Background

This report briefly describes cotton's special treatment, relative to other traditional farm program crops, in the 2014 farm bill. It also reviews the legislative attempts—which successfully culminated with the Bipartisan Budget Act of 2018 (P.L. 115-123; BBA)—to reintegrate cotton as a program crop eligible for major farm revenue support programs. Then, it reviews the specifics of the new seed cotton program and discusses three potential issues related to the establishment of seed cotton as a program crop.

The WTO Brazil-U.S. Cotton Trade Dispute

As a member of the World Trade Organization (WTO), the United States has committed to abide by WTO rules and disciplines.1 WTO rules covering agricultural trade and domestic support programs for agriculture have played a large role in shaping current U.S. cotton policy.2 In particular, in 2002, Brazil—a major cotton export competitor—initiated a long-running WTO dispute settlement case against U.S. cotton support programs. Brazil charged that these programs were depressing international cotton prices and thus artificially and unfairly reducing the quantity and value of Brazil's cotton exports, causing economic harm to its cotton sector. In 2004, a WTO panel ruled against the United States in the cotton case. As a result of the ruling and the potential for WTO-sanctioned retaliation, the United States made several policy changes—including both legislative action and administrative adjustments—in an attempt to bring the related cotton support programs into WTO compliance. Despite these efforts, Brazil successfully argued that the United States had failed to fully comply with the WTO panel's ruling. As a result, in 2009 the WTO granted Brazil authority to retaliate against U.S. goods and services.3

With trade retaliation in the offing, the United States removed upland cotton from eligibility for the PLC and ARC revenue support programs in the 2014 farm bill. Then, in October 2014, the two countries signed a Memorandum of Understanding (MOU) that finalized a mutual resolution to the case based on U.S. cotton policy as enacted in the 2014 farm bill.4 By agreeing to a mutual MOU, the two countries avoided trade retaliation. In particular, according to Section VI of the MOU—the Peace Clause—Brazil would refrain from retaliation prior to September 30, 2018, providing that the United States limits cotton payments to those programs specifically authorized by the 2014 farm bill such as STAX and MAL.

Cotton in the 2014 Farm Bill

Under the 2014 farm bill, upland cotton was made ineligible for new revenue support programs available to traditional program crops—referred to as covered commodities5—and was given a reduced marketing loan rate.6 Instead, upland cotton producers were eligible for new temporary transition payments and a stand-alone, county-based revenue insurance policy called the Stacked Income Protection Plan (STAX).7 Cotton producers also remained eligible for several smaller (in terms of payments) support programs that were unaffected by the WTO case.

Cotton Excluded from New Revenue Programs

The 2014 farm bill established two new support programs—the Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) programs—were established.8 The new revenue programs provide support to U.S. agricultural producers of covered commodities through either statutory reference prices under PLC or historical revenue guarantees based on a five-year moving average of crop prices and yields under ARC. Payments under ARC and PLC are decoupled from current plantings, meaning they are not based on current production. The decoupled payment feature was added in earlier farm bills to comply with WTO rules governing domestic support programs. Instead, payments are made on historical program acres (known as base acres)9 for a select list of program crops referred to as covered commodities. Cotton was explicitly removed from the list of covered crops, thus making cotton base acres (estimated at 17.6 million acres) ineligible for participation in the ARC and PLC programs.

Historical Cotton Program Acres Renamed as Generic Base

To avoid having cotton producers completely lose access to farm program benefits on their historic cotton base acres, those acres were renamed "generic base"10 and retained in a producer's total acreage base. As such, they were eligible for program payments under ARC and PLC but only if a covered crop (excluding upland cotton) was planted on the generic base.11 Thus, ARC and PLC payments made on generic base were coupled to actual plantings of program crops.12 The "coupling of ARC/PLC payments to specific crops" provided strong incentives to plant other eligible covered crops on generic base acres in lieu of upland cotton.

Cotton-Specific Programs Remaining in the 2014 Farm Bill

Producers of upland cotton remain eligible for support under several other farm programs under the 2014 farm bill including benefits under the following programs:

- Marketing Assistance Loan (MAL) Program for Cotton Producers. The MAL program provides both a floor price and interim financing for so-called loan commodities. A participating producer may put a harvested "loan" crop under a nine-month, nonrecourse loan valued at a statutory commodity loan rate. The loan uses the crop as collateral, and the loan rate, in effect, establishes a price guarantee. Special benefits are available if the adjusted world price—announced weekly by USDA—falls below the cotton loan rate. The 2014 farm bill changed the loan rate for upland cotton from $0.52 per pound to the simple average of the adjusted prevailing world price for the immediately preceding two market years but not less than $0.45 per pound or more than $0.52 per pound.13 During the first two years of the 2014 farm bill, cotton producers received $700 million in payments under the MAL program—$372 million in 2014 and $328 million in 2015. More recent data are not yet available.

- CTAP. The 2014 farm bill also established CTAP as an offset for the loss of ARC and PLC program eligibility. Upland cotton producers were eligible for CTAP payments on a percentage of former cotton base acres for crop years 2014 and 2015—60% of base received payments in 2014, 36.5% of base in 2015. CTAP outlays were a combined $484 million during 2014 and 2015. Transition payments ended after the 2015 crop.

- CGCS. In 2016, USDA used its administrative authority under the Commodity Credit Corporation (CCC) Charter Act to offer U.S. upland cotton producers CGCS payments valued at $328 million. The CGCS program provided cost-share payments for cotton producers' cotton ginning costs based on their 2015 cotton plantings multiplied by 40% of average regional ginning costs.14 The CGCS program was offered again in 2018 with similar payment terms but at a reduced 20% share of average regional ginning costs based on their 2016 cotton plantings.15 This second round is projected to result in $227 million in CGCS payments in 2018.16

- Economic Adjustment Assistance for Domestic Users (EAAU) Program (P.L. 113-79, §1207(c)). EAAU payments are made to domestic users for all documented use of upland cotton on a monthly basis regardless of the origin of the upland cotton. The payment rate is $0.03 per pound and results in CCC outlays of about $49 million per year. Although the payments are made to cotton users, at least a portion of the payment is likely returned to producers in the form of higher prices associated with the increased demand from domestic users.

- Cotton Storage Cost Reimbursements. Under Section 1204(g) of the 2014 farm bill, USDA cotton storage subsidies are available to U.S. cotton producers whose cotton production is being held under the MAL program.

- STAX.17 STAX was offered as a shallow-loss, area-wide revenue insurance product that could indemnify losses in county revenue of greater than 10% of expected revenue depending on the coverage level selected by a producer.18 To encourage participation, USDA pays 80% of the policy premium for STAX. In contrast to the revenue guarantees available under ARC and PLC, which have a statutorily fixed lower price bound (equal to the PLC reference price), the revenue guarantee under STAX is recalculated each year and has decreased significantly following several years of cotton market declines since 2014. As a result, participation in STAX has been low and has declined each year that it has been available (29.3% in 2015, 25.3% in 2016, and 23.3% in 2017).

Industry Push for Cotton Reintegration into ARC/PLC Programs

Economic conditions in the U.S. farm economy steadily declined from mid-2014 into 2018, including both lower farm commodity prices and income.19 Under these conditions, the new ARC and PLC programs paid out nearly $20 billion to eligible program crops during the first three years of the 2014 farm bill ($5.3 billion in 2014, $7.8 billion in 2015, and $6.9 billion in 2016).20 However, cotton producers could only indirectly benefit via coupled ARC and PLC payments made to program crops planted on generic base acres. Meanwhile, net indemnity payments (indemnities minus producer-paid premium) under the new cotton revenue insurance program, STAX, were relatively small at $20.2 million in 2015 and $37.3 million in 2016, and they turned negative (i.e., premiums paid exceeded indemnities received) at -$26.1 million in 2017.21 The National Cotton Council (NCC), in 2014, claimed that lower per-acre cotton revenues coincided with elevated costs of production and that additional economic relief was needed.22 The U.S. cotton sector was also concerned about having resources redirected to other program crops planted on generic base. In response to its exclusion from PLC program eligibility, the U.S. cotton sector actively sought to regain cotton's former status as a "covered commodity" but on the basis of cottonseed rather than cotton lint.

|

Cotton Co-Products: Lint and Cottonseed The successful cultivation of cotton results in two products: fiber (or lint) and cottonseed, which are separated from the un-ginned cotton boll by ginning the harvested cotton. In 2017, the United States produced 9.8 billion pounds of lint23 from upland cotton valued at $6.7 billion and 13.5 billion pounds of cottonseed24 valued at $1 billion.25 About 78% of U.S. upland cotton lint production is exported, while the balance is used domestically. According to the NCC, more than half of U.S. upland cotton lint production (57%) goes into apparel, 36% into home furnishings, and 7% into industrial products.26 In contrast, cottonseed goes almost entirely to domestic users—about two-thirds is fed whole to livestock (primarily dairy cows), while the remaining seed is crushed, producing a high-grade salad oil and a high protein meal for livestock, dairy, and poultry feed. |

In September 2015, the NCC proposed that the Secretary of Agriculture treat cotton lint and cottonseed separately for purposes of the ARC and PLC programs. Instead of focusing on lint, as done by past farm policy, the Secretary of Agriculture could use his apparent authority granted under the 2014 farm bill to designate cottonseed as an "other oilseed."27 Several members of the House Agriculture Committee agreed with the NCC proposal and, in December 2015, urged then-Secretary of Agriculture Tom Vilsack to use his authority under the farm bill to designate cottonseed as a covered oilseed, thus allowing cottonseed to be a "covered commodity" eligible for the ARC and PLC programs immediately and without further action by Congress.28

In response, Vilsack contended that he did not have such authority because Congress had explicitly removed cotton from the list of eligible "covered commodities" and given it two special programs—STAX and CTAP, although CTAP expired in 2015. Furthermore, Vilsack argued that Congress could amend the farm bill to explicitly allow upland cotton producers to participate in ARC or PLC, or, alternatively, it could remove a provision that has appeared since FY2012 in annual appropriations acts (e.g., §715 of P.L. 115-31, the FY2017 agriculture appropriation) that effectively prohibits USDA from providing emergency assistance through the CCC.

Seed Cotton as Program Crop: Legislative Evolution

Cotton's proponents then determined that the path forward would be through an act of Congress.29 Such an act of Congress would have budgetary implications. The general view of the agricultural community was that, if a new cotton program were to be incorporated into the next farm bill, it would likely have a budgetary cost, thus requiring possibly difficult budgetary offsets.

|

PAYGO Budgetary Restrictions on Changes to the Farm Bill Title I farm programs, in general, receive mandatory funding. Under mandatory funding, the authorizing legislation (i.e., the farm bill) defines both who is eligible to participate and how a program payment is triggered. The farm bill does not impose any spending limit on mandatory funding. Instead, program outlays are determined by producer participation, weather, and market forces. In contrast, for discretionary spending the farm bill sets program parameters and specifies funding levels. Discretionary funding levels are determined by the appropriating committees through the annual federal budget process. Thus, budget enforcement of discretionary spending is through future appropriations and budget resolutions. Outlays for mandatory programs under a new farm bill are evaluated by the Congressional Budget Office (CBO) using multiyear "baseline" projections and are enforced through "PAYGO" budget rules.30 CBO baseline projections involve five- and 10-year budget estimates calculated under the assumption that current law is extended over the projection period. CBO's five- and 10-year cost estimates establish a program's baseline funding.31 The baseline is the benchmark against which proposed changes from current law that would affect mandatory spending are measured. The baseline cost impact of a proposed program change is referred to as its budget score. Any proposed program change from current law that increases outlays from CBO's baseline (such as the designation of cottonseed as an "other oilseed") that is determined to have a positive score and under PAYGO must be offset by reductions in outlays under other current-law programs to preserve baseline neutrality. |

FY2017 Appropriations Bill (115th Congress)

Proponents of reintegrating cotton into the ARC and PLC programs first tried to include an amendment to the FY2017 appropriations bill that would build off the 2015 NCC cottonseed proposal.32 During spring 2017, a proposal had emerged for including cottonseed as a covered commodity with its own policy parameters—a MAL loan rate of $8.00 per cwt. and a PLC reference price of $15.88 per cwt. House negotiators identified two potential budget offsets for the cottonseed proposal: (1) declaring producers who participate in the cottonseed ARC or PLC program ineligible for STAX and (2) reallocating generic acres back to cottonseed base and away from other program crops. During the first three years of the 2014 farm bill, over $1 billion in ARC and PLC payments had been made to crops planted on generic base (Table 1). Thus, substantial budget offset appeared to be available. To further reduce its budgetary cost, the cottonseed proposal would not be authorized to begin or receive any funding until FY2018. Thus it would have no budget cost in the FY2017 appropriations bill under consideration.

|

Crop Year |

Total Generic Basea (1,000 Acres) |

Generic Base with Payments (1,000 Acres) |

Payments on Generic Base ($ Million) |

||||||||||||||||||

|

ARC |

PLC |

Total |

ARC |

PLC |

Total |

||||||||||||||||

|

2014 |

|

|

|

|

|

|

|

|

|

||||||||||||

|

2015 |

|

|

|

|

|

|

|

|

|

||||||||||||

|

2016 |

|

|

|

|

|

|

|

|

|

||||||||||||

|

Total |

|

|

|

|

|

|

|

|

|

||||||||||||

Source: FSA, ARC/PLC Program, https://www.fsa.usda.gov/programs-and-services/arcplc_program/index. Payment data for 2014 is as of September 30, 2016; 2015 data, February 2, 2017; and 2016 data, April 5, 2018.

Notes:

a. When base acres are aggregated by county by crop year, they add to 19.1 million acres in each of 2014 and 2015 as a result of double-cropping on generic base acres. FSA, "ARC/PLC Election Data," as of May 29, 2015, https://www.fsa.usda.gov/Assets/USDA-FSA-Public/usdafiles/arc-plc/excel/arc_plc_election_data.xlsx.

However, the cottonseed proposal became linked to proposed changes to the dairy Margin Protection Program (MPP). Senate allies of the dairy industry sought additional baseline funding to make adjustments to the MPP in response to the dairy industry's concerns but were unable to reach a budget compromise.33 Ultimately, the FY2017 appropriations bill that became law (Consolidated Appropriations Act of 2017, P.L. 115-31; May 5, 2017) included neither the cottonseed nor MPP proposal. Instead, the explanatory statement34 accompanying P.L. 115-31 directed USDA to prepare a report within 60 days on the needs of cotton growers and to consider providing immediate assistance to dairy producers through the CCC.

Senate FY2018 Appropriations Bill (S. 1603, 115th Congress)

The cottonseed proposal was revised with a lower PLC reference price of $15.00 per cwt. but the same MAL loan rate of $8.00 per cwt. and was included two months later in the Senate committee-reported Agriculture appropriations bill for FY2018 (S. 1603, §728, 115th Congress, July 20, 2017).35 The new proposal was more specific in terms of how cottonseed producers would be allowed to designate generic base acres as cottonseed base acres and about the formula to be used to determine a producer's cottonseed program yields—both of which are needed to calculate PLC payments. In addition, the Senate bill included dairy program changes alongside the cottonseed proposal. The joint provisions would have authority for $1 billion in new baseline spending over 10 years but required no budget offsets, because they would not start until after FY2018. However, Congress was unable to reach agreement on an FY2018 appropriations bill for reasons unrelated to agricultural policy, and the cotton issue remained unresolved into fall 2017.

Emergency Supplemental Bill (H.R. 4667, 115th Congress)

In December 2017, agricultural policy proponents in the House were able to include cotton and dairy proposals into an emergency appropriations bill (H.R. 4667) that was intended to provide assistance for victims of hurricanes and wildfires that had occurred during 2017.36 The cotton proposal was reshaped as a "seed cotton" program that uses a weighted average of both lint and cottonseed (described below). However, the House-passed supplemental appropriations bill, H.R. 4667, was not considered in the Senate.

Bipartisan Budget Act of 2018 (P.L. 115-123; BBA)

On February 9, 2018, Congress passed a two-year budget deal—the BBA (P.L. 115-123)37—that included the emergency supplemental bill provisions along with both the seed cotton and dairy provisions that were in the House-passed supplemental appropriations bill (H.R. 4667). Both of these farm program changes have long-term policy implications because they change the 2014 farm bill statutes. In particular, Section 60101(a) of the BBA amends the 2014 farm bill to add seed cotton as a "covered commodity," making cotton eligible for the PLC and ARC programs.

Seed Cotton: Program Design

The BBA provision, Section 60101(a), includes seed cotton as a covered commodity, thus making it eligible for participation in PLC and ARC beginning with crop year 2018. Participating producers must make three decisions during the signup period (July 30, 2018, to December 7, 2018):38 how to allocate their generic base acres, whether to update cotton program yields, and whether to participate in ARC or PLC. Signup is for the crop year 2018.

Allocation of Generic Base Acres

Before producers make any decision regarding ARC or PLC, they must decide how to reallocate their generic base to either seed cotton or to other program crops by the following formula:

No recent history of planting covered commodities: If the owner of a farm has not planted any covered commodities (including seed cotton) during the 2009 through 2016 crop years, then the generic base acres shall be allocated to "unassigned crop base" and no longer be eligible for ARC or PLC payments.

Recent history of planting covered commodities: The owner of a farm with a history of planting covered commodities during the 2009 through 2016 crop years shall allocate generic base acres between seed cotton and other program crops as follows:

- 1. To seed cotton base acres in a quantity equal to the greater of 80% of their generic base or the average upland cotton plantings (or prevented from being planted) during the 2009 to 2012 crop years (not to exceed the total generic base acres on the farm) or

- 2. To base acres for covered commodities (including seed cotton) in proportion to each crop's share of planted (or prevented from being planted) acreage during 2009 to 2012.39

Any residual or unassigned generic base acres (defined as any positive difference between generic base and the seed cotton base acres allocated under the first choice) are no longer eligible for program payments for any covered crop.

Payment Yield Choice

The seed cotton program yield is set at 2.4 times the historical upland cotton program yield (established by the 2008 farm bill [P.L. 110-246]). Producers may retain their farms' current upland cotton payment yield or opt for a one-time opportunity to update their yield based on 90% of the average yield on planted acres for the 2008 through 2012 crop years.

Program Choice

For the 2018 crop year, producers have a one-time opportunity to elect ARC or PLC for seed cotton. If no election is made, PLC becomes the automatic choice. The ARC/PLC enrollment period for the 2018 crop year began November 1, 2017, and will end on December 7, 2018.40 It is widely assumed that cotton producers with base acres will enroll in PLC.41

Payment Parameters

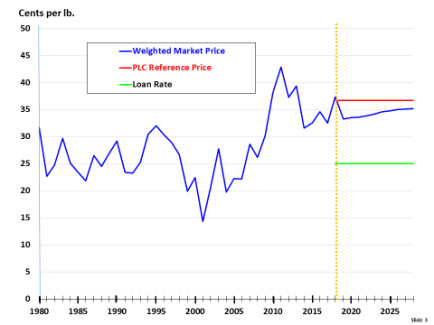

Seed cotton uses the same payment determinations for ARC and PLC as the other program crops but subject to its own statutorily fixed reference price and market loan rate. The seed cotton PLC reference price is set at 36.7 cents per pound. Seed cotton payments are to be made on 85% of the seed cotton base. Because seed cotton has never been a covered commodity, no price series exists and, thus, must be defined.42 The calculated seed cotton price (referred to as the "effective" price) is defined as the weighted annual price for upland cotton lint and cottonseed weighted by their share of combined production (lint plus cottonseed) measured in pounds (Figure 1). It is an artificial price that is computed only for purposes of operating the PLC and ARC programs.43 If the effective price is less than the reference price of 36.7 cents per pound, payments are triggered under the PLC program. A producer's payment equals the product of the payment rate (i.e., the difference between the PLC reference price and the effective price) times the seed cotton program yield times 85% of the seed cotton base.

Upland cotton production remains eligible for the MAL program under the original 2014 farm bill with a loan rate that floats between 45 and 52 cents per pound of harvested cotton lint based on the simple average of the adjusted prevailing world price for the immediately preceding two market years. The new seed cotton provisions do not establish a nonrecourse MAL for seed cotton. However, for purposes of calculating the maximum potential seed cotton payment rate, seed cotton is deemed to have a MAL rate of 25 cents per pound. Finally, any farm that enrolls seed cotton base acres in either ARC or PLC is ineligible for STAX.

CBO Cost Projections

In February 2018, as part of the BBA score, CBO estimated the cost of seed cotton payments under the ARC and PLC programs at $1.270 billion over five years (2018-2022) and $2.961 billion over 10 years (2018-2027).44 However, according to CBO, the net costs of the seed cotton provision in the BBA would be reduced to $61 million over 10 years by associated budget offsets—including the reallocation of generic base and the removal of residual generic base from ARC and PLC program eligibility (-$2.188 billion over 10 years) and by repealing the eligibility for the STAX program for cotton producers that enroll their seed cotton base in either ARC or PLC (-$711 million over 10 years).

Potential Issues

Three issues that could figure into future policy debate as a result of this program change include the potential for large budget costs if commodity markets weaken further, the realignment of program payment acres, and considerations surrounding the potential for re-opening of the WTO U.S.-Brazil cotton dispute

Potential Budget Cost of Seed Cotton as a Program Crop

Projections for PLC payments on seed cotton base are sensitive to changes in market prices. In April 2018 CBO released new baseline projections of USDA's mandatory farm program outlays including seed cotton as a covered commodity. Under slightly different market price expectations, CBO estimated the cost of seed cotton payments under the ARC and PLC programs to be $2.015 billion over five years (2018-2022), up 59% from the February 2018 score. Figure 1 compares the historical and projected weighted seed cotton price since 1980 and compares it with the PLC reference price and loan rate established for seed cotton in the BBA.

|

Figure 1. PLC Reference Price Compared with Seed Cotton Weighted-Average Price (Actual and Projected) |

|

|

Source: The PLC reference price for seed cotton of 36.7 cents per pound, the seed cotton loan rate is 25 cents per pound, and the formula for calculating the seed cotton weighted market price ("effective price") are from the Bipartisan Budget Act of 2018 (P.L. 115-123, §60101(a)(2)). Projections for prices and production are from the CBO Baseline Projections, "USDA's Mandatory Farm Programs," April 2018. Notes: The PLC payment rate equals the PLC reference price minus the higher of the effective price or the loan rate. The annual effective price for seed cotton is calculated as the average of the annual farm prices for upland cotton and cottonseed, each weighted by their share of total production measured in pounds. The projected annual effective price for seed cotton is calculated using price projections for upland cotton and cottonseed, weighted by share of combined production in pounds as projected by CBO. |

Base Acres Reduction

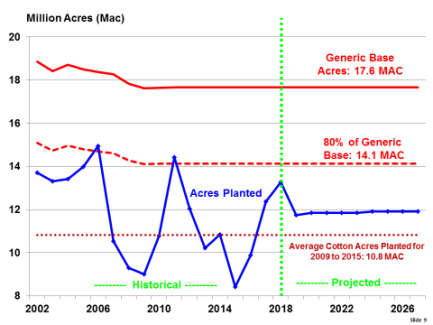

The reallocation of generic base to seed cotton or other covered commodities, combined with the elimination of payments to residual base (unallocated generic base), suggests that a significant portion of historical upland cotton base acres could become ineligible for revenue support payments. The likelihood of PLC payments to seed cotton base, as suggested in the previous section, could provide an incentive for reallocating generic base to seed cotton rather than to other program crops. Upland cotton producers planted an average of 10.8 million acres during the 2009-2015 period compared with 17.6 million acres of generic base (Figure 2). To obtain the highest seed cotton base possible, most cotton producers might opt to reallocate 80% of generic base to seed cotton per the statutory reallocation formula for farms with a recent history of covered crops. If so, national seed cotton base would be approximately 14.1 million acres. This, in turn, would imply that as much as 20% of generic base (or 3.56 million acres) would be residual generic base and thus be disqualified from receiving farm revenue support payments. This contributes to the size of the budgetary offset in the CBO score for the BBA.

|

Figure 2. Upland Cotton: Generic Base versus Planted Acres (Under the Provisions of the Bipartisan Budget Act of 2018, P.L. 115-123, Section 160101(a)) |

|

|

Source: Historical data for 2002-2018 are from NASS; projected data for 2019-2027 are from CBO April 2018 baseline projections. Notes: Mac = million acres. |

WTO U.S.-Brazil Cotton Dispute

Under the October 2014 MOU—signed by Brazil and the United States to avoid trade retaliation by Brazil—the United States agreed to limit domestic cotton support payments to those programs specifically authorized by the 2014 farm bill. However, two new U.S. cotton support programs have been implemented since the October 2014 MOU—the CGCS program and seed cotton as a covered commodity eligible for ARC and PLC payments.

Potential Revival of WTO U.S.-Brazil Cotton Dispute

According to Section VI of the MOU—the Peace Clause—Brazil would refrain from retaliation prior to September 30, 2018, provided that the United States limits cotton payments to those programs specifically authorized by the 2014 farm bill. There is some ambiguity about how Brazil might respond under WTO rules, if at all, to the addition of the two new U.S. cotton programs. For example, Brazil might choose to ignore them, or it might find these new U.S. cotton support programs to be in violation of the MOU. Under the Peace Clause of the MOU,45 Brazil must inform the United States and provide a reasonable opportunity for informal bilateral consultations before Brazil requests official dispute settlement consultations on any current domestic support program or policy.46

Alternatively, since the two new cotton support programs were implemented after the MOU was signed, there may be a legal question as to whether these programs would qualify as "current domestic support" under the MOU. Brazil might argue that these new cotton programs fall outside the MOU and that Brazil would have no obligation to inform and informally consult with the United States before requesting official consultations as part of formal dispute settlement procedures. Or Brazil could choose to operate outside of the WTO framework and impose retaliatory tariffs (or a similar trade action) on selected U.S. agricultural products.47

Finally, Brazil could avoid the issue of whether the MOU has been violated by simply awaiting the MOU's expiration on September 30, 2018. There is some ambiguity about how Brazil may proceed with charges against U.S. cotton programs after the MOU's expiration—whether Brazil could use the existing dispute settlement case and extend its retaliation authority or would have to start a new WTO dispute settlement case.48

Potential Mitigating Factors

A potential counterargument would be that, under the seed cotton related provisions of the BBA, Congress has replaced coupled payments linked to crops planted on generic base acres with decoupled payments under the new seed cotton program, thus making U.S. farm programs more WTO-compliant, not less. It is also unclear how to interpret the CGCS repeat payments, which, although linked to the previous year's plantings, were separated by a year (2017) of non-payments. Thus, CGCS payments are not decoupled from producer behavior (potentially leading to distortive incentives), but they do not occur on a continuous basis such that cotton producers may not necessarily factor CGCS payments into their production behavior.

Several economists have also raised more general concerns about linking cotton program payments to cotton market prices, particularly when the seed cotton reference price—which represents a composite of upland cotton and cottonseed market prices—is not intuitive and appears high relative to historical and projected market conditions.49 Still other economists contend that large government payments tend to mute market signals, and any incentive to produce more cotton than the market can support at current prices has potentially negative impacts on developing countries.50 However, these policy concerns may not, of themselves, be sufficient to justify a claim that the MOU has been violated or that these new programs are out of compliance with WTO rules.

Furthermore, it is not clear to what extent Brazil would have to show evidence (to either a WTO panel or the United States) that the United States is in violation of the MOU. If Brazil were compelled to show harm before a WTO panel would accept Brazil's claim that the United States had violated the MOU, this would likely delay any evidence-based determination until late 2020. This is because the seed cotton program will first be implemented for the 2018 crop. If any PLC seed cotton payments are triggered, they would not be paid out until after October 1, 2019, and would not be reported by USDA until December 2019 or January 2020 at the earliest.