Introduction

As U.S. natural gas production increased and the possibility of liquefied natural gas (LNG) exports from the continental United States became more likely, interest grew in sending U.S. natural gas to the Caribbean (see Figure 1). During the Obama Administration, Vice President Biden was a proponent of helping the Caribbean use more clean energy, including natural gas, and in 2014 the Obama Administration created the Caribbean Energy Security Initiative.1 Additionally, U.S. LNG exports to the Caribbean were a recommendation of the first Quadrennial Energy Review undertaken by the Obama Administration.2 The Trump Administration has promoted increased LNG exports, and on September 1, 2017, the U.S. Department of Energy (DOE) announced a proposed rule intended to speed up the approval process for small-scale LNG exports from U.S. facilities.3

|

|

Source: Map Resources, adapted by CRS. |

The Caribbean is a relatively small natural gas market (see Table 1). Cumulatively, the Caribbean consumed approximately 792 billion cubic feet (bcf) of natural gas in 2016, about 3% of U.S. consumption. Nevertheless, there has been interest from many in providing U.S. LNG exports to the region for mainly economic, geopolitical, and environmental reasons. This report focuses on the economic reasons U.S. companies would like to send U.S. natural gas to the Caribbean. Other topics, although important, are not addressed beyond introductory comments. Some small-scale U.S. LNG export projects have targeted Caribbean countries as the relative size of the imports makes the export projects economical. The United States also has a geopolitical reason for wanting to displace fuel oil in the region, especially Venezuelan fuel oil. Venezuela has used subsidized exports of fuel oil to gain influence in the region.4 Environmentally, the United States has supported greater natural gas use in the region to curb carbon dioxide emissions, as well.

|

Country |

Reserves |

Production |

Consumption |

Net Imports |

||||||||

|

Barbados |

|

|

|

|

||||||||

|

Cuba |

|

|

|

|

||||||||

|

Dominican Republic |

|

|

|

|

||||||||

|

Jamaica |

|

|

|

|

||||||||

|

Puerto Rico |

|

|

|

|

||||||||

|

Trinidad and Tobago |

|

|

|

|

Source: Cedigaz databases and U.S. Department of Energy, LNG Monthly, December 2016.

Notes: 2016 is the latest year of data for all countries presented in the table. Production plus net imports may not equal consumption due to rounding. Units = billion cubic feet (bcf).

Under DOE's proposed rule, a small-scale natural gas export facility may qualify for the expedited approval process if it meets two criteria: (1) it would export no more than 0.14 bcfd or 51.10 bcf per year, and (2) it qualifies for a categorical exclusion under DOE's National Environmental Policy Act (NEPA) regulations. If these two criteria are met, then the project, under the proposed rule, would be assumed to be in the public interest per the Natural Gas Act (NGA).5

Congressional Interest

On October 18, 2017, S. 1981 was introduced by Senator Bill Cassidy to amend the NGA to provide an expedited DOE approval process for small-scale LNG projects. (See "Selected Federal Approvals and Review for Natural Gas Exports" for additional regulatory discussion.) Similarly to the DOE's proposed rule, projects with a capacity of 0.14 bcfd or 51.1 bcf per year would be "deemed to be consistent with the public interest," and the permit would be "granted without modification or delay." As defined by the proposed legislation and rule, there is currently one project within the capacity requirement and awaiting a non-free trade agreement (non-FTA) approval, Eagle LNG Partners Jacksonville LLC.6 However, under DOE's proposed rule, the project would not be granted the expedited process, as it does not qualify for a categorical exclusion under NEPA. The project has submitted its application to the Federal Energy Regulatory Commission (FERC), which is still evaluating it. Under S. 1981, the project would qualify for the expedited process.

U.S. Natural Gas Market Trends

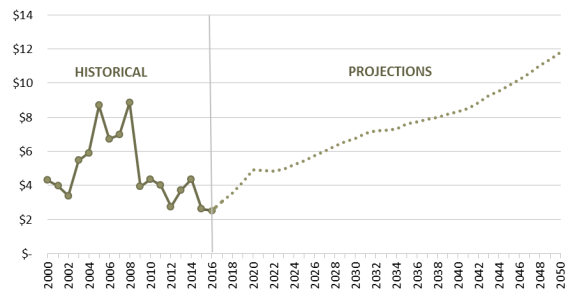

In the beginning of the 21st century, U.S. natural gas prices were generally on the rise (see Figure 2), and the United States was viewed as a growing natural gas importer. Multiple LNG import terminals were built during this time in preparation for increased demand. However, the market conditions also drove domestic producers to innovate. As prices reached their peak in 2008, domestic shale gas was brought to market. Improvements in technologies such as hydraulic fracturing and horizontal drilling made the development of unconventional natural gas resources such as shale and other lower-permeability rock formations possible.7 Improved efficiency has lowered production costs, making shale gas economically competitive at almost any market price and enabling large-scale U.S. LNG exports from the contiguous states.

|

Figure 2. Annual U.S. Natural Gas Prices, 2000-2050 Nominal Dollars per Million British Thermal Units ($/MMBtu) |

|

|

Source: U.S. Energy Information Administration, Annual Energy Outlook 2017, https://www.eia.gov/outlooks/aeo/data/browser/#/?id=13-AEO2017&cases=ref2017&sourcekey=0, https://www.eia.gov/dnav/ng/hist/rngwhhda.htm. Note: Annual average Henry Hub spot natural gas prices in the Reference Case. |

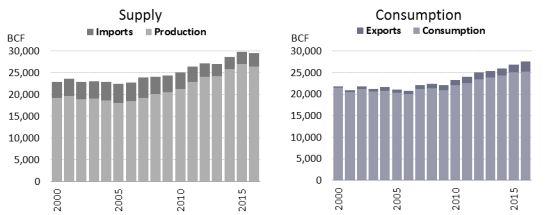

As U.S. production increased, primarily from 2005 onward, and prices fell, U.S. consumption of natural gas during the same time period grew by over 24%. The rise in consumption, though, did not keep pace with production, so companies turned to exports of natural gas, first by pipeline to Mexico and then as LNG to other parts of the world. As shown in Figure 3, supply and imports of natural gas were still greater than consumption and exports in 2016, in part because of growing use of storage.

The first large-scale LNG shipments from the continental United States occurred in February 2016 from the Sabine Pass LNG Terminal in Louisiana to Brazil, India, and the United Arab Emirates. Some in related industries believe that instead of exporting U.S. natural gas, the United States should increase its use of natural gas in the electric power sector to displace coal, as an alternative transportation fuel to displace oil, and to provide fuel and feedstock to domestic industries such as petrochemicals. Natural gas producers counter that there is enough natural gas for both domestic growth and exports. Nevertheless, some transition to natural gas is already occurring, particularly in the electric power sector,8 and according to the U.S. Energy Information Administration's (EIA's) latest annual average projections (which assume no changes in U.S. policy), prices are not expected to reach the price peak of 2008 until 2042.

|

Figure 3. U.S. Natural Gas Supply and Consumption, 2000-2016 Billion Cubic Feet |

|

|

Source: U.S. Energy Information Administration (EIA), http://www.eia.gov/naturalgas/data.cfm. Note: The difference between the two columns for a given year in each chart is balanced by changes in the volume of natural gas that is held in storage. |

Between 2000 and 2008, the United States prepared to increase imports of LNG based on forecasts of growing consumption, and companies began constructing LNG import terminals. However, the rise in prices gave the industry incentive to bring more domestic gas to market, reducing the need for import terminals. The result, as mentioned above, was the development of shale gas. Imports in 2016 were 35% below their peak in 2007; consequently, there has been a push for modification and expansion of existing LNG terminals to add liquefaction capability, as well as construction of new terminals, in order to expand U.S. export capacity. As of September 2017, DOE's Office of Fossil Energy approved 20.56 bcf per day of export capacity to non-FTA countries. Of those non-FTA approved, 0.11 bcfd were small-scale projects within the capacity limits of DOE's proposed rule and S. 1981, and an additional 0.39 bcfd to FTA countries was also approved (see Table 2).

|

Company |

FTA Volume (bcfd) |

FTA Status |

Non-FTA Volume (bcfd) |

Non-FTA Status |

|

Carib Energy (USA) LLC |

0.03 |

Approved |

0.04 |

Approved |

|

SB Power Solutions Inc. |

0.07 |

Approved |

NA |

NA |

|

Advanced Energy Solutions LLC |

0.02 |

Approved |

NA |

NA |

|

Argent Marine Management, Inc. |

0.003 |

Approved |

NA |

NA |

|

Strom Inc. |

0.08 |

Approved |

0.15 |

Pending |

|

Air Flow North America Corp. |

NA |

NA |

0.002 |

Approved |

|

American LNG Marketing LLC |

0.008 |

Approved |

0.008 |

Approved |

|

American LNG Marketing LLC |

0.08 |

Approved |

NA |

NA |

|

Floridian Natural Gas Storage Co. |

0.04 |

Approved |

0.04 |

Approved |

|

Flint Hills Resources, LP |

0.01 |

Approved |

0.01 |

Approved |

|

Eagle LNG Partners Jacksonville LLC |

0.14 |

Approved |

0.14 |

Pending |

|

Carib Energy (USA) LLC |

NA |

NA |

0.004 |

Approved |

|

Eagle LNG Partners Jacksonville II LLC |

0.01 |

Approved |

0.01 |

Approved |

Source: U.S. Department of Energy, Office of Fossil Energy, https://energy.gov/fe/downloads/summary-lng-export-applications-lower-48-states.

Notes: Where a project has an FTA volume and a non-FTA volume, the amounts are not cumulative. For example, in the case of Eagle LNG Partners Jacksonville II LLC, their application is to export 0.01 bcf per day to either FTA or non-FTA countries, not of 0.02 bcf per day. Additionally, if a project has different volumes for FTA and non-FTA exports, the volumes are not cumulative, as in the case of Carib Energy (USA) LLC's first application. NA means the application was not for either the FTA or non-FTA permit.

U.S. Interest in the Caribbean Natural Gas Market

To date, DOE has received 13 applications (four to export exclusively to FTA countries, two exclusively to non-FTA countries, and seven to either FTA or non-FTA countries) from companies seeking approval to export relatively small quantities of LNG primarily to destinations in the Caribbean, Central America, and South America. Of the 13, 11 applications are to export natural gas to FTA countries, and all have been approved. Seven of the nine applications to export to non-FTA countries have been approved, with two non-FTA applications under review.9 DOE has received approximately 66 applications in total to export LNG from the United States. Unlike large export projects shipping LNG on bulk tankers from new marine terminals, most of these 13 applications involve shipments from existing, small-scale LNG liquefaction plants using International Standards Organization (ISO) certified tank containers (see Figure 4). The use of ISO containers allows the LNG to be transported using existing container shipping infrastructure via rail, truck, and conventional container ship—and delivered to any port facility capable of receiving containerized cargo. Most of the companies also offer comprehensive services to deliver LNG to the customer facility, as needed. A few proposed projects (e.g., American LNG Marketing LLC) would construct small new LNG liquefaction plants. One proposed project (Eagle LNG Partners Jacksonville LLC) would construct custom-built tankers to deliver LNG.

|

|

Source: Tank Service Inc. |

The relatively small LNG exporters have been targeting a variety of customers in the Caribbean basin, but appear focused primarily on industrial and electric power customers. For example, Carib Energy delivers LNG to Coca-Cola Puerto Rico Bottlers, where it is used both as a fuel for on-site power generation and also in the company's refrigeration operations.10 Advanced Energy Solutions LLC has targeted primarily a group of co-generation power plants that supply industrial and commercial customers in Honduras.11

Selected Federal Approvals and Review for Natural Gas Exports

Pursuant to provisions in Section 3(a) of the NGA, both the export of LNG, regardless of the amount, and the construction or expansion of LNG terminals require federal agency authorization. According to the NGA, parties seeking to enter into natural gas transactions with foreign buyers must file for an export authorization under the rules and procedures established by DOE.12 If the United States has an FTA in effect with the nation to which the LNG would be exported, that application will be automatically deemed consistent with the "public interest."13 Exports to non-FTA countries are presumed to be in the public interest, unless, after opportunity for a hearing, DOE finds that the authorization would not be consistent with the public interest.14 The NGA does not detail what DOE must evaluate to make a public interest determination. The NGA also does not specify an amount threshold for requiring a public interest determination, so projects, whether exporting small or large amounts of natural gas, undergo the same process. Also, pursuant to Section 3(e) of the NGA, FERC is required to approve the siting, construction, expansion, or operation of an LNG export terminal, onshore or in state waters.15 Depending on the details of the commodity to be exported or terminal facility, compliance with additional requirements established under state, tribal, or federal law may also apply to the export or to the terminal project.

The approvals required by DOE and FERC are separate federal actions subject to environmental review under the National Environmental Policy Act (NEPA, 42 U.S.C. 4321 et seq.). Under NEPA, federal agencies must identify and consider the environmental impacts of an action and inform the public of the impacts of that action before a final agency decision is made.16

Project information gathered during the NEPA process is used, in part, to inform an agency's decision on a given proposal. For DOE, this means that it must consider the impacts associated with a request to export natural gas, as required under NEPA, and then must use that NEPA analysis, with other relevant information, to inform its determination of whether that export would be in the public interest, as required under the NGA. FERC does a separate NEPA analysis to identify the impacts related to the construction or modification of the terminal that would be used for the proposed exports.

The level of NEPA review required of DOE or FERC is entirely project-specific. A detailed environmental impact statement (EIS) must be prepared if the project will have significant environmental impacts. If impacts are uncertain, an agency may prepare an environmental assessment (EA) to determine whether an EIS is needed or if a finding of no significant impact (FONSI) may be issued. Projects that are known to have no significant impacts are categorically excluded from the requirement to prepare an EA or EIS (referred to as categorical exclusions, or CEs).

In their agency-specific regulations implementing NEPA, both DOE and FERC17 identify the types of projects they are authorized to approve and the level of review generally required for those actions. For each level of NEPA review, following are examples of projects that DOE is authorized to approve under Section 3 of the NGA:

- actions that require an EIS—proposals that would require construction of major new natural gas pipelines/related facilities, significant expansions and modifications of existing pipelines/related facilities, or major operational changes;18

- actions that require EA and result in a FONSI—proposals that would require minor new construction (e.g., adding new connections to an existing LNG pipeline);19

- actions approved as a CE—proposals that would require minor operational changes (e.g., changes in natural gas throughput or storage operations), but not new construction.20

If a DOE export approval involves a project subject to FERC approval, FERC typically serves as the lead agency in the NEPA review process, and DOE serves as the cooperating agency.21 That is, FERC would generally be the agency responsible for determining whether or not the proposal may have significant environmental impacts (i.e., requires an EIS or can be approved with an EA/FONSI or CE) and for preparing the necessary analysis. DOE and any other agency with legal jurisdiction or special expertise with respect to any impact associated with the proposal would assist FERC with its NEPA review. After FERC completes that review, rather than prepare a separate analysis, DOE typically adopts FERC's NEPA document.22

FERC's decision regarding the level of NEPA review required for a terminal project may affect DOE's decision to apply its expedited approval process to export approvals. As proposed, DOE expedited approval of an export would be conditioned on the proposal qualifying as a categorical exclusion (i.e., a project determined to have no significant impacts on the environment, under NEPA). If FERC determines that a terminal project cannot be approved using a CE, DOE may similarly determine that the export approval associated with that terminal does not qualify as a CE.

The Global LNG Market

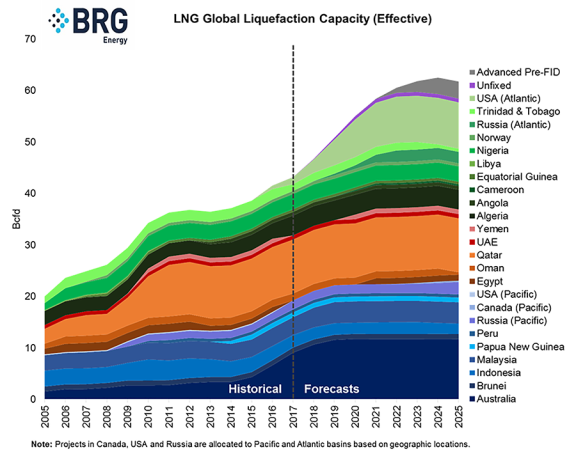

If all the U.S. LNG export projects that received DOE final approval (20.6 bcfd) were operational today, the United States would rank first in the world, by far, for global export capacity. In 2016, Qatar exported the most LNG, 3,687 bcf, or 10.1 bcfd, while U.S. LNG exports were 184 bcf, or 0.5 bcfd. Expanded U.S. LNG exports will face competition in the global LNG market. According to one study, global liquefaction capacity is projected to rise by almost 43% by 2025 (Figure 5). Many non-U.S. projects are further along than the U.S. projects. In 2016, LNG trade accounted for 32% of all natural gas traded internationally.23 Trinidad and Tobago's decline, starting around 2008, is mostly because the United States is no longer a big importer of LNG.

|

|

Source: Berkeley Research Group, LLC. Notes: Effective capacity refers to the volume each facility is cable of producing, which may be lower than nameplate capacity because of technical reasons. Unfixed facilities refers to floating terminals. Units = billion cubic feet per day (bcfd). |

Most LNG sold in the world is under long-term contracts indexed to oil prices. Long-term contracts are needed to finance the liquefaction facilities, usually the most expensive part of the LNG supply chain, which also includes LNG tankers, storage, and LNG import terminals. U.S. natural gas prices are market-based, which can give U.S. LNG export projects an advantage because the differential with oil-indexed natural gas prices can be wide compared to the U.S. price. (See Figure 6.) U.S. LNG exports could add to the pressure for other countries to delink their natural gas exports—either as LNG or by pipeline—from oil-indexed prices. Japanese companies, for example, have been vocal about their interest in a natural gas-based pricing mechanism to reduce costs and exposure to oil prices. However, recent declines in global oil prices have reduced the oil-indexed versus gas-indexed price differential.

|

Figure 6. Estimated Global LNG Prices, July 2017 Dollars per MMBtu |

|

|

Source: FERC, National Natural Gas Market Overview, July 2017, https://www.ferc.gov/market-oversight/mkt-gas/overview/ngas-ovr-lng-wld-pr-est.pdf. Notes: MMBtu = million British thermal units. Landed prices are based on a netback calculation, which factors in the cost at the point of origin. |

Many of the projected projects in Figure 5 are targeting the Asian LNG demand centers. Although the locations of most of the proposed U.S. export terminals are on the U.S. Gulf Coast and the East Coast, Asia may be the target market for U.S. LNG, as it tends to pay higher prices for its natural gas imports. The widening of the Panama Canal has contributed to U.S. competitiveness in Asia. Europe has significant LNG import capacity, but needs to continue to improve its infrastructure connections to transport gas to markets.24 Russia, the main supplier of natural gas to Europe by pipeline, may be put under increasing pressure by U.S. export projects to further delink its natural gas prices from oil. U.S. LNG exports could also provide options for some countries that are highly dependent on one supplier.

Trade Issues and Considerations

Most companies seeking permits to export LNG have applied to export LNG to countries with which the United States does not have an FTA in addition to those with an FTA.25 As noted above, exports to FTA countries are presumptively considered "in the public interest" under the NGA, as amended. Of the 51.59 bcfd non-FTA applications, about 40% have received final approval from DOE. South Korea is the only major importer of LNG of the countries with which the United States has an FTA. Of the other FTA countries, in 2016, seven have LNG import terminals, while the rest either export natural gas, receive natural gas via pipeline, or do not import natural gas. In order for LNG export projects to be financially viable, they will likely need the ability to export to non-FTA countries. In the Caribbean, only the Dominican Republic has signed an FTA with the United States; it is also one of the countries that has an LNG import terminal.

During the Obama Administration, the United States negotiated the Trans-Pacific Partnership (TPP) FTA with 11 countries of the Asia-Pacific and engaged the European Union in negotiations for a Transatlantic Trade and Investment Partnership (T-TIP) FTA. Both these agreements would have given the signatories free trade status when it comes to U.S. natural gas exports, including Japan, the largest LNG importer in the world. However, the Trump Administration withdrew from the TPP upon taking office in January 2017, and the future of T-TIP is uncertain.

The prospect of the United States limiting or restricting LNG exports has raised questions by industry analysts, particularly as a member of the World Trade Organization (WTO). In previous Congresses, legislation was introduced that would have given certain countries, like NATO members, priority in receiving U.S. LNG exports. The General Agreement on Tariffs and Trade's (GATT's) Article XI, General Prohibition Against Quantitative Restraints, states the following:

No prohibition or restrictions other than duties, taxes or other charges made effective through quotas, import or export licenses or other measures, shall be instituted or maintained by any contracting party on the importation of any product of the territory of any other contracting party or on the exportation or sale for export of any product destined for the territory of any other contracting party.

There are exceptions to Article XI based on the conservation of exhaustible natural resources or the necessity to protect human health, which may apply if the United States restricts LNG exports.26 However, these exceptions may be dependent on a country restricting its own production. Additionally, restricting LNG exports may put the United States in a contradictory position vis-à-vis cases it has brought to the WTO, specifically its successful case against China for limiting the export of rare earth elements and other metals. To some, the position of the United States as a promoter of free trade may also be challenged.

Since the start-up of the Sabine Pass Liquefaction project in Louisiana, exports of LNG have gone to approximately 26 countries, with 21 being non-FTA countries. In 2016, continental U.S. exports were 184 bcf, while so far in 2017 the volumes have increased to 410 bcf. Similarly, small-scale exports rose from 0.10 bcf in 2016 to 0.13 bcf so far in 2017.

|

Destination |

Amount |

Cargos |

% of Total |

|

Mexico |

136.4 |

41 |

23.0 |

|

South Korea |

59.3 |

18 |

10.0 |

|

Chile |

48.1 |

16 |

8.1 |

|

Japan |

43.8 |

12 |

7.4 |

|

China |

41.7 |

13 |

7.0 |

|

Jordan |

35.7 |

11 |

6.0 |

|

Argentina |

32.9 |

11 |

5.5 |

|

India |

27.4 |

8 |

4.6 |

|

Kuwait |

27.3 |

8 |

4.6 |

|

Turkey |

19.7 |

6 |

3.3 |

|

Other |

121.0 |

108 |

20.4 |

Source: DOE/Fossil Energy, Office of Oil & Natural Gas, LNG Monthly, October 17, 2017.

Notes: Data are from February 2016 through August 2017. Cargos may include those that went to more than one country, known as split cargoes. Of the other108 cargoes, 68 were ISO containers to Barbados.

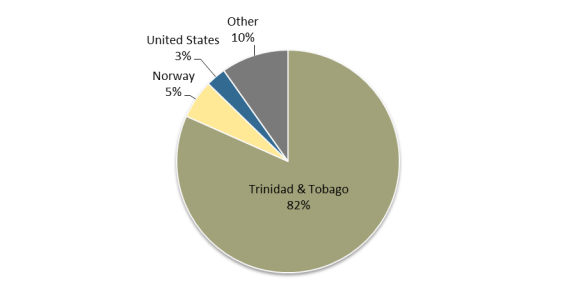

Caribbean Trade

In 2016, three Caribbean countries—Barbados (0.10 bcf), Dominican Republic (41.32 bcf), and Jamaica (0.35 bcf)—imported LNG. Puerto Rico was the largest importer of LNG in the region, with 57.56 bcf in 2016. Most Caribbean LNG imports come from Trinidad and Tobago (see Figure 7). Barbados and Dominican Republic imported LNG from the United States. Puerto Rico, in part because of the Jones Act, is not able to import LNG on LNG tankers. The Jones Act requires that vessels transporting cargo between two U.S. points be built in the United States, crewed by U.S. citizens, and at least 75% owned by U.S. citizens.27 There are no Jones Act-qualified LNG tankers available to carry U.S. natural gas to Puerto Rico; the United States has not built an LNG tanker since 1980. Puerto Rico has imported LNG from the continental United States in cryogenic containers. Since September 2014, approximately 0.50 bcf of natural gas has gone to Puerto Rico from the contiguous United States.

|

Figure 7. Major LNG Exporters to the Caribbean, 2016 100.3 Billion Cubic Feet Total |

|

|

Source: Cedigaz, http://www.cedigaz.org. |