Background and Context

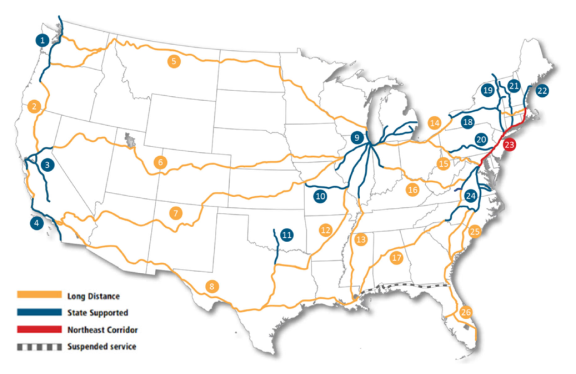

Amtrak—legally the National Railroad Passenger Corporation—was created by the Rail Passenger Service Act of 19701 and began operating in 1971, taking over intercity passenger service from financially distressed private railroad companies. It originally did not own any rail infrastructure, eventually coming to own some assets cast off by bankrupt private railroads. It is operated as a private company and not a government corporation, but the President appoints the members of its Board of Directors and its primary stockholder is the U.S. Department of Transportation (DOT), with a small proportion of common stock held by other railroad companies. Amtrak currently serves over 500 stations in 46 states and the District of Columbia, running over 300 trains per day on a network approximately 22,000 miles long (Figure 1).2

|

|

Source: Amtrak, General and Legislative Annual Report & Fiscal Year 2020 Grant Request. Notes: Numbers on map correspond to the following routes: 1. Cascades; 2. Coast Starlight; 3. Capitol Corridor, San Joaquin; 4. Pacific Surfliner; 5. Empire Builder; 6. California Zephyr; 7. Southwest Chief; 8. Sunset Limited; 9. Blue Water, Carl Sandburg, Hiawatha, Hoosier State (discontinued as of July 2019), Illini, Illinois Zephyr, Lincoln, Pere Marquette, Saluki, Wolverine; 10. Missouri River Runner; 11. Heartland Flyer; 12. Texas Eagle; 13. City of New Orleans; 14. Lake Shore Limited; 15. Capitol Limited; 16. Cardinal; 17. Crescent; 18. Maple Leaf; 19. Adirondack, Empire, Ethan Allen; 20. Keystone, Pennsylvanian; 21. Vermonter, Valley Flyer (initiated August 2019); 22. Downeaster; 23. Northeast Corridor; 24. Carolinian, Piedmont, Virginia; 25. Auto Train, Palmetto; 26. Silver Meteor, Silver Star. Where State-Supported and Long-Distance routes overlap, the State-Supported route is shown. Amtrak does not serve Alaska or Hawaii. |

Since 2008, Amtrak services have been grouped into three business lines: (1) the Washington-New York-Boston Northeast Corridor (NEC), (2) short-distance corridors under 750 miles long with service supported by state governments, and (3) long-distance trains serving destinations over 750 miles apart, usually once per day on an overnight schedule. Under the Fixing America's Surface Transportation (FAST) Act of 2015 (P.L. 114-94), the state-supported short-distance and long-distance routes were grouped together into the National Network. Amtrak's Thruway network of over 150 intercity bus routes serves as a feeder service for passenger trips originating or terminating in cities off the rail system.

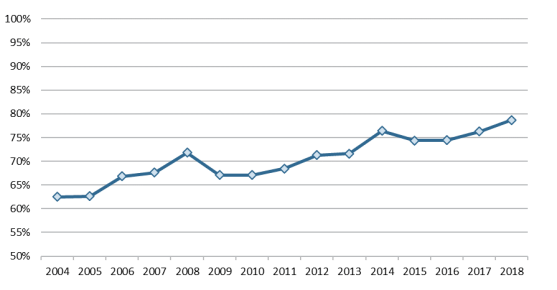

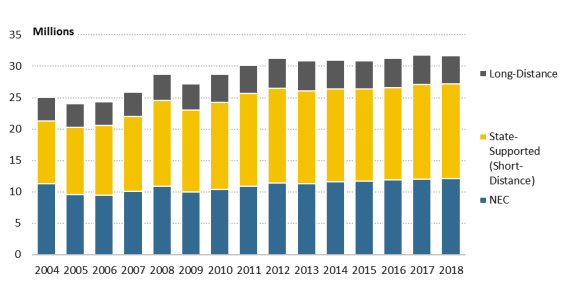

Over 31 million trips were taken on Amtrak in 2018, a company record.3 Amtrak system ridership has exceeded 30 million trips every year since 2011, and has increased 26% over the last 15 years, with much of that growth coming on Amtrak's state-supported short-distance corridors (Figure 2). Approximately 48% of all Amtrak trips were taken on state-supported routes in 2018, compared with 38% on the Northeast Corridor and the remaining 14% on long-distance trains. State-supported routes have accounted for the plurality of Amtrak trips among its three business lines every year since 2005. One contributing factor to the growth of state-supported route traffic over that period is that Amtrak and its state partners have added new routes and additional daily trains.

|

Figure 2. Amtrak Ridership by Business Line, FY2004-FY2018 (in millions of trips) |

|

|

Source: Compiled by CRS from Amtrak monthly performance reports. |

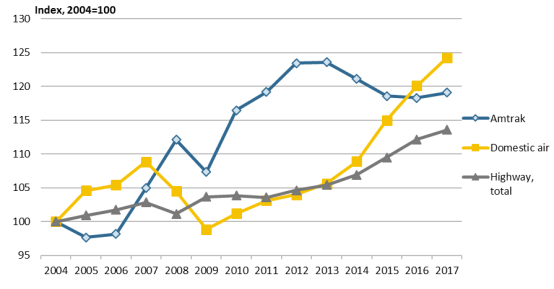

Despite record ridership levels, Amtrak trains are roughly as full as they have been at any point in the past decade (see discussion of load factor below), and Amtrak passengers account for a small fraction of intercity passenger travel volume nationwide. In 2017, the most recent year for which such data are available, Amtrak generated 6.5 billion passenger-miles (one passenger-mile is equal to one passenger traveling one mile) of traffic volume; by comparison, domestic air travel generated 694 billion passenger-miles, over 100 times as many as Amtrak. Highway users generated an estimated 5.5 trillion passenger-miles in 2017, including 365 billion on buses, though this includes trips that are not intercity in nature. However, Amtrak passenger-miles have seen a greater cumulative percent increase since 2004 than highway passenger-miles, and saw a greater cumulative percent increase than domestic air passenger-miles from 2008 to 2015 before being overtaken in 2016 (Figure 3). Though Amtrak ridership has been steady or rising in terms of trips taken, Amtrak passenger-miles have declined somewhat since 2013, suggesting an increase in shorter trips. The NEC is the only market in which Amtrak serves a larger proportion of intercity trips than airlines, with both lagging far behind highway travel.4 Lack of equipment and track capacity have inhibited Amtrak from increasing service on the NEC.

|

|

Source: Calculated by CRS using data from Bureau of Transportation Statistics, Table 1-40, https://www.bts.gov/content/us-passenger-miles. Notes: Calendar-year data. Highway passenger-miles include nonintercity travel. |

Amtrak's Finances5

Amtrak's expenses exceed its revenues each year. In FY2018, Amtrak's revenues totaled $3.2 billion, against expenses of $4.1 billion, for a net loss of $868 million. That loss was covered by federal grants made to Amtrak by DOT (see the discussion of funding issues later in this report). Revenues covered 79% of the railroad's total expenses in FY2018, the highest ratio over the 15 years for which comparable data are available (see Figure 4 and Table 1).

Table 1. Amtrak Revenues, Expenses, and Federal Support, FY2014-FY2018

(in millions of nominal dollars)

|

FY2014 |

FY2015 |

FY2016 |

FY2017 |

FY2018 |

|

|

Operating revenue |

|||||

|

Ticket revenue |

$2,147 |

$2,124 |

$2,136 |

$2,181 |

$2,207 |

|

Food and beverage revenue |

126 |

132 |

132 |

139 |

141 |

|

State-supported train revenue |

235 |

223 |

227 |

224 |

234 |

|

Total passenger-related revenue |

2,508 |

2,479 |

2,495 |

2,544 |

2,582 |

|

Commuter/other core revenue |

119 |

123 |

226 |

260 |

285 |

|

Other/ancillary revenue |

608 |

556 |

425 |

371 |

342 |

|

Total revenue |

3,236 |

3,157 |

3,146 |

3,175 |

3,208 |

|

Total expenses |

4,284 |

4,333 |

4,261 |

4,144 |

4,076 |

|

Net loss |

(1,083) |

(1,286) |

(1,081) |

(969) |

(868) |

|

Adjustments |

896 |

996 |

850 |

775 |

700 |

|

Adjusted operating loss |

(189) |

(290) |

(230) |

(194) |

(168) |

|

Federal capital and operating grants |

$1,390 |

$1,390 |

$1,390 |

$1,495 |

$1,942 |

Source: Amtrak monthly performance reports.

Notes: FY2018 figures are preliminary. Starting in FY2017, Amtrak changed definition of "total expenses" to exclude depreciation and other items. Total expenses for FY2017 and FY2018 are therefore calculated as total revenue plus amount of net loss.

Under pressure from Congress and several Administrations, Amtrak has reduced—but not eliminated—its reliance on federal subsidies to support its operations. Amtrak had net losses of roughly $900 million in each of FY2017 and FY2018, the first two years in the past 15 in which net losses were less than $1 billion. One important reason for this improvement is a doubling of revenue from commuter railroads using the NEC from pre-2016 to post-2016, due to higher payments required under the cost allocation policy established by Section 212 of the Passenger Rail Investment and Improvement Act of 2008 (PRIIA; Division B of P.L. 110-432) and enforceable by the Surface Transportation Board (STB) under Section 11305 of the FAST Act.

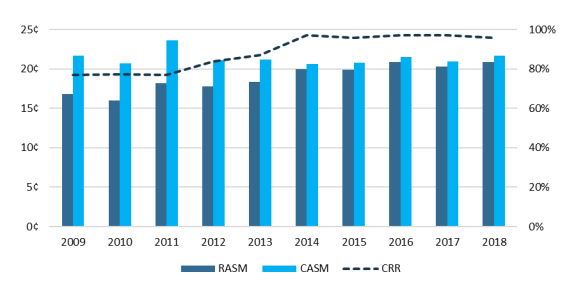

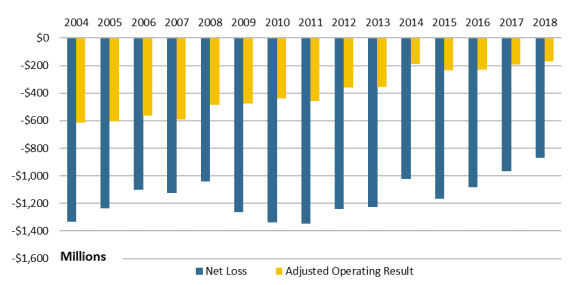

By Amtrak's preferred metric, which adjusts the net loss by removing depreciation and certain other expenses, annual operating losses have been reduced to a figure smaller than $250 million in each of the past five fiscal years; this figure was over twice as large in nominal terms in the years prior to 2007 (Figure 5). The effect is more dramatic when taking the effects of inflation into account; in constant 2019 dollars, the figure was four times as large in 2007 as it was in 2018.6 This metric, dubbed the adjusted operating result, is seen by Amtrak as more closely reflecting the need for federal operating support, but it does not take the railroad's capital investment needs into account.

|

Figure 5. Amtrak Net Loss and Adjusted Operating Result, FY2004-FY2018 (in nominal dollars) |

|

|

Source: Amtrak monthly performance reports. |

By another measure, which allocates costs and revenues to each available seat-mile of passenger capacity offered, Amtrak has recovered at least 96% of operating costs every year since 2014, up from below 80% in the preceding years (Figure 6). One contributing factor to this improved financial performance is likely the requirement, contained in PRIIA, that operating losses on short-distance routes located off the NEC be offset by state funds, effective on the first day of FY2014.

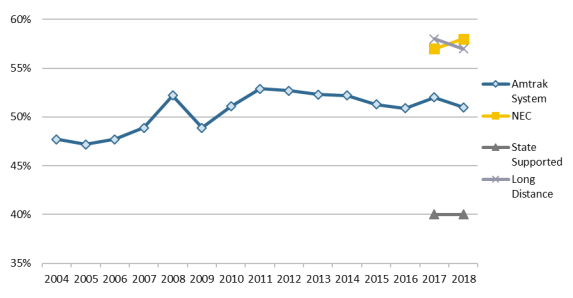

One measure of efficiency is the passenger load factor, which measures what percentage of the available seats is being used by passengers. Amtrak's load factor has varied within a fairly narrow band since 2004. Its current load factor, 51%, is near the record load factor Amtrak reported in FY1988. Load factor varies across Amtrak's three business lines, with NEC and Long Distance trains at 58% and 57%, respectively, in FY2018, while state-supported routes lagged at 40%.

Improving load factor is one way of boosting revenue without increasing costs, but this can be difficult if passenger traffic is not distributed evenly along a route. Routes on which one station generates a large share of originating and terminating traffic are likely to have relatively low load factors in some segments but higher load factors in the "peak segment." For example, if a train on the NEC is sold out between Philadelphia and New York, Amtrak may not be able to accommodate passengers who wish to travel between Baltimore and New York, resulting in empty seats between Baltimore and Philadelphia. If Amtrak were to accommodate these riders with additional cars, this could reduce load factor even as it increases ridership.

Funding Issues

As discussed above, Amtrak has never generated sufficient revenue to cover its operating and capital expenses. The Administration requests funding for Amtrak each year as part of its DOT budget request. Amtrak also submits a separate appropriation request to Congress each year;7 typically, that request is larger than the Administration's request. Table 2 shows the difference in the requests submitted for FY2020.

|

Grants |

FY2019 Enacted Grants |

FY2020 Administration Budget Request |

FY2020 Amtrak Request to Congress |

|

Northeast Corridor |

$650 |

$326 |

$600 |

|

National network |

1,292 |

611 |

1,200 |

|

Total grants |

$1,942 |

$937 |

$1,800 |

Source: U.S. Department of Transportation, Fiscal Year 2020 Budget Highlights, p. 22, https://www.transportation.gov/mission/budget/fiscal-year-2020-budget-highlights; Amtrak, General and Legislative Annual Report & FY2020 Budget Request, p. 10, https://www.amtrak.com/content/dam/projects/dotcom/english/public/documents/corporate/reports/Amtrak-General-Legislative-Annual-Report-FY2020-Grant-Request.pdf.

Notes: Although Amtrak's Inspector General is part of Amtrak, its funding is not included in Amtrak's direct budget request. Congress appropriated $23 million for the Inspector General in FY2019.

Congress addresses Amtrak's subsidy in the annual Transportation, Housing and Urban Development, and Related Agencies Appropriations Act. For most of Amtrak's existence, Congress has divided Amtrak's grant into two categories, operating and capital grants. The operating grant could be thought of as relating to Amtrak's annual cash loss, and the capital grant as relating to the depreciation of Amtrak's assets, as well as an amount for Amtrak debt repayments.

Congress changed the structure of federal grants to Amtrak in Title XI of the FAST Act. Starting in FY2017, Amtrak's appropriation has been divided between funding for the operationally self-sufficient NEC, which has large capital needs, and the National Network, which has modest capital needs (as the tracks are almost entirely owned and maintained by freight railroads) but runs an operating deficit of several hundred million dollars. The change was intended to increase transparency of the costs of Amtrak's two major lines of business and eliminate cross-subsidization between them; operating profits from the NEC and state access payments for use of the NEC will be reinvested in that corridor, and passenger revenue, state payments, and federal grants for the National Network will be used for that account.8

|

Authorized Funding |

Appropriated Funding |

|||||

|

Fiscal Year |

NEC |

NN |

Total Auth. |

NEC |

NN |

Total Appr. |

|

2016 |

450 |

1,000 |

1,450 |

1,390 |

||

|

2017 |

474 |

1,026 |

1,500 |

328 |

1,167 |

1,495 |

|

2018 |

515 |

1,085 |

1,600 |

650 |

1,292 |

1,942 |

|

2019 |

557 |

1,143 |

1,700 |

650 |

1,292 |

1,942 |

|

2020 |

$600 |

$1,200 |

$1,800 |

— |

— |

— |

Source: Congress.gov (P.L. 114-94, P.L. 114-57, P.L. 115-31, P.L. 115-141, P.L. 116-6).

Notes: NEC= Northeast Corridor. NN=National Network. Appropriated funding does not include funding for Amtrak Inspector General's Office or security grant funding received from the Department of Homeland Security.

a. Congress appropriated $289 million for Amtrak operating expenses and $1,102 million for Amtrak capital and debt service expenses in 2016, retaining the pre-FAST Act grant structure for one additional year in order to allow Amtrak time to update its internal accounting.

Amtrak's reliance on annual appropriations has made it difficult to fund long-term capital projects. DOT's Inspector General has noted that the lack of long-term funding "has significantly affected Amtrak's ability to maintain safe and reliable infrastructure and equipment, and increased its capital program's annual cost."9 Amtrak's FY2020 budget request suggests a multiyear appropriation to provide some additional stability without fundamentally altering the mechanism by which Amtrak receives its federal funding.10

Most federal funding for highway and transit programs is provided by a special form of budget authority, contract authority, which allows DOT to obligate funds from the Highway Trust Fund in advance of an appropriation. This permits DOT to commit to support highway projects that may take several years to complete. There have been proposals to create a similar trust fund for Amtrak, in order to provide a greater level of financial stability and permit such long-term funding of capital projects. Such efforts have faced objections from some Members of Congress opposed to Amtrak receiving federal funding. There is also a practical challenge to identifying a revenue source for an Amtrak trust fund. The Highway Trust Fund, which receives revenue from taxes on motor fuels and heavy trucks, is not authorized to spend money on intercity rail services; in any event, the revenues flowing into the fund are far below the level required to support the levels of federal highway and transit spending authorized by Congress, necessitating several transfers of money from the general fund since 2008.11 If a passenger rail trust fund were to be funded solely from a tax on passengers, the cost of Amtrak tickets could rise by several dollars per ticket at current ridership levels, potentially contravening the purpose of the fund by reducing ridership.

Issues for Congress

Maintaining and Improving the Northeast Corridor

Amtrak has stated that there is a $28.1 billion backlog of state-of-good-repair projects on the NEC,12 which Amtrak revenue alone is unable to fund, and which does not include capital projects deemed necessary to increase capacity. It seems unlikely that private investors would be prepared to provide that funding in exchange for a share of the operating profits generated by NEC passenger trains. The obstacles facing such an investor would be largely the same as the ones currently facing Amtrak: operating profits are insufficient to cover capital costs, and the ability to increase revenue by running additional trains into Penn Station in New York City, by far the most popular origin and destination point on the NEC, will be limited until and unless major capital improvements not included within the state-of-good-repair backlog, including a new tunnel under the Hudson River, are completed. The fragmented control of NEC infrastructure, some of which is owned by state governments, would persist even if Amtrak's assets in the corridor were operated by some private entity. A provision of the FAST Act required the Federal Railroad Administration (FRA) to solicit proposals to design, build, operate, and maintain high-speed rail systems on federally designated high-speed rail corridors, including the NEC. No such proposal was submitted for the NEC.

Plans to create a separate entity to own and/or operate the NEC, including as part of larger plans to reorganize or privatize the entire passenger rail system, have been proposed but have never been adopted in full. In 2002, the Amtrak Reform Council submitted its recommendations to Congress for a "restructured and rationalized national intercity rail passenger system" as required by the Amtrak Reform and Accountability Act of 1997.13 Among other measures, the council endorsed organizing NEC infrastructure assets under a separate government corporation that would control the assets and manage rail operations and capital improvements. The council admitted in its recommendations that this new infrastructure company would not be able to fund its own capital needs, and endorsed continued federal funding in addition to funds committed by the states. A similar suggestion, which was known as the Competition for Intercity Passenger Rail in America Act, was proposed in 2011 by the leadership of the House Committee on Transportation and Infrastructure but never introduced.

Some proposals have called for a dedicated funding source, backed by taxes or fees within the region served by the NEC. The thinking behind this is that restructuring of the NEC would be more attractive politically if it were dependent mainly on revenue raised within the region rather than on federal government resources. As the NEC passes through eight states and the District of Columbia, creation of a dedicated regional funding source is likely to require some form of interstate agreement, with each state concerned that its contribution is commensurate with the benefits it expects to receive.

The Future of the National Network

Critics of Amtrak have often questioned the necessity of continuing to operate long-distance trains, which usually require the largest operating subsidies, both in total dollars and in dollars per trip or per passenger-mile.14 Proponents of passenger rail have contended that these operating losses are distorted by Amtrak accounting practices, pointing to the allocation of fixed costs to individual routes and the differing treatment of state and federal grant funds.15 Amtrak has responded that its accounting practices, based on a performance tracking system developed by DOT's Volpe Transportation Systems Center in conjunction with the Federal Railroad Administration (FRA) and Amtrak, accurately allocate costs among its various routes. Amtrak points out, for example, that while its California Zephyr between Chicago and Emeryville, CA, has greater revenue per trip than an average Northeast Regional train on the NEC, the long-distance train requires nine times as many employees, twice as much equipment, and more switching operations in rail yards for every trip.16 Amtrak has proposed shifting its focus from maintaining existing levels of service on all 15 long-distance routes currently in the Amtrak system to shorter corridors that would be supported by the states.

Amtrak is under pressure to accomplish two goals that at times seem to work against one another: to serve as the national passenger railroad, including through the operation of long-distance routes, and to reduce or eliminate the need for federal subsidies. Federal law provides that "Amtrak shall operate a national rail passenger transportation system which ties together existing and emergent regional rail passenger service and other intermodal passenger service."17 The phrase "national rail passenger transportation system" is defined to include "long-distance routes of more than 750 miles between endpoints operated by Amtrak as of the date of enactment of the Passenger Rail Investment and Improvement Act of 2008."18 However, Amtrak also has statutory power to discontinue routes, notwithstanding the above provisions.19

In its FY2020 budget request, the Trump Administration proposed a reduction in annual appropriations to the National Network, with the expectation that either states would support continued operation of long-distance routes or Amtrak would discontinue them. The Administration proposed to offset this reduction with a $550 million appropriation to a new Restoration and Enhancements discretionary grant program, which would allow states to gradually ramp up to their full contributions, with a federal subsidy decreasing each year over a five-year period.20

In its own FY2020 budget request, Amtrak requested an appropriation equal to the full $1.8 billion authorization contained in the FAST Act, but stated some support for changing the way the National Network is funded in the future (emphasis added):

Amtrak appreciates the Administration's focus on expanding intercity passenger rail service to today's many underserved cities and corridors across the nation. We believe that a modernization of the National Network, with the right level of dedicated and enhanced federal funding, would allow Amtrak to serve more passengers efficiently while preserving our ability to maintain appropriate Long Distance routes.21

Removing federal support for long-distance service could create a circumstance in which, if one state along the route declined to contribute to its operating costs, Amtrak might be left with little recourse other than to discontinue the route. Proponents of continued long-distance train service point to the large proportion of trips taken on long-distance trains between origins and destinations other than the endpoints, and to the trains' relatively high load factor (57% in FY2018) compared to other Amtrak routes (58% on the NEC, 40% on state-supported routes), an indicator of efficient utilization of passenger space. However, depending on the number of cars in each train, this could conceal an inefficient utilization of engines and engineers, as a short train may require the same crew as a longer one no matter how many passengers are aboard.

Existing state-supported routes could also face service cuts due to a lack of state support. The Chicago-Indianapolis Hoosier State route was created in 1980 to provide service on days when the thrice-weekly Cardinal long-distance train did not operate. When PRIIA Section 209 went into effect at the beginning of FY2014, requiring the state of Indiana to cover all operating losses associated with the route, state political support began to wane, and the route was threatened with discontinuance. Under a different section of PRIIA, the state contracted with a private railroad company to operate the route, but that company withdrew from the agreement before the base contract period had expired, returning responsibility to the state government. The Hoosier State was discontinued on June 30, 2019, after Indiana declined to provide further funding.

Section 210 of PRIIA required Amtrak to generate performance improvement plans for all 15 of its long-distance routes, starting with the 5 worst-performing routes based on 2008 data.22 These reports contained a number of recommended actions to improve long-distance train performance according to various metrics: the Customer Satisfaction Index (CSI), on-time performance (OTP), and cost recovery (CR). There has been uneven improvement in long-distance train performance in the intervening years. Two routes have higher CSI scores (now referred to as eCSI scores) than they did in 2008, six routes have better on-time performance, and five have improved cost recovery rates. All other scores for these routes have stayed the same or worsened. The extent to which any actions taken as a result of the Section 210 plans either improved route performance or mitigated its decline is unclear.

Access to Freight Rail Infrastructure and On-Time Performance

Freight train interference is one cause of poor on-time performance on Amtrak routes. By law, Amtrak is to be given "preference" over other railroad traffic when using tracks it does not own.23 In practice this preference has been difficult to enforce, as freight railroads have little incentive to be overly accommodating to Amtrak trains, for which they are reimbursed only the incremental cost of Amtrak's use of their tracks. Sections 207 and 213 of PRIIA directed FRA, Amtrak, and STB to develop minimum on-time performance standards, and gave STB enforcement power over railroads that failed to meet these standards. Final metrics and standards went into effect in 2010, before being suspended in 2012 amid court challenges.24

Following a series of court decisions that ultimately upheld Amtrak's role in developing performance standards but altered the role of the STB, FRA and Amtrak are free to reformulate new on-time performance standards. At a June 2019 Senate hearing, Amtrak CEO Richard Anderson said this could be completed in less than 90 days, though he declined to commit to a specific timeline.25 Anderson compared these standards to similar metrics in use in the commercial aviation industry.

Current law permits the U.S. Department of Justice (DOJ) to enforce Amtrak's statutory track preference. Anderson has noted in communications with lawmakers that DOJ has done so only once in Amtrak's history, against the Southern Pacific railroad in 1979. Amtrak has requested that a similar enforcement power be granted statutorily to Amtrak, going so far as to recommend specific bill language that would allow Amtrak to sue host railroads.26

Another option is to make funding available to states to assist them in purchasing tracks used by passenger trains from their freight railroad owners. The state of Michigan pursued this strategy, using roughly $150 million in federal grant funds awarded in 2011 to purchase the 135-mile rail corridor from Kalamazoo to Dearborn on the Chicago-Detroit corridor. At the time of the transaction in 2012, previous owner Norfolk Southern Railway had placed several sections of the corridor under slow orders due to poor infrastructure conditions. After several years of repairs and construction funded in part by additional federal grants beyond those used to purchase the line, Amtrak's on-time performance on the Chicago-Detroit Wolverine service rose from 53% in FY2015 to nearly 70% in FY2016, though it has declined slightly since (and 70% is still below the 80% standard initially set under PRIIA 207).

Using a slightly different ownership structure, the state of North Carolina supports several passenger trains per day between Raleigh and Charlotte on tracks owned by the North Carolina Railroad, a state-owned entity that leases its tracks to Norfolk Southern. Norfolk Southern agreed to increased passenger service on the line in return for extensive public investment in improving and expanding the infrastructure. The number of daily trains offered by the state-supported Piedmont service has increased, and the service has exceeded the 80% on-time performance standard for state-supported routes in five of the past seven years.

Public ownership of rail infrastructure can be beneficial for passenger rail on-time performance because of the lessened incentive to give priority to freight traffic. Where a freight railroad may find it more profitable to delay passenger trains to accommodate freight trains, a public owner might give preference to passenger services instead. However, in situations that involve public-sector purchases of busy freight lines, it is likely that the affected freight railroads would demand protection for their services as a condition in any sale agreements. Freight railroads are less likely to give up control of their busiest main lines than in the case of parallel or secondary lines.

One issue that has hindered congressional efforts to encourage competition in passenger rail service is that freight railroads' statutory obligation to carry passenger trains applies only to trains operated by Amtrak. This may be one reason that states that have initiated state-supported routes have uniformly contracted with Amtrak to be the operator. For other operators to be able to compete with Amtrak on equal footing, legislation may be needed to address their rights to make use of freight railroads' infrastructure.

Food and Beverage Service

Amtrak has served food and beverages since it began operating in 1971, continuing the practice of its predecessor companies. As far back as 1981, Congress prohibited Amtrak from providing food and beverage service at a loss,27 and this prohibition is still in the statutes governing Amtrak:

Amtrak may ... provide food and beverage services on its trains only if revenues from the services each year at least equal the cost of providing the services.28

The law does not define what is to be included in the "cost of providing the services." Amtrak has stated that providing food and beverage service is essential to meeting the needs of passengers, especially on long-distance trains, and it has interpreted the law as requiring that revenues cover the costs of food and beverage items and commissary operations but not the labor cost of Amtrak employees providing food service aboard trains. When on-board labor costs are excluded, Amtrak says, the service covers its costs. When labor costs are included, however, the service operates at a significant deficit (see Table 4).

|

Fiscal Year |

Total Revenues |

Nonlabor Expenses |

Labor Expenses |

Total Expenses |

Total Revenues as % of Total Expenses |

|

2014 |

$137.8 |

$85.5 |

$115.5 |

$201.0 |

69% |

|

2015 |

145.6 |

84.7 |

114.5 |

199.2 |

73% |

|

2016 |

146.1 |

79.1 |

111.3 |

190.4 |

77% |

|

2017 |

153.8 |

82.3 |

112.9 |

195.2 |

79% |

|

2018 |

$155.5 |

$85.2 |

$108.4 |

$193.6 |

80% |

Source: CRS, using data provided in personal communications from Amtrak.

Notes: Amtrak provides figures for revenue, but not cost, for its food and beverage service in its monthly performance reports. Percentages calculated by CRS. "Total Revenues" includes cash food and beverage sales, a partial transfer of revenue from first-class ticket sales, and state contributions to food and beverage service.

Amtrak has taken measures, at Congress's direction, to reduce costs for food and beverage service. In 1999, it shifted from handling food and beverage supplies internally to contracting out such activities. More recently, Amtrak announced it would be discontinuing its traditional dining car service on several long-distance routes, in part to save money.29 A House proposal in the 112th Congress would have required FRA to contract out Amtrak's onboard food and beverage service but acknowledged that the service may operate at a loss.30 Section 11207 of the FAST Act requires Amtrak to develop a plan to eliminate food and beverage service losses, and prohibits federal funds from being used to cover losses starting five years after enactment—but also provides that no Amtrak employee shall lose his or her job as a result of any changes made to eliminate losses. Congress provided that Amtrak could eliminate the losses on food and beverage service through "ticket revenue allocation."31 Although that phrase is not defined in the law, it implies that Amtrak could declare that a portion of the ticket prices paid by certain passengers is dedicated to food and beverage service, as it already does for passengers traveling in first-class accommodations.

Positive Train Control Interoperability Issues

Positive train control (PTC) is an interconnected system of signals and communication devices designed to prevent collisions and derailments by automatically slowing or stopping a train if its engineer fails to do so.32 The Railway Safety Improvement Act of 2008 (RSIA; Division A of P.L. 110-432) required all tracks used by passenger trains to be equipped with PTC by the end of 2015, now effectively extended to December 31, 2020, by subsequent laws and regulations.33

All Amtrak-owned or -controlled track had PTC in operation on January 1, 2019, except approximately one mile of slow-speed track in the complex Chicago and Philadelphia terminal areas, and PTC is installed on 85% of other railroads' route miles that Amtrak uses.34 However, to fully comply with the PTC mandate, PTC-equipped Amtrak trains must be certified interoperable with all PTC systems installed by host railroads, and Amtrak's PTC system must be interoperable with other railroads' PTC-equipped trains that use its tracks. At the end of 2018, Amtrak had achieved interoperability with 2 railroads out of a total of 13 that use its tracks, though this does not necessarily reflect Amtrak's progress achieving interoperability with its host railroads.35

The Government Accountability Office has found that of all railroads subject to the statutory mandate, only two commuter railroads have achieved full operation and full interoperability.36 If Amtrak does not achieve 100% interoperability with its host railroads by the deadline, absent a waiver or subsequent extension (which FRA has stated it will not issue), Amtrak would need to suspend rail service on noncompliant lines or risk enforcement action in the form of financial penalties for each day it operates in violation of the mandate.