Introduction

On May 18, 2017, the Office of the U.S. Trade Representative (USTR) formally notified Congress of the Trump Administration's intent to renegotiate the North American Free Trade Agreement (NAFTA). As during the original NAFTA negotiations in the early 1990s among the United States, Canada, and Mexico, textile and apparel trade is once again likely to attract considerable congressional attention and debate.1

NAFTA, which took effect nearly a quarter-century ago, lowered or removed many barriers to goods trade within North America.2 Prior to NAFTA, 65% of U.S. apparel imports from Mexico entered duty-free, and the remaining 35% faced an average tariff rate of 17.9%. Mexico's average tariff on U.S. textile and apparel products was 16%, with duties as high as 20% on some products.3 Over the 10-year period after NAFTA entered into force, all tariffs on textile and apparel produced and traded within North America were fully eliminated, spurring more integrated textile and apparel production in the region.4 Many specific provisions affecting textile and apparel trade appear in NAFTA's Annex 300-B.5

The Trump Administration has stated that its objectives for renegotiation of NAFTA include maintaining duty-free access to the Mexican and Canadian markets for U.S. textile and apparel products and improving competitive opportunities for U.S. textiles and apparel, while taking into account U.S. import sensitivities.6 The Administration has also proposed changes in other areas of the agreement, such as customs enforcement and rules for determining a good's origin, which may be significant for the textile and apparel industries. U.S. textile producers and the domestic retail and apparel sectors have asked that the Trump Administration strive to "do no harm" in the renegotiation and avoid any disruption to trade and investment linkages encouraged by NAFTA.

Formal talks with Canada and Mexico began in August 2017. If a new NAFTA deal is reached, it would be subject to ratification by the legislatures of all three countries. Another possibility is that President Trump may decide to withdraw from NAFTA, which the United States can do with six months' notice to the other parties.7

Textile Industry Inputs and Markets

The textile industry is one of the oldest manufacturing industries in the United States. Since NAFTA took effect more than two decades ago, there have been substantial changes in the U.S. textile industry—perhaps most notably, it has become highly automated and capital-intensive. In addition, textile businesses have arranged their North American production around the agreement's terms.

Textile Manufacturing Inputs

U.S. textile manufacturers, generating $18.3 billion in value added in 2016, make yarns and fabrics from raw materials such as cotton and various man-made fibers.8 The United States is a significant producer of cotton, the most common natural fiber.9 Consumption of cotton by U.S. textile mills peaked in 1997.10 Since then, U.S. mill use of cotton has dropped about 70% due to the decrease in domestic textile production caused by competition from imported textile and apparel products.11 In 2016, Mexico was the 5th-largest U.S. export market for U.S. raw cotton, accounting for about 9% of total U.S. cotton exports, and Canada was 35th.12 Neither Canada nor Mexico is a significant producer of other natural fibers, such as jute, flax, or sisal.

The United States accounted for about 4% of global production of man-made fibers in 2016. Since 2000, most of the global growth in man-made textile manufacturing has taken place in China, which by 2016 accounted for two-thirds of total worldwide production, principally polyester, which is substitutable for cotton fiber.13 Other important producers of man-made fibers are India, Taiwan, Indonesia, South Korea, Turkey, and Japan.14

End-Use Markets for U.S.-Made Textiles

The U.S. textile industry is a supplier industry to three main industrial end-use sectors: apparel, home textiles and floor coverings, and technical textiles consumed in manufactured industrial production. Each faces different market conditions.

Apparel Manufacturing

Prior to the implementation of NAFTA, the domestic apparel industry consumed about a quarter of U.S.-manufactured fibers.15 By 2015, roughly 9% of U.S. manufactured fibers went to domestic apparel use.16 The United States' share of global apparel exports has fallen to 1.3% in 2015 from 4.4% in 2000, according to the World Trade Organization (WTO).17

According to the American Apparel & Footwear Association, an industry group, 98% of all apparel purchased by U.S. consumers is produced outside the United States.18 Mexico, the leading source of U.S. apparel imports in the late 1990s and early 2000s, slid to sixth place in 2016, behind China, Vietnam, Bangladesh, Indonesia, and India.19 Apparel imports from Canada comprised less than 1% of all U.S. apparel imports in 2016.

Another way the apparel industry has changed since 1994 is that although many of the world's largest apparel retailing and marketing firms are headquartered in the United States, they now frequently manufacture through a combination of facilities they own and third-party arrangements in low-cost regions of the world. U.S.-headquartered apparel firms commonly contract directly with apparel sourcing companies, which in turn portion out the production work to independent manufacturers. NAFTA rules have encouraged the sourcing of apparel from Mexican plants that use U.S.-made yarn and fabric rather than from Asian plants that use little or no U.S. content.

Home Textiles and Floor Coverings

About 40% of domestic textile output went into home textiles, furnishings, and floor coverings (a category known as "made-up textiles") in 2015. U.S. manufacturers of these products have fared far better against import competition than apparel manufacturers.20 This is mainly because manufacturing of carpets, curtains, and tablecloths is highly automated and labor costs are relatively unimportant. For example, the development of larger, faster carpet-tufting machines contributed to a decline in employment at U.S. carpet and rug mills from 47,800 workers in 2006 to 31,600 in 2016.21 The health of the carpet and rug mill industry is tied in large part to conditions in domestic housing and commercial building construction, raw material prices, and competition from foreign producers.22 Canada and Mexico are the top two export markets for the United States' made-up textiles.23

Technical Textiles

Technical textiles,24 which are used across various industrial sectors from agriculture, construction, and medical use to transportation, accounted for about half of U.S. textile output in 2015.25 Technical textiles are reportedly the fastest-growing segment of the textile industry worldwide.26 IBISWorld, a market research firm, estimates the U.S. domestic market for industrial textiles at $22 billion in 2017.27 Industry observers say the United States is a leader in the production of technical textiles chiefly because these high value-added products require advanced manufacturing processes and significant research and development, limiting import competition from low-wage countries.28

According to the U.S. Department of Commerce, Mexico is the largest market for U.S. technical textiles, especially for use in Mexico's large automotive sector, followed by Canada.29 Canada also ranks as a top market for U.S.-made industrial protective apparel, with end-user industries such as oil and gas, construction, manufacturing, and mining.30 Canada and Mexico are the first- and second-largest markets, respectively, for U.S. exports of medical textiles.31

Because the automotive industry is a large user of technical textiles, domestic producers could be affected by proposed changes to NAFTA's domestic content requirements for motor vehicle products.32 According to one estimate, automotive manufacturers in the United States used about 330 million square yards of fabric in 2015 for headliners, fabric seats, airbags, seat belts, door panels, engine filters, and trunk liners.33 One change in NAFTA proposed by the United States would require motor vehicles to have 85% North American content and 50% U.S. content to qualify for tariff-free treatment. If auto manufacturers were to import more passenger cars from outside the NAFTA region and pay the 2.5% U.S. import duty rather than complying with stricter domestic content requirements, automotive demand for U.S.-made technical textiles could be adversely affected.

|

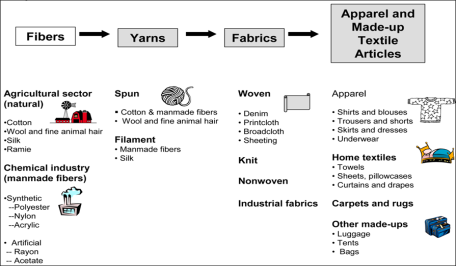

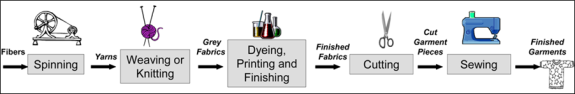

The Textile Manufacturing Process Textile manufacturing begins with fiber, which can be harvested from natural resources (e.g., cotton, wool, silk, or ramie), manufactured from cellulosic materials (e.g., rayon or acetate), or made of man-made synthetic materials (e.g., polyester, nylon, or acrylic). After the raw fibers are shipped from the farm or the chemical plant, they pass through four main stages of processing (see Figure 1):

|

Domestic Textile and Apparel Production and Employment

NAFTA has been criticized for causing a loss of production and employment in U.S. manufacturing. The effects of NAFTA with respect to textiles and apparel, however, are not straightforward, and the drop in domestic textile and apparel production and jobs cannot be blamed solely on the agreement. Making it difficult to isolate the impact of NAFTA are the many other factors that have contributed to the shrinking size of the domestic textile and apparel sectors over the past quarter-century, among them automation, industry consolidation, currency fluctuations, and economic growth.

Textile Production and Employment

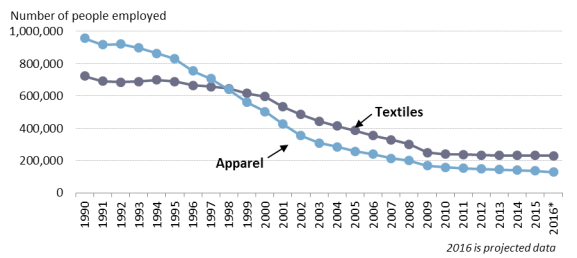

The textile industry has been less prone to relocation to lower-wage countries than apparel manufacturing because yarn and fabric production is capital- and scale-intensive, demanding higher worker skills than apparel production; as discussed below, apparel production tends to be low-tech and labor-intensive. Nonetheless, since 1994, textile manufacturers have shed about 500,000 jobs, with direct employment dropping to around 230,000 in 2016 (as shown in Figure 2).34 The Bureau of Labor Statistics predicts the overall employee count in textile manufacturing will shrink to about 185,000 by 2026.35

Output by U.S. textile mills, which transform fibers such as cotton, wool, and polyesters into products such as yarn, fabric, and thread, reached an all-time peak in December 1997, nearly four years after NAFTA took effect. It began to trend down in 2000: by the end of 2007, production was 39% lower than at its peak a decade earlier. At the end of 2016, the output of U.S. textile mills was 29% less than in 2007 and about 60% less than in 1997.36 The number of textile mills has fallen by half since 1997. The number of employees has declined by three-quarters over the same period as the surviving mills have invested heavily in technology to reduce operating costs.37 However, significant textile production remains in the United States. Textile production requires sizable capital investment; weaving mills can cost an estimated $12 million to $25 million and spinning mills $50 million to $70 million.38 Among all U.S. manufacturing industries, textiles rank near the top in productivity increases, which can be attributed both to automation and to the closure of less efficient mills.

Similar trends are seen in the textile product mills segment of the industry. These firms manufacture home textiles and floor coverings, as well as other textiles, for industrial uses from purchased yarn, fabric, and thread. Output at textile product mills began to sink in 2001; by 2016, production was 34% less than a decade earlier. According to the U.S. Census Bureau, the number of textile product mills operating in the United States fell 10% over the decade 2005 to 2015.39 The number of jobs in the textile product mill segment dropped from a high of 242,900 in 1994 to about 115,000 in 2016.40 Only 4% of U.S. textile product mills employ 100 or more workers.41

The U.S. International Trade Commission (USITC) concluded that imports of textiles had a tiny effect on U.S. textile industry employment (a 0.4% decline) from 1998 to 2014, which covers most of the period since NAFTA's enactment.42 However, the collapse of the domestic apparel industry and changing clothing tastes may have had a more significant impact on domestic textile production.43

Domestic production of textiles and textile products is primarily located in the southeastern states and in California, although every state has some textile manufacturing. In 2016, more than one-third of all textile jobs were located in Georgia and North Carolina. Appendix B compares textile employment in the top 10 states, which accounted for more than two-thirds of all textile jobs, in 1994 and 2016.

|

|

Source: Bureau of Labor Statistics, Quarterly Census of Employment and Wages for North American Industry Classification System (NAICS) 313 and 314 (textiles) and NAICS 315 (apparel). |

Apparel Production and Employment

Apparel production and the number of companies in the sector have fallen off in recent decades. In 2016, apparel manufacturers directly employed about 128,800 workers—roughly 830,000 fewer than in 1990 (see Figure 2).44 In 2015, there were around 7,000 domestic apparel manufacturers, compared to more than 11,100 in 2005.45 Industry output declined by about 85% between 1997 and 2016. In September 2017, the sector's output reached an all-time low, with apparel production down 11% since the start of 2017.46

Apparel brands, retailers, importers, and wholesalers based in the United States are highly dependent on global supply chains, with suppliers making sourcing choices based on factors such as price, speed, and flexibility. In the United States, apparel production has dwindled because many manufacturers no longer physically sew U.S.-produced apparel and other fashion products that directly compete with low-value imports, especially low-cost "fast-fashion" garments. Apparel production in the United States is largely focused on high-quality niche products and the military market, which is statutorily required to purchase U.S.-produced garments and textiles.47 As a result of more and more apparel production moving to lower-wage countries, including Mexico, apparel manufacturing employment in the United States has shrunk every year since 1990. NAFTA likely accounts for the loss of some of these jobs, but there is little evidence that NAFTA was the decisive factor, given that the major growth in apparel manufacturing for the U.S. market has occurred in Asian countries that receive no preferences under NAFTA.

According to a study by researchers at Duke University, the U.S. apparel industry has retained the more skilled, higher-paying jobs such as those involving the design, branding, and marketing of products, with lower-skilled apparel production having moved offshore.48 Because of the difficulty in automating most sewing functions, assembly of garments remains largely labor intensive, but that could change if robotic sewing machines eventually automate some apparel assembly.49

U.S. Textile and Apparel Trade

U.S. Trade in Textile Products

Overall, the United States has a strong export position in yarns and fabrics, with global export shipments of $12.9 billion in 2016 (see Table 1). For two decades, the United States has posted a modest trade surplus in these products. The U.S. trade surplus in textiles in 2016 came to $1.6 billion. When made-up textile articles are included, the United States ran a textile trade deficit of $18.8 billion in 2016.50 Import penetration—the share of U.S. demand met by textile imports—reached roughly 40% in 2016, up from 35.5% in 2010 (see Appendix A).

|

Fabric |

Yarn |

Made-Up Articlesa |

Textile Mill Products Total |

Fabric and Yarn Total |

|

|

1990 |

$2,903 |

$2,141 |

$1,232 |

$6,276 |

$5,044 |

|

1995 |

$4,770 |

$2,818 |

$1,727 |

$9,315 |

$7,588 |

|

2000 |

$7,420 |

$3,030 |

$2,258 |

$12,708 |

$10,450 |

|

2005 |

$8,810 |

$3,157 |

$2,586 |

$14,553 |

$11,967 |

|

2010 |

$7,637 |

$4,316 |

$3,152 |

$15,105 |

$11,953 |

|

2016 |

$8,563 |

$4,347 |

$3,572 |

$16,482 |

$12,910 |

Table 2 shows that the United States exported nearly $6 billion in yarns and fabrics to its NAFTA partners in 2016, with U.S. export shipments of $4.3 billion to Canada and $1.6 billion to Mexico. NAFTA partners account for nearly half (46%) of U.S. yarn and fabric exports. Last year, the United States registered a bilateral trade surplus in yarns and fabrics with both NAFTA partners of $4.1 billion and a surplus of more than $720 million in made-up textile products. Although U.S. textile products can be more expensive than those from other countries, apparel producers in Canada and Mexico use U.S.-made textiles in products that are exported to the United States because the goods may enter the United States free of tariffs.

In addition, in 2016 about $2.4 billion of U.S.-made yarns and fabrics was exported to the Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) region and $46 million was imported from the region, resulting in a $2.3 billion trade surplus.51 A tiny amount of U.S. yarns and fabrics ($52 million in 2016) was exported from the United States to the Caribbean Basin Initiative (CBI) countries, representing less than 1% of total U.S. yarn and fabric exports last year. By comparison, the United States exported almost a fifth of its textiles outside the Western Hemisphere last year, to the 28-member European Union and China.

Table 2. U.S. Yarn and Fabric Exports, by Countries or Region

(in millions of U.S. dollars, by selected years)

|

|

1994 |

1994 % Share |

2000 |

2000 % Share |

2016 |

2016 % Share |

|

World |

$6,491 |

— |

$10,450 |

— |

$12,910 |

— |

|

NAFTA |

$2,577 |

40% |

$6,005 |

57% |

$5,969 |

46% |

|

CAFTA-DRa |

$349 |

5% |

$760 |

7% |

$2,383 |

18% |

|

EU-28 |

$1,291 |

20% |

$1,477 |

14% |

$1,494 |

12% |

|

China |

$140 |

2% |

$209 |

2% |

$750 |

6% |

|

CBIb |

$53 |

1% |

$64 |

1% |

$52 |

0.4% |

Source: U.S. Department of Commerce, Office of Textiles and Apparel, accessed August 14, 2017.

a. CAFTA-DR countries include Costa Rica, the Dominican Republic, El Salvador, Guatemala, Honduras, and Nicaragua.

b. Caribbean Basin Initiative (CBI) countries include Antigua and Barbuda, Aruba, Bahamas, Barbados, Belize, British Virgin Islands, Dominica, Grenada, Guyana, Haiti, Jamaica, Montserrat, Netherlands Antilles, St. Kitts and Nevis, St. Lucia, St. Vincent and the Grenadines, and Trinidad and Tobago.

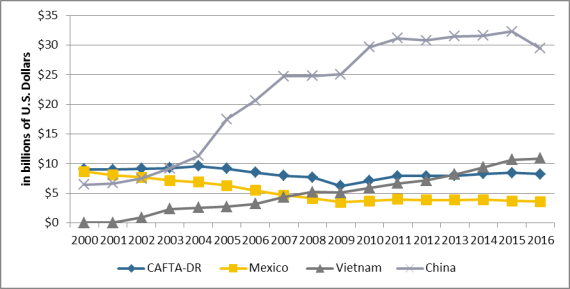

U.S. Trade in Apparel Products

In the apparel sector, import penetration reached more than 90% of U.S. demand in 2016 (see Appendix A), when the U.S. trade deficit in apparel products was $77.5 billion.52 Whereas Mexico accounted for about 4% of imported apparel for the U.S. market in 2016, about 35% of imported apparel came from China. Vietnam, a fast-growing source of apparel for the U.S. market, furnished 13% of imports. The United States had a trade surplus in apparel products with Canada of $1.4 billion and a trade deficit with Mexico of $2.7 billion last year.

Mexico's apparel exports to the United States grew rapidly following the signing of NAFTA in 1994 and extended through 2000. By then, Mexico was the largest source of apparel imports into the U.S. market, reaching a market share of 14.4%. Mexico benefited from quota-free access to the U.S. market, which gave its apparel an advantage over other products from other countries, which were subject to U.S. quotas on many textile and apparel imports through 2004. The quota system made it necessary for buyers of textile and apparel products to source from countries for which quotas for particular products were available. Once other countries were no longer constrained by textile and apparel quotas, however, Mexican apparel exports to the United States began to shrink.

The elimination of almost all textile and apparel quotas did not eliminate import tariffs. Tariffs on textile and apparel imports vary considerably, but major textile- and apparel-producing countries face average U.S. tariff rates of 7.9% for textiles and 11.6% for clothing. Rates on particular products may be as high as 32% (see Appendix C).53 However, its exemption from these tariffs under NAFTA has not been sufficient to maintain the level of Mexican apparel exports to the United States, as Mexico's apparel industry has an unfavorable cost structure compared to the leading Asian apparel-exporting countries.

Textile and Apparel Trade in the Western Hemisphere

Since NAFTA was implemented, producers in North America, particularly Mexico, have had to adjust to intensifying global competition. Some of this competition comes from other textile and apparel producers in the Western Hemisphere, an influence largely bolstered by the CAFTA-DR yarn-forward rule of origin. Still, the most significant competitive challenge for textile and apparel production in North America has come from outside the region, specifically China and Vietnam. Although neither country has a preferential trading relationship with the United States, they have become the leading sources of lower-cost apparel for U.S. importers and retailers.

Canada and Mexico

Within the NAFTA supply chain, the United States typically exports textiles to Mexico or Canada, which turn U.S.-made yarns and fabrics into apparel, home furnishings, or other industrial textiles for sale in the U.S. market. Canada and Mexico have more limited textile and apparel trade with one another, although some Canadian apparel producers have turned to Mexico for lower-wage assembly operations.

Canadian producers of textiles tend to focus on higher-value-added products, often technical textiles for the aerospace, construction, medical, agricultural, and defense industries.54 Canadian clothing companies compete directly with U.S.-owned apparel brands in designing and producing high-end attire and specialty garments.55 Canada ships about 90% of its garments to the United States.56

Similar to Canada, Mexico's apparel industry relies almost entirely on the U.S. market for exports. Its cut and assembly operations often use U.S.-made fabrics to produce basic items such as denim jeans and T-shirts, which are then exported to the United States. For example, manufacturers of cotton T-shirts or cotton twill trousers in Mexico can avoid a 16.5% import duty if U.S. inputs are used.57 Geographic proximity to the United States gives Mexican apparel producers an advantage over Asian producers, allowing quick replenishment of items for which time is a critical factor. Mexico's focus on basic apparel items suggests that U.S. importers could quickly source from elsewhere if duty savings under NAFTA are eliminated. But even now, some U.S. fashion companies say the duty savings are not worth the time and resources required to comply with the NAFTA rules of origin and documentation requirements.58 In 2016, roughly 16% of qualifying textile and apparel imports from NAFTA failed to take advantage of the duty-free benefits and instead paid applicable tariffs.59

Central America and the Caribbean

Central America and the Caribbean is another source of regional competition for NAFTA-based textile and apparel producers. The CAFTA-DR region and the Caribbean have limited textile production—virtually all fibers are imported, yielding export opportunities for U.S. yarn and fabric producers—but ample capacity to cut fabric and make apparel. CAFTA-DR includes provisions structured much like NAFTA's, with a few important differences.60 CAFTA-DR and the Caribbean Basin Initiative allow regional apparel products to enter the United States duty-free as long as the yarn and fabrics used for these manufactures originate in the region.61 A special U.S. preference program encourages apparel imports from Haiti, and the United States also has free-trade agreements with Colombia, Peru, and Chile, with each adhering to a yarn-forward rule of origin, with some exceptions.

Competition from China and Vietnam

Notwithstanding rising labor and production costs, no other country, including U.S. NAFTA partners, comes close to competing with China's enormous capacity to make complex textiles and apparel. China, which provided more than a third of total U.S. garment imports, was the top supplier of apparel to the United States, with U.S. imports registering at $29 billion in 2016, and it led in U.S. imports in the yarn, fabric, and made-up textile categories.62 It is also the world's largest manufacturer of man-made fibers, a large producer of cotton, and a major supplier of yarns, fabrics, and trims.

Vietnam, which had a small garment manufacturing sector a decade ago, is the second-largest exporter of apparel to the United States (see Figure 3).63 In 2016, Vietnam's apparel shipments to the United States totaled $10.9 billion, accounting for 13% of all U.S. apparel imports. Vietnam tends to sell fewer basic apparel products (e.g., T-shirts and trousers) and more shirts, suits, and overcoats in the United States than do Mexico and other trading partners in the Western Hemisphere.64 On the textile side, Vietnam's apparel sector buys the majority of its yarns and fabrics regionally, from China and other suppliers such as South Korea and Taiwan. It purchases a limited amount from the United States. The Vietnamese government has announced plans to substantially increase its yarn and fabric capacity in the coming years.

The highly competitive textile and apparel sectors in China and Vietnam are a consideration in the current NAFTA renegotiations. For example, U.S. textile manufacturers are concerned about existing NAFTA exceptions, such as tariff preference level (TPL) rules, which allow Mexico and Canada to bring in a limited amount of yarn and fabric each year from China and Vietnam duty free and use those imports in products for the U.S. market. Because of this, the U.S. textile industry has urged that yarns and fabrics from China and Vietnam be excluded from all NAFTA benefits. A separate issue, but one that could in the long term affect the NAFTA textile and apparel supply chain, is whether the United States will decide to enter into a free-trade agreement with Vietnam in coming years. Textiles and apparel from Vietnam would have had free access to the U.S. market under the recently negotiated Trans-Pacific Partnership trade agreement, but the United States did not ratify the agreement and withdrew from the Partnership in January 2017.

|

|

Source: U.S. Department of Commerce, OTEXA, accessed August 2017. |

Possible Effects of Potential Trade Agreement Modifications

If NAFTA were changed or terminated such that Mexican producers lose duty-free access to the U.S. market, it is possible that CAFTA's textile and apparel industry, as well as manufacturers in the Caribbean or free-trade agreement partners in South America, could benefit if increased foreign investment and trade follow. For these countries, as is the case for NAFTA partners, tariff preferences appear to be important in keeping apparel producers in the Western Hemisphere competitive in the U.S. market, and thereby helping to preserve export markets for U.S.-made textiles. Beyond apparel, if NAFTA were terminated, U.S.-made technical and industrial fabrics would lose their protected access to Canada and Mexico.

NAFTA Provisions Affecting Textiles and Apparel

Rules of Origin

Rules of origin are an important aspect of trade agreements affecting the textile and apparel industries. They generally stipulate how much processing must occur within the region for a product to obtain duty-free trade benefits.65 The U.S. textile industry generally wants to ensure that textiles and apparel are chiefly manufactured within the NAFTA region. Apparel brands and retailers say this requirement reduces their sourcing and manufacturing flexibility. As such, the apparel industry generally opposes the yarn-forward standard, supporting instead simplified and more flexible rules of origin in new or renegotiated U.S. trade agreements. One possible outcome in the NAFTA renegotiation might be a modification of these rules.

For textile and apparel products, rules of origin are usually based on the production process, which is shown in Figure 4.

The major distinctions for textiles and apparel are the following:

- Fiber Forward. Fiber must be formed in the free-trade agreement (FTA) member territory. Natural fibers such as wool or cotton must be grown in the territory. Man-made fibers must be extruded in the trading area.

- Yarn Forward. Fibers may be produced in any country, but each component starting with the yarn used to make the textiles or apparel must be formed within the FTA. This rule is sometimes called "triple transformation," as it requires that spinning of the yarn or thread, weaving or knitting of the fabric, and assembly of the final product all occur within the region.

- Fabric Forward. Producers may use fibers and yarns from any country, but fabric must be knitted or woven in FTA member countries.66

- Cut and Sew. Only the cutting and sewing of the finished article must occur in FTA member countries, providing maximum flexibility for sourcing.67

NAFTA was the first FTA to include the yarn-forward rule of origin.68 Since then, the rule has become standard in nearly every FTA negotiated by the United States.69 As described earlier in this report, NAFTA's rule of origin ensures a large market for U.S. yarns and fabrics because they are produced only in limited quantities in Canada and Mexico.

In the original NAFTA agreement, there was a textile and apparel safeguard. It allowed the United States or any other NAFTA member to reimpose tariffs if import surges caused or threatened to cause serious damage to domestic industry. The safeguard option expired on January 1, 2004, a decade after NAFTA's entry into force. NAFTA also established a Committee on Textile Trade and Apparel Matters, which may be convened at the request of any NAFTA member, to raise concerns under the FTA regarding mutual trade in these products.

Exceptions to Rules-of-Origin Requirements

When certain inputs are not available in the partner countries, NAFTA allows for several exceptions to its detailed rules-of-origin requirements. This gives producers flexibility to use materials not widely produced in North America.

Tariff Preference Levels

Under NAFTA, TPLs are an exception to the textile rules of origin. This concession to the apparel industry allows duty-free access for limited quantities of wool, cotton, and man-made fiber apparel made with yarn or fabric produced or obtained from outside the NAFTA region, thereby permitting the use of some yarns and fabrics from China and other Asian suppliers.70 In nearly every year since 2010, Mexico has come close to exporting the maximum allowable amount of cotton and man-made fiber apparel with duty-free foreign content.71 Canada's TPL fill rates are typically highest for cotton and man-made fiber fabric and made-up products, but are not usually fully filled. NAFTA's TPL program requires special paperwork to be filed with U.S. Customs and Border Protection to make a TPL claim.72

The issue of NAFTA TPLs divides textile manufacturers and the apparel sector. In the NAFTA renegotiation, the United States has reportedly proposed an end to the NAFTA TPL regime, as urged by textile manufacturers.73 Apparel and retail groups, on the other hand, claim that abandoning the TPL regime could disrupt the regional supply chains that have developed over more than two decades. It is not clear that eliminating the TPL program would result in a substantial return of textile production or jobs to the United States; if it were to raise the cost of Mexican apparel production, it could instead result in imports from other countries displacing imports from Mexico. Mexico and Canada reportedly oppose the elimination of the NAFTA TPL program.74

Other NAFTA Exemptions

Apparel produced in the NAFTA region benefits from duty-free access to the United States even if certain inputs, such as sewing threads, pocketing, and narrow elastics, are not made in the NAFTA countries. NAFTA also has a de minimis threshold that permits up to 7% of a garment's content, by weight, to come from outside the NAFTA region. Textile manufacturers generally want these exemptions eliminated in a revised NAFTA agreement, while apparel companies and retailers contend that the exemptions are critical for Mexican apparel plants to be able to adapt quickly to shifting consumer demand.

Short Supply Process

NAFTA has a short supply process, whereby its rules of origin may be amended through consultation among the NAFTA partners if yarns and fabrics are not available in commercial quantities for specific products.75 Under Annex 401 of NAFTA, apparel inputs in short supply include fine-count cotton knit fabrics for nightwear; linen; silk; cotton velveteen and fine-wale corduroy fabrics; and certain hand-woven Harris Tweed wool fabrics.76 Apparel and retail groups contend that the procedure for determining that a product is in short supply is burdensome, and they want a renegotiated NAFTA agreement to include "defined timetables and clearer requirements to achieve speedier outcomes" for materials that could come from outside the FTA region.77 According to press reports, U.S. negotiators have proposed that the short-supply list be incorporated in the NAFTA agreement itself, as is the case with the CAFTA-DR agreement,78 which lists more than 150 fibers, yarns, and fabrics that are considered to be in short supply.79

Other Provisions

The U.S. textile industry wants the NAFTA renegotiation to address certain exemptions granted to Canada and Mexico under the Kissell Amendment (6 U.S.C. §453b), a Buy American-type law that requires 100% U.S. content for textile and apparel purchases by the Department of Homeland Security, with limited exceptions.80 The Kissell Amendment treats manufacturers in Mexico, Canada, and Chile as "American" sources, thus opening U.S. government procurement to imported goods from these countries.81 Another priority for the textile industry in the NAFTA renegotiation is to avoid any future change to government procurement rules that could undermine the Berry Amendment (10 U.S.C. §2533a), a 100% domestic-in-origin requirement for textile and apparel items purchased by U.S. national security agencies.

Customs Enforcement and Trade Facilitation

Customs enforcement is particularly important to the industry, as textile and apparel trade accounts for approximately 40% of all U.S. duty revenue and involves 20% of all U.S. importers.82 According to U.S. Customs and Border Protection, more than $21.1 billion of entered textiles and wearing apparel claim preferential tariff treatment, placing textiles and apparel at a high risk for noncompliance.83 This makes the issue of transshipment of special relevance to the U.S. textile and apparel industry because of concerns that major textile- and apparel-producing countries such as China are shipping products through countries that have free-trade agreements with the United States, including the NAFTA countries.84

Conclusion

As the NAFTA renegotiations progress, there are at least three possible outcomes: (1) no change to the textile and apparel provisions in NAFTA; (2) adjustments to NAFTA, such as changes to rules of origin; or (3) full U.S. withdrawal from NAFTA.85 Over the long run, global textile and apparel supply chains would adjust to a modified NAFTA or to its elimination, but it is unclear how long that may take.

Under a withdrawal scenario, some analysts believe U.S. textile manufacturers could see a reduction in net income by as much as 1 percentage point if the result is less demand for U.S.-made yarns and fabrics within the NAFTA region.86 According to one textile and apparel industry expert, ending NAFTA would likely result in U.S. apparel brands and retailers importing more garments from other suppliers, such as China and Vietnam. Moreover, U.S. textile manufacturers could lose export sales to Mexico, the United States' single largest export market. It is possible that Asian textile and apparel suppliers would benefit the most from NAFTA's dismantlement by taking market share from Mexico.87 Whatever the outcome of the NAFTA renegotiation, in the medium and long run, the profitability of the North American textile and apparel industry will likely depend less on NAFTA preferences such as yarn forward and more on the capacity of producers in the region to innovate to remain globally competitive.

Another matter worth considering is that although the United States withdrew from the proposed TPP in January 2017, the 11 remaining TPP countries are continuing to pursue a TPP-type trade deal.88 If negotiations among the TPP-11 move forward, this could affect the supply chains established under NAFTA, although the implications are unknown because no specific proposals for a possible TPP-11 agreement have been tabled to date. If the TPP-11 countries strike a trade deal, one possible effect is that the amount of textiles and apparel sourced from the newly established TPP region would increase.89 Canada and Mexico are both parties to the TPP talks, and a TPP-11 agreement could result in them importing more textile and apparel products from other TPP countries, including Vietnam. This could ultimately be a disadvantage for U.S.-based producers. How the inclusion of Canada and Mexico in a fresh TPP arrangement would affect their participation in NAFTA is unknown.

It may take a couple of years to know exactly what changes the NAFTA renegotiation will bring, and how they will affect the existing textile and apparel regional supply chain. President Trump currently has Trade Promotion Authority until July 1, 2018, allowing him to negotiate trade agreements that Congress must approve or reject without amendment. This authority expires on July 1, 2018, but current law allows it to be extended through July 1, 2021.90

Appendix A. Textile Industry Overview

|

|

2010 |

2015 |

2016 |

2010-2016 |

|

Total U.S. manufacturing employment (all industries) |

11,487,496 |

12,291,676 |

12,295,670 |

7% |

|

Textile mills (NAICS 313) |

119,385 |

116,773 |

113,660 |

-5% |

|

Textile product mills (NAICS 314) |

119,145 |

115,466 |

115,767 |

-3% |

|

Total textile employment |

238,530 |

232,239 |

229,427 |

-4% |

|

Apparel (NAICS 315) |

157,587 |

135,263 |

128,781 |

-18% |

|

All textiles and apparel (T&A) |

396,117 |

367,502 |

358,208 |

-10% |

|

T&A employment as % of total mfg. employment |

3.4% |

3.0% |

2.9% |

|

|

Total value of shipments, in millions of U.S. $ |

||||

|

Total U.S. manufacturing |

$4,915,151 |

$5,549,100 |

$5,436,549 |

11% |

|

Textile mills (NAICS 313) |

$29,654 |

$30,629 |

$30,146 |

2% |

|

Textile product mills (NAICS 314) |

$21,409 |

$25,666 |

$25,889 |

21% |

|

Total textile shipments |

$51,063 |

$56,295 |

$56,035 |

10% |

|

Apparel manufacturing (NAICS 315) |

$13,156 |

$11,473 |

$11,951 |

-9% |

|

All textiles and Apparel (T&A) |

$64,219 |

$67,781 |

$67,504 |

5% |

|

T&A shipments as % of total mfg. shipments |

1.3% |

1.2% |

1.2% |

|

|

U.S. imports for consumption |

|

|

|

|

|

Textile mills (NAICS 313) |

$6,525 |

$8,395 |

$8,003 |

23% |

|

Textile products (NAICS 314) |

$15,825 |

$20,216 |

$20,364 |

29% |

|

Total textile imports |

$22,350 |

$28,611 |

$28,367 |

27% |

|

Apparel imports (NAICS 315) |

$75,411 |

$89,519 |

$89,509 |

19% |

|

All textiles and apparel |

$97,761 |

$118,130 |

$117,876 |

21% |

|

U.S. Exports |

||||

|

Textile mills (NAICS 313) |

$7,833 |

$8,756 |

$8,078 |

3% |

|

Textile products (NAICS 314) |

$2,582 |

$2,909 |

$2,809 |

9% |

|

Total textile exports |

$10,415 |

$11,665 |

$10,887 |

5% |

|

Apparel exports (NAICS 315) |

$3,070 |

$3,179 |

$2,874 |

-6% |

|

All textiles and apparel |

$13,485 |

$14,844 |

$13,761 |

2% |

|

Apparel imports share of U.S. market |

88.20% |

91.52% |

90.79% |

|

|

Textile imports share of U.S. market |

35.48% |

39.06% |

38.59% |

|

Source: CRS, with data from U.S. Department of Labor, Quarterly Census of Employment and Wages; Census Bureau, Manufacturers' Shipments, Inventories, and Orders; and USITC Dataweb. All data updated in August 2017.

Notes: NAICS 313 covers yarn, thread, and fabric, and NAICS 314 corresponds to made-up, nonapparel textiles articles such as sheets and towels. NAICS 315 covers cut-and-sew and knit-to-shape apparel.

Appendix B. Top 10 States in Textile Employment

|

1994 |

2016 |

% Change |

# Change |

|||||

|

United States |

|

|

|

|

||||

|

Georgia |

|

|

|

|

||||

|

North Carolina |

|

|

|

|

||||

|

South Carolina |

|

|

|

|

||||

|

California |

|

|

|

|

||||

|

Alabama |

|

|

|

|

||||

|

Texas |

|

|

|

|

||||

|

Pennsylvania |

|

|

|

|

||||

|

New York |

|

|

|

|

||||

|

Virginia |

|

|

|

|

||||

|

Tennessee |

|

|

|

|

||||

|

Top 10 States Employment Total |

|

|

|

|

||||

|

Other 40 States Plus DC |

|

|

|

|

||||

|

Top 10 States % of Total Employment |

|

|

|

|

Source: CRS, with data compiled from U.S. Bureau of Labor Statistics, Quarterly Census of Employment and Wages, updated in August 2017.

Notes: Textile employment data cover two NAICS codes, 313 and 314. The 50 states and Washington, DC, do not sum to the national total because the national total includes suppressed data and Puerto Rico.

Appendix C. Selected Apparel and Textile Duties

|

Ad Valorema Tariff Ranges |

||||||

|

Country |

Yarn |

Woven Fabric |

Knit Fabric |

Non-Woven Fabric |

Industrial Fabric |

Apparel |

|

FTA Member Countries |

||||||

|

Australia |

0%-5% |

0%-5% |

5% |

5% |

0-5% |

0-5% |

|

Chile |

6% |

6% |

6% |

6% |

6% |

6% |

|

Colombia |

0%-15% |

0%-10% |

0%-10% |

0%-10% |

0%-10% |

10% |

|

Israel |

0%-6% |

0%-6% |

0%-6% |

0%-6% |

0%-6% |

0%-6% |

|

Jordan |

0%-20% |

0% |

0% |

0% |

0%-20% |

0%-20% |

|

Morocco |

2.5% |

2.5%-17.5% |

10%-17.5% |

2.5% |

2.5%-25% |

2.5%-25% |

|

Panama |

0%-15% |

0%-15% |

0% |

0% |

0%-15% |

0%-15% |

|

Peru |

0%-11% |

0%-11% |

0%-11% |

0%-6% |

0%-11% |

6%-11% |

|

South Korea |

0-8% |

2%-13% |

10% |

8% |

8%-10% |

8%-13% |

|

CAFTA-DR |

||||||

|

Costa Rica |

0%-5% |

0%-9% |

0%-9% |

0% |

0%-9% |

0%-14% |

|

Dominican Republic |

0% |

0%-14% |

0%-8% |

0% |

0%-20% |

3%-20% |

|

El Salvador |

0%-5% |

0%-10% |

0%-10% |

0% |

0%-10% |

0%-15% |

|

Guatemala |

0-5% |

0%-10% |

0%-10% |

0% |

0%-10% |

0%-15% |

|

Honduras |

0%-5% |

0%-15% |

0%-10% |

0% |

0%-10% |

0%-15% |

|

Nicaragua |

0%-5% |

0%-10% |

0%-10% |

0% |

0%-10% |

0%-15% |

|

NAFTAb |

||||||

|

Mexico |

0%-10% |

10%-15% |

0%-10% |

10% |

0%-10% |

20% |

|

Canada |

0%-8% |

0% |

0% |

0% |

0%-18% |

0%-18% |

|

Other Countries |

||||||

|

Brunei |

0% |

0% |

0% |

0% |

0%-10% |

0% |

|

Japan |

0%-6.9% |

2.5%-12.5% |

4%-9.8% |

0%-4.3% |

2.8%-6.6% |

4.4%-12.8% |

|

Malaysia |

0%-30% |

0%-10% |

15% |

20% |

0%-20% |

0%-20% |

|

New Zealand |

0%-5% |

0%-5% |

0%-5% |

5% |

0%-5% |

0%-10% |

|

Vietnam |

0%-10% |

12% |

12% |

12% |

0%-12% |

5%-20% |

|

United States |

0%-13.2% |

0%-25% |

0%-18.5% |

0% |

0%-14.1% |

0%-32% |

|

Other Countries |

||||||

|

China |

5%-9% |

6%-18% |

10%-12% |

10% |

8%-14% |

14%-25% |

|

European Unionc |

0%-5% |

3%-8% |

6.5%-8% |

4.3% |

4%-8% |

6.3%-12% |

|

Philippines |

1%-10% |

1%-10% |

1%-10% |

15% |

0%-15% |

1%-15% |

|

Thailand |

1%-5% |

5%-17.5% |

5% |

5% |

1%-30% |

10%-30% |

Source: CRS, with information from U.S. Department of Commerce, Office of Textiles and Apparel (OTEXA), updated August 19, 2017.

Note: U.S. trade agreements generally follow a yarn-forward system for textiles and apparel rules of origin, with the notable exceptions of the U.S.-Israel FTA and the U.S.-Jordan FTA, which have more liberal "cut and sew" standard based on value-added calculations requiring only that fabric be cut and assembled to qualify.

a. Ad valorem tariff rates are based on the value of the goods.

b. Textile and apparel goods manufactured in the United States enter Canada and Mexico duty-free under NAFTA if they qualify under the rules of the agreement.

c. Members of the European Union apply the EU common external tariff to goods from non-EU countries.

Appendix D. Selected Textile and Apparel Industry Comments on NAFTA Negotiating Objectives

Links to several statements by industry representatives for U.S. fiber and textile manufacturers, U.S. fashion brands, and U.S. apparel retailers are listed here. These statements reflect a consensus from all stages of the textile and apparel supply chain that NAFTA should continue because it helps maintain both sectors' overall competitiveness. Without NAFTA, according to these statements, current textile and apparel production and jobs could be shifted to other regions of the world, especially low-cost markets in Asia. The comments also suggest a few general recommendations for other policy issues of interest, including matters related to improving intellectual property rights to combat counterfeit goods, preventing restrictions on e-commerce and digital trade, improving regulatory cooperation, and updating NAFTA's labor provisions.

|

Organization |

Links to Comments on NAFTA Renegotiation |

|

National Council of Textile Organizations |

|

|

American Fiber Manufacturers Association |

|

|

National Cotton Council of America |

|

|

American Apparel & Footwear Association |

|

|

Retail Industry Leaders Association |

|

|

United States Fashion Industry Association |

|

|

National Retail Federation |

|

|

U.S. Industrial Fabrics Institute & Narrow Fabrics Institute |

Source: "Requests for Comments: Negotiating Objectives Regarding Modernization of North American Free Trade Agreements with Canada and Mexico," http://www.regulations.gov, Docket Number USTR-2017-0006.

Note: Industry comments were submitted on June 12, 2017, before the USTR held its NAFTA hearing on June 27-29.