Introduction

In 2008, an unknown computer programmer or group of programmers using the pseudonym Satoshi Nakamoto created a computer platform that would allow users to make valid transfers of digital representations of value.1 The system, called Bitcoin, is the first known cryptocurrency. A cryptocurrency is digital money in an electronic payment system in which payments are validated by a decentralized network of system users and cryptographic protocols instead of by a centralized intermediary (such as a bank).2

Since 2009, cryptocurrencies have gone from little-known, niche technological curiosities to rapidly proliferating financial instruments that are the subject of intense public interest.3 Recently, they have been incorporated into a variety of other financial transactions and products. For example, cryptocurrencies have been sold to investors to raise funding through initial coin offerings (ICOs),4 and the terms of certain derivatives are now based on cryptocurrencies.5 Some government central banks have examined the possibility of issuing cryptocurrencies or other digital currency.6 Media coverage of cryptocurrencies has been widespread, and various observers have characterized cryptocurrencies as either the future of monetary and payment systems that will displace government-backed currencies or a fad with little real value.7

When analyzing the public policy implications posed by cryptocurrencies, it is important to keep in mind what these currencies are expressly designed and intended to be—alternative electronic payment systems. The purpose of this report is to assess how and how well cryptocurrencies perform this function, and in so doing to identify possible benefits, challenges, risks, and policy issues surrounding cryptocurrencies.8 The report begins by reviewing the most basic characteristics and economic functions of money, the traditional systems for creating money, and traditional systems for transferring money electronically. It then describes the features and characteristics of cryptocurrencies and examines the potential benefits they offer and the challenges they face regarding their use as money. The report also examines certain risks posed by cryptocurrencies when they are used as money and related policy issues, focusing in particular on two issues: cryptocurrencies' potential role in facilitating criminal activity and concerns about protections for consumers who use these currencies. Finally, the report analyzes cryptocurrencies' impact on monetary policy.

The Functions of Money

Money exists because it serves a useful economic purpose: it facilitates the exchange of goods and services. Without it, people would have to engage in a barter economy, wherein people trade goods and services for other goods and services. In a barter system, every exchange requires a double coincidence of wants—each party must possess the exact good or be offering the exact service that the other party wants.9 Anytime a potato farmer wanted to buy meat or clothes or have a toothache treated, the farmer would have to find a particular rancher, tailor, or dentist who wanted potatoes at that particular time and negotiate how many potatoes a side of beef, a shirt, and a tooth removal were worth. In turn, the rancher, tailor, and dentist would have to make the same search and negotiation with each other to satisfy their wants. Wants are satisfied more efficiently if all members of a society agree they will accept money—a mutually recognized representation of value—for payment, be that ounces of gold, a government-endorsed slip of paper called a dollar, or a digital entry in an electronic ledger.

How well something serves as money depends on how well it serves as (1) a medium of exchange, (2) a unit of account, and (3) a store of value. To function as a medium of exchange, the thing must be tradable and agreed to have value. To function as unit of account, the thing must act as a good measurement system. To function as a store of value, the thing must be able to purchase approximately the same value of goods and services at some future date as it can purchase now.10

Returning to the example above, could society decide potatoes are money? Conceivably, yes. A potato has intrinsic value (this report will examine value in more detail in the following section, "Traditional Money"), as it provides nourishment. However, a potato's tradability is limited: many people would find it impractical to carry around sacks of potatoes for daily transactions or to buy a car for many thousands of pounds of potatoes. A measurement system based on potatoes is also problematic. Each potato has a different size and degree of freshness, so to say something is worth "one potato" is imprecise and variable. In addition, a potato cannot be divided without changing its value. Two halves of a potato are worth less than a whole potato—the exposed flesh will soon turn brown and rot—so people would be unlikely to agree to prices in fractions of potato. The issue of freshness also limits potatoes' ability to be a store of value; a potato eventually sprouts eyes and spoils, and so must be spent quickly or it will lose value.

In contrast, an ounce of gold and a dollar bill can be carried easily in a pocket and thus are tradeable. Each unit is identical and can be divided into fractions of an ounce or cents, respectively, making both gold and dollars effective units of account. Gold is an inert metal and a dollar bill, when well cared for, will not degrade substantively for years, meaning can both function as a store of value. Likewise, with the use of digital technology, electronic messages to change entries in a ledger can be sent easily by swiping a card or pushing a button and can be denominated in identical and divisible units. Those units could have a stable value, as their number stays unchanging in an account on a ledger. The question becomes how does a lump of metal, a thing called a dollar, and the numbers on a ledger come to be deemed valuable by society, as has been accomplished in traditional monetary systems.

Traditional Money

Money has been in existence throughout history. However, how that money came to have value, how it was exchanged, and what roles government and intermediaries such as banks have played have changed over time. This section examines three different monetary systems with varying degrees of government and bank involvement.

No or Limited Role for a Central Authority: Intrinsic Value

Early forms of money were often things that had intrinsic value, such as precious metals (e.g., copper, silver, gold). Part of their value was derived from the fact that they could be worked into aesthetically pleasing objects. More importantly, other physical characteristics of these metals made them well suited to perform the three functions of money and so created the economic efficiency societies needed:11 these metals are elemental and thus an amount of the pure material is identical to a different sample of the same amount; they are malleable and thus easy divisible; and they are chemically inert and thus do not degrade. In addition, they are scarce and difficult to extract from the earth, which is vital to them having and maintaining value. Sand also could perform the functions of money and can be worked into aesthetically pleasing glass. However, if sand were money, then people would quickly gather vast quantities of it and soon even low-cost goods would be priced at huge amounts of sand.

Even when forms of money had intrinsic value, governments played a role in assigning value to money. For example, government mints would make coins of precious metals with a government symbol, which validated that these particular samples were of some verified amount and purity.12 Fiat money takes the government role a step further, as discussed below.

Government Authority: Fiat Money

In contrast to money with intrinsic value, fiat money has no intrinsic value but instead derives its value by government decree. If a government is sufficiently powerful and credible, it can declare that some thing—a dollar, a euro, a yen, for example—shall be money. In practice, these decrees can take a number of forms, but generally they involve a mandate that the money be used for some economic activity, such as paying taxes or settling debts. Thus, if members of society want to participate in the relevant economic activities, it behooves them to accept the money as payment in their dealings.13

In addition to such decrees, the government generally controls the supply of the money to ensure it is sufficiently scarce to retain value yet in ample-enough supply to facilitate economic activity.14 Relatedly, the government generally attempts to minimize the incidence of counterfeiting by making the physical money in circulation difficult to replicate and creating a deterrence through criminal punishment.15

Modern monies are generally fiat money, including the U.S. dollar. The dollar is legal tender in the United States, meaning parties are obligated to accept the dollar to settle debts, and U.S. taxes can (and generally must) be paid in dollars.16 This status instills dollars with value, because anyone who wants to undertake these basic economic activities in the largest economy and financial system in the world must have and use this type of money.

In the United States, the Board of Governors of the Federal Reserve System maintains the value of the dollar by setting monetary policy. Congress mandated that the Federal Reserve would conduct monetary policy in the Federal Reserve Reform Act of 1977 (P.L. 95-188), directing it to "maintain long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates."17 Under this system, a money stock currently exceeding $14 trillion circulates in support of an economy that generates over $20 trillion worth of new production a year,18 and average annual inflation has not exceeded a rate of 3% since 1993.19

In addition, the Federal Reserve operates key electronic payment systems, including those involving interbank transfers.20 In this way, the Federal Reserve acts as the intermediary when banks transfer money between each other.

Banks: Transferring Value Through Intermediaries

Banks have played a role in another evolution of money: providing an alternative to the physical exchange of tangible currency between two parties. Verifying the valid exchange of physical currency is relatively easy. The payer shows the payee he or she is in fact in possession of the money, and the transfer is valid the moment the money passes into the payee's possession. This system is not without problems, though. Physically possessing money subjects it to theft, misplacement, or destruction through accident.21 A physical exchange of money typically requires the payer and payee be physically near each other (because both parties would have to have a high degree of trust in each other to believe any assurance that the money will be brought or sent later).

From early in history, banks have offered services to accomplish valid transfers of value between parties who are not in physical proximity and do not necessarily trust each other. Customers give banks their money for, among other reasons, secure safekeeping and the ability to send payment to a payee located somewhere else (originally using paper checks or bills of exchange). Historically and today, maintaining accurate ledgers of accounts is a vital tool for providing these services. It allows people to hold money as numerical data stored in a ledger instead of as a physical thing that can be lost or stolen. In the simplest form, a payment system works by a bank recording how much money an individual has access to and, upon instruction, making appropriate additions and reductions to that amount.22

The mechanics of the modern payment system, in which instructions are sent and records are stored electronically, are covered in more detail in the following section, "The Electronic Exchange of Money." What can be noted here in this basic description is that participants must trust the banks and that ledgers must be accurate and must be changed only for valid transfers. Otherwise, an individual's money could be lost or stolen if a bank records the payer's account as having an inaccurately low amount or transfers value without permission.

A number of mechanisms can create trust in banks. For example, a bank has a market incentive to be accurate, because a bank that does not have a good reputation for protecting customers' money and processing transactions accurately will lose customers. In addition, governments typically subject banks to laws and regulations designed in part to ensure that banks are run well and that people's money is safe in them.23 As such, banks take substantial measures to ensure security and accuracy.

The Electronic Exchange of Money

Today, money is widely exchanged electronically, but electronic payments systems can be subject to certain difficulties related to lack of scarcity (a digital file can be copied many times over, retaining the exact information as its predecessor) and lack of trust between parties. Electronic transfers of money are subject to what observers refer to as the double spending problem. In an electronic transfer of money, a payer may wish to send a digital file directly to a payee in the hopes that the file will act as a transfer of value. However, if the payee cannot confirm that the payer has not sent the same file to multiple other payees, the transfer is problematic. Because money in such a system could be double (or any number of times) spent, the money would not retain its value.24

As described in the preceding section, this problem traditionally has been resolved by involving at least one centralized, trusted intermediary—such as a private bank, government central bank, or other financial institution—in electronic transfers of money. The trusted intermediaries maintain private ledgers of accounts recording how much money each participant holds. To make a payment, an electronic message (or messages) is sent to an intermediary or to and between various intermediaries, instructing each to make the necessary changes to its ledgers. The intermediary or intermediaries validate the transaction, ensure the payer has sufficient funds for the payment, deduct the appropriate amount from the payer's account, and add that amount to the payee's account.25 For example, in the United States, a retail consumer may initiate an electronic payment through a debit card transaction, at which time an electronic message is sent over a network instructing the purchaser's bank to send payment to the seller's bank. Those banks then make the appropriate changes to their account ledgers (possibly using the Federal Reserve's payment system) reflecting that value has been transferred from the purchaser's account to the seller's account.26

Significant costs and physical infrastructure underlie systems for electronic money transfers to ensure the systems' integrity, performance, and availability. For example, payment system providers operate and maintain vast electronic networks to connect retail locations with banks, and the Federal Reserve operates and maintains networks to connect banks to itself and each other.27 These intermediaries store and protect huge amounts of data. In general, these intermediaries are highly regulated to ensure safety, profitability, consumer protection, and financial stability. Intermediaries recoup the costs associated with these systems and earn profits by charging fees directly when the system is used (such as the fees a merchant pays to have a card reading machine and on each transaction) or by charging fees for related services (such as checking account fees).

In addition, intermediaries generally are required to provide certain protections to consumers involved in electronic transactions. For example, the Electronic Fund Transfer Act (P.L. 95-630) limits consumers' liability for unauthorized transfers made using their accounts.28 Similarly, the Fair Credit Billing Act (P.L. 93-495) requires credit card companies to take certain steps to correct billing errors, including when the goods or services a consumer purchased are not delivered as agreed.29 Both acts also require financial institutions to make certain disclosures to consumers related to the costs and terms of using an institution's services.30

Notably, certain individuals may lack access to electronic payment systems. To use an electronic payment system, a consumer or merchant generally must have access to a bank account or some retail payment service, which some may find cost prohibitive or geographically inconvenient, resulting in underbanked or unbanked populations (i.e., people who have limited interaction with the traditional banking system).31 In addition, the consumer or merchant typically must provide the bank or other intermediary with personal information. The use of electronic payment services generates a huge amount of data about an individual's financial transactions. This information could be accessed by the bank, law enforcement (provided proper procedures are followed),32 or nefarious actors (provided they are capable of circumventing the intermediaries' security measures).33

Cryptocurrencies—such as Bitcoin, Ether, and Litecoin—provide an alternative to this traditional electronic payment system.

Cryptocurrency: A New Money?

Description

As noted above, cryptocurrency acts as money in an electronic payment system in which a network of computers, rather than a single third-party intermediary, validates transactions.

In general, these electronic payment systems use public ledgers that allow individuals to establish an account with a pseudonymous name known to the entire network—or an address corresponding to a public key—and a passcode or private key that is paired to the public key and known only to the account holder.34 A transaction occurs when two parties agree to transfer cryptocurrency (perhaps in payment for a good or service) from one account to another. The buying party will unlock the cryptocurrency they will use as payment with their private key, allowing the selling party to lock it with their private key.35 In general, to access the cryptocurrency system, users will create a "wallet" with a third-party cryptocurrency exchange or service provider.36 From the perspective of the individuals using the system, the mechanics are similar to authorizing payment on any website that requires an individual to enter a username and password. In addition, certain companies offer applications or interfaces that users can download onto a device to make transacting in cryptocurrencies more user-friendly.

Cryptocurrency platforms often use blockchain technology to validate changes to the ledgers.37 Blockchain technology uses cryptographic protocols to prevent invalid alteration or manipulation of the public ledger. Specifically, before any transaction is entered into the ledger and the ledger is irreversibly changed, some member of the network must validate the transaction. In certain cryptocurrency platforms, validation requires the member to solve an extremely difficult computational decryption. Once the transaction is validated, it is entered into the ledger.38

These protocols secure each transaction by using digital signatures to validate the identity of the two parties involved and to validate that the entire ledger is secure so that any changes in the ledger are visible to all parties. In this system, parties that otherwise do not know each other can exchange something of value (i.e., a digital currency) not because they trust each other but because they trust the platform and its cryptographic protocols to prevent double spending and invalid changes to the ledger.

Cryptocurrency platforms often incentivize users to perform the functions necessary for validation by awarding them newly created units of the currency for successful computations (often the first person to solve the problem is given the new units), although in some cases the payer or payee also is charged a fee that goes to the validating member. In general, the rate at which new units are created—and therefore the total amount of currency in the system—is limited by the platform protocols designed by the creators of the cryptocurrency.39 These limits create scarcity with the intention of ensuring the cryptocurrency retains value. Because users of the cryptocurrency platform must perform work to extract the scarce unit of value from the platform, much as people do with precious metals, it is said that these users mine the cryptocurrencies. Alternatively, people can acquire cryptocurrency on certain exchanges that allow individuals to purchase cryptocurrency using official government-backed currencies or other cryptocurrencies.

Cryptographers and computer scientists generally agree that cryptocurrency ledgers that use blockchain technology are mathematically secure and that it would be exceedingly difficult—approaching impossible—to manipulate them. However, hackers have exploited vulnerabilities in certain exchanges and individuals' devices to steal cryptocurrency from the exchange or individual.40

The Price and Usage of Cryptocurrency

Analyzing data about certain characteristics and the use of cryptocurrency would be helpful in measuring how well cryptocurrency functions as an alternative source of payment and thus its future prospects for functioning as money. However, conducting such an analysis currently presents challenges. The decentralized nature of cryptocurrencies makes identifying authoritative sources of industry data difficult. In addition, the recent proliferation of cryptocurrency adds additional challenges to performing industry-wide analysis. For example, as of August 27, 2018, one industry group purported to track 1,890 cryptocurrencies trading at prices that suggest an aggregate value in circulation of almost $220 billion.41

Because of these challenges, an exhaustive quantitative analysis of the entire cryptocurrency industry is beyond the scope of this report. Instead, the report uses Bitcoin—the first and most well-known cryptocurrency, the total value of which accounts for more than half of the industry as a whole42—as an illustrative example. Examining recent trends in Bitcoin prices, value in circulation, and number of transactions may shed some light on how well cryptocurrencies in general have been performing as an alternative payment system.

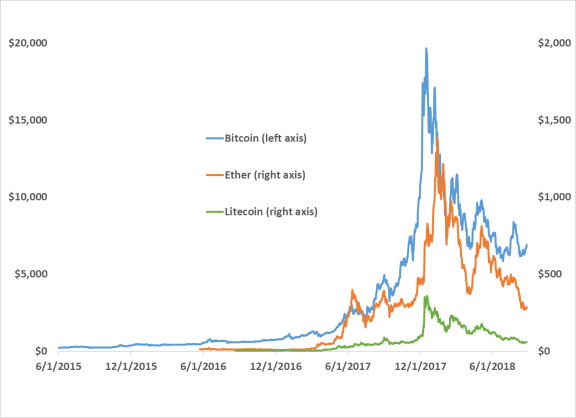

The rapid appreciation in cryptocurrencies' value in 2017 likely contributed to the recent increase in public interest in these currencies. At the beginning of 2017, the price of a Bitcoin on an exchange was about $993.43 The price surged during the year, peaking at about $19,650 in December 2017 (see Figure 1), an almost 1,880% increase from prices in January 2017. However, the price then dramatically declined by 65% to $6,905 in less than two months. From February through August 2018, the price of a Bitcoin remained volatile. Other major cryptocurrencies such as Ether and Litecoin have had similar price movements.

|

|

Source: Coinbase, accessed through the Federal Reserve Bank of St. Louis Economic Data website on August 27, 2018. |

As of October 7, 2018, the price of one Bitcoin was $6,570 and approximately 17.3 million Bitcoins were in circulation,44 making the value of all Bitcoins in existence about $113.6 billion.45

Although these statistics drive interest in and are central to the analysis of cryptocurrencies as investments, they reveal little about the prevalence of cryptocurrencies' use as money. Recent volatility in the price of cryptocurrencies suggests they function poorly as a unit of account and a store of value (two of the three functions of money discussed in "The Functions of Money," above), an issue covered in the "Potential Challenges to Widespread Adoption" section of this report. Nevertheless, the price or the exchange rate of a currency in dollars at any point in time (rather than over time) does not have a substantive influence on how well the currency serves the functions of money.

The number of Bitcoin transactions, by contrast, can serve as an indicator—though a flawed one46—of the prevalence of the use of Bitcoin as money. This number indicates how many times a day Bitcoins are transferred between accounts. Two industry data sources indicate that the number of Bitcoin transactions averaged about 208,000 per day globally in 2018 through August.47 In comparison, the Automated Clearing House—an electronic payments network operated by the Federal Reserve Bank and the private company Electronic Payments Network—processed almost 59 million transactions per day on average in 2017.48 Visa's payments systems processed on average more than 300 million transactions per day globally in 2017.49

Potential Benefits of Cryptocurrencies

The previous section illustrates that the use of cryptocurrencies as money in a payment system is still quite limited compared with traditional systems. However, the invention and growth in awareness of cryptocurrencies occurred only recently. Some observers assert that cryptocurrencies' potential benefits will be realized in the coming years or decades, which will lead to their widespread adoption.50 Skeptics, however, emphasize the obstacles facing the widespread adoption of cryptocurrencies and doubt that cryptocurrencies can overcome these challenges.51 This section of the report describes some of the potential benefits cryptocurrencies may provide to the public and the economic system as a whole. Later sections—"Potential Challenges to Widespread Adoption" and "Potential Risks Posed by Cryptocurrencies"—discuss certain potential challenges to widespread adoption of cryptocurrencies and some potential risks cryptocurrencies pose.

Potential Economic Efficiency

As discussed in the "The Electronic Exchange of Money" section, traditional monetary and electronic payment systems involve a number of intermediaries, such as government central banks and private financial institutions. To carry out transactions, these institutions operate and maintain extensive electronic networks and other infrastructure, employ workers, and require time to finalize transactions. To meet costs and earn profits, these institutions charge various fees to users of their systems. Advocates of cryptocurrencies hope that a decentralized payment system operated through the internet will be less costly than the traditional payment systems and existing infrastructures.52

Cryptocurrency proponents assert that cryptocurrency may provide an especially pronounced cost advantage over traditional payment systems for international money transfers and payments. Sending money internationally generally involves further intermediation than domestic transfers, typically requiring transfers between banks and other money transmitters in different countries and possibly exchanges of one national currency for another. Proponents assert that cryptocurrencies could avoid these particular costs because cryptocurrency transactions take place over the internet—which is already global—and are not backed by government-fiat currencies.53

Nevertheless, it is difficult to quantify how much traditional payment systems cost and what portion of those costs is passed on to consumers. Performing such a quantitative analysis is beyond the scope of this report.54 What bears mentioning here is that certain costs of traditional payment systems—and, in particular, the fees intermediaries in those systems have charged consumers—have at times been high enough to raise policymakers' concern and elicit policy responses. For example, in response to retailers' assertions that Visa and MasterCard had exercised market power in setting debit card swipe fees at unfairly high levels, Congress included Section 1075 in the Dodd-Frank Consumer Protection and Wall Street Reform Act (Dodd-Frank Act; P.L. 111-203)—sometimes called the "Durbin Amendment."55 Section 1075 directs the Federal Reserve to limit debit card swipe fees charged by banks with assets of more than $10 billion.56 In addition, studies on unbanked and underbanked populations cite the fees associated with traditional bank accounts, a portion of which may be the result of providing payment services, as a possible cause for those populations' limited interaction with the traditional banking system.57 Proponents of cryptocurrencies argue that an increase in the use of cryptocurrencies as an alternative payment system would reduce these costs through competition or would eliminate the need to pay them altogether.

An Alternative to Existing Intermediaries and Systems

As discussed in the "Traditional Money" section, traditional payment systems require that government and financial institutions be credible and have people's trust. Even if general trust in those institutions is sufficient to make them credible in a society, certain individuals may nevertheless mistrust them. For people who do not find various institutions sufficiently trustworthy, cryptocurrencies could provide a desirable alternative.58

In countries with advanced economies, such as the United States, mistrust may not be as prevalent (although not wholly absent) as in other countries. Typically, developed economies are relatively stable and have relatively low inflation; often, they also have carefully regulated financial institutions and strong government institutions. Not all economies share these features. Thus, cryptocurrencies may experience more widespread adoption in countries with a higher degree of mistrust of existing systems than in countries where there is generally a high degree of trust in existing systems.59

A person may mistrust traditional private financial institutions for a number of reasons. An individual may be concerned that an institution will go bankrupt or otherwise lose his or her money without adequately apprising him or her of such a risk (or while actively misleading him or her about it).60 In addition, opening a bank account or otherwise using traditional electronic payment systems generally requires an individual to divulge to a financial institution certain basic personal information, such as name, social security number, and birthdate. Financial institutions store this information and information about the transactions linked to this identity. Under certain circumstances, they may analyze or share this information, such as with a credit-reporting agency. In some instances hackers have stolen personal information from financial institutions, causing concerns over how well these institutions can protect sensitive data.61 Individuals seeking a higher degree of privacy or control over their personal data than that afforded by traditional systems may choose to use cryptocurrency.

Certain individuals also may mistrust a government's willingness or ability to maintain a stable value of a fiat currency. Because fiat currency does not have intrinsic value and, historically, incidents of hyperinflation in certain countries have seen government-backed currencies lose most or nearly all of their value, some individuals may judge the probability of their fiat money losing a significant portion of its value to be undesirably high in some circumstances. These individuals may place greater trust in a decentralized network using cryptographic protocols that limit the creation of new money than in government institutions.62

Potential Challenges to Widespread Adoption

The appropriate policy approach to cryptocurrencies likely depends, in part, on how prevalent these currencies become. For cryptocurrencies to deliver the potential benefits mentioned above, people must use them as money to some substantive degree. After all, as money, cryptocurrencies would do little good if few people and businesses accept them as payment. For this reason, currencies are subject to network effects, wherein their value and usefulness depends in part on how many people are willing to use them.63 Currently, cryptocurrencies face certain challenges to widespread adoption, some of which are discussed below.

Challenges to Effectively Performing the Functions of Money

Recall that how well cryptocurrency serves as money depends on how well it serves as (1) a medium of exchange, (2) a unit of account, and (3) a store of value. Several characteristics of cryptocurrency undermine its ability to serve these three interrelated functions in the United States and elsewhere. Currently, a relatively small number of businesses or individuals use or accept cryptocurrency for payment. As discussed in the "The Price and Usage of Cryptocurrency" section, there were 208,000 transactions involving Bitcoin per day globally (out of the billions of transactions that take place) in 2018 through August, and a portion of those transactions involved people buying Bitcoins for the purposes of holding them as an investment rather than as payment for goods and services.64 Cryptocurrency may be used as a medium of exchange less frequently than traditional money for several reasons. Unlike the dollar and most other government-backed currencies, cryptocurrencies are not legal tender, meaning creditors are not legally required to accept them to settle debts.65 Consumers and businesses also may be hesitant to place their trust in a decentralized computer network of pseudonymous participants that they may not completely understand.66 Relatedly, consumers and businesses may have sufficient trust in and be generally satisfied with existing payment systems.

As previously mentioned, the recent high volatility in the price of many cryptocurrencies undermines their ability to serve as a unit of account and a store of value. Cryptocurrencies can have significant value fluctuations within short periods of time; as a result, pricing goods and services in units of cryptocurrency would require frequent repricing and likely would cause confusion among buyers and sellers.67 In regard to serving as a store of value, Bitcoin lost almost 53% of its value in the first half of 2018, which equates to a 346% annualized rate of inflation. In comparison, the annualized inflation of prices in the U.S. dollar was 2.1% over the same period.68

Technological Challenges: Scaling, Transaction Validation Speed, and Energy Consumption

Whether cryptocurrency systems are scalable—meaning their capacity can be increased in a cost-effective way without loss of functionality—is uncertain.69 At present, the technologies and systems underlying cryptocurrencies do not appear capable of processing the number of transactions that would be required of a widely adopted, global payment system. As discussed in the "The Price and Usage of Cryptocurrency" section, the platform of the largest (by a wide margin) cryptocurrency, Bitcoin, processes a small fraction of the overall financial transactions parties engage in per day. The overwhelming majority of such transactions are processed through established payment systems. As well, Bitcoin's processing speed is still comparatively slow relative to the nearly instant transaction speed many electronic payment methods, such as credit and debit cards, achieve. For example, blocks of transactions are published to the Bitcoin ledger every 10 minutes, but because a limited number of transactions can be added in a block, it may take over an hour before an individual transaction is posted.

Part of the reason for the relatively slow processing speed of certain cryptocurrency transactions is the large computational resources involved with mining—or validating—transactions. When prices for cryptocurrencies were increasing rapidly, many miners were incentivized to participate in validating transactions, seeking to win the rights to publish the next block and collect any reward or fees attached to that block. This incentive led to an increasing number of miners and to additional investment in faster computers by new and existing miners. The combination of more miners and more energy required to power their computers led to ballooning electricity requirements. However, as the prices of cryptocurrencies have deflated, validating cryptocurrency transactions has become a less rewarding investment for miners; consequently, fewer individuals participate in mining operations.70

The energy consumption required to run and cool the computers involved in cryptocurrency mining is substantial. Some estimates indicate the daily energy needs of the Bitcoin network are comparable to the needs of a small country, such as Ireland.71 In addition to raising questions about whether cryptocurrencies ultimately will be more efficient than existing payment systems, such high energy consumption could result in high negative externalities—wherein the price of a market transaction, such as purchasing electricity, may not fully reflect all societal costs, such as pollution from electricity production.

Possible Need for New Intermediaries

In general, when a buyer of a good or a service provided remotely sends a cryptocurrency to another account, that transaction is irreversible and made to a pseudonymous identity. Although a cryptocurrency platform validates that the currency has been transferred, the platform generally does not validate that a good or service has been delivered. Unless a transfer is done face-to-face, it will involve some degree of trust between one party and the other or a trusted intermediary.72 For example, imagine a buyer agrees to purchase a collectible item from a seller located across the country for one Bitcoin. If the buyer transfers the Bitcoin before she has received the item, she takes on the risk that the seller will never ship the item to her; if that happened, the buyer would have little, if any, recourse. Conversely, if the seller ships the item before the buyer has transferred the Bitcoin, he assumes the risk that the buyer never will transfer the Bitcoin. These risks could act as a disincentive to parties considering using cryptocurrencies in certain transactions and thus could hinder cryptocurrencies' ability to act as a medium of exchange. As mentioned in the "Banks: Transferring Value Through Intermediaries" section, sending cash to someone in another location presents a similar problem, which historically has been solved by using a trusted intermediary.

In response to this problem, several companies offer cryptocurrency escrow services. Typically, the escrow company holds the buyer's cryptocurrency until delivery is confirmed. Only then will the escrow company pass the cryptocurrency onto the seller. Although an escrow service may enable parties who otherwise do not trust each other to exchange cryptocurrency for goods and services, the use of such services reintroduces the need for a trusted third-party intermediary in cryptocurrency transactions. As with the use of intermediaries in traditional electronic transactions discussed above, both a buyer and a seller in a cryptocurrency transaction would have to trust that the escrow company will not abscond with their cryptocurrency and is adequately protected against hacking.73

For cryptocurrencies to gain widespread acceptance as payment systems and displace existing traditional intermediaries, new procedures and intermediaries such as those described in this section may first need to achieve a sufficient level of trustworthiness and efficiency among the public. If cryptocurrencies ultimately require their own system of intermediaries to function as money, questions may arise about whether this requirement defeats their original purpose.

Potential Risks Posed by Cryptocurrencies

Policymakers developed most financial laws and regulations before the invention and subsequent growth of cryptocurrencies, which raises questions about whether existing laws and regulations appropriately and efficiently address the risks posed by cryptocurrency. Some of the more commonly cited risks include the potential that cryptocurrencies will be used to facilitate criminal activity and the lack of consumer protections applicable to parties buying or using cryptocurrency. Each of these risks is discussed below.

Criminality

Money Laundering

Criminals and terrorists are more likely to conduct business in cash and to hold cash as an asset than to use financial intermediaries such as banks, in part because cash is anonymous and allows them to avoid establishing relationships with and records at financial institutions that may be subject to anti-money laundering reporting and compliance requirements.74 Some observers are concerned that the pseudonymous and decentralized nature of cryptocurrency transactions may similarly provide a means for criminals to hide their financial dealings from authorities.75 For example, Bitcoin was the currency used on the internet-based, illegal drug marketplace called Silk Road. This marketplace and Bitcoin escrow service facilitated more than 100,000 illegal drug sales from approximately January 2011 to October 2013, at which time the government shut down the website and arrested the individuals running the site.76

Criminal use of cryptocurrency does not necessarily mean the technology is a net negative for society, because the benefits it provides could exceed the societal costs of the additional crime facilitated by cryptocurrency. In addition, law enforcement has existing authorities and abilities to mitigate the use of cryptocurrencies for the purposes of evading law enforcement.

Recall that cryptocurrency platforms generally function as an immutable, public ledger of accounts and transactions. Thus, every transaction ever made by a member of the network is relatively easy to observe, and this characteristic can be helpful to law enforcement in tracking criminal finances. Although the accounts may be identified with a pseudonym on the cryptocurrency platform, law enforcement can exercise methods involving analysis of transaction patterns to link those pseudonyms to real-life identities. For example, it may be possible to link a cryptocurrency public key with a cryptocurrency exchange customer.77 Certain cryptocurrencies may provide users with greater anonymity than others, but use of these technologies currently is comparatively rare.

In addition to law enforcement's abilities to investigate crime, the government has authorities to subject cryptocurrency exchanges to regulation related to reporting suspicious activity. The Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) has issued guidance explaining how its regulations apply to the use of virtual currencies—a term that refers to a broader class of electronic money that includes cryptocurrencies. FinCEN has indicated that an exchanger ("a person engaged as a business in the exchange of virtual currency for real currency, funds, or other virtual currency") and an administrator ("a person engaged as a business in issuing [putting into circulation] a virtual currency, and who has the authority to redeem [to withdraw from circulation] such virtual currency") generally qualify as money services businesses (MSBs) subject to federal regulation.78 Among other things, MSBs generally must register with and report suspicious transactions to FinCEN, and they must maintain anti-money laundering compliance programs.79 State law and regulation generally impose a variety of registration anti-money laundering requirements on money services businesses. The specific requirements generally vary across different states;80 a state-by-state analysis is beyond the scope of this report.

Legislation in the 115th Congress

Bills focused on investigating the criminal use of cryptocurrencies and improving government agencies' ability to address the problem have seen action in the 115th Congress. These bills include the following:

- H.R. 2433 passed the House on September 12, 2017, and would direct the Department of Homeland Security, in coordination with appropriate federal agencies, to develop an assessment of the threat of individuals using cryptocurrencies to carry out acts of terrorism.

- H.R. 5036 passed the House on September 28, 2018, and would (1) establish the Independent Financial Technology Task Force to research and develop proposals regarding the use of digital currencies in terrorism and illicit activity, (2) direct the Treasury to pay a reward to anyone who provides information that leads to a conviction of an individual involved with terrorist use of digital currencies, and (3) establish the FinTech Leadership in Innovation Program to fund the development of tools and programs to detect terrorist and illicit use of digital currencies.

- H.R. 6069 passed the House on June 25, 2018, and would direct the Government Accountability Office to produce a study on the use of virtual currencies and online marketplaces to facilitate sex and drug trafficking.

- H.R. 6411 passed the House on September 12, 2018, and would amend FinCEN's duties and powers to explicitly include "emerging technologies or value that substitutes for currency" as an area in which FinCEN can coordinate with foreign financial intelligence in anti-money laundering efforts.

Tax Evasion

The Internal Revenue Service (IRS) has issued guidance stating that it will treat virtual currencies as property (as opposed to currency), meaning users owe taxes on any realized gains whenever they dispose of virtual currency, including when they use it to purchase goods and services.81 In a court filing seeking to obtain information on customers of Coinbase—the largest U.S. cryptocurrency exchange—the IRS identified approximately 800 to 900 returns per year from 2013 to 2015 that included capital gains that likely came from cryptocurrencies.82 In addition, recent anecdotal reporting—based in part on individuals' tax return filings from one filing service—suggests that few 2017 tax filings included reported capital gains from cryptocurrencies.83 Nevertheless, considering the level of activity in the cryptocurrency markets, one analysis estimated the U.S. tax liability on cryptocurrency gains was $25 billion in 2017.84

The lack of clarity surrounding whether and to what degree people are appropriately declaring gains from cryptocurrency on their tax returns has raised concerns that the technology could facilitate tax evasion. As with money laundering, individuals could use the opportunity to hide and move money in a pseudonymous, decentralized platform (and thus avoid generating records at traditional financial institutions) as a mechanism for hiding income from tax authorities.85 Data that would aid in analyzing whether this is occurring are scarce at this time, because the IRS has only recently begun actively collecting customer information from cryptocurrency exchanges.86

Financial Sanction Evasion

Although it is outside the scope of this report, another potential reason a person or entity may want to move money or assets while avoiding engagement with traditional financial institutions could be to evade financial sanctions. For example, the Venezuelan government has launched a digital currency with the stated intention of using it to evade U.S. sanctions.87 The governments of Iran and Russia have expressed interest in doing so, as well.88 For more information on the potential use of cryptocurrencies to evade financial sanctions, see CRS In Focus IF10825, Digital Currencies: Sanctions Evasion Risks, by Rebecca M. Nelson and Liana W. Rosen.

Consumer Protections

Although there is no overarching regulation or regulatory framework specifically aimed at providing consumer protections in cryptocurrencies markets, numerous consumer protection laws and regulatory authorities at both the federal and state levels are applicable to cryptocurrencies. Whether these regulations adequately protect consumers and whether existing regulation is unnecessarily burdensome are topics subject to debate. This section will examine some of these consumer protections and present arguments related to these debated issues.

A related concern has to do with whether investors in certain cryptocurrency instruments such as initial coin offerings—wherein companies developing an application or platform issue cryptocurrencies or other digital or virtual currency that are or will be used on the application or platform—or cryptocurrency derivatives contracts are adequately informed of risk and protected from scams. However, this secondary use of cryptocurrency as investment vehicles is different from the use of cryptocurrencies as money, and it is beyond the scope of this report. For examinations of these issues, see CRS Report R45221, Capital Markets, Securities Offerings, and Related Policy Issues, by Eva Su; and CRS Report R45301, Securities Regulation and Initial Coin Offerings: A Legal Primer, by Jay B. Sykes.

Applicable Regulation

No federal consumer protection law specifically targets cryptocurrencies. However, the way cryptocurrencies are sold, exchanged, or marketed can subject cryptocurrency exchanges or other cryptocurrency-related businesses to generally applicable consumer protection laws.89 For example, Section 5(a) of the Federal Trade Commission Act (P.L. 63-203) declares "unfair or deceptive acts or practices in or affecting commerce" unlawful and empowers the Federal Trade Commission (FTC) to prevent people and most companies from engaging in such acts and practices. In recent years, the FTC has brought a number of enforcement actions against cryptocurrency promoters and mining operations due to potential violations of Section 5(a).90

In addition, Title X of the Dodd-Frank Act grants the Consumer Financial Protection Bureau (CFPB) certain rulemaking, supervisory, and enforcement authorities to implement and enforce certain federal consumer financial laws that protect consumers from "unfair, deceptive, or abusive acts and practices."91 These authorities apply to a broad range of financial industries and products, and they arguably could apply to cryptocurrency exchanges as well. Although the CFPB has not actively exercised regulatory authorities in regard to the cryptocurrency industry to date, the agency is accepting cryptocurrency-related complaints and previously has indicated it would enforce consumer financial laws in appropriate cases.92

Both the FTC and the CFPB have made available informational material, such as consumer advisories, to educate consumers about potential risks associated with transacting in cryptocurrencies.93

In addition, all states have laws against deceptive acts and practices, and state regulators have enforcement authorities that could be exercised against cryptocurrency-related businesses.94 Additional consumer protections generally are applied to cryptocurrency exchanges at the state level through money transmission laws and licensing requirements.95 Money transmitters, including cryptocurrency exchanges, must obtain applicable state licenses and are subject to state regulatory regimes applicable to the money transmitter industry in each state in which they operate. For example, money transmitters generally must maintain some amount of low-risk investments and surety bonds—which are akin to an insurance policy that pays customers who do not receive their money—as safeguards for customers in the event they do not receive money that was to be sent to them.96

Arguments That Current Protections Are Inadequate

Certain observers assert that consumers may be especially susceptible to being deceived or misinformed when dealing in cryptocurrencies.97 Cryptocurrency is a relatively new type of asset, and consumers may not be familiar with how cryptocurrencies work and how they derive their value.98 This unfamiliarity may mean a consumer could be unknowingly charged excessive fees when using or exchanging cryptocurrencies; deceived about cryptocurrencies' true value; or unaware of the possibility or likelihood of loss of value, electronic theft, or loss of access to cryptocurrency due to losing or forgetting associated public or private keys.99 In addition, a feature of cryptocurrency transfers is irreversibility, which could leave consumers without recourse in certain cryptocurrency transactions.

Although certain federal laws and regulations intended to protect consumers (such as those described in "Applicable Regulation," above) do apply to certain cryptocurrency transactions, others may not. Some of those laws and regulations that do not currently apply are specifically designed to protect consumers engaged in the electronic transfer of money, require certain disclosures about the terms of financial transactions, and require transfers to be reversed under certain circumstances. For example, the Electronic Fund Transfer Act of 1978 (EFTA; P.L. 95-630) requires traditional financial institutions engaging in electronic fund transfers to make certain disclosures about fees, correct errors when identified by the consumer, and limit consumer liability in the event of unauthorized transfers.100 In general, EFTA protections appear not to apply to cryptocurrency transactions, because these transactions do not involve a financial institution as defined in the EFTA.101

The application of state laws and consumer protections to cryptocurrency transactions is not uniform, and the stringency of regulation can vary across states.102 This variation could create a situation in which consumers in states with relatively lax regulation are inadequately protected.

If Congress decides current consumer protections are inadequate, policy options could include extending the application of certain electronic fund transfer protections to consumers using cryptocurrency exchanges and service providers and granting federal agencies additional authorities to regulate those businesses.

Arguments That Current Regulation Is Unnecessarily Burdensome

Proponents of cryptocurrencies have asserted that the application of a state-by-state consumer protection regulatory regime to cryptocurrency exchanges is unnecessarily onerous. They note that certain state regulations applicable to these exchanges are designed to address risks presented by traditional money transmission transactions (i.e., allowing fiat money to be submitted at one location and picked up at another location). For example, the previously mentioned requirements to maintain low-risk investments and surety bonds are intended to ensure customers will receive transmitted money.103 Cryptocurrency proponents argue that the services provided and the risks presented by cryptocurrency exchanges are substantively different from those of traditional money transmitters and that the requirements placed on those businesses—particularly requirements to hold minimum amounts of assets to back cryptocurrencies they hold on behalf of customers—are ill-suited to the cryptocurrency exchange industry.104

Supporters of cryptocurrencies further argue that if the United States does not reduce the regulatory burdens involved in cryptocurrency exchanges, the country will be at a disadvantage relative to others in regard to the development of cryptocurrency systems and platforms.105

If Congress decides the current regulatory framework is unnecessarily burdensome, some argue that one policy option would be to enact federal law applicable to cryptocurrency exchanges (or virtual currency exchanges more broadly) that preempts state-level requirements.106

Monetary Policy Considerations

As discussed in the "Government Authority: Fiat Money" section, in the United States, the Federal Reserve has the authority to conduct monetary policy with the goals of achieving price stability and low unemployment. The central banks of other countries generally have similar authorities and goals. Some central bankers and other experts and observers have speculated that the widespread adoption of cryptocurrencies could affect the ability of the Federal Reserve and other central banks to implement and transmit monetary policy, and some have suggested that these institutions should issue their own digital, fiat currencies.

Possible Effects of Widespread Adoption of Private Cryptocurrencies

The mechanisms through which central banks implement monetary policy can be technical, but at the most fundamental level these banks conduct monetary policy by regulating how much money is in circulation in an economy. Currently, the vast majority of money circulating in most economies is government-issued fiat money, and so governments (particularly credible governments in countries with relatively strong, stable economies) have effective control over how much is in circulation.

However, if one or more additional currencies that the government did not control (such as cryptocurrencies) were also prevalent and viable payment options, their prevalence could have a number of implications. The widespread adoption of such payment options would limit central banks' ability to control inflation, as they do now, because actors in the economy would be buying, selling, lending, and settling in cryptocurrency. Central banks would have to make larger adjustments to the fiat currency to have the same effect as previous adjustments, or they would have to start buying and selling the cryptocurrencies themselves in an effort to affect the availability of these currencies in the economy.107

Because cryptocurrency circulates on a global network, the actions of one country that buys and sells cryptocurrency to control its availability could have a destabilizing effect on other economies that also widely use that cryptocurrency; in this way, one country's approach to cryptocurrency could undermine price stability or exacerbate recessions or overheating in another country. For example, as economic conditions in one country changed, that country would respond by attempting to alter its monetary conditions, including the amount of cryptocurrency in circulation. However, the prescribed change for that economy would not necessarily be appropriate in a country that was experiencing different economic conditions. The supply of cryptocurrency in this second country nevertheless could be affected by the first country's actions.108

Another challenge in an economy with multiple currencies—as would be the case in an economy with a fiat currency and cryptocurrencies—is that the existence of multiple currencies adds difficulty to buyers and sellers making exchanges; all buyers and sellers must be aware of and continually monitor the value of different currencies relative to each other. As an example, such a system existed in the United States for periods before the Civil War when banks issued their own private currencies. The inefficiency and costs of tracking the exchange rates and multiple prices in multiple currencies eventually led to calls for and the establishment of a uniform currency.109

Central Bank Digital Currencies

To date, governments (Venezuela excepted) generally have not been directly involved in the creation of cryptocurrencies; one of the central goals in developing the technology was to eliminate the need for government involvement in money creation and payment systems. However, cryptocurrency's decentralized nature is at the root of certain risks and challenges related to its lack of widespread adoption by the public and its use by criminals. These risks and challenges have led some observers to suggest that perhaps central banks could use the technologies underlying cryptocurrencies to issue their own central bank digital currencies (CBDCs) to realize certain hoped-for efficiencies in the payment system in a way that would be "safe, robust, and convenient."110

Much of the discussion related to CBDCs is speculative at this point. The extent to which a central bank could or would want to create a blockchain-enabled payment system likely would be weighed against the consideration that these government institutions already have trusted digital payment systems in place. Because of such considerations, the exact form that CBDCs would take is not clear; such currencies could vary across a number of features and characteristics.111 For example, it is not clear that cryptography would be necessary to validate transactions when a trusted intermediary such as a central bank could reliably validate them.112

Nevertheless, some central banks are examining the idea of CBDCs and the possible benefits and issues they may present.113 The possibility of CBDCs' introduction raises a number of questions about their potential benefits, challenges, and impacts on the effectiveness of monetary policy.

Potential Benefits of Central Bank Digital Currencies

Numerous observers assert that CBDCs could provide certain benefits. For example, some proponents extend the arguments related to cryptocurrencies providing efficiency gains over traditional legacy systems to CBCDs; they contend that central banks could use the technologies underlying cryptocurrencies to deploy a faster, less costly government-supported payment system.114

Observers have speculated that a CBDC could take the form of a central bank allowing individuals to hold accounts directly at the central bank. Advocates argue that a CBDC created in this way could increase systemic stability by imposing additional discipline on commercial banks. Because consumers would have the alternative of safe deposits made directly with the central bank, commercial banks would likely have to offer interest rates and security at a level necessary to attract deposits above any deposit insurance limit.115

Potential Challenges of Central Bank Digital Currencies

One of the main arguments against CBDCs made by critics, including various central bank officials, is that there is no "compelling demonstrated need" for such a currency, as central banks and private banks already operate trusted electronic payment systems that generally offer fast, easy, and inexpensive transfers of value.116 These opponents argue that a CBDC in the form of individual direct accounts at the central bank would reduce bank lending or inappropriately expand central banks' role in lending. A portion of consumers likely would shift their deposits away from private banks toward central bank digital money, which would be a safe, government-backed liquid asset. Deprived of this funding, private banks likely would have to reduce their lending, leaving central banks to decide whether or how they should support lending markets to avoid a reduction in credit availability.117

In addition, skeptics of CBDCs object to the assertion that these currencies would increase systemic stability, arguing that CBDCs would create a less stable system because they would facilitate runs on private banks. These critics argue that at the first signs of distress at an individual institution or the bank industry, depositors would transfer their funds to this alternative liquid, government-backed asset.118

Potential Effects of Central Bank Digital Currencies on Monetary Policy

Observers also disagree over whether CBDCs would have a desirable effect on central banks' ability to carry out monetary policy. Proponents argue that, if individuals held a CBDC on which the central bank set interest rates, the central bank could directly transmit a policy rate to the macroeconomy, rather than achieving transmission through the rates the central bank charged banks and the indirect influence of rates in particular markets.119 In addition, if holding cash (which in effect has a 0% interest rate) were not an option for consumers, central banks potentially would be less constrained by the zero lower bound.120 The zero lower bound is the idea that the ability of individuals and businesses to hold cash and thus avoid negative interest rates limits central banks' ability to transmit negative interest rates to the economy.

Critics argue that taking on such a direct and influential role in private financial markets is an inappropriately expansive role for a central bank. They assert that if CBDCs were to displace cash and private bank deposits, central banks would have to increase asset holdings, support lending markets, and otherwise provide a number of credit intermediation activities that private institutions currently perform in response to market conditions.121

Prospectus

The future role and value of cryptocurrencies remain highly uncertain, due mainly to unanswered questions about these currencies' ability to effectively and efficiently serve the functions of money and displace existing money and payment systems. Proponents of the technology assert cryptocurrencies will become a widely used payment method and provide increased economic efficiency, privacy, and independence from centralized institutions and authorities. Skeptics—citing technological challenges and obstacles to widespread adoption—assert cryptocurrencies do not effectively perform the functions of money and will not be a valuable, widely used form of money in the future. As technological advancements and economic conditions play out, policymakers likely will be faced with various issues related to cryptocurrency, including concerns about its alleged facilitation of crime, the adequacy of consumer protections for those engaged in cryptocurrency transactions, the level of appropriate regulation of the industry, and cryptocurrency's potential effect on monetary policy.

CRS Resources

|

Topic |

CRS Product |

|

Brief Overview of Cryptocurrencies |

CRS In Focus IF10824, Introduction to Financial Services: "Cryptocurrencies", by David W. Perkins |

|

Blockchain Technology |

CRS Report R45116, Blockchain: Background and Policy Issues, by Chris Jaikaran |

|

Crypto-assets and ICOs: Policy Issues |

CRS In Focus IF11004, Financial Innovation: Digital Assets and Initial Coin Offerings, by Eva Su CRS Report R45221, Capital Markets, Securities Offerings, and Related Policy Issues, by Eva Su |

|

Crypto-assets and ICOs: Legal Issues |

CRS Report R45301, Securities Regulation and Initial Coin Offerings: A Legal Primer, by Jay B. Sykes |

|

Cryptocurrencies and Financial Sanctions |

CRS In Focus IF10825, Digital Currencies: Sanctions Evasion Risks, by Rebecca M. Nelson and Liana W. Rosen |