Disaster Unemployment Assistance (DUA) benefits are available only to those individuals who have become unemployed as a direct result of a declared major disaster and who are not eligible for regular Unemployment Compensation (UC).1 First created in 1970 through P.L. 91-606, DUA benefits are authorized by the Robert T. Stafford Disaster Relief and Emergency Relief Act (the Stafford Act), which authorizes the President to issue a major disaster declaration after state and local government resources have been overwhelmed by a natural catastrophe or, "regardless of cause, any fire, flood, or explosion in any part of the United States" (42 U.S.C. 5122(2)). Based upon the request of the affected state's governor, the President may declare a major disaster. The declaration identifies the areas in the state eligible for assistance. The declaration of a major disaster provides the full range of disaster assistance available under the Stafford Act, including, but not limited to, the repair, replacement, or reconstruction of public and nonprofit facilities, cash grants for the personal needs of victims, housing, and unemployment assistance related to job loss from the disaster.

The UC program generally does not provide UC benefits to the self-employed, to those who are unable to work, or to those who do not have a recent earnings history.2 However, when the President declares a major disaster, individuals who would typically be ineligible for UC (or who have exhausted UC benefits) may be eligible for DUA.3 In some cases, UC beneficiaries who had an entitlement to UC benefits of fewer than 26 weeks and who had become unemployed as a direct result of a disaster and exhaust their weeks of UC entitlement may be entitled to some DUA benefits. No more than a total of 26 weeks of total benefits (UC plus DUA) are allowable in this situation.

DUA Financing

DUA benefits are funded through the Disaster Relief Fund (DRF) administered by the Federal Emergency Management Agency (FEMA). The DRF is funded annually through discretionary appropriations on a no-year basis, meaning that any unobligated funds from a previous fiscal year may be used in future fiscal years. In general, when the balance of the DRF has become low, additional funding has previously been provided through annual and/or supplemental appropriations to replenish the account. DOL administers the DUA program and coordinates with FEMA to provide the funds to the state UC agencies for payment of DUA benefits and payment of state administrative costs under agreements with DOL.4

DUA Eligibility

The individual eligibility requirements for DUA differ from the UC program requirements. First, an individual generally must have no entitlement to UC benefits. (UC beneficiaries who had an entitlement to UC benefits of fewer than 26 weeks and who had become unemployed as a direct result of a disaster and exhaust their weeks of UC entitlement may be entitled to DUA benefits. No more than a total of 26 weeks of benefits [UC plus DUA] are allowable in this situation.) For example, eligibility for DUA benefits does not necessarily require that the individual have a substantial work history and in some cases does not require that the worker be available for work (unlike the UC program requirements). In particular, the DUA regulation defines eligible unemployed workers to include

- the self-employed;

- workers who experience a "week of unemployment" following the date the major disaster began when such unemployment is a direct result of the major disaster;

- workers unable to reach the place of employment as a direct result of the major disaster;

- workers who were to begin employment and do not have a job or are unable to reach the job as a direct result of the major disaster;

- individuals who have become the breadwinner or major support for a household because the head of the household has died as a direct result of the major disaster;5 and

- workers who cannot work because of injuries caused as a direct result of the major disaster.

As with state UC programs, workers who do not have permission to work legally in the United States are not eligible for DUA benefits. Noncitizens must have a Social Security number and an alien registration card number in order to apply for DUA benefits.

Time Limit

Generally, applications must be filed within 30 days after the date the state announces availability of DUA benefits. When applicants have good cause, they may file claims after the 30-day deadline. This deadline may be extended. However, initial applications filed after the 26th week following the declaration date will not be considered.

Eligibility Clarification

On November 13, 2001, DOL issued a new interpretive rule clarifying the definition of the phrase "unemployment as a direct result of the major disaster." DOL issued this clarifying rule because the September 11, 2001, disasters presented a number of exigencies not anticipated by the existing regulations. The action by DOL amended 20 C.F.R. §625.5 by adding a new paragraph (c) to read as follows:

§625.5 Unemployment caused by a major disaster.

(c) Unemployment is a direct result of the major disaster. For the purposes of paragraphs (a)(1) and (b)(1) of this section, a worker's or self-employed individual's unemployment is a direct result of the major disaster where the unemployment is an immediate result of the major disaster itself, and not the result of a longer chain of events precipitated or exacerbated by the disaster. Such an individual's unemployment is a direct result of the major disaster if the unemployment resulted from:

(1) physical damage or destruction of the place of employment;

(2) physical inaccessibility of the place of employment due to its closure by the federal government, in immediate response to the disaster; or

(3) lack of work, or loss of revenues, provided that, prior to the disaster, the employer, or the business in the case of a self-employed individual, received at least a majority of its revenue or income from an entity that was either damaged or destroyed in the disaster, or an entity closed by the federal government in immediate response to the disaster.

Prior to the construction of this new rule, the phrase "unemployed as a direct result of a major disaster" had never been defined in the regulations. Although DOL issued the new clarifying rule in the wake of the September 11, 2001, disasters, the rule applies to any subsequently declared major disasters. The rule is intended to make clear a distinction between those individuals unemployed as an immediate result of the disaster itself, and those whose unemployment may have been caused by a long chain of events initiated by the disaster. The rule is also intended to exclude from DUA those individuals whose unemployment is the result of general economic decline that has been an indirect effect of a major disaster.

DUA Benefit Calculation

DUA benefits are generally calculated by state UC agencies under the provisions of the state law for UC in the state where the disaster occurred. The maximum weekly benefit amount is determined under the provisions of the state law. The minimum weekly DUA benefit a worker may receive is half of the average weekly UC benefit for the state where the disaster occurred.6 In all cases, workers will receive a DUA benefit that is at least half of the average UC benefit for that state and cannot receive more than the maximum UC benefit available in that state. DUA beneficiaries (because they are not entitled to regular UC or have exhausted their entitlement to UC) are not eligible to receive Extended Benefits (EB).

When a reasonable comparative earnings history can be constructed, DUA benefits are determined in a similar manner to regular state UC benefit rules. Self-employed persons are expected to bring in their tax records to prove a level of earnings for the previous two years. These records would take the place of the employer-reported wage data in UC benefit determination. Likewise, workers who would otherwise be eligible for UC benefits except for the injuries caused as a direct result of the disaster that make them unavailable for work would receive DUA benefits of an amount equivalent to what they would have received under the UC system if they were not injured and were available to work.

Workers who do not have a sufficient employment history to qualify for UC benefits (either as a new worker or as a recent hire) receive a DUA benefit equivalent to half of the average UC benefit for that state. Unemployed workers could also be eligible for reemployment services, which may include counseling and referrals to suitable work opportunities.

Temporary Extended Duration of DUA Benefits

DUA assistance is available to eligible individuals as long as the major disaster continues, but no longer than 26 weeks after the disaster declaration.7 The duration of DUA has been temporarily extended for certain disasters three times: after the September 11th terrorist attacks, after the 2005 Hurricanes Katrina and Rita, and after the 2017 Hurricanes Irma and Maria.

In the 107th Congress, P.L. 107-154 was signed into law on March 25, 2002, temporarily extending the duration of DUA benefits from 26 to 39 weeks for victims of the September 11, 2001, terrorist attacks in the declared major disaster areas in New York and Virginia. This was the first time the duration of DUA benefits was statutorily extended. This extension did not apply to any subsequent major disasters.

In the 109th Congress, P.L. 109-176 was signed into law on March 6, 2006, extending the duration of DUA benefits from 26 to 39 weeks for victims of the Hurricanes Katrina and Rita disasters. This extension ended on June 3, 2006, for those qualifying for benefits on account of Hurricane Katrina and on June 24, 2006, for those affected by Hurricane Rita. This extension did not apply to any subsequent major disasters.

In the 115th Congress, P.L. 115-254, the FAA Reauthorization Act of 2018, was signed into law on October 5, 2018. Among its many provisions, it retroactively extended DUA for an additional 26 weeks for persons who were unemployed in Puerto Rico and the U.S. Virgin Islands as a direct result of the 2017 Hurricane Irma or Hurricane Maria disasters. (This created a total potential entitlement to DUA of up to 52 weeks for some individuals.) Because the disasters had both been declared more than 52 weeks before the enactment of P.L. 115-254, the remaining DUA weeks will be paid retroactively.8 Individuals who worked in these areas and who have exhausted entitlement to UC or EB may also be eligible for DUA benefits for the remaining otherwise uncompensated weeks in the disaster assistance period that were not covered by UC and EB.9

Reduction in DUA Benefits

DUA benefits may be reduced by other income received by the DUA beneficiary. These reductions are made in a manner similar to how such additional income reduces UC benefits (e.g., all states disregard some earnings as an incentive to take short-term work while unemployed workers search for a permanent job), but do not mirror them exactly. The reductions are made for additional income that includes

- benefits or insurance for loss of wages due to illness or disability;

- supplemental unemployment benefits paid pursuant to a collective bargaining agreement;

- private income protection insurance;

- worker's compensation or survivor's benefits if the DUA beneficiary becomes household head due to the head of the household's death because of the disaster;

- retirement, pension, or annuity income;

- earnings from employment or self-employment; and

- subsidy or price support payments, crops insurance, and farm disaster relief payments.

Patterns in DUA Benefits

When the President declares a major disaster in a state and indicates DUA benefits may be available, the state's UC agency requests DUA funds from DOL, which in turn receives funds from the Disaster Relief Fund administered by FEMA. The DOL obligates a portion of that request to the state. The state may request more funding as a supplement if needed. Table 1 shows DUA benefit payments from FY2002 through April 2018.

|

Fiscal Year |

Benefit Payments |

|

2002 |

$15.3 |

|

2003 |

2.3 |

|

2004 |

7.4 |

|

2005 |

44.6 |

|

2006 |

401.1 |

|

2007 |

9.0 |

|

2008 |

7.0 |

|

2009 |

17.3 |

|

2010 |

1.4 |

|

2011 |

5.5 |

|

2012 |

7.2 |

|

2013 |

15.9 |

|

2014 |

0.9 |

|

2015 |

0.4 |

|

2016 |

2.0 |

|

2017 |

4.9 |

|

2018* |

39.2 |

Source: U.S. Department of Labor, Office of Workforce Security.

Note: * FY2018 is a partial year: October 2017-April 2018.

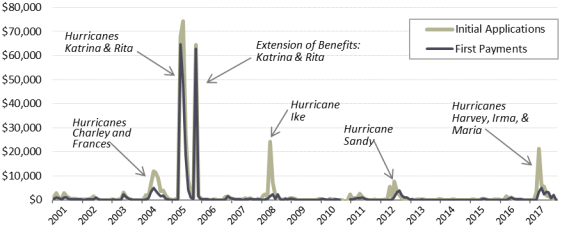

Figure 1 plots the number of individuals who applied for DUA benefits (Initial Claims) and the number of individuals who received DUA benefits for at least one week (First Payments) from January 2001 through April 2018. As with the UC program, many more individuals apply for DUA benefits than receive them.

|

Figure 1. Disaster Unemployment Assistance: Initial Claims and First Payments, January 2001-April 2018 |

|

|

Source: CRS figure from data provided by U.S. Department of Labor, Office of Workforce Security. |

There is a seasonal element to claims and payments that centers on the hurricane season (running from June 1 to November 30). The one exception to the patterns of initial claims and first payments centering on the hurricane season is the September 11, 2001, terrorist attacks. Workers continued to apply for and receive benefits stemming from the terrorist attacks in substantial numbers through March 2002. This was attributable to the extension of benefits for an additional 13 weeks provided by P.L. 107-154.

The Hurricanes Katrina and Rita disasters overwhelm all other disasters in the amount of benefits that were paid. The extension of DUA benefits for an additional 13 weeks allowed workers who would have originally been receiving UC benefits and had exhausted them to file for DUA benefits. This created a second wave of first filings and initial claims in March 2006.

How to Find Out If DUA Is Available for a Major Disaster in a State

To determine whether DUA is available in a state, disaster victims must ascertain

- whether the President has declared the event a major disaster;

- for which counties (if any) DUA has been made available; and

- how to contact the state UC agency.

FEMA maintains a list of disasters by calendar year, located at http://www.fema.gov/disasters. Each disaster is given a contract number, which provides a link to relevant information pertaining to each disaster, including a list of counties designated to receive assistance.

To determine if individual disaster assistance is available for a particular address (and the potential availability of DUA), individuals should access http://disasterassistance.gov and follow the instructions.

If counties in a state have been included in a major disaster declaration and have been designated to receive DUA, it is necessary to contact the state's unemployment agency to obtain the details of how to apply for and receive DUA benefits. The DOL maintains a website with links to each state's unemployment agency at https://www.careeronestop.org/localhelp/unemploymentbenefits/unemployment-benefits.aspx.