This report examines technological innovation in payment systems generally and particular policy issues as a result of retail (i.e., point of sale) payment innovation. The report also discusses wholesale payment, clearing, and settlement systems that send payment messages between banks and transfer funds, including the "real-time payments" service being introduced by the Federal Reserve.1 This report includes an Appendix that describes interbank payment, clearing, and settlement systems related to U.S. payments.

Background on Payments

The U.S. financial system processes millions of transactions each day to facilitate purchases and payments. In general terms, a payment system consists of the means for transferring money between suppliers and users of funds through the use of cash substitutes, such as checks, drafts, and electronic funds transfers. The Committee on Payment and Settlement Systems (CPSS), consisting of representatives from several international regulatory authorities, has developed generally accepted definitions of standard payment system terminology.2 As defined by the CPSS, a payment system is a system that consists of a set of instruments, banking procedures, and, typically, interbank funds transfer systems that ensure the circulation of money. These systems allow for the processing and completion of financial transactions.

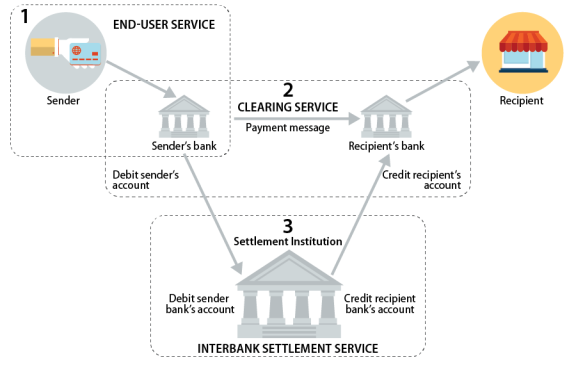

From the typical consumer's perspective, making a payment is simple. A person swipes a card, clicks a button, or taps a mobile device and the payment is approved within seconds. However, the infrastructure and technology underlying the payment systems are substantial and complex. To simplify, a payment system has three parts (see Figure 1). First, the sender (i.e., the person making the payment) initiates the payment through an end-user service, such as an online payment service or mobile app, instructing the payer's bank to make a payment to the recipient. The payer and recipient interact only with end-user services, which comprise the "retail" portion of payments. Second, the payer's bank sends a payment message containing payment details to the recipient's bank through a payment system (sometimes called a clearing service). Third, the payment is completed (or settled) when the two banks transfer funds through a settlement system. Different systems can perform each of these parts, and systems' developers and operators compete with each other to provide payment and settlement services to consumers, businesses, and banks. These final two inter-bank steps are the "wholesale" portion of payments.3

|

|

Source: Federal Reserve, Potential Federal Reserve Actions to Support Interbank Settlement of Faster Payments, 83 FR 221, November 15, 2018, p. 57356, at https://www.govinfo.gov/content/pkg/FR-2018-11-15/pdf/2018-24667.pdf. Note: See text for details. |

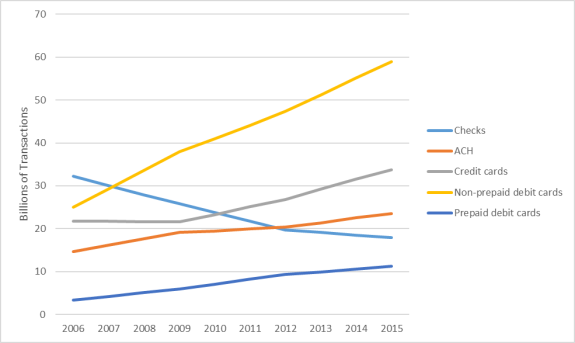

End-user services, which are operated by the private sector, facilitate a consumer's ability to purchase goods and services, pay bills, obtain cash through withdrawals and advances, and make person-to-person payments. Retail payments tend to generate a large number of transactions that have relatively small value per transaction. Retail payment services can be accessed through many consumer financial products, including credit and debit cards and checking accounts. The most common methods of payment are debit cards, cash, credit cards, direct debits and credits via an automated clearing house (ACH), checks, and prepaid debit cards (see Figure 2).4

In the United States, the Federal Reserve (Fed) operates some of the key bank-to-bank payment, clearing, and settlement (PCS) systems that process retail or wholesale transactions, and private-sector organizations operate other systems that clear and settle bank-to-bank payment, including those described in the Appendix.5

|

|

Source: The Federal Reserve Payments Study: 2018 Annual Supplement, p. 3, https://www.federalreserve.gov/newsevents/pressreleases/files/2018-payment-systems-study-annual-supplement-20181220.pdf. Note: ACH = Automated Clearing House payments. |

Payment Systems and Financial Technology

Technological advances in digitization and data processing and storage have greatly increased the availability and convenience of electronic payments. In recent years, the use of electronic payments has risen rapidly, whereas the use of cash and checks has declined (see Figure 2). According the Federal Reserve's most recent triennial payment study (released in 2016), the number of transactions of three electronic payment methods—debit card, credit card, and ACH—grew at annual rates of 7.1%, 8.0%, and 4.9%, respectively. Together, they totaled more than 144 billion transactions with a value of almost $178 trillion in 2015.6 Meanwhile, check payments declined by an annual rate of 4.4% during that period, and totaled 17.3 billion transactions worth almost $27 trillion in 2015.7 Less data are available on cash usage and the value of cash transaction in part because they are person-to-person and do not involve a digital record, but a Fed survey estimates that between 2012 and 2015, the share of transactions made in cash fell from 40.7% of all transactions to 32.5%.8

This trend is probably due, at least in part, to various new technological products and services that offer fast, convenient payments for individuals and businesses. Payment apps linked to bank accounts and payment cards can be downloaded onto mobile devices that allow individuals to send payments to each other or to merchants. These services include Venmo (owned by PayPal), Zelle (owned by a consortium of large U.S. banks), and Cash App (owned by Square). Other companies provide hardware and software products that allow individuals and small businesses to accept debit and credit card payments, online or in person. These companies include PayPal, Square, and Stripe. Another advance in payments is allowing consumers to make payments using a mobile device, wherein debit card, credit card, or bank account information is stored in a "digital wallet" and sensitive information is protected by transmitting surrogate data (a process called tokenization) at the point of sale. This service includes Apple Pay, Google Pay, and Samsung Pay.

These services are generally layered on top of traditional electronic payment systems. To use these services, the consumer or business often must link them to a bank account, debit card, or credit card. The payments are still ultimately settled when the money from the payer's account is deposited in the recipient's account. An exception are payments made by cryptocurrencies, discussed in the text box.9

|

Cryptocurrencies Cryptocurrencies are a financial innovation that allow users to make payments entirely outside existing systems, using cryptographically secured ledgers and protocols to record and validate transactions instead of centralized intermediaries such as banks and other financial institutions. Examples include Bitcoin, the first cryptocurrency, and Libra, a proposed cryptocurrency announced by Facebook. Proponents of cryptocurrencies assert this technology will one day displace existing payment systems. However, to date evidence indicates that cryptocurrencies are very rarely used to buy goods and services, pay bills, or as money. For this reason, this report does not cover cryptocurrencies in detail. For information on cryptocurrencies, see CRS In Focus IF10824, Financial Innovation: "Cryptocurrencies," by David W. Perkins, and CRS Report R45427, Cryptocurrency: The Economics of Money and Selected Policy Issues, by David W. Perkins. |

Faster Retail Payments: Policy Issues

Although faster and potentially less costly payment systems benefit consumers and businesses, the use of new technology in existing and new payment systems raise questions about whether existing regulation adequately addresses issues related to cybersecurity and data privacy, industry competition, and consumer access and protection.10

Regulatory Framework

How payments are federally regulated depends, in part, on whether they are being provided by banks. Banks are subject to a variety of prudential regulation, enforcement, and supervision by federal bank regulators. Nonbank payment processors are subject to similar regulation and supervision (but not enforcement) by bank regulators if they are a service provider to a bank, but otherwise are not. Nonbank companies that do not provide services to banks may be regulated as money transmitters at the state level by state agencies and as money service businesses at the federal level by the Department of the Treasury's Financial Crimes Enforcement Network and subject to applicable laws and regulations. These services are subject to federal consumer protection regulation under the Electronic Fund Transfer Act (P.L. 95-630);11 anti-money laundering requirements under the Bank Secrecy Act (P.L. 91-508);12 and various state licensing, safety and soundness, anti-money laundering, and consumer protection requirements.13

A broad issue that permeates many of the specific issues examined in this report is the debate over whether the various companies providing retail payment services are effectively and efficiently regulated. Nonbank money transmission is largely regulated at the state level. Some observers have argued that this state-by-state regulatory regime, designed to protect against risks presented by traditional money transmitters such as Western Union, is overly onerous and ill-suited when applied to new, technology-focused payment companies.14 State regulators assert they are best positioned to regulate these companies, noting their experience and recent efforts to coordinate and streamline state regulation.15 A greater federal role in payment regulation could impose more or less stringent standards (with federal preemption of state regulation, in the latter case) than any given state's current standards.

One potential solution for concerns that the current system is too fragmented and overly burdensome could be to allow certain nonbank payment companies to enter the bank regulatory regime. Two potential mechanisms are under consideration that could allow a technology-focused payment company to be federally regulated—the Office of the Comptroller of the Currency (OCC) special purpose national bank charter and a state-level industrial loan company (ILC) charter with Federal Deposit Insurance Corporation (FDIC) insurance. Both could be particularly desirable for payment firms if they provide an avenue to directly access Fed wholesale payment systems. However, both mechanisms are controversial and subject to contentious debate.

The OCC and proponents of the special purpose charter generally view the charter as a way to free companies from what they assert is the unnecessarily onerous regulatory burden of being subject to numerous state regulatory regimes while not overly relaxing regulations—under the special purpose charter, the companies would become subject to the OCC's national bank regulatory regime.16 Opponents generally assert that the OCC does not have the authority to charter these types of companies and that doing so would inappropriately allow fintech firms offering fast payment services to circumvent important state-level consumer protections.17 State regulators have filed lawsuits to block the granting of such charters.18 To date, no companies have applied for such a charter, although ongoing legal uncertainty is likely a discouraging factor.19

ILC charters are controversial because they allow commercial firms—such as retailers, manufacturers, or technology companies—to own banks. The United States has historically adopted policies to separate commerce and banking, and the FDIC has not approved deposit insurance for a new ILC since 2006.20 Opponents of ILC charters argue that by creating an avenue for a commercial firm to own a depository institution,21 they blur the line between commerce and banking, exposing the U.S. economy to related risks such as creating possible incentives for imprudent underwriting, inappropriately exposing taxpayers to losses through federal deposit insurance, and leading to entities that can exercise market power.22 Proponents of ILC charters assert these concerns are overstated. They cite the potential benefits of mixed arrangement (e.g., economies of scale, risk diversification, information efficiencies, customer convenience and savings) and note that certain other stable developed countries allow more blending of banking and commerce than the United States with, they argue, no or little ill effect.23 Recently, three fintech companies submitted applications to the FDIC for ILC deposit insurance. Two companies, however, have since withdrawn their applications, and the company with a pending application, Square, is a payment system provider.

Cybersecurity

All payment methods expose users to some risks, including money theft or fraudulent payments made using their accounts or identities. In general, improving technology reduces one type of risk but may expose users to new risks. For example, if a pickpocket steals a person's cash, the victim has little recourse. If instead, the pickpocket steals a payment card, the victim can cancel the card and generally would not be held liable for fraudulent purchases.24 However, identity thieves can steal card information using card reader skimmers, allowing thieves to open and use lines of credit in victims' names without their knowledge.

Similarly, new payment technologies reduce certain risks but create others. For example, digital wallets on mobile devices can eliminate the need to carry physical cards that can be lost or stolen and can protect sensitive information at the point of sale through tokenization. However, the device itself can be compromised by software designed to gain unauthorized access to devices, called malware, which may lead to fraudulent charges. In addition, storing payment information on multiple websites, apps, and devices creates more opportunities for hackers to steal it than if the information existed only on the card itself.25

Recent breaches at various financial and nonfinancial companies in which people's sensitive information were compromised illustrate the potential risk and have raised questions over whether policymakers should implement stricter cybersecurity requirements.26 Some possible policy responses include

- enacting a federal breach notification law,

- creating federal cybersecurity standards, or

- increasing federal authority to penalize companies that fail to adequately protect consumer data.

Data Privacy

Payment systems necessarily collect detailed consumer information on transactions, including the retail stores a consumer shops at, the businesses and individuals the consumer pays, and the dates, times, and amounts of each transaction.27 Through analysis, this data have the potential to reveal a lot of information about individual consumers, including where they live and their gender, age, race, ethnicity, and approximate income. Such data are valuable from a business perspective; for example, for targeting product marketing to consumers.28 In addition, scammers could use this data to facilitate fraud.29 Electronic payments have resulted in a proliferation in the availability and use of personal information, which has raised policy concerns about how companies use the data, whether consumers understand how their data will be used, and whether consumers should have more control over its use.

Payment data has the potential to improve consumer outcomes. For example, personal financial management apps or other digital tools could help consumers more easily track payments, automate saving and budgeting, and more efficiently shop for financial products that meet their personal needs.30 Consumers could also in the future share this data with financial institutions to apply for loans or other banking products.31 Given these benefits, as well as possible privacy concerns, the question becomes how much access should companies have to individuals' information.

Privacy policy disclosures to consumers is another important element of privacy policy that might be more difficult as payments become faster using new technology. For example, according to the Bureau of Consumer Financial Protection (CFPB), stakeholders suggest that "providing disclosures that are clear and sufficient for consumers to make informed decisions is difficult" in the mobile environment due to small screens, which may make it difficult to read long, technical disclosure documents.32 These stakeholders indicate that clear privacy policies and more consumer control over the use of consumer data may be important considerations in this new digital environment.33

Consumer Protection

When developing a new or faster retail payment system, consumer protection is an important consideration.34 Although new technology offers consumers many potential benefits, it raises issues of concern, such as consumer liability for fraudulent payment and consumer error or nonreceipt of goods resolution.

The Electronic Fund Transfer Act,35 currently implemented by the CFPB through Regulation E, is the most relevant consumer protection law applying to financial payments.36 Regulation E protects individual consumers who engage in electronic fund transfers. It mandates consumer disclosures, limits consumer liability for unauthorized transfers, and maintains procedures for resolving errors. Other regulations may also be relevant to a new faster payment system, depending on its structure. For example, the Expedited Funds Availability Act (P.L. 100-86),37 currently implemented by the Federal Reserve as Regulation CC,38 prescribes how quickly banks must make funds available to customers.

When developing a new faster payment system, Congress and federal regulators may consider how a new system should comply with relevant regulations, such as Regulation E.39 Depending on the structure of the new system, regulators might decide to update these regulations to tailor them as appropriate. For example, current consumer protection rules might not cover all aspects of the system, leaving consumers at risk of financial loss, without clear recourse for some payment-related disputes, or other negative impacts.40 In this spirit, in 2015, the CFPB released nine consumer protection principles for new faster payments systems, including consumer control over payments, fraud and error resolution protections, and disclosed and clear costs.41 The CFPB has not acted on these principles through rulemaking or other initiatives since their release in 2015.

Financial education might be another consumer protection policy option. As new technology is introduced into financial products, consumers may need to learn new skills, sometimes referred to as digital financial literacy, which includes "knowing how to use devices to safely access financial products and services via digital channels in ways that help consumers achieve their financial goals, protect against financial harm and enhance ability to know where to get help."42 This type of financial education might be particularly important to ensure that lower-income and older consumers are included in a new faster payment system.43

Financial Access and Underserved Groups

Innovations in the payment system may benefit some consumers and fail to reach others. New retail payment options that are linked to bank accounts, internet-based, or require mobile devices could disadvantage consumers who rely on cash payments,44 do not have easy internet or mobile access, or do not feel comfortable using this new technology.45 As long as payments remain based on the banking system, the unbanked and underbanked may encounter participation limits to faster payments.46

In contrast, innovation in technology may help marginalized groups gain access to the financial system. The ability to access digital channels using cash may be particularly important for including underserved consumers,47 leading to the development of new payment products—such as pre-paid cards and services—that allow cash to be placed in an account that can be used to make online payments.

The cost of internet and mobile data plans might limit the ability of underserved consumers to access a faster payment system that is internet- or mobile-based.48 However, as internet access and mobile devices continue to proliferate and decline in cost, barriers to accessing those technologies may decline. For example, most consumers, including unbanked and underbanked consumers, have access to mobile phones and smartphones, and the use of these technologies is growing.49 According to a national survey, in 2017, 83% of underbanked and 50% of unbanked consumers had access to a smart phone.50 The survey noted that underbanked consumers were more likely to use mobile banking services than the rest of the U.S. population.51

A faster payment system may provide certain other benefits besides access for low-income or liquidity-constrained consumers (colloquially, those living "paycheck to paycheck") who may more often need access to their funds quickly. In particular, many lower-income consumers say that they use alternative financial services, such as check cashing services and payday loans, because they need immediate access to funds.52 Faster payments may also help some consumers avoid checking account overdraft fees.53 Note, however, that some payments that households make would also be cleared faster—debiting their accounts more quickly— than the current system, which could be harmful to some underserved households.

Market Concentration

Traditional payment systems generally are characterized by strong economies of scale and are subject to network effects, wherein the more widespread a payment method's use and acceptance becomes the more incentive additional consumers and businesses have to adopt it. These economic characteristics may mean payment industries naturally become highly concentrated, because a small number of widely used systems are more efficient than many narrowly used systems. For instance, established payment systems currently have high market concentrations. Debit card payment processing networks are dominated by Visa and Mastercard, and credit card processing networks are mostly operated by Visa, Mastercard, American Express, and Discover.54 Some observers are concerned that market concentration will also be a feature in new payment systems. Others argue that new payment systems based on the internet may avoid similar concentration observed in traditional systems, because they do not require new entrants to make large initial investments in infrastructure.55 To date, the entry of multiple new services and companies into the market for end-user payment systems has supported competition and consumer choice. Whether the industry will eventually consolidate remains to be seen.

Creating additional concentration concerns is the entrance of some of the largest global technology companies into the payment industry, including U.S. companies such as Google (Google Pay), Apple (Apple Pay), Amazon (Amazon Pay) and Facebook (Facebook Pay and the Libra proposal). Such companies already have large market shares in various technology-related industries and collect huge amounts of consumer data, which could increase as they now seek to expand their scope into the payment industry. Were they to dominate electronic payments, it could pose competition concerns in the payment industry, as well as increase their dominance in their core industries. In addition, these developments raise concerns discussed above (see the "Regulatory Framework" section), relating to the implications of mixing commerce with what has traditionally been a core banking activity.

Wholesale Payment Systems and Real-Time Payments

Payments between two parties who are both members of the same end-user service—a closed loop payment—can occur in real time because the service can instantly communicate between the two parties, verifying that the payer has sufficient funds in the account to make the payment. However, a payment in which one party is outside of a single end-user service typically travels through the banking system, and thus cannot occur in real time unless real-time messaging, clearing, and settlement of the payment is available through wholesale payment systems. For example, a debit or credit card payment to a merchant needs to transfer funds from the sender's bank (in the case of a credit card, the card-issuing bank) and send them to the recipient's bank. Real-time payment can only occur in this scenario if settlement occurs in real-time or if payment occurs before settlement (putting the recipient's bank at risk that the transfer never occurs). Even within an end-user service that would provide real-time payment, if the transfer were made between two members entirely using existing balances within the service, delivery of funds could be delayed if the payer needs to add funds to their account to make payment (via direct debit or credit card transfer, for example) or if the recipient wishes to withdraw funds from the payment service to deposit in its bank account. Thus, the speed of many existing end-user services are ultimately limited by what happens with wholesale payment systems.

On August 5, 2019, the Fed announced plans to create a wholesale real-time payment (RTP) system. This section discusses the history of the Fed's role in the payment system; compares recent RTP initiatives by the Fed, the private sector, and abroad; and analyzes policy issues raised by these initiatives.

History of the Fed's Role in the Payment System

The Fed was originally created as a "banker's bank" to improve the functioning of a national banking system that was dominated at the time by small, local banks. To that end, providing bank-to-bank check-clearing services was one of the Fed's original, primary functions. Problems with private clearinghouses were one of the central issues in the financial panic that led to the Fed's creation. As other payment methods have emerged over time, the Fed has also provided other types of bank-to-bank payment and settlement systems.56 The Fed provides these services by linking the accounts that all banks maintain at the Fed to comply with reserve requirements.57

Throughout the Fed's history, the private sector has operated competing payment and settlement systems that the Fed has regulated (see Appendix for more details). For example, the Fed and the private-sector Electronic Payments Network (owned by The Clearing House, an association of large banks) currently operate competing automated clearinghouse (ACH) systems, which are payment systems that allow banks (and certain other financial institutions) to send direct debit and credit messages that initiate fund transfers.58 The Fed also operates two wholesale settlement systems for payments, Fedwire Funds Service and the National Settlement Service.59 The Clearing House Interbank Payment System (CHIPS) is a competing private-sector gross settlement system. (The Fed does not operate any end-user service directly accessed by individuals or nonfinancial businesses.)

Real-Time Payments Initiatives

A typical bank-to-bank electronic payment is currently settled on the same or next business day.60 The Fed plans to introduce an RTP system called FedNow in 2023 or 2024.61 FedNow would be "a new interbank 24x7x365 real-time gross settlement service with integrated clearing functionality to support faster payments in the United States," that "would process individual payments within seconds ... (and) would incorporate clearing functionality with messages containing information required to complete end-to-end payments, such as account information for the sender and receiver, in addition to interbank settlement information."62 According to the Fed, FedNow will be available to all banks with a reserve account at the Fed. It will require banks using FedNow to make funds transferred over it available to their customers immediately after being notified of settlement.63

In a November 2018 proposal, the Fed also sought comment on the possibility of the Fed creating "a liquidity management tool that would enable transfers between Federal Reserve accounts on a 24x7x365 basis to support services for real-time interbank settlement of faster payments, whether those services are provided by the private sector or Federal Reserve Banks."64 The purpose of this tool would be to accommodate the need for banks to move funds between their accounts at the Fed continuously, including outside of business hours in real-time settlement. In the August notice, the Fed stated it was exploring whether this goal could be accomplished by expanding Fedwire Funds Service and the National Settlement Service to permit 24x7x365 real-time gross settlement. Previously, the Fed proposed expanding same-day payment settlements on Fedwire and the National Settlement Service.65

Several private-sector initiatives are also underway to implement faster payments, some of which would make funds available to the recipient in real time (with deferred settlement) and some of which would provide real-time settlement.66 Notably, the Clearing House introduced its RTP network (with real-time settlement) in November 2017; according to the Clearing House, it currently "reaches 50% of U.S. transaction accounts, and is on track to reach nearly all U.S. accounts in the next several years."67

In addition, both the Fed and private-sector companies can set joint standards, rules, and a governance framework to facilitate the adoption of faster payments, whether those systems are operated by the Fed or the private sector, and promote interoperability between systems. The Fed convened the Faster Payments Task Force, composed of more than 300 stakeholders, which has issued a number of recommendations to facilitate the adoption of faster payments.68

Policy Issues

Other countries have already introduced or are in the process of introducing RTP.69 According to Fed Chair Jerome Powell, "the United States is far behind other countries in terms of having real-time payments available to the general public."70 Businesses and consumers would benefit from the ability to receive funds more quickly, particularly as a greater share of payments are made online or using mobile technology. Some have argued that RTP would be especially beneficial to low-income, liquidity-constrained individuals as described in the "Financial Access" section above.71 The main policy issue regarding the Federal Reserve and RTP is whether Fed entry in this market is desirable.

The Fed bases decisions on whether to introduce new payment systems or system features on three principles:

- "The Federal Reserve must expect to achieve full recovery of costs over the long run.

- The Federal Reserve must expect that its providing the service will yield a clear public benefit, including, for example, promoting the integrity of the payments system, improving the effectiveness of financial markets, reducing the risk associated with payments and securities-transfer services, or improving the efficiency of the payments system.

- The service should be one that other providers alone cannot be expected to provide with reasonable effectiveness, scope, and equity."72

Stakeholders are divided over the introduction of FedNow.73 Some question whether, in light of these principles, the Fed can justify creating a RTP system in the presence of competing private systems.74 Some fear that FedNow will hold back or crowd out private-sector initiatives already underway and could be a duplicative use of resources.75 The Treasury Department supports Fed involvement on the grounds that it will help private-sector initiatives at the retail level.76 Others, including many small banks, fear that aspects of payment and settlement systems exhibit some features of a natural monopoly (because of network effects), and, in the absence of FedNow, private-sector solutions could result in monopoly profits or anticompetitive behavior, to the detriment of financial institutions accessing RTPs and their customers (merchants and consumers).77 In 2017, the Justice Department sent the Clearing House a letter stating that it did not plan to challenge the Clearing House's RTP system on antitrust grounds, based on the Clearing House's plans at that time.78 From a societal perspective, it is unclear whether it is optimal to have a single provider or multiple providers in the case of a natural monopoly, particularly when one of those competitors is governmental. Multiple providers could spur competition that might drive down user costs, but more resources are likely to be spent on duplicative infrastructure.

RTP competition between the Fed and the private sector also has mixed implications for other policy goals:79

- Innovation. Competition typically fosters innovation, but the Fed's unique cost structure could potentially undermine the private sector's success, limiting the latter's willingness to invest in innovations.

- Ubiquity. The Fed argues that RTP ubiquity is more likely with its involvement because it has existing relationships with all banks and because no single payment system has ever achieved ubiquity historically. However, the Fed's entry into RTP could delay the achievement of universal RTP in the next few years if banks decide to wait until FedNow is available instead of joining the Clearing House's network.

- Interoperability. Interoperability (the ability to make payments across different systems) is more difficult to achieve with competing firms, but the Fed argues that if no single RTP system is ubiquitous, the ability of any two given institutions to exchange funds is improved if competing systems increase ubiquity. The ability to make payments across ACH networks is an example of how interoperability has currently been achieved between competing Fed and Clearing House systems. However, the technology involved in RTP may make interoperability more difficult. In its proposal, the Fed did not commit to ensure interoperability, but stated that it was a desirable goal.80

- Equity. The Clearing House has attempted to assuage equity concerns by pledging access to its system on equal terms to all banks, regardless of size, but these terms could change, and small banks have raised concerns that they may since the system is owned by large banks. The Clearing House has pointed to the Fed's volume discounts for existing payment systems as evidence that FedNow may not be equitable, however.

- Security. Security across competing systems could be difficult to coordinate, but systems might also attempt to compete by providing better security features. The Fed argues that competing RTP systems reduces operational and systemic risks because a system with only one provider has a "single point of failure." Repeated data breaches at large financial institutions also point to the difficulty of monitoring cybersecurity in private systems, although government has also proven to be vulnerable to data breaches as well. The Fed states that "participating banks would continue to serve as a primary line of defense against fraudulent transactions, as they do today ... " under FedNow.81

The Fed, and by extension the taxpayer, is exposed to default risk because of its provision of intraday and overnight credit (some of which is uncollateralized) when banks use its payment and settlement systems. Currently, when banks use Fed payment and settlement systems, the time lag between payment and settlement can cause mismatches in the amounts due and the amounts available in their accounts. As a result, the Fed extends intraday credit for a fee (if uncollateralized) to avoid settlement failures. Daily overdrafts have been relatively low in recent years, but peaked at $186 billion during the 2007-2009 financial crisis.82 Introducing real-time payments with deferred settlement could increase the use of intraday credit. The Fed does not state in its final rule whether it expects the level of intraday credit to be affected under FedNow, although it notes that it might need to extend the availability of intraday credit to off-hours. Note that the Fed provides this credit to reduce systemic risk to the banking system, so eliminating intraday credit has the potential to reduce financial stability.83

Regulation

RTPs offered by the private sector could fit into the existing regulatory framework. The Fed already regulates and supervises private payment systems for risk management and transparency, but not pricing.84 RTP could potentially alleviate some existing risks (e.g., if settlement is in real time, credit risk is reduced for the recipient institution) while posing new risks (e.g., RTP requires more active liquidity management). Any RTP system and regulation would need to account for these changing risks.

To address systemic risk concerns, a private RTP system could be designated as a systemically important Financial Market Utility (FMU) under Title VIII of the Dodd-Frank Act (P.L. 111-203). The Dodd-Frank Act allows the Financial Stability Oversight Council, a council of financial regulators led by the Treasury Secretary, to designate a payment, clearing, or settlement system as systemically important on the grounds that "the failure of or a disruption to the functioning of the FMU could create or increase the risk of significant liquidity or credit problems spreading among financial institutions or markets and thereby threaten the stability of the U.S. financial system."85 FMUs, currently including the Clearing House Interbank Payments System, are subject to heightened regulation, and the Fed has supervisory and enforcement powers to ensure those standards are met.86 Policymakers could consider whether systemic risk concerns are better addressed through Fed operation of payment and settlement systems or Fed regulation of private systems.

Appendix. Selected Interbank Payment, Clearing, and Settlement Systems Involved in U.S. Payments

|

Name |

Type/Regulator |

Owners/Operators |

Users/Participants |

Uses/Functions |

Transactions |

|

The Clearing House Interbank Payments System (CHIPS) |

Large-value payment system with real-time final settlement of payments. Regulated by the Federal Reserve. |

The Clearing House, which is owned by the largest U.S. banks or the U.S. branches or affiliates of major foreign banks. |

Approximately 50 depository institutions are direct participants. |

CHIPS payment instructions are settled against a positive current position in its account at the Federal Reserve Bank of New York (FRBNY) or simultaneously offset by incoming payments or both. Payments become final on completion of settlement, which occurs throughout the day. At the end of the day, remaining payment instructions are netted on a multilateral basis. CHIPS participants in a net debit position fund their residual net positions through Fedwire funds transfers to the CHIPS account at the FRBNY. |

CHIPS processes bank-to-bank wire transfer payments. |

|

Fedwire Funds Service |

Real-time gross settlement system (RGSS). Payments are continuously settled on an individual, order-by-order basis without netting. |

Federal Reserve |

Depository institutions, U.S. Treasury, federal government agencies. |

Sending funds to other institutions, including for customers. Payment orders by depository institutions are processed individually and settled in central bank money upon receipt. The U.S. Treasury and other federal agencies use this service to disburse and receive funds. |

Purchase and sale of federal funds (depository institutions lend balances at the Federal Reserve to other depository institutions overnight); purchase, sale, and financing of securities transactions; disbursement or repayment of loans; settlement of cross-border U.S. dollar commercial transactions; settlement of real estate transactions and other high-value, time-critical payments. Transfer of funds is final and irrevocable when settled. |

|

National Settlement Service (NSS) |

Multilateral settlement service. Settlement finality occurs on day of settlement. |

Federal Reserve |

Depository institutions that settle for participants in clearinghouses, financial exchanges, and other clearing and settlement groups. Key private-sector system users include Depository Trust Company and National Securities Clearing Corporation for end-of-day cash settlement; Fixed Income Clearing Corporation for funds-only settlement; Electronic Payment Network; The Options Clearing Corp; and several large and regional check clearinghouses. |

Settlement agents acting on behalf of depository institution participants in a settlement arrangement electronically submit settlement files to the Federal Reserve Banks. The files are processed upon receipt, and entries are automatically posted to a depository institution's Federal Reserve account. |

NSS arrangements established by financial market utilities, check clearinghouse associations, and automated clearinghouse networks. |

|

FedACH Service |

Electronic payment system providing automated clearing house (ACH) services. |

Federal Reserve |

Depository institutions, U.S. Treasury, federal government agencies. |

The ACH system exchanges batched direct debit and direct credit payments among business, consumer, and government accounts. |

Pre-authorized recurring payments, such as payroll, Social Security, mortgage, and utility payments. Non-recurring payments, such as telephone-initiated payments and the conversion of checks into ACH payments at lockboxes and points of sale. Also outbound cross-border ACH payments through FedGlobal service. |

|

Electronic Payments Network (EPN) |

ACH operator |

The Clearing House, which is owned by the largest U.S. banks or the U.S. branches or affiliates of major foreign banks. |

Depository institutions. |

The ACH system exchanges batched direct debit and direct credit payments among business, consumer, and government accounts. |

Pre-authorized recurring payments, such as payroll, Social Security, mortgage, and utility payments. Non-recurring payments, such as telephone-initiated payments and the conversion of checks into ACH payments at lockboxes and points of sale. |

Source: The Congressional Research Service.