Source: From the CFPB Data Point: Payday Lending.

On February 6, 2019, the Bureau of Consumer Financial Protection (CFPB) released a new Notice of Proposed Rulemaking for Payday, Vehicle Title, and Certain High-Cost Installment Loans. The proposal would rescind a significant part of a 2017 final rule that requires small-dollar, short-term lenders to determine a consumer's ability to repay before issuing a new loan. This new, controversial proposal has received congressional support and opposition.

This Insight begins with an overview of payday loans and then briefly summarizes the 2017 final rule and major changes proposed by the CFPB now. It also reviews the data and analysis supporting these rules, and the different conclusions each version of the rule reached using this same evidence. Although the CFPB's rule covers other small-dollar markets (e.g., auto title loans and other installment loans), this Insight focuses on payday loans, currently the largest market covered by the rule.

For general information on the payday loan market, see CRS Report R44868, Short-Term, Small-Dollar Lending: Policy Issues and Implications.

Payday loans are designed to be short-term advances that allow consumers to access cash before they receive a paycheck. These loans are generally paid back on a consumer's next payday. Payday loans are offered through storefront locations or online for a set fee. The underwriting of these loans is minimal, with consumers required to provide little more than a paystub and checking account information to take out a loan. Rather than pay off the loan entirely when it is due, many consumers roll over or renew these loans. Sequences of continuous "roll overs" may result in consumers being in debt for an extended period of time. Because consumers generally pay a fee for each new loan, payday loans can be expensive.

In this market, policy disagreements exist around balancing access to credit with consumer protection. Currently 17 states and DC either ban or limit the interest rates on these loans. The Dodd-Frank Wall Street Reform and Consumer Protection Act gave the federal government—the CFPB—the power to regulate payday loans for the first time.

In October 2017, during the leadership of Obama-appointed Director Cordray, the CFPB finalized a rule covering payday and other small-dollar, short-term loans. The rule asserts that it is "an unfair and abusive practice" for a lender to make certain types of short-term, small-dollar loans "without reasonably determining that consumers have the ability to repay the loans," also called loan underwriting. The rule, which mandated underwriting provisions, exempted some short-term, small-dollar loans if made with certain loan features. The compliance deadline for this rule was August 19, 2019.

The February 2019 proposal, issued under Trump-appointed Director Kraninger, would rescind the mandatory underwriting provisions before the 2017 final rule goes into effect. The rule would maintain other payment provisions relating to protections for consumers paying back these loans.

Media reports have suggested that opponents of the new proposed rule may sue the CFPB if the rule is finalized, alleging that, by rescinding the 2017 rule and issuing the 2019 rule without considering substantially changed evidence, the CFPB acted in an arbitrary and capricious manner in violation of the Administrative Procedure Act. To successfully defend against such a challenge, the CFPB would have to "demonstrate that it engaged in reasoned decision-making by providing an adequate explanation for its decision" to rescind part of the 2017 rule.

Notably, the new proposed rule principally relies on the same estimated impacts and academic research as the former 2017 final rule. In general, this evidence reflects that consumers' experiences with payday loans are mixed, and different CFPB leadership has weighed this evidence differently, as discussed below.

A survey of academic research suggests that access to payday loans does not have a large impact on consumer wellbeing, either positively or negatively. This mixed evidence may be masking diverse effects among consumers, where particular loans help certain consumers and harm others.

|

|

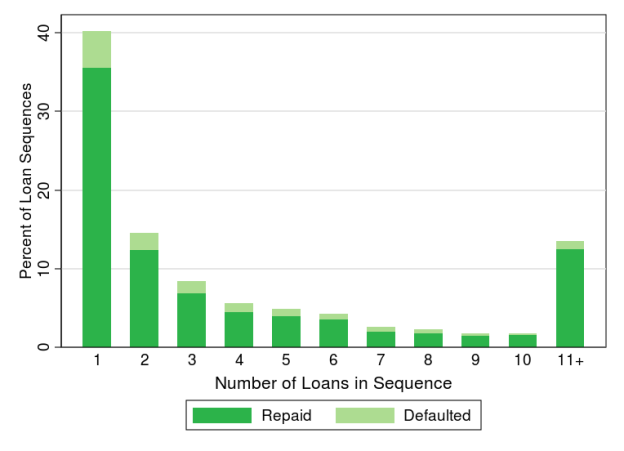

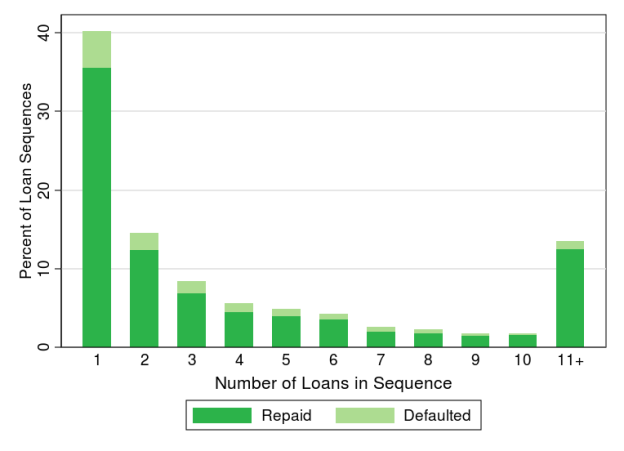

Source: From the CFPB Data Point: Payday Lending. |

A 2014 CFPB research report finds, as shown in Figure 1, that most consumers pay off payday loans quickly, but a sizable minority are in debt for a long period of time. In the sample, 36% of new payday loan sequences were repaid fully without rollovers, while 15% of sequences extended for 10 or more loans, and half of lenders' outstanding loans consisted of loans that were a part of these long sequences.

A 2014 academic study asked consumers how long they estimate it will take to pay back their loan. Prior to taking out a new loan, most people expected to pay this debt off quickly. The study found that 60% of consumers accurately estimated the time it will take to pay back their loans, while consumers in long sequences generally underestimated how long they will be in debt.

CFPB's internal analysis, which is the same under both rules, suggests that the 2017 rule's mandatory underwriting provisions would reduce new payday loan sequences by approximately 6%, but reduce the total number of payday loans made by half. The CFPB estimates that these provisions will lead to a large consolidation of the payday loan industry, reducing the number of storefronts by 71%-76%. The CFPB projects that under the underwriting provisions, consumers will need to travel slightly farther (five miles or less) to find a payday loan storefront. Rural consumers will be most affected by the reduction in access to credit.

The 2019 proposal reflects a different understanding of the evidence underlying the mandatory underwriting provisions than the 2017 rule. In the 2017 final rule, the CFPB stated that "extended loan sequences of unaffordable loans" lead to consumer harm. For this reason, the CFPB's 2017 rule attempts to mandate underwriting without "reduc[ing] meaningful access to credit among consumers." However, in the February 2019 proposal, the CFPB determined that rescinding the 2017 rule's mandatory underwriting provisions would generally benefit consumers through "increase[d] credit access" and less travel time. Also, the CFPB now asserts that the evidence was not "sufficiently robust and reliable" to justify the 2017 final rule's conclusions.