The Livestock Mandatory Reporting (LMR) Act of 1999 (P.L. 106-78, Title IX; 7 U.S.C. §1635 et seq.) amended the Agricultural Marketing Act of 1946 (7 U.S.C. §1621 et seq.) to require that meat packers report prices and other information on purchases of cattle, swine, and boxed beef (wholesale cuts of beef) to the U.S. Department of Agriculture (USDA). Lamb and lamb meat were added through initial rulemaking, and the act was amended to include wholesale pork in 2010. In September 2015, Congress reauthorized LMR until September 30, 2020, in the enacted Agriculture Reauthorizations Act of 2015 (P.L. 114-54). In past reauthorizations, most livestock industry stakeholders have supported reauthorization of the act and put forward proposals amending mandatory reporting. This report provides an overview of LMR and its legislative and rulemaking history; a description of the LMR program; and issues that the cattle, swine, and lamb industries have raised with USDA that could be considered during possible reauthorization. Information on House and Senate bills that would reauthorize LMR will be added should they become available.

Background and History

Before Congress enacted LMR in 1999, the USDA Agricultural Marketing Service (AMS) collected livestock and meat price and related market information from meat packers on a voluntary basis under the authority of the Agricultural Marketing Act of 1946. AMS market reporters collected and reported prices from livestock auctions, feedlots, and packing plants. The information was disseminated through hundreds of daily, weekly, monthly, and annual written and electronic USDA reports on sales of live cattle, hogs, and sheep and wholesale meat products from these animals. The goal was to provide all buyers and sellers with accurate and objective market information.

By the 1990s, the livestock industry had undergone many changes, including increased concentration in meat packing and animal feeding, production specialization, and vertical integration (firms controlling more than one aspect of production). Fewer animals were sold through negotiated (cash or "spot") sales, while an increasing number of purchases were made under alternative marketing arrangements (e.g., formula purchases based on a negotiated price established in the future). These formula purchases were based on prices not publicly disclosed or reported. Some livestock producers, believing that such arrangements made it difficult or impossible for them to assess "fair" market prices for livestock going to slaughter, called for mandatory price reporting for packers and others who process and market meat. USDA had estimated in 2000 that the former voluntary system was not reporting transactions of the order of 35%-40% of cattle, 75% of hogs, and 40% of lambs.1

During initial debate in Congress on LMR, opponents, including some meat packers and other farmers and ranchers, argued that a mandate would impose costly new burdens on the industry and could cause the release of confidential company information. Nonetheless, some of these early opponents ultimately supported an LMR law. Livestock producers had experienced low prices in the late 1990s and were looking for ways to strengthen market prices. Some meat packers also supported a national consensus bill at least partly to preempt what they viewed as an emerging "patchwork" of state price reporting laws that could alter competition among packers operating under different state laws.2

Legislative and Rulemaking History

LMR was enacted in October 1999 as part of the FY2000 Agriculture appropriations act. (See Table 1, "Legislative and Rulemaking History.") The law mandated price reporting for live cattle, boxed beef, and live swine and allowed USDA to establish LMR for lamb purchases and lamb meat sales. The law authorized appropriations as necessary and required USDA to implement regulations no later than 180 days after the law was enacted. LMR was authorized for five years, until September 30, 2004.

USDA issued a final rule on December 1, 2000.3 Although reporting for lamb was optional in the LMR statute, USDA established mandatory reporting for lamb in the final rule. The rule was to be implemented on January 30, 2001, but USDA delayed implementation until April 2, 2001, to allow for additional time to test the automated LMR program to ensure program requirements were being met.4

The implementation of LMR did not affect the continuation of the AMS voluntary price-reporting program. AMS continues to publish prices from livestock auctions and feeder cattle and pig sales through voluntary-based market news reports.

LMR authority lapsed for two months in October 2004 before Congress extended it for one year to September 30, 2005.5 Authority for LMR lapsed again on September 30, 2005. At that time, USDA requested that all packers who were required to report under the 1999 act continue to submit required information voluntarily. About 90% of packers voluntarily reported, which allowed USDA to continue to publish most reports. In October 2006, Congress passed legislation to reauthorize LMR through September 30, 2010.6 This act also amended swine reporting requirements from the original 1999 law by separating the reporting requirements for sows and boars from barrows and gilts, among other changes.7

Because statutory authority for the program had lapsed for a year, USDA determined that it had to reestablish regulatory authority through rulemaking in order to continue LMR operations. On May 16, 2008, USDA issued the final rule to reestablish and revise the mandatory reporting program.8 This rule incorporated the swine reporting changes and was intended to enhance the program's overall effectiveness and efficiency based on AMS's experience in the administration of the program. The rule became effective on July 15, 2008.

Mandatory wholesale pork price reporting was not included in the original LMR act because the swine industry could not agree on reporting for pork. Section 11001 of the 2008 farm bill (P.L. 110-246) directed USDA to study the effects of requiring packers to report the price and volume of wholesale pork cuts, which was a voluntary reporting activity at the time. The study was released in November 2009 and concluded that there would be benefits from a mandatory pork reporting program.9

On September 27, 2010, the President signed into law the Mandatory Price Reporting Act of 2010 (P.L. 111-239), reauthorizing LMR through September 30, 2015. The act added a provision for LMR of wholesale pork cuts, directed USDA to engage in negotiated rulemaking to make required regulatory changes for mandatory wholesale pork reporting, and established a negotiated rulemaking committee to develop these changes.10 The committee was composed of representatives of pork producers, packers, processors, and retailers. The committee met three times, was open to the public, and developed recommendations for mandatory wholesale pork reporting.11 USDA released the final rule on August 22, 2012, and the regulation was implemented on January 7, 2013.12

The Agriculture Reauthorizations Act of 2015 (P.L. 114-54) was enacted into law on September 30, 2015, extending LMR to September 30, 2020.13 P.L. 114-54 included amendments to swine and lamb reporting and addressed certain issues that livestock stakeholders had raised about LMR. (See "LMR Provisions Enacted in 2015" below.)

|

Public Law |

Rulemaking |

Description |

|

Livestock Mandatory Reporting Act of 1999 (P.L. 106-78, Title IX) 7 U.S.C. §1635 et seq. October 22, 1999 |

LMR final rule. 65 Fed. Reg. 75464 (December 1, 2000). Effective January 30, 2001. LMR final rule; postponement of effective date to April 2, 2001. 66 Fed. Reg. 8151 (January 30, 2001). 7 C.F.R. Part 59 |

Established LMR for cattle, hogs, and boxed beef through September 30, 2004. Allowed the Secretary of Agriculture to establish LMR for lamb. |

|

Notice of modification of confidentiality guideline. 66 Fed. Reg. 41194 (August 7, 2001). Effective August 20, 2001. |

Revised the guidelines to protect the confidentiality of entities subject to reporting. See "Confidentiality" section for information on the "3/70/20" guideline. |

|

|

LMR: Amendment to Revise Lamb Reporting Definitions. 69 Fed. Reg. 53784 (September 2, 2004). Effective November 1, 2004. |

Amends the threshold for boxed lamb cut reporting and the threshold for importer volume. |

|

|

P.L. 108-444, December 4, 2004 |

Extended LMR one year to September 30, 2005. |

|

|

P.L. 109-296, October 5, 2006 |

LMR final rule. Reestablishment and Revision of the Reporting Regulation for Swine, Cattle, Lamb, and Boxed Beef. 73 Fed. Reg. 28606 (May 16, 2008). |

Extended LMR to September 30, 2010. Amended reporting requirements for swine. |

|

Food, Conservation, and Energy Act of 2008 (§11001, P.L. 110-246) June 18, 2008 |

2008 farm bill directed USDA to conduct a study and provide a report to Congress on including wholesale pork cuts in LMR. |

|

|

Mandatory Price Reporting Act of 2010 (P.L. 111-239) September 27, 2010 |

LMR final rule. Establishment of the Reporting Regulations for Wholesale Pork. 77 Fed. Reg. 50561 (August 22, 2012). Effective January 7, 2013. |

Extended LMR through September 30, 2015. Amended LMR to include wholesale pork cuts. |

|

Agriculture Reauthorizations Act of 2015 (P.L. 114-54, Title I) September 30, 2015 |

LMR direct final rule. Revision of Lamb Reporting Requirements. 81 Fed Reg. 10057 (February 29, 2016). Effective May 31, 2016. LMR final rule. Reauthorization of Livestock Mandatory Reporting and Revision of Swine and Lamb Reporting Requirements. 81 Fed. Reg. 52969 (August 11, 2016). Effective October 11, 2016. |

Extended LMR through September 30, 2020. Amended LMR to include a "negotiated formula purchase" price, daily reporting, lamb import reporting, and a report to Congress on LMR. Established regulations and requirements for the amended swine and lamb reporting. |

Source: Compiled by CRS.

LMR Provisions Enacted in 2015

The Agriculture Reauthorizations Act of 2015 (P.L. 114-54) extended LMR through September 30, 2020, and established the negotiated formula purchase reporting category for swine. A negotiated formula purchase is a purchase of swine based on a formula, negotiated on a lot-by-lot basis, in which the swine are committed to packers and scheduled for delivery no later than 14 days after the formula is negotiated.

The enacted legislation also amended swine LMR by requiring the reporting of the low and high range of net swine prices to include the number of barrows and the number of gilts within the ranges and the total number and weighted average price of barrows and gilts. Lastly, the act requires that next-day reports include transaction prices that were concluded after the previous day's reporting deadlines.

P.L. 114-54 amended lamb reporting regulations to redefine lamb importers and lamb packers.14 Importer is defined as an entity that imports an average of 1,000 metric tons (MT) of lamb meat per year during the immediately preceding four years. The original threshold was 2,500 MT. If an importing entity does not meet the volume limit, the Secretary of Agriculture may still determine that an entity should be considered an importer. Lamb packer is defined as an entity having 50% or more ownership in facilities, including federally inspected facilities, that slaughtered and processed an average of 35,000 head per year over the immediately preceding five years. The original threshold was 75,000 head. Also, the Secretary may consider other facilities to be packers based on processing plant capacity.

Lastly, the reauthorization required USDA to study the price-reporting program for cattle, swine, and lamb. The study, to be conducted by AMS and the USDA Office of the Chief Economist, was directed to analyze current marketing practices and identify legislative and regulatory recommendations that are readily understandable; reflect current market practices; and are relevant and useful to producers, packers, and other market participants. AMS submitted the report to Congress in April 2018.15

The LMR Program

LMR requires livestock buyers and sellers of meat products to report prices and other characteristics of their transactions. Ten types of transactions are reported for livestock, and each is described below. Several other marketing terms are defined in the text box following the description of transactions. Lastly, there is a discussion of LMR confidentiality requirements, AMS reporting, and enforcement measures.

LMR Livestock Transaction Types

Some types of transactions required under LMR are for specific livestock, such as cattle or swine, others cover all covered species.

Negotiated purchase: a cash or "spot" market purchase by a packer of livestock from a producer under which the base price for the livestock is determined by seller-buyer interaction and agreement on a delivery day. Cattle are delivered to the packer within 30 days of the agreement. Swine are delivered within 14 days.

Negotiated grid purchase (cattle): the negotiation of a base price, from which premiums are added and discounts are subtracted, determined by seller-buyer interaction and agreement on a delivery day. Cattle are usually delivered to the packer not more than 14 days after the date the livestock are committed to the packer.

Forward contract: an agreement for the purchase of livestock, executed in advance of slaughter, under which the base price is established by reference to publicly available prices. For example, forward contracts may be priced on quoted Chicago Mercantile Exchange prices or other comparable public prices.

Formula marketing arrangement: the advance commitment of livestock for slaughter by any means other than a negotiated or negotiated grid purchase or a forward contract using a method for calculating price in which the price is determined at a future date.

Swine or pork market formula purchase: a purchase of swine by a packer in which the pricing mechanism is a formula price based on a market for swine, pork, or a pork product other than a future or option for swine, pork, or a pork product.

Negotiated formula purchase (swine): a purchase of swine based on a swine/pork market formula that is negotiated lot-by-lot and scheduled for delivery and committed to the packer within 14 days of the negotiation. The sales are reported as producer- or packer-sold.

Other market formula purchase: a purchase of swine by a packer in which the pricing mechanism is a formula price based on one or more futures or options contracts, and the sales are reported as producer- or packer-sold.

Other purchase arrangement: a purchase of swine by a packer that is not a negotiated purchase, swine or pork market formula purchase, negotiated formula, or other market formula purchase and does not involve packer-owned swine. The sales are reported as producer- or packer-sold.

Packer-sold swine: the swine that are owned by a packer (including a subsidiary or affiliate of the packer) for more than 14 days immediately before sale for slaughter and sold for slaughter to another packer.

Packer-owned: livestock that packers (includes a subsidiary or affiliate of swine packers) own for at least 14 days immediately before slaughter. Information such as weight and dressing percent is reported on packer-owned livestock.

Meat Transactions

Meat packers are also required to report negotiated sales, formula sales, and forward contracts for boxed beef, boxed lamb, carcass lamb, and wholesale pork.

Negotiated sales: a wholesale pork, boxed beef, or boxed lamb trade in which a price is determined by seller and buyer and is scheduled for delivery no more the 14 days from the date the price is established.

Formula marketing arrangements: agreements in which the price is determined based on publicly available quoted prices.

Forward sales: a wholesale pork, boxed beef, or boxed lamb sale in which the price is determined by seller and buyer and the delivery is scheduled beyond the time of a negotiate sale (over 14 days).

Export sales: meats that are delivered outside the United States but not to Canada or Mexico.

Livestock Transaction Data

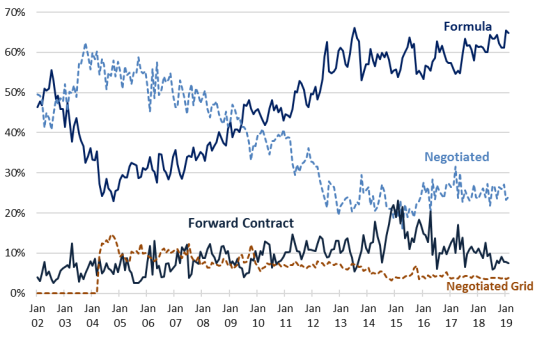

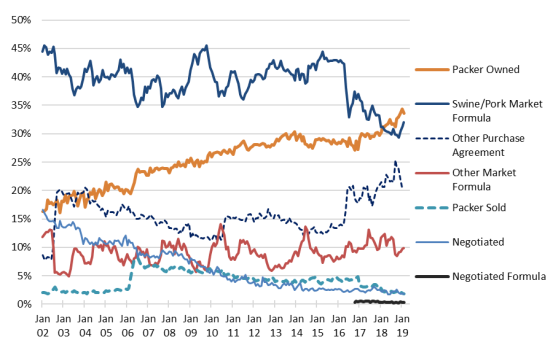

Figure 1 and Figure 2 show the monthly percentage since 2002 of cattle and swine purchases by transactions type. Both demonstrate the long-term declining trend in negotiated purchases and the move to formula-based purchases. In January 2002, almost 50% of cattle were traded on a negotiated basis, but negotiated purchases amounted to about 25% of purchases in May 2019. The declining trend in negotiated purchases in swine has gone from 17% in January 2002 to less than 2% in February 2019.

AMS does not report the number of lambs sold on a formula basis because of confidentiality requirements. Throughout 2017 AMS was unable to report formula purchases in its National Weekly Lamb Report that included both lamb negotiated and formula purchases because of confidentiality requirements.16 AMS stopped publishing the report in December 2017. In 2016, about 40% of lambs were purchased on a negotiated basis and 60% on a formula basis.

Currently, AMS reports the number of lambs, their weight and price range, and the weighted average price of purchased lambs on a negotiated basis, as well as comprehensive information that includes the average weight, net price, and dressing percent that combines negotiated and formula purchase information.17 Sufficient data are not available to publish all of the regular LMR transactions due to the limited number of transactions.

|

Figure 1. Cattle Purchases by Transaction Type January 2002-February 2019 |

|

|

Source: CRS, using data compiled by the Livestock Marketing Information Center from AMS. |

|

Figure 2. Swine Purchases by Transaction Type January 2002-February 2019 |

|

|

Source: CRS, using data compiled by the Livestock Marketing Information Center from AMS. |

Selected Reporting Requirements

The text box above provides definitions of selected marketing terms that are used in LMR reports. The following sections discuss some of the main LMR reporting requirements, a description of confidentiality, and AMS reporting and enforcement of LMR. The complete LMR reporting requirements for cattle, swine, lamb, beef, pork, and lamb meat are in the LMR statute (7 U.S.C. §1635 et seq.) and the LMR regulations (7 C.F.R. Part 59). LMR reports are available at the AMS Livestock, Poultry, and Grain Market News Portal.18 A description of selected reporting requirements under the LMR, and of the entities that are subject to them, follow.

- Packers that are subject to mandatory reporting are defined as federally inspected plants that have slaughtered a minimum annual average of 125,000 head of cattle, 100,000 head of swine, 200,000 head of sows and boars or a combination thereof, or 35,00019 lambs during the immediate five preceding years. If a plant has operated for fewer than five years, USDA determines, based on capacity, if the packer must report.

- Packers are required to report the prices established for steers and heifers twice daily (10 a.m. and 2 p.m. central time), for cows and bulls twice daily (10 a.m. central for current day and 2 p.m. for previous-day purchases), barrows and gilts three times daily (7 a.m. central for prior-day purchases and 10 a.m. and 2 p.m. central), sows and boars once daily (7 a.m. central for prior-day purchases), and lambs once daily (2 p.m. central).

- Besides the established prices, packers report premiums and discounts and the type of purchase transaction—for example, negotiated sales, formula sales, or forward contracts. Depending on the species, packers are required to report the quantity delivered for the day; the quantity committed to the packer; the estimated weight on a live weight basis or a dressed weight basis; and quality characteristics, such as quality grade.

- In addition to daily reporting, on the first reporting day of the week, packers file a cumulative weekly report of the previous week's purchases of steers, heifers, and swine. Lamb packers are required to report the previous week's purchases on the first and second reporting day of the week, depending on the data. Steer and heifer and lamb packers are to include data on type of purchase (negotiated, formula, or forward contract), premiums and discounts, and some carcass characteristics (e.g., quality grade and yield, average dressing percentage). Swine packers are required to report the amount paid in premiums that are based on noncarcass characteristics (e.g., volume, delivery timing, hog breed). Also, packers must provide producers a list of such premiums.

- In addition to livestock purchase prices, packers are required to report sales data for boxed beef, wholesale pork, and carcass and boxed lamb. Sales are reported twice daily for beef and pork and once daily for lamb. Packers are required to provide price, quantity, quality grade for beef and lamb, and type of cut. Packers must also report beef and pork domestic and export sales and domestic boxed lamb sales.

- Lamb importers who have imported a minimum average of 1,000 MT of lamb20 in the immediate four preceding years are required to report weekly lamb prices; quantities imported; the type of sale (negotiated, formula, or forward contract); cuts of lamb; and delivery period.

Confidentiality

The LMR law requires that price reporting be confidential to protect packer identity, contracts, and proprietary business information. In determining what data could be published, AMS initially adopted a "3/60" confidentiality guideline, which is commonly used throughout the federal government. Under 3/60, at least three entities must report in the regional or national reporting area, and no single entity may account for more than 60% of the reported market volume. Because of concentration in the livestock industry, AMS found that the "3/60" guideline resulted in large gaps in data reporting. For example, between April 2, 2001, and June 15, 2001, 24% of daily reports and 20% of weekly reports were not published because of confidentiality provisions.21

In order to address the data gaps, in August 2001 AMS adopted a "3/70/20" guideline,22 which requires that (1) at least three entities report 50% of the time over the most recent 60-day period, (2) no single reporting entity may account for more than 70% of reported volume over the most recent 60-day period, and (3) no single reporting entity may be the only reporting entity for a single report more than 20% of the time over the most recent 60-day period. These new guidelines eliminated most of the data gaps.

AMS Reporting

The Livestock, Poultry, and Grain Market News Division of the AMS Livestock, Poultry, and Seed Program is responsible for compiling and disseminating the information collected under LMR. It continues to operate a voluntary reporting program for livestock, poultry, and grain not covered under LMR.

Under LMR, AMS publishes 24 daily cattle reports, 20 daily swine reports, and 2 daily lamb reports, and on a weekly basis, 21 cattle reports, 2 swine reports, and 3 lamb reports. It also publishes daily 6 boxed beef reports, 4 wholesale pork reports, and 1 boxed lamb and 1 lamb carcass report, and weekly 11 boxed beef reports, 10 wholesale pork reports, and 1 boxed lamb and 1 lamb carcass report. AMS also publishes 13 monthly cattle reports under LMR.23

According to AMS, LMR provides data for 78% of total slaughtered cattle, 94% of hogs, and 43% of sheep. For meat products, LMR covers 93% of boxed beef production, 87% of wholesale pork, and 43% of boxed lamb.24 Small operations that fall below required thresholds or nonfederally inspected meat packing facilities account for the remaining percentage of livestock slaughter and meat production. AMS market news operates on an annual appropriation of about $34 million, and the LMR program accounts for about $4 million of that amount.

Enforcement

AMS compliance staff enforces LMR through audits once every six months. AMS accomplishes this by reviewing support documentation for randomly sampled lots.25

AMS classifies noncompliance as major or minor violations. Major violations occur when packers do not submit information or submit incorrect information that affects the accuracy of reports. Minor violations are submissions that have typographical or data entry errors, for example, but have a minimal effect on report accuracy. If noncompliance is found, AMS will ask the packer to correct the problem. If the packer does not correct the problem, AMS may issue a warning letter and conduct additional audits. Ultimately, AMS could fine the packer $10,000 for each violation if corrective action is not taken. Packing plants have the right to appeal any noncompliance findings within 30 days of receiving a request for corrective action.

In FY2015, AMS switched from quarterly plant visit reports to semiannual compliance reports on plant visits.26 For FY2018, AMS issued 369 noncompliance violations (270 major and 99 minor) during audits of 457 plants and 4,389 audited lots.

Issues for Reauthorization in 2020

As part of the 2015 reauthorization study requirement, AMS held several meetings with cattle, swine, and lamb industry stakeholders to gather feedback on the LMR program. Stakeholders represented at the meetings included industry associations, farm groups, meat processors and food companies.27 In several cases AMS has already implemented reporting changes to address industry concerns. A common concern among stakeholders is the limited volume of the negotiated purchase market (see Figure 1 and Figure 2). Other concerns cited went to issues of confidentiality and the need for greater clarity in how transactions are categorized in reports. Some stakeholders want to see more detailed information on transactions, such as premiums, especially as pricing models evolve, as well as changes in reporting on the number of livestock committed to packers. The sections below provide summaries of the baseline study and stakeholder feedback.

Baseline Study

In response to the report requirements in the 2015 reauthorization, AMS commissioned a baseline study that explored underlying changes in the livestock and meat markets that affect LMR.28 The study's findings include the following:

- 1. Since LMR was established, the meatpacking industry has become more concentrated and vertically integrated. Many producers are also looking to vertical integration to remain competitive.

- 2. The industry is responding to domestic and global consumer meat demand with product differentiation and a mix of new products that did not exist when LMR began.

- 3. Livestock and meat are traded differently than they were 20 years ago as negotiated trades represent a smaller share of transactions, while formula pricing, forward contracts, and other arrangements comprise an increasing share of the total trade.

- 4. There are new platforms for pricing, such as internet auctions, that did not exist in early years of LMR. The industry is likely to continue to develop other platforms that vary greatly from traditional trading of livestock and meat.

The study's authors concluded that the loss of LMR data during the 2013 government shutdown left the industry without a benchmark to accurately evaluate the markets. During the 2018-2019 shutdown AMS continued LMR reporting.29

Further structural changes—concentration and integration—in the livestock industry create challenges for confidentiality in reporting. In addition, the effectiveness of LMR as a means of providing relevant information for market participants may need to be assessed in the context of changes, such as introduction of branded or specialty programs that are not captured by LMR as it is currently structured. Also, with international trade in meat increasing, the inclusion of more market information on exported meat products could add to transparency in the market. Lastly, the study noted that timely AMS collaboration with the industry is crucial to the usefulness of LMR.

Stakeholders in the cattle, swine, and lamb industries provided a range of comments and suggestions during their meetings with AMS, and these are summarized below.

Cattle Industry

Cattle stakeholders did not offer legislative recommendations to AMS but suggested changes to LMR reporting. AMS has already addressed some cattle stakeholder concerns. For example, cattle stakeholders raised concerns about how AMS reports delivery periods for negotiated purchases. A period of 15-30 days for deliveries was added in 2008, but AMS was unable to report data because of confidentiality guidelines. Instead data was reported as deliveries of 0-30 days. In response, AMS conducted a study of delivery periods, and in November 2017 it began reporting weighted average negotiated cattle prices for delivery periods of 0-14 and 15-30 days.30 AMS has also adjusted reporting so that negotiated purchases delivered beyond 30 days are separate from forward contract purchase. Some in the cattle industry expressed the need for greater reporting of committed cattle. For example, hog packers report each morning the number of hogs they have committed to take delivery of during the next 14 days. Conversely, some cattle stakeholders disagree that additional data on committed cattle is needed, pointing out that cattle market numbers are smaller than swine numbers, and therefore the information could be misleading.

Swine Industry

Stakeholders in the swine industry also expressed concern about the low volume of transactions in the negotiated markets. They were also skeptical about whether LMR can adequately capture market information related to changes in consumer preferences for pork—such as organic, antibiotic-free, raised without sow crates, or pork raised without the growth promoter ractopamine. In general, swine stakeholders also want AMS to report more noncarcass premiums, revise its reporting on the pork cutout (cut up parts of the carcass), and provide guidance on how transactions are categorized.

Swine stakeholders offered the following six recommendations for legislative changes to LMR:31

- 1. Remove the "negotiated formula purchase" definition and reporting requirement for swine that was included in the 2015 LMR reauthorization;

- 2. Amend the definition of non-carcass merit premium32 to more clearly differentiate the reporting requirements from premiums offered for carcass merit;

- 3. Define and report swine attributes, specifically addressing how attribute premiums, base prices, and net prices are reported by purchase type;

- 4. Amend the definitions of affiliate to lower the threshold of ownership or control to anything greater than 0 percent;

- 5. Add to reporting the volume of swine or pork market formula transactions that are priced on the pork carcass cutout; and

- 6. Remove the requirement for reporting wholesale pork on a free-on-board (FOB) Omaha basis.33 Wholesale pork is reported on an FOB plant basis and FOB Omaha basis, but most of the pork industry now uses FOB plant as the basis for pricing.

Lamb Industry

The U.S. sheep and lamb industry is a concentrated market that results in price-reporting challenges not necessarily experienced by the larger cattle and hog sectors. As a result, AMS is no longer able to publish lamb formula purchases because too few companies purchase the volume needed to meet reporting confidentiality guidelines. At the request of the lamb industry, AMS commissioned a study of lamb data and confidentiality.34 The study found that it is not feasible to relax confidentiality guidelines but suggested alternatives such as publishing a comprehensive report, which AMS has done, and developing a standardized pricing model that would produce a price based on the relationship of various reporting attributes.

The lamb stakeholders raised concerns that AMS was not capturing price information for cooperative-owned lambs and for custom slaughtered lambs. AMS addressed the cooperative owned lamb issue in November 2017 by adding these lamb prices and their carcass weight information to its weekly sheep report.35 Under custom slaughter, ownership does not change. A producer's lambs are slaughtered on contract and are usually priced on a per-head basis. The lamb carcasses may then be sold to a lamb processor for fabrication (processing the carcasses into various cuts), but prices are not reported to AMS. Lastly, some stakeholders requested reporting of the number of lambs committed to be delivered to packers. However, the industry is not in agreement on reporting of committed lambs because of concern among some that this information would provide market information to import competitors.36

Lamb stakeholders involved in discussions with AMS proposed that three amendments be included in the reauthorization of LMR:37

- 1. Lower the reporting threshold for lamb packers from 35,000 head per year on average to 20,000 head per year on average.

- 2. Define and require reporting of custom slaughtered lambs.

- 3. Define and require reporting of committed lambs.

Congressional Interest

LMR, as enacted and amended over the past 20 years, has increased market transparency for all market participants and livestock analysts. Livestock stakeholders have been generally supportive of LMR and its reauthorization over the years. The five-year reauthorization period has provided an opportunity for Congress to receive input from livestock stakeholders and evaluate whether or not the law and its implementation is fulfilling its purpose. This has proven especially critical when the industry is constantly changing and adapting to market and consumer demands.

The 2015 reauthorization law that required that USDA provide a report to Congress on the LMR program offers a potential starting point for Congress to consider for possible 2020 reauthorization. Livestock stakeholders have offered specific proposals for Congress to consider should it choose to address reauthorization legislation. Other recommendations may be forthcoming. AMS regularly engages the livestock industry on LMR reporting issues and makes changes to reporting. During consideration of reauthorization, Congress may consider legislation to bolster LMR and whether AMS needs additional regulatory authority to address LMR issues. Stakeholders may have particular interest in adjusting confidentiality requirements for lamb reporting and expanding reporting requirements for certain attributes that address changing livestock markets.