Introduction

Federal aid to highways is provided through highway programs administered by the Federal Highway Administration (FHWA). These programs and activities are authorized as part of multiyear surface transportation reauthorization acts. The Fixing America's Surface Transportation Act (FAST Act; P.L. 114-94) authorized federal highway spending from FY2016 through September 30, 2020. This report examines the major highway issues Congress will likely consider during reauthorization.1

Background

There are over 4 million miles of public roads in the United States, of which roughly 25% are eligible for federal aid. These eligible roads, designated federal-aid highways, include all of the nation's major roads. Federal highway funds generally cannot be spent on local roads, neighborhood streets, or minor rural collectors.

The federal government provides funds to the states and territories for the building and improvement of eligible roads under the Federal-Aid Highway Program. The major characteristics of this program have been constant since the early 1920s. Most funds are apportioned to the states by formulas established in law. State departments of transportation largely determine which projects are funded, award the contracts, and oversee project development and construction. The states are required to pay 20% of the cost of non-Interstate System road projects and 10% for Interstate System projects. Federal assistance is focused on construction, and may not be used to fund operating costs or routine maintenance activities.

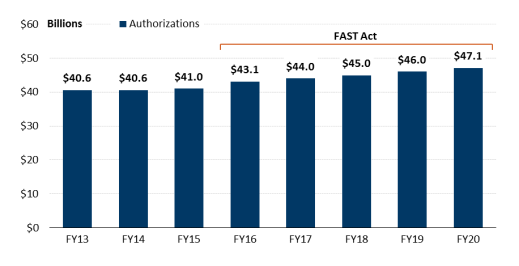

The five-year FAST Act authorized a total of $225 billion for highways from FY2016 to FY2020. It provided for modest annual increases in federal highway spending over that period (Figure 1).

|

Figure 1. Federal-Aid Highway Funding: FY2013-FY2020 (current dollars) |

|

|

Source: Federal Highway Administration. Note: Includes transportation research in addition to highway programs. |

Apportioned (Formula) and Allocated (Discretionary) Programs

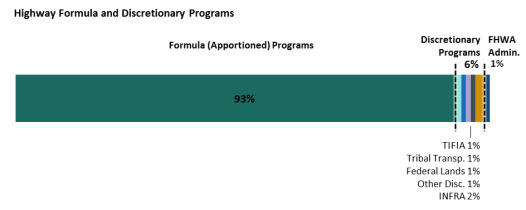

Apportionment is the distribution of funds among the states by statutory formula. Under the FAST Act, roughly 93% of federal highway funds were apportioned to the states (Figure 2). The remaining sums were allocated for roads on federally owned lands or Indian reservations, for discretionary highway grants awarded by the U.S. Department of Transportation (DOT), and for FHWA administrative expenses.

|

|

Source: Federal Highway Administration. |

Historically, many discretionary programs were established by Congress to target specific policy objectives, such as promoting bridge construction. However, from the late 1990s until 2011, nearly all competitive grant program funds were earmarked, that is, directed to projects specified by Congress in authorization or appropriations acts. Earmarks have not been permitted since 2011.2

Formulas and Apportionments

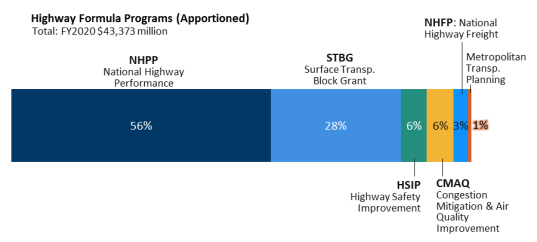

The apportioned programs within the Federal-Aid Highway Program include five "core" programs plus the Metropolitan Planning Program. The core programs are the National Highway Performance Program (NHPP), the Surface Transportation Block Grant Program (STBG), the Highway Safety Improvement Program (HSIP), the Congestion Mitigation and Air Quality Improvement Program (CMAQ), and the National Highway Freight Program (NHFP). The FAST Act does not use separate formulas to determine each state's apportionments under each core program.3 Instead, all the formula programs under the FAST Act are funded from a single annual authorization. From this amount, every state receives a single gross apportionment that is calculated based on the state's share of the FY2015 apportionments.4 Each state is then guaranteed that its apportionment represents at least a return of 95 cents for every dollar the state contributed to the highway account of the Highway Trust Fund (HTF), the mechanism through which formula funding is distributed to the states. Each state's total apportionment is then divided among the five formula programs and the Metropolitan Planning Program according to statute. Figure 3 charts the nationwide outcome of the distribution among the programs.

|

|

Source: Federal Highway Administration. |

Selected Highway Reauthorization Issues

Funding

The FAST Act provided an annual average of $45 billion for highways, about 10% more (unadjusted for inflation) than the annual average under the previous authorization bill, the two-year Moving Ahead for Progress in the 21st Century Act (MAP-21; P.L. 112-141).The America's Transportation Infrastructure Act of 2019 (S. 2302), reported by the Senate Environment and Public Works Committee on August 1, 2019, would provide a roughly 27% increase above the FAST Act authorizations.

With the United States building few entirely new highways, the condition of existing highway infrastructure is a key issue in determining funding needs. FHWA's most recent biennial Conditions and Performance (C&P) report, drawing on FY2014 data, showed a mixed picture of the federal-aid system: the share of vehicle miles traveled (VMT) on pavements with good ride quality rose from 44.2% in 2004 to 47.0% in 2014, but the share of VMT on pavements with poor ride quality also increased, from 15.1% to 17.3%, over that period. The Interstate Highways were the road category in the best condition.

Based on FY2014 data, the C&P report found that annual spending, $105.4 billion on all public roads from all sources of government, was more than sufficient to sustain the system condition and performance at the current level through 2034. Given the subsequent spending increases under the FAST Act, highway and bridge conditions may be better today than reflected in the FY2014 data.5

The C&P report also estimated the cost of completing all proposed work on federal-aid highways for which the benefits are expected to exceed the costs. The report found that annual spending by all levels of government would need to be roughly 30% higher than the 2014 level through 2034 if all such improvements were to be funded.6

Highway Trust Fund Issues

Rather than appropriating funds annually, Congress has funded federal-aid highway programs through the HTF. The HTF is able to receive revenue from dedicated taxes and spend it on highways and public transportation prior to an appropriation; a mechanism called the obligation limit, included in the authorization act and appropriations acts, caps the amount of highway funding FHWA can promise the states in any year. About 85%-90% of the tax revenues that flow into the HTF are from an 18.3 cents-per-gallon tax on gasoline and a 24.3 cents-per-gallon tax on diesel fuel, with the remainder coming mainly from taxes on sales of trucks and truck tires as well as a heavy vehicle use tax.

The HTF has two separate accounts, one for highway programs and the other for public transportation. The highway account, which funds the Federal-Aid Highway Program, much of the budget of the National Highway Traffic Safety Administration, and the entire budget of the Federal Motor Carrier Safety Administration, receives 15.4 cents per gallon from the gasoline tax and 21.4 cents per gallon from the diesel fuel tax, as well as all of the revenue from the taxes imposed on trucks and truck use.7 The reliance of the HTF on the gasoline and diesel taxes has become problematic because tax receipts do not increase with inflation in highway construction costs or with the price of fuel. The rates have not been increased since 1993. In 2018 a gasoline tax of approximately 45 cents per gallon would have been needed to equal the purchasing power of the 18.3-cents-per-gallon gasoline tax in 1998.8

In addition, sluggish growth in vehicle travel and improved vehicle efficiency have depressed the growth of gallons consumed, further constraining revenues. Since 2008, Congress has transferred nearly $144 billion to the HTF ($114.7 billion to the highway account alone) from the Treasury general fund and other sources in order to fill the gap between the tax revenue flowing into the fund and the outlays Congress has authorized. Despite these transfers, without a reduction in the size of the surface transportation programs, an increase in revenues, or further general fund transfers, the highway account balance in the HTF is projected to be close to zero in the first month of FY2022. At that point, FHWA would likely have to delay payments to state departments of transportation for completed work.9

The closures and stay-at-home orders implemented in response to the COVID-19 pandemic may make the HTF's funding shortfall more severe. As many employers closed or shifted to telework and fewer Americans drove to work, gasoline tax revenues will likely fall below projections. If states continue road projects as planned, the highway account balance could approach zero sooner than previously expected unless Congress provides additional funds.

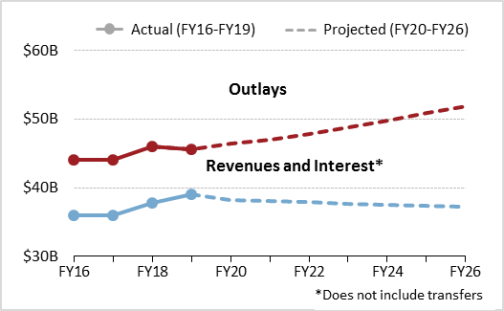

|

Figure 4. Projected HTF Highway Account Revenues and Outlays (nominal dollars in billions) |

|

|

Source: Congressional Budget Office. Highway Trust Fund Accounts, March 2020 Baseline. |

The Congressional Budget Office (CBO) projects that HTF highway account outlays (spending) will continue to outpace revenues through F2026 (Figure 4) under current law. This projection, made prior to the COVID-19-related shutdowns, estimates that in funding a five five-year reauthorization beginning in FY2021 Congress faces a projected highway account shortfall of $46.5 billion. This is the amount of additional revenue Congress would need to provide to the HTF, whether from increased taxes, transfers from the general fund, or other sources, in order to avoid reducing the scope of the highway program.10 These are the amounts that the Senate Finance Committee and the House Ways and Means Committee would have to deal with if Congress decides to fund reauthorization at current levels plus expected inflation. CBO's March 2020 projection did not consider the impact of COVID-19 on HTF revenues and spending.

Consequently, a major reauthorization issue is assuring that the HTF has sufficient resources over the life of the act to pay for the authorizations Congress provides. The options include the following:

Continue Transfers from the General Fund

Since 2008 Congress has had a de facto policy of dealing with the HTF shortfall via transfers, mostly from the Treasury general fund, weakening the long-standing link between highway user revenues and the construction and maintenance of highways. Congress could continue this policy in a reauthorization act or make the policy permanent.11 In the recent past, a rule of the House of Representatives has required Congress to identify "offsets" in the form of other revenues or spending reductions equal to the amounts transferred from the general fund to the HTF. This requirement has not been a House rule since January 2019.12

Reduce Spending from the HTF

Congress could reduce spending on the Federal-Aid Highway Program. To bring outlays into line with anticipated revenues, the needed reduction would be roughly 25%. Rather than reducing highway outlays, Congress could eliminate the HTF's mass transit account and use all HTF revenues for highway purposes only, leaving public transportation to be funded entirely from the general fund. However, even if all HTF revenues were dedicated to highways, the HTF is projected to face annual shortfalls beginning in FY2024. According to CBO, annual HTF revenue is projected to be almost $20 billion less than the cost of maintaining the present level of highway spending, adjusted for inflation, in FY2026, even if no HTF money goes to public transportation.13

Congress could make a major reduction in federal funding by devolving responsibility for highways to the states and reducing federal motor fuel and truck taxes accordingly. States could then raise their own highway revenues or reduce spending as they see fit. The challenge of making these adjustments would vary greatly from state to state.14 Devolution would have significant federal front-end costs, as the federal government would remain obligated to reimburse the states for highway projects committed to in previous years.

Increase Tax Revenue Dedicated to the HTF

Although there is a wide variety of revenue sources that could be used to provide revenues to the HTF, the four that have received significant interest in Congress in recent years are: raising the gasoline and diesel tax rates; imposing a vehicle miles traveled (VMT) charge; imposing a carbon tax; and taxing electric vehicles.

- The gasoline and diesel taxes could be raised enough to make up for loss of purchasing power and then be adjusted annually for inflation and fuel efficiency. Based upon the current level of fuel consumption, an initial increase of fuel taxes in the range of 10 cents to 15 cents per gallon would be required to fund highway and public transportation programs at their current levels, adjusted for anticipated inflation.

- Electric vehicles (EVs), which currently do not contribute to the HTF, could be charged for road use. Finding an efficient way for the federal government to tax EVs presents a challenge, as it does not collect information about their ownership or use. Some recent proposals would use the personal income tax to reach EV owners, rather than taxing the vehicles based on use.15 Approximately 1.5 million EVs are currently in use, according to the Edison Electric Institute, so an annual fee approximating the roughly $80 in federal fuel taxes paid for the average passenger vehicle each year would raise comparatively little revenue over the life of a five-year reauthorization act.

- Charging vehicle owners for each mile of travel has been discussed for many years as an alternative to the motor fuel taxes.16 However, a VMT charge would have relatively high collection and enforcement costs (estimates range from 5% to 13% of collections) and the administrative challenge of collecting the charge from roughly 268 million vehicles.17 Setting and adjusting VMT rates would likely be as controversial as increasing motor fuel taxes. Imposing a VMT on heavy trucks only,18 as has been done in Germany, might be less onerous to implement because it would involve a much smaller number of collection points. A truck-only VMT concept has already run into stiff opposition from trucking interests.19 A national VMT on heavy trucks could also face tax administrative issues. The payments to Toll Collect, the contractor that collects Germany's truck VMT charge, are estimated to be as high as 13% of annual revenues.20

- A carbon tax could be assessed on emissions of carbon dioxide and other greenhouse gases,21 with a share of the revenue dedicated to federal transportation programs. In December 2019, CBO estimated that a carbon tax of $25 per metric ton would increase federal revenues by $1.1 trillion between 2019 and 2028.The effect on the HTF would depend on the design of the tax and how much of the revenue would be reserved for the HTF.

Tolling

Federal law permits the vast majority of roads in the United States to be converted to toll roads.22 However, the law bans the tolling of existing Interstate System highway lane capacity. For an existing road or bridge to be converted to a toll facility, it must be reconstructed or replaced. FHWA does not regulate toll rates, but it does enforce statutory limitations on the use of toll revenues. In general, these limitations require that a toll facility's revenues be spent on the toll facility.23

All revenue from tolls flows to the state or local agencies or private entities that operate tolled facilities; the federal government does not collect any revenue from tolls. While tolls may be an effective way of financing specific facilities—especially major roads, bridges, or tunnels that are located such that the tolls are difficult to evade—they may not be cost-effective in areas with low population densities.24 However, a major expansion of tolling might reduce the need for federal expenditures on roads.

Within the context of surface transportation reauthorization, there are several approaches to tolling that Congress could consider:

- allowing states to toll existing Interstate Highway lane capacity under certain circumstances, such as following major capacity expansion;

- permitting or prohibiting toll schedules that favor in-state vehicles or that toll only trucks;

- regulating rate setting under certain or all conditions; and

- expanding or restricting states' ability to use toll revenue to substitute for the non-federal share of federal-aid highway projects.

State Versus Congressional Discretion

A perennial question in highway reauthorization is how much of the funding should be distributed by formula to the states and how much should be distributed at the discretion of DOT. Prior to the ban on congressional earmarking in FY2011 virtually all of the discretionary program funding was earmarked by Congress.25 This, in effect, meant that the project spending decisions for the discretionary funds were under the direct control of Members of Congress. Under the earmarking ban, discretionary program project awards are selected by DOT under criteria set in the legislative language establishing the program. Although this congressional influence over project selection is not as direct as earmarking, Congress exercises more control over the use of discretionary funds than over the core program formula funds, which are under the control of the states.

In reauthorization, Congress could increase the share of highway funding that is distributed by formula, diminishing the role of discretionary programs, or expand discretionary programs rather than formula funding. Recent surface transportation bills have reduced the number of discretionary programs, but Congress could choose to create new ones to address specific issues, for example, bridge conditions.

Maintenance of Effort

Studies have indicated that large increases in federal highway spending can lead to a substitution of federal funds for state spending on highways.26 The American Recovery and Reinvestment Act of 2009 (ARRA; P.L. 111-5), the stimulus bill enacted in the midst of the 2007-2009 financial crisis, contained a "maintenance of effort" provision requiring the governor of a state receiving stimulus funds to certify that the state would maintain its spending for specific purposes, including transportation infrastructure, in return for greater federal funding. A maintenance of effort requirement could be included in FAST Act reauthorization, especially if the bill provides a large increase in highway funding. However, declines in states' revenue resulting from employer closures due to the COVID-19 pandemic could make it more challenging for states to maintain spending levels.

Formula Distribution/State Equity Issues

Because the formula distributions in both the FAST Act and MAP-21 were based on the apportionment of the federal-aid highway formula programs to the states in the last year of the previous authorization bill, the relative distribution of funds among the states is basically the same as it was in 2009.27 It has not been adjusted for population growth, internal migration, highway and bridge infrastructure growth, or traffic growth.

Defining the formula in this way carries over the "equity" adjustments made in the Safe, Accountable, Flexible, Efficient Transportation Equity Act—A Legacy for Users (SAFETEA; P.L. 109-59), enacted in 2005. These adjustments ensured that each state received formula funds equal to at least a specified percentage of the amount of motor fuel taxes its drivers paid into the highway account of the HTF. By effectively carrying over the equity redistribution, the current funding formula minimizes debates over the fairness of the distribution to individual states.

In reauthorization, Congress could continue to retain a formula based on the previous distribution, or could replace it with a new formula paradigm that might incorporate factors intended to achieve specific policy goals. In the past, funding for individual highway programs was apportioned to the states using such formula factors as the ratio of federal-aid highway lane miles or vehicle miles traveled to the national total.

Highway Bridge Improvement

The FAST Act did not authorize a stand-alone highway bridge program. Instead, bridge improvements under the Fast Act are funded primarily via the NHPP and STBG based on states' priorities.28 As of December 31, 2018, of the 616,096 bridges in the U.S. National Bridge Inventory, 47,045 (7.6%) were in poor condition. This number has been declining for many years, but there is still a significant backlog of bridges awaiting major repairs or replacement. Should Congress wish to accelerate the reduction in the number of bridges in poor condition through the reauthorization process it could create a stand-alone bridge program. If this were a formula program, the states would select the projects; if it were a discretionary program, project choices would likely be made by DOT.

Another highway bridge issue is how much federal bridge spending should be dedicated to bridges off the federal-aid highway network. Many of these are rural county-owned bridges. Under the FAST Act, each state must devote at least 15% of the amounts it received under the Highway Bridge Program in FY2009 to bridges. This amount is taken from the state's STBG funds. If it wishes to give priority to repairing rural bridges, Congress could raise the states' minimum spending level or could dedicate a specific amount to rural bridge projects.

Current law penalizes states whose structurally deficient bridge deck area on the National Highway System,29 a network of 220,169 road-miles, exceeds 10% of its total National Highway System bridge deck area for three years in a row. In such a case, the state must devote NHPP funds equal to 50% of the state's FY2009 Highway Bridge Program apportionment to improve bridge conditions until the deck area of structurally deficient bridges falls to 10% or below. Congress could increase the penalty to encourage more spending of NHPP funds on bridges or eliminate the penalty and leave the bridge spending of NHPP funds entirely up to the states.

When state officials determine that a bridge is unsafe, they are to close it to traffic immediately. The actual closing of a bridge is usually done by the state, but in some states closures are under the authority of county commissioners. The recent failure of local officials in Mississippi to close unsafe bridges until the state was threatened with the withholding of federal funds suggests that unsafe bridge closures do not always happen immediately.30 Congress may wish to consider the safety of bridges not directly under the control of the states in reauthorization.

Freight Issues

The FAST Act created two new programs to facilitate highway freight movement. The National Highway Freight Program (NHFP) is a formula program that provided up to $1.5 billion annually to the states for highway components designated as being especially important to freight movement. Having a separate freight formula program helps states concentrate funding for projects on freight routes.

The FAST Act also created a discretionary grant program, the Nationally Significant Freight and Highway Projects Program, now called Infrastructure for Rebuilding America (INFRA), with funding of $1 billion in FY2020. INFRA discretionary grants are mostly for relatively large projects to enhance freight movement. They may be applied for by virtually any government entity. The program has received applications for far more funding than has been authorized. Despite the program's popularity, DOT has been criticized for a lack of transparency in the selection process and for selecting projects that do not have the highest cost/benefit ratios.31

Given the popularity of these programs, the likely reauthorization issues are the funding levels, eligibility changes, and, in the case of INFRA, oversight of the project selection process. If Congress wishes to allocate additional funding to improve freight movement, it would need to determine the share that would be distributed under the NHFP formula for spending at the discretion of the states versus the funding dedicated to INFRA and administered by DOT. Although the National Freight Network is vast, the worst congestion on freight routes occurs in a limited number of locations, mostly around Interstate Highway junctions in major urban areas. 32

Climate Change and Adaptation

Highway transportation is a major source of atmospheric carbon dioxide (CO2), the main human-related greenhouse gas (GHG) contributing to climate change. Highway infrastructure will also bear the effects of climate change, such as extreme heat, sea level rise, and stronger storms. Highway policy responses to climate change can involve mitigation provisions that aim to reduce GHG emissions or adaptation provisions that aim to make the highway infrastructure more resilient to a changing climate.33

The federal-aid highway program already includes some programs that can be seen as being mitigation programs. The Congestion Mitigation and Air Quality Improvement program (CMAQ), for example, although not designed to address climate change, typically funds projects that reduce pollutant emissions from cars and trucks that also co-emit CO2. Other surface transportation programs that may contribute indirectly to the reduction of GHG emissions include the Transportation Alternatives program, which funds bicycle and pedestrian infrastructure, as well as core formula program eligibility and funding transfer provisions that allow highway funds to support mass transit. Congress may wish to consider mitigation options that encourage or support activities such as ride sharing, truck stop electrification, alternative fuel fueling stations, the use of hybrid electric and electric vehicles, and congestion relief policies.

Adaptation is action to reduce the vulnerabilities and increase the resilience of the transportation system to the effects of climate change. Adaptation options for highways and bridges include structural and nature-based engineering and policy-based activities. For example, highway bridges can be engineered structurally to withstand the threats of stronger winds, higher storm surges, and increased flooding.

Although currently there is no dedicated highway funding for adaptation projects, federal-aid highway funds can be used to assess the potential impacts of climate change and to apply adaptation strategies. Congress could add programs or program provisions to encourage or pay for adaptation and resiliency measures. The federal matching share could be increased for protective features and disaster relief definitions could be expanded to include resiliency measures.

Emergency Relief Program

The Emergency Relief program provides federal assistance to state departments of transportation for emergency repairs and restoration of federal-aid highway facilities following a natural disaster or catastrophic failure. Congress has long authorized $100 million per year to be spent from the HTF for Emergency Relief, but spending exceeds this amount virtually every year. Additional funding is provided via appropriations on a "such sums as needed" basis, usually following major disasters. These additional funds both pay for both quick release funds dispersed immediately following a disaster that are in excess of the annual $100 million authorization and pay for permanent repairs for damage from both recent disasters and the repair backlog from previous disasters.34 This situation raises two policy questions: whether to raise the annual authorization to reduce the reliance on supplemental disaster appropriations and how to resolve the repair backlog.

States seeking Emergency Relief funds now must consider resilience to climate change in designing and constructing highway and bridge repairs. Resilience is broadly defined as "the capability to anticipate, prepare for, respond to and recover from significant multi-hazard threats with minimum damage to social well-being, the economy and the environment." Using risk-based analyses, this approach is designed to reduce the potential for future losses. However, states may be tempted to use Emergency Relief funding, which requires no state match, to make improvements that might otherwise have been made with federal formula funds or state funds.35

Emergency Relief is a basically a reactive program, and is not designed to fund resilience measures in advance of disasters. Congress could consider expanding the scope of the program to allow for the funding of resilience measures to some undamaged facilities that are at high risk, or could establish a separate resilience program while leaving Emergency Relief to retain its focus on disaster response and repair.

Federal Lands and Tribal Transportation Programs

Congress has established three separate programs to fund highways on federal and tribal lands. Their total funding under the FAST Act has averaged about $1.1 billion per year.

The Federal Lands Transportation Program's average annual authorization is $355 million under the FAST Act. Most of this amount is for the National Park Service, the Fish and Wildlife Service, and the Forest Service.

The Federal Lands Access Program supports projects that are on, adjacent to, or provide access to federal lands. Funding is allocated among the states by a formula.

The Tribal Transportation Program distributes funds among tribes, mainly under a statutory formula based on road mileage, tribal population, and relative need.36

In addition, the FAST Act established the Nationally Significant Federal Lands and Tribal Projects Program to support large projects on federal and tribal lands. Projects must have an estimated cost of at least $25 million, with priority given to projects costing over $50 million. The program is authorized at $100 million annually, but requires an appropriation to make funds available. It has received appropriations of $300 million for FY2018, $25 million for FY2019, and $70 million for FY2020.

Funding for all of these programs is likely to be an issue in reauthorization. The National Park Service, for example, has a considerable backlog of road repairs, but repairs to the agency-owned Memorial Bridge in Washington, DC, which cost 80% of the Park Service's average annual allocation under the FAST Act, made it difficult for the Park Service to address other repair needs. In addition, some states and Indian tribes have called for revising the formulas used to allocate Federal Lands Access Program and Tribal Transportation Program funds.

TIFIA

Although the majority of highway funds are awarded as grants, the federal government also supports highway infrastructure financing under the Transportation Infrastructure Finance and Innovation Act (TIFIA).

The TIFIA program provides secured loans, loan guarantees, and lines of credit for major surface transportation projects.37 Loans must be repaid with a dedicated revenue stream; for highway projects this is typically a toll. TIFIA is funded at $300 million for FY2020. Assuming an average subsidy cost of 7%, this funding may allow lending of roughly $4.3 billion in the year.38 States may use their funds from two formula programs, NHPP and STBG, to pay the administrative and subsidy costs of the program. Additionally, the FAST Act allows project sponsors to use discretionary INFRA grants to pay these costs, although this has not occurred.

The main issue in reauthorization is the funding level. Despite the program's popularity, DOT calculated that it had $1.65 billion unobligated budget authority at September 30, 2018. Congress could encourage greater use of TIFIA funds by increasing the federal project share allowable, broadening eligibility, and accelerating the processing of applications. Should Congress wish to increase the availability of TIFIA financing without increasing the program authorization, it could also change the subsidy calculation. A less conservative calculation by DOT and the Office of Management and Budget (OMB) could allow DOT to lend a greater amount with the same amount of budget authority, although this would increase the level of risk to the federal government. Congress could also lower TIFIA funding to eliminate the unobligated balances.

TIFIA is one means of financing projects without relying on pay-as-you-go funding, thereby accelerating construction. Other financing proposals, such as creation of a National Infrastructure Bank and expanded funding of state infrastructure banks, might also be considered in reauthorization. In the past, such proposals have faltered, in part due to their apparent duplication of intent with the TIFIA program.

Accelerating Project Delivery

The length of time between project inception and completion has long been a concern of Congress. The many reasons for delays include difficulty in achieving agreement on the commitment of funds, public opposition, litigation, public comment requirements, contractor and materials delays, and the environmental review process. The FAST Act included 18 provisions intended to accelerate project delivery, mainly directing changes in how the environmental review process is implemented.39 In highway reauthorization, Congress may want to require studies evaluating the impacts of the FAST Act changes and FHWA's implementation actions.

Highway Data Issues

A number of highway data and study issues have emerged recently that could be considered in reauthorization.

FHWA's Highway Statistics series is designed to provide a broad range of annual statistical tables and charts on the extent, condition, funding, and other attributes of U.S. highways. However, in recent years some of the tables have not been produced, while others are produced years after the fiscal year they describe, lessening their value to policymakers. Congress could request an explanation from FHWA or request the Government Accountability Office to review the FHWA's data collection and publication procedures. FHWA is dependent on the states for much of the underlying data.

The recently released 23rd edition of the biennial Status of the Nation's Highways, Bridges, and Transit: Conditions and Performance; Report to Congress was released two years late and based on FY2014 data. The report contains the most comprehensive information about the condition of U.S. highway and mass transit infrastructure conditions, along with estimates of the future funding needed to maintain or improve the conditions and transportation system performance. The most recent report does not reflect the increased funding authorized in the FAST Act or recent transportation appropriations bills, so it is difficult to judge the impact of these spending increases. Congress could consider requiring a study of why DOT relies on five-year-old data to prepare the report.

FHWA formerly produced Highway Cost Allocation Studies (HCASs) to estimate the cost, in terms of wear and tear, imposed by different types of vehicles (including trucks categorized by weight) using U.S. highways. In these studies, highway taxes per mile paid into the HTF by different types of vehicles were compared to the cost per mile of pavement, bridge, and other highway-related damage caused by each vehicle type. The last FHWA Highway Cost Allocation Study was the 2000 supplement to the 1997 study. Without a congressional directive and funding to complete a new study, the FHWA has chosen not to conduct one. Congress could consider funding and requesting a new study, which might be helpful in judging whether the current rates of highway-related taxes paid by various users adequately reflect the damage their vehicles cause to highway infrastructure.

Because freight infrastructure decisions are often made at the state or local level, it would be helpful for transportation planners to know the characteristics of the trucks traveling particular highway segments. DOT's Bureau of Transportation Statistics and the Census Bureau conduct a survey of shippers every five years that provides information on shipments leaving factories, warehouses, and ports. However, the sample size is not sufficient to provide reliable data for any specific urban area, and the survey is too infrequent to identify recent trends. The survey was designed more to provide a national picture of freight transport than to meet local or regional needs. A policy question for Congress is whether the federal government should be responsible for providing more robust and timely freight data for state and local transportation planners.40

Highway Safety

Measures to improve the safety of roadway infrastructure are funded primarily through the FHWA Highway Safety Improvement Program (HSIP). Measures related to vehicles and to driver behavior are handled by the National Highway Traffic Safety Administration (NHTSA) and, in the case of commercial vehicles and drivers, the Federal Motor Carrier Safety Administration (FMCSA).41

HSIP is the largest safety program up for reauthorization. HSIP primarily funds infrastructure improvements, such as rumble strips, roadway striping, intersection redesign, and safety-related technologies. HSIP is one of the few highway programs that allows for spending on any public road, not just federal-aid highways. Reauthorization issues include funding amounts and eligibility changes.

Driver behavior is the primary factor in the vast majority of fatal crashes. However, driver behavior is generally a state matter and not under federal control.42 When Congress wishes to change driver behavior, it typically does so by providing grants to states or by withholding grants if states fail to implement federal policies. For example, states that fail to establish 21 as the minimum age to purchase alcoholic beverages can be subject to funding reductions. A review of the effectiveness of such penalties could be part of the reauthorization process.43 Past issues in driver behavior that could emerge in reauthorization include restrictions on federal funding of automated devices to enforce speed limits, motorcycle helmet laws, and state measures concerning impaired driving.

NHTSA also establishes minimum standards for passenger vehicles. The time it takes NHTSA to update these standards has been an issue.44 NHTSA also tests vehicles for compliance with safety standards, rates the crashworthiness of vehicles, and monitors consumer complaints about vehicles for evidence of safety defects that may necessitate a vehicle recall. A study of the effectiveness of NHTSA's early warning reporting (EWR) system could be of interest to Congress.45

Unlike the behavior of ordinary drivers whose behavior is regulated by the state and local governments, the behavior of commercial drivers who engage in interstate commerce is a federal matter under the auspices of FMCSA. Issues that could be considered in reauthorization include the regulation of hours of service for commercial drivers and the related mandate for use of electronic logging devices, the roadside safety examination of intercity buses, specific driver health requirements, and possible modification of age restrictions on commercial drivers.46