Introduction

Social Security, which paid about $1,048 billion in benefits in 2019, is the largest program in the federal budget in terms of outlays. There are currently about 64 million Social Security beneficiaries.1

Most Social Security beneficiaries are retired or disabled workers, whose monthly benefits depend on their past earnings, their age, and other factors. Benefits are also paid to workers' dependents and survivors, based on the earnings of the workers upon whose work record they claim.

Social Security has a significant impact on beneficiaries, both young and old, in terms of income support and poverty reduction. Under current law, Social Security's revenues are projected to be insufficient to pay full scheduled benefits after 2035. For both of those reasons, Social Security is of ongoing interest to policymakers. Most proposals to change Social Security outlays would change the benefit computation rules. Evaluating such proposals requires an understanding of how benefits are computed under current law.

Eligibility

A person who has a sufficient history of earnings in employment subject to Social Security payroll taxes becomes insured for Social Security, which makes the worker and qualified dependents eligible for benefits. Insured status is based on the number of quarters of coverage (QCs) earned.2 In 2020, a worker earns one QC for each $1,410 of earnings, and a worker may earn up to four QCs per calendar year. The amount needed for a QC increases annually by the growth in average earnings in the economy, as measured by Social Security's average wage index.3

To be eligible for most benefits, workers must be fully insured, which requires one QC for each year elapsed after the worker turns 21 years old, with a minimum of 6 QCs and a maximum of 40 QCs. A worker is first eligible for Social Security retirement benefits at 62, so to be eligible for retirement benefits, a worker must generally have worked for 10 years. Workers are permanently insured when they are fully insured and will not lose fully insured status when they stop working under covered employment, for example, if a worker has the maximum 40 QCs.

Benefits may be paid to eligible survivors of workers who were fully insured at the time of death. Some dependents are also eligible if the deceased worker was currently insured, which requires earning six QCs in the 13 quarters ending with the quarter of death.

To be eligible for disability benefits, workers must also satisfy a recency of work requirement. Workers aged 31 or older must have earned 20 QCs in the 10 years before becoming disabled. Fewer QCs are required for younger workers.4

In the case of workers having work history in multiple countries, international totalization agreements allow workers who divide their careers between the United States and certain countries to fill gaps in Social Security coverage by combining work credits under each country's system to qualify for benefits under one or both systems.5

Average Indexed Monthly Earnings

The first step of computing a benefit is determining a worker's average indexed monthly earnings (AIME), a measure of a worker's past earnings.

Wage Indexing

Rather than using the amounts earned in past years directly, the AIME computation process first updates past earnings to account for growth in overall economy-wide earnings. That is done by increasing each year of a worker's taxable earnings after 1950 by the growth in average earnings in the economy, as measured by the national average wage index, from the year of work until two years before eligibility for benefits, which for retired workers is at 62.6 For example, the Social Security average wage grew from $32,155 in 2000 to $41,674 in 2010. So if a worker earned $20,000 in 2000 and turned 60 in 2010, the indexed wage for 2000 would be $20,000 x ($41,674/$32,155), or $25,921. Earnings from later years—for retired workers, at ages 60 and above—are not indexed.

Averaging Indexed Earnings

For retired workers, the AIME equals the average of the 35 highest years of indexed earnings, divided by 12 (to change from an annual to a monthly measure). Those years of earnings are known as computation years. If the person worked fewer than 35 years in employment subject to Social Security payroll taxes, the computation includes some years of zero earnings.

In the case of workers who die before turning 62 years old, the number of computation years is generally reduced below 35 by the number of years until he or she would have reached 62. For example, the AIME for a worker who died at 61 is based on 34 computation years.

For disabled workers, the number of computation years depends primarily on the age at which they become disabled, increasing from 2 years for those aged 24 or younger to 35 years for those aged 62 or older.7

Primary Insurance Amount

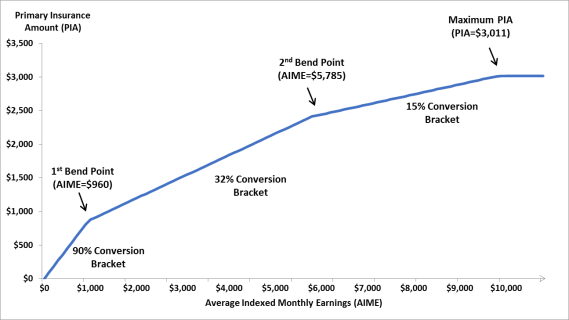

The next step in determining a benefit is to compute the primary insurance amount (PIA) by applying a benefit formula to the AIME.

First, the AIME is sectioned into three brackets (or segments) of earnings, which are divided by dollar amounts known as bend points. In 2020, the bend points are $960 and $5,785. Those amounts are indexed to the national average wage index, so they generally increase each year.

Three factors, which are fixed by law at 90%, 32%, and 15%, are applied to the three brackets of AIME. For workers with AIMEs of $960 or less in 2020, the PIA is 90% of the AIME. Because the other two factors are lower, that share declines as AIMEs increase, which makes the benefit formula progressive. For workers who become eligible for retirement benefits, become disabled, or die in 2020, the PIA is determined as shown in the example in Table 1 and in Figure 1.

Benefits are based on covered earnings. Earnings up to the maximum taxable amount ($137,700 in 2020) are subject to the Social Security payroll tax. If a worker earns the maximum taxable earnings in every year of a full work history, becomes eligible in 2020, and claims at full retirement age (FRA), the maximum PIA is $3,011.8

Table 1. Computation of a Worker's Primary Insurance Amount (PIA) in 2020 Based on an Illustrative Average Indexed Monthly Earnings (AIME) of $6,000

|

Factors |

Three Brackets of AIME |

PIA for Worker with an Illustrative AIME of $6,000 |

||

|

90% |

first $960 of AIME, plus |

|

||

|

32% |

AIME over $960 and through $5,785, plus |

|

||

|

15% |

AIME over $5,785 |

|

||

|

Total: Worker's PIA (by law, rounded down to nearest 10 cents) |

|

|||

Source: Congressional Research Service (CRS).

Note: The bend point shown in the table apply to workers who first become eligible in 2020.

|

Figure 1. Computation of a Worker's Primary Insurance Amount (PIA) in 2020 |

|

|

Source: Congressional Research Service (CRS). |

Wage Indexing Results in Stable Replacement Rates

In the AIME computation, earnings are indexed to the average wage index, and the bend points in the benefit formula are indexed to growth in the average wage index. As a result, replacement rates—the portion of earnings that benefits replace—remain generally stable. That is, from year to year, the average benefits that new beneficiaries receive increase at approximately the same rate as average earnings in the economy.

Cost-of-Living Adjustment

A cost-of-living adjustment (COLA) is applied to the benefit beginning in the second year of eligibility, which for retired workers is age 63. The COLA applies even if a worker has not yet begun to receive benefits. The COLA usually equals the growth in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of one calendar year to the third quarter of the next year. Beneficiaries will receive a COLA of 1.6% for benefits paid in January 2020.9

How Timing of Benefit Claim Affects Benefit Levels

Full Retirement Age

The full retirement age (FRA, also called the normal retirement age) is the age at which a worker can receive the full PIA, increased by any COLAs. The FRA was 65 for people born before 1938, but the Social Security Amendments of 1983 (P.L. 98-21) raised the FRA for those born later, as shown in Table 2.

|

Year of Birth |

Year Turning 62 |

Full Retirement Age |

|

1937 or earlier |

1999 or earlier |

65 |

|

1938 |

2000 |

65 and 2 months |

|

1939 |

2001 |

65 and 4 months |

|

1940 |

2002 |

65 and 6 months |

|

1941 |

2003 |

65 and 8 months |

|

1942 |

2004 |

65 and 10 months |

|

1943-1954 |

2005-2016 |

66 |

|

1955 |

2017 |

66 and 2 months |

|

1956 |

2018 |

66 and 4 months |

|

1957 |

2019 |

66 and 6 months |

|

1958 |

2020 |

66 and 8 months |

|

1959 |

2021 |

66 and 10 months |

|

1960 or later |

2022 or later |

67 |

Source: Social Security Administration, Office of the Chief Actuary, "Normal Retirement Age," at http://www.ssa.gov/OACT/progdata/nra.html.

Adjustments for Early and Late Benefit Claim

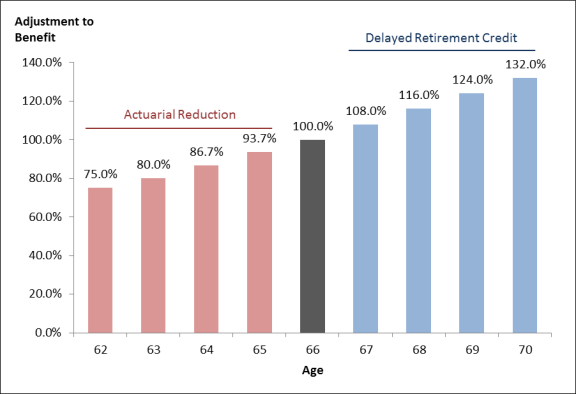

Retired workers may claim benefits when they turn 62 years old, but the longer that they wait, the higher their monthly benefit. The higher monthly benefit is intended to offset the fewer number of payments that people who delay claim will receive over their lifetimes, so that the total value of lifetime benefits is approximately the same regardless of when they claim based on average life expectancy.

The permanent reduction in monthly benefits that applies to people who claim before the FRA is an actuarial reduction. It equals 6⅔% per year for the first three years of early claim and 5% for additional years.10

The permanent increase in monthly benefits that applies to those who claim after the FRA is called the delayed retirement credit. For people born in 1943 and later, that credit is 8% for each year of delayed claim after the FRA, up to age 70.11

For people with an FRA of 66, therefore, monthly benefits are 75% of the PIA for those who claim benefits at the age of 62 and 132% of the PIA for people who wait until the age of 70 to claim (see Figure 2). Because people who claim earlier receive more payments over a lifetime, the overall effect of claiming at different ages depends on how long the beneficiary lives. For example, someone who dies at 71 years old would be better off claiming early, but someone who survives to 95 would be better off claiming late.

|

Figure 2. Monthly Retirement Benefit by Claim Age Percentage of Primary Insurance Amount for People with a Full Retirement Age of 66 |

|

|

Source: CRS. |

An increase in the FRA can result in lower benefits in two ways. First, monthly benefits will be different for individuals who have identical work histories and the same age of claiming benefits, but who have different FRAs. For example, someone with an FRA of 66 and who claims at age 62 will receive a monthly benefit equal to 75% of the PIA. For someone with an FRA of 67, claiming at 62 will result in a monthly benefit that is 70% of the PIA. Depending on the claim age, the scheduled increase in the FRA from 66 to 67 will reduce monthly benefits by between 6.1% and 7.7%. Second, lifetime benefits will be different for workers who have identical work histories and identical age of death, but different FRAs. For example, consider two workers who have FRAs of 65 and 67, respectively, both of whom claim at their FRA, and thus receive identical monthly benefits. If both workers die at age 75, the worker with an FRA of 65 will have received monthly benefits for 10 years, compared with the worker with an FRA of 67, who will have received monthly benefits for 8 years.

Dependent Benefits

Social Security benefits are payable to the spouse, divorced spouse, or dependent child of a retired or disabled worker and to the widow(er), divorced widow(er), dependent child, or parent of a deceased worker.12 When dependent beneficiaries also earned worker benefits, they receive the larger of the worker or the dependent benefit.

A spouse's base benefit (that is, before any adjustments) equals 50% of the worker's PIA. A widow(er)'s base benefit is 100% of the worker's PIA. The base benefit for children of a retired or disabled worker is 50% of the worker's PIA, and the base benefit for children of deceased workers is 75% of the worker's PIA.

Other Adjustments to Benefits

Other benefit adjustments apply in certain situations, notably

- the windfall elimination provision (WEP), which reduces benefits for worker beneficiaries who have pensions from employment that was not subject to Social Security payroll taxes;13

- the government pension offset (GPO), which reduces Social Security spousal benefits paid to people who have pensions from employment that was not subject to Social Security payroll taxes;14

- the retirement earnings test (RET), which results in a withholding of monthly Social Security benefits paid to beneficiaries who are younger than FRA and have earnings above a certain level;15 and

- the maximum family benefit, which limits the amount of benefits payable to a family based on a worker's record.16

In some cases, a portion of Social Security benefits may be subject to federal income tax. Taxation is not a benefit adjustment, but it does affect the net income of beneficiaries. For additional information, see CRS Report RL32552, Social Security: Taxation of Benefits.