The Earned Income Tax Credit (EITC): How It Works and Who Receives It

Changes from April 11, 2017 to April 18, 2018

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

The Earned Income Tax Credit (EITC): An Overview

Contents

- Introduction

- Did P.L. 115-97 modify the EITC?

Eligibility for the EITC- Filing a Federal Income Tax Return

- Earned Income

- Residency

and IdentificationRequirements - Qualifying Children

- Age Requirements for EITC Recipients with No Qualifying Children

- Investment Income

- Disallowance of the EITC Due to Fraud or Reckless Disregard of Rules

- Identification Requirements

Calculating the EITC- Income Limits for the EITC

- Payment of the EITC

- Interaction with Other Tax Provisions

- Treatment of the EITC for Need-Tested Benefit Programs

- Modifications to the EITC Made Permanent by P.L. 114-113

- Participation and Benefits

- Trends in Participation and EITC Benefits

- Participation and EITC Amounts Claimed for

20142015

- Number of Qualifying Children

- Income Level

- Filing and Marital Status

- Region

Figures

- Figure 1. Maximum EITC by Number of Qualifying Children:

20172018

- Figure 2. Amount of the EITC for an Unmarried Tax Filer with One Child,

20172018

- Figure 3. Number of Tax Filers Claiming the EITC: 1975 to

20142015

- Figure 4. EITC Claimed on Federal Income Tax Returns: 1975-

20142015

- Figure 5. Average EITC Claimed: 1975 to

20142015

- Figure 6. Total EITC Dollars Claimed for

20142015, by Number of Qualifying Children - Figure 7. Number of Tax Returns with EITC Claims for

20142015, by Number of Qualifying Children - Figure 8. Average EITC Claimed by Tax Filers in

20142015 by Number of Qualifying Children - Figure 9. Number of Returns Claiming the EITC and Average EITC Claimed for

20142015, by Adjusted Gross Income - Figure 10. Estimate of EITC Dollars Claimed by Marital Status, 2015

- Figure 11. Percentage of Tax Returns Claiming the EITC by State for

20142015

Tables

- Table 1. EITC Tax Parameters by Marital Status and Number of Qualifying Children for

20172018

- Table 2. Maximum AGI to Qualify for the EITC, by Number of Qualifying Children and Filing Status in

20172018

- Table A-1. EITC Tax Filers and Dollars Claimed: 1975-

20142015

- Table A-2. Average EITC, Number of Returns with EITC Claimed, and Total EITC Benefits for

20142015, by Adjusted Gross Income - Table A-3. Total EITC Returns and Amounts for

20142015, by State

Appendixes

Summary

The Earned Income Tax Credit (EITC) is a refundable tax credit available to eligible workers earning relatively low wages. Because the credit is refundable, an EITC recipient need not owe taxes to receive the benefit. Eligibility for and the amount of the EITC are based on a variety of factors, including residence and taxpayer ID requirements, the presence of qualifying children, age requirements for childless recipients, and the recipient's investment income and earned income. Tax filers with income above certain thresholds—these thresholds are based on marital status and number of qualifying children—are ineligible for the credit.

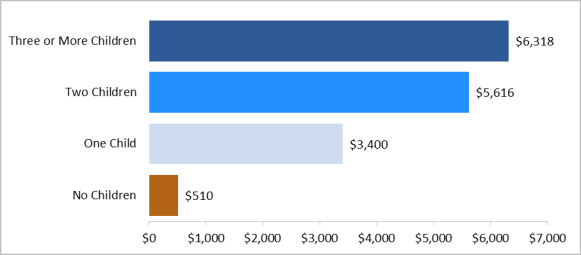

The EITC varies based on a recipient's earnings. Specifically, the EITC equals a fixed percentage (the "credit rate") of earned income until the credit amount reaches its maximum level. The EITC then remains at its maximum level over a subsequent range of earned income, between the "earned income amount" and the "phase-out amount threshold." Finally, the credit gradually decreases to zero at a fixed rate (the "phase-out rate") for each additional dollar of adjusted gross income (AGI) (or earningsearned income, whichever is greater) above the phase-out amount threshold. The specific values of these EITC parameters (e.g., credit rate, earned income amount) vary depending on several factors, including the number of qualifying children a tax filer has and his or her marital status. For the 20172018 tax year, the maximum EITC for a tax filer without children is $510519 per year. In contrast, the 20172018 maximum EITC for a tax filer with one child is $3,400461 per year; for two children, $5,616716 per year; and for three or more children, $6,318431 per year.

Two temporary modifications to the EITC were enacted as part of the American Recovery and Reinvestment Act of 2009 (ARRA; P.L. 111-5), extended by P.L. 111-312 and P.L. 112-240, and made permanent by the Protecting Americans from Tax Hikes (PATH) Act (Division Q of P.L. 114-113). The first modification was a larger credit for families with three or more children, while the second reduced the EITC's marriage penalty.

The EITC is provided to individuals and families once a year, in a lump sum payment after individuals and families file their federal income tax returns. The credit may be received in one of three ways: (1) a reduction in federal tax liability; (2) a refund from the Treasury if the tax filer has no income tax liability; or (3) a combination of a reduced federal tax liability and a refund. The amount of the credit a tax filer receives is based on the prior year's income, earnings, and family composition (marital status and number of qualifying children). That is, the EITC earned based on 2017 earnings2018 earned income will not be paid until 20182019.

The EITC cannot be counted as income in determining eligibility for or the amount of any federally funded public benefit program. An EITC refund that is saved by a tax filer does not count against the resource limits of any federally funded public benefit program for 12 months after the refund is received.

For tax year 20142015 (returns filed in 20152016), a total of $68.35 billion was claimed by 28.51 million tax filers (19% of all tax filers), making the EITC the largest need-tested antipoverty cash assistance program. In that year, 97% of all EITC dollars were claimed by families with children. However, there was considerable variation in the share of returns claiming the EITC by state, with a greater share filed in certaincertain southern states compared to other regions of the country.

Introduction

Did P.L. 115-97 modify the EITC?At the end of 2017, President Trump signed into law P.L. 115-97,1 which made numerous changes to the federal income tax for individuals and businesses.2 The final law did not make any direct changes to the EITC.

The law did however indirectly affect the credit's value in future years. Parameters of the EITC (see Table 1) are indexed to inflation. Prior to P.L. 115-97, this measure of inflation was based on the consumer price index for urban consumers (CPI-U). P.L. 115-97 changed this inflation measure to be permanently based on the chained CPI-U (C-CPI-U).3 In comparison to CPI-U, chained CPI-U tends to grow more slowly. Hence, over time, the monetary parameters of the EITC will increase more slowly.Introduction

The Earned Income Tax Credit (EITC) is a refundable tax credit available to eligible workers with relatively low earnings. Because the credit is refundable, an EITC recipient need not owe taxes to receive the benefit. The credit is authorized by Section 32 of the Internal Revenue Code (IRC) and administered as part of the federal income tax system. For tax year 20142015 (returns filed in 20152016), a total of $68.35 billion was claimed by 28.51 million tax filers, making the EITC the largest need-tested antipoverty cash assistance program.

Under current law, the EITC is calculated based on a recipient's earned income, using one of eight different formulas, which vary depending on several factors, including the number of qualifying children a tax filer has (zero, one, two, or three or more) and his or her marital status (unmarried or married). All else being equal, the amount of the credit tends to increase with the number of eligible children the EITC claimant has. Indeed, most of the benefits of the EITC—97% of EITC dollars for 20142015—go to families with children.

Two temporary modifications to the EITC were enacted under the American Recovery and Reinvestment Act of 2009 (ARRA; P.L. 111-5), extended by P.L. 111-312 and P.L. 112-240, and made permanent by the Protecting Americans from Tax Hikes (PATH) Act (Division Q of P.L. 114-113). The first modification was a larger credit for families with three or more children, while the second reduced the EITC's marriage penalty.

This report provides an overview of the EITC, first discussing eligibility requirements for the credit, followed by how the credit is computed and paid. The report then provides data on the growth of the EITC since it was first enacted in 1975. Finally the report concludes with data on the EITC claimed on 20142015 tax returns, examining EITC claims by number of qualifying children, income level, tax filing status, and location of residence.

Eligibility for the EITC

A tax filer must fulfill the following requirements to claim the EITC:

- 1. The tax filer must file a federal income tax return.

14 - 2. The tax filer must have earned income.

- 3. The tax filer must meet certain residency

and identificationrequirements. - 4. The tax filer's children must meet relationship, residency, and age requirements to be considered qualifying children for the credit.

- 5. Childless workers who claim the credit must be between ages 25 and 64. (This age requirement does not apply to EITC claimants with qualifying children.)

- 6. The tax filer's investment income must be below a certain amount.

- 7. The tax filer must not be disallowed the credit due to prior fraud or reckless disregard of the rules when they previously claimed the EITC.

labelledlabeled as "income where credit = 0" in Table 1) will be ineligible for the credit. Given that this income level is dependent on the number of qualifying children and marital status of the tax filer, this requirement is discussed in greater detail in the section of the report entitled "Calculating the EITC."

Requirements (1) through (78) are discussed in detail below.

Filing a Federal Income Tax Return

To be eligible for the EITC, a person must file a federal income tax return. Those who do not file a federal income tax return cannot receive the EITC.

The EITC can be claimed by taxpayers filing their tax return as married filing jointly, head of household, or single.25 Tax filers cannot claim the EITC if they use the filing status of married filing separately. If the tax filer has a qualifying child, the tax filer must include the child's name and Social Security number on a separate schedule (Schedule EIC) filed with the federal tax return.3

Earned Income

A tax filer must have earned income to claim the EITC. Earned income for the EITC is defined as wages, tips, and other compensation included in gross income. It also includes net self-employment income (self-employment income after deduction of one-half of Social Security payroll taxes paid by a self-employed individual).

In addition, servicemembers may elect to include combat pay in their earningsearned income when calculating the EITC. All income earned by a member of the Armed Forces while in a designated combat zone is considered combat pay and is normally not included in taxable income. However, a tax filer may elect to include combat pay as earningsearned income for the purpose of calculating the EITC.47 Generally, servicemembers will make this election if it results in a larger credit. (Using combat pay to calculate the EITC does not make the combat pay taxable income.)

Certain forms of income are not considered earningsearned income for the purpose of the EITC. These include pension and annuity income, income of nonresident aliens not from a U.S. business, income earned while incarcerated for work in a prison, and TANF benefits paid in exchange for participation in work experience or community service activities.

Finally, tax filers who claim the foreign earned income exclusion (i.e., they file Form 2555 or Form 2555EZ with their federal income tax return) are ineligible to claim the EITC.5

Residency and Identification Requirements

Requirements

Under current law, an EITC recipient must be a resident of the United States, unless the recipient resides in another country because of U.S. military service. To be eligible for the credit, the tax filer must provide valid Social Security numbers (SSNs) for work purposes6 for themselves, spouses if married filing jointly, and any qualifying children. (U.S. citizenship is not required to be eligible for the credit. SSNs do not indicate U.S. citizenship.) Nonresident aliens—those who do not have green cards or do not spend sufficient time in the United States—are generally ineligible for the EITC.7.

Qualifying Children

An EITC recipient's qualifying child must meet three requirements.89 First, the child must have a specific relationship to the tax filer (son, daughter, step child or foster child,910 brother, sister, half-brother, half-sister, step brother, step sister, or descendent of such a relative). Second, the child must share a residence with the taxpayer for more than half the year in the United States.1011 Third, the child must meet certain age requirements; namely, the child must be under the age of 19 (or age 24, if a full-time student) or be permanently and totally disabled.

As a result of these three requirements, a child may be the qualifying child of more than one tax filer in the same household. For example, a child who lives with a single parent, grandparent, and aunt in the same home could be a qualifying child of all three of these individuals. But only one of these individuals can claim the qualifying child for the EITC, and the others cannot. Indeed, it appears that under current law, the other individuals are also ineligible to claim the childless EITC.1112 In the case where the tax filers cannot agree on who claims the child, there are "tie-breaker" rules for who can claim the child for the EITC.12

Age Requirements for EITC Recipients with No Qualifying Children

If a tax filer has no qualifying children, he or she must be between 25 and 64 years of age to be eligible for the EITC. There is no age requirement for tax filers with qualifying children.

Investment Income

A tax filer with investment income over a certain dollar amount is ineligible for the EITC. The statutory limit—$2,200—is adjusted annually for inflation. For 20172018, the limit on investment income is $3,450500. Investment income is defined as interest income (including tax-exempt interest), dividends, net rent, net capital gains, and net passive income. It also includes royalties that are from sources other than the filer's ordinary business activities.

Disallowance of the EITC Due to Fraud or Reckless Disregard of Rules

A tax filer is barred from claiming the EITC for a period of 10 years after the IRS makes a final determination to reduce or disallow a tax filer's EITC because that individual made a fraudulent EITC claim. A tax filer is barred from claiming the EITC for a period of two years after the IRS determines that the individual made an EITC claim "due to reckless and intentional disregard of the rules" of the EITC, but that disregard was not found to be fraud.13

To be eligible for the credit, the tax filer must provide valid Social Security numbers (SSNs) for work purposes15 for themselves, spouses if married filing jointly, and any qualifying children. The SSNs must be issued before the due date of the income tax return.16 (U.S. citizenship is not required to be eligible for the credit. SSNs do not indicate U.S. citizenship.) Nonresident aliens—those who do not have green cards or do not spend sufficient time in the United States—are generally ineligible for the EITC.17

Calculating the EITC

The EITC amount is based on formulas that consider earned income, number of qualifying children, marital status, and adjusted gross income (AGI). In general, the EITC equals a fixed percentage (the "credit rate") of earned income until the credit reaches its maximum amount. The EITC then remains at its maximum level over a subsequent range of earned income, between the "earned income amount" and the "phase-out amount threshold." Finally, the credit gradually decreases in value to zero at a fixed rate (the "phase-out rate") for each additional dollar of earningsearned income or AGI (whichever is greater) above the phase-out amount threshold. The specific values of these EITC parameters (e.g., credit rate, earned income amount, etc.) vary depending on several factors, including the number of qualifying children a tax filer has and his or her marital status, as illustrated in Table 1.

|

Number of Qualifying Children |

0 |

1 |

2 |

3 or more |

|

unmarried tax filers (single and head of household filers) |

||||

|

credit rate |

7.65% |

34% |

40% |

45% |

|

earned income amount |

$6, |

$10, |

$14, |

$14, |

|

maximum credit amount |

$ |

$3, |

$5, |

$6, |

|

phase-out amount threshold |

$8, |

$18, |

$18, |

$18, |

|

phase-out rate |

7.65% |

15.98% |

21.06% |

21.06% |

|

income where credit = 0 |

$15, |

$ |

$45, |

$ |

|

married tax filers (married filing jointly) |

||||

|

credit rate |

7.65% |

34% |

40% |

45% |

|

earned income amount |

$6, |

$10, |

$14, |

$14, |

|

maximum credit amount |

$ |

$3, |

$5, |

$6, |

|

phase-out amount threshold |

$ |

$ |

$ |

$ |

|

phase-out rate |

7.65% |

15.98% |

21.06% |

21.06% |

|

income where credit = 0 |

$20, |

$ |

$ |

$ |

Source: IRS Revenue Procedure 2016-552018-18 and Internal Revenue Code (IRC) Section 32.

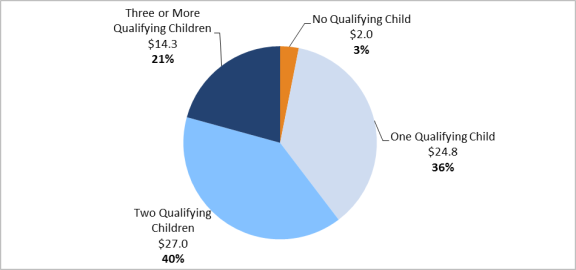

As illustrated in Table 1, the EITC's earned income amounts, credit rates, phase-out rates, and maximum credit amounts vary by the number of qualifying children a tax filer has. The EITC ranges from a maximum credit of $510519 for a tax filer without a child to $6,318431 for a tax filer with three or more qualifying children, as illustrated in Figure 1.

|

Figure 1. Maximum EITC by Number of Qualifying Children: |

|

|

Source: Congressional Research Service, based on IRS Revenue Procedure |

The phase-out amount threshold varies by both the number of qualifying children a tax filer has and his or her marital status. The phase-out amount threshold for those who are married filing joint returns is $5,590690 greater than for unmarried filing statuses with the same number of children. (Tax filers who file as married filing separately are ineligible for the EITC.) This higher phase-out amount threshold for married tax filers reduces (but generally does not eliminate) potential "marriage penalties" in the EITC whereby the credit for a married couple is less than the combined credit of two unmarried recipients.

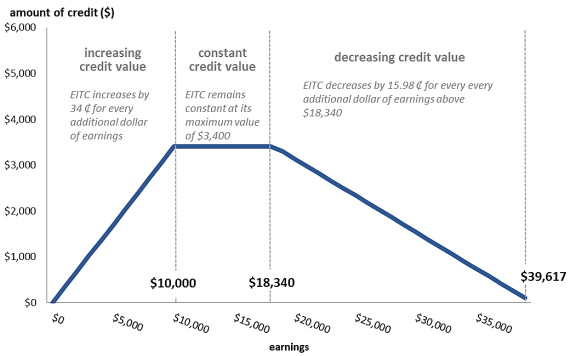

Figure 2 illustrates the EITC amount by earningsearned income level for an unmarried taxpayer with one child for 20172018. It shows the three distinct ranges of EITC for this family:

- Phase-in Range: The EITC increases with

earningsearned income from the first dollar ofearningsearned income up to earnings of $10,000180. Over thisearningsearned income range, the credit equals the credit rate (34% for a tax filer with one child) times the amount of annualearningsearned income. The $10,000180 threshold is called the earned income amount and is the earnings level at which the EITC ceases to increase with earned income. The income interval up to the earned income amount, where the EITC increases withearningsearned income, is known as the phase-in range. - Plateau: The EITC remains at its maximum level of $3,

400461 from the earned income amount ($10,000180) until earnings exceed $18,340)660. The $3,400461 credit represents the maximum credit for a tax filer with one child in20172018. The income interval with the EITC fixed at its maximum value represents the plateau on Figure 2. - Phase-out Range: Once

earnings exceed $18,340adjusted gross income (or if greater, earned income) exceeds $18,660, the EITC is reduced for every additional dollar over that amount. The $18,340660 threshold is known as the phase-out amount threshold for a single taxpayer with one child in20172018. For each dollar over the phase-out amount threshold, the EITC is reduced by 15.98%. The 15.98% rate is known as the phase-out rate. The income interval from the phase-out income level until the EITC is completely phased out is known as the phase-out range.

The EITC is completely phased out (EITC = $0) once the tax filer's AGI (or earned income, whichever is greater) reaches $39,61740,320. The earned income amounts and the phase-out amount thresholds are adjusted each year for inflation.

In practice, EITC claimants use tables published by the IRS to calculate their credit amount. A tax filer can look up the correct amount of his or her EITC based on income, marital status, and number of qualifying children. The instructions for the federal income tax form1418 show the EITC amounts in tables by income brackets (in $50 increments).

Income Limits for the EITC

As previously discussed, the amount of the EITC is reduced for each dollar of AGI (or earningsearned income, if greater) above a certain dollar threshold, referred to as the phase-out amount threshold. That threshold, combined with the phase-out rate, results in a specific income level (referred to as "income where credit = 0" in Table 1) above which a tax filer is ineligible for the credit. This income level, where the credit reaches zero, is sometimes referred to as the eligibility threshold.

As illustrated in Table 1, there are eight eligibility thresholds for the EITC depending on the number of qualifying children a taxpayer has and his or her marital status. The eligibility thresholds vary every year given that they are based in part on a parameter of the credit—the phase-out amount threshold—that is explicitly adjusted for inflation. Table 2 shows the EITC eligibility thresholds for 20172018. An EITC claimant's AGI (or earningsearned income, if higher) must be below these thresholds for the claimant to qualify for the EITC. In 20172018, these thresholds range from $15,010270 for an unmarried tax filer with no qualifying child to $53,93054,884 for a married tax filer filing jointly with three or more qualified children.

Table 2 expresses these eligibility thresholds as a percentage of the 20172018 poverty guidelines. For example, the poverty guideline for a family of three in 20162018 was $20,420780. Families of three with income at or below this amount are considered poor. The EITC eligibility threshold of $45,007802 for an unmarried person filing jointly with two qualifying children was more than twice (220.4%) the poverty guideline for a family of that type.

Table 2 also expresses these eligibility thresholds as a percentage of the earnings of one worker who works a minimum wage job ($7.25 per hour) 40 hours per week, 52 weeks a year ($15,080 annually). For the purposes of the calculations in Table 2, married EITC recipients are assumed to have the same aggregate annual earnings as unmarried recipients—$15,080. The EITC is available in 2017 to all families at this earnings level except an unmarried taxpayer with no children. The EITC was2018 to all families. It is available to families with children who hadhave earnings between 2.67 to 3.6 times the annual earnings from a minimum wage job (262.7% to 357.6267.4% to 364.0% of $15,080).

Table 2. Maximum AGI to Qualify for the EITC, by Number of Qualifying Children and Filing Status in 2017

|

No Qualifying Children |

One Qualifying Child |

Two Qualifying Children |

Three or More Qualifying Children |

||

|

Unmarried |

$15, |

$ |

$45, |

$ |

|

|

Married Filing Jointly |

20, |

45,207 |

50,597 |

53,930 |

|

|

As a percentage of the poverty threshold |

|

||||

|

Unmarried |

|

|

220.4% |

196. |

|

|

Married Filing Jointly |

126.8 |

221.4 |

205. |

|

|

|

As a percentage of work at the federal minimum wage, 40 hours per week, 52 weeks per year |

|||||

|

Unmarried |

|

|

|

|

|

|

Married Filing Jointly |

136.6 |

299.8 |

|

357.6 |

|

Source: Congressional Research Service calculations, based on IRS Revenue Procedure 2016-552018-18, Internal Revenue Code (IRC) Section 32 and the 20172018 Poverty Guidelines available at https://aspe.hhs.gov/poverty-guidelines.

a.

Represents the EITC AGI threshold divided by the poverty guidelines for a family of 4

b.

Represents the EITC AGI threshold divided by the poverty guidelines for a family of 5.

Payment of the EITC

The EITC is provided to individuals and families annually in a lump sum payment after a taxpayer files a federal income tax return.1519 It may be received in one of three ways:

- 1. a reduction in federal tax liability;

- 2. a cash payment from the Treasury if the tax filer has no tax liability, through a tax refund check; or

- 3. a combination of reduced federal tax liability and a refund.

The majority (86%) of the aggregate amount of the EITC—$68.35 billion for 20142015—is received as a refund.1620 In other words, $58.98 billion of the EITC was received as a refund for 2014, while approximately $9.57 billion offset tax liabilities.

The EITC is taken against all taxes reported1721 on the federal individual income tax return (Form 1040) after all nonrefundable credits have been taken. On the tax form, the EITC can be found in the payments section after the lines for withholding and estimated tax payments.

The EITC benefits families when they file their income taxes. Thus, payments are generally based on the prior year's income, earnings, and family composition. That is, the EITC earned in 20172018, based on a tax filer's earnings, income, and family composition, will be paid in 2018.182019.22 If the tax filer is owed a refund, and that filer's return includes an EITC, that refund will be made on or after February 15.19

Interaction with Other Tax Provisions

On the tax return, the EITC is calculated after total tax liability and all nonrefundable credits. Nonrefundable tax credits, which are taken against (reduce) income tax liability, include credits for education, dependent care, savings, and the nonrefundable portion of the child credit.2024 If an EITC-eligible family has a tax liability and can use one or more of these credits, the total amount of their EITC will remain unchanged, but how they receive the credit will change. If nonrefundable tax credits can reduce a family's tax liability, a greater amount of their EITC will be received as a refund, and less will offset their tax liability since their tax liability is smaller.

For tax filers whose income places them in the "phase-out range" of the credit, reducing their income (all else being unchanged) will result in a larger EITC. (As illustrated in Figure 2, reducing income when a tax filer is in the phase-out range results in the tax filer increasing the amount of the credit they receive.) A variety of forms of income can be excluded from both AGI and earned income, reducing a taxpayer's AGI or earned income for purposes of calculating the credit. For example, pretax contributions to savings accounts for retirement or medical expenses are not included in either AGI or earned income. Hence, by making these contributions, EITC claimants whose precontribution income places them in the phase-out range of the credit will reduce their AGI or earned income for purposes of calculating the EITC and thus receive a larger credit.2125

In contrast, for tax filers whose earned income places them in the "phase-in range" of the credit, reducing their earned income (all else unchanged) will result in a smaller EITC. (As previously discussed, the phase-in range of the credit is over a range of earned income, while the credit phases out based on adjusted gross income or earned income, whichever is greater.) As illustrated in Figure 2, reducing income when a tax filer is in the phase-in range results in the tax filer reducing the amount of the credit they receive.) Generally, nontaxable income cannot be included in earned income for purposes of calculating the EITC. However, as previously discussed, servicemembers may elect to include their nontaxable combat pay as earningsearned income, for purposes of calculating the EITC. Generally, servicemembers whose income (excluding their combat pay) places them in the phase-in range will elect to include their combat pay in earned income for purposes of calculating the EITC in order to receive a larger credit.

Treatment of the EITC for Need-Tested Benefit Programs

By law,2226 the EITC cannot be counted as income in determining eligibility for, or the amount of, any federally funded public benefit program including Supplemental Nutrition Assistance Program (SNAP) food assistance, low-income housing, Medicaid, Supplemental Security Income (SSI), and Temporary Assistance for Needy Families (TANF). An EITC refund that is saved by the filer does not count against the resource limits of any federally funded public benefit program for 12 months after the refund is received.

Modifications to the EITC Made Permanent by

P.L. 114-113

Two temporary modifications to the EITC were enacted by the American Recovery and Reinvestment Act of 2009 (ARRA; P.L. 111-5). First, ARRA enacted a temporary larger credit for families with three or more children by creating a new higher credit rate of 45% (previously, these tax filers were eligible for a credit rate of 40%). Second, ARRA expanded marriage penalty relief by increasing the earningsearned income level at which the credit phased out for married tax filers in comparison to unmarried tax filers with the same number of children. Before ARRA, the EITC for married tax filers would begin to phase out for earningsearned income $3,000 (adjusted for inflation) greater than the level for unmarried recipients with the same number of children. ARRA increased this differential to $5,000 (adjusted for inflation). In 20172018, this marriage penalty relief was equal to $5,590690. These two changes were originally scheduled to be in effect only for 2009 and 2010. The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (P.L. 111-312) extended these ARRA provisions for two years (2011 and 2012). The American Taxpayer Relief Act (ATRA; P.L. 112-240) extended the ARRA provisions for five more years (2013-2017). The Protecting Americans from Tax Hikes (PATH) Act (Division Q of P.L. 114-113) made these two modifications permanent.

Participation and Benefits

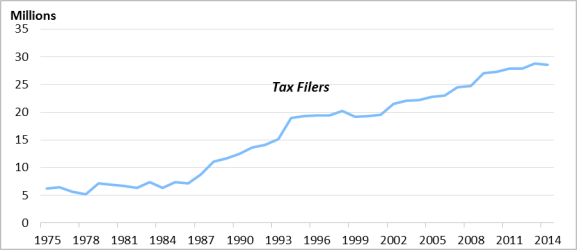

The EITC was first enacted in 1975 as a temporary measure meant to encourage economic growth in the face of the 1974 recession and rising food and energy prices. It was also originally intended to "assist in encouraging people to obtain employment, reducing the unemployment rate, and reducing the welfare rolls."2327 Over time the list of EITC objectives has grown to include poverty reduction. Today the EITC is the largest need-tested, cash benefit antipoverty program. This section first provides a historical overview of the growth of the EITC for tax years 1975 to 20142015; it then examines information on EITC participation for 20142015.

Trends in Participation and EITC Benefits

When originally enacted by the Tax Reduction Act of 1975 (P.L. 94-12), the EITC was a temporary refundable tax credit in effect for 1975. For that year, 6.2 million tax filers claimed the EITC and the total EITC amount claimed was $1.25 billion (in constant 20142015 dollars, this equals $5.5 billion). The credit was extended several more times on a temporary basis and made permanent by the Revenue Act of 1978 (P.L. 95-600). Legislation enacted in 1986 (P.L. 99-514), 1990 (P.L. 101-508), 1993 (P.L. 103-66), 2001 (P.L. 107-16), and 2009 (P.L. 111-5) increased the amount of the credit by changing the credit formula.

Before 1990, the credit amount was calculated as a percentage of earnings ("the credit rate") up until the earned income amount. The credit then remained at its maximum level before gradually decreasing in value as earningsearned income increased. Legislative changes to the credit made during this time generally increased the amount of the credit in a variety of ways including increasing the credit rate, increasing the earned income amount, increasing the phase-out amount threshold, and decreasing the phase-out rate. Nonetheless, the credit amount depended on earned income.

Beginning in 1990 and more substantially in 1993, the credit formula was revised such that the credit amount varied based on earningsearned income and, to a certain extent, the number of qualifying children. This essentially increased the credit by family size. In addition, for the first time in 1993, Congress made workers without qualifying children eligible for the EITC, although the credit was smaller than the credit for claimants with qualifying children.

In 2001, the credit formula was revised again so that it also varied based in part on marital status. As a result of this change, often referred to as "marriage penalty relief," certain married tax filers would receive a larger credit than unmarried tax filers with the same number of children. In 2009, the marriage penalty relief was expanded further and a larger credit was created for families with three or more children. These 2009 changes were extended several times and made permanent by P.L. 114-113.

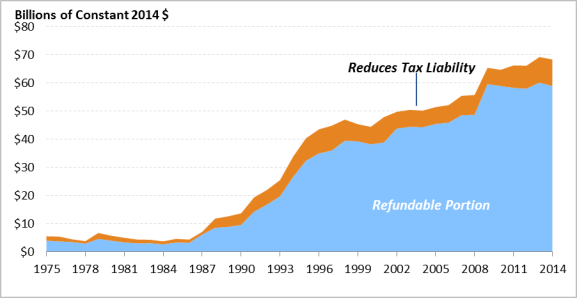

Figure 3 shows the number of tax filers claiming the EITC for 1975 to 20142015. Figure 4 shows the amount of the EITC claimed on these returns, with dollar amounts adjusted for inflation to represent 20142015 dollars. The figures show the effects of the legislative expansions of the EITC, with the credit experiencing growth in the late 1980s through the mid-1990s and then again in the 2000s. As shown on Figure 4, throughout the history of the EITC, most credits have been paid in the form of refunds, with a relatively small share of the EITC reducing regular federal income tax liability.

|

Figure 3. Number of Tax Filers Claiming the EITC: 1975 to |

|

|

Source: Congressional Research Service. For pre-2003 data, U.S. Congress, House Committee on Ways and Means, 2004 Green Book, Background Material and Data on Programs Within the Jurisdiction of the Committee on Ways and Means, 108th Congress, 2nd session, WMCP 108-6, March 2004, pp. 13-41. For 2003 and later data, Internal Revenue Service, Note: For a tabular display of this information, see Table A-1. |

|

Figure 4. EITC Claimed on Federal Income Tax Returns: 1975- |

|

|

Source: Congressional Research Service. For pre-2003 data, U.S. Congress, House Committee on Ways and Means, 2004 Green Book, Background Material and Data on Programs Within the Jurisdiction of the Committee on Ways and Means, 108th Congress, 2nd session, WMCP 108-6, March 2004, pp. 13-41. For 2003 and later data, Internal Revenue Service, Notes: Constant |

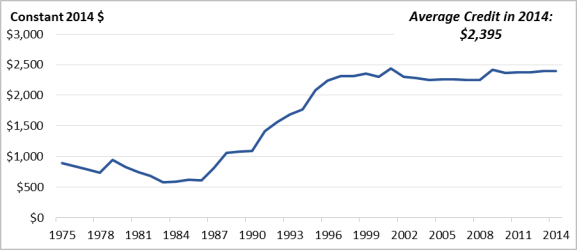

The growth in the total amount of EITC claimed in the late 1980s to the mid-1990s was due to increases not only in participation, but also in the average credit received by tax filers. Figure 5 shows the average EITC claimed for 1975 to 20142015, in inflation-adjusted (20142015) dollars. Before the 1986 Tax Reform Act (P.L. 99-514), EITC thresholds were not indexed for inflation, and the average credit lost value each year. However, the 1986 act increased the monetary parameters of the credit for prior inflation and adjusted the threshold amounts and maximum credits annually for inflation in future years. The credit formula was also revised in 1990 and then again in 1993 such that the amount of the credit depended to a certain extent on family size. These changes resulted in an increasing average credit between the late 1980s and late 1990s. Since then, the average credit has largely maintained its real value. However, increases in the average credit amount in 2001 and 2009 were likely due to legislative changes that included larger credits for some married claimants and for families with three or more children.2428 The average EITC claimed for 20142015 was $2,395440.

| 2015 |

|

|

Source: Congressional Research Service. For pre-2003 data, U.S. Congress, House Committee on Ways and Means, 2004 Green Book, Background Material and Data on Programs Within the Jurisdiction of the Committee on Ways and Means, 108th Congress, 2nd session, WMCP 108-6, March 2004, pp. 13-41. For 2003 and later data, Internal Revenue Service, Notes: Constant |

Participation and EITC Amounts Claimed for 2014

2015

For 20142015, $68.35 billion of the EITC was claimed on 28.51 million tax returns.

Number of Qualifying Children

Most tax filers claiming the EITC, and those who received the most EITC dollars, were families with children. Figure 6 shows total EITC dollars claimed for 20142015 by number of qualifying children. For 20142015, 3% of all EITC dollars were claimed by tax filers with no qualifying children and 97% were claimed by tax filers with qualifying children. Of this 97%, 36% were claimed by tax filers with one qualifying child, 40% were claimed by tax filers with two qualifying children, and 21% were claimed by tax filers with three or more qualifying children.

Though childless tax filers claimed 3% of all EITC dollars for 2014, they accounted for 26% of all tax filers that claimed the EITC. Thus, their small share of total EITC dollars reflects, in part, the lower credit amount available to childless filers.

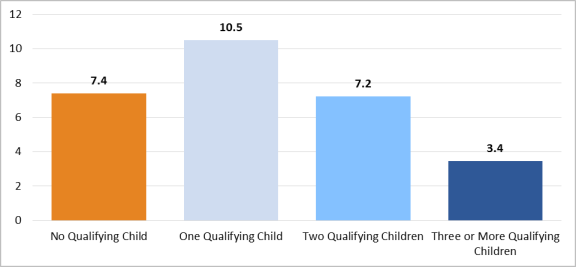

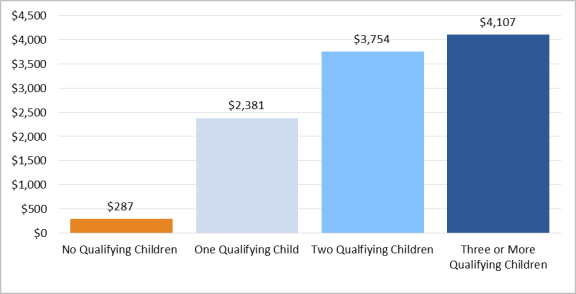

Figure 7 shows the number of returns claiming the EITC for 20142015 by number of qualifying children. Figure 8 shows the average EITC claimed for 20142015 by number of qualifying children. The average EITC for 20142015 increased with the number of qualifying children a tax filer claimed:

- The EITC was claimed by 7.

43 million tax filers with no qualifying children, with an average claim of $287294. - The EITC was claimed by 10.

53 million filers with one qualifying child, with an average claim of $2,381411. - The EITC was claimed by 7.

21 million filers with two qualifying children, with an average claim of $3,754830. - The EITC was claimed by 3.4 million filers with three or more qualifying children, with an average claim of $4,

107185.

|

Figure 7. Number of Tax Returns with EITC Claims for Number in Millions, Total Number of Returns Claiming the EITC = 28. |

|

|

Source: Congressional Research Service, based on data from the Notes: Detail does not add to total because of rounding. For detail on returns claiming the EITC by AGI and number of qualifying children, see Table A-2. |

|

Figure 8. Average EITC Claimed by Tax Filers in |

|

|

Source: Congressional Research Service, based on data from the Note: For detail on returns claiming the EITC by AGI and number of qualifying children, see Table A-2. |

Income Level

Though the EITC is targeted toward lower-income earners, tax filers with children may receive the EITC even with income well above the poverty level. (The federal poverty level for a family of three was $20,420 in 2014090 in 2015.) However, the largest EITC benefits are focused on low-income earners near the poverty line, with those with greater earnings receiving reduced benefits.

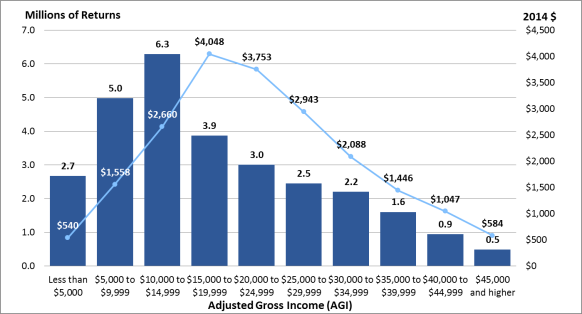

Figure 9 shows the number of tax returns with EITC claims for 20142015 by adjusted gross income level. Figure 9 shows that the most typical (modal) EITC tax return had an AGI between $10,000 and $14,999, with 6.32 million returns including an EITC in that income range for 20142015. For that year, close to half (48.1%) of all returns with EITC claims had AGIs below $15,000. This AGI is equivalent to earnings less than the $15,080 earned by a full-time (40 hour per week) full-year (52 weeks per year) worker earning the federal minimum wage ($7.25 per hour).

Figure 9 also shows the average EITC claimed by AGI category. Average EITC benefits first increase with AGI, then decline. This outcome reflects the formula for determining the EITC, which provides an increasing credit up to a maximum amount, then ultimately a reduced credit as it is phased out above a certain income threshold (see Table 1 and Figure 2). It also reflects a difference in the mix of family types claiming the EITC in the various AGI categories. For example, 7173% of all filers claiming the EITC with AGIs of less than $5,000 had no qualifying children. All those claiming the EITC at AGIs above $2025,000 in 20142015 had qualifying children, and hence were eligible for a larger maximum EITC benefit than filers without children. For detail on returns claiming the EITC by AGI and number of qualifying children, see Table A-2.

|

Figure 9. Number of Returns Claiming the EITC and Average EITC Claimed for Numbers in Millions and |

|

|

Source: Congressional Research Service, based on data from the Notes: For detail on returns claiming the EITC by AGI and number of qualifying children, see Table A-2. |

Filing and Marital Status

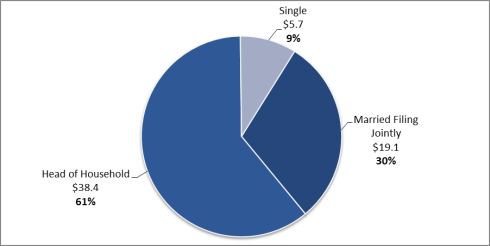

The Internal Revenue Service does not provide data on EITC dollars claimed by filing status. The Tax Policy Center (TPC), however, projectsestimated that in 2015, 70% of all EITC dollars will be claimed by unmarried tax filers (head of household and single filing statuses), with most (60% of all EITC dollars) claimed by those filing as heads of household. (The TPC projections are likely similar to the actual amounts of the EITC claimed by filing status in 2013 and 2014, given that they are based on the same credit formula.) Figure 10 shows projectionsFigure 10 shows estimates for EITC dollars claimed by filing status for 2015.

|

Figure 10. Estimate of EITC Dollars Claimed by Marital Status, 2015 Dollars in Billions |

|

|

Source: Congressional Research Service, based on estimates from the Urban-Brookings Institution Tax Policy Center Table T13-0274, available at http://www.taxpolicycenter.org/numbers/index.cfm. Estimates are for tax year 2015. |

Region

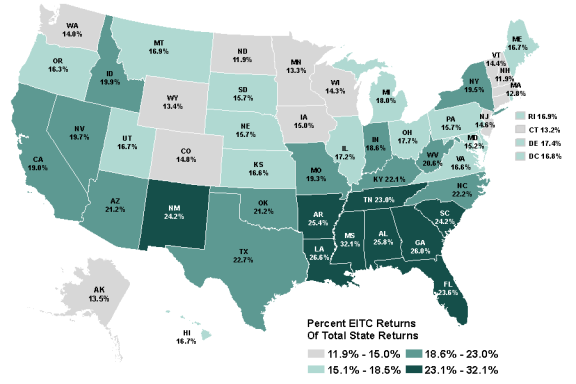

For tax year 20142015, the EITC was claimed on 19.118.7% of all tax returns. However, the rate at which the EITC is claimed by tax filers varies considerably by state. In 20142015, the state with the highest percentage of returns claiming the EITC was Mississippi, with the credit claimed on 32.131.6% of all returns. In contrast, the EITC was claimed on 11.95% of all returns in New Hampshire that year.

Figure 11 provides a map showing the percentage of all tax returns claiming the EITC by state. In addition to considerable state variation, the map shows that there is a regional pattern to EITC receipt. A greater share of returns filed in certain southern states claimed the EITC than returns in other regions of the country. The EITC was claimed on the smallest percentage of returns in New England as well as some states in the northern Midwest.

|

Figure 11. Percentage of Tax Returns Claiming the EITC by State for |

|

|

Source: Congressional Research Service, based on data from the U.S. Internal Revenue Service. Notes: For detail on EITC returns by state, see Table A-3. |

Appendix. Additional Tables

|

In millions of nominal dollars |

In millions of constant |

|||||||||||||||

|

Year |

Tax Filers Claiming the EITC (Millions) |

Total EITC |

Refunded EITC |

Average EITC |

Total EITC |

Refunded EITC |

Average EITC |

|||||||||

|

1975 |

6.215 |

$1,250 |

900 |

201 |

5,507 |

3,965 |

884 |

|||||||||

|

1976 |

6.473 |

1,295 |

890 |

200 |

5,394 |

3,707 |

832 |

|||||||||

|

1977 |

5.627 |

1,127 |

880 |

200 |

4,408 |

3,442 |

781 |

|||||||||

|

1978 |

5.192 |

1,048 |

801 |

202 |

3,810 |

2,912 |

733 |

|||||||||

|

1979 |

7.135 |

2,052 |

1,395 |

288 |

6,699 |

4,554 |

939 |

|||||||||

|

1980 |

6.954 |

1,986 |

1,370 |

286 |

5,713 |

3,941 |

822 |

|||||||||

|

1981 |

6.717 |

1,912 |

1,278 |

285 |

4,985 |

3,332 |

742 |

|||||||||

|

1982 |

6.395 |

1,775 |

1,222 |

278 |

4,360 |

2,998 |

682 |

|||||||||

|

1983 |

7.368 |

1,795 |

1,289 |

244 |

4,272 |

3,067 |

580 |

|||||||||

|

1984 |

6.376 |

1,638 |

1,162 |

257 |

3,737 |

2,651 |

586 |

|||||||||

|

1985 |

7.432 |

2,088 |

1,499 |

281 |

4,599 |

3,302 |

618 |

|||||||||

|

1986 |

7.156 |

2,009 |

1,479 |

281 |

4,345 |

3,198 |

607 |

|||||||||

|

1987 |

8.738 |

3,391 |

2,930 |

388 |

7,075 |

6,113 |

809 |

|||||||||

|

1988 |

11.148 |

5,896 |

4,257 |

529 |

11,813 |

8,529 |

1,060 |

|||||||||

|

1989 |

11.696 |

6,595 |

4,636 |

564 |

12,606 |

8,861 |

1,078 |

|||||||||

|

1990 |

12.542 |

7,542 |

5,266 |

601 |

13,677 |

9,550 |

1,090 |

|||||||||

|

1991 |

13.665 |

11,105 |

8,183 |

813 |

19,325 |

14,240 |

1,415 |

|||||||||

|

1992 |

14.097 |

13,028 |

9,959 |

924 |

21,983 |

16,824 |

1,561 |

|||||||||

|

1993 |

15.117 |

15,537 |

12,028 |

1,028 |

25,485 |

19,729 |

1,686 |

|||||||||

|

1994 |

19.017 |

21,105 |

16,598 |

1,110 |

33,753 |

26,545 |

1,775 |

|||||||||

|

1995 |

19.334 |

25,956 |

20,829 |

1,343 |

40,368 |

32,394 |

2,089 |

|||||||||

|

1996 |

19.464 |

28,825 |

23,157 |

1,481 |

43,544 |

34,982 |

2,237 |

|||||||||

|

1997 |

19.391 |

30,389 |

24,396 |

1,567 |

44,877 |

35,984 |

2,314 |

|||||||||

|

1998 |

20.273 |

32,340 |

27,175 |

1,595 |

46,970 |

39,515 |

2,319 |

|||||||||

|

1999 |

19.259 |

31,901 |

27,604 |

1,656 |

45,385 |

39,271 |

2,356 |

|||||||||

|

2000 |

19.277 |

32,296 |

27,803 |

1,675 |

44,452 |

38,268 |

2,305 |

|||||||||

|

2001 |

19.593 |

35,784 |

29,043 |

1,826 |

47,891 |

38,869 |

2,444 |

|||||||||

|

2002 |

21.574 |

37,786 |

33,258 |

1,751 |

49,783 |

43,817 |

2,307 |

|||||||||

|

2003 |

22.112 |

39,186 |

34,508 |

1,772 |

50,477 |

44,451 |

2,283 |

|||||||||

|

2004 |

22.270 |

40,024 |

35,299 |

1,797 |

50,219 |

44,290 |

2,255 |

|||||||||

|

2005 |

22.752 |

42,410 |

37,465 |

1,864 |

51,469 |

45,468 |

2,262 |

|||||||||

|

2006 |

23.042 |

44,388 |

39,072 |

1,926 |

52,186 |

45,936 |

2,264 |

|||||||||

|

2007 |

24.584 |

48,540 |

42,508 |

1,974 |

55,487 |

48,592 |

2,257 |

|||||||||

|

2008 |

24.756 |

50,669 |

44,260 |

2,047 |

55,779 |

48,724 |

2,253 |

|||||||||

|

2009 |

27.041 |

59,240 |

53,985 |

2,191 |

65,447 |

59,642 |

2,421 |

|||||||||

|

2010 |

27.368 |

59,562 |

54,256 |

2,176 |

64,741 |

58,974 |

2,365 |

|||||||||

|

2011 |

27.912 |

62,906 |

55,350 |

2,254 |

66,284 |

58,322 |

2,375 |

|||||||||

|

2012 |

27.848 |

64,129 |

56,190 |

2,303 |

66,202 |

57,938 |

2,377 |

|||||||||

|

2013 |

28.822 |

68,084 |

59,145 |

2,362 |

69,271 |

60,175 |

2,403 |

|||||||||

|

2014 |

28.538 |

68,339 |

58,889 |

2,395 |

68,420 58,959 2,398 2015 28.082 68,525 58,795 2,440 68,525 58,795 2,440 |

58,889 |

2,395 |

|||||||||

Source: Congressional Research Service. For pre-2003 data, U.S. Congress, House Committee on Ways and Means, 2004 Green Book, Background Material and Data on Programs Within the Jurisdiction of the Committee on Ways and Means, 108th Congress, 2nd session, WMCP 108-6, March 2004, pp. 13-41. For 2003 and later data, Internal Revenue Service, Total File, United States, Individual Income and Tax Data, by State and Size of Adjusted Gross Income, 2003 through 2014, expanded unpublished version, Statistics of Income, SOI Tax Stats-Individual Statistical Tables by Size of Adjusted Gross Income, Table 2.5.

Note: Constant 20142015 dollars were computed using the Consumer Price Index for all Urban Consumers (CPI-U).

Table A-2. Average EITC, Number of Returns with EITC Claimed, and Total EITC Benefits for 20142015, by Adjusted Gross Income

|

AGI |

Totals |

No Qualifying Children |

One Qualifying Child |

Two Qualifying Children |

Three or More Qualifying Children |

|

Average Credit |

|||||

|

Less than $5,000 |

$ |

$ |

$ |

$ |

$ |

|

$5,000 to $9,999 |

1,558 |

427 |

2,787 |

3,072 |

3,503 |

|

$10,000 to $14,999 |

2,660 |

202 |

3,254 |

5,028 |

5,648 |

|

$15,000 to $19,999 |

4,048 |

183 |

3,199 |

5,315 |

5,985 |

|

$20,000 to $24,999 |

3,753 |

0 |

2,644 |

4,687 |

5,501 |

|

$25,000 to $29,999 |

2,943 |

0 |

1,934 |

3,731 |

4,551 |

|

$30,000 to $34,999 |

2,088 |

0 |

1,157 |

2,728 |

3,549 |

|

$35,000 to $39,999 |

1,446 |

0 |

565 |

1,821 |

2,611 |

|

$40,000 to $44,999 |

1,047 |

0 |

323 |

925 |

1,694 |

|

$45,000 and higher |

584 |

0 |

0 |

418 |

717 |

|

Totals |

2,395 |

287 |

2,381 |

3,754 |

4,107 |

|

Total Returns with EITC |

|||||

|

Less than $5,000 |

2, |

1, |

491,682 |

201, |

84,107 |

|

$5,000 to $9,999 |

4, |

2, |

1, |

487,921 |

183,865 |

|

$10,000 to $14,999 |

6, |

2, |

1, |

1, |

532,710 |

|

$15,000 to $19,999 |

3, |

321,082 |

1, |

1, |

546,390 |

|

$20,000 to $24,999 |

3,008,698 |

0 |

1, |

1,000,063 |

453,989 |

|

$25,000 to $29,999 |

2, |

0 |

1, |

811,158 |

389,492 |

|

$30,000 to $34,999 |

2, |

0 |

1, |

777,014 |

347,605 |

|

$35,000 to $39,999 |

1, |

0 |

692,988 |

577,388 |

338,624 |

|

$40,000 to $44,999 |

945,503 |

0 |

191,427 |

454,086 |

299,990 |

|

$45,000 and higher |

492,762 |

0 |

0 |

220,167 |

272,595 |

|

Totals |

28, |

7, |

10, |

7, |

3, |

|

Total EITC Claimed ($ in Thousands) |

|||||

|

Less than $5,000 |

$1,394,768 |

409,156 |

571,509 |

314,839 |

152,256 |

|

$5,000 to $9,999 |

7, |

1, |

4, |

1, |

644,096 |

|

$10,000 to $14,999 |

16, |

496,528 |

6, |

6, |

3,008,917 |

|

$15,000 to $19,999 |

15, |

58,671 |

5, |

6,866,382 |

3, |

|

$20,000 to $24,999 |

11, |

1 |

4,107,069 |

4, |

2, |

|

$25,000 to $29,999 |

7, |

0 |

2, |

3, |

1, |

|

$30,000 to $34,999 |

4, |

0 |

1, |

2,119,707 |

1, |

|

$35,000 to $39,999 |

2, |

0 |

391,534 |

1, |

884,106 |

|

$40,000 to $44,999 |

989,895 |

0 |

61,764 |

420,006 |

508,126 |

|

$45,000 and higher |

287,554 |

0 |

0 |

91,987 |

195,567 |

|

Totals |

68, |

2, |

24, |

27, |

14, |

Source: Congressional Research Service, based on data from the U.S. Department of the Treasury, Internal Revenue Services, SOI Tax Stats - Individual Income Tax Returns Publication 1304, Internal Revenue Service, Statistics of Income, SOI Tax Stats-Individual Statistical Tables by Size of Adjusted Gross Income, Table 2.5.

|

State or Area |

Total Returns |

Returns with EITC Claimed |

Percentage of Total Returns with EITC Claimed |

Total EITC Claimed |

Average EITC |

Percent of EITC Refunded |

|

United States |

147,766,770 |

28,233,280 |

|

$ |

$2, |

86. |

|

Alabama |

2, |

529,020 |

25. |

1,444, |

2, |

89.0 |

|

Alaska |

361,130 |

48,620 |

13. |

98,599 |

2, |

88. |

|

Arkansas |

1,223,140 |

310,300 |

25.4 |

794,507 |

2, |

88.4 |

|

Arizona |

2,845,710 |

603,080 |

21.2 |

1,522,532 |

2, |

87.6 |

|

California |

17, |

3, |

19.0 |

7, |

2, |

83. |

|

Colorado |

2, |

377,440 |

14. |

810,024 |

2, |

86.1 |

|

Connecticut |

1, |

231, |

13. |

497,420 |

2, |

86. |

|

Delaware |

443,820 |

77, |

17. |

178,189 |

2, |

90.3 |

|

District of Columbia |

336,950 |

56,590 |

16. |

129,888 |

2, |

86.8 |

|

Florida |

9, |

2, |

23. |

5, |

2, |

84.7 |

|

Georgia |

4, |

1, |

26.0 |

3, |

2, |

86. |

|

Hawaii |

681,840 |

114,020 |

16. |

246,619 |

2,163 |

89.0 |

|

Idaho |

701,990 |

139,650 |

19. |

317,425 |

2, |

87.2 |

|

Illinois |

6, |

1, |

17.2 |

2, |

2, |

85. |

|

Indiana |

3, |

571,260 |

18. |

1, |

2, |

88. |

|

Iowa |

1, |

216,720 |

15.0 |

476,999 |

2, |

88. |

|

Kansas |

1, |

221,190 |

16. |

511,361 |

2, |

89.3 |

|

Kentucky |

1, |

418,880 |

22.1 |

986,209 |

2, |

88.2 |

|

Louisiana |

2,007,830 |

533,130 |

26.6 % |

1, |

2, |

88.1 |

|

Maine |

638,280 |

106,820 |

16. |

217, |

2, |

85.4 |

|

Maryland |

2, |

445,690 |

15.2 |

1, |

2, |

84. |

|

Massachusetts |

3, |

427,330 |

12. |

873,980 |

2, |

87.3 |

|

Michigan |

4, |

844,910 |

18.0 |

2, |

2, |

86. |

|

Minnesota |

2, |

357,410 |

13.3 |

761,404 |

2, |

87. |

|

Mississippi |

1, |

399,570 |

32.1 |

1,128, |

2, |

88. |

|

Missouri |

2, |

535,370 |

19.3 |

1, |

2, |

88. |

|

Montana |

492,010 |

83,200 |

16. |

172,795 |

2, |

87.3 |

|

Nebraska |

889,100 |

139,700 |

15. |

319,361 |

2, |

88. |

|

Nevada |

1, |

260,620 |

19. |

622,817 |

2, |

87. |

|

New Hampshire |

685,010 |

81,730 |

11. |

157,544 |

1, |

85. |

|

New Jersey |

4, |

633,940 |

14. |

1, |

2, |

84. |

|

New Mexico |

911,750 |

220, |

24. |

529,254 |

2, |

89. |

|

New York |

9, |

1, |

19. |

4, |

2, |

83. |

|

North Carolina |

4, |

974,660 |

22.2 |

2, |

2, |

87. |

|

North Dakota |

370,570 |

44, |

11.9 |

91,023 |

2, |

88.3 |

|

Ohio |

5, |

986,380 |

17. |

2, |

2, |

88.3 % |

|

Oklahoma |

1, |

348,000 |

21. |

853,551 |

2, |

87. |

|

Oregon |

1, |

297,650 |

16.3 |

616, |

2, |

87. |

|

Pennsylvania |

6, |

969,860 |

15. |

2, |

2, |

88. |

|

Rhode Island |

521,890 |

88,070 |

16. |

197,398 |

2, |

87. |

|

South Carolina |

2, |

513,350 |

24.2 |

1, |

2, |

88. |

|

South Dakota |

410,920 |

64,620 |

15. |

140, |

2, |

89. |

|

Tennessee |

2, |

674,840 |

23.0 |

1, |

2, |

86. |

|

Texas |

11,992,010 |

2, |

22. |

7, |

2, |

85.3 |

|

Utah |

1, |

204,370 |

16.7 |

471,171 |

2, |

88.1 |

|

Vermont |

322,860 |

46,420 |

14. |

87,885 |

1, |

84. |

|

Virginia |

3, |

641,360 |

16. |

1, |

2, |

87.5 |

|

Washington |

3, |

466,800 |

14.0 |

994,273 |

2, |

88.0 |

|

West Virginia |

|

161,330 |

20. |

357,972 |

2, |

90. |

|

Wisconsin |

2, |

401,440 |

14.3 |

873, |

2, |

88. |

|

Wyoming |

279,930 |

37,520 |

13. |

77,435 |

2, |

89.0 |

|

Other Areas |

718,040 |

23,850 |

3.3 |

52,651 |

2, |

96.2 |

Source: Congressional Research Service, based on data from the U.S. Department of the Treasury, Internal Revenue Service (IRS), Individual Income and Tax Data, by State andInternal Revenue Service, Statistics of Income, SOI Tax Stats-Individual Statistical Tables by Size of Adjusted Gross Income, Table 2.5.

Note: Totals in this table differ slightly from total shown in Table A-2. While the figures in Table A-2 and Table A-3 are both based on data from the IRS, the data in Table A-3 include "substitutes for returns" in which the IRS constructs tax returns for certain nonfilers.

Author Contact Information

Acknowledgments

The authors would like to thank Jeffrey StupakClarissa Gregory, Research Assistant in the Government Finance and TaxationDomestic Social Policy Section, for hisher assistance in updating this report and CRS graphics specialist Jamie Hutchinson for creating the original figures in this report.

Footnotes

| 1. |

The original title of the law, the Tax Cuts and Jobs Act, was stricken before final passage because it violated what is known as the Byrd rule, a procedural rule that can be raised in the Senate when bills, like the tax bill, are considered under the process of reconciliation. The actual title of the law is "To provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018." For more information on the Byrd rule, see CRS Report RL30862, The Budget Reconciliation Process: The Senate's "Byrd Rule", by [author name scrubbed]

For more information on the changes made to the tax code by P.L. 115-97, see CRS Report R45092, The 2017 Tax Revision (P.L. 115-97): Comparison to 2017 Tax Law, coordinated by [author name scrubbed] and [author name scrubbed]. For more information, see Michael Ng and David Wessel, Up Front | The Hutchins Center Explains: The Chained CPI, The Brookings Institution, December 7, 2017, https://www.brookings.edu/blog/up-front/2017/12/07/the-hutchins-center-explains-the-chained-cpi/. |

||||||

|

There is an additional filing status that may claim the EITC—"qualifying widow(er) with dependent child." Generally, tax filers may file their tax return as married filing jointly in the year their spouse died. A tax filer may be eligible to use qualifying widow(er) with dependent child as his or her filing status for two years following the year his or her spouse died. This filing status entitles the tax filer to use joint return tax rates and the highest standard deduction amount (if he or she does not itemize deductions). It does not entitle the tax filer to file a joint return. The tax filer calculates the EITC using the formula for other unmarried tax filing statuses (head of household and single). The eligibility rules for this filing status can be found on page 10 of IRS Publication 501, available at http://www.irs.gov/pub/irs-pdf/p501.pdf. |

|||||||

|

The |

|||||||

|

For more information, see https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/special-eitc-rules. |

|||||||

|

See Internal Revenue Code (IRC) §32(c)(1)(C) and http://www.irs.gov/Individuals/EITC,-Earned-Income-Tax-Credit,-Questions-and-Answers. |

|||||||

| 6. |

For more information on Social Security numbers valid for work purposes, see SSA, Social Security Number for Noncitizens, at https://www.socialsecurity.gov/pubs/EN-05-10096.pdf; CRS Report R43840, Federal Income Taxes and Noncitizens: Frequently Asked Questions, by [author name scrubbed] and [author name scrubbed]; CRS Report R44290, Legal Authority for Aliens to Claim Refundable Tax Credits: In Brief, by [author name scrubbed]. |

||||||

| 7. |

Nonresident aliens may be eligible to claim the credit if they are married to a U.S. citizen or resident alien, make the election to be treated as a resident alien, and file a joint return. For more information on the tax treatment of nonresident aliens, see CRS Report RS21732, Federal Taxation of Aliens Working in the United States, by [author name scrubbed]; CRS Report R43840, Federal Income Taxes and Noncitizens: Frequently Asked Questions, by [author name scrubbed] and [author name scrubbed]. |

||||||

|

If an individual is the qualifying child for the purposes of the EITC of another person, that individual cannot themselves claim the EITC. For more information, see http://www.irs.gov/Individuals/EITC,-Earned-Income-Tax-Credit,-Questions-and-Answers. |

|||||||

|

If placed by an authorized agency or court order. |

|||||||

|

Qualifying children who reside with a servicemember who is stationed outside the United States while serving on extended active duty with the U.S. Armed Forces are considered to reside in the United States for the purposes of the EITC. |

|||||||

|

Currently, there is no |

|||||||

|

The tie-breaker rules are: (1) if both tax filers are parents of the child, the parent with whom the child resided the longest during the year claims the child for the EITC; (2) if the child resided with each parent for the same amount of time during the year, the parent with the highest adjusted gross income (AGI) claims the child for the EITC; (3) if only one tax filer is the parent of the child, the tax filer who is the parent claims the child for the EITC; and (4) if neither tax filer is the parent of the child, the tax filer with the highest AGI claims the child for the EITC. |

|||||||

|

See IRC §32(k). |

|||||||

| 14. | For more information on Social Security numbers valid for work purposes, see SSA, Social Security Number for Noncitizens, at https://www.socialsecurity.gov/pubs/EN-05-10096.pdf; CRS Report R43840, Federal Income Taxes and Noncitizens: Frequently Asked Questions, by [author name scrubbed] and [author name scrubbed]; CRS Report R44290, Legal Authority for Aliens to Claim Refundable Tax Credits: In Brief, by [author name scrubbed]. See IRC §32(m). Nonresident aliens may be eligible to claim the credit if they are married to a U.S. citizen or resident alien, make the election to be treated as a resident alien, and file a joint return. For more information on the tax treatment of nonresident aliens, see CRS Report RS21732, Federal Taxation of Aliens Working in the United States, by [author name scrubbed] (available to congressional clients upon request); CRS Report R43840, Federal Income Taxes and Noncitizens: Frequently Asked Questions, by [author name scrubbed] and [author name scrubbed]. |

||||||

|

Before 2011, any persons with a qualified child eligible for the EITC could elect to receive advance payment of the credit through the employer's payroll withholding system by filing an eligibility certificate (Form W-5) with his or her employer. The option was little used and eliminated by P.L. 111-226. |

|||||||

|

For more information, see IRS Statistics of Income, Table 2.5 at http://www.irs.gov/uac/SOI-Tax-Stats—Individual-Statistical-Tables-by-Size-of-Adjusted-Gross-Income. |

|||||||

|

These taxes include the regular income tax and alternative income tax, as well as self-employment taxes. Less common taxes, like unreported Social Security and Medicare taxes and certain taxes on IRAs, are also included. For an example of these taxes, see lines 57 through 62 on the 2016 IRS Form 1040, https://www.irs.gov/pub/irs-pdf/f1040.pdf. |

|||||||

|

The Protecting Americans from Tax Hikes (PATH) Act (Division Q of P.L. 114-113) prevents a tax filer from claiming the EITC for any year in which the filer did not have a Social Security number (SSN) on or before the due date of the tax return for that year. This provision prevents a filer who obtains an SSN from retroactively claiming the EITC for any prior open tax years (generally three years) when the filer did not have an SSN at the time those years' returns were due.

|

|||||||

|

This was effective beginning with returns filed in 2017. Section 201 of the Protecting Americans from Tax Hikes (PATH) Act (Division Q of P.L. 114-113). |

|||||||

|

For more information on the nonrefundable (and refundable) portion of the child tax credit, see CRS Report R41873, The Child Tax Credit: Current Law and Legislative History, by [author name scrubbed]. |

|||||||

|

In contrast, if the precontribution income places them in the plateau or the phase-in range, decreasing their earned income by making certain pretax savings contributions may either have no impact or result in a smaller credit. |

|||||||

|

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (P.L. 111-312) included a provision which made tax refunds, including those resulting from the EITC, disregarded in the administration of federal programs and federally assisted programs. At the end of 2012, this provision was made permanent by the American Taxpayer Relief Act of 2012 (P.L. 112-240). |

|||||||

|

U.S. Congress, Senate Committee on Finance, Tax Reduction Act of 1975, Report to Accompany H.R. 2166, 94th Cong., 1st sess., March 17, 1975, S. |

|||||||

|

The increase in the value of the credit in 2009 is likely due to the changes made by the American Recovery and Reinvestment Act of 2009 (ARRA, P.L. 111-5) which expanded the credit for families with three or more children and increased marriage penalty relief. |