Introduction

Congress has a long-standing interest in ensuring access to broadband internet service in rural areas. Federal subsidies underwritten by taxes and long-distance telephone subscriber fees have injected billions of dollars into rural broadband markets over a period of decades—mostly on the supply side—in the form of grants, loans, and direct support to broadband providers.1 As of 2019, more than 20 million Americans still lacked broadband access.2

According to many stakeholders and policy experts, federal spending on broadband expansion has not adequately accounted for local conditions in rural areas that depress effective demand for broadband. Lower demand in rural areas may discourage private-sector investment and reduce the effectiveness of federal efforts to expand and improve broadband service.

According to the authors of a 2015 study on rural broadband expansion, "While the vast majority of federal programs dealing with broadband have focused on the provision of infrastructure, many economists and others involved in the debate have argued that the emphasis should instead be on increasing demand in the areas that are lagging behind."3 The study found that rural households' broadband adoption rate lagged that of urban households by 12-13 percentage points and that while 38% of the rural-urban "broadband gap" in 2011 was attributable to lack of necessary infrastructure, 52% was attributable to lower adoption rates.

"Implicit in many supply-side arguments is an assumption that demand-side issues will resolve themselves once there is ample supply of cheap and ultra-fast broadband," wrote the directors of the Advanced Communications Law & Policy Institute (ACLP) in a public comment to the Commerce Department's Broadband Opportunity Council in 2015. "Though appealing, this reductive cause‐and‐effect has been questioned by social scientists, researchers, practitioners, and others who have worked to identify and better understand the complex mechanics associated with broadband adoption across key demographics and in key sectors."4

The geographic and demographic distribution of rural broadband demand is uneven. There is unmet demand in some rural areas. In others, even where there is access, that may not translate into widespread adoption. Observers cite a range of factors. On average, rural areas are less wealthy than urbanized areas, and have older populations with lower educational attainment—factors which negatively correlate with demand for broadband service. Related barriers to adoption, such as lower perceived value, affordability, computer ownership, and computer literacy, have persisted over many years. Rural areas with relatively favorable geography and demographics may attract significant investment in broadband service, but even subsidies may fail to spur buildout in less-attractive rural markets.

This report complements separate CRS analyses of major federal subsidy programs on the supply side of the market by providing an analysis of demand-side issues at the nexus of infrastructure buildout and adoption.5 It focuses exclusively on demand for fixed broadband among rural households and small businesses. It does not address the role of schools, healthcare facilities, public libraries, and other "community anchor institutions" as end users of broadband. However, it does include discussion of the role schools and libraries play as providers of broadband service and training to rural residents who may lack home access to the internet, and how this may affect overall household adoption behavior. It also includes discussion of broadband-enabled services, such as telemedicine and precision agriculture, which may incentivize more rural households and small businesses to adopt broadband service.

The report begins with a discussion of the rural broadband market—specifically, the characteristics of demand in rural households and small businesses, and how these affect private-sector infrastructure investments. It then provides a survey of federal broadband programs and policies designed to spur broadband buildout and adoption, with a discussion of how demand-side issues may impede achievement of these goals. It concludes with a discussion of selected options for Congress.

The Rural Broadband Market

According to the U.S. Census Bureau, 60 million Americans, or 19.3% of the total population, live in rural areas, defined as "all population, housing, and territory not included within an urbanized area or urban cluster." As of 2010, urbanized areas and urban clusters occupied about 3% of the U.S. land mass, yet contained more than 80% of the U.S. population.6 As a result, fixed broadband network infrastructure, which largely relies on wireline connections to the physical addresses of subscribers, is geographically concentrated.

Urban areas have benefited from this concentration, especially areas with favorable geographic locations and economic conditions. For example, the City of Huntington Beach, CA, charges broadband providers rent for access to its utility poles—$2,000 per pole per year—and leases access to city-owned fiber-optic cable (fiber) infrastructure. "We continue to have a lot of carriers wanting to site on our poles in our downtown area which is next to the beach," a city official said during a 2019 webinar, noting that other, less favorably located cities had not been able to duplicate Huntington Beach's development model. "[An] inland city is not going to get what we get here on the coast."7

In contrast, in many rural areas, the cost of providing broadband service may approach—or even exceed—the predicted return on investment. Broadband providers may not be willing to serve these areas without support from direct government subsidies, grants, or loans. Local conditions in rural areas vary widely, though. Some rural markets may be relatively attractive on commercial terms, because of unique characteristics such as the presence of post-secondary educational institutions or tourism attractions, relatively high levels of economic development and educational attainment, favorable demographics, or proximity to urban areas. Other rural markets that lack these characteristics are likely to be less commercially attractive.

Long-term demographic trends suggest a growing bifurcation of the rural broadband market. According to a 2018 U.S. Department of Agriculture (USDA) analysis, rural areas have witnessed "declining unemployment, rising incomes, and declining poverty," as well as more favorable net migration rates since 2013. However, the analysis also found that "people moving to rural areas tend to persistently favor more densely settled rural areas with attractive scenic qualities, or those near large cities. Fewer are moving to sparsely settled, less scenic, and more remote locations, which compounds economic development challenges in those areas."8

For reasons that will be explained in more detail below, household and small business demand for broadband service is likely to be impacted in rural areas by demographic trends, geography, and economic context. As a result, these factors affect the infrastructure investment behavior of broadband providers, raising policy questions about the appropriate level of federal assistance and how it can be distributed most effectively and efficiently.

The next three sections of this report discuss the adoption of broadband service by rural households and rural small businesses and the implications of market demand for private-sector investment in rural broadband infrastructure.

Valuation of Broadband Service by Rural Households

Adoption rates for broadband service are highly dependent on the valuation that households and small businesses place on internet access. Studies suggest that on average, valuation of internet access—measured as willingness to pay for broadband service—is lower for rural households than for urban households. Knowledge of computers, computer ownership, and perceived relevance of the internet—all of which affect consumer valuation—tend to be lower among older, less educated, and less wealthy households. Because rural households tend to be older, less educated, and less wealthy than their urban counterparts, their willingness to pay for broadband also tends to be lower.9

Not all households are the same, of course. A substantial number of low-income households do not subscribe to broadband service even when it is offered to them at no cost, indicating a valuation of zero. At the same time, many reports indicate that some rural residents are willing go to extensive lengths to access the internet for tasks they view as essential, even if broadband service is not available at their home or business. The relatively lower proportion of potential subscribers in rural areas who are both highly motivated to adopt broadband and are able to pay for it complicates the business case.

|

Why Is the Lifeline Program Undersubscribed? The FCC established the Lifeline program in 1985 to provide discounted phone service for low-income households, in order to meet the goal of universal service established by the Communications Act of 1934.10 The Telecommunications Act of 1996 expanded the definition of universal service to include new communications technologies, such as the internet. The FCC's 2016 Lifeline Modernization Order added fixed broadband as a subsidy-eligible service. For many service plans, the end-user cost is zero. Enrollment rates vary significantly by state, but are under 40% in most cases. Persistently low Lifeline subscription rates illustrate the demand-side challenges to digital inclusion. Studies point to several possible explanations:

For more information on the Lifeline program, see "End-User Subsidies." |

A 2010 study, based on a report commissioned by the Federal Communications Commission (FCC), found that survey respondents were, on average, willing to pay an extra $45 per month for "fast" speeds adequate for music, photo sharing, and videos. However, on average, respondents were only willing to pay an extra $48—a difference of $3—for "very fast" speeds adequate for gaming, large file transfers, and high-definition movies.11 Households that already had relatively high speed broadband were generally willing to pay more than average for very fast service.

While consumer expectations have certainly evolved over the past decade, the 2010 study's findings are broadly consistent with those of subsequent studies: most consumers, regardless of where they reside, value basic internet access at speeds adequate for everyday use, but only a relative few are willing to pay substantially more for very high speeds. Members of the latter group generally have higher levels of broadband connectivity than others, and belong to relatively wealthier, better-educated demographic groups.

The FCC sponsored a series of field experiments, beginning in 2012, to gain better understanding of broadband demand among low-income households. The goal of these experiments was to inform administration of the federal Lifeline program, which subsidizes voice and broadband service charges for qualifying low-income consumers.

A 2015 report on a field experiment conducted in West Virginia and eastern Ohio found that Lifeline-eligible non-subscribers in that region were overwhelmingly willing to pay $3 more per month to move from bottom-tier speeds (1 megabits-per-second (Mbps), offered at $31.99 per month) to moderate broadband speeds (6 Mbps, offered at $34.99 per month). However, only one out of 118 participants was willing to pay $44.99 per month—an extra $10—to double their maximum download speed from 6 to 12 Mbps.12

The Lifeline program itself has long been undersubscribed, despite the fact that it frequently reduces consumer out-of-pocket costs to zero (see text box above, "Why Is the Lifeline Program Undersubscribed?").

A 2014 study, based on a survey funded by the Department of Commerce of 15,000 non-adopting households at all income levels, found that approximately two-thirds of respondents would not consider adopting broadband at any price, and that non-adopters were disproportionately rural (36% of non-adopters lived in rural areas, as compared to 19.3% of all Americans).13 The remaining one-third of respondents voiced interest in broadband adoption. Rural respondents were more likely to belong to this group than their urban counterparts, despite making up a disproportionately large share of non-adopters overall. These respondents most commonly identified price and availability as the main barriers to adoption. The study authors estimated that achieving a 10% increase in subscribership among members of the group who reported price as a factor in their decision would require an average price decrease of 15%.14

A 2012 study of broadband usage among Kentucky farmers broadly tracks with other studies that show a higher propensity for broadband adoption among younger, better educated, higher earning, business-oriented households with experience using the internet, regardless of location. The study found that a representative 45-year-old producer earning more than $50,000 on a 750 acre farm, who had experience using the internet but did not have broadband access, was willing to pay $171.42 as a hypothetical one-time property tax payment to support buildout of the necessary local infrastructure to provide broadband access to area farms.15 On the other end of the spectrum, a representative 63-year-old producer with a 250 acre farm earning less than $50,000, who had not subscribed to broadband service even when it was available, was willing to pay a one-time payment of just 20 cents to support broadband infrastructure improvements. The average age of survey respondents was 59.2 years.

The Kentucky Department of Agriculture reported in 2019 that the demographic profile of Kentucky farmers is shifting, including a larger number of younger producers.16 This demographic shift may lead to increased demand for broadband service expansion and improvements in the rural areas of Kentucky where it is most pronounced. Given that demographic trends vary at the local level, though, they will likely not affect broadband market development equally in all parts of the state.

Valuation of Broadband Service by Rural Small Businesses

Small businesses are generally more likely than residential households to regard broadband internet access as essential. However, within the small business sector there are significant differences in willingness to pay for any given level of service. Businesses with relatively modest data requirements may elect not to upgrade to a higher tier of service if the expected productivity benefits are less than the expected subscription and equipment upgrade costs.17

A 2010 study sponsored by the Small Business Administration (SBA), in fulfilment of requirements of the Broadband Data Improvement Act (P.L. 110-385), found that "broadband is central to U.S. small businesses in ways that it is not to individuals. The small business broadband adoption rate has increased to 90% as of the date of this survey (April 2010), compared to 74% of adults with broadband access in their homes.... "18 Surveys conducted for the SBA study showed that both rural and urban respondents viewed high-speed internet "as an essential service" that enabled them to "achieve strategic goals, improve competitiveness and efficiency, reach customers, and interact with vendors."19 However, the study found that non-agricultural rural businesses were significantly less likely to have their own website than their urban counterparts were. Likewise, they were less likely to be willing to pay substantially more for improved service, even though the study found that they rated the quality of service in rural areas lower than respondents in urban areas did. Most rural businesses surveyed indicated that they were not willing to pay 10% more for significantly improved service.20

Studies that are more recent have made similar findings. Although basic access to the internet in rural areas is much more widespread than it was a decade ago, usage practices of many small businesses do not appear to have changed significantly. Most appear to value basic internet access to support a few essential low-bandwidth functions, such as making the name and location of the business available on internet searches, but proportionately fewer appear to demand high-bandwidth advanced business applications.

For example, a 2017 study comparing selected rural and urban areas of North Carolina found that many small rural businesses have no web presence beyond a listing in Google search results, and that more than half of those businesses that did have a web page used it solely to provide basic information about the business.21 "Overall, small rural businesses are not using internet-based technology to support their businesses. While they may have broadband access, their use of websites, e-commerce and social media is limited, and it is significantly lower than small urban businesses," the study authors wrote.22 Apparently, small businesses find internet access useful, but many do not use applications requiring high bandwidth.

It is not clear from these results what immediate benefits would be provided to non-intensive business users in remote rural areas by improvements in broadband service speed and quality. However, broadband advocacy groups have suggested that emerging new applications and encouraging small businesses to adopt more sophisticated web development strategies may increase demand for improved service over time.

Other studies indicate that the type and location of business activity may have a significant influence on demand for higher-speed broadband. The businesses covered in the North Carolina study were, by and large, small retail establishments in isolated rural areas. Businesses in "intermediate" exurban locales that work in healthcare or knowledge-intensive sectors are more likely to use high-bandwidth applications, according to one study.23 For example, a survey of local businesses by the Central Coast Broadband Consortium, a nonprofit representing independent broadband providers serving the greater Monterey Bay area, found that business respondents had significant data and file transfer needs.24 The area surveyed includes many sparsely populated rural areas with difficult terrain, but it is also home to significant tourist destinations, large agriculture enterprises, and a University of California campus, and its northern boundary extends to the exurbs of San Jose, one of the most highly developed technology hubs in the nation.

Market Demand and Private-Sector Investment

Observers often comment that rural broadband markets are hyper-local—that is, that conditions affecting broadband deployment and adoption vary widely from one area to the next. Historically, investments in broadband infrastructure have tended to cluster in areas with lower risk and potentially higher returns. Broadband providers may view investment in rural markets with little history of internet usage as a high-risk endeavor. Subsidies may lower financial risk to broadband providers, but do not change their basic preference for low-risk, high-return projects, which guides private sector investment in expansion of broadband service.

In a 2019 report, Merit Network, Inc., a nonprofit corporation owned and governed by Michigan's public universities, highlighted the business challenges faced by broadband providers in nascent rural broadband markets. According to the report, "Despite the significant qualitative benefits that a broadband project may bring, depending on the method of financing, it is critical to accurately estimate adoption rates and build a solid financial model to ensure that adequate revenue will be achieved to repay any loan obligations, maintain ongoing operations and fund depreciation of capital equipment."25

|

Demand and Investment in Utah Utah illustrates how market forces and public investment in non-broadband infrastructures like roads and pipelines may enable expansion of broadband service into remote, sparsely populated areas—albeit unevenly. Salt Lake City built out broadband infrastructure in the city during the run-up to the 2002 Winter Olympics to improve traffic management with fiber-optic signal controls and cameras. It then sold excess broadband capacity to television broadcasters covering the Olympics—something incidental to the original purpose of the project.26 In subsequent years, authorities leveraged public-private partnerships to extend broadband fiber and wireless transmission facilities to remote university campuses, ski resorts and other outdoor recreation areas, and along pipelines—frequently aided by parallel state and federal investments in transportation infrastructure.27 The investments spurred growth of the outdoor industry and tourism, as well as knowledge-intensive educational and industry establishments, which in turn increased demand for broadband in remote areas. By contrast, state agencies are still working with private-sector partners to better connect remote Navajo and Ute tribal areas, which are more difficult to serve due to the absence of paved roads, telephones, and electricity, and also present a less attractive commercial market due to the relatively high incidence of poverty among tribal members.28 |

"Even if rural areas are profitable for telecommunications companies, urban areas offer still higher returns on investment. This makes rural areas less attractive markets and perpetuates the urban focus of market decisions," according to the authors of one academic study. "The market for telecommunications shows that a free-market rationale can ensure an efficient use of limited resources, i.e. using the resources for profitable markets in high-density areas, but it cannot ensure an equal delivery of services in all areas, leaving the rural underserved."29

A 2019 report from the Arkansas governor's office stated that low broadband adoption rates "have consistently been a primary barrier to investment by the provider community." Noting that age affects adoption rates, the report concluded that "increased adoption within [the older] demographic has the potential to strengthen the business case for broadband deployment."30 The Arkansas report also highlighted low statewide enrollment in the Lifeline program as a barrier to investment. The FCC estimates that the Lifeline enrollment rate was 18% for Arkansas in 2018.31 The Arkansas report found that "raising adoption rates [of the Lifeline program] could also strengthen the business case for private companies to invest in broadband infrastructure, resulting in better internet access for both poor and non-poor Arkansans.... "32

Studies elsewhere have found a similar relationship between demand and investment. For example, in a 2015 report on its broadband expansion projects, the Appalachian Regional Commission, which serves 13 Appalachian states, found that "broadband internet service providers [are] less likely to provide services in sparsely populated areas because it initially has a lower return on investment and is less cost-effective."33

Federal Programs and Policies

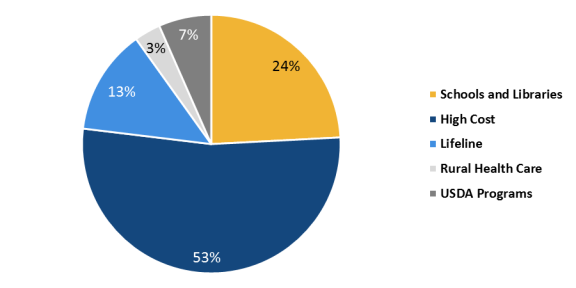

Federal programs and policies play a significant role in the development of rural broadband markets, given their often-challenging economics. In 2018, USDA and the FCC spent a combined $9.1 billion on broadband programs, largely in rural areas (see Figure 1). The following four sections discuss the major USDA and FCC broadband programs, rural considerations for the FCC's broadband speed benchmarks, demand factors in awarding federal funds for broadband infrastructure buildout, and selected federal broadband adoption programs that may influence rural demand.

Major USDA and FCC Broadband Programs

There are two major sources of federal funding for broadband in rural areas: the broadband and telecommunications programs of the USDA's Rural Utilities Service (RUS) and the Universal Service Fund (USF) programs of the FCC. Most of these programs focus on the supply side, targeting infrastructure deployment, but they also include some affordability initiatives that offer limited discounts on broadband subscription costs to low-income households, certain rural healthcare providers, and schools.

Rural Utilities Service Programs34

The RUS houses three ongoing assistance programs exclusively dedicated to financing broadband deployment: the Rural Broadband Access Loan and Loan Guarantee Program, the Community Connect Grant Program, and the ReConnect Program.35 The primary legislative authority for the Rural Broadband Access Loan and Loan Guarantee Program, and the Community Connect Grant Program, derives from the Rural Electrification Act of 1936, which Congress subsequently amended in various farm bills to support broadband buildout in rural areas.

Section 6103 of the Farm Security and Rural Investment Act of 2002 (P.L. 107-171) amended the Rural Electrification Act of 1936 to authorize the Rural Broadband Access Loan and Loan Guarantee Program to provide funds for the costs of the construction, improvement, and acquisition of facilities and equipment for broadband service in eligible rural communities. The 2018 farm bill (P.L. 115-334, Agriculture Improvement Act of 2018) authorized a grant component—the Community Connect program—in combination with the broadband loan program. This provision increased the annual authorization level from $25 million to $350 million, raising the proposed service area eligibility threshold of unserved households from 15% to 50% for broadband loans; authorizing grants, loans, and loan guarantees for middle mile infrastructure; directing improved federal agency broadband program coordination; and providing eligible applicants with technical assistance and training to prepare applications.

Congress authorized the ReConnect Program separately through the annual appropriations process, funding it at $600 million through the Consolidated Appropriations Act of 2018 (P.L. 115-141). The ReConnect Program includes both loans and grants to promote broadband deployment in rural areas where 90% of households do not have sufficient access to broadband at 10 Mbps/1 Mbps.

Two additional programs also support broadband deployment in rural areas. The Telecommunications Infrastructure Loan and Loan Guarantee Program (previously the Telephone Loan Program) is similar in purpose to the Rural Broadband Access Loan and Loan Guarantee Program, but eligibility requirements are tailored to support deployment in areas with extremely low population densities.36 Distance Learning and Telemedicine (DLT) grants—while not principally supporting connectivity—fund equipment and software that operate via telecommunications to rural end-users of telemedicine and distance learning applications.

Congress funds RUS programs through annual appropriations. For FY2019, the Consolidated Appropriations Act, 2019 (P.L. 116-6) provided $5.83 million to subsidize a Rural Broadband Access loan level of $29.851 million; $30 million for Community Connect broadband grants; $550 million for the ReConnect Program (in addition to $600 million provided for that program in FY2018); $1.725 million to subsidize a total loan level of $690 million for the Telecommunications Infrastructure Loan and Loan Guarantee Program; and $47 million for DLT grants.

Universal Service Fund Programs37

The FCC established the USF in 1997 to meet objectives and principles established by the Telecommunications Act of 1996 (P.L. 104-104). The Universal Service Administrative Company (USAC), an independent not-for-profit organization, administers the USF under FCC direction. USF programs are not funded via annual appropriations, but rather from fees the FCC receives from telecommunications carriers that provide interstate service. The FCC has discretion to spend these fees without congressional appropriations.

FCC supply-side support for broadband infrastructure, primarily through the USF High Cost program, totaled nearly $14 billion from FY2016 through FY2018.38 The High Cost program includes several funds that support broadband infrastructure deployment and provide ongoing subsidies to keep the operation of telecommunications and broadband networks in high cost areas economically viable for broadband providers. These providers must meet deployment benchmarks and offer service at rates reasonably comparable with those offered in urban areas. The subsidy indirectly benefits households and businesses in cases where there is a significant urban-rural price differential by making below-market subscription rates available. The other USF programs are the Lifeline program, which directly supports low-income households by subsidizing affordable or no-cost monthly broadband plans, and the Schools and Libraries program and Rural Health Care program, which pay for local network equipment purchases and some broadband subscription costs for eligible schools, libraries, and health care facilities.

Broadband Provider Discretion

Broadband providers have wide discretion in how—and whether—they choose to participate in these programs. Although the federal government imposes certain conditions on its subsidies, grants, and loans to broadband providers, it does not make participation compulsory. Even in subsidized markets, broadband provider investment behavior is conditioned to a greater or lesser degree by demand, predicted adoption rates, and anticipated return on investment. The federal government may—within the existing legislative framework—adjust the structure and funding levels of its major funding programs to encourage private-sector investment in rural areas that supports its policy goals.

FCC Service Benchmarks and Market Demand for Higher Speeds

The FCC changes its definition of broadband service as technologies, user expectations, and markets evolve. It reviews its data speed benchmarks on an annual basis, and its decisions have regulatory implications that may affect private-sector investment decisions in rural areas. The degree to which these benchmarks should be aspirational or reflect current market demand is a topic of frequent debate in policy circles. Assessment of demand and its likely development over time informs many of these debates.

Section 706 of the Telecommunications Act of 1996 (P.L. 104-104; the Telecommunications Act) requires the FCC to report yearly on whether "advanced telecommunications capability is being deployed to all Americans in a reasonable and timely fashion." The act does not specifically define advanced telecommunications capability, delegating this determination to the FCC. It directs the FCC to "take immediate action to accelerate deployment of such capability by removing barriers to infrastructure investment and by promoting competition in the telecommunications market" if its determination is negative.

Since 1999, there have been 11 Section 706 reports, each providing a snapshot and assessment of broadband deployment.39 As part of this assessment, and to help determine whether broadband is being deployed in "a reasonable and timely fashion," the FCC has established minimum data speeds that qualify as broadband service for the purposes of the Section 706 determination. In 2015, citing changing broadband usage patterns and multiple devices using broadband within single households, the FCC raised its minimum fixed broadband benchmark speed from 4 megabits-per-second (Mbps) (download)/1 Mbps (upload) to 25 Mbps/3 Mbps.

The 25/3 Mbps threshold is meaningful in both technical and policy terms, because the legacy copper-based connections utilized by some broadband providers would likely require significant upgrades in order to meet higher thresholds.40 While fiber-based "middle-mile" cable has been broadly deployed over the last two decades, "fiber-to-the-home" installations that enable faster speeds are much less widespread, especially in remote rural areas.

Increases in minimum speed thresholds have frequently engendered policy debates about the regulatory role of the FCC and how best to allocate limited resources for broadband expansion.41 Stakeholders in both the public and private sectors have frequently raised the issue of market demand for improved service when justifying their positions on the FCC's annual Section 706 determinations.

During the Obama Administration, FCC leadership justified increases in service speed thresholds as necessary to ensure that broadband infrastructure kept pace with changes in consumer behavior and the increasing number of bandwidth-hungry electronic devices and applications. "Application and service providers, consumers, and the broadband providers are all pointing to 25/3 as the new standard," wrote then-Chairman Tom Wheeler when commenting on the agency's 2015 progress report. "Content providers are increasingly offering high-quality video online, which uses a lot of bandwidth and could use a lot more as 4K video emerges."42

Opponents argued that demand does not justify investments in faster service that requires costly fiber-optic installations. Two FCC commissioners then serving released dissenting statements, citing tepid demand for faster broadband service as a reason to refrain from mandating higher speeds. Some criticized the FCC for subsidizing infrastructure buildout under one standard, which was then superseded by a new higher standard—in effect designating newly built-out areas as unserved. Commissioner Ajit Pai wrote, "The driving factor in defining broadband should be consumer preference.... 71% of consumers who can purchase fixed 25 Mbps service—over 70 million households—choose not to."43

As FCC Chairman since 2017, Pai has retained the 25/3 Mbps standard as sufficient to meet the Telecommunications Act requirement for the FCC to ensure availability of advanced telecommunications capabilities. In public comments submitted for the 2019 FCC progress report,44 some large broadband providers and associated trade and public policy groups expressed concerns that any increase of speed requirements beyond the existing 25/3 Mbps standard would impose unnecessary burdens on providers based on predicted cost and market demand.45 "The Commission should not change benchmarks based on aspirations that do not reflect widespread consumer demand and that are not grounded in the text of Section 706," wrote the Free State Foundation. "Instead, Section 706 implies a realistic analysis that takes stock of actual market data regarding deployment of infrastructure and the availability of advanced capabilities that a substantial majority or at least an early majority of consumers subscribe to."46

By contrast, rural co-ops and other independent broadband providers have tended to argue (directly or through trade associations) for a higher speed benchmark, which would lead to federal subsidization of higher-speed service.47 In a 2018 letter to a Member of Congress, the manager of an Iowa electric co-op wrote, "Broadband systems funded with limited federal funds should meet the growing speed and data consumption needs of today and into the future.... [Congress] should recognize that in today's 21st century economy, broadband systems built to 10/1 or slower speeds cannot support a modern household much less attract and retain new businesses."48

Trade organizations with memberships that include a cross-section of companies by size, corporate structure, and technology type have generally avoided discussing speed benchmarks in their submitted comments, focusing instead on other issues, such as substitutability of mobile broadband for fixed broadband.49

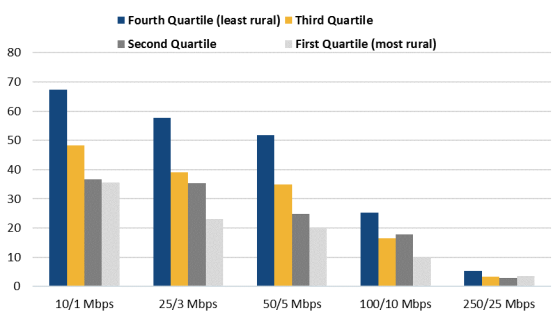

FCC data released as part of the 2019 progress report indicated that 25.3% of households in the nation's least rural counties where service was available had adopted 100/10 Mbps broadband—more than double the 9.9% adoption rate in the nation's most rural counties (see Figure 2). The same data indicated higher overall adoption of the current standard of 25/3 Mbps, with a 57.7% adoption in the least rural counties and 23.1% in the most rural.

Some recent state and regional reports have questioned whether market demand justifies government-subsidized investment in higher speed broadband in all cases. "There is an ongoing, multifaceted debate about whether, where, and when the performance advantages of fiber justify the investment in upgrading communications networks," according to the Arkansas Development Finance Authority. "Most uses of the internet today do not require the capacity and speed that fiber internet offers, and internet service providers who deploy fiber don't necessarily experience strong demand for the upgraded service."50 According to an April 2019 report from the Southeastern Indiana Regional Planning Commission, "Some providers argue that even when broadband is available, customers do not subscribe as expected."51 The authors argued for energetic measures to promote broadband affordability and adoption as a remedy.

Federal Programs' Consideration of Market Demand When Awarding Funds for Broadband Infrastructure Buildout

The primary purpose of the RUS and USF High Cost programs is to support expansion of broadband availability in unserved or underserved areas, rather than to promote broadband adoption.52 Funding under these programs has typically been awarded based on ISP commitments to making a certain level of service available to a certain number of eligible households and businesses within a certain period of time. However, there are some important differences.

The RUS programs include loans, which recipients must repay. Applicants for funding under the Rural Broadband Access Loan program are required to complete and submit a financial forecast to demonstrate that they can repay the loan, and that the proposed project "is financially feasible and sustainable."53 The forecast must include—with few exceptions—a market survey that describes service packages and rates, and provides the number of existing and proposed subscribers.54 This requirement may incentivize recipients to encourage adoption in their service areas in order to increase revenues that they can then use for loan repayment. At the same time, it may also deter providers from accepting loans to serve areas where the business case for deployment is particularly difficult.55

Perhaps because of disincentives for investment in unattractive markets, RUS selection criteria and loan terms prioritize buildout to unserved or underserved areas over subscription rates or other business performance metrics. According to the application guide, "Priority must be given to applicants that propose to offer broadband service to the greatest proportion of households that, prior to the provision of the broadband service, had no incumbent service provider."56 Program administrators prioritize projects according to four tiers, which range from 25% to 100% of households unserved. The standard loan term is 3 years, but applicants can request up to a 35-year repayment term and a principal deferral period of up to 4 years if at least 50% of the households in the proposed service area are unserved.57

The RUS ReConnect program has similar goals, but also includes grants and loan-grant combinations. Applicants can likewise request more generous loan terms if they plan to serve a Substantially Underserved Trust Area (typically tribal lands), and their application may be granted priority status. Reviewers score applications against evaluation criteria using a points-based system. They award points for population density (less dense areas receiving preference), number of farms served, number of businesses served, number of educational facilities served, performance of the offered services, and other criteria.58 Neither projected business performance metrics nor adoption rates are included in the evaluation criteria.

Under the High Cost program, federal subsidies are premised on the absence of a business case for broadband expansion. In announcing the latest proposed round of support, known as the Rural Digital Opportunity Fund (RDOF), the FCC stated that it would prioritize buildout in areas where "there is currently no private sector business case to deploy broadband without assistance."59 USF programs only require that participating broadband providers advertise the availability of broadband service within their service areas, and that the broadband provider be able to provide service at rates "reasonably comparable to rates offered in urban areas" to any area household within 10 business days if requested to do so. Census blocks—the administrative-territorial unit used by the FCC to measure broadband coverage—are considered served if a local broadband provider meets these conditions. As with the RUS programs, the High Cost program has prioritized buildout and higher broadband performance over adoption. Phase I of the proposed RDOF program would prioritize support to broadband providers that serve "completely unserved areas" at higher data speeds, higher usage allowances, and lower latency, but sets no specific adoption benchmarks.60

The FCC expressed concerns in its RDOF proposal that recipients of support might lack any incentive to aggressively market their services or otherwise stimulate demand beyond relatively low-cost high-return areas, and might even take measures to limit subscription in order to protect profits.

Since [RDOF] support may require certain providers to offer much higher data caps than they do to [non-RDOF] subscribers and price the services similarly, such providers may have an incentive to limit [RDOF] subscribers to sell their capacity to more profitable [non-RDOF] subscribers. Spectrum-based providers that do not have a network sufficient to serve most locations in a geographic area would also have an incentive to limit subscription if expanding capacity would be less profitable than limiting subscription and collecting [RDOF] subsidies based purely on deployment. Even wireline bidders may lack the proper incentives to serve additional customers in some areas, given that it may not be profitable without a per-subscriber payment to run wires from the street to the customer location and install customer premises equipment.61

Having expressed these concerns, the FCC put forward a proposal to introduce subscribership milestones for RDOF recipients. It requested comment on several different implementation options. One proposal would offer a baseline level of support to broadband providers and then add per-subscriber payments. Another would withhold a certain percentage of support if broadband providers failed to meet subscription milestones, although it raised the question of what milestones were appropriate given "the unique challenges of serving rural areas."62 Eliciting private sector participation in rural broadband programs appears to be a concern for the FCC, just as it is for USDA. In its last round of USF funding support, FCC increased the term of support to broadband providers from 5 years to 10 years in order to gain "robust participation" in the program.63

Federal Programs That May Stimulate Broadband Demand

A number of federal programs may stimulate demand for broadband in underserved areas, though this is not always their primary purpose. Such programs include end-user subsidies to reduce out-of-pocket costs for subscribers; education and outreach activities to promote digital awareness and skills; infrastructure-oriented programs that support community anchor institutions such as schools and libraries; and infrastructure-oriented programs supporting specific applications, such as telemedicine and precision agriculture. This section presents a non-exhaustive summary of these programs.

End-User Subsidies

The FCC's Lifeline program is the only major federal broadband program that directly targets broadband adoption by residential subscribers.64 It targets households earning less than 135% of the federal poverty level. Program enrollment rates vary widely by state, with a nationwide average of 28% of eligible beneficiaries.65 The program subsidizes enrollees to cover the recurring monthly service charges associated with broadband subscribership. Support is not given directly to the subscriber but to the subscriber-selected service provider. Although stimulating broadband demand is not an explicit purpose of the Lifeline program, expansion of Lifeline enrollment may improve the business case for broadband deployment in rural areas, which on average have a disproportionately high number of low-income residents.

In many cases, facilities-based telecommunications providers sell excess capacity in areas they already serve to resellers, who then rebrand the service and market low-cost plans to eligible Lifeline beneficiaries. In 2017, the FCC proposed changes to the Lifeline program that would bar resellers from participation.66 Some in Congress claimed that these changes would reduce enrollment by 70% from current levels.67

In a further action, the proposed FCC update to Lifeline minimum service standards for 2019 raised concerns in some quarters that low-income subscribers would be priced out of the market by required upgrades. In a letter to the FCC, NTCA—The Rural Broadband Association wrote that unless the FCC requirement is waived, "current Lifeline subscribers to fixed broadband service will be forced to upgrade to a higher speed tier than they may need, want, or have the ability to afford—resulting in either stretched consumer budgets or the potential for price-sensitive customers to cease buying broadband altogether."68 The FCC stated that the increase was required under provisions of the 2016 Lifeline Order.69 In its November 2019 decision, the FCC retained the existing subsidy level for broadband service and increased the monthly data minimums from 2 gigabytes to 3 gigabytes—a reduction from the 8.75 gigabyte minimum originally proposed.70

Outreach and Education Programs

The federal government has supported numerous broadband-related outreach and education activities over the years, typically as part of broad-ranging development grant programs focused primarily on housing and education. Agencies providing grant support of this type include the Departments of Education, Housing and Urban Development, and Commerce, as well as the National Science Foundation and several regional development commissions.71

The Broadband Technology Opportunities Program (BTOP) is an exception to this pattern, as it includes dedicated funding for broadband adoption programs. The American Recovery and Reinvestment Act of 2009 (P.L. 111-5) provided approximately $4 billion for BTOP, to be administered by the National Telecommunications and Information Agency (NTIA, an agency of the Department of Commerce) as a program including broadband infrastructure grants, grants for expanding public computer capacity, and grants to encourage sustainable adoption of broadband service. As of August 2015, BTOP had awarded $3.48 billion for infrastructure buildout, $201 million for public computer centers, and $250.7 million for sustainable broadband adoption.72 Most BTOP funds have been expended, but NTIA continues to monitor existing grants.73

A 2015 Government Accountability Office (GAO) report found that affordability, lack of perceived relevance, and lack of computer skills are the "principal barriers" to broadband adoption. It identified outreach and training, along with discounts, as "key approaches" to addressing those barriers. Regarding BTOP, it noted, "NTIA compiled and published self-reported information from its BTOP grantees about best practices, but has not assessed the effectiveness of these approaches in addressing adoption barriers."74 In a response to the GAO, the Deputy Secretary of Commerce wrote that grant recipients were individually responsible for program design and assessments of program effectiveness.75

Support to Community Anchor Institutions

The FCC's E-Rate (Schools and Libraries) Program under the USF provides discounts of up to 90% for broadband to and within public and private elementary and secondary schools and public libraries in both rural and nonrural areas. Some have suggested that broadband non-adopters may be more likely to subscribe to at-home service if they gain experience using the internet and become more aware of the benefits it can provide in finding employment, accessing educational resources, and interacting with government agencies, among other uses. However, a 2015 study found that "counties with libraries that aggressively increased their number of Internet-accessible computers between 2008 and 2012 did not see measurably higher increases in their rates of residential broadband adoption."76

Telemedicine and Telehealth

The USDA's Distance Learning and Telemedicine (DLT) grants fund end-user equipment and broadband facilities to help rural communities use telecommunications to "link teachers and medical service providers in one area to students and patients in another."77 DLT grants serve as initial capital for purchasing equipment and software that operate via telecommunications to rural end-users of telemedicine and distance learning. Eligible applicants include most entities in rural areas that provide education or health care through telecommunications, including most state and local governmental entities, federally recognized tribes, nonprofits, for-profit businesses, and consortia of eligible entities.78

The FCC Rural Health Care Program provides similar benefits to eligible public and nonprofit health care providers in rural areas. Additionally, providers may receive a 65% discount on the costs of broadband service (if available) or a discount equal to the urban-rural broadband service price differential. This program does not address the issue of household connectivity with providers.79

The effect that support for the emerging telehealth sector has on rural demand for broadband service is unclear. Rural counties with the least access to medical care typically also have the least access to broadband internet.80 The demographic profiles typical of these locations are associated with both lower broadband adoption and lower rates of health insurance coverage, so broadband buildout there might or might not lead to substantially greater telehealth use.

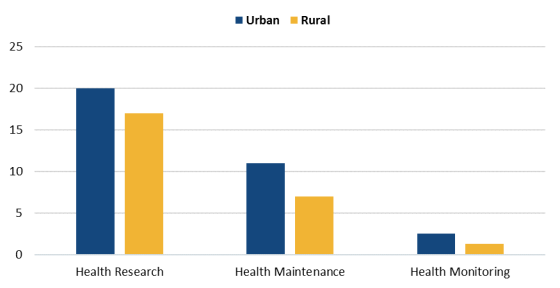

A 2018 USDA study on rural telehealth, conducted by the agency's Economic Research Service, found that rural residents were significantly less likely to use telehealth services than urban residents were, even when broadband availability was not a factor.81 The study measured usage across three categories: online health research; online health maintenance; and online health monitoring. According to the study, a usage gap between rural and urban patients existed across all three categories.

Usage rates appeared to track closely with cost. The highest usage rates were for online health research that costs little and can be conducted anywhere that has basic internet access. According to the study, "Lack of Internet service in the home, whether by choice or due to lack of availability, did not deter everyone from conducting online health research."82 The study also found that existing rural connectivity was sufficient for most health maintenance activities, but "the issue of acceptance and/or remuneration levels by the health insurance industry and government health support programs—and not technology—[was] cited as an impediment to implementation."83 Online health monitoring—the most expensive telehealth service category—was also the least used. "As online monitoring was costly, the results largely reflect who had or did not have health insurance."84

|

Figure 3. Telehealth Practices by Category Comparison of urban-rural usage rates |

|

|

Source: USDA, Economic Research Service based on data from the U.S. Census Bureau, 2015 Current Population Survey. |

Some industry groups have argued that subsidized buildout of higher speed broadband will enable the use of new applications, which may promote telehealth use. NTCA, which represents rural broadband providers, commented in 2019, "The capabilities and promise of telemedicine are as unlimited as other applications and technology that are evolving to take full advantage of broadband capabilities." These may include use of virtual and augmented reality applications, embedded devices, and wearables, technologies that depend on high-speed fiber-based broadband networks, according to NTCA.85

Likewise, some advocacy groups and researchers highlight regulatory issues, such as varying state regulations for Medicaid reimbursement, which they claim may hinder development of the market for telehealth services.86

Precision Agriculture

Section 12511 of the Agriculture Improvement Act of 2018, commonly known as the 2018 farm bill (P.L. 115-334), established the Task Force for Reviewing the Connectivity and Technology Needs of Precision Agriculture in the United States. The FCC announced the creation of this congressionally mandated task force on June 17, 2019. The task force plans to "develop policy recommendations to promote the rapid, expanded deployment of broadband Internet access service on unserved agricultural land," in consultation with the Secretary of Agriculture.87 However, the USDA has noted that adoption of precision agriculture methods by the farm community "has been hesitant and weak," especially among smaller producers, because of concerns over upfront costs, uncertain economic returns, and technological complexity.88 In addition to the interagency task force, the 2018 farm bill authorizes several initiatives to fund research and development on precision agriculture.89 It also modifies prioritization criteria for USDA broadband loans and grants to include precision agriculture activities.90 However, these provisions do not directly address end-user affordability issues.

Options for Congress

Promoting universal access to broadband has generally enjoyed wide bipartisan support in Congress. Despite federal support for broadband infrastructure buildout, however, adoption continues to lag in rural areas, even where the infrastructure exists and service is available. In turn, low adoption rates may lower the private sector's incentive to invest in nascent rural broadband markets, despite federal subsidies for high-cost service. This section highlights selected options Congress could consider as it addresses rural broadband demand issues.

Oversight or Legislation Addressing the Lifeline Program

In the Lifeline program, intended to address broadband affordability for low-income households, FCC changes to provider eligibility rules and minimum service requirements have prompted considerable debate (see "End-User Subsidies"). The FCC has wide latitude to set program rules, subject to the established rulemaking process. Congress might continue its oversight of that rulemaking process or might choose in some cases to direct FCC actions through legislation. Issues of potential interest include

- beneficiary eligibility requirements,

- beneficiary eligibility verification procedures,

- the level of the benefit (currently $9.25 per household, with additional benefits for beneficiaries who reside on tribal lands),

- ISP eligibility requirements,

- ISP minimum service requirements, and

- how oversight authorities are shared between the federal government and the states.

Research on How the Costs of Broadband-Enabled Services Affect Rural Broadband Demand

In addition to the direct cost of broadband connectivity, cost barriers may reduce the attractiveness of broadband-related services that might otherwise stimulate rural broadband demand. For example, access to affordable health insurance may be one factor affecting the affordability, and hence adoption, of telehealth services (see "Telemedicine and Telehealth"). Similarly, the upfront costs of sensors and other technology may be slowing the adoption of precision agriculture practices (see "Precision Agriculture"). Congress might consider mandating further research on the extent to which these factors influence broadband demand, and how such barriers could be overcome.

Broadband-Focused Education and Outreach Grants

With the exception of BTOP, most federal support for broadband-related education and outreach activities has been through housing and education grant programs that include internet and computer skills among numerous other eligible funding categories (see "Outreach and Education Programs"). Grant recipients typically expend the majority of funds on the non-broadband-related categories, which may be considered more central to housing development and education goals. Congress might consider whether a focused grant program or programs specifically designated for support of broadband-enabled applications would be more effective, and if so, how lessons from BTOP might be applied to program design and implementation.

In addition to general internet and computer skills, Congress might consider including broadband-enabled applications in such an education and outreach program. Rural adoption of precision agriculture practices may be stymied if the benefits are not fully understood or if familiarity with the technology is lacking. Rural small businesses often do not make full use of broadband technology, even when adequate connectivity is available (see "Valuation of Broadband Service"). Even farmers and small rural business owners who can afford broadband service might benefit from education on the use of web-based applications to improve their operations or on how to calculate long-term benefits more accurately. Rural use of telehealth services might increase if potential users were more aware of the health and convenience benefits offered by emerging applications.

Incentivizing Adoption via the Terms of Federal Infrastructure Buildout Programs

The RUS and USF programs that support broadband infrastructure buildout (see "Major USDA and FCC Broadband Programs") rely on private-sector broadband providers for on-the-ground deployment. Therefore, the conditions of federal support need to be sufficiently attractive in business terms to elicit participation from the private sector. At the same time, taxpayer or ratepayer value-for-money is also a policy concern that becomes especially salient if wide scale broadband adoption does not follow subsidized buildout.

Under current RUS program rules, award recipients must demonstrate the economic viability of proposed projects. However, scoring criteria heavily favor applicants proposing to build out infrastructure in the most remote, underserved areas, which are least likely to present a strong business case. Some in Congress have expressed concern about RUS loan subscription rates (see "Federal Programs' Consideration of Market Demand When Awarding Funds for Broadband Infrastructure Buildout"). Through legislation or enhanced oversight of RUS program rules, Congress might seek to change end-user subsidy programs to improve the business case for buildout projects, or to adjust program rules in other ways to mitigate disincentives for investment.

Under current USF program rules, participating broadband providers have limited responsibility to develop the demand side of local broadband markets. They are only responsible for ensuring availability of service at a given speed and latency benchmark, and advertising it within a designated service area. There is no other requirement for broadband providers to develop their subscriber base or otherwise promote adoption. The FCC included requests for comments on this issue in its 2019 proposal for the RDOF program. Congress might consider legislation or oversight to effect changes in program rules that would incentivize ISP investments in broadband adoption. For example, under current FCC rules, the term of support for High Cost program subsidies is 10 years; Congress might consider directing the FCC to lengthen or shorten this term to adjust ISP business incentives.

Oversight of FCC Section 706 Process

Finally, broadband speed benchmarks and other service quality metrics are frequently debated as part of the congressionally mandated requirement for the FCC to assess deployment of communications technology under Section 706 of the Telecommunications Act (see "FCC Service Benchmarks and Market Demand for Higher Speeds"). Higher service quality requirements may boost American technological leadership and ensure that citizens can use high-bandwidth internet applications, but they may also impose costs on broadband providers and lead to higher costs for customers—pricing some of them out of the market. Congress may consider the costs and benefits of proposed service requirements, and how such requirements might affect rural broadband adoption, when exercising oversight of the FCC's Section 706 responsibilities.