On November 13, 2018, Amazon announced that it would be splitting its second headquarters (HQ2) between Northern Virginia and Long Island City, NY. According to the company, each HQ2 site is expected to add 25,000 jobs over 12 years. Additionally, Amazon announced that it would build an "Operations Center of Excellence" that is expected to add more than 5,000 jobs in Nashville, TN. State and local governments offered Amazon a range of tax incentives, grants, and other benefits (e.g., a nearby state university "innovation campus"). Some of these incentives are performance-based and would depend on Amazon's actual decisions to hire and invest its own money into the locations.

Federal tax incentives might indirectly benefit investments near the new Amazon sites. In particular, a new set of Opportunity Zones (OZ) tax incentives could boost returns on investments made by Amazon or private investors in residential or commercial developments to support Amazon's workforce and their families.

OZs have generated much interest by state and local governments and private investors after being created by the 2017 tax revision (P.L. 115-97). Under part of the statute authorizing OZs, state governors had the discretion to nominate a limited number of census tracts within their states that were either (a) low-income, as defined in statute, or (b) having no more than 125% of the median family income of a contiguous low-income tract. Those designations were finalized in summer 2018.

Investors who roll over capital gains from investments (e.g., stock sales, sales of shares in commercial or residential real estate) to purchase a financial interest in a Qualified Opportunity Fund (QOF) may benefit. QOFs are corporations or partnerships that hold at least 90% of their assets in "qualified OZ property" (tangible business property, stock, or partnership interest in another QOF). QOFs are self-certified entities and do not require advance certification for formation or to begin eligibility for OZ tax incentives.

The three OZ tax incentives are all designed to reduce capital gains tax and become available at different increments over a 10-year period:

- 1. Temporary deferral of capital gains that are reinvested in qualified OZ property. Taxpayers can immediately defer capital gains tax due upon sale or disposition of an asset (even if located outside of an OZ) if the capital gain portion of that asset is reinvested within 180 days in a QOF.

- 2. Step-up in basis for investments held in QOFs. If the investment in the QOF is held by the taxpayer for at least five years, the basis on the original gain is increased by 10% of the original gain. If the OZ asset or investment is held by the taxpayer for at least seven years, the basis on the original gain is increased by an additional 5% of the original gain.

- 3. Permanent exclusion of capital gains tax on qualified OZ investments held for at least 10 years. The basis of investments maintained (a) for at least 10 years and (b) until at least December 31, 2026, will be eligible to be marked up to the fair market value of such investment on the date the investment is sold. Effectively, this amounts to an exclusion of capital gains tax on any gains earned from the investment in the QOF (over 10 years) when the investment is sold or disposed.

Under P.L. 115-97, OZ designations are in effect through 2026. To be eligible for OZ tax incentives, investments must be made before the end of 2026, and proposed Treasury regulations indicate that the permanent exclusion on gains from OZ investments would be available for qualified investors through 2047. For an illustrative calculation of OZ tax benefits, see CRS Report R45152, Tax Incentives for Opportunity Zones: In Brief, by [author name scrubbed] and [author name scrubbed].

The Joint Committee on Taxation estimated that the OZ tax incentives will result in a revenue loss to the federal government of $1.6 billion over 10 years. This estimate within the budget window reflects the relatively small revenue losses associated with the deferral of capital gains tax and the OZ basis adjustments in years five and seven. Potentially the largest tax benefit, available in year 10, would fall outside of the 10-year budget window. Those revenue losses would not be expected until 2028.

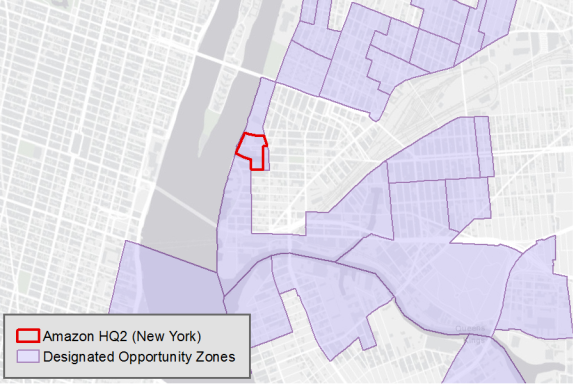

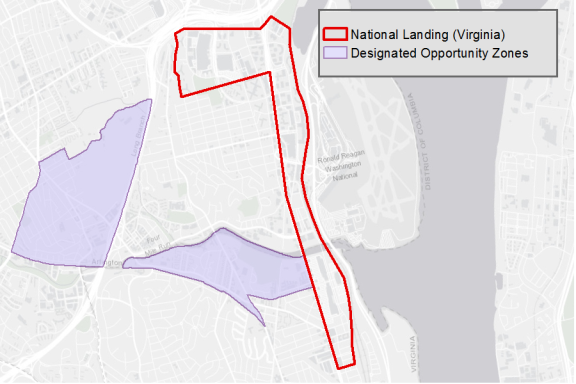

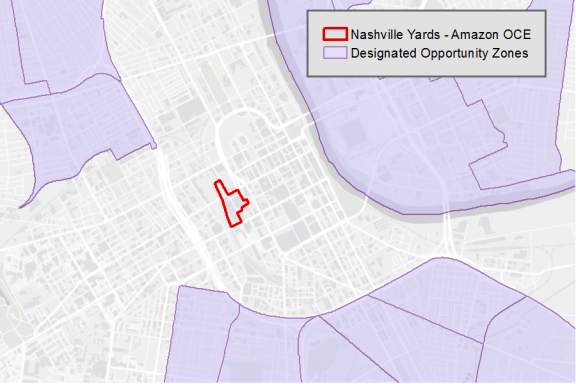

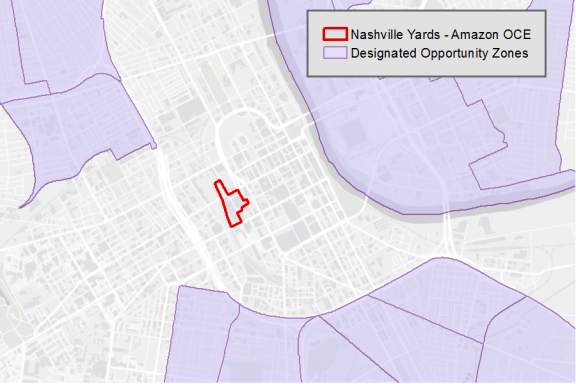

As shown in the figures, below, the planned site for the Amazon New York office is located within a designated OZ, but the Northern Virginia and Nashville sites are not. Even if the new sites are not directly located within a designated OZ, developers could look to nearby designated OZs for higher returns on investments for housing, retail, and commercial projects for use and enjoyment by Amazon's workers and their families. Investors and QOFs face consideration of the statute providing rules for OZ tax incentives, proposed regulations, and various IRS guidance as they are released.

|

Figure 1. Designated Opportunity Zones Near Proposed Amazon HQ2 Site in New York

|

|

|

Source: CRS using GIS data from Novogradac and Company, https://www.novoco.com/resource-centers/opportunity-zone-resource-center/guidance, the U.S. Census Bureau, and Esri Light Gray Base Map; letter from Howard A. Zemsky, President and CEO, New York State Urban Development Corporation, to Holly Sullivan, Head of WW Economic Development, Amazon Services, November 12, 2018, https://d39w7f4ix9f5s9.cloudfront.net/4d/db/a54a9d6c4312bb171598d0b2134c/new-york-agreement.pdf.

|

|

Figure 3. Designated Opportunity Zones Near Proposed Amazon Site in Nashville

|

|

|

Sources: CRS using GIS data from Novogradac and Company, https://www.novoco.com/resource-centers/opportunity-zone-resource-center/guidance, the U.S. Census Bureau, and Esri Light Gray Base Map; and Office of Governor Bill Haslam, "Governor Haslam, Commissioner Rolfe Announce Amazon to Create 5,000 New Jobs in Nashville," press release, November 13, 2018, https://www.tn.gov/governor/news/2018/11/13/amazon-to-create-5000-new-jobs-in-nashville.html.

|