Introduction

This report provides background information and discusses potential issues for Congress regarding the Navy's FFG(X) program, a program to procure a new class of 20 guided-missile frigates (FFGs). The Navy's proposed FY2020 budget requests $1,281.2 million for the procurement of the first FFG(X).

The FFG(X) program presents several potential oversight issues for Congress. Congress's decisions on the program could affect Navy capabilities and funding requirements and the shipbuilding industrial base.

This report focuses on the FFG(X) program. A related Navy shipbuilding program, the Littoral Combat Ship (LCS) program, is covered in detail in CRS Report RL33741, Navy Littoral Combat Ship (LCS) Program: Background and Issues for Congress, by Ronald O'Rourke. Other CRS reports discuss the strategic context within which the FFG(X) program and other Navy acquisition programs may be considered.1

Background

Navy's Force of Small Surface Combatants (SSCs)

In discussing its force-level goals and 30-year shipbuilding plans, the Navy organizes its surface combatants into large surface combatants (LSCs), meaning the Navy's cruisers and destroyers, and small surface combatants (SSCs), meaning the Navy's frigates, LCSs, mine warfare ships, and patrol craft.2 SSCs are smaller, less capable in some respects, and individually less expensive to procure, operate, and support than LSCs. SSCs can operate in conjunction with LSCs and other Navy ships, particularly in higher-threat operating environments, or independently, particularly in lower-threat operating environments.

In December 2016, the Navy released a goal to achieve and maintain a Navy of 355 ships, including 52 SSCs, of which 32 are to be LCSs and 20 are to be FFG(X)s. Although patrol craft are SSCs, they do not count toward the 52-ship SSC force-level goal, because patrol craft are not considered battle force ships, which are the kind of ships that count toward the quoted size of the Navy and the Navy's force-level goal.3

At the end of FY2018, the Navy's force of SSCs totaled 27 battle force ships, including 0 frigates, 16 LCSs, and 11 mine warfare ships. Under the Navy's FY2020 30-year (FY2020-FY2049) shipbuilding plan, the SSC force is to grow to 52 ships (34 LCSs and 18 FFG[X]s) in FY2034, reach a peak of 62 ships (30 LCSs, 20 FFG[X]s, and 12 SSCs of a future design) in FY2040, and then decline to 50 ships (20 FFG[X]s and 30 SSCs of a future design) in FY2049.

U.S. Navy Frigates in General

In contrast to cruisers and destroyers, which are designed to operate in higher-threat areas, frigates are generally intended to operate more in lower-threat areas. U.S. Navy frigates perform many of the same peacetime and wartime missions as U.S. Navy cruisers and destroyers, but since frigates are intended to do so in lower-threat areas, they are equipped with fewer weapons, less-capable radars and other systems, and less engineering redundancy and survivability than cruisers and destroyers.4

The most recent class of frigates operated by the Navy was the Oliver Hazard Perry (FFG-7) class (Figure 1). A total of 51 FFG-7 class ships were procured between FY1973 and FY1984. The ships entered service between 1977 and 1989, and were decommissioned between 1994 and 2015.

|

|

Source: Photograph accompanying Dave Werner, "Fighting Forward: Last Oliver Perry Class Frigate Deployment," Navy Live, January 5, 2015, accessed September 21, 2017, at http://navylive.dodlive.mil/2015/01/05/fighting-forward-last-oliver-perry-class-frigate-deployment/. |

In their final configuration, FFG-7s were about 455 feet long and had full load displacements of roughly 3,900 tons to 4,100 tons. (By comparison, the Navy's Arleigh Burke [DDG-51] class destroyers are about 510 feet long and have full load displacements of roughly 9,300 tons.) Following their decommissioning, a number of FFG-7 class ships, like certain other decommissioned U.S. Navy ships, have been transferred to the navies of U.S. allied and partner countries.

FFG(X) Program

Meaning of Designation FFG(X)

In the program designation FFG(X), FF means frigate,5 G means guided-missile ship (indicating a ship equipped with an area-defense AAW system),6 and (X) indicates that the specific design of the ship has not yet been determined. FFG(X) thus means a guided-missile frigate whose specific design has not yet been determined.7

Procurement Quantity

The Navy wants to procure 20 FFG(X)s, which in combination with the Navy's planned total of 32 LCSs would meet the Navy's 52-ship SSC force-level goal. A total of 35 (rather than 32) LCSs have been procured through FY2019, but Navy officials have stated that the Navy nevertheless wants to procure 20 FFG(X)s.

The Navy's 355-ship force-level goal is the result of a Force Structure Analysis (FSA) that the Navy conducted in 2016. The Navy conducts a new or updated FSA every few years, and it is currently conducting a new FSA that is scheduled to be completed by the end of 2019. Navy officials have stated that this new FSA will likely not reduce the required number of small surface combatants, and might increase it. Navy officials have also suggested that the Navy in coming years may shift to a new fleet architecture that will include, among other things, a larger proportion of small surface combatants.

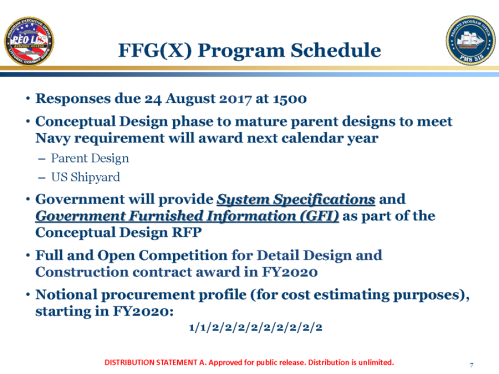

Procurement Schedule

The Navy wants to procure the first FFG(X) in FY2020, the next 18 at a rate of two per year in FY2021-FY2029, and the 20th in FY2030. Under the Navy's FY2020 budget submission, the first FFG(X) is scheduled to be delivered in July 2026, 72 months after the contract award date of July 2020.

Ship Capabilities and Design

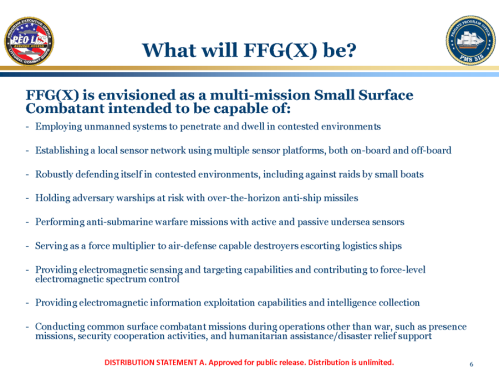

As mentioned above, the (X) in the program designation FFG(X) means that the design of the ship has not yet been determined. In general, the Navy envisages the FFG(X) as follows:

- The ship is to be a multimission small surface combatant capable of conducting anti-air warfare (AAW), anti-surface warfare (ASuW), antisubmarine warfare (ASW), and electromagnetic warfare (EMW) operations.

- Compared to an FF concept that emerged under a February 2014 restructuring of the LCS program, the FFG(X) is to have increased AAW and EMW capability, and enhanced survivability.

- The ship's area-defense AAW system is to be capable of local area AAW, meaning a form of area-defense AAW that extends to a lesser range than the area-defense AAW that can be provided by the Navy's cruisers and destroyers.

- The ship is to be capable of operating in both blue water (i.e., mid-ocean) and littoral (i.e., near-shore) areas.

- The ship is to be capable of operating either independently (when that is appropriate for its assigned mission) or as part of larger Navy formations.

Given the above, the FFG(X) design will likely be larger in terms of displacement, more heavily armed, and more expensive to procure than either the LCS or an FF concept that emerged from the February 2014 LCS program restructuring.

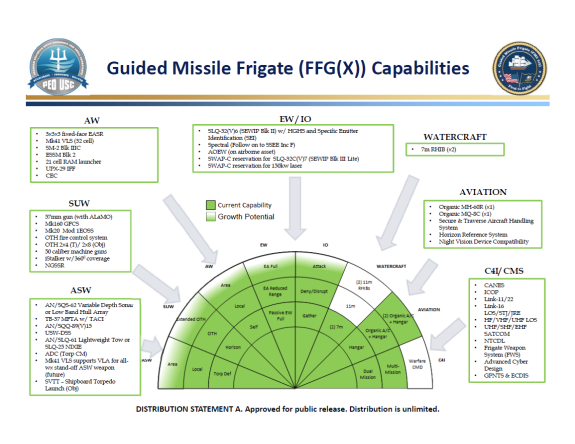

Figure 2 shows a January 2019 Navy briefing slide summarizing the FFG(X)'s planned capabilities. For additional information on the FFG(X)'s planned capabilities, see the Appendix.8

Dual Crewing

To help maximize the time that each ship spends at sea, the Navy reportedly is considering operating FFG(X)s with dual crews—an approach, commonly called blue-gold crewing, that the Navy uses for operating its ballistic missile submarines and LCSs.9

Procurement Cost

The Navy wants the follow-on ships in the FFG(X) program (i.e., ships 2 through 20) to have an average unit procurement cost of $800 million to $950 million each in constant 2018 dollars.10 The Navy reportedly believes that the ship's cost can be held closer to the $800 million figure.11 By way of comparison, the Navy estimates the average unit procurement cost of the three LCSs procured in FY2019 at $523.7 million (not including the cost of each ship's embarked mission package), and the average unit procurement cost of the three DDG-51 class destroyers that the Navy has requested for procurement in FY2020 at $1,821.0 million.

As shown in Table 1, the Navy's proposed FY2020 budget requests $1,281.2 million for the procurement of the first FFG(X). The lead ship in the program will be considerably more expensive than the follow-on ships in the program, because the lead ship's procurement cost incorporates most or all of the detailed design/nonrecurring engineering (DD/NRE) costs for the class. (It is a traditional Navy budgeting practice to attach most or all of the DD/NRE costs for a new ship class to the procurement cost of the lead ship in the class.) As shown in Table 1, the Navy's FY2020 budget submission shows that subsequent ships in the class are estimated by the Navy to cost roughly $900 million each in then-year dollars over the next few years.

The Navy's FY2020 budget submission estimates the total procurement cost of 20 FFG(X)s at $20,470.1 million (i.e., about $20.5 billion) in then-year dollars, or an average of about $1,023.5 million each. Since the figure of $20,470.1 million is a then-year dollar figure, it incorporates estimated annual inflation for FFG(X)s to be procured out to FY2030.

Parent-Design Approach

The Navy's desire to procure the first FFG(X) in FY2020 does not allow enough time to develop a completely new design (i.e., a clean-sheet design) for the FFG(X). (Using a clean-sheet design might defer the procurement of the first ship to about FY2024.) Consequently, the Navy intends to build the FFG(X) to a modified version of an existing ship design—an approach called the parent-design approach. The parent design could be a U.S. ship design or a foreign ship design.12

Using the parent-design approach can reduce design time, design cost, and cost, schedule, and technical risk in building the ship. The Coast Guard and the Navy are currently using the parent-design approach for the Coast Guard's polar security cutter (i.e., polar icebreaker) program.13 The parent-design approach has also been used in the past for other Navy and Coast Guard ships, including Navy mine warfare ships14 and the Coast Guard's new Fast Response Cutters (FRCs).15

No New Technologies or Systems

As an additional measure for reducing cost, schedule, and technical risk in the FFG(X) program, the Navy envisages developing no new technologies or systems for the FFG(X)—the ship is to use systems and technologies that already exist or are already being developed for use in other programs.

Number of Builders

Given the currently envisaged procurement rate of two ships per year, the Navy's baseline plan for the FFG(X) program envisages using a single builder to build the ships.16 Consistent with U.S. law,17 the ship is to be built in a U.S. shipyard, even if it is based on a foreign design. Using a foreign design might thus involve cooperation or a teaming arrangement between a U.S. builder and a foreign developer of the parent design. The Navy has not, however, ruled out the option of building the ships at two or three shipyards. At a December 12, 2018, hearing on Navy readiness before two subcommittees (the Seapower subcommittee and the Readiness and Management Support subcommittee, meeting jointly) of the Senate Armed Services Committee, the following exchange occurred:

SENATOR ANGUS KING (continuing):

Talking about industrial base and acquisition, the frigate, which we're talking about, there are 5 yards competing, there are going to be 20 ships. As I understand it, the intention now is to award all 20 ships to the winner, it's a winner take all among the five. In terms of industrial base and also just spreading the work, getting the—getting the work done faster, talk to me about the possibility of splitting that award between at least two yards if not three.

SECRETARY OF THE NAVY RICHARD SPENCER:

You bring up an interesting concept. There's two things going on here that need to be weighed out. One, yes, we do have to be attentive to our industrial base and the ability to keep hands busy and trained. Two, one thing we also have to look at, though, is the balancing of the flow of new ships into the fleet because what we want to avoid is a spike because that spike will come down and bite us again when they all go through regular maintenance cycles and every one comes due within two or three years or four years. It gets very crowded. It's not off the table because we've not awarded anything yet, but we will—we will look at how best we can balance with how we get resourced and, if we have the resources to bring expedition, granted, we will do that.18

Competing Industry Teams

At least five industry teams are reportedly competing for the FFG(X) program. Two of these teams are offering designs for the FFG(X) that are modified versions of the two Littoral Combat Ship (LCS) designs that the Navy has procured in prior years. The other three industry teams are offering designs for the FFG(X) that are based on other existing ship designs. One of these three other industry teams is proposing to build its design at one of the LCS shipyards.

On February 16, 2018, the Navy awarded five FFG(X) conceptual design contracts with a value of $15.0 million each to

- Austal USA of Mobile, AL;

- Huntington Ingalls Industry/Ingalls Shipbuilding (HII/Ingalls) of Pascagoula, MS;

- Lockheed Martin of Baltimore, MD;

- Fincantieri/Marinette Marine (F/MM) of Marinette, WI; and

- General Dynamics/Bath Iron Works (GD/BIW), of Bath, ME.19

Being a recipient of a conceptual design contract is not a requirement for competing for the subsequent Detailed Design and Construction (DD&C) contract for the program. The Navy plans to announce the outcome of the FFG(X) competition—the winner of the DD&C contract—in July 2020.

A February 16, 2018, press report states the following:

The Navy would not confirm how many groups bid for the [FFG(X)] work. At least one U.S.-German team that was not selected for a [conceptual] design contract, Atlas USA and ThyssenKrupp Marine Systems, told USNI News they had submitted for the [DD&C] competition....

During last month's Surface Navy Association [annual symposium], several shipbuilders outlined their designs for the FFG(X) competition.

Austal USA

Shipyard: Austal USA in Mobile, Ala.

Parent Design: Independence-class [i.e., LCS-2 class] Littoral Combat Ship

One of the two Littoral Combat Ship builders, Austal USA has pitched an upgunned variant of the Independence-class LCS as both a foreign military sales offering and as the answer to the Navy's upgunned small surface combatant and then frigate programs. Based on the 3,000-ton aluminum trimaran design, the hull boasts a large flight deck and space for up to 16 Mk-41 Vertical Launching System (VLS) cells.

Fincantieri Marine Group

Shipyard: Fincantieri Marinette Marine in Marinette, Wisc.

Parent Design: Fincantieri Italian FREMM

As part of the stipulations of the FFG(X) programs, a contractor can offer just one design in the competition as a prime contractor but may also support a second bid as a subcontractor. Fincantieri elected to offer its 6,700-ton Italian Fregata europea multi-missione (FREMM) design for construction in its Wisconsin Marinette Marine shipyard, as well as partner with Lockheed Martin on its Freedom-class pitch as a subcontractor. The Italian FREMM design features a 16-cell VLS as well as space for deck-launched anti-ship missiles.

General Dynamics Bath Iron Works

Shipyard: Bath Iron Works in Bath, Maine

Parent Design: Navantia Álvaro de Bazán-class F100 Frigate

The 6,000-ton air defense guided-missile frigates fitted with the Aegis Combat System have been in service for the Spanish Armada since 2002 and are the basis of the Australian Hobart-class air defense destroyers and the Norwegian Fridtjof Nansen-class frigates. The Navantia partnership with Bath is built on a previous partnership from the turn of the century. The F100 frigates were a product of a teaming agreement between BIW, Lockheed Martin and Navantia predecessor Izar as part of the Advanced Frigate Consortium from 2000.

Huntington Ingalls Industries

Shipyard: Ingalls Shipbuilding in Pascagoula, Miss.

Parent Design: Unknown

Out of the competitors involved in the competition, HII was the only company that did not present a model or a rendering of its FFG(X) at the Surface Navy Association symposium in January. A spokeswoman for the company declined to elaborate on the offering when contacted by USNI News on Friday. In the past, HII has presented a naval version of its Legend-class National Security Cutter design as a model at trade shows labeled as a "Patrol Frigate."

Lockheed Martin

Shipyard: Fincantieri Marinette Marine in Marinette, Wisc.

Parent Design: Freedom-class [i.e., LCS-1 class] Littoral Combat Ship

Of the two LCS builders, Lockheed Martin is the first to have secured a foreign military sale with its design. The company's FFG(X) bid will have much in common with its offering for the Royal Saudi Navy's 4,000-ton multi-mission surface combatant. The new Saudi ships will be built around an eight-cell Mk-41 vertical launch system and a 4D air search radar. Lockheed has pitched several other variants of the hull that include more VLS cells.

"We are proud of our 15-year partnership with the U.S. Navy on the Freedom-variant Littoral Combat Ship and look forward to extending it to FFG(X)," said Joe DePietro, Lockheed Martin vice president of small combatants and ship systems in a Friday evening statement.

"Our frigate design offers an affordable, low-risk answer to meeting the Navy's goals of a larger and more capable fleet."20

Block Buy Contracting

As a means of reducing their procurement cost, the Navy envisages using one or more fixed-price block buy contracts to procure the ships.21

Program Funding

Table 1 shows funding for the FFG(X) program under the Navy's FY2020 budget submission.

|

Prior years |

FY18 |

FY19 |

FY20 |

FY21 |

FY22 |

FY23 |

FY24 |

|

|

Research and development |

84.6 |

137.7 |

132.8 |

59.0 |

85.3 |

75.4 |

70.7 |

72.1 |

|

Procurement |

0 |

0 |

0 |

1,281.2 |

2,057.0 |

1,750.4 |

1,792.1 |

1,827.9 |

|

(Procurement quantity) |

(1) |

(2) |

(2) |

(2) |

(2) |

Source: Navy FY2020 budget submission.

Notes: Research and development funding is located in PE (Program Element) 0603599N, Frigate Development, which is line 54 in the FY2020 Navy research and development account.

Issues for Congress

FY2020 Funding Request

One issue for Congress is whether to approve, reject, or modify the Navy's FY2020 funding request for the program. In assessing this question, Congress may consider, among other things, whether the work the Navy is proposing to do in the program in FY2020 is appropriate, and whether the Navy has accurately priced that work.

Cost, Capabilities, and Growth Margin

Another issue for Congress is whether the Navy has appropriately defined the cost, capabilities, and growth margin of the FFG(X).

Analytical Basis for Desired Ship Capabilities

One aspect of this issue is whether the Navy has an adequately rigorous analytical basis for its identification of the capability gaps or mission needs to be met by the FFG(X), and for its decision to meet those capability gaps or mission needs through the procurement of a FFG with the capabilities outlined earlier in this CRS report. The question of whether the Navy has an adequately rigorous analytical basis for these things was discussed in greater detail in earlier editions of this CRS report.22

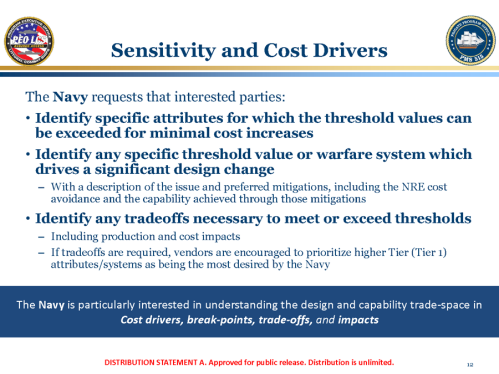

Balance Between Cost and Capabilities

Another potential aspect of this issue is whether the Navy has arrived at a realistic balance between its desired capabilities for the FFG(X) and the its estimated procurement cost for the ship. An imbalance between these two could lead to an increased risk of cost growth in the program. The Navy could argue that a key aim of the five FFG(X) conceptual design contracts and other preliminary Navy interactions with industry was to help the Navy arrive at a realistic balance by informing the Navy's understanding of potential capability-cost tradeoffs in the FFG(X) design.

Number of VLS Tubes

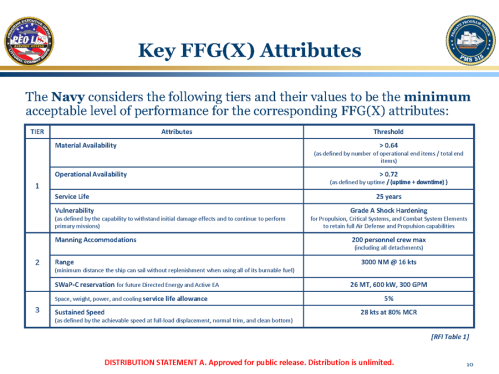

Another potential aspect of this issue concerns the planned number of Vertical Launch System (VLS) missile tubes on the FFG(X). The VLS is the FFG(X)'s principal (though not only) means of storing and launching missiles. As shown in Figure 2 (see the box in the upper-left corner labeled "AW," meaning air warfare), the FFG(X) is to be equipped with 32 Mark 41 VLS tubes. (The Mark 41 is the Navy's standard VLS design.)

Supporters of requiring the FFG(X) to be equipped with a larger number of VLS tubes, such as 48, might argue that the FFG(X) is to be roughly half as expensive to procure as the DDG-51 destroyer, and might therefore be more appropriately equipped with 48 VLS tubes, which is one-half the number on recent DDG-51s. They might also argue that in a context of renewed great power competition with potential adversaries such as China, which is steadily improving its naval capabilities,23 it might be prudent to equip the FFG(X)s with 48 rather than 32 VLS tubes, and that doing so might only marginally increase the unit procurement cost of the FFG(X).

Supporters of requiring the FFG(X) to have no more than 32 VLS tubes might argue that the analyses indicating a need for 32 already took improving adversary capabilities (as well as other U.S. Navy capabilities) into account. They might also argue that the FFG(X), in addition to having 32 VLS tubes, is also to have a separate, 21-cell Rolling Airframe Missile (RAM) missile launcher (see again the "AW" box in the upper-left corner of Figure 2), and that increasing the number of VLS tubes from 32 to 48 would increase the procurement cost of a ship that is intended to be an affordable supplement to the Navy's cruisers and destroyers.

Potential oversight questions for Congress might be: What would be the estimated increase in unit procurement cost of the FFG(X) of increasing the number of VLS tubes from 32 to 48? What would be the estimated increase in unit procurement cost of equipping the FFG(X) with 32 VLS tubes but designing the ship so that the number could easily be increased to 48 at some point later in the ship's life?

Growth Margin

Another potential aspect of this issue is whether, beyond the specific question of the number of VLS tubes, the Navy more generally has chosen the appropriate amount of growth margin to incorporate into the FFG(X) design. As shown in the Appendix, the Navy wants the FFG(X) design to have a growth margin (also called service life allowance) of 5%, meaning an ability to accommodate upgrades and other changes that might be made to the ship's design over the course of its service life that could require up to 5% more space, weight, electrical power, or equipment cooling capacity. As shown in the Appendix, the Navy also wants the FFG(X) design to have an additional growth margin (above the 5% factor) for accommodating a future directed energy system (i.e., a laser or high-power microwave device) or an active electronic attack system (i.e., electronic warfare system).

Supporters could argue that a 5% growth margin is traditional for a ship like a frigate, that the FFG(X)'s 5% growth margin is supplemented by the additional growth margin for a directed energy system or active electronic attack system, and that requiring a larger growth margin could make the FFG(X) design larger and more expensive to procure.

Skeptics might argue that a larger growth margin (such as 10%—a figure used in designing cruisers and destroyers) would provide more of a hedge against the possibility of greater-than-anticipated improvements in the capabilities of potential adversaries such as China, that a limited growth margin was a concern in the FFG-7 design,24 and that increasing the FFG(X) growth margin from 5% to 10% would have only a limited impact on the FFG(X)'s procurement cost.

A potential oversight question for Congress might be: What would be the estimated increase in unit procurement cost of the FFG(X) of increasing the ship's growth margin from 5% to 10%?

Parent-Design Approach

Another potential oversight issue for Congress concerns the parent-design approach for the program. One alternative would be to use a clean-sheet design approach, under which procurement of the FFG(X) would begin about FY2024 and procurement of LCSs might be extended through about 2023.

As mentioned earlier, using the parent-design approach can reduce design time, design cost, and technical, schedule, and cost risk in building the ship. A clean-sheet design approach, on the other hand, might result in a design that more closely matches the Navy's desired capabilities for the FFG(X), which might make the design more cost-effective for the Navy over the long run. It might also provide more work for the U.S. ship design and engineering industrial base.

Another possible alternative would be to consider frigate designs that have been developed, but for which there are not yet any completed ships. This approach might make possible consideration of designs, such as (to cite just one possible example) the UK's new Type 26 frigate design, production of which was in its early stages in 2018. Compared to a clean-sheet design approach, using a developed-but-not-yet-built design would offer a reduction in design time and cost, but might not offer as much reduction in technical, schedule, and cost risk in building the ship as would be offered by use of an already-built design.

Cost, Schedule, and Technical Risk

Another potential oversight issue for Congress concerns cost, schedule, and technical risk in the FFG(X) program. The Navy can argue that the program's cost, schedule, and technical risk has been reduced by use of the parent-design approach and the decision to use only systems and technologies that already exist or are already being developed for use in other programs, rather than new technologies that need to be developed.

Skeptics, while acknowledging that point, might argue that lead ships in Navy shipbuilding programs inherently pose cost, schedule, and technical risk, because they serve as the prototypes for their programs, and that, as detailed by CBO25 and GAO,26 lead ships in Navy shipbuilding programs in many cases have turned out to be more expensive to build than the Navy had estimated. An April 2018 report from the Government Accountability Office on the status of various Department of Defense (DOD) acquisition programs states the following about the FFG(X) program:

Current Status

In May 2017, the Navy shifted away from its plan for a new frigate derived from minor modifications to an LCS design and now plans to select a new frigate design and shipbuilder through a full and open competition that is not limited to LCS derivatives. The program intends to leverage the proposed capabilities of the original frigate program and expand upon them to create a more lethal and survivable ship.

In fiscal year 2018, the FFG(X) program plans to focus on system specifications development and approval, acquisition program documentation needs, test strategy development, and combat management system integration. The program released a request for conceptual design proposals in November 2017 and plans to award multiple contracts in 2018 in an effort to reduce risk by maturing industry designs to meet FFG(X) capability needs.

Consistent with statute and knowledge-based practices, the Navy has scheduled a preliminary design review prior to a development start decision in February 2020. To support the development start decision, the program expects to complete an independent cost estimate, affordability and should-cost analyses, and an independent technical risk assessment. Although the number of planned frigates remains uncertain due to previous Secretary of Defense direction to cap the combined total of LCS and frigates at 40 ships, the program plans to award what the Navy refers to as a "block buy" contract for FFG(X) detail design and construction in September 2020. This block buy contract, which the Navy plans to award to a single shipbuilder, is intended to achieve more favorable pricing, but as planned, would require the Navy to commit to more than 1 year's worth of procurement in a single contract. If the Navy requests congressional authorization during 2019 for the planned fiscal year 2020 block buy, the Navy will lack key knowledge, such as an independent cost estimate, to support its request.

Program Office Comments

We provided a draft of this assessment to the program office for review and comment. The program stated that conceptual design allows the Navy to mature multiple designs and better understand cost and capability drivers across design options before a detail design and construction award, as well as inform final specifications that will achieve a best value solution.27

Procurement of LCSs in FY2020 as Hedge against FFG(X) Delay

Another potential issue for Congress is whether any additional LCSs should be procured in FY2020 as a hedge against potential delays in the FFG(X) program. Supporters might argue that, as detailed by GAO,28 lead ships in Navy shipbuilding programs in many cases encounter schedule delays, some quite lengthy, and that procuring additional LCSs in FY2020 could hedge against that risk at reasonable cost by taking advantage of hot LCS production lines. Skeptics might argue that the Navy does not have a requirement for any additional LCSs, and that funding the procurement of additional LCSs in FY2020 could reduce FY2020 funding available for other Navy or DOD programs, with an uncertain impact on net Navy or DOD capabilities.

Potential Industrial-Base Impacts of FFG(X) Program

Another issue for Congress concerns the potential industrial-base impacts of the FFG(X) for shipyards and supplier firms.

Shipyards

One aspect of this issue concerns the potential impact on shipyards of the Navy's plan to shift procurement of small surface combatants from LCSs to FFG(X)s starting in FY2020, particularly in terms of future workloads and employment levels at the two LCS shipyards, if one or both of these yards are not involved in building FFG(X)s.

If a design proposed for construction at one of the LCS shipyards is chosen as the winner of the FFG(X) competition, then other things held equal (e.g., without the addition of new work other than building LCSs), workloads and employment levels at the other LCS shipyard (the one not chosen for the FFG(X) program), as well as supplier firms associated with that other LCS shipyard, would decline over time as the other LCS shipyard's backlog of prior-year-funded LCSs is completed and not replaced with new FFG(X) work. If no design proposed for construction at an LCS shipyard is chosen as the FFG(X)—that is, if the winner of the FFG(X) competition is a design to be built at a shipyard other than the two LCS shipyards—then other things held equal, employment levels at both LCS shipyards and their supplier firms would decline over time as their backlogs of prior-year-funded LCSs are completed and not replaced with FFG(X) work.29

As mentioned earlier, the Navy's current baseline plan for the FFG(X) program is to build FFG(X)s at a single shipyard. One possible alternative to this baseline plan would be to build FFG(X)s at two or three shipyards, including one or both of the LCS shipyards. This alternative is discussed further in the section below entitled "Number of FFG(X) Builders."

Another possible alternative would be would be to shift Navy shipbuilding work at one of the LCS yards (if the other wins the FFG(X) competition) or at both of the LCS yards (if neither wins the FFG(X) competition) to the production of sections of larger Navy ships (such as DDG-51 destroyers or amphibious ships) that undergo final assembly at other shipyards. Under this option, in other words, one or both of the LCS yards would function as shipyards participating in the production of larger Navy ships that undergo final assembly at other shipyards. This option might help maintain workloads and employment levels at one or both of the LCS yards, and might alleviate capacity constraints at other shipyards, permitting certain parts of the Navy's 355-ship force-level objective to be achieved sooner. The concept of shipyards producing sections of larger naval ships that undergo final assembly in other shipyards was examined at length in a 2011 RAND report.30

Supplier Firms

Another aspect of the industrial-base issue concerns the FFG(X) program's potential impact on supplier firms (i.e., firms that provide materials and components that are incorporated into ships). Some supporters of U.S. supplier firms argue that the FFG(X) program as currently structured does not include strong enough provisions for requiring certain FFG(X) components to be U.S.-made, particularly since two of the five industry teams reported to be competing for the FFG(X) program (see the earlier section entitled "Competing Industry Teams") are reportedly using European frigate designs as their proposed parent design. For example, the American Shipbuilding Suppliers Association (ASSA)—a trade association for U.S. ship supplier firms—states:

The US Navy has historically selected US manufactured components for its major surface combatants and designated them as class standard equipment to be procured either as government-furnished equipment (GFE) or contractor-furnished equipment (CFE). In a major departure from that policy, the Navy has imposed no such requirement for the FFG(X), the Navy's premier small surface combatant. The acquisition plan for FFG(X) requires proposed offerings to be based on an in-service parent craft design. Foreign designs and/or foreign-manufactured components are being considered, with foreign companies performing a key role in selecting these components. Without congressional direction, there is a high likelihood that critical HM&E components on the FFG(X) will not be manufactured within the US shipbuilding industrial supplier base.….

The Navy's requirements are very clear regarding the combat system, radar, C4I suite,31 EW [electronic warfare], weapons, and numerous other war-fighting elements. However, unlike all major surface combatants currently in the fleet (CGs [cruisers], DDGs [destroyers]), the [Navy's] draft RFP [Request for Proposals] for the FFG(X) does not identify specific major HM&E components such as propulsion systems, machinery controls, power generation and other systems that are critical to the ship's operations and mission execution. Instead, the draft RFP relegates these decisions to shipyard primes or their foreign-owned partners, and there is no requirement for sourcing these components within the US shipbuilding supplier industrial base.

The draft RFP also does not clearly identify life-cycle cost as a critical evaluation factor, separate from initial acquisition cost. This ignores the cost to the government of initial introduction [of the FFG(X)] into the [Navy's] logistics system, the training necessary for new systems, the location of repair services (e.g., does the equipment need to leave the US?), and the cost and availability of parts and services for the lifetime of the ship. Therefore, lowest acquisition cost is likely to drive the award—certainly for component suppliers.

Further, the US Navy's acquisition approach not only encourages, but advantages, the use of foreign designs, most of which have a component supplier base that is foreign. Many of these component suppliers (and in some cases the shipyards they work with) are wholly or partially owned by their respective governments and enjoy direct subsidies as well as other benefits from being state owned (e.g., requirements relaxation, tax incentives, etc.). This uneven playing field, and the high-volume commercial shipbuilding market enjoyed by the foreign suppliers, make it unlikely for an American manufacturer to compete on cost. As incumbent component manufacturers, these foreign companies have a substantial advantage over US component manufacturers seeking to provide equipment even if costs could be matched, given the level of non-recurring engineering (NRE) required to facilitate new equipment into a parent craft's design and the subsequent performance risk.

The potential outcome of such a scenario would have severe consequences across the US shipbuilding supplier base…. the loss of the FFG(X) opportunity to US suppliers would increase the cost on other Navy platforms [by reducing production economies of scale at U.S. suppliers that make components for other U.S. military ships]. Most importantly, maintaining a robust domestic [supplier] manufacturing capability allows for a surge capability by ensuring rapidly scalable capacity when called upon to support major military operations—a theme frequently emphasized by DOD and Navy leaders.

These capabilities are a critical national asset and once lost, it is unlikely or extremely costly to replicate them. This would be a difficult lesson that is not in the government's best interests to re-learn. One such lesson exists on the DDG-51 [destroyer production] restart,32 where the difficulty of reconstituting a closed production line of a critical component manufacturer—its main reduction gear—required the government to fund the manufacturer directly as GFE, since the US manufacturer for the reduction gear had ceased operations.33

Other observers, while perhaps acknowledging some of the points made above, might argue one or more of the following:

- foreign-made components have long been incorporated into U.S. Navy ships (and other U.S. military equipment);

- U.S-made components have long been incorporated into foreign warships34 (and other foreign military equipment); and

- requiring a foreign parent design for the FFG(X) to be modified to incorporate substitute U.S.-made components could increase the unit procurement cost of the FFG(X) or the FFG(X) program's acquisition risk (i.e., cost, schedule, and technical risk), or both.

Current U.S. law requires certain components of U.S. Navy ships to be made by a manufacturer in the national technology and industrial base. The primary statute in question—10 U.S.C. 2534—states in part:

§2534. Miscellaneous limitations on the procurement of goods other than United States goods

(a) Limitation on Certain Procurements.-The Secretary of Defense may procure any of the following items only if the manufacturer of the item satisfies the requirements of subsection (b):…

(3) Components for naval vessels.-(A) The following components:

(i) Air circuit breakers.

(ii) Welded shipboard anchor and mooring chain with a diameter of four inches or less.

(iii) Vessel propellers with a diameter of six feet or more.

(B) The following components of vessels, to the extent they are unique to marine applications: gyrocompasses, electronic navigation chart systems, steering controls, pumps, propulsion and machinery control systems, and totally enclosed lifeboats.

(b) Manufacturer in the National Technology and Industrial Base.-

(1) General requirement.-A manufacturer meets the requirements of this subsection if the manufacturer is part of the national technology and industrial base….

(3) Manufacturer of vessel propellers.-In the case of a procurement of vessel propellers referred to in subsection (a)(3)(A)(iii), the manufacturer of the propellers meets the requirements of this subsection only if-

(A) the manufacturer meets the requirements set forth in paragraph (1); and

(B) all castings incorporated into such propellers are poured and finished in the United States.

(c) Applicability to Certain Items.-

(1) Components for naval vessels.-Subsection (a) does not apply to a procurement of spare or repair parts needed to support components for naval vessels produced or manufactured outside the United States….

(4) Vessel propellers.-Subsection (a)(3)(A)(iii) and this paragraph shall cease to be effective on February 10, 1998….

(d) Waiver Authority.-The Secretary of Defense may waive the limitation in subsection (a) with respect to the procurement of an item listed in that subsection if the Secretary determines that any of the following apply:

(1) Application of the limitation would cause unreasonable costs or delays to be incurred.

(2) United States producers of the item would not be jeopardized by competition from a foreign country, and that country does not discriminate against defense items produced in the United States to a greater degree than the United States discriminates against defense items produced in that country.

(3) Application of the limitation would impede cooperative programs entered into between the Department of Defense and a foreign country, or would impede the reciprocal procurement of defense items under a memorandum of understanding providing for reciprocal procurement of defense items that is entered into under section 2531 of this title, and that country does not discriminate against defense items produced in the United States to a greater degree than the United States discriminates against defense items produced in that country.

(4) Satisfactory quality items manufactured by an entity that is part of the national technology and industrial base (as defined in section 2500(1) of this title) are not available.

(5) Application of the limitation would result in the existence of only one source for the item that is an entity that is part of the national technology and industrial base (as defined in section 2500(1) of this title).

(6) The procurement is for an amount less than the simplified acquisition threshold and simplified purchase procedures are being used.

(7) Application of the limitation is not in the national security interests of the United States.

(8) Application of the limitation would adversely affect a United States company….

(h) Implementation of Naval Vessel Component Limitation.-In implementing subsection (a)(3)(B), the Secretary of Defense-

(1) may not use contract clauses or certifications; and

(2) shall use management and oversight techniques that achieve the objective of the subsection without imposing a significant management burden on the Government or the contractor involved.

(i) Implementation of Certain Waiver Authority.-(1) The Secretary of Defense may exercise the waiver authority described in paragraph (2) only if the waiver is made for a particular item listed in subsection (a) and for a particular foreign country.

(2) This subsection applies to the waiver authority provided by subsection (d) on the basis of the applicability of paragraph (2) or (3) of that subsection.

(3) The waiver authority described in paragraph (2) may not be delegated below the Under Secretary of Defense for Acquisition, Technology, and Logistics.

(4) At least 15 days before the effective date of any waiver made under the waiver authority described in paragraph (2), the Secretary shall publish in the Federal Register and submit to the congressional defense committees a notice of the determination to exercise the waiver authority.

(5) Any waiver made by the Secretary under the waiver authority described in paragraph (2) shall be in effect for a period not greater than one year, as determined by the Secretary....

In addition to 10 U.S.C. 2534, the paragraph in the annual DOD appropriations act that makes appropriations for the Navy's shipbuilding account (i.e., the Shipbuilding and Conversion, Navy, or SCN, appropriation account) has in recent years included this proviso:

…Provided further, That none of the funds provided under this heading for the construction or conversion of any naval vessel to be constructed in shipyards in the United States shall be expended in foreign facilities for the construction of major components of such vessel….

10 U.S.C. 2534 explicitly applies to certain ship components, but not others. The meaning of "major components" in the above proviso from the annual DOD appropriations act might be subject to interpretation.

The issue of U.S.-made components for Navy ships is also, for somewhat different reasons, an issue for Congress in connection with the Navy's John Lewis (TAO-205) class oiler shipbuilding program.35

Number of FFG(X) Builders

Another issue for Congress whether to build FFG(X)s at a single shipyard, as the Navy's baseline plan calls for, or at two or three shipyards. As mentioned earlier, one possible alternative to the Navy's current baseline plan for building FFG(X)s at a single shipyard would be to build them at two or three yards, including potentially one or both of the LCS shipyards. The Navy's FFG-7 class frigates, which were procured at annual rates of as high as eight ships per year, were built at three shipyards.36 Supporters of building FFG(X)s at two or three yards might argue that it could

- boost FFG(X) production from the currently planned two ships per year to four or more ships per year, substantially accelerating the date for attaining the Navy's small surface combatant force-level goal;

- permit the Navy to use competition (either competition for quantity at the margin, or competition for profit [i.e., Profit Related to Offers, or PRO, bidding])37 to help restrain FFG(X) prices and ensure production quality and on-time deliveries; and

- perhaps complicate adversary defense planning by presenting potential adversaries with multiple FFG(X) designs, each with its own specific operating characteristics.

Opponents of this plan might argue that it could

- weaken the current FFG(X) competition by offering the winner a smaller prospective number of FFG(X)s and perhaps also essentially guaranteeing the LCSs yard that they will build some number of FFG(X)s;

- substantially increase annual FFG(X) procurement funding requirements so as to procure four or more FFG(X)s per year rather than two per year, which in a situation of finite DOD funding could require offsetting reductions in other Navy or DOD programs; and

- reduce production economies of scale in the FFG(X) program by dividing FFG(X) among two or three designs, and increase downstream Navy FFG(X) operation and support (O&S) costs by requiring the Navy to maintain two or three FFG(X) logistics support systems.

Potential Impact on Requirements for Cruisers and Destroyers

Another potential oversight issue for Congress is whether the FFG(X) program has any implications for required numbers or capabilities of U.S. Navy cruisers and destroyers. The Navy's goal to achieve and maintain a force of 104 cruisers and destroyers and 52 small surface combatants was determined in 2016, and may reflect an earlier plan to procure FFs, rather than the current plan to procure more-capable FFG(X)s. If so, a question might arise as to whether the current plan to procure FFG(X)s would permit a reduction in the required number of cruisers and destroyers, or in the required capabilities of those cruisers and destroyers.

As mentioned earlier, Navy officials have stated that the new Force Structure Assessment (FSA) being conducted by the Navy may shift the Navy to a new fleet architecture that will include, among other thing, a larger proportion of small surface combatants—and, by implication, a smaller proportion of large surface combatants (i.e., cruisers and destroyers). A September 7, 2018, press report stated the following:

Ahead of the Navy's next force-structure assessment [FSA], the service aims to "pull together something" quicker to help inform the fiscal year 2020 budget request, according to the Navy's top requirements officer….

[Vice Adm. William Merz, deputy chief of naval operations for warfare systems,] said Sept. 5 he'll be paying attention to the mix of large and small surface combatants.

"A lot of that will depend on our perception of what is this next frigate really going to look like," he said, referring to the future frigate, FFG(X). "How much capability and modernization are we actually going to be able to do to that ship? That could influence how much of another kind of ship we need."38

A January 15, 2019, press report states:

The Navy plans to spend this year taking the first few steps into a markedly different future, which, if it comes to pass, will upend how the fleet has fought since the Cold War. And it all starts with something that might seem counterintuitive: It's looking to get smaller.

"Today, I have a requirement for 104 large surface combatants in the force structure assessment; [and] I have [a requirement for] 52 small surface combatants," said Surface Warfare Director Rear Adm. Ronald Boxall. "That's a little upside down. Should I push out here and have more small platforms? I think the future fleet architecture study has intimated 'yes,' and our war gaming shows there is value in that."39

An April 8, 2019, press report states that Navy discussions about the future surface fleet include

the upcoming construction and fielding of the [FFG(X)] frigate, which [Vice Admiral Bill Merz, the deputy chief of naval operations for warfare systems] said is surpassing expectations already in terms of the lethality that industry can put into a small combatant.

"The FSA may actually help us on, how many (destroyers) do we really need to modernize, because I think the FSA is going to give a lot of credit to the frigate—if I had a crystal ball and had to predict what the FSA was going to do, it's going to probably recommend more small surface combatants, meaning the frigate … and then how much fewer large surface combatants can we mix?" Merz said.

An issue the Navy has to work through is balancing a need to have enough ships and be capable enough today, while also making decisions that will help the Navy get out of the top-heavy surface fleet and into a better balance as soon as is feasible.

"You may see the evolution over time where frigates start replacing destroyers, the Large Surface Combatant [a future cruiser/destroyer-type ship] starts replacing destroyers, and in the end, as the destroyers blend away you're going to get this healthier mix of small and large surface combatants," he said—though the new FSA may shed more light on what that balance will look like and when it could be achieved.40

Legislative Activity for FY2020

Summary of Congressional Action on FY2020 Funding Request

Table 2 summarizes congressional action on the Navy's FY2020 funding request for the LCS program.

Table 2. Congressional Action on FY2020 FFG(X) Program Funding Request

Millions of dollars, rounded to nearest tenth.

|

Authorization |

Appropriation |

||||||

|

Request |

HASC |

SASC |

Conf. |

HAC |

SAC |

Conf. |

|

|

Research and development |

59.0 |

||||||

|

Procurement |

1,281.2 |

||||||

|

(Procurement quantity) |

(1) |

||||||

Source: Table prepared by CRS based on FY2020 Navy budget submission, committee and conference reports, and explanatory statements on the FY2020 National Defense Authorization Act and the FY2020 DOD Appropriations Act.

Notes: HASC is House Armed Services Committee; SASC is Senate Armed Services Committee; HAC is House Appropriations Committee; SAC is Senate Appropriations Committee; Conf. is conference agreement. Research and development funding is located in PE (Program Element) 0603599N, Frigate Development, which is line 54 in the FY2020 Navy research and development account.

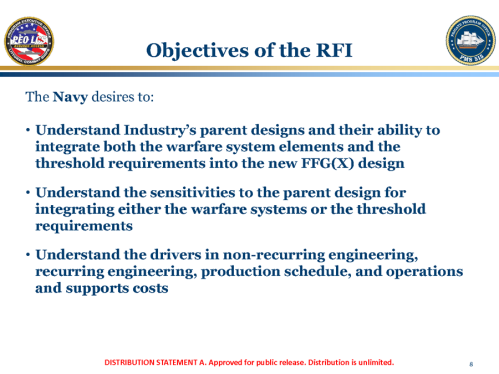

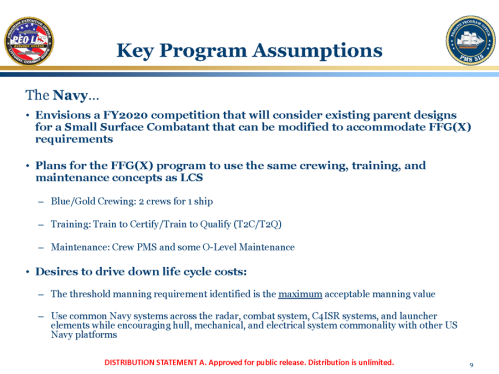

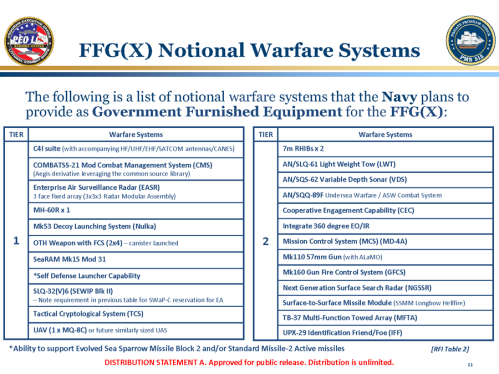

Appendix. Navy Briefing Slides from July 25, 2017, FFG(X) Industry Day Event

This appendix reprints some of the briefing slides that the Navy presented at its July 25, 2017, industry day event on the FFG(X) program, which was held in association with the Request for Information (RFI) that the Navy issued on July 25, 2017, to solicit information for better understanding potential trade-offs between cost and capability in the FFG(X) design. The reprinted slides begin on the next page.

|

Slides from Navy FFG(X) Industry Day Briefing

Source: Slides from briefing posted on July 28, 2017, at RFI: FFG(X) - US Navy Guided Missile Frigate Replacement Program, https://www.fbo.gov/index?s=opportunity&mode=form&tab=core&id=d089cf61f254538605cdec5438955b8e&_cview=0, accessed August 11, 2017. |