Introduction

Families may choose to save for college or elementary and secondary education expenses using tax-advantaged qualified tuition programs (QTPs), also known as 529 plans. This report provides an overview of the mechanics of 529 plans and examines the specific tax advantages of these plans. For an overview of all tax benefits for higher education, see CRS Report R41967, Higher Education Tax Benefits: Brief Overview and Budgetary Effects, by Margot L. Crandall-Hollick.

Overview of 529 Plans

529 plans, named for the section of the tax code which dictates their tax treatment, are tax-advantaged investment trusts used to pay for education expenses. The specific tax advantage of a 529 plan is that distributions (i.e., withdrawals) from this savings plan are tax-free if they are used to pay for qualified higher education expenses. In addition up to $10,000 may be withdrawn tax-free per beneficiary per year and used for qualifying elementary and secondary school expenses. If some or all of the distribution is used to pay for nonqualified expenses, then a portion of the distribution is taxable, and may also be subject to a 10% penalty tax.1 (A description of qualified and nonqualified expenses is provided later in this report.)

Generally, a contributor, often a parent, establishes an account in a 529 plan for a designated beneficiary, often their child.2 Upon establishment of a 529 account, an account owner, who maintains ownership and control of the account, must also be designated. In many cases the parent who establishes the account for their child also names herself or himself as the account owner.

According to federal law, payments to 529 accounts must be made in cash using after-tax dollars.3 Hence, contributions to 529 plans are not tax-deductible on federal income taxes to the contributor. The contributor and designated beneficiary cannot direct the investments of the account, and the assets in the account cannot be used as a security for a loan. A contributor can establish multiple accounts in different states for the same beneficiary.4 Contributors are not limited to how much they can contribute based on their income. With respect to higher-education expenses, beneficiaries are not limited to how much they can receive based on their income. With respect to elementary and secondary school expenses, beneficiaries can withdraw the amount of their K-12 tuition expenses up to $10,000 tax-free from a 529 plan. (This limit applies to all accounts, not each account.) However, each 529 plan has established an overall lifetime limit on the amount that can be contributed to an account, with contribution limits ranging from $250,000 to nearly $400,000 per beneficiary.5

Types of 529 Plans: Prepaid and Savings Plans

There are two types of 529 plans: "prepaid" plans and "savings" plans. A 529 prepaid plan allows a contributor (i.e., a parent, grandparent, or nonrelative) to make lump-sum or periodic payments that entitle the beneficiary to a specified number of academic periods, course units, or a percentage of tuition costs at current prices. Essentially, the contributor is paying for and purchasing a given amount of education today which will be used by the student in the future, providing a hedge against tuition inflation. For example, in 2010 a contributor could have purchased two years of community college education through a prepaid plan for $5,000. Even if the price doubled by the time the beneficiary attended community college, they would have already paid the tuition in 2010.

Generally, a prepaid plan is used to purchase education at a public in-state institution.6 Prepaid plans are established and maintained by a state or a state agency or by an educational institution.7,8 Prepaid plans tend to have certain restrictions in terms of the expenses they cover, residency requirements, and eligible educational institutions. In some states, the value of these plans is backed by the full faith and credit of the state government, implying that the state bears the risk of the account performance, not the account holder. In addition, some prepaid plans are closed to new beneficiaries, meaning a family cannot open an account in the plan.

A 529 savings plan allows contributors to invest in a portfolio of mutual funds or other underlying investments.9 Contributors can make periodic investments directly in the plan, with the ultimate value of these accounts determined by the performance of the underlying investments. In addition, 529 savings plans can be purchased directly from a plan manager ("direct sold") or purchased through financial advisers ("broker sold"). Unlike prepaid plans, the amount of education which can ultimately be purchased using a savings plan is not guaranteed. Instead the amount of education that can be purchased depends on both the cost of education and the performance of the underlying assets in the 529 savings plan. In addition, the value of savings plans is not limited to tuition at in-state public institutions. Savings plans are established and maintained by a state or a state agency, but tend to be less risky for the state to administer because their value is typically not guaranteed by the state.10

While prepaid 529 plans were the first type of 529 plan established, savings plans have grown in popularity and are now the most common type of 529 plan. There are currently 18 prepaid 529 plans offered in contrast to 90 savings plans. In addition, according to the most recent data, of the $275.1 billion worth of assets in 529 plans at the end of 2016, 91.8% ($252.6 billion) were held in savings plans, while 8.2% ($22.5 billion) were held in prepaid plans.11

There are a variety of differences between savings plans and prepaid plans which may explain the increased popularity of savings plans. States may be more inclined to offer savings plans because they may be less costly or risky for states to run. Many states back prepaid plans with their full faith and credit. In these cases, states must provide a guaranteed benefit to beneficiaries of 529 prepaid plans, even if they do not have sufficient funds in the state's 529 trust to pay for beneficiaries' college expenses. Hence, these plans can be riskier for states to sponsor.12 In fact, one of the first 529 prepaid plans established, the Michigan Education Trust (MET), had to close to new beneficiaries shortly after starting because "the program administrators had relied on overly optimistic projections of the rate of return on invested funds in relation to the trust's obligation to pay for rising tuition prices. Simply put, the trust was headed toward insolvency."13

Savings plans may also be more common because they are more popular with students and their families. Savings plans generally can be used for more types of expenses at a wider variety of institutions than prepaid plans, making them attractive to parents who may not know where their child will ultimately go to college or how much it may cost.14 In addition, prepaid programs generally require that either the account owner or beneficiary meet state residency requirements, limiting who can ultimately invest in these plans. The majority of savings programs are open to contributors and beneficiaries irrespective of their residency.

Notably, while there are many differences between prepaid and savings plans, the tax treatment of these plans (which will be described later in this report) is identical. Hence, there is not a greater tax benefit associated with one plan rather than another and contributors may compare other features of these plans detailed in Table 1 when deciding which plan is the most appropriate type for their needs.15

|

Prepaid |

Savings |

|

|

Number |

18 |

90 |

|

Qualified Expenses |

Generally they cover tuition and required fees, in most cases at undergraduate institutions. |

Qualified distributions can be used for tuition and required fees, room and board (capped), books, supplies, equipment, and additional expenses of special needs beneficiaries at higher education institutions. In addition, up to $10,000 can be withdrawn for a given beneficiary in a given year and used for tuition expenses at elementary or secondary schools. |

|

Residency Requirements |

Account owner or beneficiary generally has to meet state residency requirements. |

Account owner or beneficiary generally does not have to meet state residency requirements, although more favorable benefits (state tax deductibility, matching) may be provided to in-state residents. |

|

Institutional Limitations |

In-state public institution (if used for out-of-state school, the amount is generally limited to in-state tuition and fees at public institution). |

Varies from plan to plan, but generally available for a wide variety of public and private higher education institutions nationally. (Any eligible educational institution meeting Federal Title IV requirements.) K-12 institutions include public, private, and religious schools. |

|

Refund |

If not all of the amount is used by the student, contributors can request a refund, although the refund amount is determined by the 529 plan. |

An amount not used can be taken out as a nonqualified distribution. The amount withdrawn as a refund is ultimately determined by plan performance. |

|

Distributions Go To |

Directly to institution. |

Beneficiary or account owner or directly to institution. |

|

Time Limitation |

Most prepaid plans can only be used for a limited duration, generally a given number of years from the beneficiary's expected matriculation date. |

Generally, there is no program-imposed limit on how long the account may remain open (as long as the beneficiary is living). |

|

Enrollment period |

Generally yes. Each year, contributors must purchase future college education during a given period. Prices are adjusted annually before each enrollment period. |

No |

|

Who Bears Risk? |

In some states, the plans are backed by the full faith and credit of the state government, meaning the state bears the risk. |

Contributors bear the risk because the performance of the plan is determined by the performance of the underlying assets. |

Sources: Internal Revenue Code (IRC) §529; Internal Revenue Service, Publication 970: Tax Benefits for Education, 2011, http://www.irs.gov/pub/irs-pdf/p970.pdf; Joseph F. Hurley, The Best Way to Save for College: A Complete Guide to 529 Plans 2011-2012 (Pittsford, NY: JFH Innovative LLC, 2011); text of P.L. 115-97; and the College Savings Plan Network.

|

Glossary of Selected Terms16 Account Owner: The person with ownership and control of the 529 account. This individual is usually a contributor to the account. Basis: The sum of all the cash contributed or paid into the account. Designated Beneficiary: The individual for whom the account is established. Distribution: An amount of cash withdrawn from a 529 account (or in the case of prepaid plans, the value of the education benefits paid by the plan). Earnings: The total account value minus the basis. |

Tax Treatment of 529 Plans

As previously mentioned, the specific tax advantage of a 529 plan is that the withdrawals from these plans are excludable from gross income, and hence not subject to the income tax, if they are used to pay for certain education expenses incurred in a given year. These expenses are referred to as adjusted qualified education expenses (AQEE—see shaded text box below). Any amount withdrawn from a 529 account which does not go toward these expenses is subject to income taxation and may be subject to an additional 10% penalty tax.

Logically, a taxpayer who receives a 529 distribution (often the beneficiary or the account owner) would seek to minimize their income tax liability by withdrawing just enough money from their 529 account to cover AQEE and no more. However, this is not as straightforward as it may seem due to a variety of factors, including the availability of other education tax benefits and student aid.17 In order to understand the complex decisions taxpayers must consider when determining the amount of money they should withdraw from a 529 plan, this section details the income tax treatment of 529 distributions, including the definition of AQEE; when 529 distributions may be taxable; and the interaction of 529 distributions with other education tax benefits. (An overview of basic gift tax rules is also included.)

|

Adjusted Qualified Education Expenses Adjusted qualified education expenses include certain higher education expenses and K-12 expenses. Higher Education Qualified higher education expenses are expenses related to enrollment or attendance at an eligible educational institution and include any of the following (or combination thereof):18

Elementary and Secondary School Qualified K-12 expenses include up to $10,000 per beneficiary per year for tuition expenses at a public, private, or religious elementary school. To determine the amount of adjusted qualified education expenses, qualified education expenses must be reduced by the amount of any tax-free educational assistance. Tax-free educational assistance includes the tax-free portion of scholarships and fellowships, veterans' educational assistance, Pell grants, and employer-provided educational assistance. They also, in the case of higher education expenses, must be reduced by the value of expenses used to claim education tax credits (see "Interaction with Other Education Tax Benefits"). |

Income Tax Treatment

Contributors to 529 plans receive no federal income tax benefit from funding a 529 plan. Instead the main beneficiaries (in terms of reduced income taxes) of 529 plans are the recipients of 529 distributions, who may be able to exclude the entire 529 withdrawal from income taxation. In most cases, the recipient of the 529 distribution (and hence the person who may be liable to pay tax on the distribution) is either the designated beneficiary or the account owner.21

Contributions

Contributions made to 529 plans are not deductible from income, meaning that contributions to these plans are made using after-tax dollars. Additionally, this implies that contributors to 529 plans receive no federal tax benefit from contributing to a 529 plan. In contrast, many states allow residents to deduct part or all of their 529 contributions from their state income taxes if they contribute to an in-state plan. All 529 plan contributions are allowed to grow tax-free in the 529 account. Hence, unlike the typical bank savings account, where interest income is annually subject to income taxes, the increase in asset values in a 529 plan account is not subject to current income taxes while the funds are in the account.

Distributions

Distributions from 529 plans are not subject to federal income taxes if, for a given year, the withdrawal entirely covers AQEE. In other words, if the amount of the distribution is less than or equal to the AQEE, the entire distribution is tax free. In addition to this limitation, only a maximum of $10,000 per beneficiary per year may be used for K-12 tuition expenses. Hence, if a child's K-12 education expenses were $7,000, but their parents withdrew $10,000 from her 529 account, a portion of the excess ($3,000) would be subject to taxation. A portion of any amount that is in excess of $10,000 will be taxable.

When a distribution is used to pay for nonqualified expenses, the earnings portion of the withdrawal is subject to the income tax and may be subject to a 10% penalty tax. In other words, if the amount of a 529 withdrawal is greater than the beneficiary's AQEE, then some of the earnings portion of the distribution is taxable. The earnings portion of a distribution reflects the growth of the value of the 529 plan and not amounts originally contributed (which are sometimes referred to as basis). The percentage of the earnings portion subject to taxation is equal to the ratio of the difference of the total distribution amount and AQEE to the total distribution amount. To ultimately calculate the amount of tax the taxpayer will owe, the taxpayer's marginal tax rate must be applied to this taxable income. In addition, in many cases, a 10% penalty tax will also be applied to this taxable income.22

Calculating the Taxable Portion of a 529 Distribution: A Stylized Example

Mr. Smith establishes an account in a 529 plan for his daughter Sara. He is the account owner and his daughter is the designated beneficiary. He makes a one-time contribution (i.e., basis) of $10,000. Five years later the account balance is $15,000 (i.e., it has increased in value by $5,000) and Mr. Smith takes a $9,000 distribution for his daughter's $9,000 tuition payment. But Sara also receives a $4,000 tax-free scholarship. Hence, Sara has $5,000 in AQEE ($9,000 of tuition minus $4,000 in tax-free aid). Notably, Mr. Smith pays Sara's tuition costs and also designates himself as the recipient of the 529 distribution, implying he (and not his daughter) will be liable to pay any taxes on the 529 distribution.23

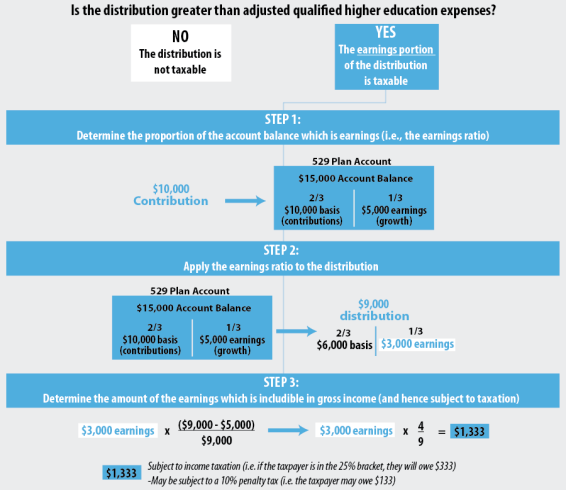

The steps to calculate the taxable portion of the distribution—and it is taxable because adjusted qualified education expenses ($5,000) are less than the 529 distribution ($9,000)—are outlined in Figure 1.

First, Mr. Smith must calculate the proportion of the distribution that is earnings. Since one-third of the account balance ($5,000) reflects earnings (two-thirds of the account balance reflects $10,000 of contributions), one-third of the distribution is attributable to earnings. Second, Mr. Smith applies the earnings ratio (in this case, one-third) to the distribution. Hence, of the $9,000 distribution, one-third or $3,000 reflects earnings. Finally, Mr. Smith calculates the proportion of the $3,000 earnings portion that is subject to taxation. The percentage of the earnings portion that is subject to taxation is equal to the ratio of the difference of the total distribution amount ($9,000) and AQEE ($5,000) to the total distribution amount ($9,000). Ultimately, as Figure 1 illustrates, of the $9,000 distribution, $1,333 of it is includible in Mr. Smith's income and thus subject to taxation on his income tax return.

|

Figure 1. Calculating the Taxable Portion of a 529 Distribution: A Stylized Example |

|

|

Sources: Congressional Research Service using information obtained from the Internal Revenue Service, Publication 970: Tax Benefits for Education, http://www.irs.gov/pub/irs-pdf/p970.pdf; and Joseph F. Hurley, The Best Way to Save for College: A Complete Guide to 529 plans 2011-2012 (Pittsford, NY: JFH Innovative LLC, 2011). |

Interaction with Other Education Tax Benefits

In addition to 529 plans, there are a variety of other tax benefits taxpayers (either the beneficiary or the account owner) may use to lower their income tax bill based on education expenses.24 Notably, taxpayers may be eligible to claim either the American Opportunity tax credit (AOTC),25 the Lifetime Learning credit, or the tuition and fees deduction.26 A taxpayer cannot claim more than one of these tax benefits for the same student in a given year.

To determine if any of their 529 distribution is taxable, a taxpayer must reduce their 529 qualified education expenses by any amounts used to claim either the AOTC or the Lifetime Learning credit. The qualified education expenses as defined for 529 plans are not identical to the qualified higher education expenses of education tax credits. The qualified higher education expenses common to both 529 plans and education tax credits are tuition and fees, and hence these are the expenses which taxpayers may (mistakenly) try to use to claim both an education tax credit and a tax-free 529 distribution. (Other expenses, like room and board, which are a qualified expense for 529 plans, are not a qualified expense for education tax credits and hence would not be used to claim an education tax credit.) For example, if an eligible taxpayer has $10,000 of tuition payments of which they used $4,000 to qualify for an American Opportunity tax credit, the amount of qualified higher education expenses used to determine if their 529 distribution is tax free is $6,000. Thus, if a 529 distribution is less than or equal to $6,000, none of the distribution is subject to taxation because the distribution covered all of their AQEE.

Instead of an education tax credit, a taxpayer may choose to both take a 529 distribution and claim the tuition and fees deduction for the same student in the same year. Taxpayers who take a 529 distribution and also choose to claim the tuition and fees deduction must reduce the amount of expenses used for the tuition and fees deduction by the earnings portion of the 529 distribution (not the entire amount of the distribution).27

Rollovers and Transfers

Any distribution from a 529 plan for a given beneficiary which is rolled over into a different 529 plan for either the same beneficiary28 or a member of the beneficiary's family29 is not taxable. A distribution is considered "rolled over" if it is paid to another 529 plan within 60 days of the distribution. A rollover between 529 plans for the same beneficiary is limited to once every 12 months. In addition, if the designated beneficiary of an account is changed to a member of the beneficiary's family, the transfer of funds is not taxable.

Gift Tax

A contribution to a 529 plan is generally not subject to the gift tax if the amount contributed is less than the annual gift tax exclusion.30 For 2017, the annual gift tax exclusion was $14,000.31 For example, a grandparent could contribute $14,000 to each of their seven grandchildren's 529 accounts without being subject to the gift tax.32 In addition, a contributor may be able to deposit more than the annual exclusion amount into a 529 plan without being subject to the gift tax.33 The Internal Revenue Code (IRC) allows a donor to make a contribution larger than the annual gift tax exclusion by treating the contribution as if it were made ratably over five years. In other words, a contributor could have opened a 529 savings plan for a beneficiary in 2017 and contributed up to $70,000 (five times $14,000) without being subject to the gift tax. The contributor could not make another excludable gift to that beneficiary's 529 plan until 2022. In addition to these gift tax rules, for the purposes of the estate tax, a donor can exclude the value of the 529 plan from their gross estate, even though they maintain control of the account.

Interaction of Assets and Distributions from 529 Plans with Federal Student Aid34

In addition to the tax advantages of 529 plans, these plans are also treated more favorably than other types of college savings or investments when determining a student's eligibility for federal need-based student aid. For instance, 529 plans generally have a minimal impact on a student's federal expected family contribution (EFC). The EFC is the amount that, according to the federal need analysis methodology, can be contributed by a student and the student's family toward the student's cost of education. All else being equal, the higher a student's EFC, the lower the amount of federal student need-based aid he or she will receive. A variety of financial resources are reported by students and their families on the Free Application for Federal Student Aid (FAFSA). These resources are assessed at differing rates under the federal need analysis methodology.35

Distributions36 from 529 plans are generally not considered income in the federal need analysis calculation and are therefore not reported on the FAFSA, although the value37 of the 529 plan is considered an asset in the federal need analysis methodology and should be reported on the FAFSA.38

When calculating a student's EFC, the federal need analysis methodology considers a percentage of the student's assets and a percentage of the parents' assets reported on the FAFSA. A student's assets are assessed at a flat rate of 20%, while parents' assets are assessed on a sliding scale, resulting in a maximum effective rate of up to 5.64%.39 Therefore, the ownership of the asset is important when determining how it will affect a student's EFC. For students who are classified as dependent students for FAFSA purposes (which differs from the classification of dependent for tax purposes),40 the 529 plans are considered an asset of the parent, as long as the custodial ownership of the plan belongs either to the parent or student. Therefore, dependent students benefit from a lower assessment rate on 529 plans, which, all else being equal, results in a lower EFC and the potential for more federal need-based student aid. For students who are classified as independent students for FAFSA purposes, 529 plans are treated as an asset of the student, as long as the custodial ownership of the plan belongs either to the student or student's spouse (if applicable). 529 plans that are owned by someone other than the student, parent, or spouse are not reported as an asset on the FAFSA, but distributions from these 529 plans are reported as untaxed income for the beneficiary on the FAFSA.41 In general, income is assessed at a higher rate compared to assets in the federal need analysis methodology.