Frequently Asked Questions

In addition to the Senate and House of Representatives, what is funded by the legislative branch appropriations bill?

In addition to the Senate and House of Representatives, the legislative branch bill typically funds Joint Items, including the Joint Economic Committee, Joint Committee on Taxation, Office of the Attending Physician, and Office of Congressional Accessibility Services; Capitol Police; Office of Congressional Workplace Rights (OCWR, formerly the Office of Compliance); Congressional Budget Office (CBO); Architect of the Capitol (AOC); Library of Congress (LOC), including the Congressional Research Service (CRS); Government Publishing Office (GPO); Government Accountability Office (GAO); and Open World Leadership Center.

How has funding for the legislative branch changed in recent years in current and constant (inflation-adjusted) dollars?

Table 1 provides information on the enacted funding levels provided for the legislative branch from FY2008 to FY2019. The table includes annual and supplemental appropriations, rescissions, and the FY2013 sequestration.

Table 1. Legislative Branch Funding, FY2008-FY2019: Current and Constant Dollars

(in billions of dollars)

|

Fiscal Year |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

Current Dollars |

3.970 |

4.501 |

4.669 |

4.543 |

4.307 |

4.061 |

4.259 |

4.300 |

4.363 |

4.440 |

4.700 |

4.836 |

|

Constant Dollars |

4.705 |

5.331 |

5.434 |

5.174 |

4.802 |

4.457 |

4.603 |

4.621 |

4.654 |

4.655 |

4.804 |

4.836 |

Source: CRS analysis of legislative branch appropriations acts and related budget documents.

Notes: These figures exclude permanent budget authorities, including funding for Member pay, that are not included in the annual legislative branch appropriations bill. Totals include supplementals and rescissions. Constant 2019 dollars calculated using the "Total Non-Defense" deflator in Table 10.1—Gross Domestic Product and Deflators Used in the Historical Tables: 1940–2024 in the President's FY2020 budget request.

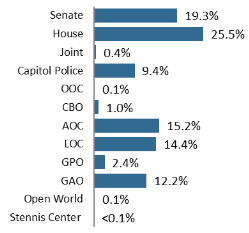

How is funding divided across the legislative branch?

Figure 1 shows the distribution of budget authority across the legislative branch in FY2019.

What funding has been provided in recent years for the Senate, House of Representatives, and legislative branch agencies, and what is the status of FY2020 funding?

Table 2 provides information on funding levels for the Senate, House of Representatives, and legislative branch agencies in recent years as well as the requested, House-reported, Senate-reported, and enacted levels for FY2020.

By law, the President includes the legislative branch request in the annual budget submission without change.

Table 2. Legislative Branch Appropriations: Prior Enacted Levels and FY2020 Action

(in thousands of dollars)

|

Entity |

FY2014 |

FY2015 |

FY2016 |

FY2017 |

FY2018 Enacted |

FY2019 Enacted |

FY2020 Requested |

FY2020 |

FY2020 Senate-Reported |

FY2020 Enacted |

|

Senate |

$859,293 |

$864,286 |

$870,159 |

$871,177 |

$919,932 |

$934,667a |

$1,046,478 |

—b |

969,396 |

|

|

House of Representatives |

1,180,908 |

1,180,735 |

1,180,909 |

1,189,223 |

1,200,173 |

1,232,663a |

1,356,669 |

1,345,725 |

—b |

|

|

Joint Itemsc |

18,994 |

19,056 |

20,732 |

19,565 |

20,654 |

20,656 |

21,143 |

21,143 |

22,643 |

|

|

Capitol Police |

338,459 |

347,959 |

375,000 |

393,300 |

426,500 |

456,308 |

463,341 |

463,341 |

464,341 |

|

|

Office of Congressional Workplace Rightsd |

3,868 |

3,959 |

3,959 |

3,959 |

4,959 |

6,333 |

6,333 |

6,333 |

6,333 |

|

|

Congressional Budget Office |

45,700 |

45,700 |

46,500 |

46,500 |

49,945 |

50,737 |

53,556 |

52,666 |

54,941 |

|

|

Office of Technology Assessment |

— |

— |

— |

— |

— |

— |

— |

6,000 |

— |

|

|

Architect of the Capitolb |

602,030 |

600,261 |

612,904 |

617,887 |

712,105 |

733,745 |

831,694 |

624,668b |

585,782b |

|

|

Library of Congress, including CRS |

578,982 |

590,921 |

599,912 |

631,958 |

669,890 |

696,112 |

747,077 |

720,290 |

735,801 |

|

|

CRS (non-add) |

105,350 |

106,945 |

106,945 |

107,945 |

119,279 |

125,688 |

121,572 |

119,889e |

120,495e |

|

|

Government Publishing Office |

119,300 |

119,993 |

117,068 |

117,068 |

117,068 |

117,000 |

117,000 |

117,000 |

117,000 |

|

|

Government Accountability Office |

505,383 |

522,000 |

531,000 |

544,506 |

578,917f |

589,750g |

647,637 |

615,604 |

639,436 |

|

|

Open World Leadership Center |

6,000 |

5,700 |

5,600 |

5,600 |

5,600 |

5,600 |

5,800 |

5,800 |

5,900 |

|

|

Stennis Center for Public Service |

430 |

430 |

430 |

430 |

430 |

430 |

430 |

430 |

430 |

|

|

Administrative Provisions |

-1,000 |

-1,000 |

-1,000 |

-1,000 |

-2,000 |

-2,000 |

-2,000 |

— |

-2,000 |

|

|

Otherh |

0 |

0 |

0 |

0 |

-4,000 |

-6,000 |

-7,000 |

-7,000 |

— |

|

|

Total Legislative Branch |

$4,258,347 |

$4,300,000 |

$4,363,172 |

$4,440,173 |

$4,700,173 |

$4,836,001 |

$5,288,158 |

$3,972,000b |

3,600,003b |

Sources: P.L. 113-76, P.L. 113-235, P.L. 114-113, P.L. 115-31, P.L. 115-141, P.L. 115-244, explanatory materials for FY2014, FY2015, FY2016, FY2017, and FY2018 inserted into the Congressional Record, H.Rept. 115-929, the Budget for Fiscal Year 2020, H.Rept. 116-64, S.Rept. 116-124, and CRS calculations.

a. Total does not include gratuity payments for survivors of deceased Members of Congress.

b. By tradition, the House does not consider appropriations for the Senate or Senate office buildings, and the Senate does not consider appropriations for the House or House office buildings.

c. "Joint Items" generally contains funding for the Joint Economic Committee, the Joint Committee on Taxation, the Office of the Attending Physician, and the Office of Congressional Accessibility Services. In fiscal years prior to an inauguration, it also contains funding for the Joint Congressional Committee on Inaugural Ceremonies (e.g., $1.25 million for FY2016; $1.5 million recommended for FY2020 in S.Rept. 116-124).

d. Formerly known as the Office of Compliance, the Office of Congressional Workplace Rights (OCWR) was renamed by the Congressional Accountability Act of 1995 Reform Act (P.L. 115-397).

e. The House Appropriations Committee report (H.Rept. 116-64) describes "Appropriations Shifts to Reflect Centralized Funding for Information Technology" that affected the four LOC appropriations headings. The report states that the House-reported FY2020 level represents an increase of $2.99 million for CRS when reflecting the centralized IT funding.

f. Does not include emergency appropriation provided by P.L. 115-123. Title IX of Division B provided $14.0 million to GAO "for audits and investigations relating to Hurricanes Harvey, Irma, and Maria and the 2017 wildfires."

g. Does not include emergency appropriation provided by P.L. 116-20. Title IX provided $10.0 million to GAO for audits and investigations related to storms and disasters.

h. Includes, for example, scorekeeping adjustments or prior-year outlays.

Why is the legislative branch budget request included in the President's budget request? Does the President play any role in its development?

The President has no formal role in the development of the legislative branch budget request, even though it is included in the President's annual budget request documents.

By long-standing law and practice, the legislative branch request and any supplemental requests are submitted to the President and included in the budget without change.1 While the executive branch budget submissions generally involve interaction between an agency and the Office of Management and Budget (OMB), the legislative branch requests do not. The executive branch does not review or maintain documentation in support of the legislative branch requests.2

What percent of discretionary budget authority historically goes to the legislative branch?

Discretionary budget authority is provided and controlled by the annual appropriations acts.

Since FY1976, the legislative branch as a proportion of total discretionary budget authority has averaged approximately 0.40%.3 The maximum level, 0.48%, was in FY1995 and the minimum, 0.31%, was in FY2009.

What percent of total budget authority (mandatory and discretionary) historically goes to the legislative branch?

Total budget authority includes both discretionary budget authority controlled by the annual appropriations acts and mandatory budget authority controlled by previous laws, including entitlements.

Since FY1976, the legislative branch as a proportion of total budget authority has averaged 0.16%. The maximum level, 0.23%, was in FY1977, and the minimum, 0.11%, was in FY2017 and FY2018.4

Are Member salaries funded or adjusted in the legislative branch appropriations bill?

No, salaries for Members of Congress are neither funded nor increased in the legislative branch bill.

Member salaries have been included as mandatory spending since FY1983, and the amount of potential Member pay adjustments is calculated pursuant to the Ethics Reform Act of 1989, which established a formula based on changes in the Employment Cost Index (ECI).5 The adjustment automatically takes effect unless (1) Congress statutorily prohibits the adjustment; (2) Congress statutorily revises the adjustment; or (3) the annual base pay adjustment of General Schedule (GS) federal employees is established at a rate less than the scheduled increase for Members, in which case the percentage adjustment for Member pay is automatically lowered to match the percentage adjustment in GS base pay.

Members of Congress last received a pay adjustment in January 2009. Since then, the compensation for most Senators, Representatives, Delegates, and the Resident Commissioner from Puerto Rico has been $174,000.

The maximum potential January 2020 member pay adjustment is 2.6%, or $4,500.6 The Senate-reported bill contained an administrative provision prohibiting this adjustment. The House-reported bill did not contain this provision. No separate votes have been held on the Member pay adjustment.

Although discussion of Member pay is often associated with appropriations bills, these bills do not contain language funding or increasing Member pay, and a prohibition on the automatic annual Member pay adjustments could be included in any bill, or be introduced as a separate bill.

For a list of the laws that have previously contained provisions prohibiting the annual pay adjustments, see "Table 3. Legislative Vehicles Used for Pay Prohibitions, Enacted Dates, and Pay Language" in CRS Report 97-1011, Salaries of Members of Congress: Recent Actions and Historical Tables, by Ida A. Brudnick.

In contrast, the salaries and benefits for legislative branch employees are provided by the legislative branch appropriations acts, although they generally do not address pay adjustments.7

Why do the initial committee-reported versions of the annual bill not fund the other chamber?

The House and Senate both consider funding levels for the legislative branch agencies and joint entities. By long-standing tradition, however, the House bill does not propose funding levels for Senate items, including the account that funds the Senate and the Senate office buildings account within the Architect of the Capitol.8 Similarly, the Senate does not comment on House items, including the account that funds the House or the House office buildings account within the Architect of the Capitol. The House, Senate, and conference reports on legislative branch appropriations bills regularly contain language illustrating the deference of each chamber to the internal practices of the other.9 If comparing the House and Senate bill totals, or the total provided to the Architect of the Capitol at different stages of consideration, adjustments may be necessary to address any omissions due to this practice.