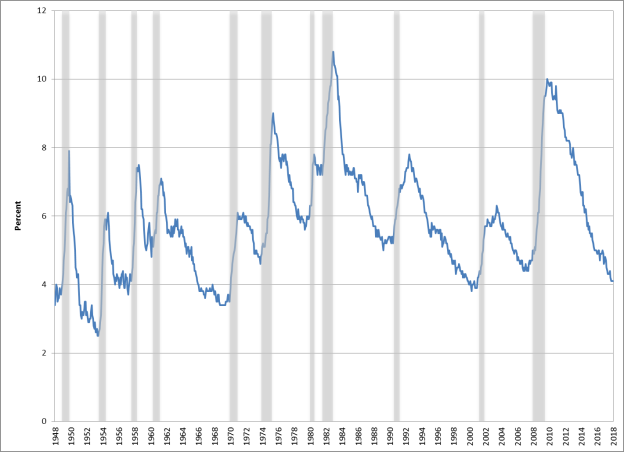

1948-2018

Source: Bureau of Labor and Statics (BLS).

Note: Recessions are shaded.

The unemployment rate has fallen from 10% in 2009 to 4.1% today, its lowest since 2000. Several other labor market indicators also point to an economy at or near full employment. If unemployment gets too low, it could plant the seeds for a future recession. An overheating economy can temporarily surge past full employment, but a recession typically follows to restore labor market equilibrium. Fiscal and monetary policy can help avoid—or exacerbate—overheating.

The economy has achieved full employment when it reaches the lowest sustainable unemployment rate consistent with stable inflation (called the natural rate of unemployment). Below the natural rate, economic theory predicts that excessive demand for labor would drive wages up at an unsustainable pace, causing an increase in general price inflation. As discussed in CRS In Focus IF10443, Introduction to U.S. Economy: Unemployment, by [author name scrubbed], the economy reaches full employment before the unemployment rate reaches zero.

In only one of the seven economic expansions since 1970 did the unemployment rate fall below the current 4.1% (3.9% at times in 1999-2000). Unemployment is below the Congressional Budget Office's (CBO's) natural rate estimate of 4.7%, a view shared by most economists. Thus, the United States may have reached full employment (see Figure 1), despite higher unemployment for minorities, less-educated Americans, and certain geographic regions. In the last expansion, the lowest unemployment rate was 4.4%.

|

1948-2018 |

|

|

Source: Bureau of Labor and Statics (BLS). Note: Recessions are shaded. |

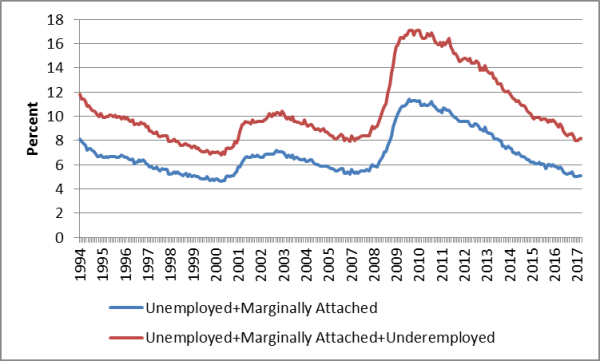

Most other labor market indicators are also consistent with full employment. As shown in Figure 2, broader measures of labor underutilization (available only since 1994) are currently lower than the last expansion's low and almost as low as during the 1990s expansion's low. Only underemployment (involuntary part-time workers) remains slightly higher than it was in the 1990s.

|

Figure 2. Broader Measures of Labor Underutilization 1994-2018 |

|

|

Source: BLS. Note: Definitions are available BLS's website. |

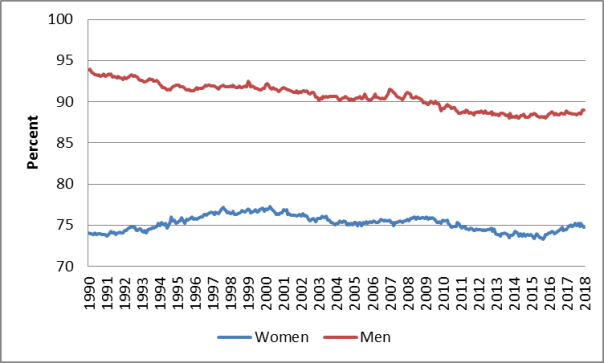

One measure that has shown less improvement is the labor force participation rate (LFPR), consisting of the employed and unemployed. (Individuals without jobs are classified as unemployed only if they are actively seeking work; otherwise, they are classified as "not in the labor force.") The LFPR experienced an unprecedented drop in the 2000s and only a relatively small recovery in the current expansion.

The aging of the workforce can explain part of this decline, as older workers have a lower LFPR. But even the prime-age (aged 25-54) LFPR is still lower than usual, as shown in Figure 3. Between 2013 and 2015, the prime-age male LFPR rate fell to its lowest level since the data series began in 1948. It has since risen modestly to 89%, but is still lower than at any time before 2009. Likewise, the prime-age female LFPR is still more than two percentage points below its peak in 2000, and about one percentage point below the 2007-2009 recession. If more individuals could be enticed back into the labor force, then employment would still have room to grow before reaching full employment. However, research indicates that workers who have been out of the labor force for an extended period of time are less likely to rejoin it.

|

Figure 3. Labor Force Participation Rate, Age 25-54 1990-2018 |

|

|

Source: BLS. |

Unemployment always follows the same cyclical pattern—it drops to its lowest point in the expansion near the end of the expansion and then rises as the economy shifts into a recession. Sometimes the subsequent recession is caused by overheating (of which, low unemployment is a symptom), and sometimes it has other causes, as discussed in CRS Insight IN10853, What Causes a Recession?, by [author name scrubbed].

Although the pattern is always the same, no single threshold unemployment rate has consistently triggered a recession because the estimated natural rate has fluctuated between 4.7% and 6.3% since 1949, according to CBO. Further, the exact timing differs across cycles—it has taken zero to 18 months from unemployment's lowest point before the next recession started. Thus, although the unemployment rate is currently lower than CBO's estimate of full employment has ever been, it might stay that way for some time.

Overheating would become more likely if employment continued to grow at its current pace. At full employment, employment can only grow as fast as workers are added to the labor force. In 2017, the labor force grew by 94,000 workers and employment grew by 158,000 workers per month; that pace of employment growth has been exceeded in recent months. If employment continues to grow faster than the labor force in 2018, the unemployment rate would soon surpass its lowest level since 1970.

Inflation does not point to an overheating economy so far. It has remained below the Federal Reserve's (Fed's) goal of 2% in recent years by its preferred measure, with no upward trend. Individuals' median wages have increased more quickly in the last year than previously in the expansion, but are still increasing more slowly than they did in the previous two expansions.

The standard macroeconomic prescription to prevent overheating is to tighten fiscal and monetary policy. Fiscal policy is tightened through changes to spending or revenue that decrease the budget deficit. Monetary policy is tightened through higher short-term interest rates. Some economists would likely assign blame for overheating (and the subsequent recession) to the policy error of not tightening policy enough to prevent it.

The Fed has been tightening monetary policy since 2015, but at a gradual pace that has kept policy stimulative on balance. A key question among economists is whether the Fed is "behind the curve" on raising rates to prevent overheating or whether its gradual approach is justified by low inflation. Fiscal policy, in contrast, has been expansionary instead of contractionary, in large part, as a result of the tax cuts enacted in December 2017 (P.L. 115-97) and the recent agreement to increase spending (P.L. 115-123). As a result, the budget deficit is projected to be high despite an economy at or near full employment.