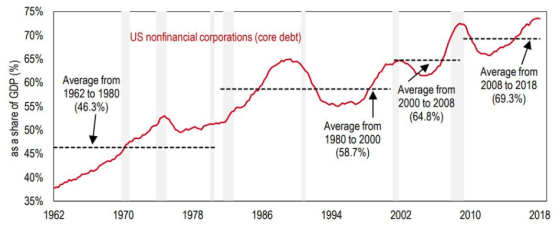

Source: HSBC, BIS total credit statistics.

Notes: Shaded areas indicate U.S. recessions. BIS core debt consists of debt securities (bonds), loans, and currency and deposits.

U.S. companies are carrying record levels of debt to finance their operations and growth (Figure 1). Corporate debt largely consists of bonds and, to a lesser extent, leveraged loans, bank loans, and other liabilities. The Securities and Exchange Commission (SEC) is the primary regulator overseeing the debt capital markets. In recent years, financial authorities have become increasingly vocal about the buildup of the higher-risk portions of the corporate debt market. This Insight explains the market's composition and risks in the context of the current coronavirus (COVID-19)-induced capital markets stress.

|

|

Source: HSBC, BIS total credit statistics. Notes: Shaded areas indicate U.S. recessions. BIS core debt consists of debt securities (bonds), loans, and currency and deposits. |

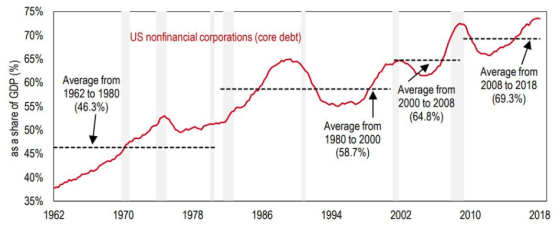

A company can issue and sell bonds to investors in exchange for cash. Investors of corporate bonds are functioning as lenders who generally receive the payments of principal plus interest over a period of time. The bonds themselves are financial instruments that can be bought or sold. The bond issuers' borrowing costs and liquidity are largely determined by their credit ratings assigned by credit rating agencies. These ratings intend to indicate the issuers' investment risks and payment capabilities. For example, a bond could receive either investment grade or high yield (also called speculative grade or junk bond) ratings—the higher the ratings the lower the borrowing costs (Figure 2).

|

|

Source: PIMCO. |

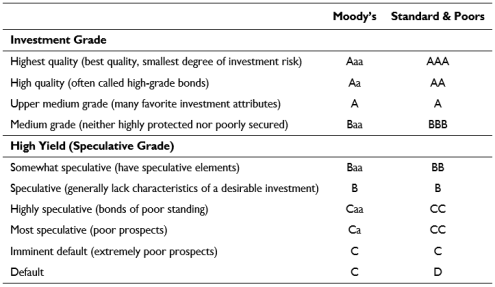

Financial regulators have shown particular concern over the growth of corporate bonds, especially the BBB bonds—referring to the lowest-quality investment-grade bonds in this Insight (Figure 3). BBB bonds made up around 50% of the investment-grade market as of 2019, compared to 17% in 2001. This has prompted the Fed to state that a widespread downgrade of BBB bonds during market stress could increase market illiquidity and downward price pressure, accelerating an economic downturn.

|

Figure 3. Market Capitalization of U.S. Corporate Bonds by Credit Rating |

|

|

Source: Evergreen Gavekal. |

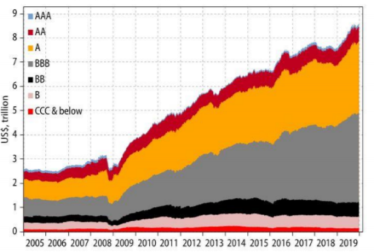

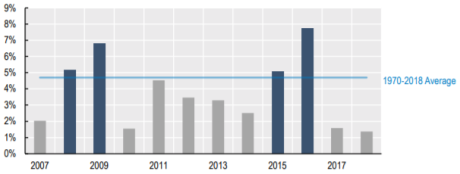

BBB bonds draw concerns over "fallen angels" risk—the risk that further downgrades could push a BBB bond from being investment grade to high yield. This migration would adversely affect a company's borrowing capacity and costs, thus increasing the likelihood that these already risky companies may default. Large-scale defaults might, in turn, lead to system-wide financial stability concerns. The long-term average rate by which "angels fall" is around 5% per year, with higher rates seen in business downturns (Figure 4).

|

Figure 4. Percentage of BBB-Rated Issuers That Become Fallen Angels Within a Year |

|

|

Source: OECD. |

Some also have concerns that large volumes of BBB downgrades may force bond sales that are hard for non-investment-grade investors to absorb. This is because investment-grade and high-yield bonds have different investor pools that convey different levels of investment capacity and liquidity. Many institutional investors are mandated to focus on investment-grade bonds, leaving the high-yield market to a narrower investor pool that may not be able to absorb large volumes of fallen angels. As such, there could be forced sales to further distort price and liquidity.

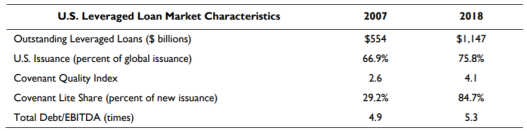

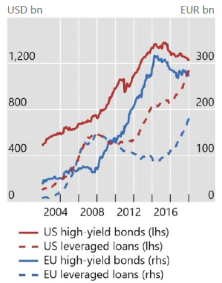

Financial authorities also expressed concerns about the rapid growth of leveraged loans, a type of corporate debt that is alleged to have high credit risk and low investor protection (Figure 5). The U.S. leveraged loan market has experienced higher growth relative to other developed economies, and the market has reached a size comparable to high-yield bonds (Figure 6).

|

|

Source: IMF. Note: For more details on the table, see page 32 of CRS Report R45957, Capital Markets: Asset Management and Related Policy Issues, by Eva Su. |

|

Figure 6. Leveraged Loans and High-Yield Bonds Outstanding in U.S. and E.U. |

|

|

Source: Financial Stability Board. |

Because a major portion of the corporate debt market is in higher -risk positions, the concern in recent years is that, during a market downturn, funding costs and availability could change, driving the already risky companies to defaults and business closures. Furthermore, the funding dislocation could drain out financial system liquidity and amplify financial and economic vulnerabilities.

The coronavirus-induced market crash in March has put the corporate debt market to a real-world test. At the time of this writing, corporate debt market has already seized up (Figure 7). The investment-grade bond funds experienced the largest outflow on record. High-yield bonds and leveraged-loan prices have also "fallen off a cliff." Members of Congress followed up on the issue to express concerns. As to the real economy, economic activities, especially those in the hardest hit segments (e.g., travel, retail, sports), have nearly come to a stop. Affected businesses have begun to have difficulty generating earnings. This could reduce their ability to repay corporate debt. Policymakers are seeking ways to avoid permanent damage to sound corporate borrowers who face a temporary period of low income during the coronavirus pandemic.

The SEC has some existing tools to address market volatility—circuit breakers and limit up-limit down mechanisms. These cross-market temporary halts have been triggered multiple times in recent weeks, but the effects of such actions are debated.

The Fed has also taken actions, including establishing a Primary Market Corporate Credit Facility and a Secondary Market Corporate Credit Facility to provide liquidity to investment-grade companies and their corporate bonds. Although such actions could help corporate issuers and investors, some have concerns that they may create moral hazard that could fuel excessive risk taking.