Introduction

In 2016, the price of oil averaged about $41 per barrel (average composite price), down from $92 per barrel in 2014. Oil prices have been on the rise since 2016, when the Organization of Petroleum Exporting Countries (OPEC) announced production cuts. The Energy Information Administration (EIA) projects crude oil prices to average about $65 per barrel through 2018, falling slightly to $63 per barrel in 2019.1 In mid-October 2018, prices are fluctuating between $75-$80 per barrel.

A number of legislative proposals and executive branch initiatives designed to increase domestic energy supply, enhance energy security, or amend the requirements of environmental statutes that apply to energy development are before the 115th Congress. There are legislative proposals that include new revenue-sharing provisions for coastal states (H.R. 4239) that would allow states the authority to manage federal energy leases within their state. The Trump Administration's theme of "energy dominance" has translated into several administration initiatives and executive orders, including the opening of ANWR under the 2017 tax revision (P.L. 115-97), modifying monument designations, streamlining the permitting process for energy projects on federal land, and authorizing more leasing in the Outer Continental Shelf (OCS) under a new Draft Proposed Program (DPP) for 2019-2024. The new DPP would supersede the current five-year leasing program (2017-2022). Conversely, there are congressional proposals that oppose this Administration's policy direction. For example, S. 750/H.R. 2242 would, among other things, prohibit the Bureau of Land Management (BLM) or the Bureau of Ocean Energy Management (BOEM) from renewing or extending any nonproducing fossil fuel lease on federal land or water, and H.R. 4426 seeks to promote renewable energy development and reform fossil fuel leasing and development on federal land.2

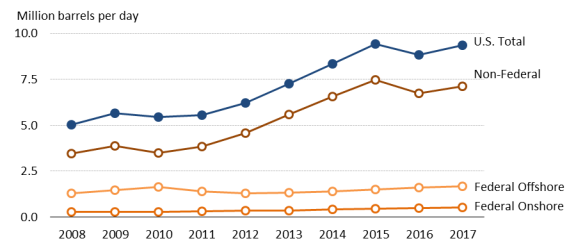

A key question addressed in this discussion is how much oil and gas is produced in the United States each year and how much of that comes from federal versus nonfederal areas. Oil production has risen in federal areas (onshore and offshore) over the past 10 years but has increased at a faster rate on nonfederal lands. Nonfederal crude oil production rapidly increased in the past few years, primarily due to improved extraction technology, favorable geology, and the ease of leasing, more than doubling daily production between FY2008 and FY2017 (see Table 1 and Figure 1). The federal share of total U.S. crude oil production fell from its peak at nearly 36% in 2009 to less than 24% in 2017.

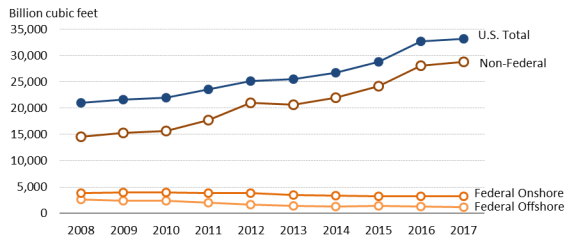

U.S. natural gas prices, on the other hand, have remained low for the past several years, as the shale gas boom has resulted in rising supplies of natural gas. This has allowed gas to become more competitive with coal for power generation. Overall, annual U.S. natural gas production rose by about 7.5 trillion cubic feet (tcf) since 2008,3 while annual production on federal lands (onshore and offshore) fell by about 2.0 tcf (or nearly 32%) over the same time period. Natural gas production on nonfederal lands rose by 50% over the same time period.4 The big shale gas plays have been primarily on nonfederal lands and have attracted a significant portion of investment for natural gas development. The federal share of natural gas production fell from nearly 25% in 2008 to 13% in 2017.

This report presents issues that Congress may consider as it examines U.S. oil and natural gas production data for federal and nonfederal areas with an emphasis on the past 10 years of production.5

U.S. Crude Oil Production: Federal and Nonfederal Areas

Historically, according to Department of the Interior (DOI) data, crude oil production on federal lands (onshore and offshore) was consistently under 20% of total U.S. production until the late 1990s. Annual production then surged on federal lands (primarily offshore), rising to over 30% in the early 2000s and reaching a high point of nearly 36% in 2009.6 There are an estimated 5.3 billion barrels of proved oil reserves located on federal acreage onshore,7 and another 3.9 billion barrels of proved reserves offshore (nearly all in the Gulf of Mexico).8 Taken together, U.S. federal oil reserves equal about 26% of all U.S. crude oil (and condensate) reserves, which are estimated at 35.2 billion barrels, according to the EIA.9 Proved oil reserves are amounts accessible under current policy, prices, and technology. Higher prices often translate into higher reserve estimates.

Crude oil production on federal lands, particularly offshore, is likely to continue to make a significant contribution to the U.S energy supply picture and could remain consistently higher than previous decades depending on the level of total U.S. crude oil production. There is continued interest among some in Congress to open more federal lands for oil and gas development and increase the speed of the permitting process. But having more lands accessible may not translate into higher levels of production on federal lands, as industry seeks out the most promising prospects and higher returns, which in recent years have come on more accessible nonfederal lands. Others in Congress would like to discontinue the leasing of fossil fuels altogether on federal lands or account for climate change impacts and other environmental impacts in its evaluation of energy leasing projects on federal land.

Table 1. U.S. Crude Oil Production: Federal and Nonfederal Areas 2008-2017

(million barrels per day)

|

Year |

U.S. Total |

Nonfederal |

Total Federal |

Federal Offshore |

Federal Onshore |

|||||||||

|

|

|

|

2.224 (23.7) |

|

|

|||||||||

|

|

|

|

2.098 (23.7) |

|

|

|||||||||

|

|

|

|

2.065 (21.9) |

|

|

|||||||||

|

|

|

|

1.907 (21.8) |

|

|

|||||||||

|

|

|

|

1.703 (22.8) |

|

|

|||||||||

|

|

|

|

1.680 (25.9) |

|

|

|||||||||

|

|

|

|

1.694 (30.0) |

|

|

|||||||||

|

|

|

|

1.911 (34.9) |

|

|

|||||||||

|

|

|

|

1.911 (35.7) |

|

|

|||||||||

|

|

|

|

1.508 (30.2) |

|

|

Source: Federal data obtained from the Office of Natural Resources Revenue (ONRR) Production Data, as of August 20, 2018, http://www.onrr.gov. U.S. total production data obtained from EIA, Petroleum and Other Liquids, U.S. Field Production of U.S. Crude Oil, July 31, 2018, http://www.eia.gov.

Notes: Data includes lease condensate, defined by EIA as a liquid hydrocarbon recovered from lease separators or field facilities at associated and nonassociated natural gas wells.

|

Figure 1. U.S. Crude Oil Production: (million barrels per day) |

|

|

Source: Federal data obtained from ONRR Production Data, http://www.onrr.gov. Nonfederal from EIA. Figure created by CRS. Note: This figure represents the data in Table 1 graphically. |

Federal Onshore Oil Production Data for Selected States

Crude oil production trends for selected states in Table 2 show significant increases in New Mexico and North Dakota and moderate increases in Colorado and Wyoming. California and Utah declined in production over the past few years. The six states below account for 96% of onshore oil production on federal land.

|

Year |

California |

Colorado |

New Mexico |

North Dakota |

Utah |

Wyoming |

|

2017 |

25.4 |

14.3 |

244.0 |

95.8 |

24.9 |

107.1 |

|

2016 |

30.2 |

12.0 |

211.0 |

73.6 |

25.6 |

104.6 |

|

2015 |

36.7 |

13.8 |

219.5 |

74.1 |

31.6 |

122.0 |

|

2014 |

40.2 |

14.9 |

181.0 |

57.6 |

63.7 |

107.5 |

|

2013 |

41.9 |

12.0 |

143.5 |

49.9 |

33.1 |

94.4 |

|

2012 |

41.6 |

12.2 |

121.5 |

44.4 |

30.7 |

89.9 |

|

2011 |

40.9 |

11.3 |

97.3 |

34.1 |

29.2 |

88.7 |

|

2010 |

38.2 |

10.4 |

86.1 |

26.7 |

29.7 |

88.9 |

|

2009 |

38.5 |

10.8 |

77.9 |

20.6 |

30.1 |

87.6 |

|

2008 |

36.9 |

11.4 |

70.5 |

20.2 |

27.8 |

89.4 |

Source: Office of Natural Resources Revenue (ONRR) http://www.onrr.gov (see Data and Statistics).

U.S. Natural Gas Production: Federal and Nonfederal Areas

Natural gas production in the United States overall has steadily increased since 2008, while production on federal lands has declined each year from 2009 to 2017 (see Table 3 and Figure 2). Much of the decline can be attributed to offshore production falling by over 55%. Onshore production declines, beginning in FY2010, were less dramatic. Federal natural gas production fluctuated around 30% of total U.S. production for much of the 1980s through the early 2000s, after which there began a steady decline (as a percent of U.S. total production) through 2017. For example, federal natural gas production declined from about 25% of total U.S. gross withdrawals10 in 2008 to 13% of U.S. production in 2017; however, as noted below, this mostly reflects the significant growth in nonfederal production rather than the decline in total federal production. This picture of natural gas production is much different than that of federal crude oil in that federal natural gas had accounted for a much larger portion of total U.S. natural gas over the previous few decades.

Any increase in production of natural gas on federal lands is likely to be outpaced by increases on nonfederal lands, particularly because shale plays are primarily situated on nonfederal lands and are located where most of the growth in production has occurred in recent years and where future growth is projected to occur.

U.S. natural gas proved reserves are estimated at about 341.1 trillion cubic feet (tcf) by the EIA,11 of which the federal share is about 22% (69 tcf onshore, 6.6 tcf offshore).12 Nearly all of the offshore proved reserves are located in the Central and Western Gulf of Mexico (GOM).

|

Year |

U.S. Total |

Nonfederal |

Total Federal (% of U.S. Total) |

Federal Offshore |

Federal Onshore |

||||

|

2017 |

|

|

4,328 (13.0) |

|

|

||||

|

2016 |

|

|

4,541 (13.9) |

|

|

||||

|

2015 |

|

|

4,829 (14.7) |

|

|

||||

|

2014 |

|

|

4,861 (15.5) |

|

|

||||

|

2013 |

|

|

4,958 (16.8) |

|

|

||||

|

2012 |

|

|

5,389 (18.2) |

|

|

||||

|

2011 |

|

|

5,763 (20.2) |

|

|

||||

|

2010 |

|

|

6,259 (23.3) |

|

|

||||

|

2009 |

|

|

6,530 (25.1) |

|

|

||||

|

2008 |

|

|

6,331 (24.7) |

|

|

Source: Federal data obtained from ONRR Production Data, http://www.onrr.gov (as of August 20, 2018). Total U.S. natural gas production data obtained from EIA, Natural Gas, Natural Gas Gross Withdrawals and Production, July 31, 2018, http://www/eia/gov.

Notes: Natural gas production is reported in gross withdrawals.

|

Figure 2. U.S. Natural Gas Production: |

|

|

Source: Federal data obtained from ONRR Statistics, http://www.onrr.gov (using calendar year data). Figure created by CRS. Note: This figure represents the data in Table 3 graphically. |

Federal Onshore Natural Gas Production Data for Selected States

Production data below show that the leading natural gas producing states of Wyoming, New Mexico, and Colorado accounted for 88% of total onshore gas produced on federal land in 2017. Even though there were significant declines in Wyoming and New Mexico, they remain the top two states producing natural gas on federal leases.

|

Year |

Colorado |

New Mexico |

North Dakota |

Texas |

Utah |

Wyoming |

|

2017 |

652.9 |

801.4 |

65.4 |

34.3 |

189.7 |

1,372.0 |

|

2016 |

636.8 |

789.0 |

48.2 |

38.3 |

227.4 |

1,440.7 |

|

2015 |

664.7 |

803.2 |

42.4 |

33.5 |

264.7 |

1548.0 |

|

2014 |

742.1 |

785.7 |

27.1 |

38.8 |

280.8 |

1,537.0 |

|

2013 |

725.2 |

782.7 |

22.2 |

45.9 |

293.3 |

1,586.0 |

|

2012 |

734.9 |

806.2 |

18.1 |

57.1 |

328.3 |

1,730.0 |

|

2011 |

726.4 |

820.1 |

13.9 |

34.4 |

301.2 |

1,836.0 |

|

2010 |

686.3 |

841.2 |

11.1 |

21.7 |

288.9 |

1,938.0 |

|

2009 |

669.6 |

895.5 |

10.0 |

23.4 |

305.0 |

1,939.0 |

|

2008 |

622.7 |

927.1 |

10.9 |

25.1 |

296.8 |

1,857.0 |

Source: ONRR.

EIA Projections

In the short term, the EIA estimates show oil production increasing in federal offshore areas (lower 48), from 1.71 million barrels per day (mbd) in 2017 to 1.95 mbd in 2019, while EIA's longer-term estimates show a decrease in federal offshore (GOM) oil production overall, declining to 1.45 mbd in 2040.13 Overall, the EIA projects in the short term U.S. oil production reaching 11.70 mbd in 2019.14 Long-term estimates show U.S. oil production rising as high as 11.90 mbd by 2040.15 According to these estimates, federal lower 48 offshore production in 2040 could account for about 12% of total U.S. crude oil production. (See Table 5.)

Offshore dry natural gas production is projected to peak in 2019 at 1.36 tcf,16 with annual production dropping to 1.15 tcf in 2040. In contrast, total U.S. dry natural gas production is projected to rise from around 31 tcf in 2019 to 40 tcf in 2040 (See Table 6).

|

Year |

U.S. Federal Offshore |

U.S. Total |

|

2019 |

1.95 |

10.44 |

|

2040 |

1.45 |

11.90 |

Source: EIA, Annual Energy Outlook, 2018, February 8, 2018, https://www.eia.gov/outlooks/aeo/tables_ref.php.

Note: Nearly all of U.S. offshore oil and gas production is in the Gulf of Mexico.

|

Year |

U.S. Federal Offshore |

U.S. Total |

|

2019 |

1.28 |

31.19 |

|

2040 |

1.14 |

40.15 |

Source: EIA, Annual Energy Outlook, 2018, February 8, 2018. http://www.eia.gov/outlooks/aeo.

Note: Natural gas production is reported as dry production. Nearly all of U.S. offshore oil and gas production is in the Gulf of Mexico.

Oil and Natural Gas Lease Data for Federal Lands

Based on the federal government's 2008 inter-agency Phase III report, 113 million acres of onshore federal lands were open and accessible for oil and gas development and about 166 million acres were off-limits or inaccessible.17 The BLM says it is addressing public concerns (including legal challenges) prior to a lease sale at a higher rate than in the past.

In 2017, 38% of onshore federal leases and 71% of offshore leases were not in production (see Table 7). In the offshore areas, 73% of the acreage that is leased is not in production, but may have an approved exploration or development plan. Offshore, 97 million of 1.7 billion acres of federal water (or 6%) are available for leasing under the current leasing schedule. The current five-year leasing program18 (FY2017-FY2022) has 10 lease sales scheduled in the Gulf of Mexico and 1 in the Alaska region.19

In January of 2018, BOEM released a draft proposed program (DPP) for the period from 2019 through 2024.20 The DPP proposes 47 lease sales during the five-year period: 12 in the Gulf of Mexico region, 19 in the Alaska region, 9 in the Atlantic region, and 7 in the Pacific region. If implemented, the DPP would replace the final years of the current five-year program and would increase the acreage available for leasing to more than 90% of total OCS acreage, up from 6% under the current plan.

However, about 50% of the undiscovered technically recoverable resource (UTRR)21 oil and 40% of the gas is available under the current Five-Year Leasing Program. In the previous Five-Year Program (2012-2017) 78% of the OCS UTRR were made available for lease. Removing most of Alaskan oil and gas resources from the current Five-Year Program eliminated about 25 billion barrels of oil and 104 tcf of natural gas classified as UTRR.

Through FY2017, according to the BLM and the Bureau of Ocean Energy Management (BOEM), there were over 41 million acres of oil and gas leases in federal areas (onshore and offshore). About 25.7 million acres were located onshore and an additional 15.4 million acres were offshore. Approximately 12.8 million federal acres onshore and about 4.1 million federal acres offshore were in production. (See Table 7.)

For onshore federal land, the amount of acreage under lease fell from 34.6 million acres in 2014, to 25.7 million acres in 2017, a 25% drop, as oil production rose by 16% over the same three-year period. The number of producing acres remained the same over from 2014 to 2017. Natural gas production onshore declined by 9% over the same time period.

|

Onshore 2017 |

Onshore 2016 |

Offshore 2017 |

Offshore 2016 |

|

|

Acreage under lease |

25.7 million acres |

27.2 million acres |

15.4 million acres |

17.7 million acres |

|

Leased acres producing |

12.8 million acres |

12.8 million acres |

4.1 million acres |

4.5 million acres |

|

Leased acres not in production or exploration |

12.9 million acres |

14.4 million acres |

11.3 million acres |

13.2 million acres |

|

Number of Leases |

38,556 |

40,143 |

2,905 |

3,341 |

|

Producing Leases (or with approved DOCD)a |

23,991 |

23,926 |

836 |

917 |

|

Percentage of producing leases |

62 |

60 |

29 |

27 |

Source: Offshore data: DOI/BOEM, Combined Leasing Reports, December 1, 2016, and December 1, 2017 (http://www.boem.gov). Onshore data: DOI/BLM, Oil and Gas Statistics (https://www.blm.gov/programs/energy-and-minerals/oil-and-gas/oil-and-gas-statistics), accessed August 21, 2018.

a. A DOCD is a Development Operations Coordination Document that must be submitted for approval to BOEM before offshore development activities begin.

Issues for Congress

Withdrawals and Access to Federal Land and Water

Onshore Federal Land

The President and executive branch agencies have historically issued executive orders, secretarial orders, and public land orders to withdraw federal lands from mineral entry and other uses under what was viewed as the President's authority, including certain statutory authorities such as the Antiquities Act. Modern executive withdrawals are governed by the Federal Land Policy and Management Act of 1976 (FLPMA, 43 U.S.C. 1701 et seq.). FLPMA repealed earlier land withdrawal authorities.

The Antiquities Act, which was not repealed by FLPMA, authorizes the President to "declare by public proclamation ... objects of historic or scientific interest that are situated on land owned or controlled by the Federal Government to be national monuments," and "may reserve parcels of land as part of the national monuments." The amount of land that the President may reserve is limited "to the smallest area compatible with the proper care and management of the objects to be protected."22

A withdrawal restricts the use of land under the multiple use management framework, typically segregating the land from some or all public land laws as well as some or all of the mining and mineral leasing laws for a period of 20 years.23 Initially, the area is segregated for two years during which time an environmental review is conducted to determine whether a longer term withdrawal of 20 years is warranted. The longer term withdrawal is often subject to renewal.

FLPMA established a federal land use management policy that includes land use planning based on a multiple-use approach that allows for significant public and congressional input. Sections of FLPMA detail procedures (see 43 U.S.C. 1714 (d)) for the sales and acquisition of public lands, withdrawals, and exchanges of public lands. Under FLPMA, withdrawals can be made by the executive branch or Congress. The withdrawal can be temporary or permanent. Under this section of the code the Secretary of the Interior may make, modify, extend, or revoke withdrawals.

Withdrawals of parcels exceeding 5,000 acres require congressional approval. Proposed withdrawals must be submitted to Congress with a report explaining the reasons for the withdrawal in detail, effects on the economy and environment, alternatives to withdrawal, how the BLM is consulting with other agencies and groups, and the geological and mineral potential of the areas proposed. The Secretary, however, can make emergency withdrawals of any size for up to three years. A report explaining the reasons why must be available three months following a withdrawal.

Generally, federal land withdrawals are subject to valid existing rights, meaning that the minerals rights holder may develop those minerals subject to terms of the federal land-managing agency (e.g., the National Park Service, BLM, or the Forest Service).

Mineral industry representatives maintain that federal withdrawals inhibit mineral exploration and limit the reserve base even when conditions are favorable for production. Mineral reserves are not renewable. Thus, they argue that whether minerals are in the public or private sector, without new reserves or technological advancements, mineral production costs may rise. They further contend that higher domestic costs may lead to greater exploration on foreign soil, boosting import dependence.

Critics of mineral development argue that mining often is an exclusive use of land inasmuch as it can preclude other uses, and that in many cases there is no way to protect other land values and uses short of withdrawal of lands from development under the law. They point to unreclaimed areas that have been mined for hardrock minerals in the past, Superfund sites related to past mining and smelting, and instances where development of resources could adversely affect or destroy scenic, historic, cultural, and other resources on public land.

Congressional debate has been ongoing for decades over how much federal land should be available for energy development or other uses and how much should be set aside (e.g., off limits or restricted) for conservation and environmental concerns. There has been recent controversy over revoking or modifying previously withdrawn areas.

ANWR

One previously withdrawn area, the Arctic National Wildlife Refuge (ANWR) was opened to oil and gas development under the 2017 tax revision (P.L. 115-97). The law enacted directs the Secretary of the Interior to establish an oil and gas leasing program in ANWR's coastal plain (1002 Area).

Mean economically recoverable oil estimates reported by the U.S. Geological Survey for the coastal plain of ANWR are 7.3 billion barrels but gas prospects are considered low. Opponents argue that this pristine environment is being used for other purposes and should be protected for caribou migration, poplar bear habitat, and its biological diversity. And further, they argue that the oil and gas resources should be left in the ground because of concerns over climate change. (For more details on ANWR see CRS Report RL33872, Arctic National Wildlife Refuge (ANWR): An Overview, by [author name scrubbed], [author name scrubbed], and [author name scrubbed].)

National Monuments

The Trump Administration placed under review for modification (i.e., reduction in size), areas withdrawn for National Monuments such as Bears Ears and Grand Staircase Escalante under the Antiquities Act during the Obama and Clinton Administrations, respectively. The Administration's final report, issued on December 5, 2017, recommended that Bears Ears be shrunk by 85% of the original area and the Grand Staircase Escalante National Monument be reduced by about 50% of its original size. These areas, even though there are some valid existing mineral rights, could open the door for additional mineral entry and development. The Trump Administration was challenged in court immediately, and those challenges remain pending as of this update. At issue in those cases is whether the President can revoke or make major modifications to National Monuments under the Antiquities Act. (For more details, see CRS Report R41330, National Monuments and the Antiquities Act, by [author name scrubbed].)

The Outer Continental Shelf

The Outer Continental Shelf Lands Act (OCSLA) is the primary law governing leasing of offshore areas under the control of the United States for exploration for and production of oil and natural gas. The law also addresses offshore federal leasing for all other energy development. Section 12(a) of OCSLA provides that the President may periodically withdraw unleased lands of the Outer Continental Shelf.

In the OCS, the Trump Administration's Executive Order (EO), 13795, issued on April 28, 2017, modified the Obama Administration's withdrawal of the Chukchi and Beaufort Seas in Alaska among other areas of the OCS, and reviewed the National Marine Sanctuaries. An outstanding concern (unresolved) is whether the President has the authority to make this modification under OCSLA (12a) provision. The statute does not explicitly grant (allow) the President to unilaterally revoke existing withdrawals. For more details see CRS Legal Sidebar WSLG1799, Trump's Executive Order on Offshore Energy: Can a Withdrawal be Withdrawn?, by [author name scrubbed].

Streamlining the Application for Permits to Drill

Another issue that Congress may consider whether to continue addressing (for onshore federal lands) is streamlining the processing of applications for permits to drill (APDs). Some Members contend that this would be one way to help boost energy production on federal lands and would be consistent with the Trump Administration's energy policy of "energy dominance."

After an oil and gas lease has been obtained, either competitively or noncompetitively, an application for a permit to drill must be approved for each oil and gas well. As stated in the Mineral Leasing Act, Section 226 (g) (for onshore federal lands), "no permit to drill on an oil and gas lease issued under this chapter may be granted without the analysis and approval by the Secretary concerned of a plan of operations covering proposed surface-disturbing activities within the lease area." The application form (APD form 3160-3) must include, among other things, a drilling plan, a surface use plan, and evidence of bond/surety coverage. The surface use plan should contain information on drillpad location, pad construction, the method for containment and waste disposal, and plans for surface reclamation.24 This issue was addressed in the Energy Policy Act of 2005 (EPAct '05) (P.L. 109-58), providing new timelines and the introduction of a pilot program to streamline the permitting process.

Streamline Pilot

EPAct '05 included a provision to initiate and fund a pilot program at seven BLM field offices in an effort to streamline the permitting process for oil and gas leases on federal lands. Initial results from the pilot project were published according to the timetable required by EPAct '05 (within three years after enactment). The conclusion was that the pilot made a difference in reducing the processing times for APDs at the pilot offices overall and increased the number of environmental inspections.

BLM noted that the National Environmental Policy Act (NEPA) processing time for APDs and rights of way (ROW) applications fell from 81 to 61 days or roughly 25% due to "colocation" of agency staff. BLM reported that the number of environmental inspections went up by 78% from FY2006 to FY2007.25 BLM reported mixed results at the specific field offices. While some of the offices processed more permits in 2007 than they did in 2005, all the pilot sites reported more completed environmental inspections.26 Funding for the pilot program was made permanent under the FY2015 National Defense Authorization Act (P.L. 113-291).

The Trump Administration Initiative

The Trump Administration introduced an initiative in Secretarial Order 3354 to seek ways to improve the oil and gas leasing system and ensure that the regulatory process serves its intended purpose. More specifically, the initiative seeks to clear up the backlog of applications for permits to drill and hold quarterly lease sales held by the BLM state field offices. An Instruction Memorandum (IM 2018-034) was published on February 1, 2018, that presents BLM policy with the intent to streamline (expedite) the oil and gas leasing process by "alleviating unnecessary impediments and burdens and to ensure quarterly lease sales are held as required in the MLA."

Congressional Activity

Congressional action includes several bills that would also seek to shorten the timelines for approving the permitting process for energy development. H.R. 6106 would clarify the categorical exclusions (CE) authorized under EPAct '05 and the use of additional CEs to expedite oil and gas permitting. There are provisions that would allow more flexibility in skipping the environmental review (ER) or an environmental impact statement (EIS) if action has only minimum impact on the human environment (not defined in the bills). S. 2151, a bill to streamline the oil and gas permitting process, would remove drilling permit requirements under the Federal Oil and Gas Royalty Management Act (FOGRMA) of 1982 for an action occurring within an oil and gas drilling or spacing unit under certain circumstances. H.R. 6088 would allow for a notification of permit to drill (NPD) to be submitted to the Secretary of the Interior in lieu of an application for permit to drill (APD) for developed fields, existing wells, and an approved land use plan and an environmental review that was prepared within the last 10 years under NEPA.

Critics, including some Members of Congress and environmental groups, argue that the proposals to shorten the review timelines would limit public input into land use decisions and overlook important environmental impacts.

Background

Prior to the Energy Policy Act of 2005, a major concern that prompted the permit streamlining debate was the lengthy timetable to process an APD. The BLM attributed the longer timelines to the rewriting of outdated Resource Management Plans (RMPs). BLM revised several RMPs over the preceding decade. Leading up to the provisions in EPAct '05 that attempted to streamline the permitting process, the BLM announced, in April 2003, new strategies to expedite the APD process. The new strategies included processing and conducting environmental analyses on multiple permit applications with similar characteristics, implementing geographic area development planning for an oil or gas field or an area within a field, establishing a standard operating practice agreement that identifies surface and drilling practices for oil and gas operators, allowing for a block survey of cultural resources, promoting consistent procedures across BLM offices, and revising relevant BLM manuals.27 EPAct '05 Section 366 (Deadline for Consideration of Application for Permits) provided a new timeline for BLM to process APDs.28

Addressing a backlog, the previous and current Administrations processed more APDs than they received from 2009 to 2017, with the exception of 2014 (See Table 8). They received far fewer applications over that period than had been received annually from 2006 to 2008. Even though the number of pending applications fell steadily from 2008 to 2013, the ratio of APDs pending to APDs processed was higher than during the period 2006-2008. The BLM expects to process about 4,300 APDs in 2018. In addition, as of the beginning of 2016 there were 7,000 approved APDs not in the exploration or production stages (approved but not drilled).29

|

Fiscal Year |

New APDs Received |

Total APDs Processed |

APDs Pending at |

|||||||||

|

2017 (est.) 2016 2015 |

|

|

|

|||||||||

|

2014 |

|

|

|

|||||||||

|

2013 |

|

|

|

|||||||||

|

2012 |

|

|

|

|||||||||

|

2011 |

|

|

|

|||||||||

|

2010 |

|

|

|

|||||||||

|

2009 |

|

|

|

|||||||||

|

2008 |

|

|

|

|||||||||

|

2007 |

|

|

|

|||||||||

|

2006 |

|

|

|

Source: DOI/ BLM, FY2018 Budget Justification for years FY2013-FY2017. For earlier years, see earlier budget justifications, and DOI, Oil and Gas Utilization, Onshore and Offshore, May 2012.

It took an average of 307 days for the BLM to process (approve or deny) an APD in FY2011, but that declined to an average of 257 days in FY2016 (up from 194 days in FY2013).30 The BLM has stated in its annual budget justifications that overall processing times per APD rose to such high levels in FY2011 and other years because of the complexity of the process, but they expect shorter time frames in the future.

Some critics of this time frame highlight the relatively faster process for permit processing on private and state lands. However, crude oil and gas development on federal lands takes place in a wholly different regulatory framework than that of development on private lands.31 State agencies permit drilling activity on private lands within their states, with some approving permits within 10 business days of submission. This faster approval rate does not necessarily diminish the additional work required by the state to address other state requirements. But often, some surface management issues are negotiated between the producer and the individual land/mineral owner. A private land versus federal land permitting regime does not lend itself to an "apples-to-apples" comparison.

State Management of Federal Energy Leases

Congressional Activity

Several legislative proposals introduced in the 115th Congress would amend the Mineral Leasing Act (MLA) to authorize states to manage either federal oil and gas leases, or all energy leases, on federal land.32 The intent of these bills is to expedite the energy leasing and permitting process, which is consistent with the Administration's strategy of U.S. "energy dominance." Most of the bills are similar in that the Secretary of the Interior could delegate (transfer) the responsibility of managing oil and gas or all energy leases once a state program has been established and an application showing the state's capacity and capability has been submitted. Thus, the question arises, do states have the capacity and capability to manage federal leases?

The bills would further propose that, generally, any action by a state would not be subject to or considered a federal action, and would not require a federal permit or a federal license. Among other things, such state actions would not be subject to the Endangered Species Act (ESA) or NEPA. The bills would require that there be no effect on royalties or other federal revenues.

There is language in three of the bills (H.R. 4239, S. 316, and S. 2319) that would prohibit the Secretary of the Interior from enforcing any federal regulation guidance or permit requirement for hydraulic fracturing for oil, gas or geothermal energy on any land in a state that has its own regulations for hydraulic fracturing.

Supporters argue that under a state process, energy development on federal lands would occur more efficiently and expediously. Critics argue that without the NEPA process, public input and a more rigorous environmental review would be lost.

State Authority

BLM regulations authorize cooperative agreements between federal and state agencies for joint administration and enforcement of oil and gas leases on federal land. The state may require mineral developers to obtain certain permits from state agencies.

Federal land managing agencies often delegate environmental regulatory roles to the state when they are as strict or stricter than federal policy. The MLA gives BLM discretionary power to attach conditions to mineral leases for protection of the interests of the United States, but provides that such provisions shall not be in conflict with the laws of the state. The MLA also includes a broad disclaimer against affecting "the rights of the state or other local authority to exercise any rights which they may have.…"33 FLPMA requires BLM's land use plans to provide for compliance with "applicable pollution control laws," but also to be as consistent as possible with state and local land use plans.34

In the offshore areas, states have significant input regarding energy development off their coastlines under both the Outer Continental Shelf Lands Act (43 U.S.C. Sec. 1331 et seq.) and the Coastal Zone Management Act of 1972 (P.L. 92-583, 16 U.S.C. Ch. 33).

Leased and Producing Acres

The number of federal producing acres may or may not be a function of how many acres are leased, and the number of acres leased may or may not correlate to production levels, and it is beyond the scope of this report to examine that issue thoroughly. (Table 9 provides data on the amount of federal acreage leased annually for onshore and offshore oil and gas development.) In recent years, some Members of Congress have proposed a $4/acre lease fee for nonproducing leases. This proposal grew out of efforts to promote more oil and gas drilling and development on public land and water (offshore) when gasoline prices spiked in 2006-2008. Some in Congress noted that there were many leases they believed were not being developed in a timely manner, while at the same time, others in Congress were advocating greater access to areas off-limits (such areas under leasing moratoria offshore). Higher rents for offshore leases were imposed by the Secretary of the Interior in 2009 to discourage holding unused leases and to move more leases into production, if possible.35 Rents escalate over time. The escalation in annual rents is significant, as they rise from $7/acre to $28/acre (in year-8 forward) in water depths less than 200 meters, and increase from $11/acre to $44/acre (in year-8 forward) in water depths between 200 and 400 meters. However, Congress has not established a similar escalation for onshore leases, as they remain $1.50/acre for years 1-5, and then rise to $2/acre thereafter.36

A nonproducing fee or an escalation of rents may not increase production but may increase the ratio of producing leases to active leases if some leaseholders relinquish their leases rather than pay the fee. Thus, there might be fewer "idle" leases and acreage not in production or exploration. The BLM can re-lease acreage that has been relinquished or passed over at a future lease sale.

|

Year |

Onshore Acres Leased |

Offshore Acres Leased |

||

|

2017 |

|

|

||

|

2016 |

|

|

||

|

2015 |

|

|

||

|

2014 |

|

|

||

|

2013 |

|

|

||

|

2012 |

|

|

||

|

2011 |

|

|

||

|

2010 |

|

|

||

|

2009 |

|

|

||

|

2008 |

|

|

||

|

2007 |

|

|

||

|

2006 |

|

|

||

|

2005 |

|

|

||

|

2004 |

|

|

||

|

2003 |

|

|

||

|

2002 |

|

|

||

|

2001 |

|

|

||

|

2000 |

|

|

Source: Onshore data obtained from BLM: Oil and Gas Statistics, accessed August 21, 2018. Offshore data obtained from BOEM, Oil and Gas Leasing, August 1, 2018 (https://www.boem.gov/Outer-Continental-Shelf-Lease-Sale-Statistics/).