Introduction

The federal government subsidizes a wide range of activities through the tax code. The majority of available tax incentives are claimed directly by the party engaged in the activity targeted by the subsidy. There are several tax credits, however, that often require or encourage the intended beneficiary of the subsidy to partner with a third party to use the tax incentive. This may happen because the tax credits are nonrefundable and the intended beneficiary of the tax credit has little or no tax liability (e.g., a nonprofit), or because the credits are delivered over multiple years whereas upfront funding is needed to break ground. This situation often results in a tax equity transaction—the intended beneficiary of the tax credit agrees to transfer the rights to claim the credits to a third party in exchange for an equity financing contribution. One estimate placed the size of the tax equity market in 2017 at $20 billion.1

This report provides an introduction to the general tax equity financing mechanism. To facilitate the presentation of the tax equity approach to subsidization, three categories of tax credits that either currently use or have recently used this mechanism are examined: the low-income housing tax credit (LIHTC); the new markets tax credit (NMTC); and two energy-related tax credits—the renewable electricity production tax credit (PTC) and energy investment tax credit (ITC).2 This report does not evaluate the economic rationale for subsidizing the activities targeted by these tax credits, and does not analyze whether these subsidies increase net investment in these activities. Instead, this report focuses on explaining the structure and functioning of tax equity arrangements.

Tax Equity Investments

Tax equity investment is not a statutorily defined term, but rather identifies transactions that pair the tax credits or other tax benefits generated by a qualifying physical investment with the capital financing associated with that investment.3 These transactions involve one party agreeing to assign the rights to claim the tax credits to another party in exchange for an equity investment (i.e., cash financing). The exchange is sometimes referred to as "monetizing," "selling," or "trading" the tax credits.4 Importantly, however, the "sale" of federal tax credits occurs within a partnership or contractual agreement that legally binds the two parties to satisfy federal tax requirements that the tax credit claimant have an ownership interest in the underlying physical investment. This makes the trading of tax credits different than the trading of corporate stock, which occurs between two unrelated parties on an exchange.5 The partnership form also allows for income (or losses), deductions, and other tax items to be allocated directly to the individual partners. In some cases, nonprofit entities can form a partnership with taxable investors and benefit from tax credits through this relationship.

Overview of Structure and Mechanics

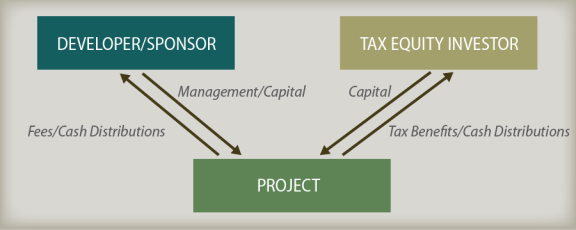

While the specifics of a tax equity arrangement vary depending on the project and tax credit program involved, these deals often share some general common structural features.6 Figure 1 provides a graphical summary of the structure and mechanics of one kind of project that relies on tax equity investment.

|

|

Source: CRS illustration. |

The process begins with a developer, also sometimes referred to as a "sponsor," identifying a potential project eligible for federal tax credits. For projects where an application is required, the developer will apply to the entity in charge of awarding the credits.7 At the same time, the developer will seek out potential investors willing to contribute equity capital in exchange for the tax credits expected to be awarded. A developer can partner directly with an investor, or, as is also common, partner with a tax credit "syndicator" that manages a tax credit fund for multiple investors that may not have the expertise to partner directly with a developer, or that may want to diversify their tax equity investment portfolio. The syndicator will earn a syndication fee for identifying, evaluating, and managing tax equity investments for the fund. Regardless of whether the partnership with investors is direct or via a syndicator, the tax equity investors are typically large corporations with predictable tax liabilities.8

The developer and investors will negotiate how much equity capital will be contributed in exchange for the right to claim the tax credits and other tax benefits.9 As previously mentioned, this is commonly referred to as the "selling," "trading," or "monetizing" of tax credits. The tax equity investors will serve as the "limited" partners in the partnership, meaning they generally have a passive role and do not participate in management decisions.10 The developer will serve as the "general" partner overseeing day-to-day operations in exchange for a fee and possibly any cash distributions the project may generate. The developer may also contribute their own capital to or arrange or coordinate other sources of capital for the project, depending on the particular tax credit program being used. While tax equity investors are not generally required to have an active management role, they have an incentive to monitor the project to ensure it complies with the program's rules, since compliance violations can result in forfeiture of tax credits.

The Tax Equity Investor's Return

A tax equity investor's return depends on the price paid per credit and associated benefits the investor secures in exchange. In the simplest case, the only benefit the investor receives from the credits is the ability to reduce their tax liability. For example, consider a project that will cost $1.5 million to complete and that will generate $1 million in federal tax credits that its owner is seeking to sell to finance the upfront cost of the project. An outside investor has agreed to contribute 90 cents in equity financing in exchange for each $1.00 of tax credit. Thus, the investor pays (contributes in capital) $900,000 in exchange for $1 million in tax credits. The net return to the investor is $100,000 (in reduced taxes), or 11.1% ($100,000 divided by $900,000).11

The project developer will need to make up the difference between the project's cost ($1.5 million) and tax equity investor's capital contribution ($900,000). This difference is often referred to as the "equity gap." Possible options for filling the equity gap include traditional loans or equity financing from other sources. The gap could also be filled with additional federal, state, or local subsidies. These might be grants, below-market-rate loans, or other tax incentives.

Depending on the structure of the arrangement, the tax equity investor may also secure other benefits, such as additional state and federal tax incentives, a claim to operating income and losses, a share of any capital gains when the underlying investment is sold, or goodwill with the community or regulators. With regard to regulatory-driven motives, investments in LIHTC and NMTC projects, for example, can assist financial institutions in satisfying requirements under the Community Reinvestment Act (CRA; P.L. 95-128), which is intended to encourage banks to make credit more readily available in low- and moderate-income communities. Tax equity investors in renewable energy projects generally have returns that consist of both tax attributes and operating cash flow to conform to guidance provided by the Internal Revenue Service (IRS).12

The price investors are willing to pay for tax credits not only depends on the benefits attached to the credits, but on factors associated with the underlying project. These factors can include the risk associated with the project, how it is financed, and the time period over which benefits accrue.13

Due to the complexity of tax equity transactions and the size of investors' tax liabilities they desire to offset, the current federal tax equity mechanism may not, in some cases, be well suited for assisting small individual projects. When possible, tax equity investors typically seek large projects expected to generate a fairly significant amount of credits.14

Since tax equity investors require a financial return in exchange for providing financial capital, a portion of the subsidy is diverted away from the targeted activity. Returning to the previous example, if a tax equity investor agrees to contribute 90 cents in equity financing per $1.00 of federal tax credit, it means that for every $1.00 in government subsidy (i.e., tax credit), 10 cents is diverted away from subsidizing the underlying activity and to the investor and middlemen. Put differently, every 90 cents in federal subsidy that reaches the targeted industry actually costs the government $1.00 in lost tax revenue. This aspect of the tax equity mechanism is discussed in more detail in the "Policy Options and Considerations" section.

Subsidy Fluctuations

The use of the tax equity mechanism can create fluctuations in the amount of subsidy qualified activities receive. The subsidy flowing into a project depends on the price tax equity investors receive in exchange for their financing contributions. All else equal, higher tax credit prices imply more federal subsidization of the targeted activity per dollar loss of federal tax revenue. Therefore, factors that cause variability in tax credit prices also cause variability in the subsidization rate. This can lead to fluctuation in the subsidy delivered via the tax equity mechanism, even though there has been no direct policy change regarding the tax credit program itself. For example, during the Great Recession, falling corporate tax liabilities reduced investor demand for credits, leading to depressed credit prices. In turn, qualified investments had difficulty raising enough equity to finance projects. To bypass the tax equity mechanism, some credits were temporarily converted into direct grants.15

Policies enacted by Congress, but not directly related to the underlying tax credit program itself, can also lead to subsidy fluctuations. This occurred most recently with the 2017 tax revision (P.L. 115-97). Although some direct changes were made to several incentives that use the tax equity mechanism, there have also been concerns that the reduction in corporate tax rates and overall corporate tax liabilities could curb investor appetite for credits, and reduce the amount of tax equity investment being offered in the market. With less tax equity being supplied in the market, tax equity investors might demand higher rates of return, which could increase the cost of financing from the perspective of investors in targeted activities.16 Additionally, the subsidies delivered by LIHTC and NMTC can also vary geographically due to the CRA.

Policies can also affect the demand for tax equity. For example, with renewable energy tax incentives phasing down, renewable energy investors may have fewer tax credits they are seeking to monetize. Less demand for tax equity could tend to reduce tax equity financing costs from the perspective of investors in targeted activities, reducing the overall rate of return for tax equity investors.

Select Case Studies

While several current federal tax credits use the tax equity financing mechanism, no two credits do so in the same manner. For example, affordable housing developers are awarded LIHTCs by officials in each state who review applications, decisions regarding NMTC applications are made by federal officials, and renewable energy tax credits have no similar application and review process. The rate of subsidization and time frame over which the various tax credits may be claimed are also different, as are many of the intricacies of the rules and requirements of each. This section reviews three large tax credits that employ the tax equity financing mechanism to illustrate the various ways the approach is used in practice.

Low-Income Housing Tax Credit

The LIHTC program was created by the Tax Reform Act of 1986 (P.L. 99-514) to replace various affordable housing tax incentives that were viewed as inefficient and uncoordinated at the time.17 The tax credits are given to developers over a 10-year period in exchange for constructing affordable rental housing. Originally scheduled to expire in 1989, the program was extended several times before being made permanent in the Omnibus Budget Reconciliation Act of 1993 (P.L. 103-66). According to the Joint Committee on Taxation's (JCT's) most recent tax expenditure estimates, the LIHTC is estimated to cost the government an average of approximately $9.9 billion annually in reduced federal tax revenues.18

The mechanics of the program are complex. The process begins at the federal level, with each state receiving an annual LIHTC allocation based on population. In 2019, states received an LIHTC allocation of $2.75625 per person, with a minimum small-population state allocation of $3,166,875.19 These amounts reflect a temporary increase in the amount of credits each state received as a result of the 2018 Consolidated Appropriations Act (P.L. 115-141). The increase is equal to 12.5% above what states would have received absent P.L. 115-141, and is in effect through 2021.

State or local housing finance agencies (HFAs) then award credits to developers using a competitive application process to determine which developers receive a credit award. HFAs review developer applications to ensure that proposed projects satisfy certain federally required criteria, as well as criteria established by each state. For example, some states may choose to give priority to buildings that offer specific amenities such as computer centers or that are located close to public transportation, while others may give priority to projects serving a particular demographic, such as the elderly. Delegating authority to HFAs to award credits gives each state the flexibility to address its individual housing needs, which is important given the local nature of housing markets.

Upon receipt of an LIHTC award, developers typically "sell" the tax credits to investors in exchange for an equity investment. This transaction occurs within a partnership structure and in a manner similar to the generalized example discussed in the previous section. While LIHTC prices fluctuate over time and geographic regions, they typically range from the mid-$0.80s to mid-$0.90s per $1.00 of tax credit. In addition to the tax credits, the equity investor may also receive tax benefits related to any tax losses and other deductions, as well as residual cash flow.

New Markets Tax Credit

The NMTC program was created by the Community Renewal Tax Relief Act of 2000 (P.L. 106-554) to provide an incentive to stimulate investment in low-income communities (LICs).20 The original allocation authority eligible for the NMTC program was $15 billion from 2001 to 2007.21 Congress subsequently increased the total allocation authority to $61 billion and extended the program through 2019.22 The tax credits are awarded to community development entities (CDEs) to make eligible low-income community investments.23 According to JCT's most recent tax expenditure estimates, the NMTC is estimated to cost the government an average of approximately $1.2 billion annually in reduced federal tax revenues.24

The process by which the NMTC affects eligible low-income communities involves multiple agents and steps. The multiple steps and agents are designed to ensure that the tax credit achieves its primary goal: encouraging investment in low-income communities. For example, the Department of the Treasury's Community Development Financial Institutions Fund (CDFI) reviews NMTC applicants submitted by CDEs, issues tax credit authority to those CDEs deemed most qualified, and plays a significant role in program compliance.

To receive an allocation, a CDE must submit an application to the CDFI, which asks a series of standardized questions about the CDE's track record, the amount of NMTC allocation authority being requested, and the CDE's plans for any allocation authority granted.25 The application is reviewed and scored to identify those applicants most likely to have the greatest community development impact and ranked in descending order of aggregate score.26 Tax credit allocations are then awarded based upon the aggregate ranking until all of the allocation authority is exhausted.27

Upon receipt of an NMTC award, developers often "sell" the tax credits to investors in exchange for an equity investment. This transaction typically occurs through a limited liability corporation obtaining a loan from a bank and combining the loan proceeds with the tax credit proceeds to invest in the low-income community. While NMTC prices fluctuate over time, geographic regions, and the business cycle, they typically range from the mid-$0.70s to mid-$0.80s per $1.00 of tax credit.28 Unlike the LIHTC investor, the NMTC equity investor does not generally receive tax benefits related to any tax losses and other deductions.

Energy Tax Credits

Investment tax credits for renewable energy date back to the late 1970s.29 The production tax credit (PTC) for renewable energy was enacted in the Energy Policy Act of 1992 (P.L. 102-486).30 In recent years, the cost of both of these incentives has increased, as investment in renewable energy technologies has accelerated. For FY2018, the JCT estimates tax expenditures for the renewable energy investment tax credit (ITC) will be $2.8 billion.31 Tax expenditures estimates for the PTC are $5.1 billion for FY2018. Most of the forgone revenue associated with the ITC is attributable to solar ($2.5 billion of the $2.8 billion for all eligible technologies).32 In the case of the PTC, most of the forgone revenue is associated with tax credits claimed for using wind to produce electricity ($4.7 billion of the $5.1 billion for all eligible technologies).33

The energy credit for solar is 30% of the amount invested in solar projects that start construction before the end of calendar year 2019. In 2020, the credit rate is reduced to 26% for property beginning construction in 2020, before being reduced again to 22% in 2021. For property that begins construction after 2021, the credit is 10%.34 As an investment credit, the ITC is generally claimed in the year the property is placed in service.35 The energy credit may be recaptured, meaning a taxpayer must add all or part of the tax credit to their tax liability, if a taxpayer disposes of the energy property or ceases to use the property for the purpose for which a tax credit was claimed. The recapture period is five years.36

The PTC is a per-kilowatt-hour (kWh) tax credit that can be claimed for the first 10 years of qualified renewable energy production. In 2018, the tax credit for wind was 2.4 cents per kWh. The amount of the credit is adjusted annually for inflation. Since 2009, taxpayers have had the option of electing to receive an ITC in lieu of the PTC.37 Wind or solar projects that began construction in 2009, 2010, or 2011 had an option to elect to receive a one-time grant in lieu of tax credits.38 Using tax equity financing arrangements has allowed developers to monetize the tax benefits, essentially trading future tax benefits for upfront capital.

The ITC and PTC were not designed as tax equity incentives. Rather, they were intended to subsidize investment in and production of renewable energy. Unlike the LIHTC and the NMTC, the energy tax credits were not intended to rely on taxpayer investors to deliver the subsidy.39 In the case of the PTC, when enacted, it was anticipated that tax credits would be claimed for electricity produced at facilities owned by the taxpayer and later sold by the taxpayer.40 Over time, however, partnerships began to form to efficiently use tax benefits.

Recognizing that tax equity transactions were being undertaken with respect to wind development, in 2007 the IRS released Revenue Procedure 2007-65, which established a safe harbor under which the allocation of tax credits in a tax equity partnership structure would not be challenged as long as certain ownership requirements were met.41 While separate guidance has not been issued for solar projects claiming the ITC, industry practice has generally been to follow the safe harbor guidance provided to wind projects claiming the PTC.42

Partnership flips are a common tax equity financing structure in renewable energy markets.43 Under a partnership flip structure, a renewable energy developer partners with a third-party tax equity investor.44 The tax equity investor has (or expects to have) sufficient tax liability to use the tax credits associated with the renewable energy investment or production. The tax equity investor and renewable energy developer establish a partnership, which is the project company. The tax equity investor may provide upfront cash to the project company, in exchange for production or investment tax credits, depreciation, interest deductions, and operating income.45

During the initial phase of the project, the tax equity investor will receive most of the tax benefits, as well as the income or loss (often the share is 99%). The developer retains a small allocation of tax benefits and income (profit or loss). Once the tax equity investor has achieved a targeted internal rate of return (IRR), the partners' interests in the project company will flip, with the developer now receiving most of the tax benefits and income (profit or loss) associated with the project (typically 95%, leaving the tax equity investor with 5%). The developer may also buy out the tax equity investor, such that the tax equity investor no longer owns any part of the project.

Tax equity generally provides a portion of a project's capital needs—somewhere from 30% to 60%, depending on the specifics of the project.46 For renewable energy projects, tax equity is generally more expensive than other sources of debt financing. For example, tax equity investors require rates of return that are 7% to 10% higher than the return on a comparable debt product.47 Tax equity yields (or the after-tax return required by tax equity investors) can vary widely across energy projects, but often fall in the 6% to 8% range, depending on the technology and specifics of the project.48

Policy Options and Considerations

There are a range of policy options to consider when it comes to using tax equity markets to monetize tax benefits. For existing programs and new tax policies that could involve tax equity transactions, consideration of various options might ask whether the use of tax equity markets is an efficient and effective means of delivering federal financial support. At first glance, it may appear that the government would get more "bang for its buck" by structuring the subsidy delivery mechanism to eliminate investors. However, such a conclusion overlooks one role that tax equity investors often play in addition to providing financing: tax equity investors evaluate the quality of projects before investing, as well as provide continuing oversight and compliance monitoring. Effectively, the tax equity mechanism outsources a portion of the oversight and compliance monitoring to the investors in exchange for a financial return. There may be value to the federal government in being able to rely on outside investors to provide oversight and monitoring. It could be argued, though, that for some tax equity programs that have a government entity overseeing participant compliance, the monitor role of investors is redundant.

This section presents several policy options frequently discussed in debates regarding tax equity. The options are with respect to the general tax equity approach. Due to important differences in the underlying structure of various current or future credits, some options may be better suited for particular credits than others. Careful consideration on a case-by-case basis is part of evaluating the appropriateness of each option. The list of options presented here is by no means exhaustive.

Make the Credits Refundable

Making the tax credits refundable could, in some cases, reduce or eliminate the need for tax equity. In other cases, making the tax credits refundable could reduce the cost of such financing for those who still need to access tax equity markets.

All the tax credits currently using the tax equity approach are nonrefundable. Nonrefundable credits have value only to the extent that there is a tax liability to offset. In contrast, refundable credits have value regardless of tax liability.49 For example, if a developer has $1,000 in refundable tax credits and no tax liability, they may claim the credits and receive a tax refund of $1,000.50 Thus, fully refundable credits are similar to direct grants administered through the tax system.

Even if the relevant tax credits were made refundable, there could still be a role for tax equity investment. Current tax credits relying on tax equity are delivered over multiple years or when the investment in qualifying property is complete and tax returns are filed. Project developers, however, typically need upfront capital to make their investments. Thus, developers (for-profit and nonprofit) may still choose to rely on tax equity markets to monetize tax credits even if they were refundable. Alternatively, allowing tax credits to be refundable could make it easier for projects to rely on debt financing. Lenders may be more willing to lend on favorable terms to a project that expects a refundable tax benefit in the future.

Moving to refundable credits could potentially increase the amount of subsidy per dollar of federal revenue loss. That is, it could increase the efficiency of the subsidy delivery mechanism and result in more of the targeted activity taking place. As discussed previously, all else equal, higher tax credit prices imply there is more federal subsidization per dollar loss of federal tax revenue. With refundable tax credits, current tax equity investors would be expected to pay more for each tax credit because the risk of not having sufficient tax liability to use the credits would be removed. Additionally, potential investors who are currently not purchasing tax credits because of uncertainty over their ability to use nonrefundable tax credits may enter the market now that the uncertainty is gone. This would add to the competition among investors and would likely put upward pressure on tax credit prices, further enhancing the subsidy mechanism.

Transitioning to refundable business tax credits raises two potential concerns. The first is the federal cost. Refundable tax credits typically result in a large revenue loss because they may be fully utilized regardless of tax liability, whereas nonrefundable credits may be claimed only to the extent there is a tax liability, which can result in a portion of nonrefundable credits ultimately going unused. This concern is likely less of an issue with LIHTC and NMTC, since few of these tax credits currently go unclaimed.51 This implies that converting these to refundable credits would likely not result in a significant increase in federal revenue loss.

Making the energy credits (PTC and ITC) refundable could result in considerable federal revenue loss. ITCs and PTCs that are currently carried forward and ultimately go unused under current law could instead be claimed immediately by taxpayers. For energy tax credits, many are claimed without the involvement of tax equity investors. Tax equity investors typically require projects to be of a certain size (i.e., generate a certain amount of tax benefits) to invest. As a result, there are many PTC- and ITC-eligible projects that are not able to monetize tax benefits using tax equity investors. Making energy tax credits refundable could (1) make the tax credits more attractive to developers that are not currently participating in tax equity markets; and (2) reduce the cost of tax equity for developers that are participating. Without a cap on the amount of ITCs or PTCs that can be claimed, if policy changes were made that increased demand for credits, the cost associated with delivering those credits would increase. One option to address concerns about the potential cost associated with an unlimited tax credit would be to limit the amount of tax credits that could be claimed.52

There is some experience with refundable energy tax credits. The energy tax credits enacted for wind and solar in the late 1970s were refundable, although legislation was enacted to make the credits nonrefundable in 1980.53 Also, several states offer tax credits designed to promote renewable energy that are refundable.54

The second concern is allowing businesses to claim a refundable tax credit generally. Refundable tax credits are a useful tool for providing income support via the tax code. For this reason, refundable tax credits have generally been reserved for households, and mostly for lower-income households. Some may take issue with allowing businesses to access an income-support tax incentive. Others assert that allowing the credits to be refundable would likely result in each dollar of federal tax revenue loss yielding more subsidy flowing into the intended activity.

Convert to Grants

The tax credits could be replaced with grants. A concern with the current tax equity mechanism is the amount of subsidy that is diverted away from the underlying activity and toward third-party investors and middlemen. Even if the tax credits were fully refundable, as discussed above, tax equity might still be used to monetize tax credits to get upfront financing. Nonprofit entities that do not file federal income tax returns would also not generally benefit directly from an incentive delivered through the tax code. Another concern with the current tax equity structure that has already been mentioned is that it can potentially create a bias toward larger-scale projects because of tax credit investors' appetite for credits combined with the cost savings from evaluating and monitoring fewer projects.55

One way to potentially overcome or mitigate these concerns would be to provide lump-sum grants. The effective subsidy would correspond to the federal revenue loss, and there would no longer be a bias toward larger projects resulting from the way the subsidy was delivered.56 The tradeoff, however, is that there would be no outside investors scrutinizing the long-term feasibility of potential projects or monitoring compliance after construction—though a mechanism such as that used to award NMTCs may help address this concern. Thus, there could be an increase in project failure and noncompliance, without the federal government (and in some cases, state governments) filling the role of tax credit investors. Carefully designed recapture provisions would also be needed in the case of project failure. In the end, replacing tax credits with grants would likely increase government administrative costs that could offset the increased subsidy flowing to the projects from the removal of tax credit investors.

An option for maintaining the role of investors would be to deliver a portion of the tax credits as upfront grants, and deliver the remaining tax credits over time. To maintain a feasible tax credit market and investor participation, the proportion of grant funding would have to be such that enough developers sold their remaining tax credits. It is not clear exactly what proportion would achieve the appropriate balance, although there are several options. The federal government could statutorily determine a particular split, such as 50% grants and 50% tax credits. For programs primarily administered by states, such as the LIHTC, the decision could be left to the states. Alternatively, developers could request that a specific amount of their funding be in the form of grants up to a certain percentage. In any case, if enough developers chose not to sell their credits, then the tax credit market would not function well, and project feasibility assessment and compliance monitoring responsibilities would fall on the government.

There is recent precedent for allowing grants in lieu of tax credits. During the Great Recession, falling corporate tax liabilities reduced investor demand for credits, leading to depressed credit prices.57 In response to the general macroeconomic conditions at the time, Congress passed the American Recovery and Reinvestment Act (ARRA; P.L. 111-5) in early 2009. The act allowed a portion of LIHTCs to be converted into grants. Renewable energy tax credits also had the option of receiving a grant in exchange for forgoing future tax benefits.

In the case of the LIHTC, the grants were awarded via the competitive process used for awarding the credits. The need to intervene in tax credit markets highlights that the tax equity mechanism can create fluctuations in the subsidy qualified activities receive, as was discussed in the "Subsidy Fluctuations" section.

In addition, ARRA allowed taxpayers who otherwise would have been eligible for the PTC or ITC to elect to receive a one-time grant from the Treasury in lieu of these tax benefits.58 Initially, the grant option was to be available for 2009 and 2010, although the policy was later extended such that projects that began construction before the end of 2011 could qualify. Since the grant was designed to be in lieu of existing tax benefits, tax benefits that could be claimed only by tax-paying entities, tax-exempt entities were not eligible.

Allow the Direct Transfer of Credits

The tax code could be modified to allow the direct transfer of tax credits without having to form a legal partnership. Currently, federal tax law requires tax equity investors to have an ownership interest in the underlying business venture in order to claim the associated tax credits. To meet this requirement, monetization of federal tax credits typically takes place within a partnership structure that legally binds the project's sponsor and investors for a period of time. In contrast, certain states permit state tax credits to be sold directly to investors without the need to establish a legal relationship.

Removing the need to form a partnership to invest in tax equity projects could broaden the pool of potential investors. In turn, this could enhance competition for tax credits, resulting in more equity finance being raised per dollar of forgone federal tax revenue. It is unclear, however, what impact the direct transfer of credits would have on deals involving other tax benefits that are often bundled with the tax credits. For example, the section titled "The Tax Equity Investor's Return" notes that investors may also secure a claim to other state and federal tax incentives, operating income and losses, capital gains when the underlying investment is sold, or goodwill with the community or regulators.

A number of issues would need to be addressed before allowing tax credits to be directly transferred. For example, allowing credits to be sold to anonymous investors with no formal ties to the underlying project potentially removes the tax equity investors' oversight incentives, which are a crucial feature of the current approach. Additionally, procedures would need to be implemented to track who has the right to claim the credits and prevent credits from being claimed (or from being recaptured) in instances of noncompliance or project failure. A decision would also need to be made about whether credits could be transferred only once, or if purchasers could resell credits. This would determine the resources needed to accurately track eligible credit claimants. Policymakers would also face the issue of who could participate in this market. Unsophisticated investors may not fully understand the risks or how to properly scrutinize these investments.59

Some of these issues may be resolved by the market itself if direct transfers were permitted. For example, at the state level, tax credit brokers have emerged to facilitate the exchange of transferable credits.60 There are also a number of online tax credit exchanges where state tax credits are traded. Brokers or exchanges can provide some level of expertise and guidance on the risks of these transactions. Their services also come at a cost that reduces the subsidy directed to the targeted activity. Imposing reporting requirements on brokers or exchanges may help with the administration of a direct transfer regime.

Another option would be to allow more flexibility in transferring tax credits among various project participants. For example, tax-exempt entities engaged in a subsidized activity could be allowed to transfer their tax credit to someone else involved in the project (a designer or builder, or the provider of financing, for example) without entering into a formal partnership.61 As was the case with general transferability of credits, even allowing more restricted transfer of credits could impose additional administrative and oversight burdens on both taxpayers and the government.

Accelerate the Credits

Accelerating the credits could potentially reduce the cost of tax equity. This option, however, would not eliminate the need to rely on tax equity markets altogether. Further, this option is most directly applicable to tax credits or other tax benefits that accrue and reduce tax liability over a multiyear period, as opposed to the current tax year.

A straightforward way to accelerate the credits would be to shorten the time period over which they are claimed. Alternatively, acceleration could also be achieved by leaving the claim periods unaltered, and frontloading the credits so that a greater proportion could be claimed in the earlier years. Either of these changes would likely increase the amount of equity a developer could raise from a given tax credit award because tax equity investors would be willing to pay a higher price per dollar of tax credit. This, in turn, would result in more subsidy flowing into the targeted investment, and allow for more projects to be undertaken for the same federal revenue loss.

Tax equity investors would be willing to pay more if credits were accelerated for two reasons. First, a shorter claim period means that investors would reduce the discount applied to the total stream of tax credits, since they could offset tax liabilities sooner. Second, longer claim periods result in more uncertainty (risk) over whether an investor will have sufficient tax liability to use purchased credits. Accelerating the tax credit reduces that risk, and less risk would lead to current investors being willing to pay higher prices for tax credits. Less risk could also bring new tax equity investors into the market, which would also tend to increase tax credit prices.

A concern with accelerating the tax credits is the potential for participants to lose focus on the investment after they have claimed all the credits. This concern could be addressed with a compliance period that is longer than the claim period and with credit recapture. For example, currently LIHTC is claimed over a 10-year period, but investors and developers are subject to a 15-year compliance period. Should the project fall out of compliance with the LIHTC rules in the last five years, the investors are subject to recapture of previously claimed tax credits. For purposes of this example, the claim period could be shortened to five years while leaving the 15-year compliance period in place.