What Is Commercial Paper and Why Is It Important?

As COVID-19 spread rapidly in the United States, fears of its economic effects led to strains in the commercial paper (CP) market, one of the main funding sources for many firms and for providers of credit to individuals. Commercial paper is short-term debt issued primarily by corporations and generally is unsecured. The CP market is an important source of short-term credit for a range of financial and nonfinancial businesses, who may rely on it as an alternative to bank loans—for example, in making payroll or for other short-term funding needs. The CP market also helps provide credit to individuals through short-term asset-backed commercial paper (ABCP), which finances certain consumer loans such as auto loans or other consumer debt. Municipalities also issue CP for short-term funding needs. Some money market funds (MMFs) are key purchasers of CP, which plays a significant role in this short-term funding market. As of March 31, 2020, about 24% of total CP outstanding was ABCP; 47% of total CP was from financial issuers; and 28% was from nonfinancial issuers.

The total CP market in the United States was $1.092 trillion as of the end of March 2020, though this amount can fluctuate based on market conditions. For a sense of scale, this is roughly 65% of the amount of currency in circulation by the public ($1.73 trillion as of March 9, 2020).

The CP market grew rapidly in the 1970s and 1980s in the United States, as a lower-cost alternative to bank loans. A provision in the securities laws allowing for an exemption from more elaborate Securities and Exchange Commission (SEC) registration requirements for debt securities with maturities of 270 days or less helped fuel this market's rapid expansion. From 1970 to 1991, outstanding commercial paper grew at an annual rate of 14%. The subsequent growth of securitization, in which loans are packaged into bonds and sold to investors as securities, also fueled a rapid expansion of ABCP.

Between 1997 and 2007, ABCP grew from $250 billion to more than $1 trillion. This growth was partly fueled by the expansion of residential mortgage securitization. In August 2007, ABCP comprised over 52% of the total CP; financial CP accounted for 38%; and nonfinancial CP constituted 10%. The amount of CP outstanding peaked at $2.2 trillion in August 2007, before shrinking considerably during and after the 2008 financial crisis.

Because CP involves short maturities (much CP matures in 30 days or less), many firms have to "roll over" maturing CP—issuing new CP as existing CP matures. Thus, the CP market is generally susceptible to roll-over risk, meaning the risk that market conditions may change and the usual buyers of CP might decline to purchase new notes when existing ones expire, preferring perhaps to hold cash. This is often sparked by credit risk, wherein fears over a CP issuer's credit, or even the bankruptcy of a CP issuer, lead to depressed demand for commercial paper. The risk of being unable to roll over maturing commercial paper due to credit risk has been demonstrated as real in recent financial history, both in the financial crisis following Lehman Brothers' collapse and in prior sudden corporate bankruptcies. When credit and liquidity become unavailable through the CP market, the effects can spill over into credit markets more generally.

Commercial Paper Market Stress and Federal Government Support

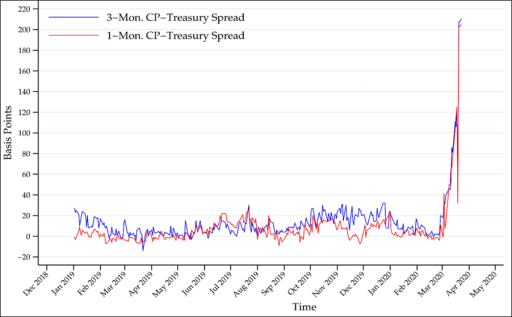

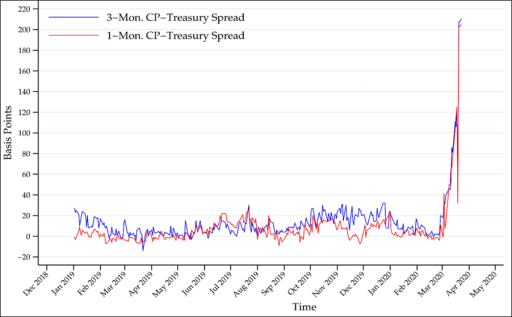

As concerns over the spread of COVID-19 grew, stresses in the CP market became linked to the supply of business credit, putting pressure on banks and heightening the market demand for cash. Such strains on credit markets can sharply increase borrowing costs for financial and nonfinancial firms. When investment bank Lehman Brothers failed during the 2008 crisis, the cost of borrowing in CP, as measured by the spread for CP borrowing rates over more stable overnight index swap rates, rose by about 200 basis points (2%) in the following week, and the rates for financial firms' CP notes eventually climbed higher. Data from the Federal Reserve shown in Figure 1 indicate that CP borrowing rates for financial issuers, as measured in spreads for CP borrowing rates over Treasuries, spiked by about 200 basis points in March 2020, as investors grew reluctant to buy new CP. To add liquidity and foster credit provision in the CP market, the Federal Reserve intervened on March 17, 2020, with a credit facility.

|

Figure 1. Spreads Between 1-Month and 3-Month AA-rated Financial Commercial Paper

and 3-Month Constant Maturity Treasury Rates

|

|

|

Source: CRS, based on data obtained from the Federal Reserve Bank of St. Louis FRED website.

Note: "AA-rated" is the second-highest credit rating. For more information, see the Federal Reserve Bank of New York website.

|

On March 17, the Federal Reserve (Fed) announced that it was establishing a Commercial Paper Funding Facility (CPFF) to support the flow of credit to households and businesses. This facility is backed by funding from the Treasury's Economic Stabilization Fund. The Fed noted the CPFF was designed to support the CP markets, which "directly finance a wide range of economic activity, supplying credit and funding for auto loans and mortgages as well as liquidity to meet the operational needs of a range of companies." The Fed aims to provide a liquidity backstop to CP issuers by buying both ABCP and regular, unsecured CP of a minimum credit quality from eligible companies. By acting as a buyer of the last resort, the Fed program aims to reduce investors' risk that CP issuers would not repay them because they became unable to roll over any maturing CP. On March 23, the Fed expanded the CPFF to facilitate the flow of credit to municipalities by including high-quality, tax-exempt commercial paper as eligible securities, and also reduced the pricing of the facility. (For more information, see CRS Insight IN11259, Federal Reserve: Recent Actions in Response to COVID-19, by Marc Labonte; and CRS Report R44185, Federal Reserve: Emergency Lending, by Marc Labonte.)