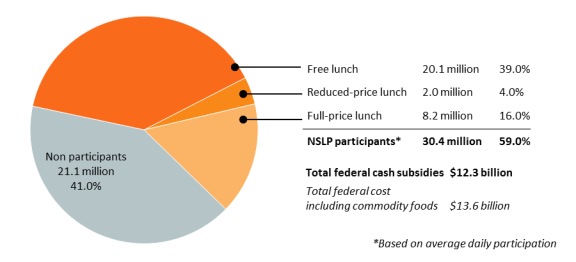

Whether a child receives a free or reduced-price meal depends on three groups of federal rules:

1. Household income eligibility rulesThere are three pathways through which a child can become certified to receive a free or reduced-price meal:1. Household income eligibility for free and reduced-price meals (information typically collected via household application),- 2. Categorical (or automatic) eligibility

rulesfor free meals (information collected via household application or a direct certification process), and - 3. School-wide free meals under the Community Eligibility Provision (CEP), an option for eligible schools that is based on the share of students identified as eligible for free meals.

28

29Each of these groupspathways is discussed in more detail below.

Income Eligibility Rules

The income eligibility thresholds (summarized belowshown in Table 2) are based on multipliers of the federal poverty guidelines. As the poverty guidelines are updated every year, so are the eligibility thresholds for NSLP and SBP.

- Free Meals: Children receive free meals if they have household income at or below 130% of the federal poverty guidelines; these meals receive the highest subsidy rate. (Reimbursements are approximately $3.

2530 per lunch served, less for breakfast.) - Reduced-Price Meals: Children may receive reduced-price meals (charges of no more than 40 cents for a lunch or 30 cents for a breakfast) if their household income is

betweenabove 130% and less than or equal to 185% of the federal poverty guidelines; these meals receive a subsidy rate that is 40 cents (NSLP) or 30 cents (SBP) below the free meal rate. (Reimbursements areover $2.80approximately $2.90 per lunch served.) - Paid Meals: A comparatively small per-meal reimbursement is provided for full-price or paid meals served to children whose families do not apply for assistance or whose family income does not qualify them for free or reduced-price meals.

2930 The paid meal price is set by the school but must comply with federal regulations.3031 (Reimbursements areoverapproximately 30 cents per lunch served.)

The annual income thresholds for meal assistance for school year 2017-2018 are listed below in Table 2. The above reimbursement rates are approximate; exact current-year federal reimbursement rates for NSLP and SBP are listed in Table B-1 and Table B-3, respectively.

Table 2. Income Eligibility Guidelines for a Family of Four for National School Lunch Program (NSLP) and School Breakfast Program (SBP) in the 48 States and DC

Income Eligibility Requirements for School Year 2017-2018

Though these income guidelines primarily influence funding and administration of NSLP and SBP, they also affect the eligibility rules for the SFSP, CACFP, and SMP (described further in subsequent sections).

Table 2. Income Eligibility Guidelines for a Family of Four for NSLP and SBPFor 48 states and DC, school year 2018-2019

|

Meal Type |

Income Eligibility Threshold |

Annual Income for a |

|

Free |

<130% |

<$ |

|

Reduced-Price |

130-185% |

$ |

Source: USDA, Food and Nutrition Service, "Child Nutrition Programs—: Income Eligibility Guidelines," 8283 Federal Register 17184, April 10, 201720788, May 8, 2018.

Note: This school year is defined as July 1, 20172018, through June 30, 2018.

a2019. For other years, household sizes, Alaska, and Hawaii, see USDA-FNS website: http://www.fns.usda.gov/school-meals/income-eligibility-guidelines.

Households complete paper or online applications that collect relevant income and household size data so the school district may determine if children in the household are eligible for free meals, reduced-price meals, or neither.

Note: Though these income guidelines primarily influence funding and administration of the schools, institutions, and facilities participating in the NSLP and SBP, they also affect the eligibility rules for the SFSP, CACFP, and SMP. As described in subsequent sections, some of these programs use income thresholds to determine an institution's area eligibility, rather than individual household eligibility.

Categorical Eligibility for Free Meals

In addition to the eligibility thresholds listed above, the school meals programs also convey eligibility for free meals based on household participation in certain other need-tested programs or children's specified vulnerabilities (e.g., foster children). Per Section 12 of the National School Lunch Act, "a child shall be considered automatically eligible for a free lunch and breakfast ... without further application or eligibility determination, if the child is":31

- 32in a household receiving benefits through

SNAP (Supplemental Nutrition Assistance Program)

or; FDPIR (Food Distribution Program on Indian Reservations, a program that operates in lieu of SNAP on some Indian reservations) benefits,; ororTANF (Temporary Assistance for Needy Families) cash assistance; - enrolled in Head Start;

- in foster care;

- a migrant;

- a runaway; or

- homeless.

32

33For meals served to students certified in the above categories, the state/school will receive reimbursement at the free meal amount and children receive a free meal. (See Table B-1 and Table B-3 for school year 2017-20182018-2019 rates.)

Some school districts collect information for these categorical eligibility rules via paper application. Others conduct a process called direct certification—a proactive process where the government agencies typically cross-check their program rolls and certify a household's children for free school meals without the household having to complete a school meals application.

Prior to 2004, it was a statestates had the option to conduct direct certification of SNAP (then, the Food Stamp Program), TANF, and FDPIR participants. In the 2004 child nutrition reauthorization (P.L. 108-265), states were required under federal law to conduct direct certification for SNAP participants, with nationwide implementation taking effect in school year 2008-2009. Conducting direct certification for TANF and FDPIR remains at the state's discretion.

The Healthy, Hunger-Free Kids Act of 2010 (HHFKA; P.L. 111-296) made further policy changes to expand the impact of direct certification (discussed further in the next section). Conducting direct certification for TANF and FDPIR remains at the state's discretion.

Under SNAP direct certification rules generally, schools enter into agreements with SNAP agencies to certify children in SNAP households as eligible for free school meals without requiring a separate application from the family. Direct certification systems match student enrollment lists against SNAP agency records, eliminating actions forthe need for action by the child's parents or guardians. Direct certification allows schools to make use of theSNAP's more in-depth eligibility certification done for SNAPprocess; this can reduce errors that may occur in school lunch application eligibility procedures that are otherwise used.3335 From a program access perspective, direct certification also reduces applications forthe number of applications a household tomust complete.

Figure 2, created by GAO and published in theira May 2014 report, provides an overview of how school districts certify students for free and reduced-price meals under the income-based and category-based rules, via applications and direct certification.3436 A USDA-FNS study of school year 2014-2015 estimates that 11.1 million students receiving free meals were directly certified; this is —68% of all categorically eligible students receiving free meals.35

HHFKA made additional policy changes to federal law that would expand and incentivize states to make full use of direct certification. The law created a demonstration project to look at expanding categorical eligibility and direct certification to Medicaid households. It also funded performance incentive grants for high-performing states and authorized correcting action planning for low-performing states.36

Community Eligibility Provision: An Option for Eligible Schools to Offer Free Meals to All Enrolled Students37

(CEP)

HHFKA also authorized the school meals Community Eligibility Provision (CEP), an option in NSLP and SBP law that allows eligible schools and school districts to offer free meals to all enrolled students based on the percentage of their students who are identified as automatically eligible from non-householdnonhousehold application sources, (primarily direct certification through other programs).38

Based on the statutory parameters, USDA-FNS phased in this option, and it has been available nationwide sincepiloted CEP in various states over three school years and it expanded nationwide in school year 2014-2015. Eligible LEAs have until June 30 of each yearLEAs had until August 31, 2014, to notify USDA-FNS if they will participate in CEP.39 According to a database maintained by the Food Research and Action Center, just over 20,70020,721 schools in more than 3,500 3,538 school districts (Local Education Agencies (LEAs)) participated in CEP for 2016-2017.39

For a school (or school district, or group of schools within a district) to provide free meals to all children:

- the school(s) must be eligible for CEP

,based on the share (40% or greater) ofitsenrolled children that can be identified as categorically (or automatically) eligible for free meals, and - the school must opt-in to CEP.

Though CEP schools serve free meals to all students, they are not reimbursed at the "free meal" rate for every meal. Instead, the law provides a funding formula: the percentage of students identified as automatically eligible is multiplied by a factor of 1.6; the(the "identified student percentage" or ISP) is multiplied by a factor of 1.6 to estimate the proportion of students who would be eligible for free or reduced-price meals had they been certified via application.41 The result is the percentage of meals served that will be reimbursed at the free meal rate, with the remainder reimbursed at the far smallerlower paid meal rate. As anFor example, if a CEP school identifies that 40% of students are eligible for free meals, then 64% of the meals served will be reimbursed at the free meal rate and 36% at the paid meal rate.4042 Schools that identify 62.5% or more students as eligible for free meals receive the free meal reimbursement for all meals served.

Some of the considerations that may impact a school's decision mayto participate in CEP include whether the new funding formula would ultimately be beneficial for their school meal budget; an interest in reducing paperwork for families and schools; and an interest in providing more free meals, including meals to students who have not participated in the program before.

National School Lunch Program (NSLP): Program-Specific Data and Policies

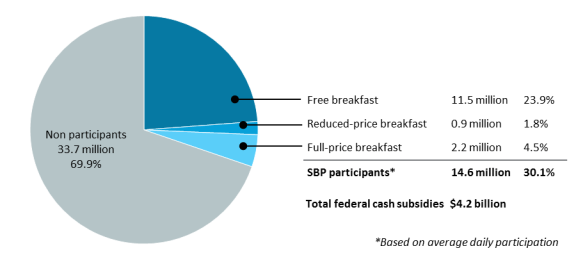

Figure 3 shows FY2016 participation and spending data. In that year

In FY2017, NSLP subsidized over 5.04.9 billion lunches to children in nearlyclose to 96,000 schools and over 3,500 RCCIs3,200 residential child care institutions (RCCIs). Average daily participation was 30.40 million students (59.0% of the 51.5 million 58% of children enrolled in participating schools and RCCIs). Of the participating students, 66.17% (20.10 million) received free lunches and 6.75% (2.0 million) received reduced-price lunches. The remainder were served full-price meals, though schools still receive a reimbursement for these meals.

FY2016 federal school lunch costs totaled approximately $13.6 billion (see Table 3 for the various components of this total). The vast majority of this funding is for per-meal reimbursements for free and reduced-price lunches.

HHFKA also provided an additional 6-cent per-lunch reimbursement to schools that provide meals that meet the updated nutritional guidelines requirements.4143 This bonus is not provided for breakfast, but funds may be used to support schools' breakfast programs. NSLP lunch reimbursement rates are listed in Table B-1.

In addition to federal cash subsidies, schools participating in NSLP receive USDA-acquired commodity foods. Schools are entitled to a specific, inflation-indexed value of USDA commodity foods for each lunch they serve. Also, schools may receive donations of bonus commodities acquired by USDA in support of the farm economy.4244 In FY2016FY2017, the value of federal commodity food aid to schools totaled over $1.3nearly $1.4 billion. The per-meal rate for commodity food assistance is included in Table B-4.

While the vast majority of NSLP funding is for lunches served during the school day, during the school year, NSLP may also be used to support snack service during the school year and to serve meals during the summer. These features are discussed in subsequent sections, "Summer Meals: Provided through Several Authorities" and "Support for " and "After-School Meals and Snacks: CACFP, NSLP Options." Reimbursement rates for snacks are listed in Table B-2.

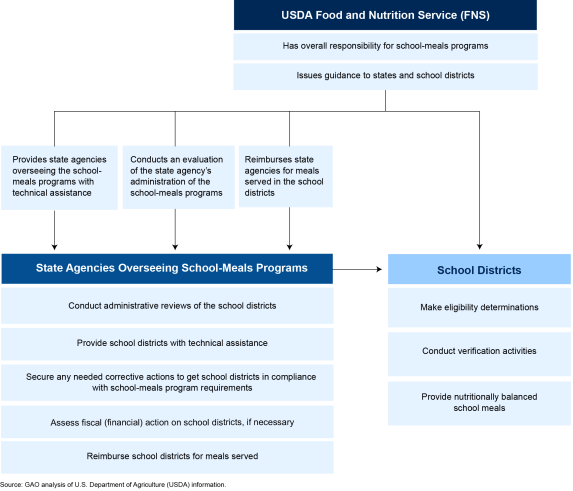

School Breakfast Program (SBP): Program-Specific Data and Policies

The School Breakfast Program (SBP) provides per-meal cash subsidies for breakfasts served in schools. Participating schools receive subsidies based on their status as a severe need or non-severenonsevere need institution. Schools can qualify as a severe need school if 40% or more of their lunches are served free or at reduced prices. See Table B-3 for SBP reimbursement rates.

Figure 4 displays FY2016 SBP participation and spending datadata for FY2017. In that year, SBP subsidized over 2.4 billion breakfasts in over 8788,000 schools and nearly 3,600200 RCCIs. Average daily participation was 14.67 million children (30.1% of the students enrolled in participating schools and RCCIs). The majority of meals served through SBP are free or reduced -price. Of the participating students, 79.1% (11.56 million) received free meals and nearly 6% (8605.7% (835,000) purchased reduced -price meals in FY2016.

Significantly fewer schools and fewer students participate in SBP than in NSLP. Participation in SBP tends to be lower for several reasons, including the (traditionally)traditionally required early arrival by students in order to receive a meal and eat before school starts. Some schools offer (and anti-hunger groups have encouraged) models of breakfast service that can result in greater SBP participation, such as Breakfast in the Classroom, where meals are delivered in the classroom; "grab and go" carts, where students receive a bagged breakfast that they bring to class, or serving breakfast later in the day in middle and high schools.4345

Unlike NSLP, commodity food assistance is not a formal part of SBP funding; however, commodities provided through NSLP may be used for school breakfasts as well.

Other Child Nutrition Programs

In addition to the school meals programs discussed above, other federal child nutrition programs provide for federal subsidies and commodity food assistance for schools and other institutions that offer meals and snacks to children in early childhood, summer, orand after-school settings. This assistance is provided to (1) schools and other governmental institutions, (2) private for-profit and nonprofit child care centers, (3) family/group day care homes, and (4) nongovernmental institutions/organizations that offer outside-of-school programs for children. (Although this report focuses on the programs that serve children, one child nutrition program [CACFP] also serves day care centers for chronically impaired adults and elderly persons under the same general per-meal/snack subsidy terms.) The programs in the sections to follow serve comparatively fewer children and spend comparatively fewer federal funds than the school meal programs. This report discusses these smaller programs in comparatively less detail.

Child and Adult Care Food Program (CACFP)

CACFP subsidizes meals and snacks served in early childhood, day care, and after-school settings. CACFP provides subsidies for meals and snacks served at participating non-residentialnonresidential child care centers, family day care homes, and (to a lesser extent) adult day care centers.46 The program also provides assistance for meals served at after-school programs. CACFP reimbursements are available for meals and snacks served to children age 12 or under, migrant children age 15 or under, children with disabilities of any age, and, (in the case of adult care centers), chronically impaired and elderly adults. Pre-school age children formChildren in early childhood settings are the overwhelming majority of those served by the program.

CACFP provides federal reimbursements for breakfasts, lunches, suppers, and snacks served in participating centers (facilities or institutions) or day care homes (private homes). The eligibility and funding rules for CACFP meals and snacks depend, first, on whether the participating institution is a center or a day care home. This section provides an overview of the program generally, while (the next two sections will discuss the rules specific to centers and day care homes). According to FY2016FY2017 CACFP data, child care centers have an average daily attendance of about 5456 children per center, day care homes have an average daily attendance of approximately 7 children per home, and adult day care centers typically care for an average of 4648 chronically ill or elderly adults per center.4447

Subsidized CACFP meals and snacks must meet program-specific federal nutrition standards, and providers must demonstrate that they comply with government-established standards for other child care programs. Like in school meals, federal assistance is made up overwhelmingly of cash reimbursements calculated based on the number of meals/snacks served and federal per-meal/snack reimbursements rates, but a far smaller share of federal aid (4.43% in FY2016FY2017) is in the form of federal USDA commodity foods (or cash in lieu of foods). Federal CACFP reimbursements flow to individual providers either directly from the administering state agency (this is the case with many child/adult care centers able to handle their own CACFP administrative functions) or through "sponsors" who oversee and provide administrative support for a number of local providers (this is the case with some child/adult care centers and with all day care homes).4548

In FY2016FY2017, total CACFP spending was over $3.5 billion, including cash reimbursement, commodity food assistance, and costs for sponsor audits. (See Table 3 for a further breakdown of CACFP costs.) This spending total also includes the after-school meals and snacks provided through CACFP's "at-risk after-school" pathway; this aspect of the program is discussed later in "Support for After-School Meals and Snacks: CACFP, NSLP Options." CACFP also supports meals in emergency shelters.46

CACFP at Centers

Participation

Child care centers in CACFP can be (1) public or private nonprofit centers, (2) Head Start centers, (3) for-profit proprietary centers (if they meet certain requirements as to the proportion of low-income children they enroll), and (4) shelters for homeless families. Adult day care centers include public or private nonprofit centers and for-profit proprietary centers (if they meet minimum requirements related to serving low-income disabled and elderly adults).4749 In FY2016FY2017, over 65,000 child care centers with an average daily attendance of over 3.56 million children participated in CACFP. Over 2,800700 adult care centers, serving 131,000 adults, were served served nearly 132,000 adults through CACFP.

Eligibility and Administration

Participating centers may receive daily reimbursements for up to either two meals and one snack or one meal and two snacks for each participant, so long as the meals and snacks meet federal nutrition standards.

The eligibility rules for CACFP centers largely track those of NSLP. The same income guidelines apply for CACFP centers (see Table 2), based on 130% and 185% of the current poverty line. Participation: children in households at or below 130% of the current poverty line qualify for free meals/snacks while those between 130% and 185% of poverty qualify for reduced-price meals/snacks (see Table 2). In addition, participation in the same categorical eligibility programs as NSLP as well as foster child status convey eligibility for free meals in CACFP.50 Like school meals, eligibility is determined through paper applications or direct certification processes.

Like.48 Like school meals, all meals and snacks served in the centers are federally subsidized to some degree, even those that are paid. Different reimbursement amounts are provided for breakfasts, lunches/suppers, and snacks, and reimbursement rates are set in law and indexed for inflation annually. The largest subsidies are paid for meals and snacks served to participants with family income below 130% of the federal poverty income guidelines (the income limit for free school meals), and the smallest to those who have not met a means test. Like school meals, eligibility is determined through paper applications or direct certification processes. See Table B-5 for current CACFP center reimbursement rates.

Unlike school meals, CACFP institutions are less likely to collect per-meal payments. Although federal assistance for day care centers differentiates by household income, centers have discretion on their pricing of meals. Centers may adjust their regular fees (tuition) to account for federal payments, but CACFP itself does not regulate these fees. In addition, centers can charge families separately for meals/snacks, so long as there are no charges for children meeting free-meal/snack income tests and limited charges for those meeting reduced-price income tests.

Independent centers are those without sponsors handling administrative responsibilities. These centers must pay for administrative costs associated with CACFP out of non-federalnonfederal funds or a portion of their meal subsidy payments. For centers with sponsors, the sponsors may retain a proportion of the meal reimbursement payments they receive on behalf of their centers to cover theirsuch costs..

CACFP for Day Care Homes

Participation

CACFP-supported day care homes tend to serve a smaller number of children per home than the than CACFP-supported centers, both in terms of the total number of children served and the average number of children per facility. Roughly 17number of children CACFP-supported centers serve per center. Roughly 18% of children in CACFP (approximately 757,000 in FY2016FY2017 average daily attendance) are served through day care homes. In FY2016FY2017, approximately 108103,000 homes (with nearly 800just over 700 sponsors) received CACFP support.

Eligibility and Reimbursement

As with centers, payments to day care homes are provided for up to either two meals and one snack or one meal and two snacks a day for each child. Unlike centers, day care homes must participate under the auspices of a public or, more often, private nonprofit sponsor that typically has 100 or more homes under its supervision. CACFP day care home sponsors receive monthly administrative payments, based on the number of homes for which they are responsible.4951

Federal reimbursements for family day care homes differ by the home's status as "Tier I" or "Tier II." Unlike centers, day care homes receive cash reimbursements (but not commodity foods) that generally are not based on the child participants' household income. Instead, there are two distinct, annually indexed reimbursement rates that are based on area or operator eligibility criteria.

- Tier I homes are located in low-income areas

or operated by low-income providers.(defined as areas in which at least 50% of school-age and enrolled children qualify for free or reduced-price meals) or operated by low-income providers whose household income meets the free or reduced-price income standards.52 They receive higher subsidies for each meal/snack they serve. - Tier II (lower) rates are by default those for homes that do not qualify for Tier I rates; however, Tier II providers may seek the higher Tier I subsidy rates for individual low-income children for whom financial information is collected and verified. (See Table B-6 for current Tier I and Tier II reimbursement rates.)

Additionally, HHFKA introduced a number of additional ways (as compared to prior law) by which family day care homes can qualify as low-income and get Tier I rates for the entire home or for individual children.5053

As with centers, there is no requirement that meals/snacks specifically identified as free or reduced-price be offered; however, unlike centers, federal rules prohibit any separate meal charges.

Summer Meals: Provided through Several Authorities

Current law SFSP and the NSLP/SBP Seamless Summer Option (discussed in text box) provide meals in congregate settings nationwide; the related Summer Electronic Benefits Transfer (SEBTC or Summer EBT) demonstration project is an alternative to congregate settings. The demonstration is discussed below; proposals to expand the demonstration are discussed in "Selected Current Issues in the USDA Child Nutrition Programs."

Summer Food Service Program (SFSP)

SFSP supports meals for children during the summer months. The program provides assistance to local public institutions and private nonprofit service institutions running summer youth/recreation programs, summer feeding projects, and camps. Assistance is primarily in the form of cash reimbursements for each meal or snack served; however, federally donated commodity foods are also offered. Participating service institutions often, but not of necessity, areare often entities that provide ongoing year-round service to the community and includeincluding schools, local governments, camps, colleges and universities in the National Youth Sports program, and private nonprofit organizations like churches.

SponsorsSimilar to the CACFP model, sponsors are institutions that manage the food preparation, financial, and administrationadministrative responsibilities of SFSP. Sites are the places where food is served and eaten. At times, a sponsor may also be a site. State agencies authorize sponsors, monitor and inspect sponsors and sites, and implement USDA policy.

Participation

In FY2016, overFY2017, nearly 5,500 sponsors with over 4850,000 food service sites participated in the SFSP and served an average of approximately 2.87 million children daily (according to July data).54

Participation of sites and children reached its height in FY2014 (see Figure 5)in SFSP has increased in recent years. Program costs for FY2016FY2017 totaled over $478485 million, including cash assistance, commodity foods, administrative cost assistance, and health inspection costs.

Average Daily Attendance and Number of Food Distribution Sites |

|

|

Eligibility and Administration

There are several options for eligibility and meal/snack service for SFSP sponsors (and their sites):

- Open sites provide summer food to all children in the community. These sites are certified based on area eligibility measures, where 50% or more of area children have family income that would make them eligible for free or reduced-price school meals (see Table 2).

- Closed or Enrolled sites provide summer meals/snacks free to all children enrolled at the site. The eligibility test for these sites is that 50% or more of the children enrolled in the sponsor's program must be eligible for free or reduced-price school meals based on household income. Closed/enrolled sites may also become eligible based on area eligibility measures noted above.

- Summer camps (that are not enrolled sites) receive subsidies only for those children with household eligibility for free or reduced-price school meals.

- Other programs specified in law, such as the National Youth Sports Program

,and centers for homeless or migrant children.

Summer sponsors get operating cost (food, storage, labor) subsidies for all meals/snacks they serve—up to one meal and one snack, or two meals (three meals for children in programs for migrant children) per child per day.55 In addition, sponsors receive payments for administrative costs, and states are provided with subsidies for administrative costs and health and meal-quality inspections. See Table B-7 for current SFSP reimbursement rates. Actual payments vary slightly (e.g., by about 5 cents for lunches) depending on the location of the site (e.g., rural vs. urban) and whether meals are prepared on-site or by a vendor.

School Meals' Seamless Summer Option51

56

Although SFSP is the child nutrition program most associated with providing meals during summer months, it is not the only program option for providing these meals and snacks. The Seamless Summer Option, run through NSLP or SBP programs, is also a means to provide foodthrough which food can be provided to students during summer months. Much like SFSP, Seamless Summer operates in summer sitessites (summer camps, sports programs, churches, private nonprofit organizations, etc.) and for a similar duration of time. Unlike SFSP, schools are the only eligible sponsors, although schools may operate the program at other sites. Reimbursement rates for Seamless Summer meals are the same as current NSLP/SBP rates.

Summer EBT for Children (SEBTC or "Summer EBT"): An Alternative to SFSP or Seamless Summer Option SitesDemonstration

Beginning in the summer ofsummer 2011 and (as of the date of this report) each summer since, USDA-FNS has operated Summer EBTElectronic Benefit Transfer for Children (SEBTC or "Summer EBT") demonstration projects in a limited number of states and Indian Tribal Organizations (ITOs). These Summer EBT projects provide electronic food benefits over summer months to households with children eligible for free or reduced-price school meals. Depending on the site and year, either $30 or $60 per month is provided, through a WIC or SNAP EBT card model. In the demonstration projects, these benefits were provided as a supplement to the Summer Food Service Program (SFSP) meals available in congregate settings.

Summer EBT and other alternatives to congregate meals through SFSP were first authorized and funded by the FY2010 appropriations law (P.L. 111-80). Although a number of alternatives were tested and evaluated, findings from Summer EBT were among the most promising, and Congress provided subsequent funding.5257 Summer EBT evaluations (discussed later in "Alternatives to "Congregate Feeding" in Summer Meals") showed significant impacts on reducing child food insecurity and improving nutritional intake.53 Summer EBT in the summers from 2011 to 2014 was funded by P.L. 111-80. In limited areas, projects have been operated and funded subsequently in FY2015-FY2017, most recently with $23 million in the FY2017 appropriations law (P.L. 115-31). For FY2018, the President's budget and House- and Senate-reported bills would continue Summer EBT funding. According to USDA-FNS, in summer 2016, Summer EBT continued to operate in six states and two tribal nations, but expanded to serve over 250,000 children.5458 Summer EBT was funded by P.L. 111-80 in the summers from 2011 to 2014. Projects have continued to operate and were annually funded by FY2015-FY2018 appropriations; most recently, the FY2018 appropriations law (P.L. 115-141) provided $28 million. According to USDA-FNS, in summer 2016 Summer EBT served over 209,000 children in nine states and two tribal nations—an increase from the 11,400 children served when the demonstration began in summer 2011.59

Special Milk Program (SMP)

Schools (and institutions like summer camps and child care facilities) that are not already participating in the other child nutrition programs can participate in the Special Milk Program. Schools may also administer SMP for their part-day sessions for kindergartners or pre-kindergartners.

Under SMP, participating institutions provide milk to children for free and/or at a subsidized paid price, depending on how the enrolled institution opts to administer the program (see Table B-8 for current Special Milk reimbursement rates for each of these options):

- An institution that only sells milk will receive the same per-half pint federal reimbursement for each milk sold (approximately 20 cents).

- An institution that sells milk and provides free milk to eligible children (income eligibility is the same as free school meals, see Table 2), receives a reimbursement for the milk sold (approximately 20 cents) and a higher reimbursement for the free milks.

- An institution that does not sell milk provides milk free to all children and receives the same reimbursement for all milk (

the same as the paid rateapproximately 20 cents). This option is sometimes callednon-pricing.

In FY2016, over 45nonpricing.In FY2017, over 41 million half-pints were subsidized, 9.5% of which were served free. Federal expenditures for this program were approximately $9.18.3 million in FY2016FY2017.

Fresh Fruit and Vegetable Program (FFVP)

States receive formula grants through the Fresh Fruit and Vegetable Program, under which state-selected schools receive funds to purchase and distribute fresh fruit and vegetable snacks to all children in attendance (regardless of family income). Money is distributed by a formula under which about half the funding is distributed equally to each state and the remainder is allocated by state population. States select participating schools (with an emphasis on those with a higher proportion of low-income children) and set annual per-student grant amounts (between $50 and $75).

Funding is set by law at $150 million for school year 2011-2012 and inflation-indexed for later years. Funding allocated for school year 2015-2016 wasevery year after. In FY2017, states used approximately $177184 million in FFVP funds.60 FFVP is funded by a mandatory transfer of funds from USDA's Section 32 program—a permanent appropriation of 30% of the previous year's customs receipts.61 This transfer is required by FFVP's authorizing laws (Section 19 of the Richard B. Russell National School Lunch Act and Section 4304 of P.L. 110-246). Up until FY2018's law, annual appropriations laws delayed a portion of the funds to the next fiscal year.

After a pilot period, the Child Nutrition and WIC Reauthorization Act of 2004 (P.L. 108-265) permanently authorized and funded FFVP for a limited number of states and Indian reservations.62 In recent years, FFVP has been amended by omnibus farm bill laws rather than through child nutrition reauthorizations. The 2008 farm bill (P.L. 110-246) expanded FFVP's mandatory funding, specifically providing funds through Section 32, and enabled all states to participate in the program. The 2014 farm bill (P.L. 113-79) essentially made no changes to this program but .55

In recent years, FFVP has been amended by omnibus farm bill laws, rather than through child nutrition reauthorization. After a limited pilot, FFVP was expanded to all states and permanently funded by the 2008 farm bill (P.L. 110-246).56 The 2014 farm bill essentially made no changes to this program. The 2014 farm bill (P.L. 113-79) did include, and fund at $5 million in FY2014, a pilot project that requires USDA to test schools offering frozen, dried, and canned fruits and vegetables in at least five states as well as an evaluation of the pilot. Since then, other proposals have been introduced to expand fruits and vegetables offered in FFVP.57

Support for and publish an evaluation of the pilot. Four states (Alaska, Delaware, Kansas, and Maine) participated in the pilot in SY2014-2015 and the evaluation was published in 2017.63 Other proposals to expand fruits and vegetables offered in FFVP have been introduced in both the 114th and 115th Congress.64

Other Topics

After-School Meals and Snacks: CACFP, NSLP Options

Two of the child nutrition programs discussed in previous sections, the National School Lunch Program (NSLP) and Child and Adult Care Food Program (CACFP), also provide federal support for snacks and meals served during after-school programs.5865

NSLP provides reimbursements for after-school snacks; however, this option is open only to schools that already participate in NSLP. These schools may operate after-school snack-only programs during the school year which, and can do so in two ways: (1) if low-income area eligibility criteria are met, provide free snacks in lower-income areas; or (2) if area eligibility criteria are not met, offer free, reduced-price, or fully paid-for snacks, based on household income eligibility (like lunches in NSLP). The vast majority of snacks provided through this program are through the first option, area eligible schools. Through this program, a total of approximately 220206 million snacks were served in FY2015FY2017 (a daily average of nearly 1.43 million). This is a fraction (under 5%) of the over 5compares with nearly 4.9 billion lunches served (a daily average of 28.327.8 million).

CACFP provides assistance for after-school food in two ways. First, centers and homes that participate in CACFP and provide after-school care may participate in traditional CACFP (the eligibility and administration described earlier). Second, the CACFP At-Risk Afterschool program provides free snacks and suppers to all children at centers locatedcenters in areas where at least half the children in the community are eligible for free or reduced-price school meals can opt to participate in the CACFP At-Risk Afterschool program, which provides free snacks and suppers. Expansion of the At-Risk After-School meals program was a major policy change included in HHFKA. Prior to the law, 13 states were permitted to offer CACFP At-Risk After-School meals (instead of just a snack); the law allowed all CACFP state agencies to offer such meals.5966 In FY2015FY2017, the At-Risk Afterschool program served a total of approximately 56 million free snacks, 131.7242.6 million free suppers, and 1.5 million other mealsmeals and snacks to a daily average of nearly 829,000 children.more than 1.7 million children.67

Table 3. FY2015 and FY2016FY2016 and FY2017 Federal Expenditures foron Child Nutrition Programs

In millions of dollars

|

Program or Program Component |

FY2015 |

FY2016 |

Change from |

|

|

National School Lunch Program |

$13, |

$13, |

+$ |

+ |

|

free meal reimbursements |

$9, |

$9, |

+$ |

|

|

reduced-price meal reimbursements |

$ |

$ |

-$ |

-3% |

|

paid meal reimbursements |

$1, |

$1, |

+$ |

|

|

additional funding to schools with more than 60% free or reduced-price participation |

$ |

$ |

|

|

|

performance-based meal reimbursements |

$ |

$ |

+$7 |

|

|

commodity food assistancea |

$1, |

$1, |

+$ |

+ |

|

School Breakfast Program |

$ |

$4, |

+$ |

+ |

|

free meal reimbursements |

$3, |

$3, |

+$ |

+ |

|

reduced-price meal reimbursements |

$ |

$ |

+$1 |

|

|

paid meal reimbursements |

$ |

$106 |

+$8 |

|

|

Child and Adult Care Food Program |

$3, |

$3, |

+$ |

|

|

meal reimbursements at child care centers |

$2, |

$2, |

+$ |

+ |

|

meal reimbursements at child care homes |

$ |

$ |

-$ |

- |

|

meal reimbursements at adult day care centers |

$ |

$ |

+$ |

+ |

|

commodity food assistancea |

$ |

$ |

+$14 |

|

|

administrative costs for child care sponsors |

$146 |

$ |

$0 |

|

|

Summer Food Service Program |

$ |

$ |

-$9 |

|

|

meal reimbursements |

$ |

$ |

-$9 |

|

|

commodity food assistancea |

$2 |

$2 |

$0 |

0% |

|

sponsor and inspection costs |

$58 |

$ |

$0 |

|

|

Special Milk Program |

$ |

$ |

-$ |

- |

|

Fresh Fruit and Vegetable Programb |

$ |

$ |

-$7 |

|

|

State Administrative Expenses |

$ |

$ |

+$ |

+ |

|

Mandatory Other Program Costsc |

$ |

$ |

+$ |

+ |

|

Discretionary Activitiesd |

$ |

$ |

+$14 |

|

|

TOTAL OF FUNDS DISPLAYEDe |

$ |

$22, |

+$ |

+ |

Source: Program expenditures data (outlays) from USDA-FNS Keydata Reports (dated January 2015 and May 2017March 2017 and March 2018), except where noted below.

Notes: Expenditures displayed here will vary from displays in CRS appropriations reports and in some cases the USDA-FNS annual budget justification. Since the majority of program funding is for open-ended entitlements, expenditure data capture spending better than the total of appropriations. This table includes some functions that are funded through permanent appropriations or transfers (i.e., funding not provided in appropriations billslaws). Due to rounding to the nearest million, percentage increases or decreases may be exaggerated or understated.

a. Amounts included in this table for commodity food assistance include only entitlement commodities for each program, not bonus commodities.

b. Obligations data displayed on p. 32-15 of FY201814 of FY2019 USDA-FNS Congressional Budget Justification.

c. Obligations data displayed on p. 32-13 of FY201812 of FY2019 USDA-FNS Congressional Budget Justification. These costs are made up of Food Safety Education, Coordinated Review, Computer Support, Training and Technical Assistance, studies, payment accuracy, and Farm to School Team.

d. Obligations data displayed on p. 32-13 of FY201812 of FY2019 USDA-FNS Congressional Budget Justification. FY2013 obligationsThese costs include Team Nutrition and School Breakfast Expansion Grants. FY2012 obligations include Team Nutrition only, the Summer EBT demonstration, and School Meal Equipment Grants.

e. This table summarizes the vast majority of child nutrition programs' federal spending, but does not capture all federal costs.

Related Programs, Initiatives, and Support Activities60

Federal child nutrition laws authorize and program funding supports a range of additional programs, initiatives, and activities.68

Through State Administrative Expenses funding, states are entitled to federal grants to help cover administrative and oversight/monitoring costs associated with child nutrition programs. The national amount each year is equal to about 2% of child nutrition reimbursements. The majority of this money is allocated to states based on their share of spending on the covered programs; about 15% is allocated under a discretionary formula granting each state additional amounts for CACFP, commodity distribution, and Administrative Review efforts. In addition, states receive payments for their role in overseeing summer programs (about 2.5% of their summer program aid). States are free to apportion their federal administrative expense payments among child nutrition initiatives (including commodity distribution activities) as they see fit, and appropriated funding is available to states for two years. State Administrative Expense spending in FY2016FY2017 totaled to approximately $260279 million.61

Team Nutrition is a USDA-FNS program that includes a variety of school meals initiatives around nutrition education and the nutritional content of the foods children eat in schools. TheseThis includes Team Nutrition Training Grants, which provide funding to state agencies for training and technical assistance, such as help implementing USDA's nutrition requirements and the Dietary Guidelines for Americans. From 2004 to 2018, Team Nutrition also included the HealthierUS Schools Challenge (HUSSC), which originated in the 2004 reauthorization of the Child Nutrition Act. HUSSC iswas a voluntary certification initiative designed to recognize schools that have created a healthy school environment through the promotion of nutrition and physical activity.6270

Farm-to-school programs broadly refer to "efforts that bring regionally and locally produced foods into school cafeterias," with a focus on enhancing child nutrition.6371 The goals of these efforts include increasing fruit and vegetable consumption among students, supporting local farmers and rural communities, and providing nutrition and agriculture education to school districts and farmers. HHFKA amended existing child nutrition programs to establish mandatory funding of $5 million per year for competitive farm-to-school grants that support schools and nonprofit entities in establishing farm-to-school programs that improve a school's access to locally produced foods.6472 The FY2018 appropriations law provided an additional $5 million in discretionary funding to remain available until expended.73 Grants may be used for training, supporting operations, planning, purchasing equipment, developing school gardens, developing partnerships, and implementing farm-to-school programs. USDA's Office of Community Food Systems provides additional resources on farm-to-school issues.6574

Through an Administrative Review process (formerly referred to as Coordinated Review Effort [CRE](CRE)), USDA-FNS, in cooperation with state agencies, conducts periodic on-site NSLP school compliance and accountability evaluations to improve management and identify administrative, subsidy claim, and meal quality problems.6675 State agencies are required to conduct administrative reviews of all SFAsschool food authorities (SFAs) that operate the NSLP under their jurisdiction at least once during a three-year review cycle.6776 Federal Administrative Review obligationsexpenditures were approximately $9.39 million in FY2015FY2017.

USDA-FNS and state agencies conduct many other child nutrition program support activities for which dedicated funding is provided. Among other examples, there is the Institute of Child Nutrition (ICN), which provides technical assistance, instruction, and materials related to nutrition and food service management; it receives $5 million a year in directly appropriated mandatory fundingmandatory funding appropriated in statute. ICN is located at the University of Mississippi. USDA-FNS provides training on food safety education. Funding is also provided for USDA-FNS to conduct studies, provide training and technical assistance, and oversee payment accuracy.

Selected Current Issues in the USDA Child Nutrition Programs

This section provides further information on current issues in the child nutrition programs. In particular, it provides background on (1) USDA regulations updating various nutrition standards in the child nutrition programs and, (2) current and proposed alternatives to the "congregate feeding requirement" in the Summer Food Service Program.

Regulations Updatingsummer meals, and (3) recent changes and proposals aimed at addressing "lunch shaming" and unpaid meal costs.

Regulations on Nutrition Standards

Since the enactment of HHFKAthe Healthy, Hunger-Free Kids Act of 2010 (HHFKA; P.L. 111-296), USDA-FNS has promulgated multiple regulations, formulated various program guidance, and published many other policy documents and reports. Three of the major changes authorized by the 2010 law relate to program nutrition standards: (1) requiring an update to the nutrition standards for NSLP and SBP meals, (2) giving USDA the authority to regulate other foods sold in schools (e.g., through vending machines, a cafeteria's and cafeterias' a la carte linelines) and requiring the agency to issue related nutrition standards, and (3) requiring an update to the nutrition standards in CACFP. Improving school food quality and reducing childhood obesity were priorities of the Obama Administration; the new nutrition standards were part of the First Lady'sThe new nutrition standards were championed by First Lady Michelle Obama through her "Let's Move" initiative, among other groups.77.68

Updated Nutrition Standards for Lunch and Breakfast (Final Rule, January 26, 2012)69