Normalization of the Federal Reserve’s Balance Sheet

Changes from June 27, 2017 to September 20, 2017

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

This Insight answers questions about the Federal Reserve's (Fed's) June 14 statement regarding normalizingSeptember 20 announcement that it would begin to normalize its balance sheet in October by gradually reducing its asset holdings.

How Did the Balance Sheet Get So Large?

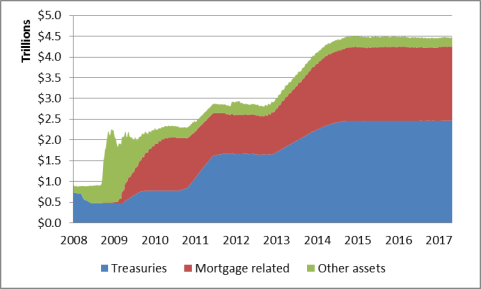

During the 2008 financial crisis, the Fed allowed increased its balance sheet to increase in an attempt to stabilize economic conditions. Initially, the increase mainly took the form of emergency assistance to provide liquidity to financial firms. As that assistance was repaid, the growth in assetsbalance sheet growth shifted to large -scale purchases of Treasury securities and mortgage-backed securities (MBS), popularly known as "quantitative easing" (QE). The Fed made the unprecedented decision to pursue QE in an attempt to place downward pressure on long-term interest rates, in order to stimulate economic activity during and following the "Great Recession." The Fed currently holds $2.5 trillion in Treasury securities and $1.8 trillion in mortgage-related assets (see Figure 1).

|

Figure 1. Assets on Fed's Balance Sheet 2008-2017 |

|

|

Source: Federal Reserve (Fed). |

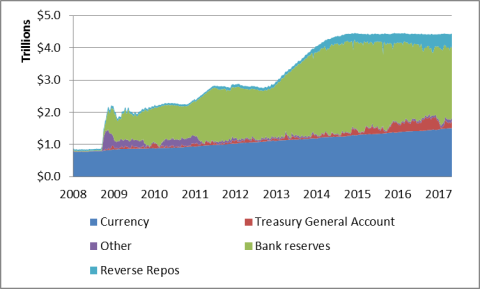

The growth in the Fed's assets was matched by growth in its liabilities—mainly bank reserves held at the Fed, which grew from less than $50 billion in 2008 to $2.24 trillion today (see Figure 2).

|

Figure 2. Liabilities on Fed's Balance Sheet 2008-2017 |

|

|

Source: Fed. |

After three rounds of QE, the Fed's balance sheet had increased from less than $1 trillion in September 2008 to $4.5 trillion in October 2014. Since thenUntil now, the Fed has maintained the balance sheet at that size by reinvesting the principal from maturing securities in new securities.

When Will The Fed Begin to Shrink the Balance Sheet?

In its June announcement, the Fed stated that it would continue reinvesting all maturing securities for the time being. Following the announcement, Fed Chair Janet Yellen stated that the Fed expected to begin phasing out the reinvestment of maturing securities later this year, provided that the economy evolves as anticipated.

How Quickly Will the Balance Sheet Shrink? By How Much?

The Fed has decided to shrink theHow Quickly Will the Balance Sheet Shrink? By How Much?

The Fed set out the details of its normalization plan in June. It has decided to shrink its balance sheet gradually to minimize its economic impact. Initially, the Fed plans toIt will initially reduce the balance sheet by no more than $10 billion per month, of which $6 billion will be Treasury securities and $4 billion will be MBS. The Fed intends to increase this capcap will increase by $10 billion every three months until it reaches $50 billion per month. (In some months, the balance sheet will shrink by less than the maximum amount because fewer securities will mature.) The Fedbalance sheet will continue to allow the balance sheet to shrink by, at most, $50 billion a month until itthe Fed "is holding no more securities than necessary to implement monetary policy efficiently and effectively." ItThe decline will come solely through reducing reinvestments; the Fed does not plan to sell assets to expedite balance sheet normalization.

After normalization, it is anticipated that the balance sheet willis expected to be smaller than its current size. But it will be, but larger than its pre-crisisprecrisis size because all four of the Fed's main liabilities—currency, the Treasury's account, reverse repurchase agreements, and bank reserves—have grown since then. Of the four, the Fed only has much influence over only the level of (domestic) reverse repurchase agreements and bank reserves. As the Fed's holdings of securities decline, bank reserves will be automatically drained from the banking system.

The size of the balance sheet at the end of normalization is unknown because it depends on the Fed'sand exactly how long the process will take has not been announced because the Fed has not determined its desired level of bank reserves. The June statement said that after the balance sheet was normalized, the level of reserves "will reflect the banking system's demand for reserve balances and the [Fed's] decisions about how to implement monetary policy most efficiently and effectively in the future." The Fed has not yet decided whether it wishes to return to the pre-crisis monetary policy framework, where excess bank reserves were minimal, or whether it wants to maintain the current policy framework, featuring abundant excess reserves. Former Fed Chair Ben Bernanke recently estimated that if the Fed wanted to maintain the current framework, it would likely be desirable to maintain "well over $1 trillion" of bank reserves. Goldman Sachs projects that the balance sheet will shrink until it reaches $3.3 trillion in 2020. Whether the Fed ultimately decides to maintain a high or low reserve balance, it will take a few years to normalize the balance sheet at the planned rate of reinvestment.

What Might Alter this Plan?

The New York Fed projects that the balance sheet wind down will be completed between 2020 and 2023, depending on a range of assumptions about Fed liabilities from a survey. Once completed, the balance sheet will start growing again, with a 2025 balance sheet size of $2.6 trillion-$4.2 trillion. Although the Fed has stated that it intends to eventually stop holding MBS, it would still have sizable MBS holdings in these projections in 2025. In these scenarios, the Fed is not projected to run any losses—a concern that some have raised about normalization.In its June statement, the Fed

What Might Alter this Plan?

The Fed has set a fairly high bar for deviating from this (nonbinding) plan. It would be prepared to resume reinvestments (to maintain a steady balance sheet) if economic conditions deteriorated enough to require a sizeable reduction in the federal funds rate. It would be prepared to resume QE (to increase the balance sheet) if the economy needed more stimulus than could be achieved solely through reductions in the federal funds rate.

How likely is it that these contingencies would ariseare these scenarios? History suggests there will likely be another recession before the process of balance sheet normalization wasis complete. This expansion is already the third longest on record, and would become the longest ever if it lasted two more yearsuntil mid-2019. Because the federal funds rate is currently very low, a smaller rate reduction would be possible before reaching zero than the rate reductionsrate reductions comparable to those implemented in each recession since 1957 would not be possible before reaching zero.

Why Has The Fed Waited So Long to Shrink the Balance Sheet?

The Fed continued reinvesting maturing assets even after a series of federal funds rate increases that began in December 2015. Why has the Fed still not begunWhy did the Fed wait so long before it began winding down the balance sheet as an alternative or complementary method of monetary tightening monetary conditionswhen it began raising interest rates in 2015? Chair Yellen explained that asset sales were rejected because their economic and financial effects are less understood and less predictable than changes to the federal funds rate. Fed Governor Lael Brainard argued that raising rates first allowed the Fed to get more "headroom" from the zero bound in case it needs to reduce rates in response to a future deterioration in economic conditions. Bernanke noted that more headroom also provides more flexibility given the uncertainty about the effects of balance sheet normalization.